- • Directed a credit team of 20, implementing strategic initiatives to reduce bad debt expenses by 15% within one fiscal year.

- • Developed and executed a new credit risk assessment framework, resulting in a 10% improvement in portfolio risk profile.

- • Spearheaded the integration of AI-based credit scoring techniques, enhancing underwriting efficiency by 25%.

- • Managed the credit cycle for accounts worth over $500M, maintaining a 97% collection rate through proactive customer engagement.

- • Orchestrated cross-departmental collaboration, reducing turnaround time for credit analysis by 30% and boosting customer satisfaction.

- • Championed a financial literacy program for clients, which improved payment timeliness by 20% and deepened business relationships.

- • Led credit risk evaluations for corporate clients, optimizing credit exposure for a $300M portfolio.

- • Initiated a risk mitigation plan that reduced portfolio defaults by 18% by aligning with business growth objectives.

- • Delivered comprehensive credit risk training to over 35 team members, enhancing departmental knowledge and capabilities.

- • Collaborated closely with sales and operations teams to align credit risk policies with overarching business strategies.

- • Negotiated and structured workout arrangements for high-risk accounts, preserving customer relationships and minimizing losses.

- • Managed a team of 10 credit analysts, achieving a 5% year-on-year decrease in delinquency rates.

- • Designed and implemented credit evaluation tools that increased risk assessment accuracy by 12%.

- • Played a pivotal role in restructuring credit processes, enhancing team productivity by 20%.

- • Fostered strong working relationships with clients, contributing to a client retention rate of over 95%.

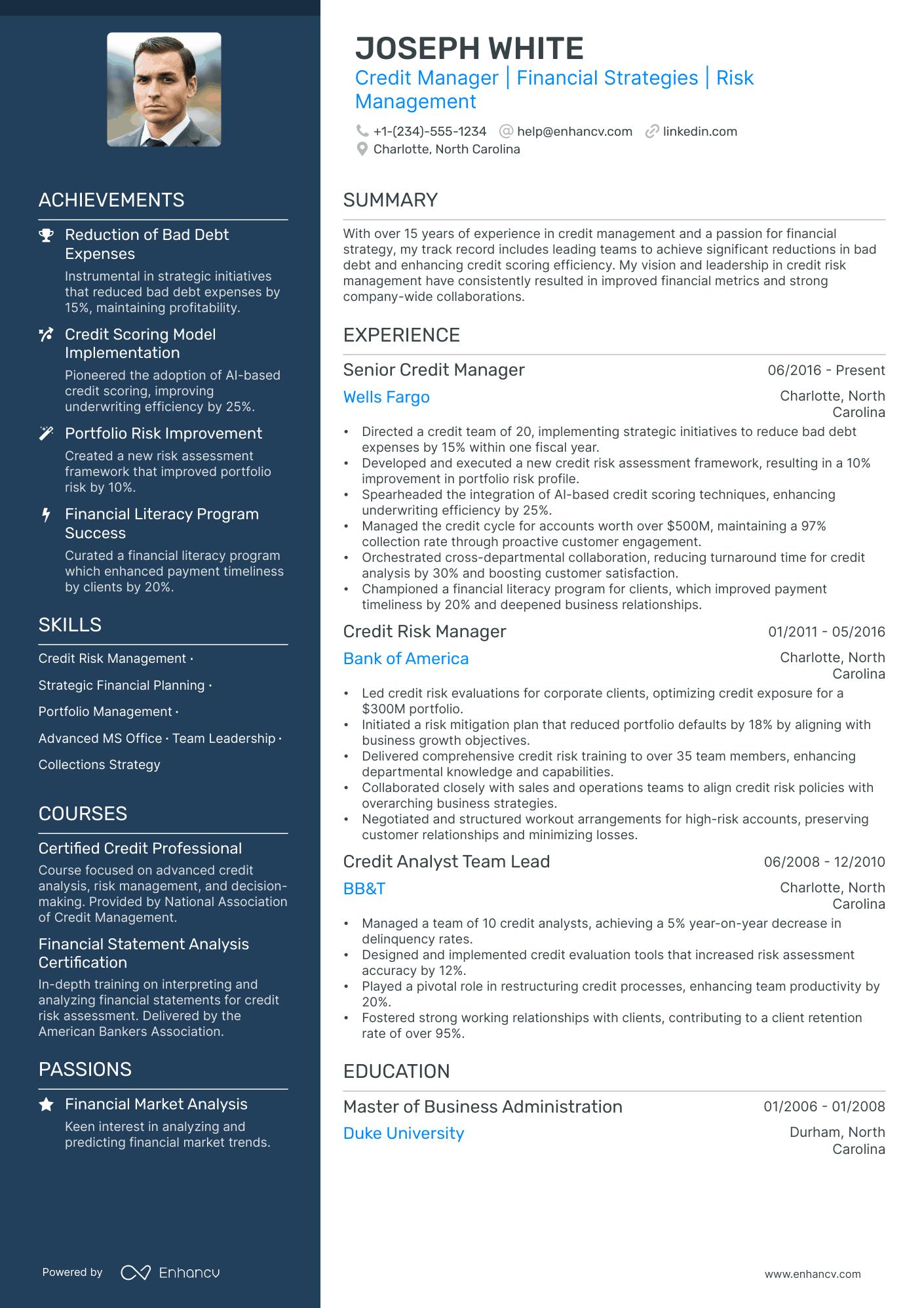

5 Credit Manager Resume Examples & Guide for 2024

As a credit manager, your resume must showcase your ability to assess credit risk. Highlight your proficiency in analyzing financial statements and credit data. You need to demonstrate a history of successful credit portfolio management. Detail your experience in setting credit policies and recovery strategies to capture the reader's attention.

All resume examples in this guide

Resume Guide

Resume Format Tips

Resume Experience

Skills on Resume

Education & Certifications

Resume Summary Tips

Additional Resume Sections

Key Takeaways

As a credit manager, articulating your complex risk analysis and decision-making experiences on your resume can be challenging. Our guide is designed to help you distill these intricate responsibilities into clear, impactful bullet points that will catch an employer's eye.

- credit manager resumes that are tailored to the role are more likely to catch recruiters' attention.

- Most sought-out credit manager skills that should make your resume.

- Styling the layout of your professional resume: take a page from credit manager resume examples.

How to write about your credit manager achievements in various resume sections (e.g. summary, experience, and education).

- Junior Financial Analyst Resume Example

- Assistant Finance Manager Resume Example

- Fund Accountant Resume Example

- Hotel Night Auditor Resume Example

- IT Auditor Resume Example

- Management Accounting Resume Example

- Construction Accounting Resume Example

- Full Cycle Accounting Resume Example

- Tax Director Resume Example

- Purchase Accounting Resume Example

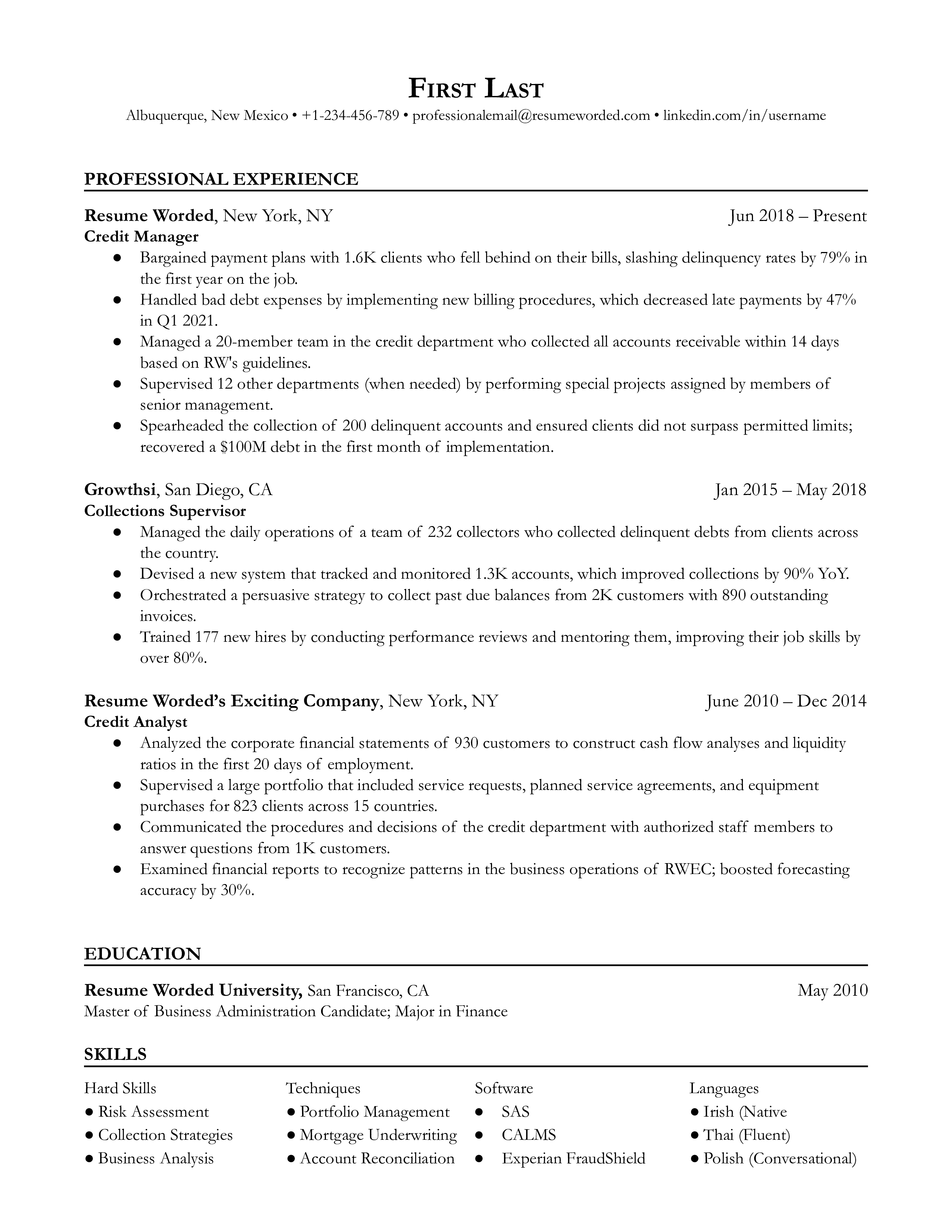

Designing your credit manager resume format to catch recruiters' eyes

Your credit manager resume will be assessed on a couple of criteria, one of which is the actual presentation.

