What is a notice of assignment?

An assignment takes place when one party is holding a right to property, claims, bills, lease, etc., of another party and wishes to pass it along (or sell it) to a third party. As complicated as that sounds, it really isn’t. Strangely enough, many assignments can be made under the law without immediately informing, or obtaining the permission, of the personal obligated to perform under the contract. An example of this is when your mortgage is sold to another mortgage company. The original mortgage company may not inform you for several weeks, and they certainly aren’t going to ask your permission to make the sale.

If a person obligated to perform has received notice of the assignment and still insists on paying the initial assignor, the person will still be obligated to pay the new assignee according to the agreement. If the obligated party has not yet been informed of the assignment and pays the original note holder (assignor), the assignor is obligated to turn those funds over to the new assignee. But, what are the remedies if this doesn’t take place? Actually, the new assignee may find themselves in a difficult position if the assignor simply takes off with their funds or payment. They are limited to taking action against the person they bought the note from (assignor) and cannot hold the obligator liable. Therefore, it is important to remember that if any note or obligation is assigned to another party, each party should be well aware of their responsibilities in the transaction and uphold them according to the laws of their state. Assignment forms should be well thought out and written in a manner which prevents the failure of one party against another.

Related posts:

- Does your Agreement Require an Assignment Legal Form?

- Why Every Landlord and Tenant Needs a Lease Agreement

- Why you need a Power of Attorney and How to Assign One

Related Posts

- Seven Slip-and-Fall Accidents FAQs That You Should Know

- What is a mutual non-disclosure agreement?

- Can I use a form to change my name?

- When do I need a mechanic’s lien?

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

CAPTCHA Code *

1.915-859-8900 Get a Free Quote

WE ARE CELEBRATING 25 YEARS OF EXCELLENCE! 🎉 JOIN US IN CELEBRATING THIS MILESTONE YEAR.

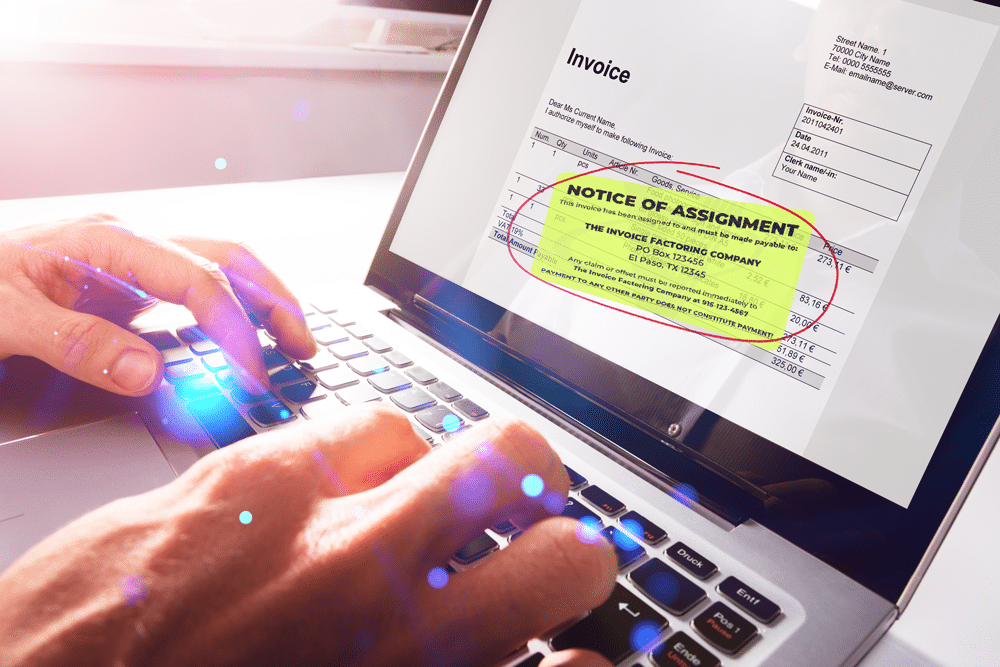

Factoring Notice of Assignment (NOA): Everything You Need to Know

A factoring notice of assignment (NOA) is usually required when you factor your invoices. Rest assured, NOAs are quite common in business and aren’t a cause for concern. However, it helps to understand what they are and how they work so that you can explain them to your customers as needed.

Assignment of Debt Explained

Companies transfer debt, along with all associated rights and obligations, to third parties all the time. One example of this occurs with collection companies. In these cases, the business, also referred to as the creditor, sells its uncollectable balances or assigns specific debts to the collection company. The collection company is then authorized to collect those specific balances on behalf of the creditor.

Assignment of debt may also come into play when businesses outsource their receivables and leverage certain types of funding, among other situations.

What Does Notice of Assignment Mean?

The customer, also referred to as the debtor, must be informed when a creditor assigns their debt to a third party. The document used in this process is referred to as a notice of assignment of debt.

What is a Notice of Assignment in Factoring?

When you leverage invoice factoring , you’re selling an unpaid B2B invoice to a factoring company at a discount. In exchange, you receive up to 98 percent of the invoice’s value right away and get the remaining sum minus a small factoring fee when your client pays. This means you’re not waiting 30, 60, or more days for payment. This cash flow acceleration helps businesses bridge cash flow gaps caused by slow-paying customers, seasonality, rapid growth, and more. Plus, the cash can be used for anything the business needs. This unique process means businesses can receive immediate funding without creating debt like other funding sources.

A notice of assignment is required in factoring because you’re assigning debt to a third party – the factoring company – and the customers involved need to know.

The Role of Notice of Assignment for Cash Flow

Invoice factoring stands out as a solution for businesses seeking to improve their cash flow. When a company decides to use invoice factoring, it enters into a factoring relationship, where accounts receivable and financial rights are handled differently than usual. This process involves the NOA, a pivotal document in factoring transactions. Essentially, NOA is a simple letter informing customers that the payment terms have changed and future payments should be made payable to the factoring company.

This notification ensures that there are no misdirected payments, which is a critical aspect when managing accounts payable and securing immediate cash. By using factoring, businesses can access working capital, which reduces the strain of slow-paying customers. It’s important for factoring clients to understand how factoring companies notify your customers and the implications of this process. The factoring contract typically outlines these details, ensuring that every party in a factoring transaction is aware of their responsibilities, especially regarding remittance addresses and payment information.

Factoring services offer an alternative to traditional lines of credit, providing businesses with high advances at low rates. This method is beneficial for companies that demand longer payment terms from their clients. By transferring the right to collect payments to the factoring company, the business can focus on its core operations while the finance company handles the receivables. Understanding the benefits of factoring and effectively communicating them to your customers may improve the factoring process and maintain healthy customer relationships, even when introducing new financial arrangements like invoice factoring.

The Importance of a Notice of Assignment in Factoring

Notice of Assignment in invoice factoring keeps your customers in the loop so they know who is collecting and why. It also lets them know where to send their payments. This streamlines the process and helps ensure there’s no confusion about where payments need to go.

