Choose a regional site for content and services specific to your location.

Featured service.

What's Trending

TRENDING INSIGHT

What's trending.

- Our Leadership

- Cybersecurity & Technology

- Diverse Wealth Strategies

- Investing Capital for Good

locate an office

<a title="All Offices" href="/content/jpm-pb-aem/americas/nam/en/locations.html" aria-label="All Offices">Our Offices</a></b> Page to find the office closest to you." data-error-invalidformat="Invalid Postal Code"> Location Not Found

offices near you

Office near you, how can we help.

- Mid Year Outlook

- Sustainable Investing

- Interest Rates

- Family Office

Investment Strategy

The case for alternative investments

We all have different motivations for why we invest. Some individuals hope to generate enough income to sustain their lifestyles. Others may be seeking ways to grow their wealth over decades, whether to fund a legacy for generations or a comfortable retirement. Financial goals are unique for every individual.

That said, many of the challenges facing today’s investors are universal: The revival of inflation calls for the pursuit of higher expected returns to help grow purchasing power over time. Alpha opportunities have generally become harder to find in “traditional” stocks and bonds, and last year’s selloff in bonds left investors seeking more reliable portfolio factors. Also, the appetite for steady income generation is ever-present.

Alternative investments can help investors solve for many of these challenges. Below, we explore three primary roles they can play in portfolios: Access to broader opportunity sets, enhanced diversification and premium income generation hedges.

1. Access to a broader opportunity set of long-term growth potential

Historically, equities have enabled investors to grow their capital over time. However, we have seen a 26% decline in the number of publicly traded companies since 2000, 1 and there are now over 32x more private companies than public companies with more than 100 employees. 2 Limiting your investment approach to public markets means missing out on the vast opportunity set in private markets.

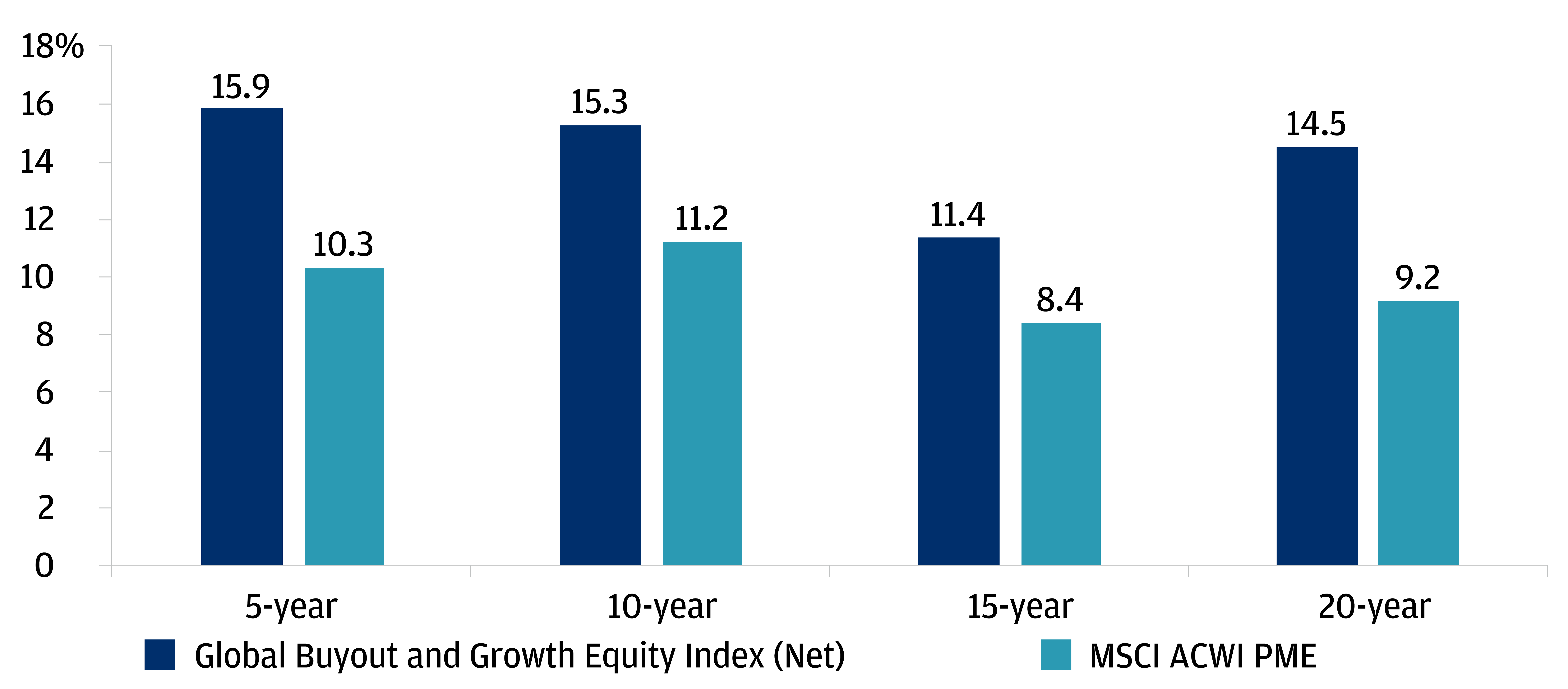

Private equity managers often take a hands-on approach, driving operational improvements in portfolio companies. With this expanded access and more comprehensive toolkit, private equity has consistently outperformed global public equity markets by 4-12% annually (see chart below).

Historical annualized returns of Global Buyout & Growth Equity Index vs. MSCI ACWI PME

2. Portfolio diversification for when the going gets tough

Portfolio diversification can come in many forms. Regarding private credit, higher base rates, we believe wider spreads and protective loan covenants could support attractive private credit returns into 2024 and beyond, on an absolute basis and relative to public credit and equity markets. We also expect to see transaction activity fueled by an uptick in defaults & distressed exchanges in the leveraged loan & high yield bond markets and exacerbated by a growing debt maturity wall.

For further diversification, hedge funds can be used as a tool in portfolios. Hedge funds may help reduce portfolio volatility by using hedging strategies and accessing niche exposures that may generate uncorrelated return streams. Therefore, hedge funds may help a portfolio to compound more efficiently.

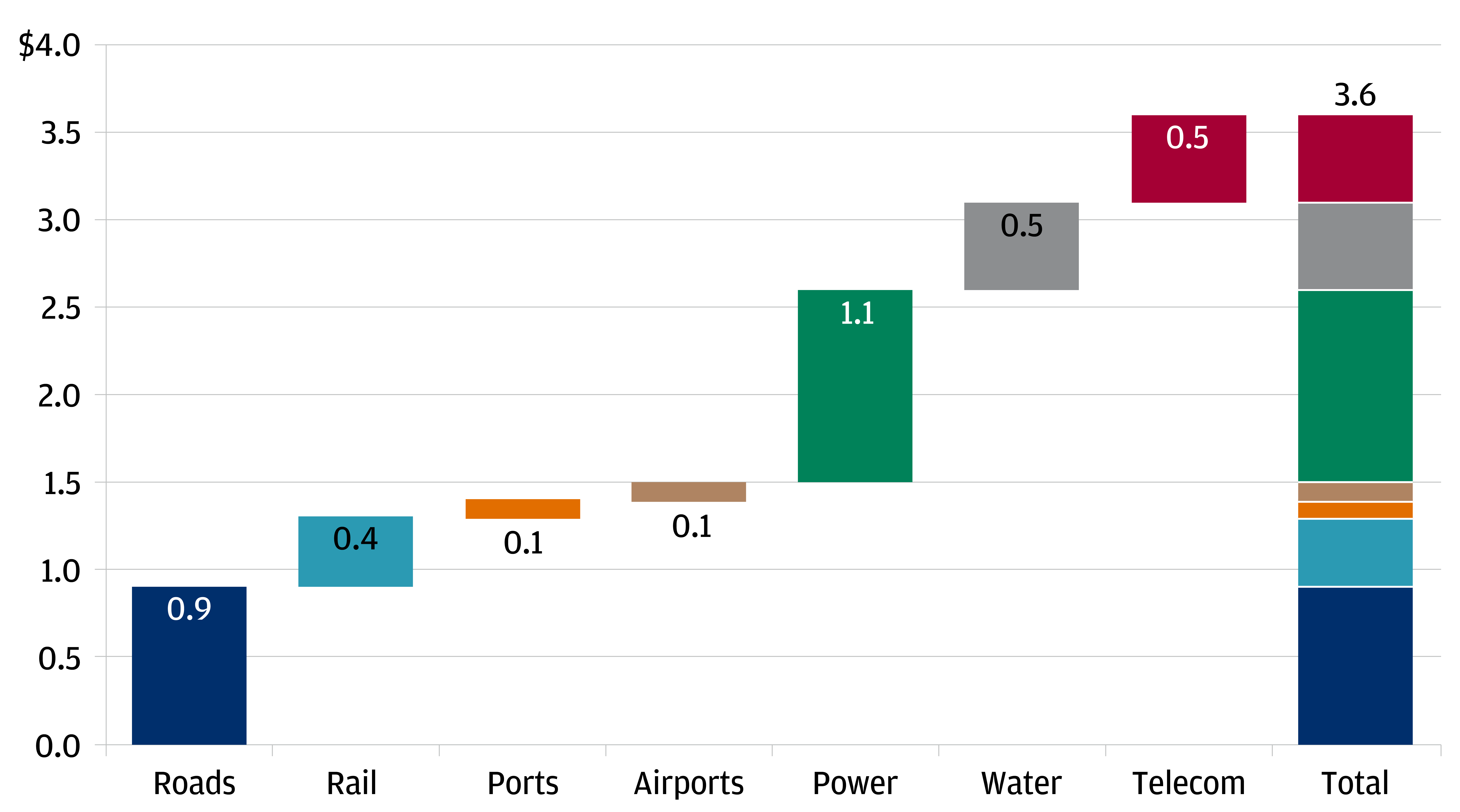

Real assets, too, can act as powerful diversifiers in a portfolio. Infrastructure assets, in particular, can offer exposure to essential services with resilient demand and inflation-linked revenue. Similarly, real estate tend to offer historically low correlation to public markets, including publicly traded REITs.