Is your resume legible and organized? Does it follow a smooth flow?

Or have you presented recruiters with a chaotic document that includes everything you've ever done in your career?

Unless specified otherwise, there are four best practices to help maintain your resume format consistency.

- The top one third of your credit manager resume should definitely include a header, so that recruiters can easily contact you and scan your professional portfolio (or LinkedIn profile).

- Within the experience section, list your most recent (and relevant) role first, followed up with the rest of your career history in a reverse-chronological resume format .

- Always submit your resume as a PDF file to sustain its layout. There are some rare exceptions where companies may ask you to forward your resume in Word or another format.

- If you are applying for a more senior role and have over a decade of applicable work experience (that will impress recruiters), then your credit manager resume can be two pages long. Otherwise, your resume shouldn't be longer than a single page.

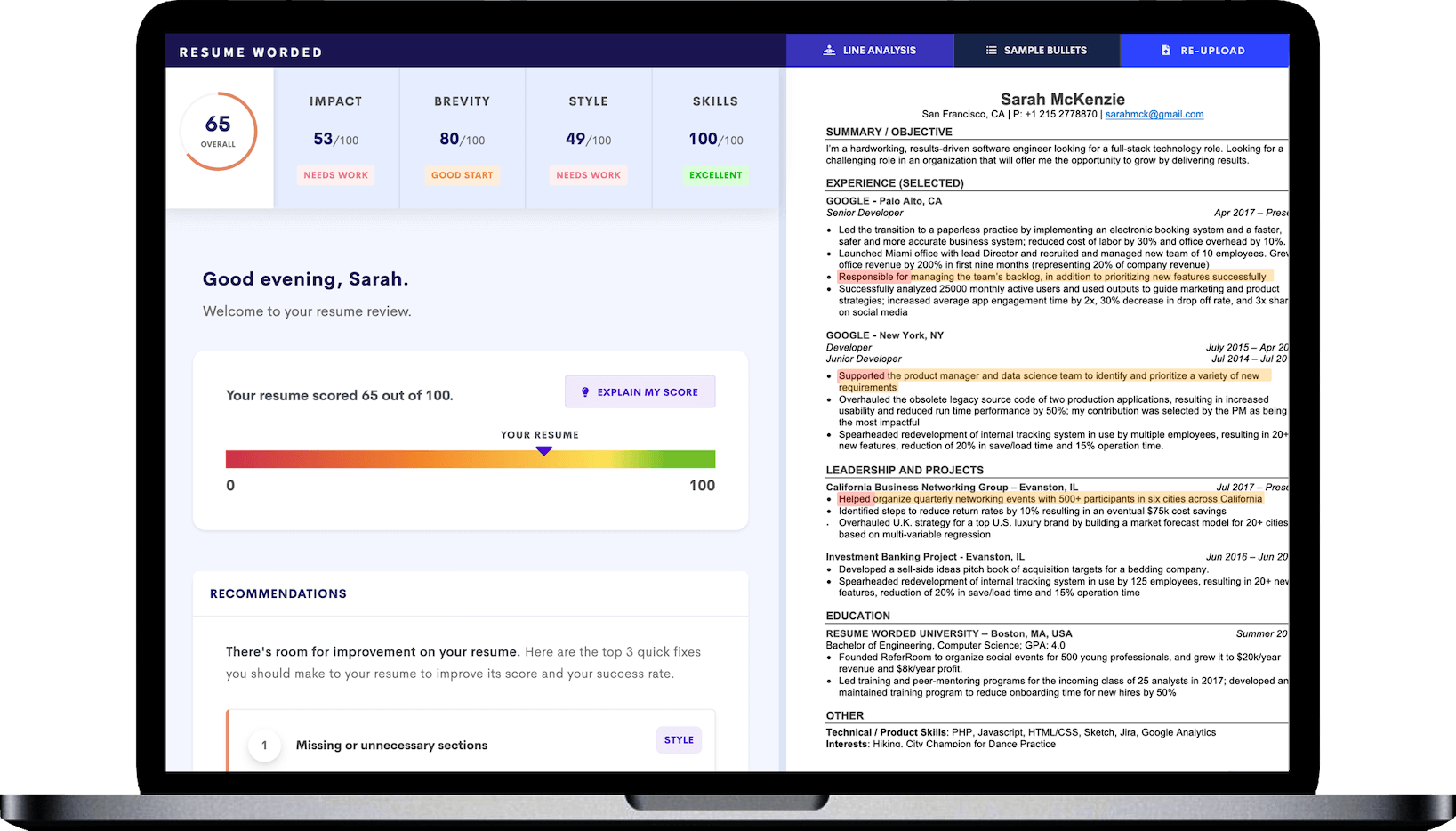

Upload & Check Your Resume

Drop your resume here or choose a file . PDF & DOCX only. Max 2MB file size.

If you happen to have plenty of certificates, select the ones that are most applicable and sought-after across the industry. Organize them by relevance to the role you're applying for.

Fundamental sections for your credit manager resume:

- The header with your name (if your degree or certification is impressive, you can add the title as a follow up to your name), contact details, portfolio link, and headline

- The summary or objective aligning your career and resume achievements with the role

- The experience section to curate neatly organized bullets with your tangible at-work-success

- Skills listed through various sections of your resume and within an exclusive sidebar

- The education and certifications for more credibility and industry-wide expertise

What recruiters want to see on your resume:

- Proven experience in credit risk analysis and decision-making.

- Capability to develop and implement credit policies and procedures.

- Proficiency with credit management software and financial analysis tools.

- Demonstrated experience managing and leading a team of credit analysts or related staff.

- Strong understanding of financial regulations and compliance as it pertains to credit and lending.