Elements of a Factoring NOA Document

Each factoring company words its NOA a bit differently, but NOAs usually include:

- A statement that indicates the factoring company is now managing the invoice or invoices.

- A notice that payments should be made to the factoring company.

- Details on how payments can be made, including addresses, bank details, or payment portal information.

- What will occur if payments are sent to the business instead of the third party.

- A signature from someone at your business to show your customer that the NOA is authentic and a signature space for your customer to sign indicating that they’ve read and understand the document.

How Do Factoring Companies Notify Your Customers

A factoring notice of assignment is usually sent to customers by U.S. mail, though sometimes factoring companies use other delivery services or even digitize the NOA.

What Will Your Clients Think of You Factoring Your Invoices?

Sometimes, businesses that are new to invoice factoring have concerns about how customers will react to factoring or receiving an NOA. However, it’s usually not a cause for concern.

Although your factoring company isn’t an outsourcing company, it behaves quite similarly when collecting invoices. Nearly 40 percent of small businesses outsource at least one business process, Clutch reports. That means a significant portion of your customers already have some experience engaging with third parties. Furthermore, invoice factoring is growing in leaps and bounds and is expected to grow by eight percent in the coming years, per Grandview Research . Many of your customers already have experience with factoring or will very soon. Because most businesses have some exposure to factoring or will in the near future, it’s generally seen as an ordinary business practice – nothing more, nothing less.

However, even if factoring is entirely new to your customers, how they respond to your decision is often determined by how you present it. For instance, it accelerates payments without putting pressure on your customers to pay faster. It has benefits for them, too, and can help improve the relationship. This alone can actually help some businesses win bids or attract new customers. Explaining it to them this way can help soothe any concerns if customers come to you with questions.

How to Ensure Your Customer Relationships Are Protected

Most factoring companies will take good care of their customers because they are a reflection of you. Your repeat business helps ensure they’ll have repeat business. However, reviewing a factoring company’s testimonials and success stories is always a good idea to understand better how they operate before you sign up.

It’s also essential to work with a company like Viva that doesn’t send mass notifications to all its customers. We only notify those who are debtors on the invoices you’d like to factor to eliminate any confusion.

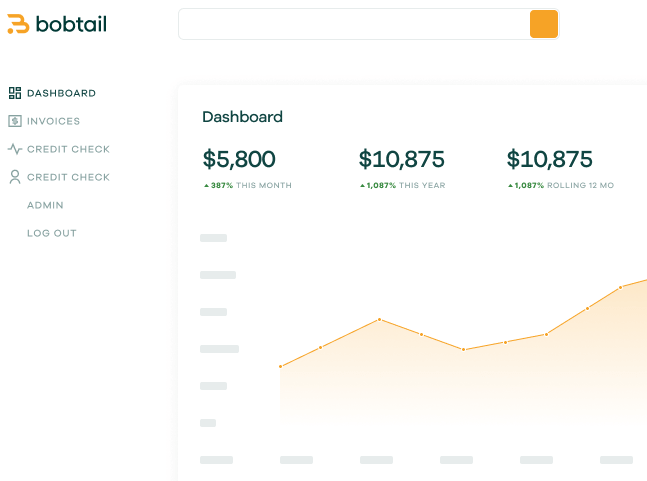

Lastly, it’s better to work with a company that provides you with 24/7 access to your account so you can see what’s paid and outstanding at a glance and can make decisions about orders using real-time data.

Request a Complimentary Invoice Factoring Quote

At Viva Capital, we always provide white glove care to the businesses we serve and their customers.As part of our service, we handle the Notice of Assignment with professionalism. Our collection experts make it easy for your customers to manage their bills and are happy to answer their questions. You’ll also have access to your personal Customer Account Portal so you can make informed decisions on the fly and always know what’s outstanding. To learn more or get started, request a complimentary invoice factoring quote .

- Recent Posts

- Step-by-Step Guide to Crafting a Business Plan Effectively - October 25, 2024

- Invoice Factoring Myths: Uncovering Truths for Your Business - September 13, 2024

- Cash Conversion Cycles: What Every Business Owner Must Know - July 16, 2024

About Armando Armendariz

The Cost of Invoice Factoring: Is it Worth It?

Why Relying on Business Credit Cards is Dangerous

Comments are closed.

Request FREE Funding Estimate

Discover how we've helped businesses just like yours.

How Medlock Contractors has forged better relationships with their subcontractors with the help of Viva Capital Funding.

How R. Ramirez Express saves $5,000 per year in fuel costs with Viva Capital Funding.

How BelCon Logistics grew 1,000% in just 3.5 years with Viva Capital Funding.

How Top of the Line Healthcare Staffing boosted revenue 1,000% with Viva Capital Funding.

How Sun City Pallets boosted revenue 400% with Viva Capital Funding.

How DMI Industries Supplies grew and continued its global expansion plans with Viva Capital Funding.

How Cold Way Transportation boosted revenue 47% with Viva Capital Funding.

Industries we serve

- Transportation

- Manufacturing

- Service providers

- Construction

- Other Industries

Get the Latest Viva Insights &

Your Free Growth Checklist

Receive a FREE

Business Growth Checklist

when you sign up for our Business Insights Newsletter.

Latest articles and insights

- Step-by-Step Guide to Crafting a Business Plan Effectively October 25, 2024

- Overcome Loan Rejection: Next Steps for Business Financing October 21, 2024

- How Invoice Factoring for Startups Fuels Success September 25, 2024

- Invoice Factoring Myths: Uncovering Truths for Your Business September 13, 2024

- Factoring: A Strategy for Managing Large Orders & Contracts August 28, 2024

Notice of assignment in invoice factoring

Many businesses that are underserved by banks - such as startups and those engaged in international trade - are turning to alternative funding solutions, such as invoice factoring, to access liquid capital, reaping the rewards in speed, efficiency, and simplicity. However, each of these financial services includes documentation to ensure a smooth process and to avoid relationships or contracts breaking down. For example, in an invoice factoring agreement, the finance provider must issue a 'notice of assignment'.

In this guide, Stenn explains what a notice of assignment is and its role in an invoice factoring agreement.

What is a notice of assignment (NOA)?

A notice of assignment is issued in an invoice factoring agreement - in which an intermediary provider buys a company's accounts receivable and assumes responsibility for chasing payment from the debtors.

In this agreement, the factoring company must advise each debtor that it has taken ownership of the right to collection.

A notice of assignment (NOA) is the legal document presented to the owing party, proving that the invoice factoring company is eligible to assume ownership of debts owed to their client. It's a legal agreement that informs accounts payable that a third party will receive invoice payments instead of the original invoice owner.

What is included in an NOA?