3. Attractive yield generation

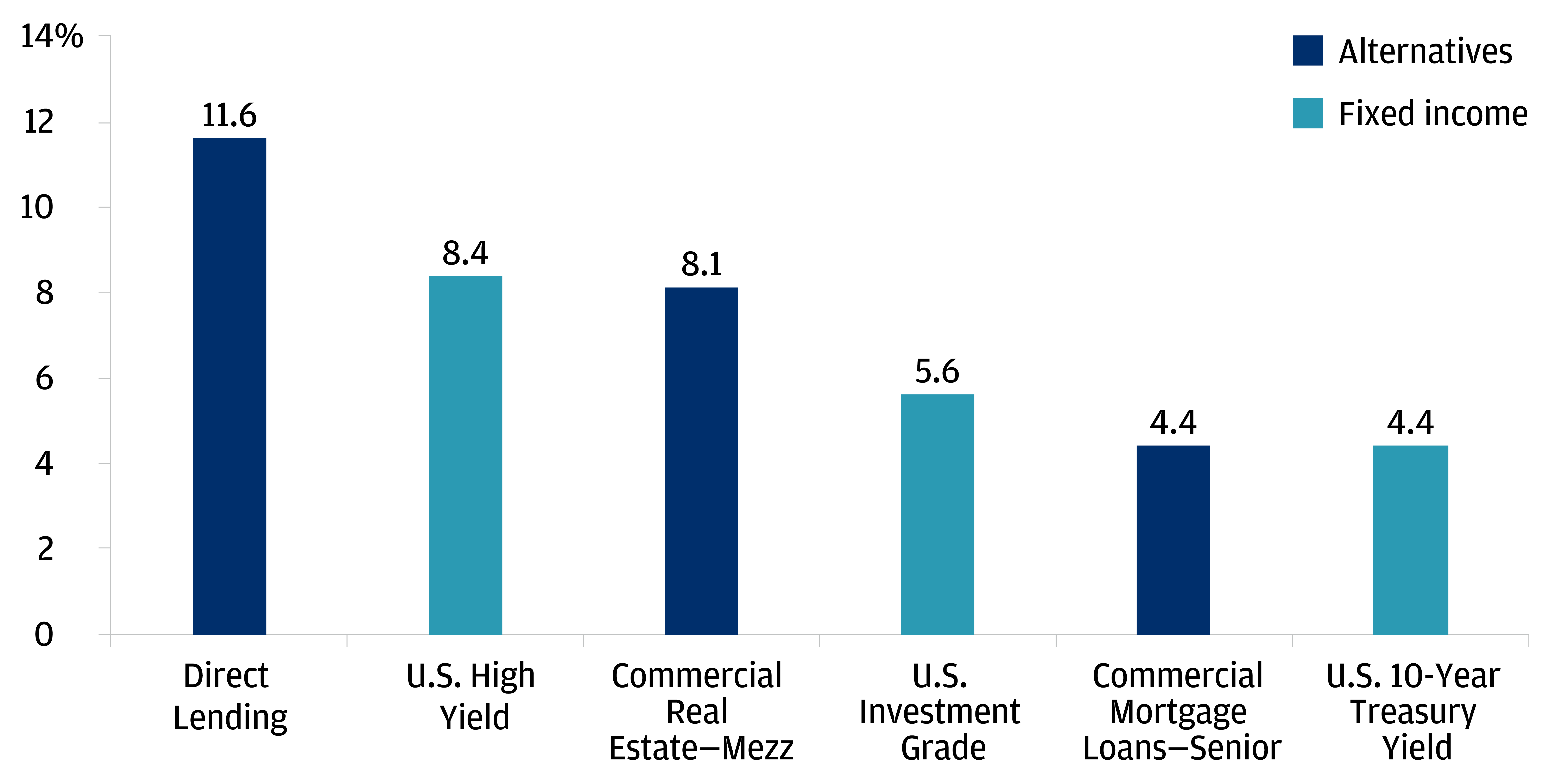

J.P. Morgan’s 2024 Long-Term Capital Market Assumptions estimate that total returns in U.S. investment grade bonds could average 4.6% per year over a 10-year investment horizon, but with an average inflation assumption of 2.4%, the real return prospects look less compelling. 3

To boot, as the size of the average high yield borrower has grown, many borrowers are too small to tap into public credit markets; conversely, larger companies may not want to risk the uncertainty or lengthy processes that come with accessing traditional capital markets. Private lenders can fill this financing gap, offering their investors the chance to collect a premium for providing capital where it’s scarce.

Asset class yields

Global infrastructure investment

We can help

Those with the desire—or need—to overcome today’s investment challenges would be remiss not to consider alternative investments.

As always—but especially in alternatives—due diligence and selectivity are essential, as performance can vary widely. 4

Many investors choose to partner with us to narrow the alternative investment universe because of our rigorous scrutiny of managers. Our in-house team conducts on-site visits, examining the structure, operations, incentives and individuals on a manager’s team.

As one of the largest alternatives platforms, we set out to continually bring a carefully curated set of high-conviction opportunities to help you realize your goals.

If you’re interested in learning more about our alternative investment platform, the latest opportunities, and how they may fit in your financial plan, speak with your J.P. Morgan team, or let us reach out to you by filling out the form below.

1 “A Guide to Private Markets,” Hamilton Lane, as of September 2021 for Year 2000. The World Bank, as of November 2023 for Year 2023.

2 Source: U.S. Bureau of Labor Statistics, “Number of Business Establishments by Size of Establishment in Selected Private Industries.” Number of private companies is comprised of U.S. business establishments with 100 or more employees in natural resources and mining, construction, manufacturing, trade, transportation and utilities, information, financial activities, professional and business services, education and health services, leisure and hospitality, and other services as of March 2023. Number of public companies is the sum of companies listed on NYSE and NASDAQ, as of November 2023.

3 J.P. Morgan Asset Management’s Long-Term Capital Market Assumptions 2024. Data as of December 2023.

4 Top-and-bottom-quartile private equity managers, for example, have had, on average, a 21% performance differential. In hedge funds, the difference is 14% between top-quartile and bottom-quartile performing managers. Sources: Burgiss, NCREIF, Morningstar, PivotalPath, J.P. Morgan Asset Management. Data as of November 30, 2023. Manager dispersion for hedge funds is based on annual returns over a 10-year period ending 3Q 2023. Global private equity is represented by the 10-year horizon internal rate of return (IRR) ending 2Q 2023. Past performance is no guarantee of future results. It is not possible to invest in an index.

Alternative Investments

Learn more about alternative investment opportunities, such as private equity, real assets, private credit and hedge funds, to…

Private Equity Investment Strategies

Discover private equity investments with J.P. Morgan Private Bank. Explore various private equity opportunities, strategies, an…

Economy & Markets

Markets & Investing

From market updates to long-term strategic thinking, we tap the extensive knowledge and experience of our economists,…

- Michael Cembalest

- Access to a broader opportunity set of long-term growth potential

- Portfolio diversification for when the going gets tough

- Attractive yield generation

Contact us to discuss how we can help you experience the full possibility of your wealth.

Please tell us about yourself, and our team will contact you.

Contact us to discuss how we can help you experience the full possibility of your wealth. Please tell us about yourself, and our team will contact you.

Thank you for contacting us! We look forward to discussing how we can help you and your family.</h3> " data-failuremsg="There was an error submitting this form">

Enter your First Name

> or < are not allowed

Only 40 characters allowed

Enter your Last Name

Select your country of residence

Enter valid street address

Only 150 characters allowed

Enter your city

Only 35 characters allowed

Select your state

> or < are not allowed

Enter your ZIP code

Please enter a valid zipcode

Only 10 characters allowed

Enter your postal code

Enter your phone number

Enter your email address

Please enter a valid email address

Only 50 characters allowed

Tell Us More About You

Only 1000 characters allowed

> or < are not allowed

Checkbox is not selected

Your Recent History

Important information.

JPMAM Long-Term Capital Market Assumptions

Given the complex risk-reward trade-offs involved, we advise clients to rely on judgment as well as quantitative optimization approaches in setting strategic allocations. Please note that all information shown is based on qualitative analysis. Exclusive reliance on the above is not advised. This information is not intended as a recommendation to invest in any particular asset class or strategy or as a promise of future performance. Note that these asset class and strategy assumptions are passive only – they do not consider the impact of active management. References to future returns are not promises or even estimates of actual returns a client portfolio may achieve. Assumptions, opinions and estimates are provided for illustrative purposes only. They should not be relied upon as recommendations to buy or sell securities. Forecasts of financial market trends that are based on current market conditions constitute our judgment and are subject to change without notice. We believe the information provided here is reliable, but do not warrant its accuracy or completeness. This material has been prepared for information purposes only and is not intended to provide, and should not be relied on for, accounting, legal or tax advice. The outputs of the assumptions are provided for illustration/discussion purposes only and are subject to significant limitations.

