- Go to our main website ⟶

Writing a Business Plan

Team sequoia.

When Brian, Joe and Nate founded Airbnb, they had an air mattress, entrepreneurial passion, and a vision for reinventing travel and hospitality, but no clear idea how to approach VCs or how to craft a pitch deck.

They came across Sequoia’s guide for how to write a business plan and the rest is history . They made a great deck.

But it wasn’t really the slides we liked—it was their ideas, the clarity of their thinking, and the scope of their ambition. We love partnering with founders hell-bent on bringing an idea to life that conventional wisdom deems impossible. And we love to partner early— when an idea is newly formed and has the maximal room to grow.

You can find our guide to pitching below (with a few refinements from years of use).

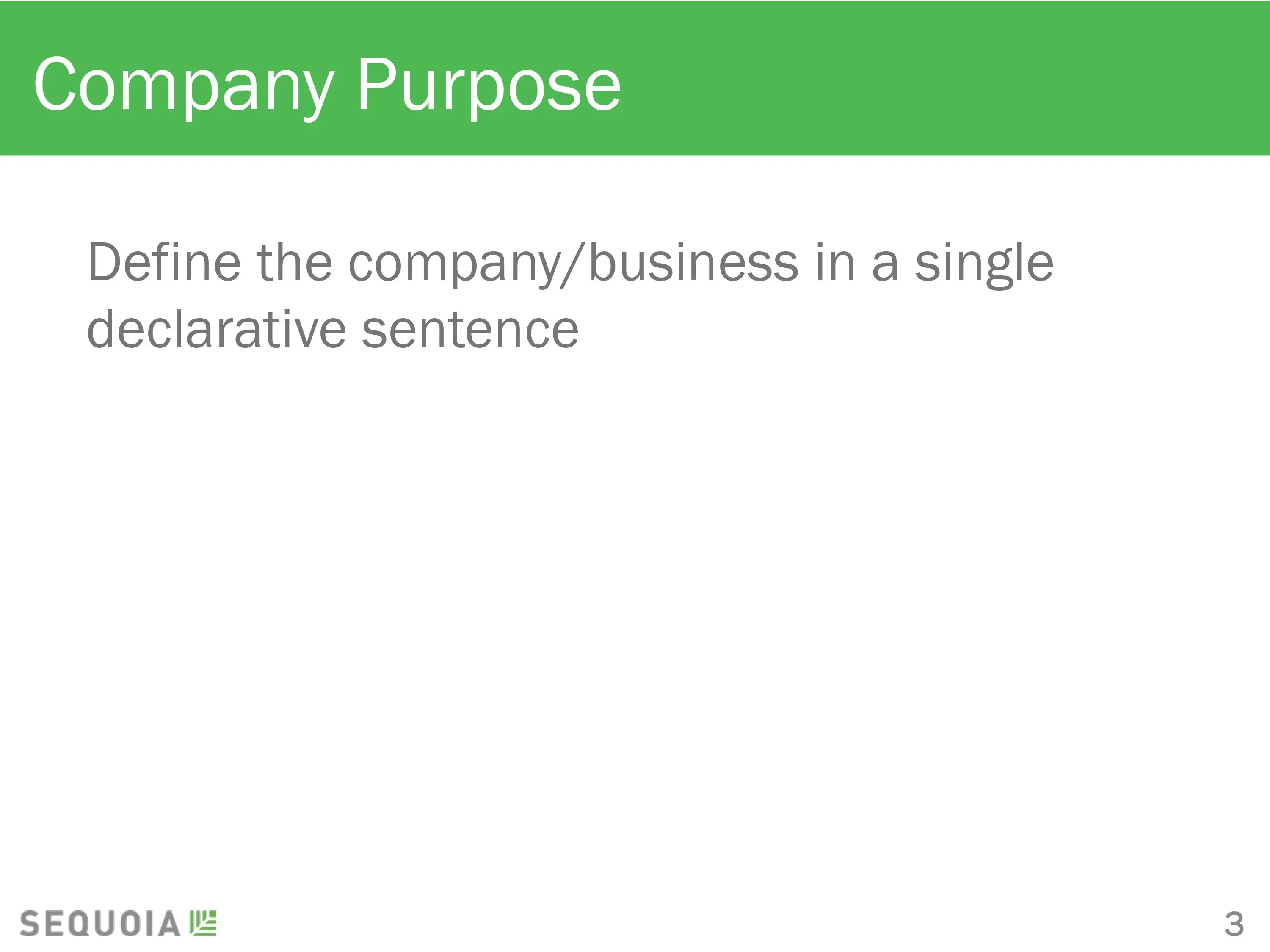

Company purpose Start here: define your company in a single declarative sentence. This is harder than it looks. It’s easy to get caught up listing features instead of communicating your mission.

Problem Describe the pain of your customer. How is this addressed today and what are the shortcomings to current solutions.

Solution Explain your eureka moment. Why is your value prop unique and compelling? Why will it endure? And where does it go from here?

Why now? The best companies almost always have a clear why now? Nature hates a vacuum—so why hasn’t your solution been built before now?

Market potential Identify your customer and your market. Some of the best companies invent their own markets.

Competition / alternatives Who are your direct and indirect competitors. Show that you have a plan to win.

Business model How do you intend to thrive?

Team Tell the story of your founders and key team members.

Financials If you have any, please include.

Vision If all goes well, what will you have built in five years?

- Custom decks

- Pitch deck review

- Financial model review

- How to raise

- Is my startup fundable?

- Should I quit?

- Testimonial

Sequoia Capital Pitch Deck Template

The Sequoia Pitch Deck Template has been viewed by hundreds of thousands of startup founders that are preparing their pitch deck.

It started as a simple blog post that some smart cookie turned into a very simple series of slides. Sometimes the best things in life are super simple.

Now yes, Sequoia are a big deal and yes they know what they are talking about but no… you’re not going to learn a massive amount when it comes to what to actually write and the narrative you want to tell. This is, however, a nice quick read for you to start building a framework upon which to build you frame of reference

The back story on the Sequoia Capital Pitch Deck Template

So what is the back story with the pitch deck template? In Sequoia’s words:

When Brian, Joe and Nate founded Airbnb, they had an air mattress, entrepreneurial passion, and a vision for reinventing travel and hospitality, but no clear idea how to approach VCs or how to craft a pitch deck. They came across Sequoia’s guide for how to write a business plan and the rest is history . They made a great deck. But it wasn’t really the slides we liked—it was their ideas, the clarity of their thinking, and the scope of their ambition. We love partnering with founders hell-bent on bringing an idea to life that conventional wisdom deems impossible. And we love to partner early— when an idea is newly formed and has the maximal room to grow.

So they shared their guide to pitching (with a few refinements from years of use).

Investors have a short attention span

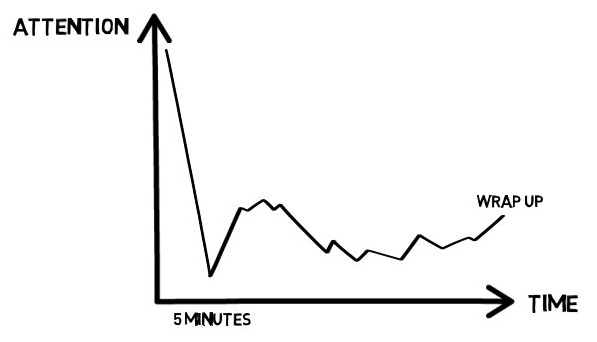

Investors will give you the most attention at the start of your pitch.

A rookie mistake is to assume that if you have scheduled an hour-long meeting, you will get an hour of attention. #fail

The typical attention span in an hour-long meeting will follow this curve most of the time.

Understand this when you think about the order and priority of the information you want to communicate to venture capitalists.

You have five minutes to earn attention for the rest of the meeting. If you can’t get them thinking ‘Ok, this might be interesting’ they may even call an end to the meeting and say ‘come back when you have more traction.’ Founders LOVE hearing that. Not.

For the love of god, make sure in the first few minutes investors are crystal clear what you actually do! It’s crazy how many founders forget to actually do that. You know your business- everyone else does not!