A notice of assignment (NOA) is a legal document that must be drafted in a certain format, with several key elements that must be included. These are essential in providing the terms, contract information and stipulations of the debts being bought:

- Proof of Assignment: All notices of assignment must include proof of debt ownership. This must include a warning that accounts payable shall now be directed to a third party, who that third party is and the accounts that need to be paid.

- Address: The notice of assignment must include a new payment address associated with the factoring provider.

- Liability Warning: An explanation and warning of the parameters for customer liability in the event of a misdirected payment and the repercussions for missed payments.

Why is an NOA important in factoring?

A notice of assignment is important in factoring as it gives the debtor a clear outline of whom further payments will be sent to, and the third party now involved in taking over debt liability.

It also provides a factoring company with proof that they now have ownership over those liabilities. This allows for smooth and effective cross-party communication and outlines the responsibilities of both parties in binding legal terms.

This represents an important part of the invoice factoring process - as the exporter signs over ownership of its invoice, allowing it to continue offering attractive delayed payment terms to importers without risking bad debt or being unable to meet its own accounts payable obligations. The importer simply has to amend payment details when paying the invoice, with no further obligations or expectations.

Plus, an NOA is one of only two documents that a client needs to sign to qualify for invoice factoring with Stenn - and this process is fully online, making it easy to apply in just minutes.

For more information on invoice factoring and the process of applying for finance with Stenn, check out our helpful video .

How will it affect business?

When a notice of assignment has been issued, the invoice factoring company takes control of the debts as a third party, and the previous owner of those debts receives an advance on owed payments quickly.

The significant consideration for any company accessing invoice factoring - and therefore notice of assignment - is the fees associated with the service. Invoice factoring providers buy customer invoices at a slight discount, meaning the client doesn't receive the full invoice amount owed.

No major aspects of the debt change for the owing party, which simply amends the company to which it submits full payment of its accounts payable. However, some stipulations of mispayments may change as may the terms by which repayments can be enforced.

This includes the supplier-buyer relationship, which remains unchanged. Invoice factoring services simply allow the buyer to enjoy longer payment terms while the supplier gets immediate access to liquid capital, which it can invest in improving its offering long-term.

Access invoice factoring with Stenn

Are you engaged in overseas trade with delayed payment terms? Do you need a liquid capital injection to help cover your own accounts payable in the short term or to fund business growth? Simply submit your unpaid invoices for an instant working capital boost.

Stenn finances invoices for hundreds of small and medium-sized importers and exporters with manageable payment terms. And we only require two documents to be signed to qualify for funding, so we don't need to see your credit score.

Apply for financing with Stenn today or find out about the other financing options available to your business in our Resource Hub - including guides to:

- Invoice financing

- Revenue-based financing

- Stock financing

- Business Lines lines of credit

- Alternative lending options for e-commerce businesses

About the Authors

This article is authored by the Stenn research team and is part of our educational series.

Stenn is the largest and fastest-growing online platform for financing small and medium-sized businesses engaged in international trade. It is based in London, provides financing services in 74 countries and is backed by financial giants like HSBC , Barclays , Natixis and many others.

Stenn provides liquid cash to SMEs within the global financial system. On stenn.com you can apply online for financing and trade credit protection from $10 000 to $10 million (USD) . Only two documents are required. No collateral is needed and funds are transferred within 48 hours of approval.

Check the financing limit available on your deal or go straight to Stenn's easy online application form .

Legal information

© Stenn International Ltd. All rights reserved. Any redistribution or reproduction of part or all of the contents in any form is prohibited other than the following:

- You may copy the content to your website page but only if you acknowledge this website as the source of the material and provide a backlink to this article.

- You may not, except with our express written permission, distribute or commercially exploit the content in any other way.

Disclaimer : The above article has been prepared on the basis of Stenn's understanding of the subject. It is for information only and doesn't constitute advice or recommendation. Whilst every care has been taken in preparing this article, we cannot guarantee that inaccuracies will not occur. Stenn International Ltd. will not be held responsible for any loss, damage or inconvenience caused as a result of anything published above. All those applying for credit should seek professional advice when doing so.

About Stenn

Since 2016, Stenn has powered over $20 billion in financed assets, supported by trusted partners, including Citi Bank, HSBC, and Natixis. Our team of experts specializes in generating agile, tailored financing solutions that help you do business on your terms.

Related Blog Posts

Talk to our team to get started

Secure your fast, flexible financing today.

- Get Invoice Funding!

- 800-997-7330

What Is Notice of Assignment?

Invoice factoring is a growing trend amongst small and mid-sized businesses, set to grow by 8% each year . Factoring provides tremendous benefits to small businesses looking to increase cash flow and pay employees/bills on time. Notice of assignment is a critical feature in factoring, as it alerts both the business and the customer that the invoice has changed hands. Below is an in-depth look at notice of assignment to better educate you on the subject.

If you are looking for a reliable and trusted factoring company, don’t hesitate to contact Outsource Financial Services today . We have 20+ years of experience helping small businesses in the trucking industry.

Notice of Assignment and Invoice Factoring

A Notice of Assignment lets customers know that the financing company or bank is now responsible for payments and is in charge of accounts receivable. The letter contains legal language outlining the terms of the invoice(s) and to who the payment is to be directed. It also includes instructions informing the customer that any payments made to you or other parties do not count as invoice payments.

The notice of assignment is the first step in establishing the relationship between debtors and the factoring provider. Your customers need this notice to be aware of any changes to their payment structure.

Why Factoring Companies Use a Notice of Assignment When Funding Invoices

Factoring companies issue these notices for important reasons. The first is to inform them that their balance has changed from your business to the factoring company. Second, it creates the legal frameworks necessary for pursuing the debt they are owed. The notice will also contain pertinent information regarding future payments. Bank information and payment instructions are included. Finally, NOAs are issued to comply with any local and federal laws.

Why Your Customers Must Know You Are Factoring Their Invoices

Keeping your customers in the loop about invoice factoring is essential. It’s best to inform them that an NOA from the factoring company is on its way. This lets them know what to expect ahead of time. It’s also important to let them know so they don’t attempt to pay you for the outstanding invoice. Once the factoring company has taken over the debt, all payments should go to them. Finally, it lets them know who to contact going forward, helping them establish a working relationship with the creditor and preventing improper payments and other issues.

What Happens If You Receive a Payment Intended for Your Factoring Company

The notice of assignment informs your customers that the factoring company is now the party to be paid for outstanding invoices. Unfortunately, mistakes do happen from time to time. So what do you do if your client pays you instead of the factoring company?

Contact Your Client

The first step is to contact your client and let them know about the mistake. Odds are they forgot to adjust their accounts payable to reflect the change in recipient. Let them know the factoring company is the one they need to pay, not you.

Void the Payment

Suppose your client attempted to pay you via a check, void or shred the check and inform your customer to make the payment to the factoring company. If they paid you electronically, you’d need to return the funds to them so they can redirect them to the factoring company. Remember, it’s their responsibility to pay, not yours.

