What is business risk?

You know about death and taxes. What about risk? Yes, risk is just as much a part of life as the other two inevitabilities. This became all the more apparent during COVID-19, as each of us had to assess and reassess our personal risk calculations as each new wave of the pandemic— and pandemic-related disruptions —washed over us. It’s the same in business: executives and organizations have different comfort levels with risk and ways to prepare against it.

Where does business risk come from? To start with, external factors can wreak havoc on an organization’s best-laid plans. These can include things like inflation , supply chain disruptions, geopolitical upheavals , unpredictable force majeure events like a global pandemic or climate disaster, competitors, reputational issues, or even cyberattacks .

But sometimes, the call is coming from inside the house. Companies can be imperiled by their own executives’ decisions or by leaks of privileged information, but most damaging of all, perhaps, is the risk of missed opportunities. We’ve seen it often: when companies choose not to adopt disruptive innovation, they risk losing out to more nimble competitors.

The modern era is rife with increasingly frequent sociopolitical, economic, and climate-related shocks. In 2019 alone, for example, 40 weather disasters caused damages exceeding $1 billion each . To stay competitive, organizations should develop dynamic approaches to risk and resilience. That means predicting new threats, perceiving changes in existing threats, and developing comprehensive response plans. There’s no magic formula that can guarantee safe passage through a crisis. But in situations of threat, sometimes only a robust risk-management plan can protect an organization from interruptions to critical business processes. For more on how to assess and prepare for the inevitability of risk, read on.

Learn more about McKinsey’s Risk and Resilience Practice.

What is risk control?

Risk controls are measures taken to identify, manage, and eliminate threats. Companies can create these controls through a range of risk management strategies and exercises. Once a risk is identified and analyzed, risk controls can be designed to reduce the potential consequences. Eliminating a risk—always the preferable solution—is one method of risk control. Loss prevention and reduction are other risk controls that accept the risk but seek to minimize the potential loss (insurance is one method of loss prevention). A final method of risk control is duplication (also called redundancy). Backup servers or generators are a common example of duplication, ensuring that if a power outage occurs no data or productivity is lost.

But in order to develop appropriate risk controls, an organization should first understand the potential threats.

What are the three components to a robust risk management strategy?

A dynamic risk management plan can be broken down into three components : detecting potential new risks and weaknesses in existing risk controls, determining the organization’s appetite for risk taking, and deciding on the appropriate risk management approach. Here’s more information about each step and how to undertake them.

1. Detecting risks and controlling weaknesses

A static approach to risk is not an option, since an organization can be caught unprepared when an unlikely event, like a pandemic, strikes. So it pays to always be proactive. To keep pace with changing environments, companies should answer the following three questions for each of the risks that are relevant to their business.

- How will a risk play out over time? Risks can be slow moving or fast moving. They can be cyclical or permanent. Companies should analyze how known risks are likely to play out and reevaluate them on a regular basis.

- Are we prepared to respond to systemic risks? Increasingly, risks have longer-term reputational or regulatory consequences, with broad implications for an industry, the economy, or society at large. A risk management strategy should incorporate all risks, including systemic ones.

- What new risks lurk in the future? Organizations should develop new methods of identifying future risks. Traditional approaches that rely on reviews and assessments of historical realities are no longer sufficient.

2. Assessing risk appetite

How can companies develop a systematic way of deciding which risks to accept and which to avoid? Companies should set appetites for risk that align with their own values, strategies, capabilities, and competitive environments—as well as those of society as a whole. To that end, here are three questions companies should consider.

- How much risk should we take on? Companies should reevaluate their risk profiles frequently according to shifting customer behaviors, digital capabilities, competitive landscapes, and global trends.

- Are there any risks we should avoid entirely? Some risks are clear: companies should not tolerate criminal activity or sexual harassment. Others are murkier. How companies respond to risks like economic turmoil and climate change depend on their particular business, industry, and levels of risk tolerance.

- Does our risk appetite adequately reflect the effectiveness of our controls? Companies are typically more comfortable taking risks for which they have strong controls in place. But the increased threat of severe risks challenges traditional assumptions about risk control effectiveness. For instance, many businesses have relied on automation to increase speed and reduce manual error. But increased data breaches and privacy concerns can increase the risk of large-scale failures. Organizations, therefore, should evolve their risk profiles accordingly.

3. Deciding on a risk management approach

Finally, organizations should decide how they will respond when a new risk is identified. This decision-making process should be flexible and fast, actively engaging leaders from across the organization and honestly assessing what has and hasn’t worked in past scenarios. Here are three questions organizations should be able to answer.

- How should we mitigate the risks we are taking? Ultimately, people need to make these decisions and assess how their controls are working. But automated control systems should buttress human efforts. Controls guided, for example, by advanced analytics can help guard against quantifiable risks and minimize false positives.

- How would we respond if a risk event or control breakdown happens? If (or more likely, when) a threat occurs, companies should be able to switch to crisis management mode quickly, guided by an established playbook. Companies with well-rehearsed crisis management capabilities weather shocks better, as we saw with the COVID-19 pandemic.

- How can we build true resilience? Resilient companies not only better withstand threats—they emerge stronger. The most resilient firms can turn fallout from crises into a competitive advantage. True resilience stems from a diversity of skills and experience, innovation, creative problem solving, and the basic psychological safety that enables peak performance.

Change is constant. Just because a risk control plan made sense last year doesn’t mean it will next year. In addition to the above points, a good risk management strategy involves not only developing plans based on potential risk scenarios but also evaluating those plans on a regular basis.

Learn more about McKinsey’s Risk and Resilience Practice.

What are five actions organizations can take to build dynamic risk management?

In the past, some organizations have viewed risk management as a dull, dreary topic, uninteresting for the executive looking to create competitive advantage. But when the risk is particularly severe or sudden, a good risk strategy is about more than competitiveness—it can mean survival. Here are five actions leaders can take to establish risk management capabilities .

- Reset the aspiration for risk management. This requires clear objectives and clarity on risk levels and appetite. Risk managers should establish dialogues with business leaders to understand how people across the business think about risk, and share possible strategies to nurture informed risk-versus-return decision making—as well as the capabilities available for implementation.

- Establish agile risk management practices. As the risk environment becomes more unpredictable, the need for agile risk management grows. In practice, that means putting in place cross-functional teams empowered to make quick decisions about innovating and managing risk.

- Harness the power of data and analytics. The tools of the digital revolution can help companies improve risk management. Data streams from traditional and nontraditional sources can broaden and deepen companies’ understandings of risk, and algorithms can boost error detection and drive more accurate predictions.

- Develop risk talent for the future. Risk managers who are equipped to meet the challenges of the future will need new capabilities and expanded domain knowledge in model risk management , data, analytics, and technology. This will help support a true understanding of the changing risk landscape , which risk leaders can use to effectively counsel their organizations.

- Fortify risk culture. Risk culture includes the mindsets and behavioral norms that determine an organization’s relationship with risk. A good risk culture allows an organization to respond quickly when threats emerge.

How do scenarios help business leaders understand uncertainty?

Done properly, scenario planning prompts business leaders to convert abstract hypotheses about uncertainties into narratives about realistic visions of the future. Good scenario planning can help decision makers experience new realities in ways that are intellectual and sensory, as well as rational and emotional. Scenarios have four main features that can help organizations navigate uncertain times.