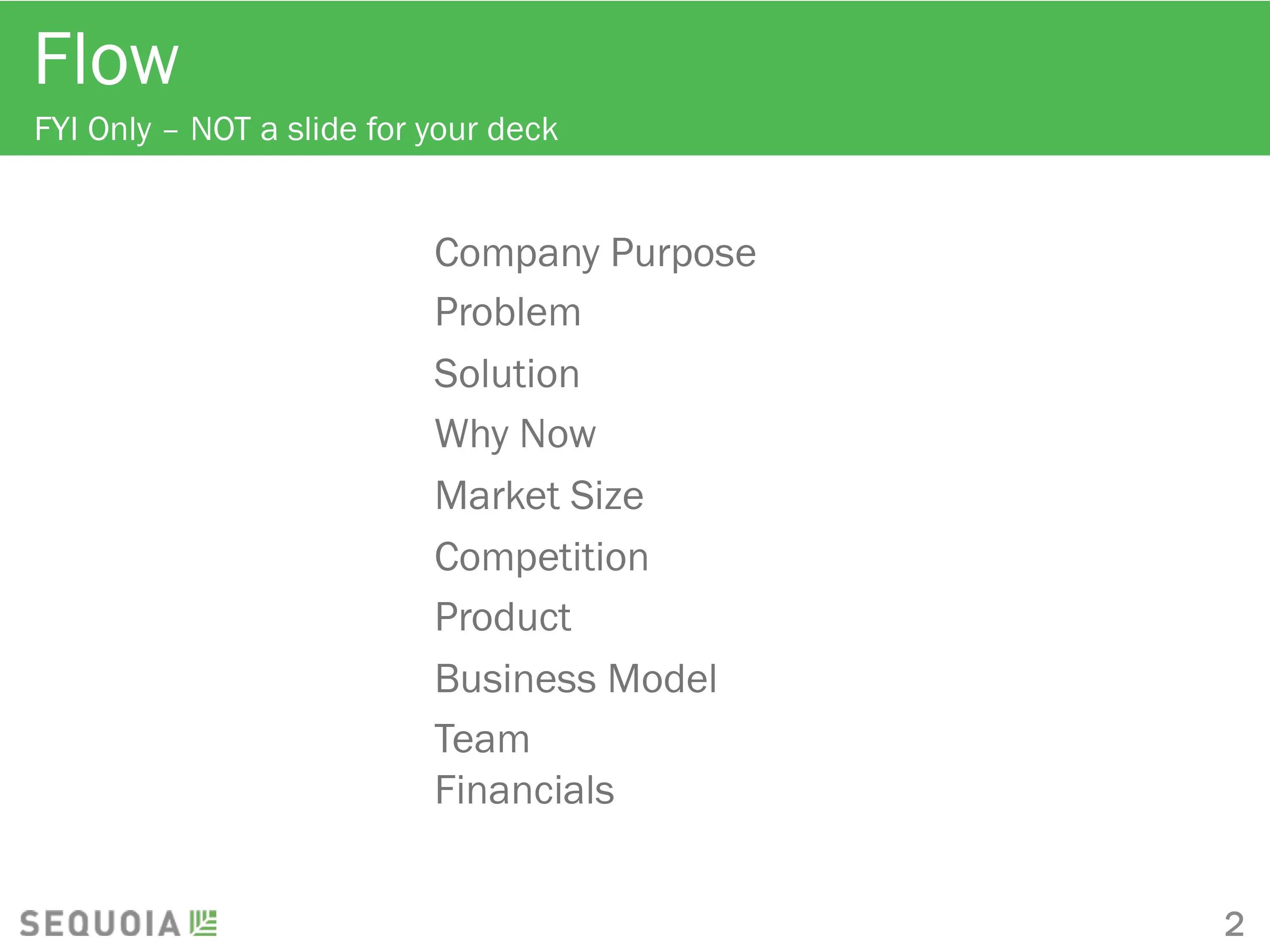

The flow of the Sequoia Capital Pitch Deck Template

- Company Purpose

- Market Size

Competition

- Business Model

Company purpose

Start here: define your company in a single declarative sentence. This is harder than it looks. It’s easy to get caught up listing features instead of communicating your mission.

I personally like using and x for y (Just don’t use Uber!) and then a simple explanation.

‘Visions’ might work in America, but in most places investors might think it is naff. Investors would prefer to know the insight you identified and how you are proving that out.

Describe the pain of your customer. How is this addressed today and why the current offerings are totally inadequate.

The bigger the pain point the better!

Be very clear about the problem you are solving:

- For consumer concepts, talk about user needs (You need to market to them)

- For enterprise ideas, show a detailed understanding of your customer’s pain (you need to be an industry expert)

If you cannot convince an investor there’s something deeply broke, they will not be interested in what your solution is to the problem. You might have a solution looking for a problem… in which case, come back later.

There are a lot of manners to approach describing the solution. Some of the things you can address include:

- What was your eureka moment?

- Why is your value prop unique and compelling?

- Why will it endure? Is there a competitive moat build in such as network effects?

- And where does it go from here? How big can this get?

You need to figure out the key points that really communicate the big value here.

Timing matters.

The best companies almost always have a clear why now? What happened in the industry to bring your industry to being at the perfect time for you to act on it?

Nature hates a vacuum—so why hasn’t your solution been built before now? There are often good reasons for this.

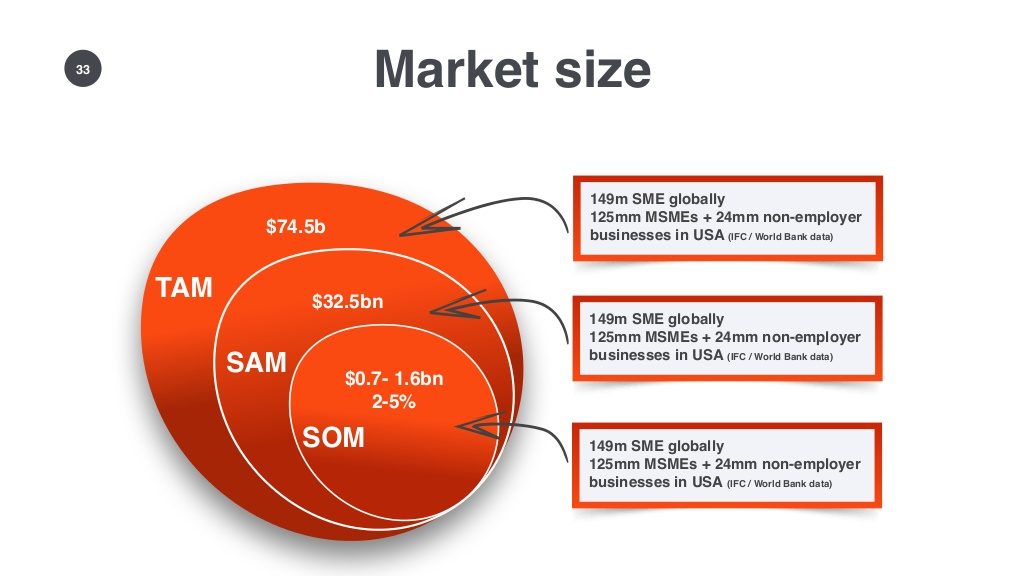

Market potential

Can this be really big? How big is the market?

You have two ways to size the market:

And some sizing jargon you can use is:

Here is an example of how we have presented it.

You need to identify your customer and your market clearly. Have an avatar in your head.

‘ If we just get 1% of the market ‘ is naive. In fact, some of the best companies invent their own markets (think Airbnb).

If it’s a new market, the best way to tackle this is to explain how many users or customers there are for the product/service, how this number grows over time, and how much each of these users/customers is worth (this last part is a chance to cover pricing/revenue model).

If it’s a replacement market, for example where software is automating an existing service, then explain how big the existing market is today and how much you expect your solution to shrink it, through lower prices. You can read about shrinking a market and owning it here .

One thing not to do is to put up huge numbers from a market study such as Gartner or Forrester and not add any details behind them. Airbnb does this in their deck , albeit simply.

If you cannot prove you have a large market you will not get very far. Here is why .

EVERYONE has competitors. Inertia is always an option.

Who are your direct and indirect competitors? Typically these are mapped out in an x/y axis.

The best is to add some commentary, or at least show that you have a plan to win by talking to the slide.

Better to identify all the competitors than have the investors discover them afterwards. That way, you can proactively explain how you are different. You want to control the discussion and not undermine your credibility.

Especially for early stage where you don’t have a lot of numbers you really want to give a demo.

My recommendation is not to do this live, but to pre-record the demo. DO NOT record your voice. Talk to the video. Otherwise, why didn’t you just send them a link to watch when they want? You can also pause the video and add extra comments on the fly and answer specific questions. You never know if wifi breaks etc.

It’s not possible every time (e.g. for infrastructure software), but whenever you can, a demo is worth a thousand words. Failing that, screenshots and the workflow to bring the solution alive.

Business model

So how do you actually make money?

How you address this slide depends on your business model and the stage you are at (maybe you aren’t clear on pricing yet?).

If you have many ways to make money, don’t talk about them all! Pick one main method. It’s almost always:

- Subscription

- Ads (Ergh…)

- Transactions

Ideally you can add metrics here around critical areas including CAC and LTV.

By this point, if the investor is interested, they will want to know about the team, so it’s worth spending a couple of minutes on the founders’ backgrounds, highlighting any special talents or experiences that make them well-suited to building the business.

Team is critical. Everything else is sort of pointless with out the team to execute on it. Here is a guide so you know what an investible founding team looks like .

I disagree with the Sequoia Capital pitch deck template format here though. If your team is amazing, you want to put it up front. It adds credibility to everything you say.

If you are sending satellites to space, I like to know first that you worked at NASA.