“Expected” or “alpha” return estimates are subject to uncertainty and error. For example, changes in the historical data from which it is estimated will result in different implications for asset class returns. Expected returns for each asset class are conditional on an economic scenario; actual returns in the event the scenario comes to pass could be higher or lower, as they have been in the past, so an investor should not expect to achieve returns similar to the outputs shown herein. References to future returns for either asset allocation strategies or asset classes are not promises of actual returns a client portfolio may achieve. Because of the inherent limitations of all models, potential investors should not rely exclusively on the model when making a decision. The model cannot account for the impact that economic, market, and other factors may have on the implementation and ongoing management of an actual investment portfolio. Unlike actual portfolio outcomes, the model outcomes do not reflect actual trading, liquidity constraints, fees, expenses, taxes and other factors that could impact the future returns. The model assumptions are passive only – they do not consider the impact of active management. A manager’s ability to achieve similar outcomes is subject to risk factors over which the manager may have no or limited control.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction, nor is it a commitment from J.P. Morgan Asset Management or any of its subsidiaries to participate in any of the transactions mentioned herein. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice. All information presented herein is considered to be accurate at the time of production. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. In addition, users should make an independent assessment of the legal, regulatory, tax, credit and accounting implications and determine, together with their own financial professional, if any investment mentioned herein is believed to be appropriate to their personal goals. Investors should ensure that they obtain all available relevant information before making any investment. It should be noted that investment involves risks, the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Both past performance and yield are not a reliable indicator of current and future results.

General/Macro Reference only

Investing in alternative assets involves higher risks than traditional investments and is suitable only for sophisticated investors. Alternative investments involve greater risks than traditional investments and should not be deemed a complete investment program. They are generally not tax efficient and an investor should consult with his/her tax advisor prior to investing. Alternative investments have higher fees than traditional investments and they may also be highly leveraged and engage in speculative investment techniques, which can magnify the potential for investment loss or gain. The value of the investment may fall as well as rise and investors may get back less than they invested.

Real Estate/Hedge Funds/Other Private Investments

Real estate, hedge funds, and other private investments may not be suitable for all individual investors, may present significant risks, and may be sold or redeemed at more or less than the original amount invested. Private investments are offered only by offering memoranda, which more fully describe the possible risks. There are no assurances that the stated investment objectives of any investment product will be met. Hedge funds (or funds of hedge funds): often engage in leveraging and other speculative investment practices that may increase the risk of investment loss; can be highly illiquid; are not required to provide periodic pricing or valuation information to investors; may involve complex tax structures and delays in distributing important tax information; are not subject to the same regulatory requirements as mutual funds; and often charge high fees. Further, any number of conflicts of interest may exist in the context of the management and/or operation of any hedge fund.

Investing in alternative assets involves higher risks than traditional investments and is suitable only for sophisticated investors. Alternative investments involve greater risks than traditional investments and should not be deemed a complete investment program. They are not tax-efficient and an investor should consult with his/her tax advisor prior to investing. Alternative investments have higher fees than traditional investments and they may also be highly leveraged and engage in speculative investment techniques, which can magnify the potential for investment loss or gain. The value of the investment may fall as well as rise, and investors may get back less than they invested. Diversification and asset allocation does not ensure a profit or protect against loss.

Private investments are subject to special risks. Individuals must meet specific suitability standards before investing. This information does not constitute an offer to sell or a solicitation of an offer to buy. As a reminder, hedge funds (or funds of hedge funds), private equity funds and real estate funds often engage in leveraging and other speculative investment practices that may increase the risk of investment loss. These investments can be highly illiquid, and are not required to provide periodic pricing or valuation information to investors, and may involve complex tax structures and delays in distributing important tax information. These investments are not subject to the same regulatory requirements as mutual funds; and often charge high fees. Further, any number of conflicts of interest may exist in the context of the management and/or operation of any such fund. For complete information, please refer to the applicable offering memorandum.

As a reminder, hedge funds (or funds of hedge funds) often engage in leveraging and other speculative investment practices that may increase the risk of investment loss. These investments can be highly illiquid, and are not required to provide periodic pricing or valuation information to investors, and may involve complex tax structures and delays in distributing important tax information. These investments are not subject to the same regulatory requirements as mutual funds; and often charge high fees. Further, any number of conflicts of interest may exist in the context of the management and/or operation of any such fund. For complete information, please refer to the applicable offering memorandum.

Real Estate Investments Trusts may be subject to a high degree of market risk because of concentration in a specific industry, sector or geographical sector. Real estate investments may be subject to risks including, but not limited to, declines in the value of real estate, risks related to general and economic conditions, changes in the value of the underlying property owned by the trust and defaults by borrower.

This material is for informational purposes only, and may inform you of certain products and services offered by private banking businesses, part of JPMorgan Chase & Co. (“JPM”). Products and services described, as well as associated fees, charges and interest rates, are subject to change in accordance with the applicable account agreements and may differ among geographic locations. Not all products and services are offered at all locations. If you are a person with a disability and need additional support accessing this material, please contact your J.P. Morgan team or email us at [email protected] for assistance. Please read all Important Information.

General Risks & Considerations

Any views, strategies or products discussed in this material may not be appropriate for all individuals and are subject to risks. Investors may get back less than they invested, and past performance is not a reliable indicator of future results. Asset allocation/diversification does not guarantee a profit or protect against loss. Nothing in this material should be relied upon in isolation for the purpose of making an investment decision. You are urged to consider carefully whether the services, products, asset classes (e.g. equities, fixed income, alternative investments, commodities, etc.) or strategies discussed are suitable to your needs. You must also consider the objectives, risks, charges, and expenses associated with an investment service, product or strategy prior to making an investment decision. For this and more complete information, including discussion of your goals/situation, contact your J.P. Morgan team.

Non-Reliance

Certain information contained in this material is believed to be reliable; however, JPM does not represent or warrant its accuracy, reliability or completeness, or accept any liability for any loss or damage (whether direct or indirect) arising out of the use of all or any part of this material. No representation or warranty should be made with regard to any computations, graphs, tables, diagrams or commentary in this material, which are provided for illustration/reference purposes only. The views, opinions, estimates and strategies expressed in this material constitute our judgment based on current market conditions and are subject to change without notice. JPM assumes no duty to update any information in this material in the event that such information changes. Views, opinions, estimates and strategies expressed herein may differ from those expressed by other areas of JPM, views expressed for other purposes or in other contexts, and this material should not be regarded as a research report . Any projected results and risks are based solely on hypothetical examples cited, and actual results and risks will vary depending on specific circumstances. Forward-looking statements should not be considered as guarantees or predictions of future events.

Nothing in this document shall be construed as giving rise to any duty of care owed to, or advisory relationship with, you or any third party. Nothing in this document shall be regarded as an offer, solicitation, recommendation or advice (whether financial, accounting, legal, tax or other) given by J.P. Morgan and/or its officers or employees, irrespective of whether or not such communication was given at your request. J.P. Morgan and its affiliates and employees do not provide tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any financial transactions.

IMPORTANT INFORMATION ABOUT Your investments and potential conflicts of interest

Conflicts of interest will arise whenever JPMorgan Chase Bank, N.A. or any of its affiliates (together, “J.P. Morgan”) have an actual or perceived economic or other incentive in its management of our clients’ portfolios to act in a way that benefits J.P. Morgan. Conflicts will result, for example (to the extent the following activities are permitted in your account): (1) when J.P. Morgan invests in an investment product, such as a mutual fund, structured product, separately managed account or hedge fund issued or managed by JPMorgan Chase Bank, N.A. or an affiliate, such as J.P. Morgan Investment Management Inc.; (2) when a J.P. Morgan entity obtains services, including trade execution and trade clearing, from an affiliate; (3) when J.P. Morgan receives payment as a result of purchasing an investment product for a client’s account; or (4) when J.P. Morgan receives payment for providing services (including shareholder servicing, recordkeeping or custody) with respect to investment products purchased for a client’s portfolio. Other conflicts will result because of relationships that J.P. Morgan has with other clients or when J.P. Morgan acts for its own account.

Investment strategies are selected from both J.P. Morgan and third-party asset managers and are subject to a review process by our manager research teams. From this pool of strategies, our portfolio construction teams select those strategies we believe fit our asset allocation goals and forward-looking views in order to meet the portfolio’s investment objective.

As a general matter, we prefer J.P. Morgan managed strategies. We expect the proportion of J.P. Morgan managed strategies will be high (in fact, up to 100 percent) in strategies such as, for example, cash and high-quality fixed income, subject to applicable law and any account-specific considerations.

While our internally managed strategies generally align well with our forward-looking views, and we are familiar with the investment processes as well as the risk and compliance philosophy of the firm, it is important to note that J.P. Morgan receives more overall fees when internally managed strategies are included. We offer the option of choosing to exclude J.P. Morgan managed strategies (other than cash and liquidity products) in certain portfolios.

Legal entity, brand & regulatory information

In the United States , bank deposit accounts and related services, such as checking, savings and bank lending, are offered by JPMorgan Chase Bank, N.A. Member FDIC.

JPMorgan Chase Bank, N.A. and its affiliates (collectively “JPMCB” ) offer investment products, which may include bank managed investment accounts and custody, as part of its trust and fiduciary services. Other investment products and services, such as brokerage and advisory accounts, are offered through J.P. Morgan Securities LLC (“JPMS”) , a member of FINRA and SIPC . Insurance products are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. JPMCB, JPMS and CIA are affiliated companies under the common control of JPM. Products not available in all states.