- Scenarios expand your thinking. By developing a range of possible outcomes, each backed with a sequence of events that could lead to them, it’s possible to broaden our thinking. This helps us become ready for the range of possibilities the future might hold—and accept the possibility that change might come more quickly than we expect.

- Scenarios uncover inevitable or likely futures. A broad scenario-building effort can also point to powerful drivers of change, which can help to predict potential outcomes. In other words, by illuminating critical events from the past, scenario building can point to outcomes that are very likely to happen in the future.

- Scenarios protect against groupthink. In some large corporations, employees can feel unsafe offering contrarian points of view for fear that they’ll be penalized by management. Scenarios can help companies break out of this trap by providing a “safe haven” for opinions that differ from those of senior leadership and that may run counter to established strategy.

- Scenarios allow people to challenge conventional wisdom. In large corporations in particular, there’s frequently a strong bias toward the status quo. Scenarios are a nonthreatening way to lay out alternative futures in which assumptions underpinning today’s strategy can be challenged.

Learn more about McKinsey’s Strategy & Corporate Finance Practice.

What’s the latest thinking on risk for financial institutions?

In late 2021, McKinsey conducted survey-based research with more than 30 chief risk officers (CROs), asking about the current banking environment, risk management practices, and priorities for the future.

According to CROs, banks in the current environment are especially exposed to accelerating market dynamics, climate change, and cybercrime . Sixty-seven percent of CROs surveyed cited the pandemic as having significant impact on employees and in the area of nonfinancial risk. Most believed that these effects would diminish in three years’ time.

Introducing McKinsey Explainers : Direct answers to complex questions

Climate change, on the other hand, is expected to become a larger issue over time. Nearly all respondents cited climate regulation as one of the five most important forces in the financial industry in the coming three years. And 75 percent were concerned about climate-related transition risk: financial and other risks arising from the transformation away from carbon-based energy systems.

And finally, cybercrime was assessed as one of the top risks by most executives, both now and in the future.

Learn more about the risk priorities of banking CROs here .

What is cyber risk?

Cyber risk is a form of business risk. More specifically, it’s the potential for business losses of all kinds in the digital domain—financial, reputational, operational, productivity related, and regulatory related. While cyber risk originates from threats in the digital realm, it can also cause losses in the physical world, such as damage to operational equipment.

Cyber risk is not the same as a cyberthreat. Cyberthreats are the particular dangers that create the potential for cyber risk. These include privilege escalation (the exploitation of a flaw in a system for the purpose of gaining unauthorized access to resources), vulnerability exploitation (an attack that uses detected vulnerabilities to exploit the host system), or phishing. The risk impact of cyberthreats includes loss of confidentiality, integrity, and availability of digital assets, as well as fraud, financial crime, data loss, or loss of system availability.

In the past, organizations have relied on maturity-based cybersecurity approaches to manage cyber risk. These approaches focus on achieving a particular level of cybersecurity maturity by building capabilities, like establishing a security operations center or implementing multifactor authentication across the organization. A maturity-based approach can still be helpful in some situations, such as for brand-new organizations. But for most institutions, a maturity-based approach can turn into an unmanageably large project, demanding that all aspects of an organization be monitored and analyzed. The reality is that, since some applications are more vulnerable than others, organizations would do better to measure and manage only their most critical vulnerabilities.

What is a risk-based cybersecurity approach?

A risk-based approach is a distinct evolution from a maturity-based approach. For one thing, a risk-based approach identifies risk reduction as the primary goal. This means an organization prioritizes investment based on a cybersecurity program’s effectiveness in reducing risk. Also, a risk-based approach breaks down risk-reduction targets into precise implementation programs with clear alignment all the way up and down an organization. Rather than building controls everywhere, a company can focus on building controls for the worst vulnerabilities.

Here are eight actions that comprise a best practice for developing a risk-based cybersecurity approach:

- fully embed cybersecurity in the enterprise-risk-management framework

- define the sources of enterprise value across teams, processes, and technologies

- understand the organization’s enterprise-wide vulnerabilities—among people, processes, and technology—internally and for third parties

- understand the relevant “threat actors,” their capabilities, and their intent

- link the controls in “run” activities and “change” programs to the vulnerabilities that they address and determine what new efforts are needed

- map the enterprise risks from the enterprise-risk-management framework, accounting for the threat actors and their capabilities, the enterprise vulnerabilities they seek to exploit, and the security controls of the organization’s cybersecurity run activities and change program

- plot risks against the enterprise-risk appetite; report on how cyber efforts have reduced enterprise risk

- monitor risks and cyber efforts against risk appetite, key cyber risk indicators, and key performance indicators

How can leaders make the right investments in risk management?

Ignoring high-consequence, low-likelihood risks can be catastrophic to an organization—but preparing for everything is too costly. In the case of the COVID-19 crisis, the danger of a global pandemic on this scale was foreseeable, if unexpected. Nevertheless, the vast majority of companies were unprepared: among billion-dollar companies in the United States, more than 50 filed for bankruptcy in 2020.

McKinsey has described the decisions to act on these high-consequence, low-likelihood risks as “ big bets .” The number of these risks is far too large for decision makers to make big bets on all of them. To narrow the list down, the first thing a company can do is to determine which risks could hurt the business versus the risks that could destroy the company. Decision makers should prioritize the potential threats that would cause an existential crisis for their organization.

To identify these risks, McKinsey recommends using a two-by-two risk grid, situating the potential impact of an event on the whole company against the level of certainty about the impact. This way, risks can be measured against each other, rather than on an absolute scale.

Organizations sometimes survive existential crises. But it can’t be ignored that crises—and missed opportunities—can cause organizations to fail. By measuring the impact of high-impact, low-likelihood risks on core business, leaders can identify and mitigate risks that could imperil the company. What’s more, investing in protecting their value propositions can improve an organization’s overall resilience.

Articles referenced:

- “ Seizing the momentum to build resilience for a future of sustainable inclusive growth ,” February 23, 2023, Børge Brende and Bob Sternfels

- “ Data and analytics innovations to address emerging challenges in credit portfolio management ,” December 23, 2022, Abhishek Anand , Arvind Govindarajan , Luis Nario and Kirtiman Pathak

- “ Risk and resilience priorities, as told by chief risk officers ,” December 8, 2022, Marc Chiapolino , Filippo Mazzetto, Thomas Poppensieker , Cécile Prinsen, and Dan Williams

- “ What matters most? Six priorities for CEOs in turbulent times ,” November 17, 2022, Homayoun Hatami and Liz Hilton Segel

- “ Model risk management 2.0 evolves to address continued uncertainty of risk-related events ,” March 9, 2022, Pankaj Kumar, Marie-Paule Laurent, Christophe Rougeaux, and Maribel Tejada

- “ The disaster you could have stopped: Preparing for extraordinary risks ,” December 15, 2020, Fritz Nauck , Ophelia Usher, and Leigh Weiss

- “ Meeting the future: Dynamic risk management for uncertain times ,” November 17, 2020, Ritesh Jain, Fritz Nauck , Thomas Poppensieker , and Olivia White

- “ Risk, resilience, and rebalancing in global value chains ,” August 6, 2020, Susan Lund, James Manyika , Jonathan Woetzel , Edward Barriball , Mekala Krishnan , Knut Alicke , Michael Birshan , Katy George , Sven Smit , Daniel Swan , and Kyle Hutzler

- “ The risk-based approach to cybersecurity ,” October 8, 2019, Jim Boehm , Nick Curcio, Peter Merrath, Lucy Shenton, and Tobias Stähle

- “ Value and resilience through better risk management ,” October 1, 2018, Daniela Gius, Jean-Christophe Mieszala , Ernestos Panayiotou, and Thomas Poppensieker

Want to know more about business risk?