If you don’t know… here is the real reason founders are not funded (that doesn’t get talked about).

I would put advisors at the bottom and very small. Most people think advisors are BS and your friend who agreed to get involved for the sole purpose of the deck. You can add credibility by saying they actually invested. That makes it real, even if it is a small amount.

I typically don’t include financials in a pitch deck, at least nothing like a P&L. What I focus on instead are your metrics and adding growth charts.

You can mention high level MRR/ARR numbers and the like depending on your business model.

It’s easy to lose yourself in the numbers. Sequoia suggest keeping it simple and just showing on a timeline how you would spend the money (e.g., headcount) to achieve specific milestones (e.g., launching the service). I however recommend making a source and use slide which shows what you are raising, how you are going to spend it, and the key milestones you will achieve with it and your defined runway.

There we go. What do you think of the Sequoia Capital Pitch Deck Template? Let me know in the comments and we can discuss them.

Join the pitch deck thinking course

Join and get 11 daily emails on the key topic no one talks about

Success! Now check your email to confirm your subscription.

There was an error submitting your subscription. Please try again.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

This site uses Akismet to reduce spam. Learn how your comment data is processed .

- All templates

Sequoia Capital Pitch Deck

Pitch decks are an essential tool for startups seeking investment from venture capital firms or angel investors. A pitch deck is a presentation slideshow that helps to explain the investment opportunity being offered to potential investors. It's similar to a business plan in that it helps to answer questions that investors may have before deciding to invest in a company.

One pitch deck template that is particularly popular among startups is the Sequoia Capital Pitch Deck Template. Sequoia Capital is a well-known venture capital firm that has a reputation for making successful investments, so it makes sense for startups to use their pitch deck template as a guide.

The Sequoia Capital Pitch Deck Template includes a number of slides that are designed to build upon each other to create a comprehensive pitch. These slides include:

- Problem: This slide explains the problem that your company is solving and how it affects your target market.

- Solution: This slide outlines your proposed solution to the problem and how it addresses the needs of your target market.

- Why Now?: This slide explains why now is the right time to address this problem, taking into account market trends and other factors.

- Market Size: This slide estimates the size of the market that your product or service is targeting.

- Competition: This slide outlines the competition that your company is facing and how your product or service is different from what's already available.

- Product: This slide provides more detail about your product or service, including its features and benefits.

- Business Model: This slide explains how your company plans to make money, including your revenue streams and pricing model.

- Team: This slide introduces the key members of your team and their relevant experience and expertise.

- Board/Advisors: This slide highlights any advisors or board members that you have, including their credentials and expertise.

- Financial: This slide provides financial information about your company, including revenue projections and funding needs.

- Fundraising: This slide explains how much funding you're seeking and how you plan to use it to grow your business.

Overall, the Sequoia Capital Pitch Deck Template is a valuable resource for startups looking to develop a pitch for potential investors. By using this template, you can ensure that you have a well-structured, comprehensive pitch that addresses all of the key points that investors will be looking for.

Need a hand?

Sequoia Capital Pitch Deck Template (+ Free Design)

Building a pitch deck but don't know where to start? Use Sequoia Capital's pitch deck template & LeadLoft's free design as a place to start.

Download Sequoia Capital's pitch deck template with a fresh new design!

We struggled to find Sequoia Capital's pitch deck online so we went ahead and created a free resource so anyone can access it. Not only have we organized the pitch deck so it's easier to find and edit, but we've completely redesigned the original template and have open sourced the design!

Fresh Design

We've seen some terrible pitch decks so we wanted to make sure no startup ever struggles to design a great looking pitch deck again. Simply submit the form above and LeadLoft will send you the Sequoia Capital pitch deck with our fresh new design all for free.

Want a copy?

Simply submit the resources form and we'll send you a download link to the resource for free!

Related Resources

- All templates

Sequoia Pitch Deck Template

593817 uses

AI generated Pitch Deck 🤖

What is Sequoia Capital Investments?

Sequoia Capital Investments is a well-known venture capital firm that has been successful in investing globally. With a legacy spanning several decades, the firm has a reputation for identifying groundbreaking opportunities and making successful investments. They are experts in various industries, including technology, healthcare, and consumer sectors. Sequoia Capital Investments is committed to supporting exceptional entrepreneurs and driving transformative growth. They are a trusted partner and catalyst for success, shaping the future of the investment world through their vision and dedication to long-term value creation.

Sequoia successful investments

Sequoia Capital has a history of successful investments, and here are some examples of notable ones that yielded significant returns for the firm:

In 1999, Sequoia Capital made a crucial early investment in Google, providing the search engine giant with much-needed funding during its early stages. This investment has since become one of the most successful in venture capital history, contributing immensely to Sequoia Capital's reputation and financial success.

Sequoia Capital invested in Apple during the company's early days in the late 1970s. This investment proved to be highly lucrative, as Apple went on to revolutionize the technology industry with its iconic products, such as the iPhone, iPad, and Macintosh computers.

In 2011, Sequoia Capital made a strategic investment in WhatsApp, the popular messaging app. When Facebook acquired WhatsApp for a staggering $19 billion in 2014, Sequoia Capital generated substantial returns.

Sequoia Capital invested in Airbnb in its early stages, recognizing its disruptive potential in the travel and hospitality industry. As Airbnb grew significantly in value, Sequoia Capital's investment also grew.

Sequoia Capital backed YouTube, the world's leading video-sharing platform, in 2005. The investment played a pivotal role in YouTube's growth and eventual acquisition by Google, further solidifying Sequoia Capital's successful track record.

Sequoia Pitch Deck template

Since Sequoia Capital has quite the reputation for investments, it makes sense to take a page out of their book. This pitch deck is perfect for companies that are getting ready to develop a pitch when seeking investors. Similar to a business plan, a pitch helps to answer potential questions that an investor will have before putting up their money in your business. This presentation slideshow has slides that build upon each other to create your overall pitch.

Slides Included:

Each slide of the pitch deck will help you walk your potential investors through the investment opportunity you’re offering them. The slides included in the Sequoia Capital Pitch Deck Template each have a specific purpose that leads them down the path of discovery into your pitch.

This slide is your opener. You’re presenting the problem that your target market has and works to set up your pitch. This problem is what is creating the need for your service, widget, or other solution that your company offers. Often, you want this slide to be a problem that isn’t up for debate and that you can verify exists while staying away from problematic terminology.

This slide follows up the problem by showing your solution to the previous slide’s problem. Without going into technical details or too much jargon that could turn off investors, you’ll want to lay out your solution with benefits that it offers towards the problem.

The next slide covers a potential question that many investors will have in that why is now the time? Why does this problem need an answer now? Why is now the time to capitalize on this problem? This slide is the perfect opportunity to discuss the market validation that exists.

Market Size

This slide is your chance to let investors know about the scalability of this opportunity. Give your potential investors a chance to see what your share of the market can be once funded.

Competition

The competition slide is where you can show your market research skills by showing what competitors currently exist in your market, and how your solution is a better fit for consumers. This slide is where you explain how your company can create their own niche based on what other companies are currently doing.

Your product slide is where you get a chance to really get down to the meat and potatoes of the product you’re offering and what investors are putting their money into. This part is where you can go into more details about your product as the solution.

Business Model

The business model that you present to your investors can make a huge difference in how your pitch is received. Investors want your company to succeed and make money because that means their investment is going to pay them back. Most investors want to see a solid business model that will create returns for them.

This slide is your time to shine a light on all those behind the company. Highlight what each of these team members brings to the project and why they are right for the future of the company.

Board/Advisors

This one is an additional slide that can be useful for discussing others that play an essential role in the company and the potential for growth.

Your financial slide can be the basics about your company’s current financials that help to explain why you’ll need the investor’s help and why you believe that the company’s future depends on that investment to move forward to the next stage. This slide is helping to get the investor to see your current success before moving on to the final slide, fundraising where you’re giving the investor the ask of your pitch.

Fundraising

Your final slide is almost like your call to action. You’re laying down the terms of what you’re asking for from investors. You are breaking down what the initial investment you’re looking for, and what is predicted to happen from this investment.

The Sequoia Capital Pitch Deck can be changed to fit your particular needs, such as removing slides or revising the order of slides presented

Most popular templates

The Startup Pitch Deck Template

979474 uses

Airbnb Pitch Deck Template

978276 uses

Uber Pitch Deck Template

839136 uses

Investor Deck Template

625510 uses

Investment Proposal Template

483383 uses

Need a hand?

to access the full template

Presentations made painless

- Get Premium

Sequoia Pitch Deck Template

Sequoia Pitch Deck Template is an invaluable tool for startups looking to make a lasting impression with investors. This template provides a comprehensive guide for organizing and presenting all the key elements of your pitch, including executive summary, market analysis, product details, and financials. It is designed to help startups make the most of their limited time with investors and create a compelling story that will make them stand out from the competition.