In Germany , this material is issued by J.P. Morgan SE , with its registered office at Taunustor 1 (TaunusTurm), 60310 Frankfurt am Main, Germany, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB). In Luxembourg , this material is issued by J.P. Morgan SE – Luxembourg Branch , with registered office at European Bank and Business Centre, 6 route de Treves, L-2633, Senningerberg, Luxembourg, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB); J.P. Morgan SE – Luxembourg Branch is also supervised by the Commission de Surveillance du Secteur Financier (CSSF); registered under R.C.S Luxembourg B255938. In the United Kingdom , this material is issued by J.P. Morgan SE – London Branch , registered office at 25 Bank Street, Canary Wharf, London E14 5JP, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB); J.P. Morgan SE – London Branch is also supervised by the Financial Conduct Authority and Prudential Regulation Authority. In Spain , this material is distributed by J.P. Morgan SE, Sucursal en España , with registered office at Paseo de la Castellana, 31, 28046 Madrid, Spain, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB); J.P. Morgan SE, Sucursal en España is also supervised by the Spanish Securities Market Commission (CNMV); registered with Bank of Spain as a branch of J.P. Morgan SE under code 1567. In Italy , this material is distributed by J.P. Morgan SE – Milan Branch , with its registered office at Via Cordusio, n.3, Milan 20123, Italy, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB); J.P. Morgan SE – Milan Branch is also supervised by Bank of Italy and the Commissione Nazionale per le Società e la Borsa (CONSOB); registered with Bank of Italy as a branch of J.P. Morgan SE under code 8076; Milan Chamber of Commerce Registered Number: REA MI 2536325. In the Netherlands , this material is distributed by J.P. Morgan SE – Amsterdam Branch , with registered office at World Trade Centre, Tower B, Strawinskylaan 1135, 1077 XX, Amsterdam, The Netherlands, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB); J.P. Morgan SE – Amsterdam Branch is also supervised by De Nederlandsche Bank (DNB) and the Autoriteit Financiële Markten (AFM) in the Netherlands. Registered with the Kamer van Koophandel as a branch of J.P. Morgan SE under registration number 72610220. In Denmark , this material is distributed by J.P. Morgan SE – Copenhagen Branch, filial af J.P. Morgan SE, Tyskland , with registered office at Kalvebod Brygge 39-41, 1560 København V, Denmark, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB); J.P. Morgan SE – Copenhagen Branch, filial af J.P. Morgan SE, Tyskland is also supervised by Finanstilsynet (Danish FSA) and is registered with Finanstilsynet as a branch of J.P. Morgan SE under code 29010. In Sweden , this material is distributed by J.P. Morgan SE – Stockholm Bankfilial , with registered office at Hamngatan 15, Stockholm, 11147, Sweden, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB); J.P. Morgan SE – Stockholm Bankfilial is also supervised by Finansinspektionen (Swedish FSA); registered with Finansinspektionen as a branch of J.P. Morgan SE. In Belgium , this material is distributed by J.P. Morgan SE – Brussels Branch with registered office at 35 Boulevard du Régent, 1000, Brussels, Belgium, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB); J.P. Morgan SE Brussels Branch is also supervised by the National Bank of Belgium (NBB) and the Financial Services and Markets Authority (FSMA) in Belgium; registered with the NBB under registration number 0715.622.844. In Greece , this material is distributed by J.P. Morgan SE – Athens Branch , with its registered office at 3 Haritos Street, Athens, 10675, Greece, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB); J.P. Morgan SE – Athens Branch is also supervised by Bank of Greece; registered with Bank of Greece as a branch of J.P. Morgan SE under code 124; Athens Chamber of Commerce Registered Number 158683760001; VAT Number 99676577. In France , this material is distributed by J.P. Morgan SE – Paris Branch, with its registered office at 14, Place Vendome 75001 Paris, France, authorized by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) and jointly supervised by the BaFin, the German Central Bank (Deutsche Bundesbank) and the European Central Bank (ECB) under code 842 422 972; J.P. Morgan SE – Paris Branch is also supervised by the French banking authorities the Autorité de Contrôle Prudentiel et de Résolution (ACPR) and the Autorité des Marchés Financiers (AMF). In Switzerland , this material is distributed by J.P. Morgan (Suisse) SA , with registered address at rue du Rhône, 35, 1204, Geneva, Switzerland, which is authorised and supervised by the Swiss Financial Market Supervisory Authority (FINMA) as a bank and a securities dealer in Switzerland.

This communication is an advertisement for the purposes of the Markets in Financial Instruments Directive (MIFID II) and the Swiss Financial Services Act (FINSA). Investors should not subscribe for or purchase any financial instruments referred to in this advertisement except on the basis of information contained in any applicable legal documentation, which is or shall be made available in the relevant jurisdictions (as required).

In Hong Kong , this material is distributed by JPMCB, Hong Kong branch . JPMCB, Hong Kong branch is regulated by the Hong Kong Monetary Authority and the Securities and Futures Commission of Hong Kong. In Hong Kong, we will cease to use your personal data for our marketing purposes without charge if you so request. In Singapore , this material is distributed by JPMCB, Singapore branch . JPMCB, Singapore branch is regulated by the Monetary Authority of Singapore. Dealing and advisory services and discretionary investment management services are provided to you by JPMCB, Hong Kong/Singapore branch (as notified to you). Banking and custody services are provided to you by JPMCB Singapore Branch. The contents of this document have not been reviewed by any regulatory authority in Hong Kong, Singapore or any other jurisdictions. You are advised to exercise caution in relation to this document. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. For materials which constitute product advertisement under the Securities and Futures Act and the Financial Advisers Act, this advertisement has not been reviewed by the Monetary Authority of Singapore. JPMorgan Chase Bank, N.A., a national banking association chartered under the laws of the United States, and as a body corporate, its shareholder’s liability is limited.

With respect to countries in Latin America , the distribution of this material may be restricted in certain jurisdictions. We may offer and/or sell to you securities or other financial instruments which may not be registered under, and are not the subject of a public offering under, the securities or other financial regulatory laws of your home country. Such securities or instruments are offered and/or sold to you on a private basis only. Any communication by us to you regarding such securities or instruments, including without limitation the delivery of a prospectus, term sheet or other offering document, is not intended by us as an offer to sell or a solicitation of an offer to buy any securities or instruments in any jurisdiction in which such an offer or a solicitation is unlawful. Furthermore, such securities or instruments may be subject to certain regulatory and/or contractual restrictions on subsequent transfer by you, and you are solely responsible for ascertaining and complying with such restrictions. To the extent this content makes reference to a fund, the Fund may not be publicly offered in any Latin American country, without previous registration of such fund´s securities in compliance with the laws of the corresponding jurisdiction.

JPMorgan Chase Bank, N.A. (JPMCBNA) (ABN 43 074 112 011/AFS Licence No: 238367) is regulated by the Australian Securities and Investment Commission and the Australian Prudential Regulation Authority. Material provided by JPMCBNA in Australia is to “wholesale clients” only. For the purposes of this paragraph the term “wholesale client” has the meaning given in section 761G of the Corporations Act 2001 (Cth). Please inform us if you are not a Wholesale Client now or if you cease to be a Wholesale Client at any time in the future.

JPMS is a registered foreign company (overseas) (ARBN 109293610) incorporated in Delaware, U.S.A. Under Australian financial services licensing requirements, carrying on a financial services business in Australia requires a financial service provider, such as J.P. Morgan Securities LLC (JPMS), to hold an Australian Financial Services Licence (AFSL), unless an exemption applies. JPMS is exempt from the requirement to hold an AFSL under the Corporations Act 2001 (Cth) (Act) in respect of financial services it provides to you, and is regulated by the SEC, FINRA and CFTC under US laws, which differ from Australian laws. Material provided by JPMS in Australia is to “wholesale clients” only. The information provided in this material is not intended to be, and must not be, distributed or passed on, directly or indirectly, to any other class of persons in Australia. For the purposes of this paragraph the term “wholesale client” has the meaning given in section 761G of the Act. Please inform us immediately if you are not a Wholesale Client now or if you cease to be a Wholesale Client at any time in the future.

This material has not been prepared specifically for Australian investors. It:

- May contain references to dollar amounts which are not Australian dollars;

- May contain financial information which is not prepared in accordance with Australian law or practices;

- May not address risks associated with investment in foreign currency denominated investments; and

- Does not address Australian tax issues.

References to “J.P. Morgan” are to JPM, its subsidiaries and affiliates worldwide. “J.P. Morgan Private Bank” is the brand name for the private banking business conducted by JPM. This material is intended for your personal use and should not be circulated to or used by any other person, or duplicated for non-personal use, without our permission. If you have any questions or no longer wish to receive these communications, please contact your J.P. Morgan team.

© $$YEAR JPMorgan Chase & Co. All rights reserved.

LEARN MORE About Our Firm and Investment Professionals Through FINRA Brokercheck

To learn more about J.P. Morgan’s investment business, including our accounts, products and services, as well as our relationship with you, please review our J.P. Morgan Securities LLC Form CRS and Guide to Investment Services and Brokerage Products .

JPMorgan Chase Bank, N.A. and its affiliates (collectively "JPMCB") offer investment products, which may include bank-managed accounts and custody, as part of its trust and fiduciary services. Other investment products and services, such as brokerage and advisory accounts, are offered through J.P. Morgan Securities LLC ("JPMS"), a member of FINRA and SIPC . Insurance products are made available through Chase Insurance Agency, Inc. (CIA), a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. JPMCB, JPMS and CIA are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states.

Please read the Legal Disclaimer for key important J.P. Morgan Private Bank information in conjunction with these pages.