Related articles.

What matters most? Six priorities for CEOs in turbulent times

Creating a technology risk and cyber risk appetite framework

Risk and resilience priorities, as told by chief risk officers

Business Plan Risk Analysis - What You Need to Know

The business plan risk analysis is a crucial and often overlooked part of a robust business plan. In the ever-changing world of business knowing potential pitfalls and how to mitigate them could be the difference between success and failure. A well-crafted business plan acts as a guiding star for every venture, be it a startup finding its footing or a multinational corporation planning an expansion. However, amidst financial forecasts, marketing strategies, and operational logistics, the element of risk analysis frequently gets relegated to the back burner. In this blog, we will dissect the anatomy of the risk analysis section, show you exactly why it is important and provide you with guidelines and tips. We will also delve into real-life case studies to bring to life your learning your learning.

Table of Contents

- Risk Analysis - What is it?

- Types of Risks

- Components of Risk Analysis

- Real-Life Case Studies

- Tips & Best Practices

- Final Thoughts

Business Plan Risk Analysis - What Exactly Is It?

Risk analysis is like the radar system of a ship, scanning the unseen waters ahead for potential obstacles. It can forecast possible challenges that may occur in the business landscape and plan for their eventuality. Ignoring this can be equivalent to sailing blind into a storm. The business plan risk analysis section is a strategic tool used in business planning to identify and assess potential threats that could negatively impact the organisation's operations or assets. Taking the time to properly think about the risks your business faces or may face in the future will enable you to identify strategies to mitigate these issues.

Types of Business Risks

There are various types of risks that a business may face, which can be categorised into some broader groups:

- Operational Risks: These risks involve loss due to inadequate or failed internal processes, people, or systems. Examples could include equipment failure, theft, or employee misconduct.

- Financial Risks: These risks are associated with the financial structure of the company, transactions the company makes, and the company's ability to meet its financial obligations. For instance, currency fluctuations, increase in costs, or a decline in cash flow.

- Market Risks: These risks are external to the company and involve changes in the market. For example, new competitors entering the market changes in customer preferences, or regulatory changes.

- Strategic Risks: These risks relate to the strategic decisions made by the management team. Examples include the entry into a new market, the launch of a new product, or mergers and acquisitions.

- Compliance Risks: These risks occur when a company must comply with laws and regulations to stay in operation. They could involve changes in laws and regulations or non-compliance with existing ones.

The business risk analysis section is not a crystal ball predicting the future with absolute certainty, but it provides a foresighted approach that enables businesses to navigate a world full of uncertainties with informed confidence. In the next section, we will dissect the integral components of risk analysis in a business plan.

Components of a Risk Analysis Section

Risk analysis, while a critical component of a business plan, is not a one-size-fits-all approach. Each business has unique risks tied to its operations, industry, market, and even geographical location. A thorough risk analysis process, however, typically involves four main steps:

- Identification of Potential Risks: The first step in risk analysis is to identify potential risks that your business may face. This process should be exhaustive, including risks from various categories mentioned in the section above. You might use brainstorming sessions, expert consultations, industry research, or tools like a SWOT analysis to help identify these risks.

- Risk Assessment: Once you've identified potential risks, the next step is to assess them. This involves evaluating the likelihood of each risk occurring and the potential impact it could have on your business. Some risks might be unlikely but would have a significant impact if they did occur, while others might be likely but with a minor impact. Tools like a risk matrix can be helpful here to visualise and prioritise your risks.

- Risk Mitigation Strategies: After assessing the risks, you need to develop strategies to manage them. This could involve preventing the risk, reducing the impact or likelihood of the risk, transferring the risk, or accepting the risk and developing a contingency plan. Your strategies will be highly dependent on the nature of the risk and your business's ability to absorb or mitigate it.

- Monitoring and Review: Risk analysis is not a one-time task, but an ongoing process. The business landscape is dynamic, and new risks can emerge while old ones can change or even disappear. Regular monitoring and review of your risks and the effectiveness of your mitigation strategies is crucial. This should be an integral part of your business planning process.

Through these four steps, you can create a risk analysis section in your business plan that not only identifies and assesses potential threats but also outlines clear strategies to manage and mitigate these risks. This will demonstrate to stakeholders that your business is prepared and resilient, able to handle whatever challenges come its way.

Business Plan Risk Analysis - Real-Life Examples

To fully grasp the importance of risk analysis, it can be beneficial to examine some real-life scenarios. The following are two contrasting case studies - one demonstrating a successful risk analysis and another highlighting the repercussions when risk analysis fails.

Case Study 1: Google's Strategic Risk Mitigation

Consider Google's entry into the mobile operating system market with Android. Google identified a strategic risk : the growth of mobile internet use might outpace traditional desktop use, and if they didn't have a presence in the mobile market, they risked losing out on search traffic. They also recognised the risk of being too dependent on another company's (Apple's) platform for mobile traffic. Google mitigated this risk by developing and distributing its mobile operating system, Android. They offered it as an open-source platform, which encouraged adoption by various smartphone manufacturers and quickly expanded their mobile presence. This risk mitigation strategy helped Google maintain its dominance in the search market as internet usage shifted towards mobile.

Case Study 2: The Fallout of Lehman Brothers

On the flip side, Lehman Brothers, a global financial services firm, failed to adequately analyse and manage its risks, leading to its downfall during the 2008 financial crisis. The company had significant exposure to subprime mortgages and had failed to recognise the potential risk these risky loans posed. When the housing market collapsed, the value of these subprime mortgages plummeted, leading to significant financial losses. The company's failure to conduct a robust risk analysis and develop appropriate risk mitigation strategies eventually led to its bankruptcy. The takeaway from these case studies is clear - effective risk analysis can serve as an essential tool to navigate through uncertainty and secure a competitive advantage, while failure to analyse and mitigate potential risks can have dire consequences. As we move forward, we'll share some valuable tips and best practices to ensure your risk analysis is comprehensive and effective.

Business Plan Risk Analysis Tips and Best Practices

While the concept of risk analysis can seem overwhelming, following these tips and best practices can streamline the process and ensure that your risk management plan is both comprehensive and effective.

- Be Thorough: When identifying potential risks, aim to be as thorough as possible. It’s crucial not to ignore risk because it seems minor or unlikely; even small risks can have significant impacts if not managed properly.

- Involve the Right People: Diverse perspectives can help identify potential risks that might otherwise be overlooked. Include people from different departments or areas of expertise in your risk identification and assessment process. They will bring different perspectives and insights, leading to a more comprehensive risk analysis.

- Keep it Dynamic: The business environment is continually changing, and so are the risks. Hence, risk analysis should be an ongoing process, not a one-time event. Regularly review and update your risk analysis to account for new risks and changes in previously identified risks.