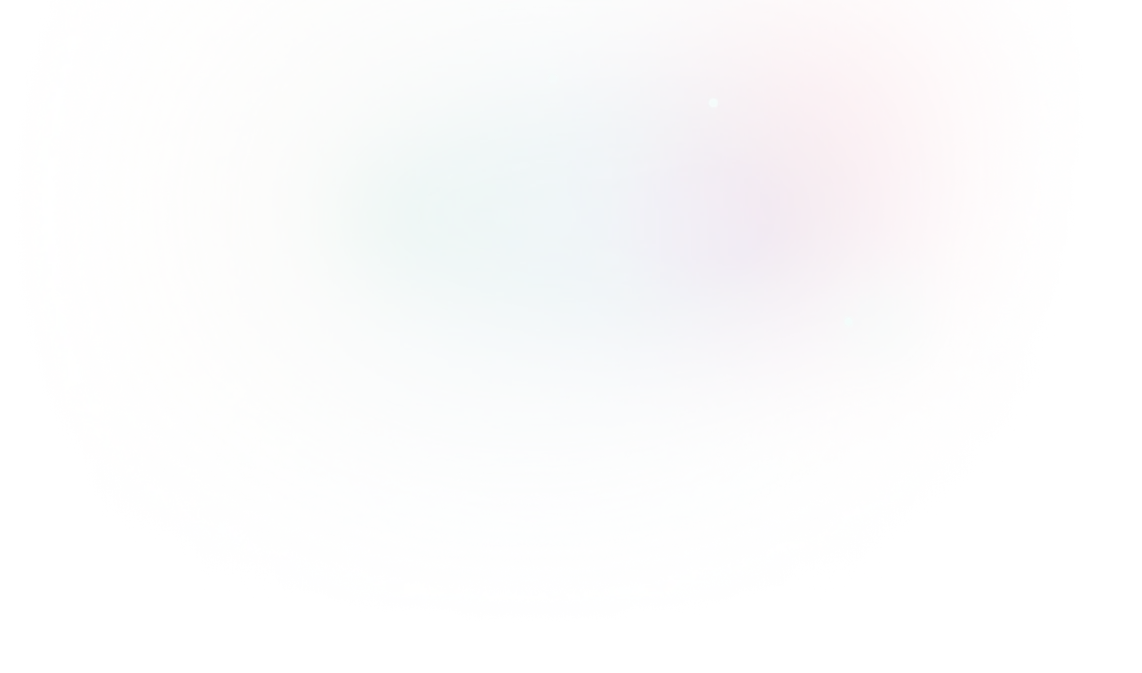

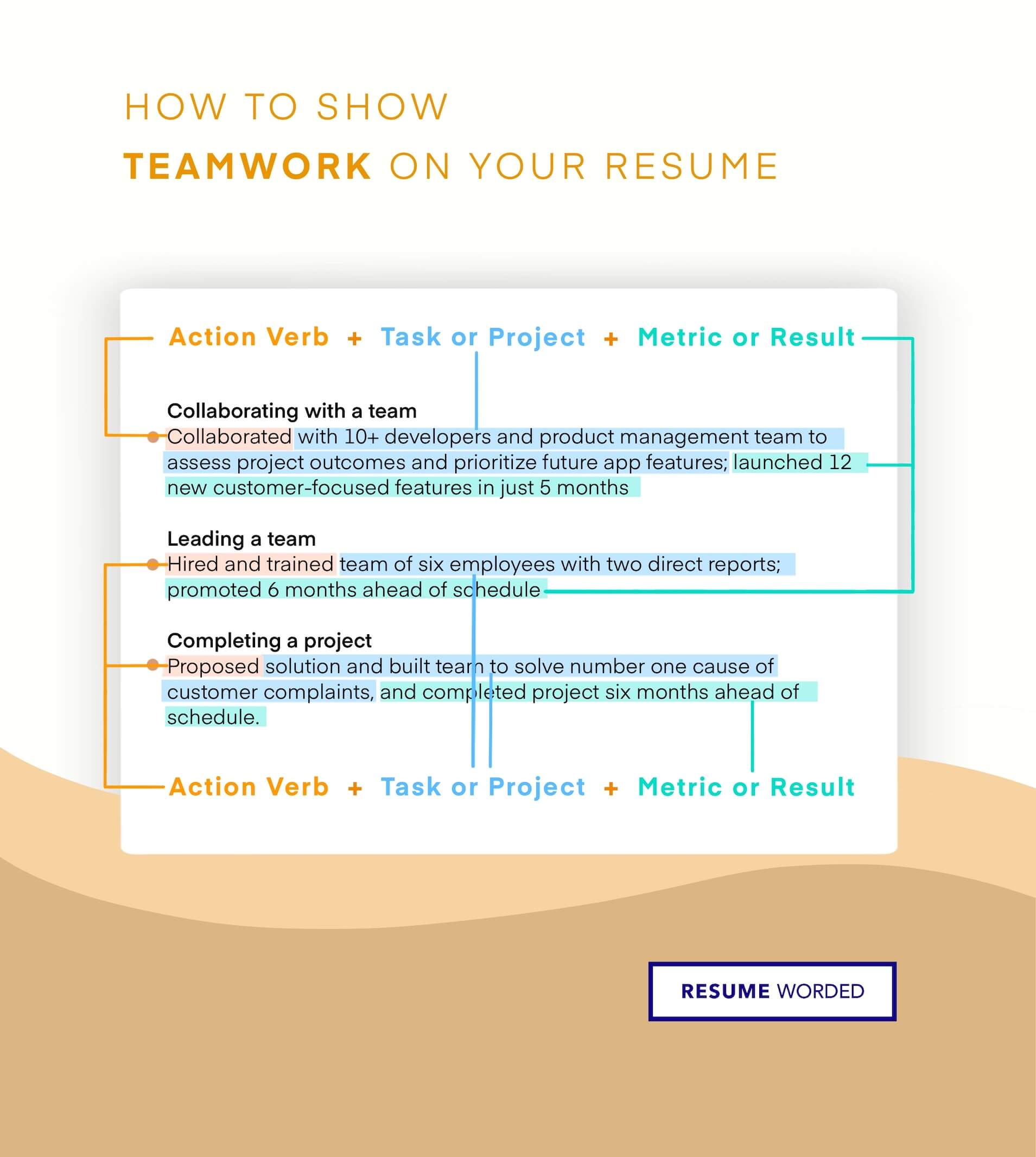

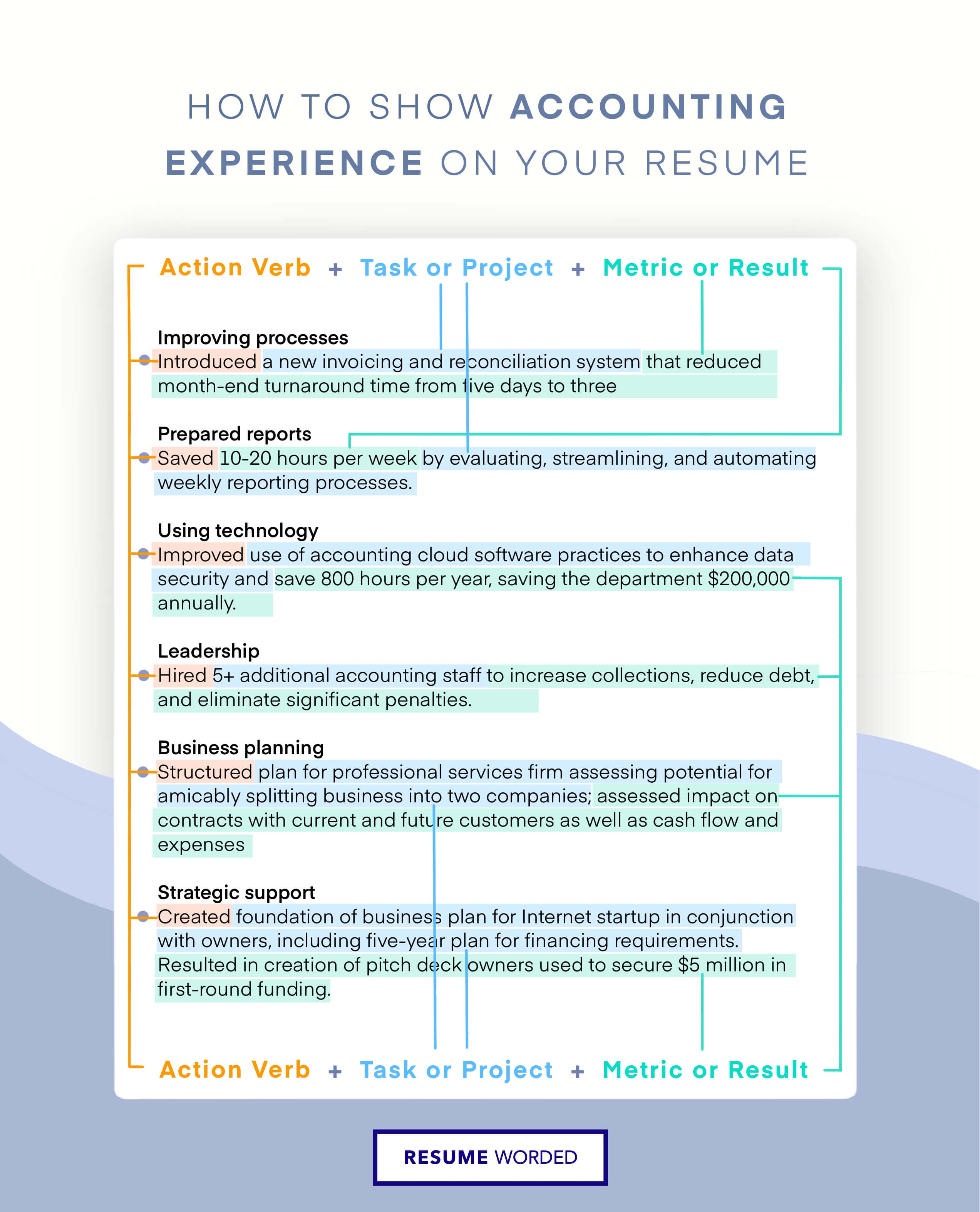

What is the resume experience section and how to write one for your past roles

The experience section in a credit manager resume is critical for your profile and overall application. It should not only display your work history, but also highlight your achievements in previous roles .

Many candidates either simply list their duties or provide excessive details about past, irrelevant jobs. A more effective approach involves first examining the job advertisement for keywords - specifically, skills essential for the role . Then, demonstrate these key requirements throughout different parts of your resume, using accomplishments from your roles.