Contact Your Factoring Company

If you’re unsure of what to do, you can reach out to the client and the factoring company. A reputable factoring company, such as Outsource Financial Services, will offer you customer service to help you rectify any issues you encounter.

Why Factoring Benefits Customers

A common question about notice of assignment and invoice factoring entails customer benefits. Knowing how factoring benefits you is essential, as customers gain significant benefits from partnering with a factoring company.

Favorable Payment Terms

Many companies prefer having net 30, 60, or 90-day invoices. Small businesses often can’t maintain proper cash flow with these rates and would be excluded from operating with companies that use these terms. You can get your cash when you need it and cater to customers who want standard invoice deadlines with invoice factoring.

Improves Your Ability to Serve Them

Managing your finances while simultaneously delivering your services can be quite a headache! Factoring enables you to focus on the things your customers want most while ensuring you still get paid.

Paperwork Reduction

Finances and lines of credit involve tons of paperwork. On the other hand, factoring requires very little paperwork. This benefits both you and your customers, as there’s less to comb through and fewer chances to miss something important.

No Threat of Harassment

Reputable factoring companies do not harass your customers. Beyond the notice of assignment, your customers’ only interactions are invoices and late payment notices. On the off-chance your clients skip the bill, the factoring company will use proper legal means for repayment.

We hope the article above helps you better understand the nuances of the role of notice of assignment in invoice factoring. At Outsource Financial Services , we take the pain out of factoring. Whether you’re a small or large business, we can help you manage your invoices and improve your cash flow. If you have any questions about notice of assignment, invoice factoring, or our services, please contact us today . We’d be glad to discuss any questions you might have.

Get a Quote

Featured posts.

A Quick Guide To Business Credit Scores

A Quick Guide To Becoming A Truck Driver in America

How To Celebrate Holidays On The Road As A Truck Driver

Have questions? We're here to Help

- 5145 N. JOLIET STREET DENVER, CO 80239

Send a message

Si, habla español.

© Outsource Financial Services. All rights reserved.

Banks will be closed on Nov 11 for Veterans Day. Bobtail will remain open, but funding for invoices and wire transfers will resume on Nov 12.

Banks will be closed on Nov 11 for Veterans Day. Bobtail will remain open, but funding and wire transfers will resume on Nov 12.

What Is A Notice Of Assignment In The Trucking Industry?

To understand a notice of assignment, trucking company owners first have to be familiar with factoring—and to understand factoring, we’ll have to discuss the nuances of cash flow in the shipping industry.

Basically, the challenge for fleet owners (and owner-operators) is that their customers take forever to pay their invoices. You deliver a load and issue the invoice. The shipper may take 30 or 45 or 60 days—or more—to pay that invoice. Meanwhile, you’ve got fuel costs, payroll, insurance payments, and the thousand other financial obligations that keep your trucks on the road. You need that invoice paid now .

Factoring is the industry’s solution for quick payments to carriers. A factoring company steps in and pays your invoice today. Then that company collects from your customer, the shipper or broker who hired you to haul a given load. For their service, the factoring company keeps a low percentage of the total invoice value. (With Bobtail, the factoring fee ranges from 1.99% to 2.99%, depending on the volume of invoices you factor.)

Note that factoring is not a loan; the factoring company buys your invoices, so there’s no compounding interest or credit impact. Factoring beats loans as a cash-flow solution, hands down.

Struggling with slow payments from shippers and brokers? Keep cash flowing the simple way with Bobtail factoring.

With these preliminaries out of the way, we’re ready to answer the question that brought you here: What exactly is a notice of assignment in trucking?

Defining The Notice Of Assignment In Trucking

Factoring requires shippers and brokers to make changes in their billing systems. You’re no longer the collector on a factored invoice; the factoring company is. Accounts payable departments are busy places, and it’s easy for a shipper’s finance team to get confused when you do the work but another company collects the payment (after that company pays you, of course).

A notice of assignment clears up the billing relationship in a factoring agreement. A notice of assignment is a contractual document, supplied to both the carrier and the customer, that tells the customer to pay the factoring company, not the carrier.

The notice of assignment is an essential piece of paperwork, one of the documents you’ll have to keep on file as you establish a factoring relationship. You’ll have to sign the notice of assignment, and so will your customer. In short, this is a contractual agreement that carries legal consequences, and clarifies who exactly the shipper should pay for a delivered load.

Why is a notice of assignment important?

Consider the case of a trucking company that shifts to factoring after months or years of collecting directly from a shipper. That carrier’s payment details are already set up in the shipper’s accounting systems. Due to accidents or willful fraud, it’d be easy for the carrier to collect on an invoice twice—once from the factoring company and again from the customer.

In that scenario, the factoring company loses money, or at least becomes embroiled in a flurry of paperwork and legal challenges. So the notice of assignment is designed to protect the factoring company. But this document provides benefits for you, the carrier, and your customers, too.

How A Notice Of Assignment Benefits Shippers And Carriers

Who needs more paperwork? While it may seem like just another legal document, notices of assignment are actually helpful for all three parties involved in a factoring payment deal: the factoring company, sure, but also the carrier and the customer.

For shippers , the notice of assignment is a strong incentive to update payment details in their accounting systems. It delineates the nature of the financial agreement. It provides visibility and clarity that avoids conflict down the line. Most importantly, factoring companies require shippers to sign a notice of assignment—and factoring benefits customers, too. It keeps them from having to renegotiate payment terms, and gives them the full 30 or 60 days to pay, which allows them to optimize their own cash utilization.

Carriers also benefit from the clarity that comes with a notice of assignment. This document allows you to rest assured that the customer won’t accidentally pay you for a factored invoice, so you don’t have to spend all day trying to get the money into the right hands—or face collection threats of your own.

The binding agreement contained within a notice of assignment protects you from legal problems. It’s simply smart business to make sure everyone knows exactly who should get paid, and for what. Notices of assignment accomplish this goal—and, with Bobtail, the paperwork is simpler than you might think.

Simplifying Notices Of Assignment

Traditional factoring companies aren’t the most efficient financial operators in the world. They make you sign restrictive contracts. They might even tell you who you can work with, and who you can’t. They stack hidden fees on everything from set-up to ACH transfers to terminating the deal. And they make you fill out reams of paperwork before depositing a cent.

Bobtail is different every step of the way. We started this company to eliminate the inefficiencies in the factoring process, and that includes personalized assistance with handling notices of assignment.

When you sign up with Bobtail—a quick, online process involving a single application form—you’ll get a personal account manager who’s always ready to answer questions and solve problems. They’ll issue your notice of assignment and make sure your customers understand the document and why it’s necessary.

All you have to do is carry on carrying loads.

When you decide to factor an invoice, the process is even simpler. Just deliver the load, upload the invoice, attach a rate confirmation and a bill of lading, and get paid. It’s all done through Bobtail’s online system, so you can handle financing from the rig. We also provide a user-friendly digital dashboard that makes it easy to track every invoice at every step of the financing process. There’s simply no easier way to factor an invoice.