- Be Proactive, Not Reactive: Use your risk analysis to develop mitigation strategies in advance, rather than reacting to crises as they occur. Proactive risk management can help prevent crises, reduce their impact, and ensure that you're prepared when they do occur.

- Quantify When Possible: Wherever possible, use statistical analysis and financial projections to evaluate the potential impact of a risk. While not all risks can be quantified, putting numbers to the potential costs can provide a clearer picture of the risk and help prioritise your mitigation efforts.

Implementing these tips and best practices will strengthen your risk analysis, providing a more accurate picture of the potential risks and more effective strategies to manage them. Remember, the goal of risk analysis isn't to eliminate all risks—that's impossible—but to understand them better so you can manage them effectively and build a more resilient business.

In the ever-changing landscape of business, where uncertainty is a constant companion, the risk analysis section of a business plan serves as a guiding compass, illuminating potential threats and charting a course toward success. Throughout this blog, we have explored the critical role of risk analysis and the key components involved in its implementation. We learned that risk analysis is not just about identifying risks but also about assessing their potential impact and likelihood. It involves developing proactive strategies to manage and mitigate those risks, thereby safeguarding the business against potential pitfalls. In conclusion, a well-crafted business plan risk analysis section is not just a formality but a strategic asset that empowers your business to thrive in an unpredictable world. As you finalise your business plan, keep in mind that risk analysis is not a one-time task but an ongoing practice. Revisit and update your risk analysis regularly to stay ahead of changing business conditions. By embracing risk with a thoughtful and proactive approach, you will position your business for growth, resilience, and success in an increasingly dynamic and competitive landscape. Want more help with your business plan? Check out our Learning Zone for more in-depth guides on each specific section of your plan.

How to Highlight Risks in Your Business Plan

Tallat Mahmood

5 min. read

Updated October 25, 2023

One of the areas constantly dismissed by business owners in their business plan is an articulation of the risks in the business.

This either suggests you don’t believe there to be any risks in your business (not true), or are intentionally avoiding disclosing them.

Either way, it is not the best start to have with a potential funding partner. In fact, by dismissing the risks in your business, you actually make the job of a lender or investor that much more difficult.

Why a funder needs to understand your business’s risks:

Funding businesses is all about risk and reward.

Whether it’s a lender or an investor, their key concern will be trying to balance the risks inherent in your business, versus the likelihood of a reward, typically increasing business value. An imbalance occurs when entrepreneurs talk extensively about the opportunities inherent in their business, but ignore the risks.

The fact is, all funders understand that risks exist in every business. This is just a fact of running a business. There are risks that exist with your products, customers, suppliers, and your team. From a funder’s perspective, it is important to understand the nature and size of risks that exist.

- There are two main reasons why funders want to understand business risks:

Firstly, they want to understand whether or not the key risks in your business are so fundamental to the investment proposition that it would prevent them from funding you.

Some businesses are not at the right stage to receive external funding and placate funder concerns. These businesses are best off dealing with key risk factors prior to seeking funding.

The second reason why lenders and investors want to understand the risk in your business is so that they can structure a funding package that works best overall, despite the risk.

In my experience, this is an opportunity that many business owners are wasting, as they are not giving funders an opportunity to structure deals suitable for them.

Here’s an example:

Assume your business is seeking equity funding, but has a key management role that needs to be filled. This could be a key business risk for a funder.

Highlighting this risk shows that you are aware of the appointment need, and are putting plans in place to help with this key recruit. An investor may reasonably decide to proceed with funding, but the funding will be released in stages. Some will be released immediately and the remainder will be after the key position has been filled.

The benefit of highlighting your risks is that it demonstrates to investors that you understand the danger the risks pose to your company, and are aware that it needs to be dealt with. This allows for a frank discussion to take place, which is more difficult to do if you don’t acknowledge this as a problem in the first place.

Ultimately, the starting point for most funders is that they want to invest in you, and want to validate their initial interest in you.

Highlighting your business risks will allow the funder to get to the nub of the problem, and give them a better idea of how they may structure their investment in order to make it work for both parties. If they are unsure of the risks or cannot get clear explanations from the team, it is unlikely they will be forthcoming when it comes to finding ways to make a potential deal work.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- The right way to address business risks:

The main reason many business owners don’t talk about business risks with potential funders is because they don’t want to highlight the weaknesses in their business.

This is a fair concern to have. However, there is a right way to address business risk with funders, without turning lenders and investors off.

The solution is to focus on how you mitigate the risks.

In other words, what are the steps you are taking in your business as a direct reaction to the risks that you have identified? This is very powerful in easing funder fears, and in positioning you as someone who has a handle on their business.

For example, if a business risk you had identified was a high level of customer concentration, then a suitable mitigation plan would be to market your products or services targeting new clients, as opposed to focusing all efforts on one client.

Having net profit margins that are lower than average for your market would raise eyebrows and be considered a risk. In this instance, you could demonstrate to funders the steps you are putting in place over a period of time to help increase those margins to at least market norms for your niche.

The process of highlighting risks—and, more importantly, outlining key mitigating actions—not only demonstrates honesty, but also a leadership quality in solving the problems in your business. Lenders and investors want to see both traits.

- The impact on your credibility:

Any lender or investor backs the leadership team of a business first, and the business itself second.

This is because they realize that it is you, the management team, who will ultimately deliver value and grow the business for the benefit for all. As such, it is imperative that they have the right impression about you.

The consequence of highlighting business risks in your business plan with mitigations is that it provides funders a real insight into you as a business leader. It demonstrates that not only do you have an understanding of their need to understand risk in your business, but you also appreciate that minimizing that risk is your job.

This will have a massive impact on your credibility as a business owner and management team. This impact is more acute when compared to the hundreds of businesses they will meet that omit discussing the risks in their business.

The fact is, funders have seen enough businesses and business plans in all sectors to instinctively know what risks to expect. It’s just more telling if they hear it from you first.

- What does this mean for you going forward?

Funders rely on you to deliver on your inherent promise to add value to your business for all stakeholders. The weight of this promise becomes much stronger if they can believe in the character of the team, and that comes from your credibility.

A business plan that discusses business risks and mitigations is a much more complete plan, and will increase your chances of securing funding.

Not only that, but highlighting the risks your business faces also has a long-term impact on your character and credibility as a business leader.

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Tallat Mahmood is founder of The Smart Business Plan Academy, his flagship online course on building powerful business plans for small and medium-sized businesses to help them grow and raise capital. Tallat has worked for over 10 years as a small and medium-sized business advisor and investor, and in this period has helped dozens of businesses raise hundreds of millions of dollars for growth. He has also worked as an investor and sat on boards of companies.

Table of Contents

- Why a funder needs to understand your business’s risks:

Related Articles

6 Min. Read

How to Forecast Sales for a Subscription Business

How to Create a Profit and Loss Forecast

8 Min. Read

How to Plan Your Exit Strategy

5 Min. Read

9 Common Mistakes with Business Financial Projections

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

- Search Search Please fill out this field.

Identifying Risks

Physical risks, location risks, human risks, technology risks, strategic risks, making a risk assessment, insuring against risks, risk prevention, the bottom line.