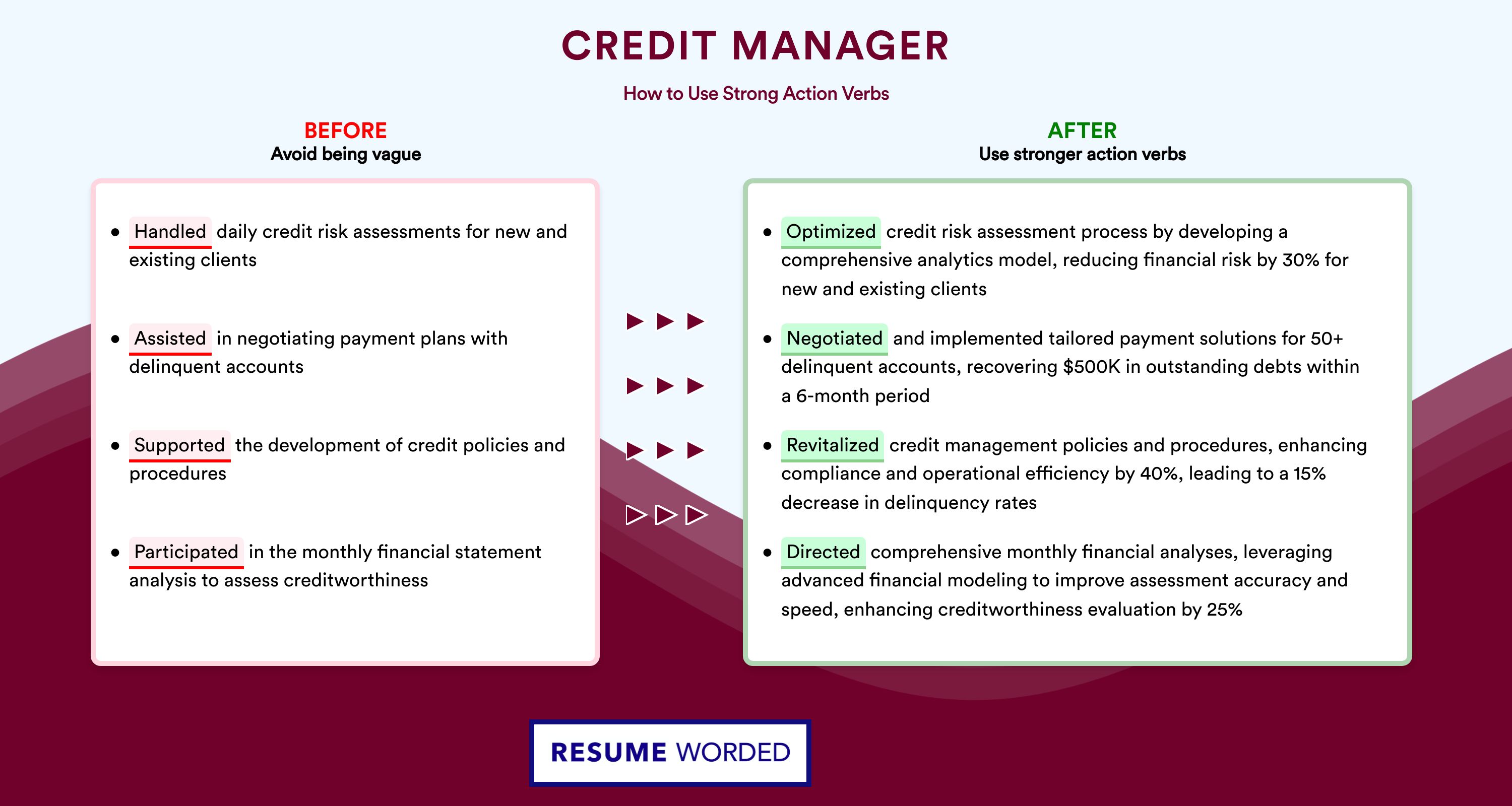

Format each bullet point in your experience section by starting with a strong action verb . Follow this with a description of your role and its impact on the team or organization.

Aim to include three to five bullet points for each role.

Finally, gain insights into how professionals have crafted their credit manager resume experience sections by exploring some best practice examples.

- Spearheaded the restructuring of the credit evaluation process, introducing data analytics tools that improved the accuracy of credit scoring by 30%.

- Negotiated and implemented new credit terms with key vendors, improving cash flow by 20% and reducing average days sales outstanding by 15 days.

- Led a cross-functional team in a successful pilot program to automate risk assessment, which was then adopted company-wide, decreasing processing times by 40%.

- Managed a portfolio of over 500 commercial accounts, reducing delinquency rates from 7% to 4.5% within the first year.

- Developed and conducted credit management training for new team members, enhancing department expertise and reducing onboarding time by 25%.

- Established and led quarterly credit review meetings that contributed to strategic planning, resulting in a 20% reduction in credit losses.

- Implemented an innovative credit scoring model using predictive analytics that led to a 12% improvement in loan performance.

- Collaborated with IT to launch a new credit reporting system, improving reporting efficiency and cutting errors by 25%.

- Drove company policy changes that aligned credit risk objectives with overall business strategy, improving risk-adjusted returns on the portfolio.

- Oversaw a team that successfully reduced credit card fraud by 40% through implementing advanced fraud detection systems.

- Played a key role in the negotiation of a multimillion-dollar loan syndication transaction that expanded the company’s market presence.

- Initiated and managed a comprehensive debt recovery program that increased recoveries on impaired loans by 35%.

- Optimized credit line increases, reducing churn by 18% and simultaneously maintaining a healthy risk profile for the credit portfolio.

- Developed a standardized credit risk reporting framework that enhanced visibility for executive decision-making and was later adopted across regional offices.

- Championed a client retention program that incorporated credit incentives, resulting in the retention of key accounts and an increase in profitability by 10%.

- Re-engineered underwriting policies for SMB lending, leading to a portfolio growth of $100M while maintaining loss rates below industry average.

- Orchestrated the transition to a new credit monitoring platform that increased operational efficiency by streamlining credit reviews and approvals.

- Drove international credit expansion initiatives, successfully penetrating new markets in Europe and Asia, resulting in a 15% portfolio growth in those regions.

- Designed a comprehensive risk assessment model tailored for SMEs that improved credit decision turnaround times by 30%.

- Directed the successful integration of a newly acquired company's credit processes, maintaining service levels throughout the transition.

- Achieved a 20% efficiency gain in the collections process through the implementation of a new CRM system, enhancing customer payment behaviors.

- Enhanced credit risk assessment for high-net-worth individuals, increasing the portfolio under management by $50 million with an improved risk profile.

- Contributed to interdepartmental teams that developed new financial products which aligned with emerging market demands and credit trends.

- Aligned credit approval processes with regulatory requirements, ensuring 100% compliance with local and federal financial regulations.

Quantifying impact on your resume

- Include the total value of receivables managed to showcase financial stewardship.

- Specify the percentage reduction in bad debt achieved through credit policies to demonstrate risk mitigation effectiveness.

- Highlight the number of credit analysis reports produced to show analytical productivity.

- Mention the dollar amount of loans or credit lines approved to convey the scale of credit authority.

- State the percentage of credit limit increases granted to illustrate strategic account growth support.

- List the number of clients managed to reflect customer relationship and portfolio management skills.

- Provide the frequency of financial reviews conducted to emphasize due diligence and ongoing creditworthiness assessment.

- Detail any process improvements made in terms of reduced processing time or increased efficiency, using percentages or time saved to demonstrate operational enhancements.

Action verbs for your credit manager resume

Experience section for candidates with zero-to-none experience

While you may have less professional experience in the field, that doesn't mean you should leave this section of your resume empty or blank.

Consider these four strategies on how to substitute the lack of experience with:

- Volunteer roles - as part of the community, you've probably gained valuable people (and sometimes even technological capabilities) that could answer the job requirements

- Research projects - while in your university days, you may have been part of some cutting-edge project to benefit the field. Curate this within your experience section as a substitute for real-world experience

- Internships - while you may consider that that summer internship in New York was solely mandatory to your degree, make sure to include it as part of your experience, if it's relevant to the role

- Irrelevant previous jobs - instead of detailing the technologies you've learned, think about the transferable skills you've gained.

Recommended reads:

- How to List Expected Graduation Date on Your Resume

- Perfecting the Education Section on Your Resume

If you're in the process of obtaining your certificate or degree, list the expected date you're supposed to graduate or be certified.

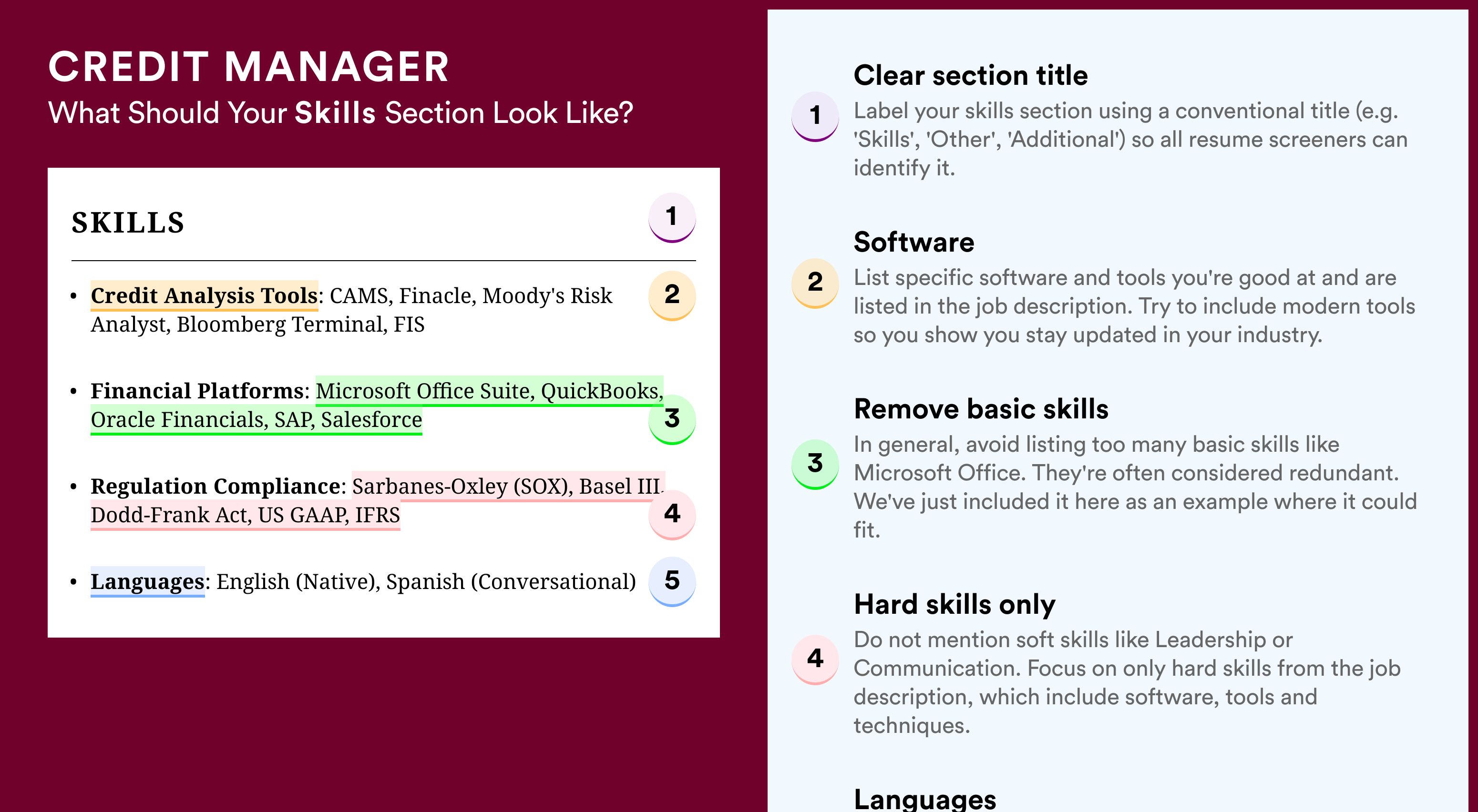

In-demand hard skills and soft skills for your credit manager resume

A vital element for any credit manager resume is the presentation of your skill set.