In this blog post, you will learn:

- What a Pitch Deck is and what to include in one

- The benefits of using a Sequoia Pitch Deck Template

- The components of a Sequoia Pitch Deck and how to craft a strong pitch

- Tips for making an impressive Pitch Deck

- Final thoughts on Sequoia Pitch Deck Templates

What is a Pitch Deck?

A pitch deck is a presentation that entrepreneurs use to give investors an overview of their business. It is typically used to get funding, as investors will use the deck to evaluate the potential of a business. The goal of a pitch deck is to explain the business concept and convince investors to invest in the startup.

Benefits of Using a Sequoia Pitch Deck Template

Sequoia Capital, one of the world's most successful venture capital firms, has developed a pitch deck template that can be used to create a successful pitch for a business. The template is designed to help entrepreneurs craft a compelling story that will convince investors to invest in their business. It includes detailed guidance on the structure of the pitch, as well as tips for crafting a strong story.

What to Include in Your Pitch Deck

When creating a pitch deck, it is important to include essential information about the business. This information should include the business concept, the target market, the competitive landscape, the team, the financials, and the milestones. Additionally, it should include a summary of the business and its goals, as well as a call to action.

Sequoia Pitch Deck Components

The Sequoia pitch deck template includes several components, including a welcome page, an introduction to the business, a product overview, a market analysis, a financial overview, a competitive analysis, a timeline, and a call to action. Each component should be included in the deck to ensure that investors have all the information they need to make an informed decision.

How to Craft a Strong Pitch

When creating a pitch deck, it is important to craft a compelling story that will convince investors to invest in the business. This can be done by highlighting the unique value proposition of the business, focusing on the customer need, and providing evidence of the market opportunity. Additionally, it is important to be concise and to focus on the most important information.

Tips for Making an Impressive Pitch Deck

When creating a pitch deck, it is important to make sure it is visually appealing and easy to understand. This can be done by including visuals, such as graphs and charts, and by using a simple font and color scheme. Additionally, it is important to keep the deck concise and to focus on the most important information.

Final Thoughts on Sequoia Pitch Deck Templates

Sequoia's pitch deck template is a great resource for entrepreneurs who are looking to create a successful pitch. The template provides detailed guidance on the structure of the pitch, as well as tips for crafting a strong story. Additionally, it includes key components that should be included in the deck, such as a welcome page, an introduction, a product overview, a market analysis, a financial overview, a competitive analysis, a timeline, and a call to action. When creating a pitch deck, it is important to make sure it is visually appealing and easy to understand, as well as concise and focused on the most important information. Below we answer common questions entrepreneurs have about these topics.

1. What is a Pitch Deck?

What information should a pitch deck contain.

The key to any pitch deck is to keep it simple and straightforward. You don't want to overcomplicate things or give the wrong impression by having a deck that's too long and is too difficult to get through. Keep it short and sweet, and make sure the key points are easy to understand. Your goal is to get your message across in a way that's clear and concise, so don't complicate things.

How can a pitch deck help to secure funding?

The pitch deck is your opportunity to help potential investors understand your company. It's your chance to highlight the benefits of your product, explain your market strategy, and show how you can scale your business. The deck is your chance to show that your business plan is strong and that you can deliver on your ambitions.

2. Benefits of Using a Sequoia Pitch Deck Template

How does using a sequoia pitch deck template help to improve the presentation of my pitch.

The use of a high-quality template provides an opportunity to focus on your message instead of the presentation of your message. The best salespeople and marketers in the world can create a great pitch. But they're not great because they have a great presentation. They're great because they have a great product.

If you've spent time honing your product, you have the opportunity to focus on your unique value proposition and what you bring to the market. Using a template ensures that you have a solid structure and offers the opportunity to focus on the most important aspects of your pitch.

How will using a Sequoia Pitch Deck Template help me to more effectively communicate my company's value proposition to potential investors?

The most effective pitch deck templates will allow you to create a clear and concise presentation that highlights your product's most compelling features. The more you invest in the product, the more you want to show off. It is also essential to include a clear call-to-action so that potential investors know exactly what they need to do next.

3. What to Include in Your Pitch Deck

What should be the overall message of your pitch deck.

The main takeaway that your pitch deck should leave with investors is that you are the right person with the right plan to execute a profitable business. More than anything investors want to know that they are investing in a company that is likely to succeed, and the best way to convey that is to show that you have what it takes to make it happen. Your track record, your reputation, and your plan of action should paint a clear picture of your ability to succeed, and if you can effectively communicate that to investors, the rest is in your hands.

What visual aids can you use to best communicate your message?

Whether you're presenting to a board, a client, or your team, you want to make sure you're making a strong impression. One way to do that is to use eye-catching visual aids to grab your audience's attention and keep them engaged. From infographics to colorful charts and graphs, the possibilities are endless. So whether you're presenting financial results or sharing company milestones, using visual aids is a great way to make sure your message comes across loud and clear.

4. Sequoia Pitch Deck Components

What key elements should be included in a sequoia pitch deck.

There's a fine line between being personable and being pandering. You want to come off as genuine, but you also don't want to hammer home the fact that you're trying too hard to get potential investors on your side. It's all about finding that balance between letting them see your true self and giving them enough information about your business to feel like they're making an informed decision.

How should the information in the pitch deck be structured?

The most important thing to keep in mind when creating a pitch deck is to make sure it is visually appealing and easy to understand. An entrepreneur's presentation skills are key to this, but the visuals are what the audience will remember most so it is important to make sure everything is clear and concise.

A good rule of thumb is to use a maximum of 18 slides and keep each slide under three minutes. This will ensure your audience is engaged and will make your deck easy to follow.

5. How to Craft a Strong Pitch

What elements should be included in a successful pitch.

Many investors are looking for that "wow" factor. If your idea is innovative, show them how it will captivate consumers. Demonstrate how your product is revolutionary while still staying within the realm of reality. Keep your presentation simple, straightforward, and honest. The more confident you appear, the more likely you are to impress investors.

How can I ensure that my pitch stands out from the competition?

First, don't be afraid to be yourself. Entrepreneurs are often expected to be perfect, and be "on" all the time. But the best pitch is one where you are honest, authentic, and transparent. Let your personality shine through and don't be afraid to be vulnerable.

6. Tips for Making an Impressive Pitch Deck

How can i create clear and concise visuals to effectively communicate my message.

With clear and concise visuals, you have to remember the old adage of "show, don't tell." When you're communicating with a potential customer or partner, you want to show them what you have to offer, not just tell them about it. This means using graphics and visuals in your content, and not just words.

Think about using charts, graphs, and infographics to show your information visually. This will help people understand your message more easily and quickly. You can also use video or animation to show your information in a way that is more engaging.

What techniques can I use to make sure my presentation grabs and keeps my audience's attention?

We live in a world of distractions, so you need to grab your audience's attention in the first few seconds. This can be done by using an attention-grabbing question or statement. For example, "How many of you are sick of working from home?" This statement gets people to focus on what I'm about to say.

7. Final Thoughts on Sequoia Pitch Deck Templates

How have sequoia pitch deck templates helped you develop and refine your business strategy.

As an entrepreneur, you need to be able to communicate your vision clearly and concisely. A good business plan will help you do this. A good business plan will also help you analyze various scenarios and identify potential risks. A good business plan will also help you determine how much you need to raise and how you will use that money to grow your business.

What advice do you have for other entrepreneurs who are considering using a Sequoia Pitch Deck Template?

I think the key to answering this question is to give specific examples of what went right and what went wrong. For example, you could say "We made sure to include a strong call to action at the end of each slide, which led to a 30% increase in email subscribers. And we made the mistake of using too many colors in our presentation, which led to audience members getting tired and distracted after only 20 minutes."

Key Takeaways:

- A Pitch Deck is a presentation used to showcase the value of a business or product to potential investors.

- Utilizing a Sequoia Pitch Deck Template can offer many advantages, such as increased clarity and a higher level of detail.

- When crafting a Pitch Deck, key elements to include are a business overview, customer and market analysis, and a financial overview.

- Sequoia Pitch Decks typically consist of 8-10 slides, designed to provide a comprehensive overview of the business.

- To make an impressive Pitch Deck, ensure that the content is succinct and visually appealing, and focus on the key value proposition.

A Sequoia Pitch Deck Template is a great resource for entrepreneurs to use as they create their own pitch decks. It provides a comprehensive overview of what should be included in a pitch deck and offers guidance on how to craft a strong pitch. The template offers components to help you create a comprehensive, effective, and visually appealing pitch deck. Additionally, it provides tips for making an impressive pitch deck, such as using the Rule of Three and focusing on the key components that investors look for. By leveraging a Sequoia Pitch Deck Template, entrepreneurs can craft a compelling and professional presentation that is sure to capture the attention of investors.

More Pitch Deck Templates

Want to research companies faster?

Instantly access industry insights

Let PitchGrade do this for me

Leverage powerful AI research capabilities

We will create your text and designs for you. Sit back and relax while we do the work.