- Business Essentials

Identifying and Managing Business Risks

:max_bytes(150000):strip_icc():format(webp)/522293_3816099810338_52357726_n1__marc_davis-5bfc2625c9e77c0058760671.jpg)

Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. Her expertise is in personal finance and investing, and real estate.

:max_bytes(150000):strip_icc():format(webp)/YariletPerez-d2289cb01c3c4f2aabf79ce6057e5078.jpg)

Running a business comes with many types of risk. Some of these potential hazards can destroy a business, while others can cause serious damage that is costly and time-consuming to repair. Despite the risks implicit in doing business, CEOs and risk management officers can anticipate and prepare, regardless of the size of their business.

Key Takeaways

- Some risks have the potential to destroy a business or at least cause serious damage that can be costly to repair.

- Organizations should identify which risks pose a threat to their operations.

- Potential threats include location hazards such as fires and storm damage, a l cohol and drug abuse among personnel, technology risks such as power outages, and strategic risks such as investment in research and development.

- A risk management consultant can recommend a strategy including staff training, safety checks, equipment and space maintenance, and necessary insurance policies.

If and when a risk becomes a reality, a well-prepared business can minimize the impact on earnings, lost time and productivity, and negative impact on customers. For startups and established businesses, the ability to identify risks is a key part of strategic business planning . Risks are identified through a number of ways. Strategies to identify these risks rely on comprehensively analyzing a company's specific business activities. Most organizations face preventable, strategic and external threats that can be managed through acceptance, transfer, reduction, or elimination.

A risk management consultant can help a business determine which risks should be covered by insurance.

Below are the main types of risks that companies face:

Building risks are the most common type of physical risk. Think fires or explosions. To manage building risk, and the risk to employees, it is important that organizations do the following:

- Make sure all employees know the exact street address of the building to give to a 911 operator in case of emergency.

- Make sure all employees know the location of all exits.

- Install fire alarms and smoke detectors.

- Install a sprinkler system to provide additional protection to the physical plant, equipment, documents and, of course, personnel.

- Inform all employees that in the event of emergency their personal safety takes priority over everything else. Employees should be instructed to leave the building and abandon all work-associated documents, equipment and/or products.

Hazardous material risk is present where spills or accidents are possible. The risk from hazardous materials can include:

- Toxic fumes

- Toxic dust or filings

- Poisonous liquids or waste

Fire department hazardous material units are prepared to handle these types of disasters. People who work with these materials, however, should be properly equipped and trained to handle them safely.

Organizations should create a plan to handle the immediate effects of these risks. Government agencies and local fire departments provide information to prevent these accidents. Such agencies can also provide advice on how to control them and minimize their damage if they occur.

Among the location hazards facing a business are nearby fires, storm damage, floods, hurricanes or tornados, earthquakes, and other natural disasters. Employees should be familiar with the streets leading in and out of the neighborhood on all sides of the place of business. Individuals should keep sufficient fuel in their vehicles to drive out of and away from the area. Liability or property and casualty insurance are often used to transfer the financial burden of location risks to a third-party or a business insurance company.

There are other business risks associated with location that are not directly related to hazards, such as city planning. For example, a gas station exists on a major road, and as a result of its location, it receives plenty of business. City planning can eventually restructure the area around the gas station. The city may close the road the gas station is on, build other infrastructure that would make the gas station inaccessible, or overall just not take the gas station into consideration with any redevelopment. This would leave the gas station with no traffic to serve.

Alcohol and drug abuse are major risks to personnel in the workforce. Employees suffering from alcohol or drug abuse should be urged to seek treatment, counseling, and rehabilitation if necessary. Some insurance policies may provide partial coverage for the cost of treatment.

Protection against embezzlement , theft and fraud may be difficult, but these are common crimes in the workplace. A system of double-signature requirements for checks, invoices, and payables verification can help prevent embezzlement and fraud. Stringent accounting procedures may discover embezzlement or fraud. A thorough background check before hiring personnel can uncover previous offenses in an applicant's past. While this may not be grounds for refusing to hire an applicant, it would help HR to avoid placing a new hire in a critical position where the employee is open to temptation.

Illness or injury among the workforce is a potential problem. To prevent loss of productivity, assign and train backup personnel to handle the work of critical employees when they are absent due to a health-related concern. Other human-related risks under public attention could be associated with their behaviors and values. Misbehavior of management related to bias, racism, sexism, harassment, corruption, discrimination, pollutive actions, and carelessness about the environment are all actions that represent risk for the companies where these managers work.

A power outage is perhaps the most common technology risk. Auxiliary gas-driven power generators are a reliable back-up system to provide electricity for lighting and other functions. Manufacturing plants use several large auxiliary generators to keep a factory operational until utility power is restored.

Computers may be kept up and running with high-performance back-up batteries. Power surges may occur during a lightning storm (or randomly), so organizations should furnish critical business systems with surge-protection devices to avoid the loss of documents and the destruction of equipment.

Cloud storage is another source of risks nowadays. The process involves backing up data with Amazon Web Services, for example, using Azure, IBM, and Oracle, for instance. This is a huge undertaking that should be considered given the reliance on cloud-based data to run most businesses now. It is important to establish both offline and online data backup systems to protect critical documents.

Although telephone and communications failure are relatively uncommon, risk managers may consider providing emergency-use company cell phones to personnel whose use of the phone or internet is critical to their business.

Strategy risks are not altogether undesirable. Financial institutions such as banks or credit unions take on strategy risk when lending to consumers, while pharmaceutical companies are exposed to strategy risk through research and development for a new drug. Each of these strategy-related risks is inherent in an organization's business objectives. When structured efficiently, the acceptance of strategy risks can create highly profitable operations.

Companies exposed to substantial strategy risk can mitigate the potential for negative consequences by creating and maintaining infrastructures that support high-risk projects. A system established to control the financial hardship that occurs when a risky venture fails often includes diversification of current projects, healthy cash flow, or the ability to finance new projects in an affordable way, and a comprehensive process to review and analyze potential ventures based on future return on investment .

After the risks have been identified , they must be prioritized in accordance with an assessment of their probability. The first step is to establish a probability scale for the purposes of risk assessment .

For example, risks may:

- Be very likely to occur

- Have some chance of occurring

- Have a small chance of occurring

- Have very little chance of occurring

Other risks must be prioritized and managed in accordance with their likelihood of occurring. Actuarial tables —statistical analysis of the probability of any risk occurring and the potential financial damage ensuing from the occurrence of those risks—may be accessed online and can provide guidance in prioritizing risk.

Insurance is a principle safeguard in managing risk, and many risks are insurable. Fire insurance is a necessity for any business that occupies a physical space, whether owned outright or rented, and should be a top priority. Product liability insurance, as an obvious example, is not necessary for a service business.

Some risks are an inarguably high priority, for example, the risk of fraud or embezzlement where employees handle money or perform accounting duties in accounts payable and receivable. Specialized insurance companies will underwrite a cash bond to provide financial coverage in the event of embezzlement, theft or fraud.

When insuring against potential risks, never assume a best-case scenario. Even if employees have worked for years with no problems and their service has been exemplary, insurance against employee error may be a necessity. The extent of insurance coverage against injury will depend on the nature of your business. A heavy manufacturing plant will, of course, require more extensive coverage for employees. Product liability insurance is also a necessity in this context.