Recruiters always take the time to assess your:

- Technological proficiency or hard skills - which software and technologies can you use and at what level?

- People/personal or soft skills - how apt are you at communicating your ideas across effectively? Are you resilient to change?

The ideal candidate presents the perfect balance of hard skills and soft skills all through the resume, but more particular within a dedicated skills section.

Building your credit manager skills section, you should:

- List up to six skills that answer the requirements and are unique to your expertise.

- Include a soft skill (or two) that defines you as a person and professional - perhaps looking back on feedback you've received from previous managers, etc.

- Create up to two skills sections that are organized based on the types of skills you list (e.g. "technical skills", "soft skills", "credit manager skills", etc.).

- If you happen to have technical certifications that are vital to the industry and really impressive, include their names within your skills section.

At times, it really is frustrating to think back on all the skills you possess and discover the best way to communicate them across.

We understand this challenge - that's why we've prepared two lists (of hard skills and soft skills) to help you build your next resume, quicker and more efficiently:

Top skills for your credit manager resume:

Credit Analysis

Financial Statement Analysis

Risk Management

Credit Policy Creation

Debt Collection

Account Reconciliation

Regulatory Compliance

Financial Reporting

Credit Scoring Models

Business Acumen

Communication

Problem-Solving

Negotiation

Attention to Detail

Decision Making

Analytical Thinking

Time Management

Customer Service

The more trusted the organization you've attained your certificate (or degree) from, the more credible your skill set would be.

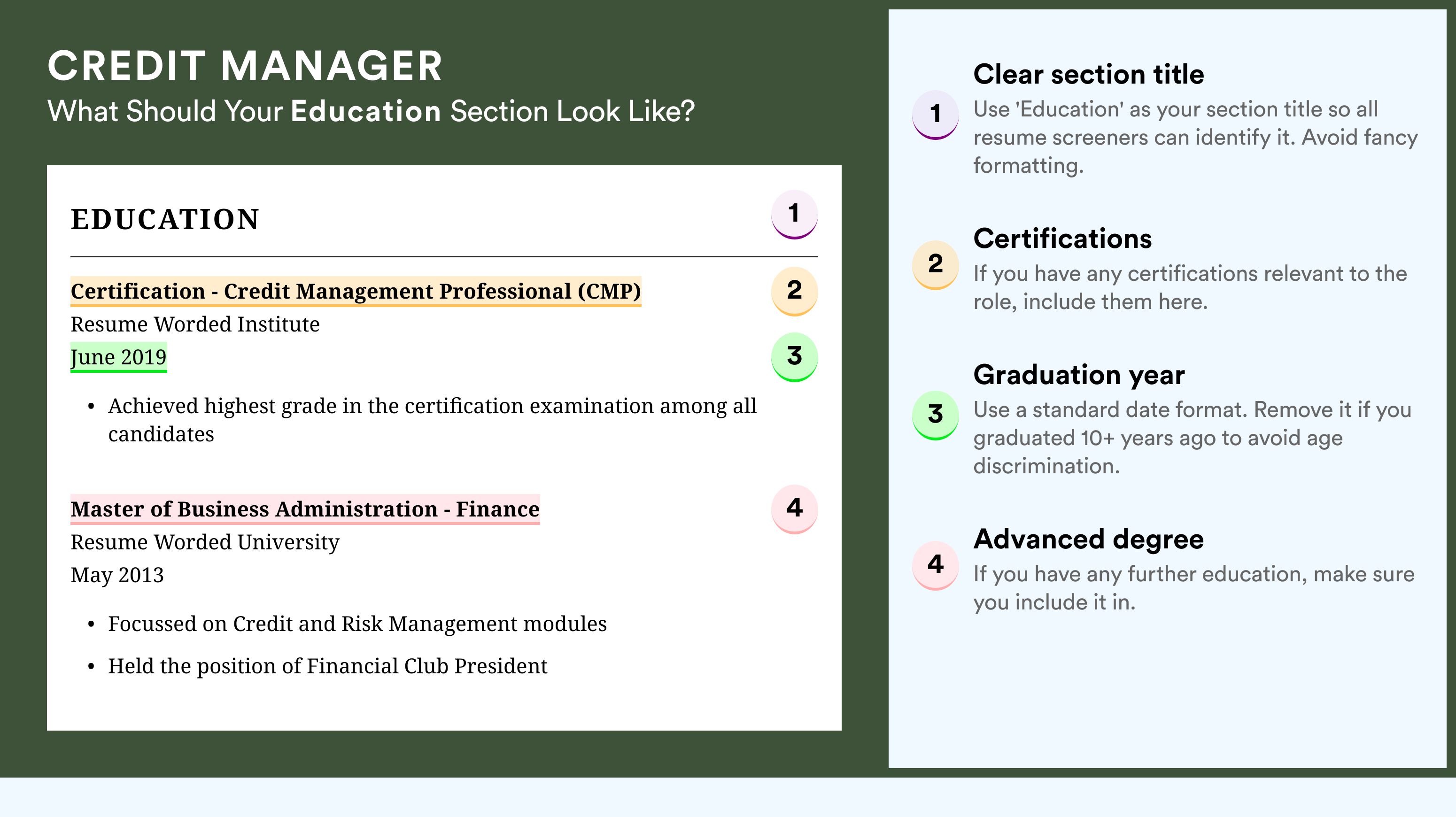

Credit Manager-specific certifications and education for your resume

Place emphasis on your resume education section . It can suggest a plethora of skills and experiences that are apt for the role.

- Feature only higher-level qualifications, with details about the institution and tenure.

- If your degree is in progress, state your projected graduation date.

- Think about excluding degrees that don't fit the job's context.

- Elaborate on your education if it accentuates your accomplishments in a research-driven setting.

On the other hand, showcasing your unique and applicable industry know-how can be a literal walk in the park, even if you don't have a lot of work experience.

Include your accreditation in the certification and education sections as so:

- Important industry certificates should be listed towards the top of your resume in a separate section

- If your accreditation is really noteworthy, you could include it in the top one-third of your resume following your name or in the header, summary, or objective

- Potentially include details about your certificates or degrees (within the description) to show further alignment to the role with the skills you've attained

- The more recent your professional certificate is, the more prominence it should have within your certification sections. This shows recruiters you have recent knowledge and expertise

At the end of the day, both the education and certification sections hint at the initial and continuous progress you've made in the field.

And, honestly - that's important for any company.

Below, discover some of the most recent and popular Credit Manager certificates to make your resume even more prominent in the applicant pool:

The top 5 certifications for your credit manager resume:

- Certified Credit Executive (CCE) - National Association of Credit Management (NACM)

- Credit Business Associate (CBA) - National Association of Credit Management (NACM)

- Credit Business Fellow (CBF) - National Association of Credit Management (NACM)

- Certified Manager of Credit (CMC) - The Credit Management Association (CMA)

- Financial Risk Manager (FRM) - Global Association of Risk Professionals (GARP)

If the certificate you've obtained is especially vital for the industry or company, include it as part of your name within the resume headline.