INVESTMENT AND INSURANCE PRODUCTS ARE: • NOT FDIC INSURED • NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY • NOT A DEPOSIT OR OTHER OBLIGATION OF, OR GUARANTEED BY, JPMORGAN CHASE BANK, N.A. OR ANY OF ITS AFFILIATES • SUBJECT TO INVESTMENT RISKS, INCLUDING POSSIBLE LOSS OF THE PRINCIPAL AMOUNT INVESTED

The page you are looking for is on the J.P. Morgan Private Bank {{REGION}} site.

Would you like to be redirected?

You're Now Leaving J.P. Morgan

J.P. Morgan’s website and/or mobile terms, privacy and security policies don’t apply to the site or app you're about to visit. Please review its terms, privacy and security policies to see how they apply to you. J.P. Morgan isn’t responsible for (and doesn’t provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the J.P. Morgan name.

- Capital Markets

- Global Asset Management

- S&P Dow Jones Indices

- S&P Global Market Intelligence

- S&P Global Mobility

- S&P Global Commodity Insights

- S&P Global Ratings

- S&P Global Sustainable1

- Investor Relations Overview

- Investor Presentations

- Investor Fact Book

- News Releases

- Quarterly Earnings

- SEC Filings & Reports

- Executive Committee

- Corporate Governance

- Merger Information

- Stock & Dividends

- Shareholder Services

- Contact Investor Relations

- Email Subscription Center

- Media Center

Case Study: Alternative Investment Funds Scorecard

Equity Issuance Proceeds Increase in Q1; IPO Performance Improves

Investment Banking Essentials: April 17

Investment Banking Essentials: April 3

Investment Banking Essentials: March 6

- 23 Jul, 2021

- Author Suming Xue

- Theme Capital Markets Credit Analysis

- Segment Investment Banking Investment Management Private Equity

- Tags Credit Assessment Scorecards Alternative Investment Funds

Alternative Investment Funds (AIFs) provide an option to invest in different asset classes − such as venture capital, private credit, and hedge funds − primarily for Limited Partners (LPs) that are typically large pension funds, endowments, and family offices. The trend toward fund financing for AIFs, where a lender takes risk against the uncalled capital of the underlying investors, has become popular since it can help aid a fund's liquidity and boost the Internal Rate of Return (IRR).

Fund financing continues to grow in popularity. It is especially attractive in today’s environment as funds actively seek liquidity due to the economic slowdown caused by the COVID-19 pandemic and lenders look to enhance yield given low interest rates. Fund financing methods include subscription-line facilities, Net Asset Value (NAV) or asset-backed facilities, and a range of other structures at the fund level. This increased leverage within the AIF universe poses potential credit risks to various lenders to the funds.

This case study looks at how to enable the credit risk and fund finance teams at financial institutions and other lending organizations to assess the creditworthiness of AIFs.

Learn more about Alternative Investment Funds (AIFs)

- DOWNLOAD THE FULL REPORT

Leveraging a Comprehensive Alternative Investment Funds (AIFs) Scorecard

Fund financing through a credit lens understanding the basics of alternative investment funds aifs.

- Capital Markets Credit Analysis

- Investment Banking Investment Management Private Equity

- Credit Assessment Scorecards Alternative Investment Funds

- Get 7 Days Free

The (Limited) Case for Investing in Alternatives

Does Vanguard’s recent private-equity announcement bolster the argument for alts?

/s3.amazonaws.com/arc-authors/morningstar/2e13370a-bbfe-4142-bc61-d08beec5fd8c.jpg)

Vanguard's recent announcement that it is launching a private-equity strategy brings front and center (not for the first time) the question of whether (and to what degree) individuals should allocate some portion of their portfolio to alternatives. Granted, Vanguard is initially making the product available only to institutional clients, but given Vanguard's vast retail presence, not to mention CEO Tim Buckley's statement that its partnership with HarbourVest Partners "will present an incredible opportunity" for individuals investors, one suspects that it's only a matter of time.

The notion of “hedge funds for the masses” is hardly new. The boom in liquid alternative mutual funds after the 2008 financial crisis was supposed to provide individual investors with a tantalizing opportunity to access the same types of strategies typically reserved for institutions and the ultra-wealthy, all at a fraction of the cost and with increased transparency and liquidity. Has the reality matched the hype? Should investors look to take advantage of alternative asset classes, whether in liquid public or illiquid private investment structures?

What We Talk About When We Talk About Alternatives There's no single agreed-upon definition of what constitutes alternatives, but broadly speaking we can think of alternatives as strategies or asset classes that provide low correlations to the traditional portfolio building blocks of stocks and bonds, and thus serve to diversify a portfolio and improve its risk-adjusted performance (or its portfolio efficiency, in the lingo of Markowitzian Modern Portfolio Theory). A somewhat more expansive version of the definition incorporates illiquidity as a trait of alternatives, thus bringing private equity into the fold, despite its meaningful correlations with growth equity (as AQR's Cliff Asness recently argued , PE can be thought of as analogous to a leveraged small-cap growth portfolio). While some hedge fund strategies, such as merger-arbitrage, equity market-neutral, and managed-futures, have proved readily adaptable to liquid structures (minus excessive leverage), less-liquid strategies such as private equity and distressed debt do not work so well in open-end vehicles.

The Endowment Effect Alternatives have achieved their current reputation and mystique in large part because of the success of the Yale endowment under David Swensen, in what has come to be known as the endowment model. Beginning in the 1980s, Swensen eschewed the typical practice of investing heavily in bonds and stocks, turning instead to private equity, hedge funds, and real assets such as timberland. Other major university endowments adopted the model, and soon enough many pensions also turned copycat. According to the NACUBO-TIAA 2019 study of endowments, the dollar-weighted average allocation to alternatives across all endowments and foundations it surveys was nearly 40%, with another 12% in real assets.

It is understandable that people would look at the track record and tactics of the best institutional investors and say, "Hey, let’s adopt that model for individuals!" It’s also an oversimplification. There are several critical distinctions that make the endowment model less relevant for individuals, including:

1) Time horizon . Endowments have a perpetual time horizon, giving them an unusual capacity to withstand volatility and illiquidity, an advantage that you, dear reader, likely do not possess. If you are investing for retirement in your 401(k), then you do at least have a time horizon and objective comparable to a pension fund, but if your goals are nearer-term, the case is considerably weaker for incorporating alternatives.

2) Expertise. Hedge fund strategies (as well as their liquid-alternative counterparts) and private equity are more complex and less transparent than traditional investments. Larger endowments and pensions have extensive research groups equipped to do due diligence in these areas, while smaller outfits typically hire out the work to specialist consultants.

3) Access. Most private funds are available only to institutions or individuals who meet accredited investor definitions of income or total wealth (the SEC is currently reviewing some of the existing criteria for accredited investors). Moreover, even for those who meet the criteria, getting access to top-tier funds is often very much an insider's game, limited to investors with previous relationships with the managers.

Theory Versus Practice Putting aside (momentarily) the practical obstacles, the theoretical case for alternatives remains strong--adding noncorrelated assets with positive expected performance to a portfolio should, all things being equal, reduce drawdowns during market sell-offs and improve your overall risk-adjusted results, while some less-liquid assets offer the potential to outperform equities in the long term. Moreover, the anecdotal evidence of endowments and pensions taking up the cause for alternatives further bolsters the case.

But how strong is the case in practice? Here we run into some data-related challenges. Liquid alternatives are a relatively new innovation; of currently surviving liquid alts funds, only around 115 have 10-year records. Hedge fund and private-equity databases and indexes are subject to many well-documented biases, data-validity questions, and performance calculation debates. Still, we can only do the best with the data we have and make decisions based on those findings.

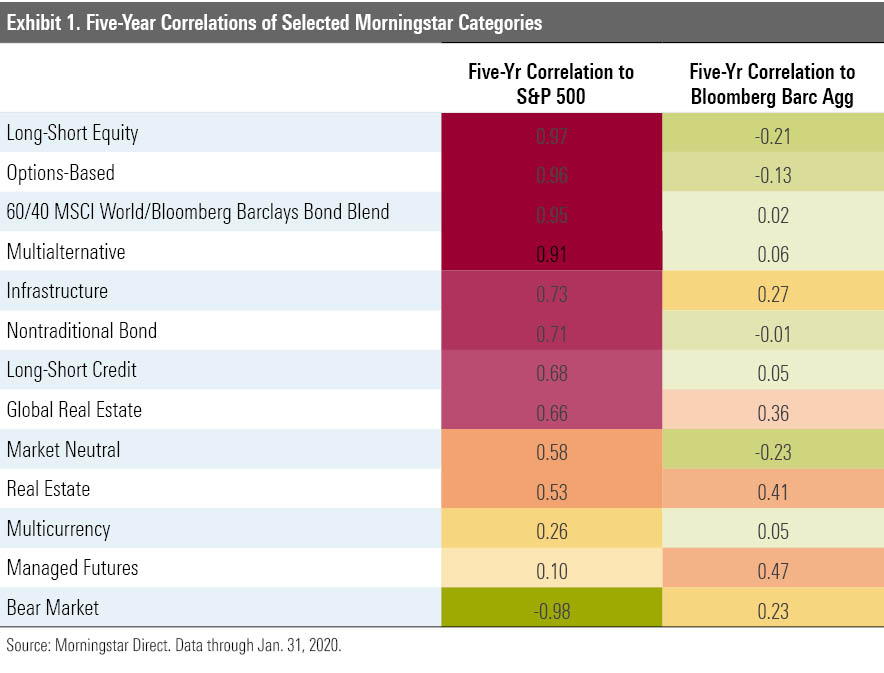

The story told by the available data is, at best, uninspiring. Let’s begin with correlations. Exhibit 1 shows five-year correlations to the S&P 500 and Bloomberg Barclays Aggregate Bond indexes, based on monthly return for Morningstar alternative categories (too few alts funds have 10-year records to produce a robust cohort), plus a few others sometimes considered as alternatives, including nontraditional bond and several real-asset groups. Relative to the stock index, very few categories provided significant correlation benefits. Unsurprisingly, the stock-based long-short equity and options-based categories generate very high correlations with stocks; more surprising is the correspondence of multalternative funds, which are supposed to offer exposure to a range of alternative strategies.