- Privacy Policy

- Terms of Service

© 2024 Pitchgrade

Sequoia Capital Pitch Deck Presentation Template

Use our very own Sequioa Capital pitch deck template which you can use as a guide to help you prepare your own presentation for investors.

- Design style modern

- Colors light

- Size Custom (1024 x 576 px)

- File type PNG, PDF, PowerPoint

The sequoia capital pitch deck template has become a key starting point for many entrepreneurs and investors, as the venture capital firm sequoia is considered to be one of the best in the business. In addition to having a history of successful investments under their belt, which include virtually every name brand tech company from apple to uber, sequoia has also earned a reputation for being brutally honest. The sequoia capital pitch deck template that was used by the firm even has a distinctive design such as its golden sequoia tree illustration and big fonts that can be seen on their presentation paper. Having no design experience can be intimidating. But the best believes are the ones that push you outside your comfort zone. That's why we've created an online course that takes you through all steps of the design process, from sketching to prototyping, without requiring any design experience whatsoever. And with our interactive feedback and inspiration tools, getting feedback for your work has never been easier! Using this sequoia capital pitch deck template, the investors were attracted to know more about

Read more >

Explore more

Related presentations.

SEQUOIA CAPITAL PITCH DECK TEMPLATE

Sequoia capital investor pitch deck.

I created this classic pitch deck outline from an older version of this document . I published it on SlideShare on March 24, 2015. It's now closing in on 3,000,000 views. Enjoy.

Sequoia Capital pitch deck — Flow

Sequoia's recommended deck flow.

Sequoia Capital pitch deck — Company Purpose Slide

What do you do? Who do you help? How do you help? Keep it simple.

Sequoia Capital pitch deck — Problem Slide

What are the biggest problems you solve? Who do you solve them for? How do those people solve these problems without your solution?

Sequoia Capital pitch deck — Solution Slide

How does your product solve the problems discussed previously? What makes your product unique? How does it work? What are some common use cases?

Sequoia Capital pitch deck — Why Now Slide

What trends make now the perfect time to introduce a product like yours?

Sequoia Capital pitch deck — Market Size Slide

How big is your market? How much money could you make if you dominate your market?

Sequoia Capital pitch deck — Competition Slide

Who do you compete with? What makes your product better than theirs?

Sequoia Capital pitch deck — Product Slide

What does your product look like and how does it work?

Sequoia Capital pitch deck — Business Model Slide

How do you make money? What are your unit economics?

Sequoia Capital pitch deck — Team Slide

What makes your team the right team for the job? What relevant experience and expertise do they bring to the table?

Sequoia Capital pitch deck — Financials Slide

How much money do you expect to make in your first few years?

Less is more. Keep your content simple and don't overwhelm your story with complex design. Make sure your deck proactively answers common investor questions and objections before they get asked.

Need more help? Check out my free Pitch Deck Guide for more hints and tips on what to include in your pitch deck. If you need a helping hand, check out my pitch deck coaching services .

© 2023, PitchDeckCoach · Services · Testimonials · Contact · LinkedIn

Sequoia Capital PowerPoint Pitch Deck

Our Sequoia Capital PowerPoint Pitch Deck provides a set of editable slide deck for business professionals and entrepreneurs. A pitch deck or a startup pitch deck is the most effective way to communicate your agenda, financial plans, and other improvement schemes before your audience. For investors, it gives them the motive to spend on your business idea. Thus, we have designed this PPT template using high-quality graphics that unicorn startups can use to present their idea before venture capitalists or private investors. This PowerPoint template covers all the essential components of the sequoia pitch deck in 100% editable format.

The Sequoia Capital PowerPoint Pitch Deck has a homogenous color pellet and a well-designed SlideMaster. However, presenters can alter any settings according to their choices. The following are the slide titles and included sections included in this pitch deck:

- Business Problem: customer vision for the problem

- Solution: value proposition and use cases

- Why Now?: graphical representation of product category evolution (stock exchange data)

- Market Size: TAM, SAM, SOM, and target market analysis

- Competition: potential competitors and competitive analysis

- Product: product lineup and development map

- Business Model: revenue, sales, and lifetime value

- Founding Team: Hustler, Hacker, and Hipster

- Board of Directors: team members for organizational setup

- Financial and Cap Table: cashflow, runway, and cap table

- Fundraising: fundraising and deal terms

These slides cover every aspect of a solid business idea and portray a sound working behind the proposition. Placeholder images and table data are used in these template slides. Users can replace these components to customize this layout. Various graphical icons indicate the concept and help presenters demonstrate the concept. Executives can add a company logo to the slides and change relevant color schemes. Attractive zoom animation further makes this template presentable. So, download this PPT template and create a winning startup pitch deck!

You must be logged in to download this file.

Favorite Add to Collection

Subscribe today and get immediate access to download our PowerPoint templates.

Related PowerPoint Templates

Restaurant Company Profile PowerPoint Template

Money Management PowerPoint Template

Client Meeting Presentation Template

Corporate Presentation Slide Deck Template

Killer Sequoia Pitch Deck Templates Based on Their Format

Grab a sequoia capital pitch deck template with all the required sequoia capital slides . Impress investors with interactive deck design beyond PowerPoint .

Choose template by:

A business solution you can trust

What makes Storydoc better than PowerPoint or PDF?

With your same-old PowerPoint Sequoia pitch deck design, you’ll never stand out, let alone engage.

Sequoia investors have seen beautiful pitch deck PPTs and PDFs a thousand times before. Though pretty, they’re still static, dull, and hard to understand.

You can go see examples of pitch decks that got funded made better than the originals with Storydoc.

What is the goal of a sequoia capital pitch deck template?

The goal of a Sequoia Capital pitch deck template is to provide a clear, concise framework for startups to effectively communicate their business idea, vision, and strategy to potential investors.

It's designed to showcase the company's value proposition, market opportunity, and competitive advantages in a compelling and organized manner.

What makes a good sequoia capital pitch deck design?

- Simplicity: Keep the design clean and uncluttered.

- Clarity: Use clear, easy-to-understand language.

- Consistency: Maintain consistent fonts, colors, and styles.

- Visual appeal: Incorporate high-quality images and graphics.

- Data visualization: Use charts and graphs for financials and metrics.

- Storytelling: Craft a narrative that connects with the audience.

- Interactivity: Include interactive elements like hyperlinks or videos.

- Focus: Highlight key points and avoid information overload.

- Branding: Align with your brand's look and feel.

- Adaptability: Ensure it's easily customizable for different audiences.

Why use a Storydoc template instead of paying a design agency?

- Stroydocs are 2x more engaging than a typical agency-made sequoia capital pitch deck

- Our templates cost a fraction of the price you pay an agency.

- With Storydoc you can produce content about 5x faster than using the legacy design approach.

Try our pitch deck creator .

What should a sequoia capital pitch deck template include?

- Cover slide: Company name and logo.

- Problem statement: Clearly define the problem your product solves.

- Solution: Present your product or service as the solution.

- Why now: Explain why now is the right time to launch your startup and why not acting now signifies a missed opportunity.

- Market opportunity: Size and characteristics of your target market.

- Product demo: Visuals or descriptions of your product in action.

- Business model: How you plan to make money.

- Go-to-market strategy: Your plan for market entry and growth.

- Competitive analysis: Overview of competitors and your advantages.

- Financials: Key financial projections and current status.

- Team: Bios of key team members.

- Ask: Clearly state what you're asking from investors.

You can get a breakdown of the original Sequoia deck here .

What are the main types of sequoia capital pitch decks?

- Early-stage startups: Focused on vision and potential.

- Growth-stage companies: Emphasizing scalability and market traction.

- Product-launch decks: Centered around a new product or feature.

- Fundraising decks: Tailored for raising capital from investors.

Create your best deck to date.

Stop losing opportunities to ineffective presentations. Your new winning deck is one click away!

- Pitch Deck Consulting & Creation

- Pitch Deck Review Service

- Business Plan Writing

- Feasibility Study Consulting

- Meet Our Managing Director

- Our Case Studies

- UK Investor List Database 2024

- Sequoia Pitch Deck Templates

- The Start-up Encyclopaedia

- The Sequoia Model Explained

- UK Startup Funding News

Why is the Sequoia Pitch Deck Template popular?

The Sequoia pitch deck template is a widely recognised and highly effective pitch deck structure that has been used by many successful businesses.

There are a few reasons why venture capitalists may be drawn to this template:

- Clarity : The Sequoia pitch deck template is designed to clearly and concisely communicate the key elements of a business idea and strategy. It includes slides that cover the problem the business is solving, the solution it offers, the target market, the competitive landscape, the marketing and sales strategy, the financial projections, and the team behind the business. By providing a clear overview of these key areas, the Sequoia pitch deck template helps venture capitalists to quickly understand the value and potential of a business.

- Simplicity : The Sequoia pitch deck template is designed to be simple and straightforward, with a focus on clearly communicating the key points of the business. This can be particularly appealing to venture capitalists, who may be presented with many pitches and may appreciate a clear and concise structure that makes it easy to understand the key points of a business.