- How to Put Cum Laude on Your Resume

- How To Include Your Relevant Coursework On A Resume

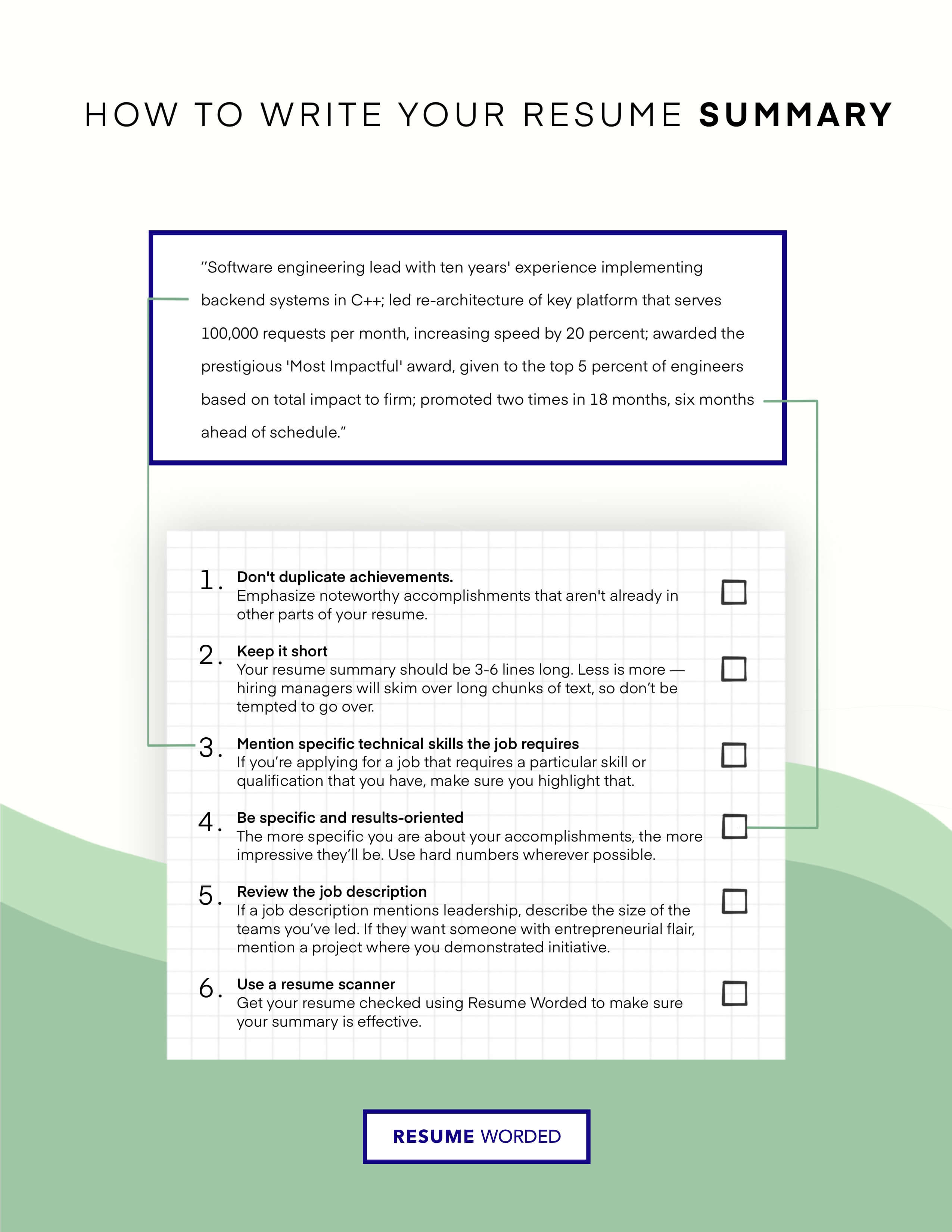

Deciding between a resume summary or objective for your credit manager role

Understanding the distinction between a resume summary and an objective is crucial for your credit manager resume.

A resume summary, typically three to five sentences long, offers a concise overview of your career . This is the place to showcase your most pertinent experience, key accomplishments, and skills. It's particularly well-suited for those with professional experience relevant to the job requirements.

In contrast, a resume objective focuses on how you can add value to potential employers. It addresses why they should hire you and outlines your career expectations and learning goals. Therefore, it's ideal for candidates with less experience.

In the following section of our guide, explore how resume summaries and objectives differ through some exemplary industry-specific examples.

Resume summaries for a credit manager job

- Seasoned Credit Manager with over 10 years of experience in high-volume finance environments, skilled in developing credit policies that reduce delinquency rates. Expert in SAP and advanced risk assessment techniques, I've spearheaded the reduction of bad debt by 30% within a Fortune 500 company, resulting in a significant boost to the bottom line.

- With a robust history spanning 15 years as a Senior Credit Analyst, I moved into managing credit operations, fostering a team-driven environment that reduced credit processing times by 25%. My proficiency in Oracle Financials, combined with a strong track record in optimizing credit controls, has consistently enhanced departmental efficiencies.

- Former Financial Analyst transitioning to Credit Management, bringing a fresh perspective on data-driven risk analysis and an impressive background in utilizing statistical software for financial forecasting. Eager to leverage my advanced Excel skills and my achievement in reducing forecasting errors by 20% to excel in managing credit risk and policy formation.

- Dedicated Operations Manager with a decade of experience in managing supply chains looking to pivot into Credit Management. My knack for strategic planning and keen analytical skills, honed through managing multi-million dollar inventories, will be instrumental in devising comprehensive credit strategies and maintaining fiscal health.

- Aspiring to build a career in Credit Management, I am eager to apply my recent master's degree in Finance and my profound enthusiasm for quantitative analysis. My objective is to harness cutting-edge financial tools and a data-centric approach to contribute to prudent credit decision-making and support sustainable financial growth.

- Graduate with a Bachelors in Business Administration, enthusiastic to begin a career in Credit Management. Determined to use my academic knowledge of financial reporting and creditworthiness assessment, coupled with an internship experience focusing on debtor analysis, to bring a detail-oriented and fresh approach to credit operations.

Other relevant sections for your credit manager resume

Apart from the standard credit manager resume sections listed in this guide, you have the opportunity to get creative with building your profile. Select additional resume sections that you deem align with the role, department, or company culture. Good choices for your credit manager resume include:

- Language skills - always ensure that you have qualified each language you speak according to relevant frameworks;

- Hobbies - you could share more about your favorite books, how you spend your time, etc. ;

- Volunteering - to highlight the causes you care about;

- Awards - for your most prominent credit manager professional accolades and achievements.

Make sure that these sections don't take too much away from your experience, but instead build up your credit manager professional profile.

Key takeaways

Securing your ideal job starts with crafting a compelling credit manager resume. It should not only highlight your professional strengths but also reflect your personality. Key aspects to remember include:

- Choose a clear, easily editable format, allowing more time to focus on the content of your resume;

- Emphasize experience relevant to the job, focusing on your impact on the team;

- Opt for a resume summary if you have extensive professional experience, and a resume objective if you're just starting out;

- Include technical skills in the skills section and interpersonal skills in the achievements section;

- Recognize the importance of various resume sections (e.g., My Time, Projects) in showcasing both your professional abilities and personal traits.

Looking to build your own Credit Manager resume?

- Resume Examples

How to Write a Resume for Internal Position

The best ats-friendly cv examples (+ ats-compliant template), how to network effectively to get hired, should you include irrelevant experience on your resume, 12 great jobs for seniors (with tips), what is a cv definition, structure, purpose, types & meaning.

- Create Resume

- Terms of Service

- Privacy Policy

- Cookie Preferences

- Resume Templates

- AI Resume Builder

- Resume Summary Generator

- Resume Formats

- Resume Checker

- Resume Skills

- How to Write a Resume

- Modern Resume Templates

- Simple Resume Templates

- Cover Letter Builder

- Cover Letter Examples

- Cover Letter Templates

- Cover Letter Formats

- How to Write a Cover Letter

- Resume Guides

- Cover Letter Guides

- Job Interview Guides

- Job Interview Questions

- Career Resources

- Meet our customers

- Career resources

- English (UK)

- French (FR)

- German (DE)

- Spanish (ES)

- Swedish (SE)

© 2024 . All rights reserved.

Made with love by people who care.

- Resume Builder

- Resume Templates

- Resume Formats

- Resume Examples

- Cover Letter Builder

- Cover Letter Templates

- Cover Letter Formats

- Cover Letter Examples

- Career Advice

- Interview Questions

- Resume Skills

- Resume Objectives

- Job Description

- Job Responsibilities

- FAQ’s

Credit Manager Resume Examples

Writing an effective resume for a credit manager position is an essential part of the job search process. Credit managers are responsible for a variety of tasks including managing the credit limits of customers, processing payments, and monitoring the creditworthiness of customers. In order to stand out from other candidates, it is important to create a resume that highlights your relevant experience and qualifications. This guide is designed to provide insight on how to craft a winning credit manager resume, from creating a targeted summary to showcasing your expertise with key words. With the help of this guide and some of the provided examples, you can create a resume that will make you stand out from the competition.

If you didn’t find what you were looking for, be sure to check out our complete library of resume examples .

Start building your dream career today!

Create your professional resume in just 5 minutes with our easy-to-use resume builder!

Credit Manager

123 Main Street | Anytown, USA 99999 | Phone: (123) 456-7890 | Email: [email protected]

A credit manager with more than 5 years of experience in the banking and finance industry, I have a strong knowledge of credit policies, procedures, and regulations, as well as a proven record managing large portfolios of consumer and commercial credit accounts. I am highly organized, detail oriented, and have a keen eye for risk assessment. My ability to think strategically and execute effectively has enabled me to consistently meet and exceed goals. I am looking to use my expertise to take on new challenges and grow with a company.

Core Skills :

- Credit Risk Assessment

- Financial Analysis

- Credit and Portfolio Management

- Regulatory Compliance

- Credit Policies & Procedures

- Credit Underwriting

- Account Administration

- Team Leadership

Professional Experience :

- Credit Manager, ABC Bank – 2015- 2020 Managed a team of 8 credit analysts responsible for loan processing, underwriting and portfolio management of consumer and commercial credit accounts. Developed and implemented credit policies, procedures and guidelines in accordance with regulatory compliance. Performed credit risk analysis and provided recommendations on loan structure and interest rates to maximize risk- adjusted returns. Analyzed financial statements, credit reports, and other documents to make informed credit decisions.

- Credit Analyst, XYZ Bank – 2013- 2015 Reviewed loan documentation and credit applications to ensure accuracy and completeness. Analyzed consumer and commercial credit accounts to assess creditworthiness and credit risk. Assisted senior credit manager with portfolio management of consumer and commercial accounts. Performed regular credit monitoring and reporting on portfolio performance.

Education :

- Bachelor of Science, Finance – ABC University – 2009- 2013

- Certified Credit Professional – XYZ Institute – 2013- 2014

Create My Resume

Build a professional resume in just minutes for free.

Credit Manager Resume with No Experience

Recent college graduate looking to use organizational and problem- solving skills to excel in a credit manager role. Experienced in customer service and financial management through internships and part- time jobs.

- Strong analytical skills

- Attention to detail

- Highly organized

- Excellent verbal and written communication

- Proficient in Microsoft Office

- Proactive problem- solver

Responsibilities

- Manage customer credit and debt collection

- Analyze customer credit reports and financial information

- Develop and implement credit policies and procedures

- Monitor customer accounts for overdue payments and take appropriate action

- Maintain and update records of customer credit and debt

- Liaise with clients and internal teams to resolve any credit issues

- Identify and recommend ways to improve credit processes and procedures

- Provide timely and accurate financial information to management

- Prepare reports and presentations on credit activities

Experience 0 Years

Level Junior

Education Bachelor’s

Credit Manager Resume with 2 Years of Experience

A highly motivated and organized Credit Manager with over two years of experience in the banking and finance industry. Skilled in conducting financial analysis, assessing credit risk, and loan analysis. Good understanding of relevant regulations, policies and procedures, and ability to maintain effective relationship with lenders, customers, and colleagues. Possesses excellent communication and interpersonal skills, and the ability to manage multiple projects in a fast- paced environment.