Real estate funds did provide moderate diversification benefits, with a 0.53 correlation over the period, while the 0.58 correlation of market-neutral funds is disconcertingly elevated for a group of funds that are supposed to minimize market exposure (however, a subset of the category, including event-driven and merger-arbitrage funds, does have net long exposure). The only true diversifiers were managed-futures, multicurrency, and bear-market funds, the latter of which bet directly against the market through short positions. The correlations to fixed-income are far lower, but the risk that most investors likely need to diversify away from is equity risk.

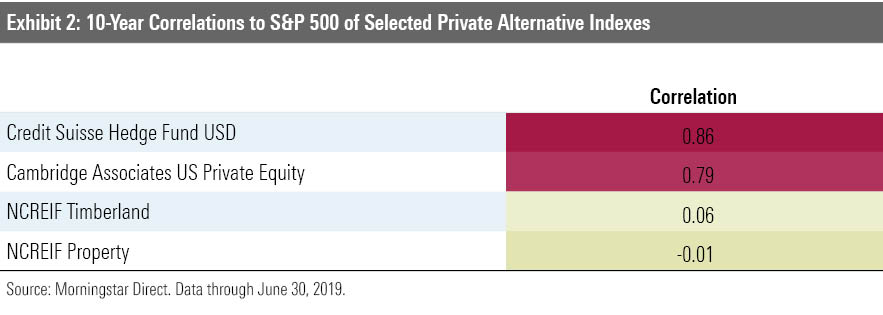

I also looked at the correlations of several private market indexes. Because several of these data providers report performance only quarterly, I used correlation based on quarterly returns through June 30, 2019, but going back 10 years. There was a similar divide here. The two real asset indexes, which are based on direct investments in timberland and property, exhibit very low correlations (however, smoothing characteristics of those indexes may lead to artificially suppressed correlations); at the same time, the hedge fund and private-equity indexes show relatively high correspondences with stocks.

Averages can mask significant variation, of course. These figures don’t mean you cannot get the desired diversification benefits from an alternative fund, but you’ll have to put some work into it. There can be significant dispersion within categories. For example, five-year correlations in the market-neutral category run from 0.87 at the top end to negative 0.81 at the low end, while in the multialternative category, despite high average correlations, one fourth of the funds with five-year track records have correlations of less than 0.30.

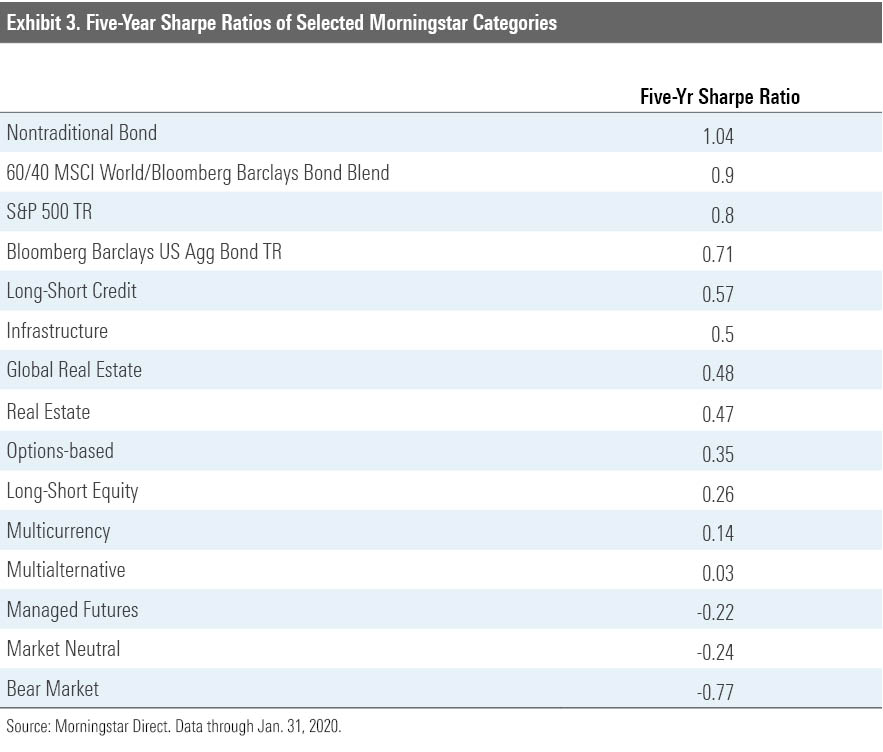

Correlation is only part of the story. Whether offering greater or lesser degrees of correlation, have alternative strategies been additive from a risk-adjusted performance perspective? One way to check this is by eyeballing funds’ Sharpe ratios. Again, the results aren’t particularly persuasive (see Exhibit 3). For comparison purposes, a 60/40 global blended benchmark earned a Sharpe ratio of 0.90 over the five-year period. The only category to beat that benchmark’s Sharpe (admittedly, a strong period for stocks and core bonds) was the nontraditional bond category. Several of the alternative categories produced negligible or even negative Sharpe ratios, disappointingly including lower-correlation areas such as managed-futures and market-neutral.

The private alternative indexes, again using 10-year quarterly returns, generated more attractive performance results. The blended index had a 0.98 Sharpe ratio for the period (slightly better than its five-year result), which was nearly matched by the Credit Suisse Hedge Fund Index, matched by the timberland index, and surpassed by the property and private equity indexes. I take those results with a dash of salt, as the volatility levels (the denominator in the Sharpe formula) are likely suppressed because of smoothing effects (a result of the lagged reporting of values with such investments), inflating the Sharpe as a result. Still, it does seem likely that the private equity and direct real estate, in particular, have provided strong performance and diversification benefits during the past decade.

The generally disappointing results observed in these metrics are reinforced by a study conducted in 2018 by my colleagues Jason Kephart and Maciej Kowara, which used an optimizer to analyze the effects of adding alternatives to a hypothetical 60/40 portfolio. They found that “most liquid alternatives would have failed to improve the starting portfolio” over the three- and five-year periods covered.

Further external confirmation comes by way of CEM Benchmarking's " Hedge Fund Reality Check " study from May 2018. Rather than using hedge funds' own self-reported benchmarks, CEM created customized, investable blended global balanced benchmarks that had high correlations to hedge fund performance, then looked at the excess returns produced by the hedge funds over a 17-year period. On average, the researchers found a net negative value-add of 1.27% annualized relative to those benchmarks; 36% of funds did exceed their benchmarks, but the majority of those did so by only 1% to 3%. The overall result indicates that most hedge funds perform no better than straightforward passive balanced portfolios.

Conclusions and Caveats The empirical case for including alternatives as a diversifier to equity risk and as a return enhancer is less persuasive than the theoretical case. Private funds may offer better results, but access to them is limited, and even then the benefits are often uncertain. Private equity likely offers the best long-term potential, but access is limited and lockup periods are long (at least until more retail-friendly options emerge from Vanguard or other innovators). Real assets offer some diversification potential, but their value may lie more in their value as an inflation hedge, an area I have not pursued in this article but plan to in the future.

One big caveat lies behind all of the above. These results are based on historical (and often limited) data, and the future could look very different. In particular, it is worth noting that the past decade has seen a virtually uninterrupted equity bull market, along with a strong market propelled by declining interest rates, featuring unusually low and stable volatility. Alternative strategies tend to fare better during periods of elevated volatility and market stress, and many are further boosted by higher interest rates. Whether or how long the past decade’s market conditions can continue is anyone’s guess. One lingering concern, however, is the heightened correlations noted above and in the Kephart/Kowara study, raising the question of whether they will offer protection in a drawdown scenario. Many reasons have been suggested for the rise in correlations; one could be that managers have increased beta exposure in light of the strong equity markets and could easily shift back, given their wide mandates. Other explanations point to structural factors that might make it more difficult to disentangle certain hedge fund strategies from the broader markets.

This is not to say that individual investors should never make allocations to alternatives. Given the greater complexities, risks, fees, and potential for adverse selection with alternatives, the bar should be much higher for deciding to invest. Unlike the 30%-plus allocations to alternatives seen with many endowments, or the 15% to 20% allocations typical of pension funds, individuals would be better off restricting allocations to the 3% to 10% range--enough to have some impact on the portfolio but not so high as to potentially imperil the portfolio. Selecting a range of strategy types, or a multistrategy fund, will help mitigate the risk of idiosyncratic events. Focusing on funds that earn Morningstar Analyst Ratings of Bronze or better and which offer low correlations to equities or fixed income (depending on which risk you wish to diversify away from) can also help lead to better outcomes. If you meet accredited investor criteria and have access to private products through a wealth advisor, the case for alternatives may be yet stronger.