At Bobtail, we believe that you know what’s best for your business. That’s why we don’t make you sign a long-term contract; this is no-contract factoring. You pick which accounts to factor and which to collect from directly, and we don’t have volume requirements or exclusive financing deals.

We also don’t charge hidden fees. You just pay a flat factoring fee so there’s no confusion on exactly how much cash will hit your bank account—or when. Invoices are filled the same day you submit them, or the next day if the invoice arrives after 11 a.m. Eastern time.

Don’t be intimidated by a notice of assignment in trucking—or any other documents related to your factoring service. With Bobtail, our devoted customer service team makes sure everything runs smoothly, and we’re there to help every step of the way. Or, as one Trustpilot review puts it:

“They always answer the phone! The staff is very helpful and cordial. The three things I love are: Payments are on time, the website is easy to use, and great customer service!”

(Read more customer reviews on Trustpilot.)

Ready to improve cash flow without the headaches? Sign up to learn more today.

If you have questions about account set-up, notices of assignment, or anything else related to factoring, contact the Bobtail sales team at (410) 204-2084, or email us at [email protected].

Caroline Asiala is the Digital Marketing Manager at Bobtail. With a background rooted in advocating for migrant rights, Caroline leverages her expertise in content creation to support small trucking businesses, many of which are immigrant-owned and operated, with the information they need to make their businesses thrive.

Download our mobile app

- Case studies

- Testimonials

- Litigation & Dispute Resolution

- Commercial Law

- Employment Law

- Professional Negligence

- Data Breach & Cyber

- Private Client

- Business owners

- High-net worth individuals

- Group actions & professional negligence

Deed of Assignment and the Notice of Assignment -What is the Difference?

In this article, Richard Gray barrister takes a brief look at the differences between a Deed of Assignment and a Notice of Assignment and the effect of the assignment on the contracting party

At the end of 2020, Elysium Law were instructed to act for a significant number of clients in relation to claims made by a company known as Felicitas Solutions Ltd (an Isle of Man Company) for recovery of loans which had been assigned out of various trust companies following loan planning entered into by various employees/contractors.

Following our detailed response, as to which please see the article on our website written by my colleague Ruby Keeler-Williams , the threatened litigation by way of debt claims seem to disappear. It is important to note that the original loans had been assigned by various Trustees to Felicitas, by reason of which, Felicitas stood in the shoes of the original creditor, which allowed the threatened action to be pursued.

After a period of inertia, Our Clients, as well as others, have been served with demand letters by a new assignee known as West 28 th Street Ltd . Accompanying the demand letters is a Notice of Assignment, by reason of which the Assignee has informed the alleged debtor of the Assignees right to enforce the debt.

Following two conferences we held last week and a number of phone call enquiries which we have received, we have been asked to comment upon the purport and effect of the Notice of Assignment, which the alleged debtors have received. Questions such as what does this mean (relating to the content) but more importantly is the ‘Notice’ valid?

Here I want to look briefly at the differences between the two documents.

There is no need for payment to make the assignment valid and therefore it is normally created by Deed.

The creation of a legal assignment is governed by Section 136 of the Law of Property Act 1925:

136 Legal assignments of things in action.

(1)Any absolute assignment by writing under the hand of the assignor (not purporting to be by way of charge only) of any debt or other legal thing in action, of which express notice in writing has been given to the debtor, trustee or other person from whom the assignor would have been entitled to claim such debt or thing in action, is effectual in law (subject to equities having priority over the right of the assignee) to pass and transfer from the date of such notice—

(a) the legal right to such debt or thing in action;

(b) all legal and other remedies for the same; and

(c) the power to give a good discharge for the same without the concurrence of the assignor:

Some of the basic requirements for a legal assignment are;

- The assignment must not be subject to conditions.

- The rights to be assigned must not relate to only part of a debt, or other legal chose in action.

- The assignment must be in writing and signed by the assignor.

- The other party or parties to the agreement must be given notice of the assignment.

Notice of assignment

To create a legal assignment, section 136 requires that express notice in writing of the assignment must be given to the other contracting party (the debtor).

Notice must be in writing

Section 136 of the LPA 1925 requires “express notice in writing” to be given to the other original contracting party (or parties).

Must the notice take any particular form?

The short answer is no. Other than the requirement that it is in writing, there is no prescribed form for the notice of assignment or its contents. However, common sense suggests that the notice must clearly identify the agreement concerned.

Can we challenge the Notice?

No. You can challenge the validity of the assignment assignment by ‘attacking the Deed, which must conform with Section 136. In this specific case, the Notice sent by West 28 th Street in itself is valid. Clearly, any claims made must be effected by a compliant Deed and it is that which will require detailed consideration before any right to claim under the alleged debt is considered.

Can I demand sight of the assignment agreement

On receiving a notice of assignment, you may seek to satisfy yourself that the assignment has in fact taken place. The Court of Appeal has confirmed that this is a valid concern, but that does not give an automatic right to require sight of the assignment agreement.

In Van Lynn Developments Limited v Pelias Construction Co [1969]1QB 607 Lord Denning said:

“After receiving the notice, the debtor will be entitled, of course, to require a sight of the assignment so as to be satisfied that it is valid…”

The Court of Appeal subsequently confirmed this stating the contracting party is entitled to satisfy itself that a valid absolute assignment has taken place, so that it can be confident the assignee can give it a good discharge of its obligations

The important document is the Deed of Assignment, which sets out the rights assigned by the Assignor. The Notice of Assignment is simply a communication that there has been an assignment. The deed is governed by Section 136 of the LP 1925. It should be possible to obtain a copy of the Deed prior to any action taken in respect of it.

For more information on the claims by West 28 th Street or if advice is needed on the drafting of a Deed, then please call us on 0151-328-1968 or visit www.elysium-law.com .

Related news

Get in touch

- About Apex Factoring

- Get Started

- Apex Factoring Reviews

- Freight Factoring Guide

- Factoring FAQs

- Client Success Stories

- Apex Fuel Card

- Apex Fuel Finder

- Free Guide to Save More on Fuel

- Start a Trucking Company

- Trucking Authority

- Costs to Start a Trucking Company

- Startup FAQ

- About Our Tools

- blynk® Payment System

- Client Website: AMP

- Apex Credit Checks

- Mobile Factoring™ App

- Roadside Rescue

- Cash Flow Assistance

- All Discounts

- Tires & Service

- Free Load Board

- Extra Discounts

- About Apex Capital

- Apex Careers

- Apex Racing

- Media Information

- Privacy Policy

What is a Notice of Assignment in Trucking?

Trucking companies factor invoices every day. It’s a common practice in the industry for business owners to partner with a factoring company that provides cash flow so that truckers keep hauling the goods we need daily.

What is Factoring?