If a business relies heavily on computerized data—customer lists and accounting data, for example—exterior backup and insurance coverage is necessary. Finally, hiring a risk management consultant may be a prudent step in the prevention and management of risks.

The best risk insurance is prevention. Preventing the many risks from occurring in your business is best achieved through employee training, background checks, safety checks, equipment maintenance and maintenance of the physical premises. A single, accountable staff member with managerial authority should be appointed to handle risk management responsibilities. A risk management committee may also be formed with members assigned specific tasks with a requirement to report to the risk manager.

The risk manager, in conjunction with a committee, should formulate plans for emergency situations such as:

- Hazardous materials accidents or the occurrence of other emergencies

Employees must know what to do and where to exit the building or office space in an emergency. A plan for the safety inspection of the physical premises and equipment should be developed and implemented regularly including the training and education of personnel when necessary. A periodic, stringent review of all potential risks should be conducted. Any problems should be immediately addressed. Insurance coverage should also be periodically reviewed and upgraded or downgraded as needed.

Prevention is the best insurance against risk. Employee training, background checks, safety checks, equipment maintenance, and maintenance of physical premises are all crucial risk management strategies for any business.

While business risks abound and their consequences can be destructive, there are ways and means to ensure against them, to prevent them, and to minimize their damage, if and when they occur. Finally, hiring a risk management consultant may be a worthwhile step in the prevention and management of risks.

:max_bytes(150000):strip_icc():format(webp)/BusinessPlanMeeting-570270145f9b5861953a6732.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

If you still have questions or prefer to get help directly from an agent, please submit a request. We’ll get back to you as soon as possible.

Please fill out the contact form below and we will reply as soon as possible.

- Economics, Finance, & Analytics

- Investments, Trading, and Financial Markets

Market Risk - Explained

What is a market risk.

Written by Jason Gordon

Updated at April 23rd, 2024

- Marketing, Advertising, Sales & PR Principles of Marketing Sales Advertising Public Relations SEO, Social Media, Direct Marketing

- Accounting, Taxation, and Reporting Managerial & Financial Accounting & Reporting Business Taxation

- Professionalism & Career Development

- Law, Transactions, & Risk Management Government, Legal System, Administrative Law, & Constitutional Law Legal Disputes - Civil & Criminal Law Agency Law HR, Employment, Labor, & Discrimination Business Entities, Corporate Governance & Ownership Business Transactions, Antitrust, & Securities Law Real Estate, Personal, & Intellectual Property Commercial Law: Contract, Payments, Security Interests, & Bankruptcy Consumer Protection Insurance & Risk Management Immigration Law Environmental Protection Law Inheritance, Estates, and Trusts

- Business Management & Operations Operations, Project, & Supply Chain Management Strategy, Entrepreneurship, & Innovation Business Ethics & Social Responsibility Global Business, International Law & Relations Business Communications & Negotiation Management, Leadership, & Organizational Behavior

- Economics, Finance, & Analytics Economic Analysis & Monetary Policy Research, Quantitative Analysis, & Decision Science Investments, Trading, and Financial Markets Banking, Lending, and Credit Industry Business Finance, Personal Finance, and Valuation Principles

Market risk refers to the risk where there is a possibility of an investor experiencing a decrease in value of an investment as a result of changes in financial market factors. Note that you cannot completely eliminate market risk through diversification. However, you can hedge against by diversifying it into assets that have no correlation with the market. Hence, another term used to refer to market risk is, systematic risk.

How Does a Market Risk Work?

Public firms in the U.S. are obligated by the Securities and Exchange Commission (SEC) to reveal how their output and results are connected to the financial markets performance. This is for the purpose of detailing the exposure of the company to financial risk. Note that there are high chances of financial risk exposure for companies that provide investment that is derivative or foreign exchange future, compared to companies without these kinds of investments. Traders and investors use this information to help them to assess and make informed decisions as per the laid down risk management rules. Generally, there are two major categories of investment risk which are made up of market risk and specific risk. Market risk represents the overall securities markets or the overall economy. On the other hand, specific risk refers to only a section of this.

Market Risk Example

You can decide to buy a new car with a full warranty or get yourself a second-hand car without a warranty. Your choice will depend on features, mechanic knowledge, risk tolerance as well as the ability to afford it. You will come across different models of cars. Some with better performance and repairs history that is superior to others. Irrespective of which car you will end up with, there are road risks which you may experience that is not associated with the kind of car you have chosen but can have an adverse effect on your driving skills. An example of such include:

- Hitting an animal along the road

- Weather conditions

- Traffic lights that are not working correctly, etc.

Types of Market Risks Factors

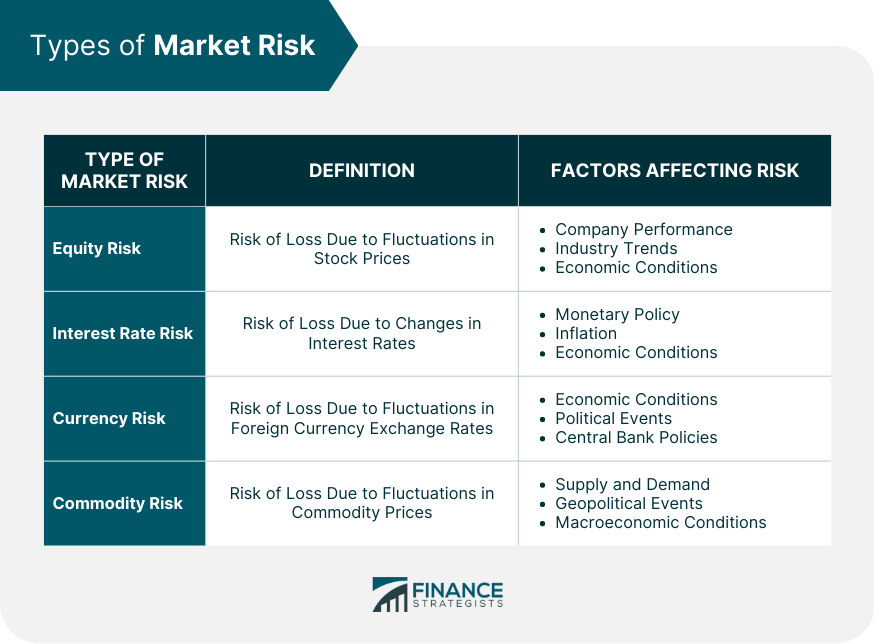

The commonly known types of risk market factors include the following:

- Equity risk: This refers to the risk where there is the possibility of share prices changing.

- Interest rate risk: This where there is a likelihood of interest rates fluctuating (going up or down)

- Currency risk: This refers to the possibility of foreign exchange rates changing.

- Commodity risk: This is the likelihood of a commodity's price changing. Example of such commodities includes grain or metal.

- Inflation risk: this risk refers to the risk that there is a possibility of overall price increases which in turn will weaken the value of money, hence significantly affecting investments value.

Generally, market risk consists of the unknown which happen as a result of daily life. Note that market risk is always unavoidable in all investments that are known to be risky. Market risk, in other words, it is known to be an opportunity cost where the money is put at risk.