If you are investing through your 401(k), you likely won’t find stand-alone alternatives as an option, as their fees and idiosyncrasies make them unpalatable to most plan sponsors. To my mind, allocation or target-date funds that incorporate alternatives would be the most sensible route for individual investors; unfortunately, there aren’t that many options that do so. Vanguard Managed Payout VPGDX allocates about 12% of assets to Vanguard Alternative Strategies VASFX Other firms have incorporated direct real estate into CIT versions of their target-date products, while Vantagepoint announced last year that it would gradually incorporate private equity into its CIT target-date funds. Some large U.S. firms have taken a more innovative tack with custom retirement offerings, incorporating hedge funds and private equity into such products, leveraging work they have already done on the defined-benefit side of their investment committees. Such products can make sense because the long time horizon for retirement investing aligns with the less-liquid nature of many alternatives, and investors in defined-contribution plans have shown little tendency to trade out of investments like target-date funds, even during the 2008 bear market.

More in Alternative Investments

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HTLB322SBJCLTLWYSDCTESUQZI.png)

How to Use Alternatives in Your Portfolio

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TAIQTNFTKRDL7JUP4N4CX7SDKI.png)

Will the Institutional Private Equity Push Leave Investors With Scraps?

What’s unique about private equity, about the author, josh charlson.

Josh Charlson, CFA, is a director, manager selection, for Morningstar Research Services LLC, a wholly owned subsidiary of Morningstar, Inc. Charlson provides fiduciary services for retirement plans and is responsible for selecting portfolio managers and mutual funds.

Previously, Charlson was a director of manager research focused on alternatives research. He was an editor of the Alternative Investments Observer, a quarterly newsletter. Charlson was also a member of Morningstar's ratings committee for alternative strategies and the stewardship committee that oversees the manager research team's assessment of fund companies.

Before assuming the role overseeing the alternatives team in 2014, Charlson was a strategist for the manager research team, covering a number of risk parity, target-date, and other fund-of-funds strategies. He oversaw Morningstar's annual target-date series research white papers as well as its quarterly target-date series reports and ratings.

Prior to Charlson's role as a strategist, he served as a hedge fund analyst for Morningstar for two years and as a senior editor for Morningstar Associates for seven years, where he focused on retirement planning and advice solutions. Charlson began his career at Morningstar as a mutual fund analyst.

Charlson holds a bachelor's degree in English from the University of Michigan, as well as a master's degree and doctorate in English from Northwestern University. He also holds the Chartered Financial Analyst® designation.

Target-Date Funds Have Suffered Losses. What Should Near-Retirees Do?

Integrating sustainable investing: strategies for transitioning a portfolio, integrating sustainable investing: the landscape of opportunities, integrating sustainable investing: assessing current portfolios, integrating sustainable investing: defining client goals, integrating esg into your client's portfolio, how to invest in your 401(k), putting infrastructure to work in your portfolio, when it comes to funds, read the fine print, how to pick a large-value fund, sponsor center.

- Program Overviews

- Stackable Credential Program

- Digital Assets Microcredential

- Private Debt Microcredential

- Fundamentals of Alternative Investments

- Financial Data Professional Charter

- Chapter Events

- Industry Events

- Thought Leadership

- Capital Decanted Podcast

- Educational Alpha Podcast

- Chronicles Newsletter

- Multimedia Library

- Publications

- Academic Partners

- Association Partners

- DEI Initiative

- CAIA Foundation

- Jobs at CAIA

- Official Merchandise

Welcome to Portfolio for the Future™!

Alternative Investments: Investment Allocations 5 Questions to Ask

- Manager Selection

- Risk Management

Chris Carsley CFA | CAIA: Chief Investment Officer & Managing Partner, Kirkland Capital ; Group & Chief Investment Officer & Managing Partner Arch River Capital

John Canorro CFA | CAIA: Director of Operational Due Diligence, Pathstone

Introduction

Enclosed is the second edition of our white paper mini-series on due diligence red flags in alternative investments. As previewed in the introductory paper , this edition will focus on the process managers use to allocate investment opportunities, i.e., how managers decide which investments go into which funds or accounts. This process, referred to as the investment allocation process, or “allocations” for short, is a critical component to the due diligence process because the interests of the manager and investors are not always aligned. The paper’s case study will delve into BlueCrest Capital Management Limited (“BlueCrest,” “the Manager,” or “the Firm”) and the conflicts of interest that existed as a result of inadequate compliance processes governing the allocation of resources between the Firm’s flagship fund, that held external client capital, and an internal, employees and affiliates only, fund that ultimately resulted in the Firm agreeing to a $170m settlement with the SEC.

Investment firms typically manage multiple funds where the underlying strategies of those funds have some degree of overlap. For example, a manager may manage, on the one hand, a fund focused on investment opportunities in Europe, and on the other hand, a fund focused on investment opportunities globally. Continuing with this example, the manager must decide, in a fair and equitable manner, how to allocate investment opportunities in Europe between A) the European fund, and B) the global fund, which would also include Europe as part of its investment mandate.

The industry standard, or default, is to allocate investments based on the proportional demand of the underlying strategies. This allocation methodology is commonly referred to as “pro-rata.” Sticking with our current example, if the manager identifies an investment opportunity in Europe with $10m of capacity, and the European fund desires $15m of that opportunity and the Global fund wants $25m of that opportunity, then the European and Global fund will receive allocations of $3.75m and $6.25m, respectively [i] .

It is imperative for investors to understand the investment allocation process when performing due diligence on an investment manager because interests between the manager and investors can, and often do, conflict within this area. These conflicts of interest can create misalignment between manager and investor, potentially resulting in negative investor outcomes. For investment managers that are registered with the Securities and Exchange Commission “SEC”, they are legally bound by their Fiduciary Duty to fairly allocate trades, and where conflicts of interest may exist, must fully disclose those conflicts. [ii] Provided below are scenarios where conflicts of interest, as they pertain to investment allocations, often come to light:

- The manager charges higher management fees in Fund A vs Fund B : Therefore, the manager is possibly incentivized to place assets with higher expected returns into Fund A vs. Fund B.

- The manager charges an incentive fee in Fund A, but not Fund B : Fund A might be an unregistered limited partnership, a.k.a. a hedge fund, and Fund B might be a mutual fund or UCIT fund version of the hedge fund. In this scenario, the manager can charge significantly higher fees in Fund A vs Fund B, and because of the potential for higher fee income, may be conflicted in equitably allocating investment opportunities between the funds.

- The manager may have a higher proportion of his or her personal capital invested in Fund A rather than Fund B : Alternatively, the firm may have set up a separate investment vehicle specifically for employees and affiliates of the firm. In either situation, the manager may be conflicted in equitably allocating the investment between funds where they have differing ownership levels. In the latter situation, where a manager has created a separate, employee only investment vehicle, the manager may have a material conflict of interest in allocating investments between a fund where they have A) an indirect ownership given the fees they collect and B) the vehicle where they directly own the underlying assets (more on this scenario in our case study!).

Questions to Ask

Given this backdrop, what are some questions that investors can use to either 1) identify scenarios where the allocation of investment opportunities may be an issue, or 2) if an investor has already flagged allocations as an issue, to then determine the severity of the problem? The introductory paper , noted some of these questions. They are reproduced below with potential remedies that we have used when conducting due diligence:

- Request and review the manager’s trade allocation policy. For SEC registered investment advisors, this will likely be disclosed in the manager’s ADV materials. Additionally, review the allocations of real trades with the manager to see if the actual allocations of various trades are consistent with the policy. When possible, do not let the manager choose the example transaction(s). Instead, pick a trade(s) at random, or, if practical, review the entire trade book.

- Ask the question directly to the manager,

- Examine the manager’s regulatory filings for any vehicles that don’t contain investors unaffiliated with the investment manager, and

- Review an allocation of actual trades with the manager to see how it was allocated (as described above).

- There is an ongoing and non-investor friendly trend in the alternative investment space where the limited partnership agreements (“LPAs”) that govern non-registered funds include language that dilutes the manager’s fiduciary duty to its investors by disclosing that the manager may act in its own best interest, rather than its clients’ best interests, in areas where the manager’s interests may conflict with those of its clients or limited partners. Any dilution of a manager’s fiduciary duty is inconsistent with ILPA guidelines. [iii] Furthermore, the SEC is actively looking into these types of activities and may introduce legislation to limit these practices. [iv]

- Where applicable, use legal counsel with expertise in fund structure and operations to review private fund LPAs. Furthermore, it is helpful to continually educate your manager due diligence team on changing rules.

- Review the audits or holdings for the funds where strategies overlap and identify common positions. Then review the trade allocations for trades where a manager traded in commonly held names. This exercise can be particularly helpful when funds either initiate or liquidate a position in a given security or company.

- Obtain the specifications of what is deemed a “best idea.” Specifically, is labeling a position as a “best idea” made ex-ante on empirical data, or is the manager cherry picking winners on an ex-post basis?

- It is common for LPAs to provide the investment manager with the right to create parallel funds. These vehicles may trade in the same investments as the primary fund. Therefore, it is important to understand how investments are allocated between the parallel and primary funds. In accordance with the ILPA guidelines, the parallel vehicle should have language and provisions, including those regarding fees, that are materially the same as the original fund. [v] As we will see in our case study below, it is also important to determine the timing of investments between vehicles.

Case Study: BlueCrest Capital Management Limited

BlueCrest Capital Management Limited represents a very clear example of the conflicts of interests and negative outcomes that can arise when a manager creates a separate investment vehicle for the exclusive use of employees, or affiliates of the manager, and the manager does not have an adequate compliance infrastructure to ensure prudent investment allocation policies are being followed.