- Proven success : The Sequoia pitch deck template has been used by many successful businesses, which can give venture capitalists confidence in its effectiveness. By using a proven template, businesses can demonstrate that they have done their homework and are presenting a well-researched and thoughtfully crafted pitch.

Ultimately, venture capitalists are looking for businesses that have the potential to grow and succeed. By using the Sequoia pitch deck template, businesses can clearly and concisely communicate their value proposition and strategy, which can be an appealing proposition for venture capitalists.

Popular PitchBuilder.io Downloads View all

Other popular articles: View all

- DEALMAKERS PODCAST

- BUSINESS TEMPLATES

- M&A ADVISOR

- BOOK A CALL

I hope you enjoy reading this blog post.

If you want help with your fundraising or acquisition, just book a call click here .

Sequoia Capital Pitch Deck Template

by Alejandro Cremades

What is the Sequoia Capital pitch deck template? What are Sequoia Capital’s recommendations for creating a pitch deck?

What does well known VC Sequoia Capital pitch deck template look like? How do you utilize their format to create a deck of your own that you can go out fundraising with?

*FREE DOWNLOAD*

The ultimate guide to pitch decks.

Here is the content that we will cover in this post. Let’s get started.

- 1.Sequoia Capital

- 2. What’s Important To Them

- 3. Sequoia Capital Pitch Deck Template

- 4. Company Purpose

- 6. Solution

- 7. Why Now?

- 8. Market Potential

- 9. Competition & Alternatives

- 10. Business Model

- 12. Financials

- 14. Making This Pitch Deck Your Own

- 15. Alternative Pitch Deck Template

- 16. What’s Most Important When Creating A Pitch Deck?

- 17. Summary

Sequoia Capital

Sequoia is one of the most well-known venture capital investment firms. Founded 50 years ago, this Menlo Park, California-based investor had around $85B in assets under management in 2022.

They invest in seed to growth stage companies. With limited partners that provide their funding, including endowment funds, charitable foundations , and other large institutions.

See How I Can Help You With Your Fundraising Or Acquisition Efforts

- Fundraising or Acquisition Process: get guidance from A to Z.

- Materials: our team creates epic pitch decks and financial models.

- Investor and Buyer Access: connect with the right investors or buyers for your business and close them.

Book a Call

What’s Important To Them

If you’ve seen Airbnb’s early pitch deck, it wasn’t really a beautiful work of art. Even Sequoia says that it wasn’t their slides that they liked, but their clarity of thinking, and the scope of their ambition.

Via their website and page on writing a business plan, they say that they love to invest when an idea is newly formed and has maximum room to grow.

Keep in mind that in fundraising, storytelling is everything. In this regard, for a winning pitch deck to help you here, you can also take a look at the template created by Silicon Valley legend, Peter Thiel ( see it here ) that I recently covered. Thiel was the first angel investor in Facebook with a $500K check that turned into more than $1 billion in cash.

Remember to unlock the pitch deck template that is being used by founders around the world to raise millions below.

Unlock the pitch deck template used by founders to raise millions. Just enter your email below.

Via their website, below is their guide to writing a business plan and pitching.

It’s just 10 slides. Far less than most new entrepreneurs can fathom making theirs.

Let’s take a look at the slides and points that they recommend including, what should go on them, and then how to pull it all together.

1. Company Purpose

Sequoia Capital would like to see startup founders able to sum up their companies in a single sentence.

What is the purpose for your startup to exist?

This is your mission. Not the one product that you are working on right now. It is the one thing that you are in business to do, which everything else will come from.

Do not use this space to talk about all the features of your products. While your mission may resonate with some investors, and not with others, it is most important that you use this slide to prove you can focus.

You can only create incredible results if you are able to focus. You won’t be able to stay on track and push the progress investors are looking for if you cannot maintain your clarity and keep things simple.

If you can’t be clear when millions or more are on the line for raising funding, then they won’t believe that you can create the messaging needed to sell customers either.

What is the pain that your target customers are suffering from today?

What is the urgent need that is so painful that it needs to be solved? What is such a problem that people are going to pay money for a solution, or a better solution than is on the market currently?

You may contrast this to what solutions your customers have been trying to use prior to yours. As well as the problems with them, and gaps in the market.

Do not use too many words, but be clear about the problem, and why it is so important that a lot of money should be poured in to fix it.

3. Solution

What is your compelling, and unique value proposition ?

Sequoia Capital would like to know what your eureka moment was. How you discovered the problem and solution, and where you are taking this all from here.

Again, you need to keep this clean and simplified. Though, be ready to answer questions about your product roadmap.

Remember that your solution needs to be far superior to existing options.

4. Why Now?

Sequoia believes that the best companies have a clear why now.

Timing can be everything when it comes to the success and survival of a startup. If you want investors to have that sense of urgency to take action to back you right now, then you need to have a compelling argument for why doing it right now is so important, and valuable.

If there is a real gap and vacuum begging for a solution to this problem, then why hasn’t it been filled already? How have others failed to succeed in this space, where you think you can win?

How have things changed to make this possible and viable as a business now?

5. Market Potential

What is this industry? How big is it? Who exactly are your customers?

While some companies appear to create their own markets, and Sequoia says they love the outliers, having a proven market also makes many investors more comfortable and confident in providing their capital.

If this is a new market, how is it being created and made possible now? How will it be supported going forward?

If this is an existing market, what share of it do you believe you can win? Is it still growing, and if so, how fast?

6. Competition & Alternatives

Who are your competitors in this space? Both indirect and direct competitors ?

What other options do your customers have than you? How do they compare? How will you win against them?

7. Business Model

How will your company thrive?

How do you make money? A business is about making money. An investor is putting their money in to get a financial reward, and you are responsible to them for delivering the financial returns you promised.

What is your business cycle? From getting the product to selling the product, and putting money back in the bank?

Who are your key team members and company founders? What is their story?

In the early days, the only real tangible thing or performance for investors to base their investment decision on is your people. Do they have what it takes to make it through the series of battles, and grueling endurance race that is ahead? What have they achieved before that proves that they can do this?

Sequoia Capital loves ambitious founders that are passionate and can be very clear in conveying their message. Yet, a startup team also needs to be capable of delivering on its aspirations.

9. Financials

Does your company have existing financials?

If you have been selling, or have raised previous rounds of financing, then you use this slide to show your performance and financial status.

If you are just starting out, then you may use this slide for your financial forecast . What are the financial projections for this company over the next 12 to 36 months?

What’s the big vision for this venture?

Sequoia wants startups to put this in terms of a five-year timeline if everything goes well.

For other investors, you may want to go even bigger than this. It is not uncommon for it to take 10 years to create a startup that is an ‘overnight success’, and a big success. One which goes the distance to be able to hold its own as a profitable private company, can go public, or is going to be acquired, and will return investors their capital and expected returns. It takes some even longer than that.

Note that this is different from your mission. It is what the world will look like once you’ve been successful.

Making This Pitch Deck Your Own

So, how do you take this Sequoia Capital Pitch Deck template and make it your own?

If you are planning on pitching Sequoia for funding at your next round, then you can adopt this framework for that pitch.

You will want to begin by creating an outline. Including slide names and what you will put on each slide.

Then create your pitch deck in the optimal software for building the deck, collaborating on it with your team, and sharing it with your advisors and prospective investors. As well as for pitching live.

This may be in Microsoft Powerpoint . Though Google Slides can offer a lot more flexibility and integration for those that are using Google for other things.

Pitch a theme and background which is clean, simple, and will both match your brand identity, and resonate with investors as a startup that is going to be just as successful as the best in their portfolio history, or those they’ve missed out on.

Everything is on the line here. This is about selling. It is a marketing exercise, and test if you can pitch correctly, far more than it is about showing off your technical expertise and product.

Be sure to utilize the best copywriters and graphic designers you can to create a pitch deck that will convert your desired investors into funding partners.

Alternative Pitch Deck Template

The Sequoia Capital pitch deck template isn’t the only business plan and format out there. There are other successful pitch deck templates. Below is another great option for startup founders.

This 16-slide pitch deck template may be easier for many entrepreneurs to use. It may be more effective when out there pitching other investors, angel groups , and VCs.

This template provides a little more room, and space to have clean and focused slides. Without going so long that you’ll bore investors and run out of time for them to take action on your funding request.

1. Cover Slide 2. The Problem 3. The Solution 4. Market Size 5. The Competition 6. Competitive Advantages 7. Your Product 8. Traction 9. Customers and Engagement Slide 10. Business Model 11. Financials 12. Amount Being Raised And Other Investors 13. Use Of Funds 14. The Team 15. Advisors 16. Back Cover and Contact Information

What’s Most Important When Creating A Pitch Deck?

Above all else, it is vital to have a clean, simple, and clear pitch deck.

It doesn’t matter how great everything else is if you cannot explain it, and get the message across clearly and quickly.

This trumps deep technical genius, more features, and the product every time.