Volatility and Hedging Market Risk

As long as there are price changes in the overall market, there will always be market risks. The price changes may occur in stocks, commodities or currencies, hence the term, price volatility. Note that since volatility rating is an annual thing, it can, therefore, be expressed in terms of percentage (e.g. 20%) or as an absolute number (e.g. $20) of the initial value. For investors to be able to guard themselves against risk and volatility, they make use of hedging strategies. Investors do this by targeting specific securities, where they buy put options so that they can protect against downside movement. For those investors who want to hedge against portfolios with huge stocks can do this by using index options.

Diversification and Market Risk

Investment diversification is the best strategy for reducing market risks. Note that due to nature, some market risks are impossible to foresee or prevent. Some of the risks that cannot be prevented or foreseen but does affect investment when they strike are those that are related to natural disasters such as:

- Volcanic eruptions

- Earthquakes

There are also other sources of market risks such as recession, political instability, terrorist attacks, and trade embargoes. The best strategy of reducing market risk is by diversifying portfolios. For a portfolio to be regarded as a well-diversified portfolio, it must include:

- Securities from different industries

- Asset classes

- Countries with varying degrees of risk

In general, the chances of each investor facing market risks due to economic indicators such as normal business cycle and recessions are high. The risk can be the overall market or specific market investment. As an investor, you need to know that due to market efficiency, there will be no compensation for any additional risk that you may incur in case you fail to diversify your portfolio. This is important for investors with one large holding of the stock.

Metrics for Measuring Market Risk

There are two major models that analysts and investors can use to measure market risks. They are as follows:

Value-at-risk (VaR) method :

This is a method that quantifies portfolios or stock through statistical risk management as well as the possibility of loss taking place. To limit the VaR method, certain assumptions must be applied. For instance, VaR is of the assumption that the portfolios makeup, as well as content that is subject to measurement, remains unchanged for a specified time. Note that this is only favorable where short-term investments are involved. However, it may provide inaccurate measurements when it comes to long-term investments.

Beta method :

This is another method that investors and traders can use to measure market risks. The beta method is used to measure a portfolio of security's market risk or volatility in comparison to the overall market. Note that this method is mostly used when measuring capital asset model where investors and traders apply it when calculating the assets anticipated returns.

Related Articles

- Call Swaption - Explained

- Accelerated Return Note - Explained

- Multiple Discriminant Analysis - Explained

- At The Money Option Price - Explained

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Market Analysis for a Business Plan

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

A lot of preparation goes into starting a business before you can open your doors to the public or launch your online store. One of your first steps should be to write a business plan . A business plan will serve as your roadmap when building your business.

Within your business plan, there’s an important section you should pay careful attention to: your market analysis. Your market analysis helps you understand your target market and how you can thrive within it.

Simply put, your market analysis shows that you’ve done your research. It also contributes to your marketing strategy by defining your target customer and researching their buying habits. Overall, a market analysis will yield invaluable data if you have limited knowledge about your market, the market has fierce competition, and if you require a business loan. In this guide, we'll explore how to conduct your own market analysis.

How to conduct a market analysis: A step-by-step guide

In your market analysis, you can expect to cover the following:

Industry outlook

Target market

Market value

Competition

Barriers to entry

Let’s dive into an in-depth look into each section:

Step 1: Define your objective

Before you begin your market analysis, it’s important to define your objective for writing a market analysis. Are you writing it for internal purposes or for external purposes?

If you were doing a market analysis for internal purposes, you might be brainstorming new products to launch or adjusting your marketing tactics. An example of an external purpose might be that you need a market analysis to get approved for a business loan .

The comprehensiveness of your market analysis will depend on your objective. If you’re preparing for a new product launch, you might focus more heavily on researching the competition. A market analysis for a loan approval would require heavy data and research into market size and growth, share potential, and pricing.

Step 2: Provide an industry outlook

An industry outlook is a general direction of where your industry is heading. Lenders want to know whether you’re targeting a growing industry or declining industry. For example, if you’re looking to sell VCRs in 2020, it’s unlikely that your business will succeed.

Starting your market analysis with an industry outlook offers a preliminary view of the market and what to expect in your market analysis. When writing this section, you'll want to include:

Market size

Are you chasing big markets or are you targeting very niche markets? If you’re targeting a niche market, are there enough customers to support your business and buy your product?

Product life cycle

If you develop a product, what will its life cycle look like? Lenders want an overview of how your product will come into fruition after it’s developed and launched. In this section, you can discuss your product’s:

Research and development

Projected growth

How do you see your company performing over time? Calculating your year-over-year growth will help you and lenders see how your business has grown thus far. Calculating your projected growth shows how your business will fare in future projected market conditions.

Step 3: Determine your target market

This section of your market analysis is dedicated to your potential customer. Who is your ideal target customer? How can you cater your product to serve them specifically?

Don’t make the mistake of wanting to sell your product to everybody. Your target customer should be specific. For example, if you’re selling mittens, you wouldn’t want to market to warmer climates like Hawaii. You should target customers who live in colder regions. The more nuanced your target market is, the more information you’ll have to inform your business and marketing strategy.

With that in mind, your target market section should include the following points:

Demographics

This is where you leave nothing to mystery about your ideal customer. You want to know every aspect of your customer so you can best serve them. Dedicate time to researching the following demographics:

Income level

Create a customer persona

Creating a customer persona can help you better understand your customer. It can be easier to market to a person than data on paper. You can give this persona a name, background, and job. Mold this persona into your target customer.

What are your customer’s pain points? How do these pain points influence how they buy products? What matters most to them? Why do they choose one brand over another?

Research and supporting material

Information without data are just claims. To add credibility to your market analysis, you need to include data. Some methods for collecting data include:

Target group surveys

Focus groups

Reading reviews

Feedback surveys

You can also consult resources online. For example, the U.S. Census Bureau can help you find demographics in calculating your market share. The U.S. Department of Commerce and the U.S. Small Business Administration also offer general data that can help you research your target industry.

Step 4: Calculate market value

You can use either top-down analysis or bottom-up analysis to calculate an estimate of your market value.

A top-down analysis tends to be the easier option of the two. It requires for you to calculate the entire market and then estimate how much of a share you expect your business to get. For example, let’s assume your target market consists of 100,000 people. If you’re optimistic and manage to get 1% of that market, you can expect to make 1,000 sales.

A bottom-up analysis is more data-driven and requires more research. You calculate the individual factors of your business and then estimate how high you can scale them to arrive at a projected market share. Some factors to consider when doing a bottom-up analysis include:

Where products are sold

Who your competition is

The price per unit

How many consumers you expect to reach

The average amount a customer would buy over time

While a bottom-up analysis requires more data than a top-down analysis, you can usually arrive at a more accurate calculation.

Step 5: Get to know your competition

Before you start a business, you need to research the level of competition within your market. Are there certain companies getting the lion’s share of the market? How can you position yourself to stand out from the competition?

There are two types of competitors that you should be aware of: direct competitors and indirect competitors.

Direct competitors are other businesses who sell the same product as you. If you and the company across town both sell apples, you are direct competitors.

An indirect competitor sells a different but similar product to yours. If that company across town sells oranges instead, they are an indirect competitor. Apples and oranges are different but they still target a similar market: people who eat fruits.

Also, here are some questions you want to answer when writing this section of your market analysis:

What are your competitor’s strengths?