BlueCrest, a London-based hedge fund that, at its peak, managed $36 billion, was forced by the SEC to return $170 million to its investors after the Commission said it prioritized an internal, employee / affiliates only hedge fund, named BSMA, over its flagship fund, referred to herein as BCI, where it managed capital for its outside clients. The following issues are central to understanding the conflicts of interest inherent in this case study [vi] :

- BlueCrest’s human traders generated most of the firm’s historical performance. From 2011 to 2015, defined herein as the “Relevant Period” of the wrongdoing, the Manager reassigned a majority of its existing best performing traders from BCI to BSMA, and then assigned its most promising new hires to BSMA rather than BCI.

- While BlueCrest allocated its high performing human traders to BSMA, it replaced those traders in BCI with an algorithm, called Rates Management Trading, or RMT for short. RMT implemented the trades initiated by the human traders, on behalf of BSMA, on a 1-day trading lag. As you will see when we dig further, RMT materially underperformed the human traders.

- BlueCrest employees and affiliates invested significantly more of their own money in BSMA rather than BCI. Insider ownership of BSMA peaked at $1.79 billion during the Relevant Period, versus $619m in BCI.

- Most surprisingly, and central to the SEC’s order , BlueCrest failed to adequately disclose 1) the existence of BSMA, 2) the movement of traders from BCI to BSMA, and the use of RMT within BCI. Furthermore, BlueCrest’s executive committee specifically instructed the Firm’s Investor Relations department to not proactively disclose BSMA’s existence.

To summarize, 1) BlueCrest allocated its best traders from BCI to BSMA, 2) it replaced the human traders in BCI with an algorithm, RMT, that traded on a 1-day lag relative to BSMA, 3) employees of the firm allocated a significant portion of their personal capital to BSMA, and 4) none of these activities were clearly disclosed to investors or regulators. In 2014, due diligence consultants discovered BSMA and RMT, and once they clearly understood the conflicts of interests at play, they recommended that clients redeem from BCI. As a result, BCI suffered significant redemptions, and BlueCrest ultimately liquidated BCI and returned capital to investors. Today, BlueCrest does not manage outside capital.

Let us now delve a bit further into each of the key elements of this case study. The fact pattern displayed below is based upon the SEC’s order :

The Allocation of Traders Between BCI and BSMA: When BlueCrest launched BSMA, it transferred six traders from BCI to BSMA. Subsequently, the Manager continued allocating existing, high-performing traders to BSMA from BCI, and as the Manager hired new traders, it assigned the most promising of those traders to BSMA rather than BCI. By the end of the Relevant Period, nearly half of BlueCrest’s traders had been transferred from BCI to BSMA [vii] .

BCI’s Allocation to RMT: RMT was designed to replicate the risk profile and profits of BlueCrest’s live traders on a T+1, or next day, basis. However, RMT underperformed the live traders both in terms of profit generation and volatility of returns, i.e., RMT had lower absolute returns combined with a higher standard deviation of returns. For example, BlueCrest’s own reports showed that RMT’s slippage relative to live traders was 60%-75% since inception. In dollar terms, the slippage was $198 million during just the first half of 2014 and $116m during the first five months of 2015 [viii] . Despite the underperformance, BCI’s allocation to live traders decreased from $12.5b in January 2012 to $7.4b in June 2015, and the Fund’s allocation to RMT increased from $0b to $7.2b during that same period. Simultaneously, BSMA’s allocation to live traders increased from $4.5b to over $22b [ix] .

BlueCrest’s compensation structure created a further incentive for the Manager to allocate investor capital in BCI to RMT. Taking a step back, hedge fund managers typically charge investors 20% of the annual profits generated by a fund. This fee is called the carried interest. BlueCrest paid its live traders approximately 15%-18% of the trading profits they generated as part of their annual bonus. However, BlueCrest did not have to allocate part of BCI’s carried interest to their personnel that managed the RMT trade replication process. As a result, BlueCrest could retain a greater percentage of performance fees [x] .

Lack of Disclosures: Prior to 2014, BlueCrest did not disclose the existence of BSMA, nor did they disclose BCI’s increasing reliance on RMT in any of the firm’s due diligence questionnaires (“DDQs”), investor letters, investor presentation or other marketing materials [xi] . Instead, the Manager advertised the performance of its live traders to prospective BCI investors but failed to disclose that many high performing traders had been transferred from BCI to BSMA. For example, BlueCrest’s 2012 DDQ stated that “traders actively manage portfolios and dramatically adjust positions in real-time,” while in actuality, 24% of BCI’s capital at the time was managed through RMT [xii] .

In terms of regulatory filings, BlueCrest did identify BSMA in Parts 5 and 10 of its Form ADV Part 2A brochure. BlueCrest then omitted BSMA in its next brochure filing on July 10 th , 2012 and continued to omit BSMA in all subsequent filings during the Relevant Period. BlueCrest followed a similar pattern of disclosing BSMA in its Form ADV, i.e., it initially disclosed the Fund in March and July of 2012 but then omitted the Fund from all subsequent filings [xiii] . The reasoning behind the decision by BlueCrest to initially disclose BSMA and then omit the Fund from its regulatory filings is unknown.

Unearthing of BSMA: A due diligence consultant working on behalf of an institutional investor discovered BSMA while conducting an onsite examination of the Manager in January 2014. A BlueCrest employee told the consultant that BMSA was a “partner retention vehicle” with roughly $1.5b in AUM. BlueCrest declined to respond to the consultants follow up questions regarding BSMA’s traders and historical performance, and as a result, the consultant downgraded their rating of BlueCrest on the grounds that 1) BlueCrest failed to disclose BSMA, 2) the potential conflicts of interest presented by BSMA, 3) the possibility that high performing traders were being allocated to BSMA, and 4) the potential that investors in BCI were not receiving the full benefit of BlueCrest’s investment expertise, even though, they were paying for their expertise via market rate management fees, carried interest and fund expenses [xiv] .

RMT was subsequently discovered by a second due diligence consultant in March of 2014, as part of BlueCrest’s response to that consultant’s concerns that high-performing traders were being allocated to BSMA. BlueCrest, however, failed to disclose to that consultant that BlueCrest had indeed transferred numerous traders from BCI to BSMA and that RMT had lower returns and higher volatility than live traders [xv] . Both consultants communicated to clients that they were unable to sufficiently assess the conflicts of interest posed by BSMA and downgraded BlueCrest to “uninvestable.” As a result, investors submitted redemptions. AUM in BCI dropped from $13.9 billion to $9.4 billion during 2014. After further redemptions in 2015, assets declined to $2.2 billion, and BlueCrest decided to ultimately shut BCI down and stop managing external client money [xvi] .

The BlueCrest case study highlights several items of note from a due diligence perspective. Provided below are our key takeaways:

- Onsite Reviews: Onsite reviews are still important, particularly in open end hedge funds. Due to COVID-19 and the advent of video technology, many managers and investors are increasingly relying on “virtual” due diligence meetings. While meeting virtually is more convenient, and often sufficient, the onsite examination should remain an important part of the due diligence process, particularly in terms of initial investments in hedge funds.

- GP Commitment: Understand and, to the degree possible, obtain access to where the top employees and portfolio managers of an asset manager have invested their capital. Is their capital invested alongside yours? As we saw with BlueCrest, this question was central.

- Analyze Trade Allocations: The due diligence process should include a thorough examination of actual trade allocations. Sitting with a trader or middle office professional and seeing actual trade allocations is invaluable.

- Changes to Regulatory Filings: Investors should closely monitor changes to regulatory filings. Thankfully, services now exist that can easily identify the changes to a manager’s ADV filings.

- Trust, but Verify: While this is cliché in due diligence, you shouldn’t take the word of the manager or their IR department as gospel. Review the materials and ask the questions. Due Diligence is hard work, but valuable to a level that can’t always be priced until something goes wrong.

Upcoming Paper - Valuation

“ All successful investment involves trying to get into something where it’s worth more than you’re paying. ” – Charlie Munger.

From the words of famed investor, Charlie Munger, valuation is central to the investment process. Accordingly, it is important to understand the process a manager undertakes to determine that valuation and how that valuation is used in the operation of the fund. In our next segment we will dive into valuation methodology, review Fair Value Measurement, discuss best practices, walk through a few case studies and arm you with questions to consider in your due diligence process so you can better identify potential investor/manager conflicts related to valuation.

If have any questions or would like to learn more, please contact Chris Carsley [email protected] or John Canorro at [email protected] .

[i] The prorate allocation is defined as the Fund’s demand as a proportion of the total demand for all funds ($40m in this example) under the purview of the manager times the capacity of the opportunity. European Fund Allocation: ($10m*($15m/40m))= $3.75m. Global Fund Allocation: ($10m*($25m/$40m)) = $6.25m.

[ii] See “ Commission Interpretation Regarding Standard of Conduct for Investment Advisers ,” Advisers Act Release 5248.

[iii] See ILPA Principles 3.0: Fostering Transparency, Governance and Alignment of Interests for General and Limited Partners .

[iv] See “ Prepared Remarks At the Institutional Limited Partners Association Summit ”, Chair Gary Gensler.

[v] See ILPA Principles 3.0: Fostering Transparency, Governance and Alignment of Interests for General and Limited Partners

[vi] Please see BlueCrest to return $170m to former investors after SEC settlement , Financial Times, December 8 th , 2020; and The SEC Says your Algorithm is Not Good Enough , Compliance Building, December 10 th , 2020.

[vii] Please see paragraphs 15-17 of the SEC order .

[viii] Please see paragraph 43 of the SEC order .

[ix] Please see paragraph 24 of the SEC order .

[x] Please see paragraph 28 of the SEC order .