This is a sale. It is about showing investors that you can check the boxes that they are looking for, and have what it takes to build a hyper-growth company that can deliver outsized returns.

You can also learn how to create your own pitch deck by watching the video below.

The Sequoia Capital pitch deck template offers a glimpse of what they are looking for in a pitch deck on their page about writing a business plan. This 10-slide deck tells founders what they need to include in their presentation to get funded.

There are other pitch deck templates that you may prefer as well. Including this 16-slide deck.

No matter which template you use, it is essential to boil your message down to the simplest version you can. Keep it clean and compelling.

You can provide a lot more detail, and weave a great story around this slide presentation when you are pitching investors live.

You may find interesting as well our free library of business templates. There you will find every single template you will need when building and scaling your business completely for free. See it here .

Facebook Comments

Do You Want More Funding Or Get Acquired?

Get a custom action plan and all the help you need to start raising more capital or to get your company acquired.

About the Author

Alejandro Cremades leads the vision and execution for Panthera Advisors as its Co-Founder and…

Recent Posts

- Funded Vs. Unfunded Startups: How To Raise Your Chances Of Success

- Adam Mendelsohn On Raising $100 Million To Develop A Portfolio Of Miniature, Long-Term Implants To Deliver Drugs More Efficiently And Consistently

- He Raised $100 Million To Develop A Portfolio Of Miniature, Long-Term Implants To Deliver Drugs More Efficiently And Consistently

- Ulrik Stig Hansen On Raising $50 Million To Build Data Tools And Infrastructure For Artificial Intelligence Development

- This Entrepreneur Raised $50 Million To Build Data Tools And Infrastructure For Artificial Intelligence Development

If you want help with your fundraising or acquisition, just book a call

Swipe Up To Get More Funding!

See How I Can Help You With Your Fundraising Or Acquisition Effort

Book a call

Want To Raise Millions?

Get the FREE bundle used by over 160,000 entrepreneurs showing you exactly what you need to do to get more funding.

Lenny's Newsletter

Raising a seed round 101

The whys, whats, and hows of seed funding, with advice from the founders of notion, linear, figma, ramp, instacart, 37signals, and more.

👋 Hey, I’m Lenny, and welcome to a 🔒 subscriber-only edition 🔒 of my weekly newsletter. Each week I tackle reader questions about building product, driving growth, and accelerating your career. For more: Best of Lenny’s Newsletter | Hire your next product leader | Podcast | Lennybot | Swag

Q: I’m a founder and I’m planning to raise a seed round. What do I need to understand to raise a great round?

Fundraising is arguably the most heartbreaking, confusing, and high-stakes part of a founder’s job. You have to learn how to do it from scratch, stay positive in spite of incessant rejection, and if you don’t get it right, your company dies. Then you have to do it over and over and over again. Don’t get it right once? That’s right, your company dies.

Considering how essential getting this right is for most founders, it surprised me that I’d never come across a great, in-depth, practical how-to guide on raising a seed round—especially one written by people who’ve been through it hundreds of times. So I pulled in two of my favorite co-investors to write one: Terrence Rohan and Jack Altman . Terrence and Jack have been involved with over 1,000 seed rounds, and are my go-to people whenever I need fundraising advice.

Below, you’ll learn:

Should my company raise venture capital at all?

What do I need to prove to investors before I raise?

How much should i raise, what should i know about seed round sizes and compositions, how do i maximize the odds of raising a great seed round, how do i talk terms in a seed raise.

How should I think about dilution?

How do I know if a fundraise is going well?

How do i choose the right investors.

Should I make an announcement?

To make this guide even more practical, they’ve integrated anecdotes and advice from the founders of some of today’s most iconic companies. If you’re planning to raise a seed round, this guide is for you.

Terrence is a seed investor building a new type of angel fund, Otherwise . Previously he managed the seed practice at Index Ventures. He has supported companies like Figma, Notion, Vanta, Hugging Face, and Robinhood from their earliest stages. You can find him on X , LinkedIn and trohan.com .

Jack is the founder of Alt Capital , a brand-new early-stage venture that raised its first $150 million fund in February. Before starting Alt, he was the founder and CEO of Lattice , where he currently serves as chairman. For more from Jack, follow him on X .

We’ve watched this process play out from both the VC and founder sides. Collectively, we’ve seen over 1,000 seed fundraises—including tactics that work and tactics that are harmful.

Although each situation is different, and there’s no one simple answer to these questions, our goal with this post is to help deepen founders’ understanding of the nuances of raising a seed round and help you take the right steps for your company.

We reached out to some of our favorite founders to ask them for candid advice to supplement our own experience on both sides of early-stage pitches. Thank you to Christina Cacioppo (Vanta), Dylan Field (Figma), Eric Glyman (Ramp), Ivan Zhao (Notion), Jason Fried (37signals/Basecamp), Josh Miller (The Browser Company), Karri Saarinen (Linear), Mathilde Collin (Front), Max Mullen (Instacart), Tomer London (Gusto), Qasar Younis (Applied Intuition), Siqi Chen (Runway), and Zach Perret (Plaid), who collectively have raised nearly $9 billion in venture capital. You’ll see insights from all of them incorporated throughout this guide.

Should my company raise venture capital at all?

Vanta founder Christina Cacioppo looks at it this way: “If you think you can build a business that makes hundreds of millions of dollars a year, you don’t mind ceding some decision-making to someone who doesn’t work at your company day-to-day, and you want to grow an organization faster than it would naturally grow,” then taking some venture might be the right decision for you.

Seed capital has historically been the first formal round of venture capital (i.e. why it’s called a “seed” round). Smaller rounds are sometimes branded “pre-seed” or “angel” rounds, and larger ones are sometimes called “mango seed”—but all these fall under the umbrella of a seed round.

A seed round typically entails raising $1 million to $4 million from a variety of investors and most likely doesn’t involve the creation of an outside board (we’ll break this down in more detail later).

You should pursue raising a seed round if you have conviction on the following points:

Scale: You (and your co-founders) want to build a massive company, public or private, and aim to grow it as big as possible.

Dilution (and control): You are OK with selling off approximately 10% to 20% of your company to investors. (A VC board typically doesn’t happen at seed, but it could.)

Funding: You believe raising outside capital will have concrete upsides you couldn’t get with bootstrapping. For example, building an expensive product, outpacing competition, etc.

If you answered no to any of these questions, seed capital might not be right for you, and that is OK. There are advantages to not raising (e.g. less dilution, more control, and fewer voices in the room).

If you can manage it, there can also be benefits to delaying your seed fundraise. Jason Fried of 37signals advises, “Raising money too early teaches you how to spend rather than earn. When flush with cash, you’re encouraged to spend and raise more, practicing skills that won’t sustain your business long-term. Building a self-sustaining business requires practicing making money—a skill that, like playing an instrument, takes considerable time to master. The sooner you start practicing, the better. And there’s no better practice than having to make more than you spend right from the start, especially when it’s yours that you’re spending.”

It’s worth noting that just because you raise a seed round doesn’t mean you need to raise tons more venture capital. VCs can commonly “over-prescribe” venture capital, both in terms of frequency and amount (if you are a hammer, everything is a nail). Just because you took a little doesn’t mean you’re obligated to take a lot.

Related, it’s helpful to remember that focusing on the business and not on venture capital might be one of the strongest approaches to both. Ivan Zhao at Notion puts it this way: “You can decide your energy allocation between selling/socializing vs. building. At least for Notion, I believe if you built something great, the network will come and the investors will say yes. So we spent most of ours on the latter, as opposed to the tactics for the former.”

Every round of venture capital requires you to build a case to investors. For them to want to invest, they need to believe you are positioned to build an important and enduring business. Unfortunately, there isn’t consensus in the market for what that proof looks like or how far along you need to be in order to raise, and each investor has a different approach to picking their investments. Some founders raise a seed with a built product and paying customers; others simply have a deck and an idea.

Generally speaking, before you raise, you should have taken the following steps:

Proof of commitment: You have left your old job and are fully committed to being a founder. You can’t expect to raise capital if you aren’t yet fully committed yourself.

Proof of work: You have done enough customer development and research on the problem to give yourself total conviction in the opportunity. Tomer London from Gusto puts it this way: “Validate the customer’s needs and your unique product insight. Speak with buyers (100+ in the consumer space, 30+ in SMB, 10+ in enterprise) to deeply understand their pain point, and offer them your solution in the most realistic way possible (a prototype is better than a pitch deck) and name a price. You’re looking for at least 40% of ‘wow!’ and ‘when can I get this?.’ Anything less is just people being nice to you.”

Proof of insight: You have some expression of your thesis. At the most, you have built a simple product and have some paying customers. At the least, you have a clear written memo and/or deck that outlines what you plan to build (more on this below). According to Ivan at Notion, “Notion was like a better mousetrap but built differently. (We wanted to decompose SaaS into software Lego blocks—text editor, databases, charts—and allow end users to create their own tools with our Legos. The value prop is to reduce their tool fragmentations and give them new power.) We knew, or at least we had the conviction, that if we build it, people will come. That first-principle conviction turned out to be true. It is also why we started the company in the first place.”