- Credit Risk Analysis

- Loan Analysis

- Relationship Management

- Project Management

- Interpersonal Skills

- Communication Skills

Responsibilities :

- Manage, organize, and assess credit risk on all loan operations

- Analyze and assess new and existing loan applications in line with loan approval process

- Develop and implement credit risk management strategies to reduce risk exposure

- Analyze financial statements and assess credit for loan approval

- Monitor credit limits and collateral values and review customer portfolios

- Maintain updated knowledge of government regulations and lending policies

- Monitor customer accounts, identify and investigate delinquent accounts

- Monitor loan performance and report to relevant stakeholders

Experience 2+ Years

Credit Manager Resume with 5 Years of Experience

I am an experienced Credit Manager with five years of experience in overseeing credit and financial operations. I have a deep knowledge of credit risk analysis and credit management, as well as a proven track record of managing high- volume loan portfolios and ensuring accuracy in loan documents. I have excellent communication and relationship management skills, as well as a high level of integrity, which allows me to develop strong working relationships with clients, lenders, and team members. My ability to analyze and interpret financial statements, as well as my problem- solving and decision- making skills, are integral in my successful management of credit and financial operations.

- Financial Statement Analysis

- Loan Portfolio Management

- Client Relationship Management

- Problem Solving & Decision Making

- Loan Documentation Accuracy

- Team Collaboration & Leadership

- Oversee and coordinate credit and financial operations

- Analyze and interpret financial statements

- Analyze credit risks associated with loan portfolios

- Develop and maintain relationships with clients, lenders and internal teams

- Ensure accuracy in loan documents throughout the entire loan process

- Lead teams in developing and/or implementing credit management policies and procedures

- Develop and implement strategies to manage credit risk

- Resolve discrepancies or disputes regarding credit or financial operations

Experience 5+ Years

Level Senior

Credit Manager Resume with 7 Years of Experience

Results- oriented Credit Manager with 7 years of extensive experience in reviewing and evaluating credit applications to determine credit- worthiness. Experienced in developing credit policies and procedures, managing risk, and researching credit and financial information of potential clients. Adept in leading and motivating teams to meet performance targets. Outstanding communication, interpersonal, and problem- solving skills.

- Credit Risk Management

- Credit Policies and Procedures

- Risk Assessments

- Credit Reporting

- Customer Relationship Management

- Developed and implemented credit policies and procedures to ensure efficient credit management

- Provided guidance and recommendations to the management team on credit- related issues and risks

- Analyzed and evaluated credit applications to determine credit- worthiness and approve or reject requests

- Monitored client portfolios and identified opportunities for risk mitigation

- Developed and maintained relationships with clients to facilitate the collection of credit payments

- Investigated and resolved customer credit disputes in a timely and professional manner

- Developed and maintained a credit information database and filing system

- Ensured compliance with local, state and federal regulations governing credit and lending activities.

Experience 7+ Years

Credit Manager Resume with 10 Years of Experience

A highly experienced and successful Credit Manager with 10+ years of experience in implementing and managing high- level credit portfolios and operations. Possessing strong organizational, analytical and problem- solving skills coupled with an impressive track record for improving customer service, reducing overdue debt and increasing payments collection. A highly motivated and confident individual who is comfortable in dealing with stakeholders at all levels and able to work to tight deadlines in a pressured environment.

- Excellent knowledge of credit management and control

- Superior customer service and communication skills

- Highly organized and able to plan and prioritize workloads

- Proven ability to identify risks and take proactive measures

- Ability to assess, manage and monitor credit portfolios

- Skilled negotiator and decision- maker

- Strong knowledge of credit legislation and regulations

- Excellent numerical and financial analysis skills

- Reviewing credit applications, evaluating credit risk and making recommendations

- Maintaining up- to- date records of credit data and customer accounts

- Monitoring and managing overdue debt, including chasing payments

- Negotiating repayment plans and debt restructuring

- Liaising with customers, creditors and internal teams to resolve disputes

- Implementing credit control policies and procedures

- Analyzing financial data and making credit decisions

- Producing reports and recommendations for management

- Keeping abreast of changes and developments in the credit management industry

Experience 10+ Years

Level Senior Manager

Education Master’s

Credit Manager Resume with 15 Years of Experience

Talented and results- driven credit manager with 15 years of experience in credit, financial analysis and risk management. Possesses a strong track record of reducing financial losses and improving portfolio performance. Recognized as a leader in identifying and managing credit risk and developing innovative strategies to reduce credit losses. Proven ability to identify and mitigate potential risks, determine credit limits and manage loan portfolios.

- Credit Analysis

- Credit and Risk Management

- Negotiation of Credit and Loan Terms

- Financial Planning and Analysis

- Project Management and Leadership

- Strategic Planning

- Budgeting and Forecasting

- Credit Scorecard and Portfolio Management

- Developed and maintained appropriate credit policies and procedures

- Evaluated credit applications, analyzed financial statements, and determined appropriate credit limits

- Monitored customer accounts on a regular basis and tracked customer’s payment patterns

- Developed, implemented and monitored credit scorecards and portfolio management strategies

- Conducted financial and market analysis of customer’s ability to pay

- Negotiated loan and credit terms with customers

- Collaborated with other departments to evaluate customer’s risk, approve credit applications and manage customer’s portfolio

- Developed and managed credit portfolio, budgets and forecasts

Experience 15+ Years

Level Director

In addition to this, be sure to check out our resume templates , resume formats , cover letter examples , job description , and career advice pages for more helpful tips and advice.

What should be included in a Credit Manager resume?

A Credit Manager is responsible for overseeing the credit worthiness of customers and ensuring that the company’s credit policy is followed. The job requires a combination of financial, management and customer service skills. In order to make a strong impression with potential employers, it is important to include the following in a Credit Manager résumé:

- Professional summary: A brief summary of your experience and qualifications, including how many years of credit management experience you possess.

- Core competencies: List of the skills and knowledge that you possess, such as credit analysis, risk assessment and loan management.

- Education: List of any education or certifications related to credit management.

- Employment History: List of previous credit management jobs and a description of the duties you performed.

- Achievements: List any awards, certifications or other achievements you have earned while working in credit management.

- Additional skills: List of any other skills that are relevant to credit management, such as accounting, customer service, or sales.

Following these guidelines will help make your résumé stand out from the competition. A well-crafted résumé can help you land your dream job as a Credit Manager.

What is a good summary for a Credit Manager resume?

A good summary for a Credit Manager resume should highlight the candidate’s ability to monitor and manage credit limits, accounts receivable, and cash collection. It should also detail the candidate’s ability to evaluate credit applications and mitigate risk, as well as their expertise in developing and implementing credit policies. The summary should also mention any relevant experience in financial analysis, budgeting, and reporting. Finally, the summary should emphasize the candidate’s strong interpersonal and communication skills, as well as their ability to work collaboratively with other departments.

What is a good objective for a Credit Manager resume?

A Credit Manager is responsible for managing the credit and collections activities within a company. As such, the objective of a Credit Manager resume should be to demonstrate the applicant’s ability to manage the company’s credit and collections with accuracy, efficiency, and professionalism. Here are some good objectives for a Credit Manager resume:

- Establish and maintain a positive relationship with clients and customers

- Manage and analyze credit applications and credit data

- Monitor adherence to credit policies and procedures

- Manage accounts receivable and ensure timely collection

- Negotiate payment arrangements with customers

- Monitor outstanding invoices and accounts receivables

- Develop and implement credit and collections strategies

- Prepare monthly and quarterly reports for management

- Monitor credit trends and identify potential risks

- Handle customer disputes and complaints

How do you list Credit Manager skills on a resume?

When crafting a resume for a Credit Manager position, skill section is critical to showcase your qualifications. Knowing what skills to list can be tricky, as you don’t want to miss any important abilities while also not wanting to include irrelevant information. To help you plan and organize your resume, here are some key Credit Manager skills to consider when putting together your resume:

- Analytical Thinking: Credit Managers must be able to analyze financial documents and data quickly and accurately. This includes being able to detect any inconsistencies or irregularities that may indicate a potential problem.

- Financial Acumen: Credit Managers must have a deep understanding of various financial principles and how to apply them. This includes having a solid grasp of accounting, budgeting, and taxation.

- Problem Solving: A successful Credit Manager must be able to troubleshoot complex issues and come up with solutions in a timely manner.

- Decision Making: Credit Managers must be able to make sound decisions quickly while taking into account all relevant factors.

- Negotiating: Credit Managers must be able to negotiate with customers and other parties in order to achieve desired outcomes.

- Communication: Credit Managers must be able to communicate effectively both verbally and in writing. This includes being able to communicate complex concepts in a clear and concise manner.

- People Skills: Credit Managers must be able to interact with customers, colleagues, and other stakeholders in a professional manner.

By including these Credit Manager skills on your resume, you can demonstrate to potential employers that you have the knowledge and experience necessary for the role.

What skills should I put on my resume for Credit Manager?

When applying for a job as a Credit Manager, it is important to make sure that your resume contains the skills and qualifications that are necessary to be successful in the role. Here is a list of skills and qualifications that should be included on your resume when applying for a Credit Manager position:

- Financial Management: Experience with financial management and understanding of accounting principles, including budgeting, forecasting and financial statements.

- Credit Analysis: Knowledge of credit analysis techniques and abilities to review financial statements and credit reports.

- Risk Management: Understanding of risk management principles and processes, including credit scoring and risk assessment.

- Regulatory Compliance: Knowledge of relevant regulations and compliance standards to ensure that all activities are compliant with applicable laws and regulations.