What are your competitor’s weaknesses?

How can you cover your competitor’s weaknesses in your own business?

How can you solve the same problems better or differently than your competitors?

How can you leverage technology to better serve your customers?

How big of a threat are your competitors if you open your business?

Step 6: Identify your barriers

Writing a market analysis can help you identify some glaring barriers to starting your business. Researching these barriers will help you avoid any costly legal or business mistakes down the line. Some entry barriers to address in your marketing analysis include:

Technology: How rapid is technology advancing and can it render your product obsolete within the next five years?

Branding: You need to establish your brand identity to stand out in a saturated market.

Cost of entry: Startup costs, like renting a space and hiring employees, are expensive. Also, specialty equipment often comes with hefty price tags. (Consider researching equipment financing to help finance these purchases.)

Location: You need to secure a prime location if you’re opening a physical store.

Competition: A market with fierce competition can be a steep uphill battle (like attempting to go toe-to-toe with Apple or Amazon).

Step 7: Know the regulations

When starting a business, it’s your responsibility to research governmental and state business regulations within your market. Some regulations to keep in mind include (but aren’t limited to):

Employment and labor laws

Advertising

Environmental regulations

If you’re a newer entrepreneur and this is your first business, this part can be daunting so you might want to consult with a business attorney. A legal professional will help you identify the legal requirements specific to your business. You can also check online legal help sites like LegalZoom or Rocket Lawyer.

Tips when writing your market analysis

We wouldn’t be surprised if you feel overwhelmed by the sheer volume of information needed in a market analysis. Keep in mind, though, this research is key to launching a successful business. You don’t want to cut corners, but here are a few tips to help you out when writing your market analysis:

Use visual aids

Nobody likes 30 pages of nothing but text. Using visual aids can break up those text blocks, making your market analysis more visually appealing. When discussing statistics and metrics, charts and graphs will help you better communicate your data.

Include a summary

If you’ve ever read an article from an academic journal, you’ll notice that writers include an abstract that offers the reader a preview.

Use this same tactic when writing your market analysis. It will prime the reader of your market highlights before they dive into the hard data.

Get to the point

It’s better to keep your market analysis concise than to stuff it with fluff and repetition. You’ll want to present your data, analyze it, and then tie it back into how your business can thrive within your target market.

Revisit your market analysis regularly

Markets are always changing and it's important that your business changes with your target market. Revisiting your market analysis ensures that your business operations align with changing market conditions. The best businesses are the ones that can adapt.

Why should you write a market analysis?

Your market analysis helps you look at factors within your market to determine if it’s a good fit for your business model. A market analysis will help you:

1. Learn how to analyze the market need

Markets are always shifting and it’s a good idea to identify current and projected market conditions. These trends will help you understand the size of your market and whether there are paying customers waiting for you. Doing a market analysis helps you confirm that your target market is a lucrative market.

2. Learn about your customers

The best way to serve your customer is to understand them. A market analysis will examine your customer’s buying habits, pain points, and desires. This information will aid you in developing a business that addresses those points.

3. Get approved for a business loan

Starting a business, especially if it’s your first one, requires startup funding. A good first step is to apply for a business loan with your bank or other financial institution.

A thorough market analysis shows that you’re professional, prepared, and worth the investment from lenders. This preparation inspires confidence within the lender that you can build a business and repay the loan.

4. Beat the competition

Your research will offer valuable insight and certain advantages that the competition might not have. For example, thoroughly understanding your customer’s pain points and desires will help you develop a superior product or service than your competitors. If your business is already up and running, an updated market analysis can upgrade your marketing strategy or help you launch a new product.

Final thoughts

There is a saying that the first step to cutting down a tree is to sharpen an axe. In other words, preparation is the key to success. In business, preparation increases the chances that your business will succeed, even in a competitive market.

The market analysis section of your business plan separates the entrepreneurs who have done their homework from those who haven’t. Now that you’ve learned how to write a market analysis, it’s time for you to sharpen your axe and grow a successful business. And keep in mind, if you need help crafting your business plan, you can always turn to business plan software or a free template to help you stay organized.

This article originally appeared on JustBusiness, a subsidiary of NerdWallet.

On a similar note...

MANAGEMENT • 4 MIN READ

Taking Risks in Business the Right Way: Full Guide

As a successful entrepreneur , business risks are essential to achieving growth and success. While it can be daunting to step outside of your comfort zone, the rewards can be significant.

In this article, we’ll explore the definition and importance of taking risks in business, provide examples of different types of business risks, and offer ideas and strategies for entrepreneurs looking to take calculated risks.

What Do We Mean By Taking Risks in Business?

Business risks refers to the process of identifying and pursuing opportunities that may be uncertain or have the potential for failure. It involves taking calculated risks to achieve business objectives and goals , such as increasing revenue, market share, or expanding into new markets.

However, taking risks in business does not mean taking reckless or blind risks that may result in significant losses or problems to the business .

Should You Be Taking Risks in Business?

Taking risks in business is critical to achieving significant growth and success. According to the Bureau of Labor Statistics (BLS), 50% of small businesses fail within the first five years, while 65% fail within ten years.

However, businesses that take calculated risks are more likely to succeed and achieve long-term growth.

Are There Any Benefits?

- Increased innovation and creativity : Taking risks can encourage entrepreneurs to explore new and innovative ideas that can lead to breakthrough products or services.

- Competitive advantage : Businesses that take risks and innovate can gain a competitive advantage over their competitors, leading to increased market share and revenue.

- Improved decision-making skills : Taking risks requires entrepreneurs to make strategic decisions based on careful analysis and planning, which can improve their decision-making skills over time.

- Increased revenue and profitability : Taking calculated risks can lead to increased revenue and profitability, as businesses can identify new markets and revenue streams.

- Enhanced reputation : Successful risk-taking can enhance a business’s reputation, leading to increased customer loyalty and brand awareness.

9 Ideas for Taking Business Risks Effectively

There are many types of business risks out there. Some are better to take on than others.

Here are 9 examples of business risks and ideas to help take your business to the next level.

1. Launch a New Product or Service

Taking risks in product and service offerings can help businesses differentiate themselves from their competitors and appeal to new customers.

For instance, a restaurant may risk offering a new menu item, such as a vegan option, to attract a new customer base and create a competitive advantage.

2. Expand Into New Markets

Expanding into new markets can help businesses tap into new customer segments and increase revenue . It also helps to diversify their income streams and reduce risks associated with relying on one market.

Furthermore, entering new markets can help businesses gain insights into different cultures and new trends in the industry.

3. Invest in New Technology

Investing in new technology can help businesses increase efficiency, reduce costs, and improve the quality of their products or services. Companies that invest in technology are better equipped to compete in the global marketplace, as the technology helps them stay ahead of their competitors.

In addition, new technology can help businesses become more innovative and agile, allowing them to respond quickly to changing customer needs/

4. Take on Strategic Partnerships

5. diversify revenue streams, 6. hire new talent.

Hiring new talent can help businesses bring in fresh perspectives and ideas, leading to increased innovation and growth . New talent often brings with them fresh insights and skills that can help to grow a business in ways that existing staff may be unable to.

By bringing on new talent, businesses can tap into new markets, create new products and services, and open up new possibilities for growth.

7. Try New Marketing and Advertising Strategies