Importantly, your own conviction across all three of these points might be the single most predictive variable in raising capital. If you truly believe in the opportunity, you will likely be able to convince someone to give you money.

A simple formula is to aim for a 24- to 36-month runway, building in a 25% buffer .

Why 24 to 36 months? Generally, this is the right amount of time because it tends to be about how long it takes to hit product-market fit (and ideally become default alive) and/or raise a series A. As one data point, Carta has the median time from seed to Series A as 23 months.

You also probably want a 25% buffer because unexpected things always happen.

Here’s a simple spreadsheet illustrating how to model this out.

Most seed rounds now are around $2M to $4M. Some companies require much less or much more to get going, so think carefully and use your judgment. As of today, a typical post-money valuation will be around $20M (in the San Francisco Bay Area). It is typical to sell around 15% equity in a seed round.

If you want to raise $2M to 3M, it’s also better to say you are raising $2M than to say you are raising $3M. It’s always better to be oversubscribed than fail to reach your target.

Here is a table outlining common dilution scenarios from a seed round.

It’s worth remembering that when you take the venture path, outcomes tend to be sufficiently binary so that if you are the founder of a successful startup, you will end up with life-changing money regardless of the dilution you took.

Taking on too little funding can limit your company’s performance, but taking on too much can have its own downsides. Too much capital, especially too early, can reduce urgency and innovation, and contribute to unnecessarily high headcount and burn. There are exceptions to every rule, but generally, if you raised 2 to 3x or more than a typical seed round for your category, you probably raised too much.

According to Linear founder Karri Saarinen, “With each round, you want to think simultaneously that it is the last round you’ll ever raise—ideally you get to profitability and don’t need to raise— and that you’re raising enough to hit the milestones that you need to get to the next valuation range.”

Creating a product customers love and pay for and keeping profitability as a plan B is more likely to maximize your company’s odds of survival as well as the odds of your raising your next round. “First and foremost, build a great business,” says Plaid founder Zach Perret. “Fundraising is easy if you identify a great market and find a unique customer insight, so do that first.”

AngelList and Carta have good third-party data on the latest round sizes and valuations.

Most rounds are put together with at least one big check (seed fund or multi-stage firm) and any number of angels and smaller funds. The big check is typically referred to as the “lead investor,” and the smaller checks traditionally provide an entry point for strategic investors who bring signal value (e.g. Elad Gil) or specific skills to the table (e.g. growth, distribution, hiring).

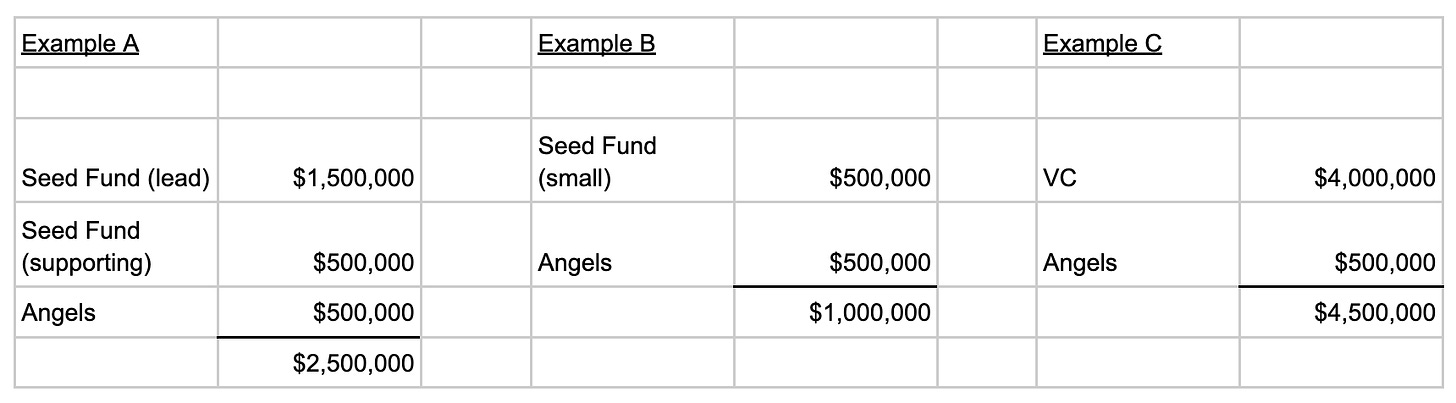

There is no universal “right” way to put together a seed round. You can do it with a single seed fund, a constellation of angels, with a multi-stage VC, and everything in between. Below are some examples:

Rising above the numbers, Dylan Field of Figma advises, “Treat this as the start of a very long-term relationship, not a one-off transaction or optimization puzzle. Find people you love spending time with and want to learn from over time.”

Seed-stage venture capital comes primarily from three different types of investors: angels, seed funds, and multi-stage firms.

Angels typically move quickly and bring highly relevant startup expertise but usually can only invest small amounts of $10K to $250K. Although they typically have less time to commit than professional investors, they are often the highest help per dollar on your cap table. Notable angels can also carry high brand signals that bring crucial early validation to your company.

Seed funds are set up to bring more capital than angels, typically investing $1M to $3M. They offer stage-specific expertise and typically provide a lot of direct support to their investments. Many seed funds also provide access to valuable founder peer communities that unlock useful resources and networks. These firms are more resource-constrained than multi-stage firms, and can’t continue to provide meaningful capital over time.

Multi-stage firms can offer bigger checks, from $1M to $5M+, but usually aren’t structurally set up to support their seed investments as much as their venture or growth investments. These firms usually have massive pools of resources and can support your company with capital as you scale. The flip side is that if they don’t support a future round, that can send a negative signal about your company’s prospects.

To find investors, we believe the most comprehensive third-party resource is Crunchbase .

We recommend one of two approaches:

You can find companies analogous to your own and see which investors backed those companies at seed. For a B2B SaaS company, here is an example of Lattice’s seed round .

You can go to the “ search investors ” tab and run your own custom query. Here is a list of the most active angels in the U.S., for example.

As a sweet bonus, Crunchbase gave us an exclusive discount for readers of Lenny’s Newsletter: Get 20% off your first year of Crunchbase Pro with code LENNY20.

To maximize the odds of a successful raise, you need to choreograph your approach to maximize the number of potential options. Raising a seed round comes down to activating emotional triggers in prospective investors, including the fear of missing an incredible opportunity. The most surefire to get a yes from many investors is to get a yes from other investors.

In short, you have to create FOMO among investors . Here’s how to do that:

1. Plan your raise

You probably double the odds of success if you spend some time planning your raise. Carve out a two- to three-week window on your calendar to run your fundraise and speak to investors. Ideally, you want to speak to as many investors as possible in the shortest period of time. This compression of time creates the conditions for desire and scarcity, which can help prompt an investor to a yes. Here is a link to a sample timeline you can use to plan your raise.

Related, there is a common question about whether to build relationships with investors when you are not raising. Relationship building with investors “off-cycle” is fine, but don’t let relationship building turn into a situation where the investors gain control of your fundraise. The main principle around planning is that you drive and architect the process. As such, if investors are talking about a pre-emptive term sheet, be thankful and gracious, but then confidently tell them when you are going to be raising—and say that is the time when you are accepting term sheets (notice the power flip). This will not “turn them off.” In fact, it will likely have the opposite effect. The reason you want to slot even “pre-emptive” offers into a larger process is to weigh all potential options and potentially have more leverage on terms.

2. Do your research on investors

Assemble your target list and research each investor before your pitch window. Have they invested in similar companies? (Check Crunchbase and their LinkedIn.) What’s their check size and investment philosophy, and do they lead? (Check their fund and personal website.) What do other founders think of them? (Ask for references from other founders.) Here is a spreadsheet to help organize your outreach.

But all seed investors are looking for large return multiples on any investment—typically over 100x—and evaluate based on the caliber of the team, the size of the market, and the strength of the early product.

3. Prepare (well-crafted) materials

A minimal deck and/or memo with a simple budget is all that you’ll need at this stage. You need to show there’s a real problem to solve, in a big enough market, and that you’re the one to solve it. That’s it.

However, the quality of this content matters a lot. The better crafted the materials, the more persuasive they will be, and the more likely they will result in capital. You should have all your materials polished and ready to go before your pitch window, and you should be ready to tailor your pitch to each prospective investor. Sequoia has a great template for a deck , as does YC . And Rippling wrote the gold standard for a memo . (But craft doesn’t have to mean visual finesse. It’s more important for the deck to be substantive than beautiful. Airbnb’s seed deck is a good example.)

Remember to strive for honesty, not just optimism. Tomer at Gusto says, “Show your honest assessment of your scorecard,” while Dylan of Figma advises, “Be honest about what you know and don’t know.”

4. Get powerful, warm intros