Factoring is the purchasing of account receivables (invoices) at a discount. The trucking company that enters into an agreement with the factor, sells its invoices for loads they hauled and then gets an advance payment (anywhere from 70-90%). The factoring company, in turn, collects payment for that invoice from the broker. Once the factoring company gets paid by the broker, it will take its factoring service fee and remit the balance of the invoice to the trucking company.

A standard part of the factoring agreement is a notice of assignment (NOA) sent by the factoring company to the broker. Factoring companies usually send brokers one NOA at the beginning of their business partnership with the trucking company, informing them where to send payments.

An NOA is a legal agreement that informs the accounts payable that a third party will receive payments, rather than the original owner of the invoice. In trucking, the NOA informs a broker of the trucking company’s factoring relationship and instructs the broker to remit all payments to the factoring company instead of directly to the carrier that hauled their load.

If the broker pays anybody other than the factoring company without written consent, and that includes the carrier, it is then required by law to repay the amount of the invoice to the factoring company. This highlights the importance of managing payment terms and helps business owners understand that the NOA is a document designed to protect the interests of both the factoring company and the trucking company.

What is an NOA Release Letter?

When is there a need for an NOA release letter? An NOA release letter is sent by the factoring company to the broker when the business partnership between the factor and the carrier has been dissolved. NOA release letters are usually brief, and they may sometimes inform the broker of where to submit future invoice payments for that carrier. If a new address to remit invoice payments is available, the factor will provide it to the broker. Otherwise, it is strictly a notice of the terminated business relationship.

Check Out the Apex Factoring Guide

At Apex Capital, we prioritize transparency and strong customer relationships, taking pride in being open with both our clients and their brokers. If you have questions about how to switch factoring companies or would like more information, download our our free guide to switching factoring companies .

Finding the right factoring partner can be key to growing your trucking company. Apex factoring is here to help you manage your cash flow with a variety of valuable tools as well as excellent customer service and back-office support. Visit our website or give us a call at 855-369-2739 .

Download the Free Guide to Switching Factoring Companies.

What Is A Notice of Assignment And How Does It Protect Your Business?

by CapitalPlus Financial | Blog

A Notice of Assignment (NOA) is a crucial document playing a significant role in protecting all parties involved. Understanding its definition and benefits is essential for business owners utilizing such services as invoice factoring to manage cash flow and operations effectively.

What is a Notice of Assignment?

A Notice of Assignment (NOA) is a legal document that signals the transfer of rights or obligations under a contract from one party to another . This transfer can involve leases, intellectual property rights, loans, or other contractual rights. For instance, if you sell your accounts receivable through factoring, a Notice of Assignment is sent to your client, notifying them that the factoring company is the new payee.

Who Sends the Notice of Assignment?

The Notice of Assignment is typically sent by the party transferring the rights, often referred to as the assignor, or in this case by the factoring company (the new owner of the accounts receivable). In factoring, it’s common for the factoring company to send the NOA to the debtor (your client), informing them that future payments should be made directly to the factoring company instead of to your business. The NOA paperwork is usually sent immediately after all agreements are signed but may be delayed by a few weeks into the process.

How Does a Notice of Assignment Protect Everyone?

- Ensures Payment: By notifying your debtor of the new arrangement, the NOA outlines the factoring company’s right to collect the payment, minimizing the risk of payment disputes with you, their client. This is especially important for debtors who are chronically slow-paying or late in payments.

- Improves Cash Flow: With the factoring company handling the invoice’s payment, the construction company receives immediate cash flow, enabling them to manage payroll and purchase materials without delays.

- Legal Rights: Being a legal agreement, the NOA binds the debtor to pay the factoring company, reducing the risk of non-payment and securing the factoring company’s interests.

- Clear Communication: The NOA provides clear communication and payment terms with the debtor reducing confusion.

- Transparency: The NOA ensures transparency, informing the debtor of the change in payment direction, which helps avoid any inadvertent payments to the original contractor.

- Streamlined Process: It creates a streamlined process for handling payments, ensuring that the debtor is clear on who and when to pay which can prevent legal complications.

While a Notice of Assignment acts as “official” announcement of a new arrangement, it is always best to make your client aware of your working with the factoring company. Most clients understand and accept invoice factoring, but surprises are rarely welcomed, especially when money is involved.

Notices of Assignment are an indispensable tool in the factoring process for businesses like construction companies, trucking, or staffing services. The NOA ensures that all parties — the construction company, the factoring company, and the debtor — are protected and aware of their roles and responsibilities. By understanding the purpose of NOAs, construction businesses can rest assured that the factoring can be implemented quickly with minimal distractions.

If you still have questions about how NOAs can protect your business, or other aspects of the invoice factoring process , feel free to reach out . We are glad to help.

Factoring , Newsletters

THE NOTICE OF ASSIGNMENT: A REFRESHER COURSE

Allen J. Heffner Nov 20, 2023

The Notice of Assignment is probably the single most important document for a Factor. Understanding what needs to be included in the Notice of Assignment, how to send it, and who to send it to can mean the difference between getting paid and not. Despite the fact that every Factor is (or should be) familiar with legal requirements relating to Notices of Assignment, we still find that many of our factoring clients who end up in litigation make basic mistakes relating to their Notices of Assignment. The article focuses on what information needs to be included in the Notice, who the Notice should be sent to, and how the Notice should be delivered.

What needs to be included in the Notice of Assignment?

To be effective, there is certain information that must be included in the Notice of Assignment. The Uniform Commercial Code (“UCC”) requires that the notice must:

- Notify the Account Debtor that the amount due or to become due has been assigned;

- Notify the Account Debtor that payment is to be made to the Factor;

- Reasonably identify the rights assigned; and

- Be signed by the Factor or its client.

The Notice of Assignment should also include a remittance address so the Account Debtor is informed how and in what manner the Factor should be paid.

Additionally, while not explicitly required under the current version of the UCC, Factors should include language in their Notice of Assignment that: (i) the Client has assigned all of its present and future accounts receivable to Factor; (ii) the Factor holds a first priority security interest in all of the client’s accounts receivable; and (iii) all payments owing to the client must be paid to the Factor.

Who should the Notice of Assignment be sent to?

Notices of Assignment should not be sent directly to individuals with an Account Debtor. Sending the Notice to a specific individual may lead to issues relating to the authority of that individual to receive documents on behalf of the Account Debtor. Moreover, Factors that direct Notices of Assignment directly to individuals open themselves up to arguments that the Notices of Assignment was not properly delivered. For instance, our clients that have sent Notices of Assignment to individuals have ended up in situations where the individual to whom the Notice of Assignment was addressed no longer worked with the Account Debtor or the individual was located at a different office and the Notice of Assignment was not sent to the proper location. To be safe and to avoid unnecessary issues, Factors should send the Notice of Assignment to the Account Debtor’s accounts payable department.

Additionally, some states have specialized definitions for what constitutes “notice” on behalf of a company. If there is any question as to where a Notice of Assignment should be sent, Factors should check with their attorney to determine where these should be sent.

How should the Notice of Assignment be delivered?

The crucial issue for the enforceability of a Notice of Assignment is proof of receipt by the Account Debtor, not proof of delivery. Therefore, it is good business practice to send the Notice of Assignment either certified mail or other method that provides for proof of delivery.

Many of our clients have asked about whether it is proper to deliver the Notice of Assignment via e-mail asking the Account Debtor to confirm receipt or with “read receipts” turned on. Some Factors prefer this method because it is more cost efficient.

While sending Notices of Assignment via e-mail is enforceable, we would not recommend it as a general business practice. Sending the Notice in this manner requires delivering the Notice to a specific individual, which we have discussed above can be problematic. Sometimes officers and directors of companies have assistants or other personnel manage their e-mail accounts, raising the possibility that the individual to whom the Notice was sent, never saw the e-mail, even though the e-mail was “read.”

Last, there is no requirement that the Notice be signed by the Account Debtor and returned to the Factor. Often, we see our client’s Notice include a “confirmation of receipt” line for the Account Debtor to sign and return. Sometimes, the Factor will have proof of delivery to the Account Debtor but the Notice was not signed and returned by the Account Debtor. This adds unnecessary ambiguity as to whether the Notice was actually received by the Account Debtor. Therefore, we instruct our clients not to include such requests for proof of receipt.

Who should send the Notice of Assignment?

Some of our clients that have had bad experiences with Account Debtors after delivering a Notice of Assignment have chosen to have their Client be the one to deliver the Notice of Assignment. There is no legal requirement as to whether the Factor or the Client is the correct party to deliver the Notice of Assignment. However, we recommend the Factor be the one to deliver the Notice of Assignment. This way, the Factor is in complete control of the contents of the Notice of Assignment, how it is delivered, and receives confirmation of its delivery. We have been in situations in which the Factor allowed the Client to deliver the Notice of Assignment, but the Client did not deliver the Notice of Assignment in accordance with the law, leading to avoidable litigation.

Should a Factor respond to an Account Debtors questions regarding a Notice of Assignment?

Absolutely, yes. If requested by an Account Debtor, pursuant to the UCC, a Factor must furnish reasonable proof of the assignment for the Notice of Assignment to be valid. Too often we see situations in which requests are made or questions are posed by Account Debtors that the Factor ignores, thinking that because the Account Debtor received the Notice of Assignment, nothing else needs to be done. The Factor should respond to the Account Debtor and provide reasonable proof of the assignment. These communications can also provide invaluable insight as to the relationship between the client and the Account Debtor, how and when payments will be made, and can provide the Account Debtor a sense of trust with the Factor.

A Notice of Assignment is crucial for Factors because it provides legal protection, establishes priority of interest, prevents confusion, facilitates legal recourse, and enables effective communication with Account Debtors. Without this notice, Factors may encounter difficulties in asserting their rights and collecting payments from Account Debtors, potentially jeopardizing the financial transaction.

Bruce Loren and Allen Heffner of the Loren & Kean Law Firm are based in Palm Beach Gardens and Fort Lauderdale. For over 25 years, Mr. Loren has focused his practice on construction law and factoring law. Mr. Loren has achieved the title of “Certified in Construction Law” by the Florida Bar. The Firm represents factoring companies in a wide range of industries, including construction, regarding all aspects of litigation and dispute resolution. Mr. Loren and Mr. Heffner can be reached at [email protected] or [email protected] or 561-615-5701

Bruce E. Loren · Michael I. Kean · Allen J. Heffner · Kyle W. Ohlenschlaeger · Frank Sardinha, III

Newsletters & Media

Testimonials

Press Releases Privacy Policy Terms of Use

© 2022 All Rights Reserved

Assignments: why you need to serve a notice of assignment

Catherine phillips.

PSL Principal Associate

It's the day of completion; security is taken, assignments are completed and funds move. Everyone breathes a sigh of relief. At this point, no-one wants to create unnecessary paperwork - not even the lawyers! Notices of assignment are, in some circumstances, optional. However, in other transactions they could be crucial to a lender's enforcement strategy. In the article below, we have given you the facts you need to consider when deciding whether or not you need to serve notice of assignment.

What issues are there with serving notice of assignment?

Assignments are useful tools for adding flexibility to banking transactions. They enable the transfer of one party's rights under a contract to a new party (for example, the right to receive an income stream or a debt) and allow security to be taken over intangible assets which might be unsuitable targets for a fixed charge. A lender's security net will often include assignments over contracts (such as insurance or material contracts), intellectual property rights, investments or receivables.

An assignment can be a legal assignment or an equitable assignment. If a legal assignment is required, the assignment must comply with a set of formalities set out in s136 of the Law of Property Act 1925, which include the requirement to give notice to the contract counterparty.

The main difference between legal and equitable assignments (other than the formalities required to create them) is that with a legal assignment, the assignee can usually bring an action against the contract counterparty in its own name following assignment. However, with an equitable assignment, the assignee will usually be required to join in proceedings with the assignor (unless the assignee has been granted specific powers to circumvent that). That may be problematic if the assignor is no longer available or interested in participating.

Why should we serve a notice of assignment?

The legal status of the assignment may affect the credit scoring that can be given to a particular class of assets. It may also affect a lender's ability to effect part of its exit strategy if that strategy requires the lender to be able to deal directly with the contract counterparty.

The case of General Nutrition Investment Company (GNIC) v Holland and Barrett International Ltd and another (H&B) provides an example of an equitable assignee being unable to deal directly with a contract counterparty as a result of a failure to provide a notice of assignment.

The case concerned the assignment of a trade mark licence to GNIC . The other party to the licence agreement was H&B. H&B had not received notice of the assignment. GNIC tried to terminate the licence agreement for breach by serving a notice of termination. H&B disputed the termination. By this point in time the original licensor had been dissolved and so was unable to assist.

At a hearing of preliminary issues, the High Court held that the notices of termination served by GNIC , as an equitable assignee, were invalid, because no notice of the assignment had been given to the licensee. Although only a High Court decision, this follows a Court of Appeal decision in the Warner Bros Records Inc v Rollgreen Ltd case, which was decided in the context of the attempt to exercise an option.

In both cases, an equitable assignee attempted to exercise a contractual right that would change the contractual relationship between the parties (i.e. by terminating the contractual relationship or exercising an option to extend the term of a licence). The judge in GNIC felt that "in each case, the counterparty (the recipient of the relevant notice) is entitled to see that the potential change in his contractual position is brought about by a person who is entitled, and whom he can see to be entitled, to bring about that change".

In a security context, this could hamper the ability of a lender to maximise the value of the secured assets but yet is a constraint that, in most transactions, could be easily avoided.

Why not serve notice?

Sometimes it's just not necessary or desirable. For example:

- If security is being taken over a large number of low value receivables or contracts, the time and cost involved in giving notice may be disproportionate to the additional value gained by obtaining a legal rather than an equitable assignment.

- If enforcement action were required, the equitable assignee typically has the option to join in the assignor to any proceedings (if it could not be waived by the court) and provision could be made in the assignment deed for the assignor to assist in such situations. Powers of attorney are also typically granted so that a lender can bring an action in the assignor's name.

- Enforcement is often not considered to be a significant issue given that the vast majority of assignees will never need to bring claims against the contract counterparty.

Care should however, be taken in all circumstances where the underlying contract contains a ban on assignment, as the contract counterparty would not have to recognise an assignment that is made in contravention of that ban. Furthermore, that contravention in itself may trigger termination and/or other rights in the assigned contract, that could affect the value of any underlying security.

What about acknowledgements of notices?

A simple acknowledgement of service of notice is simply evidence of the notice having been received. However, these documents often contain commitments or assurances by the contract counterparty which increase their value to the assignee.

Best practice for serving notice of assignment

Each transaction is different and the weighting given to each element of the security package will depend upon the nature of the debt and the borrower's business. The service of a notice of assignment may be a necessity or an optional extra. In each case, the question of whether to serve notice is best considered with your advisers at the start of a transaction to allow time for the lender's priorities to be highlighted to the borrowers and captured within the documents.

For further advice on serving notice of assignment please contact Kirsty Barnes or Catherine Phillips from our Banking & Finance team.

NOT LEGAL ADVICE. Information made available on this website in any form is for information purposes only. It is not, and should not be taken as, legal advice. You should not rely on, or take or fail to take any action based upon this information. Never disregard professional legal advice or delay in seeking legal advice because of something you have read on this website. Gowling WLG professionals will be pleased to discuss resolutions to specific legal concerns you may have.

Related services

- Rules/Help/FAQ Help/FAQ

- Members Current visitors

- Interface Language

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

- Spanish-English / Español-Inglés

- Spanish-English Vocabulary / Vocabulario Español-Inglés

notice of assignment

- Thread starter khao loy

- Start date Jun 27, 2010

- Jun 27, 2010

No encuentro la traducción para esto: "Notice of assignment" el contexto sería en negocios internacionales, entre empresas de diferentes países. Gracias saludos

Senior Member

- Jun 28, 2010

¿A qué se refiere "assignment"? Es difícil traducir una frase suelta sin saber más detalles del trasfondo. Gracias.

IMAGES

COMMENTS

A Notice of Assignment (NOA) is a document that factoring companies send to the end-customers of their clients. This document informs end-customers of the factoring financing relationship. Clients usually have some concerns when they learn that a factor will notify their customers. This article addresses these concerns and explains how the NOA ...

An assignment takes place when one party is holding a right to property, claims, bills, lease, etc., of another party and wishes to pass it along (or sell it) to a third party. As complicated as that sounds, it really isn't. Strangely enough, many assignments can be made under the law without immediately informing, or obtaining the permission,… Read More »

A Notice of Assignment (NOA) for accounts receivables is an essential legal document in the financial world. It serves as a formal notification that a business's rights to certain accounts receivable have been transferred or assigned to another party. This third party, often a lending institution or a factoring company, then has the right to ...

Nuestro equipo de expertos se especializa en generar soluciones financieras ágiles y personalizadas que le ayuden a hacer negocios según sus condiciones. Learn about the benefits of invoice factoring for businesses underserved by banks. This guide by Stenn explains the importance of a Notice of Assignment (NOA) in ensuring smooth invoice ...

A Notice of Assignment is a formal document used to inform a debtor or other relevant parties that a creditor (the assignor) has transferred its rights to receive payments or benefits under a contract to another party (the assignee). This notice is typically used in situations where accounts receivable, loans, or other financial claims are sold, transferred, or assigned to a third party.

Each factoring company words its NOA a bit differently, but NOAs usually include: A statement that indicates the factoring company is now managing the invoice or invoices. A notice that payments should be made to the factoring company. Details on how payments can be made, including addresses, bank details, or payment portal information.

A notice of assignment (NOA) is a legal document that must be drafted in a certain format, with several key elements that must be included. These are essential in providing the terms, contract information and stipulations of the debts being bought: Proof of Assignment: All notices of assignment must include proof of debt ownership. This must ...

A Notice of Assignment lets customers know that the financing company or bank is now responsible for payments and is in charge of accounts receivable. The letter contains legal language outlining the terms of the invoice (s) and to who the payment is to be directed. It also includes instructions informing the customer that any payments made to ...

A notice of assignment clears up the billing relationship in a factoring agreement. A notice of assignment is a contractual document, supplied to both the carrier and the customer, that tells the customer to pay the factoring company, not the carrier. The notice of assignment is an essential piece of paperwork, one of the documents you'll ...

The important document is the Deed of Assignment, which sets out the rights assigned by the Assignor. The Notice of Assignment is simply a communication that there has been an assignment. The deed is governed by Section 136 of the LP 1925. It should be possible to obtain a copy of the Deed prior to any action taken in respect of it.

An NOA is a legal agreement that informs the accounts payable that a third party will receive payments, rather than the original owner of the invoice. In trucking, the NOA informs a broker of the trucking company's factoring relationship and instructs the broker to remit all payments to the factoring company instead of directly to the carrier ...

The Notice of Assignment (NOA) is a document signed by a factoring company and carrier that informs brokers of the agreement to purchase your receivables. It includes important details like the factoring company's address and banking information, and ensures the broker sends payment to the right place. When you sign up with new brokers, they ...

A Notice of Assignment (NOA) is a legal document that signals the transfer of rights or obligations under a contract from one party to another. This transfer can involve leases, intellectual property rights, loans, or other contractual rights. For instance, if you sell your accounts receivable through factoring, a Notice of Assignment is sent ...

The Notice of Assignment is probably the single most important document for a Factor. Understanding what needs to be included in the Notice of Assignment, how to send it, and who to send it to can mean the difference between getting paid and not. Despite the fact that every Factor is (or should be) familiar with legal requirements relating to ...

A notice of assignment is essentially a one-time notification to the paying party that the factoring company is in charge of collecting payment. An NOA is ju...

An assignment can be a legal assignment or an equitable assignment. If a legal assignment is required, the assignment must comply with a set of formalities set out in s136 of the Law of Property Act 1925, which include the requirement to give notice to the contract counterparty.

traducir ASSIGNMENT: trabajo, misión, asignación, tarea [feminine], asignación [feminine], misión [feminine]. Más información en el diccionario inglés-español.

I understand that I can get my divorce in PA because I have been a resident for more than six months. He wants it done in Ohio. Today I received a letter titled Notice of Assignment. The body of the letter states Please be advised the above captioned matter is set for oral hearing for pre trial on a given date before a magistrate in Ohio.

No encuentro la traducción para esto: "Notice of assignment" el contexto sería en negocios internacionales, entre empresas de diferentes países...