- Relationship Management: Ability to build and maintain positive relationships with customers, vendors and other external stakeholders.

- Negotiation: Strong negotiation skills to ensure that mutually beneficial agreements are reached.

- Communication: Effective written and verbal communication skills to communicate with internal and external stakeholders.

- Problem Solving: Strong problem-solving skills to effectively identify and resolve any credit issues.

- Risk Mitigation: Ability to develop and implement strategies to mitigate credit risks.

- Decision Making: Ability to make sound and informed decisions based on analysis of data and credit reports.

Key takeaways for an Credit Manager resume

When it comes to crafting an effective resume, there are many elements to consider. As a credit manager, your resume should showcase your experience, as well as your technical, managerial and communication skills. Here are some key takeaways to help you create an effective credit manager resume.

- Highlight Your Education: Your resume should include any relevant educational qualifications, such as a degree in business, accounting or finance. In addition, you can also list any certifications or specialized training you may have completed.

- Showcase Your Professional Experience: An effective credit manager resume should include an overview of your professional experience. This should include any managerial roles you’ve held, as well as any relevant projects or initiatives you’ve been involved in.

- Detail Your Skills: As a credit manager, you need to demonstrate that you have the necessary skills and capabilities. In your resume, make sure to list any technical and managerial skills you possess, as well as any software programs you are familiar with.

- Describe Your Achievements: To stand out from the crowd, be sure to include any accomplishments or successes you have achieved in previous roles. This will help potential employers to get a better understanding of your abilities.

- Use Action-Oriented Language: To make your resume even more compelling, be sure to use action-oriented language throughout. Instead of simply stating your job duties, focus on the results you achieved.

Following these tips can help to ensure your credit manager resume is effective and stands out from the crowd. Make sure to include all relevant information, use action-oriented language and showcase your experience and skills. Good luck!

Let us help you build your Resume!

Make your resume more organized and attractive with our Resume Builder

Resume Worded | Proven Resume Examples

- Resume Examples

- Finance Resumes

- Credit Analyst Resume Guide & Examples

Credit Manager Resume Examples: Proven To Get You Hired In 2024

Jump to a template:

- Credit Manager

- Senior Credit Manager

Get advice on each section of your resume:

Jump to a resource:

- Credit Manager Resume Tips

Credit Manager Resume Template

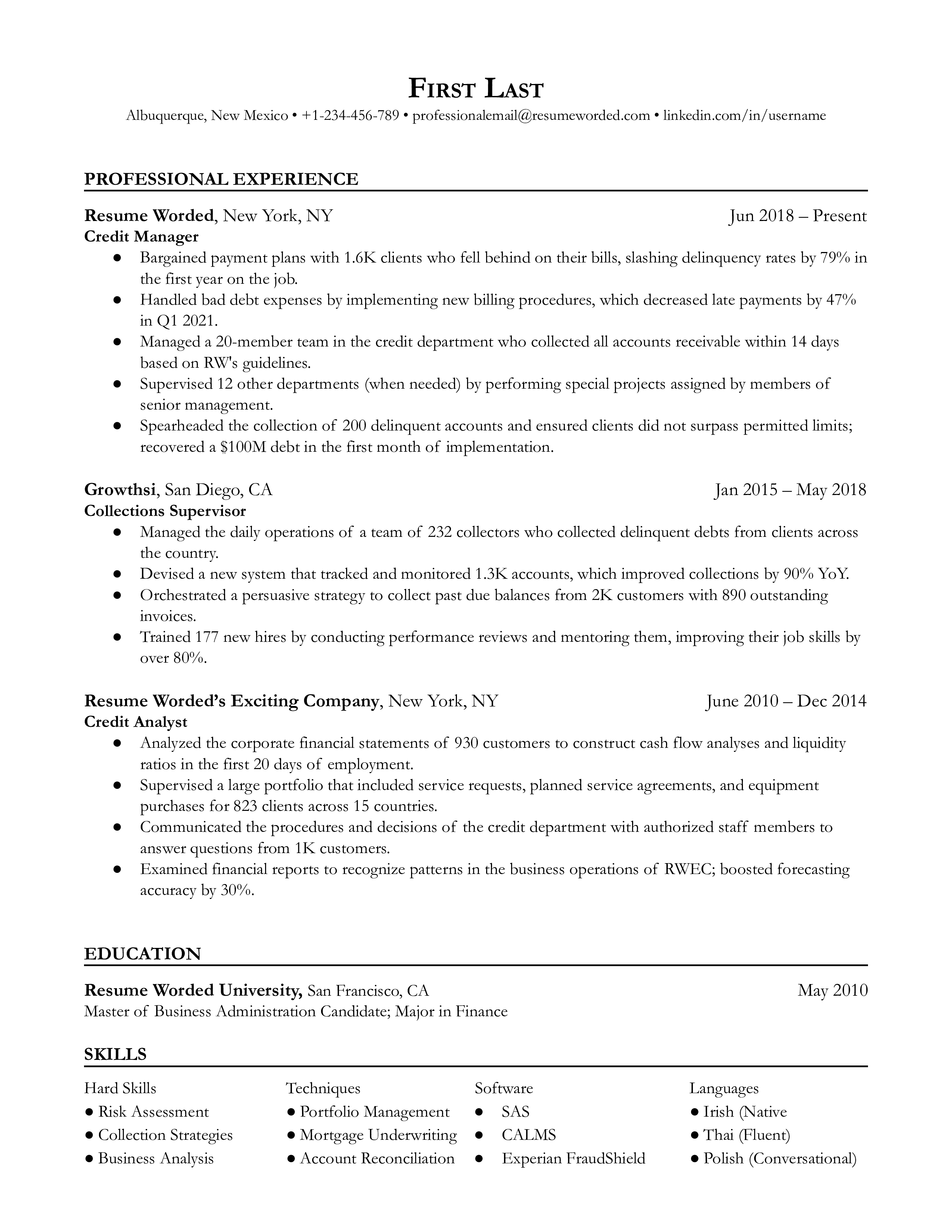

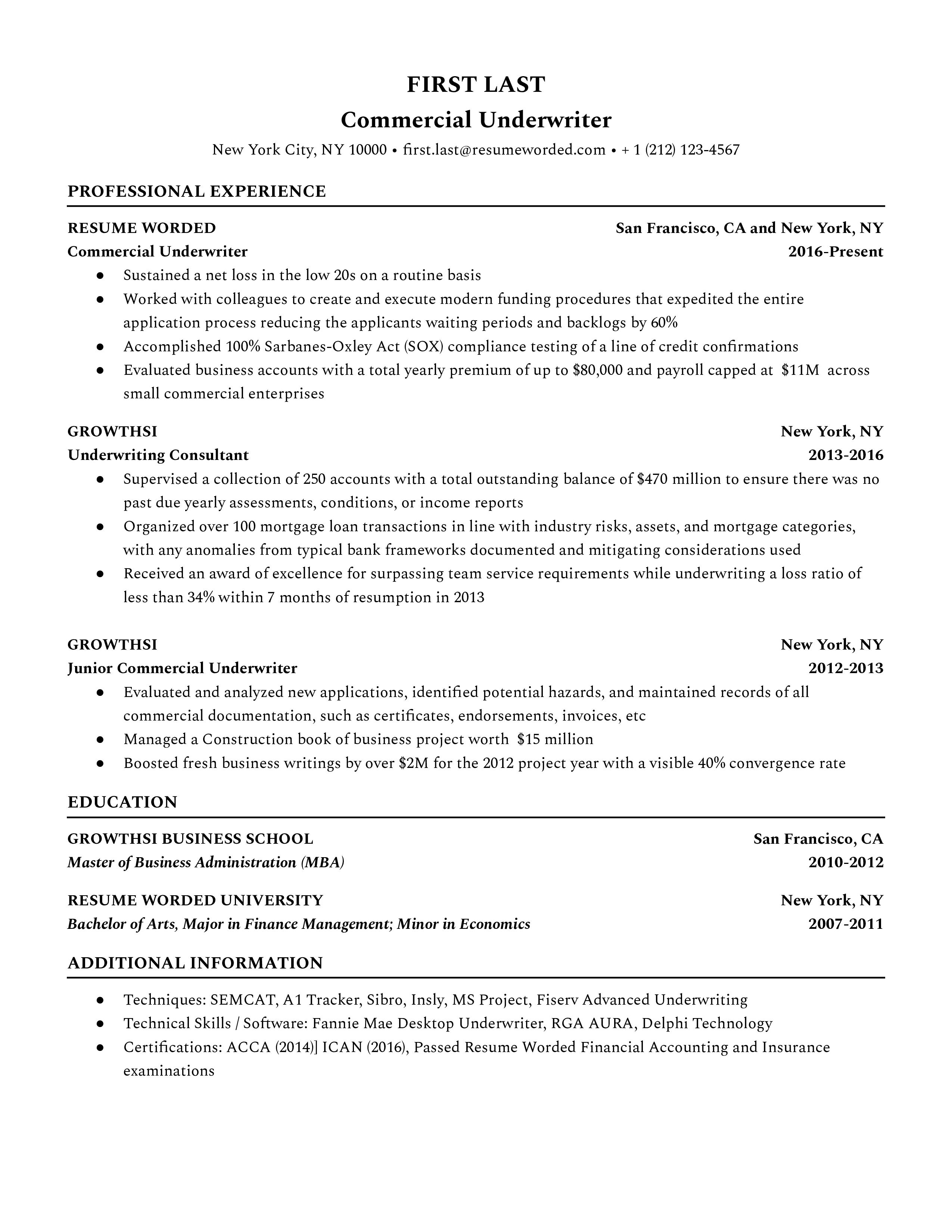

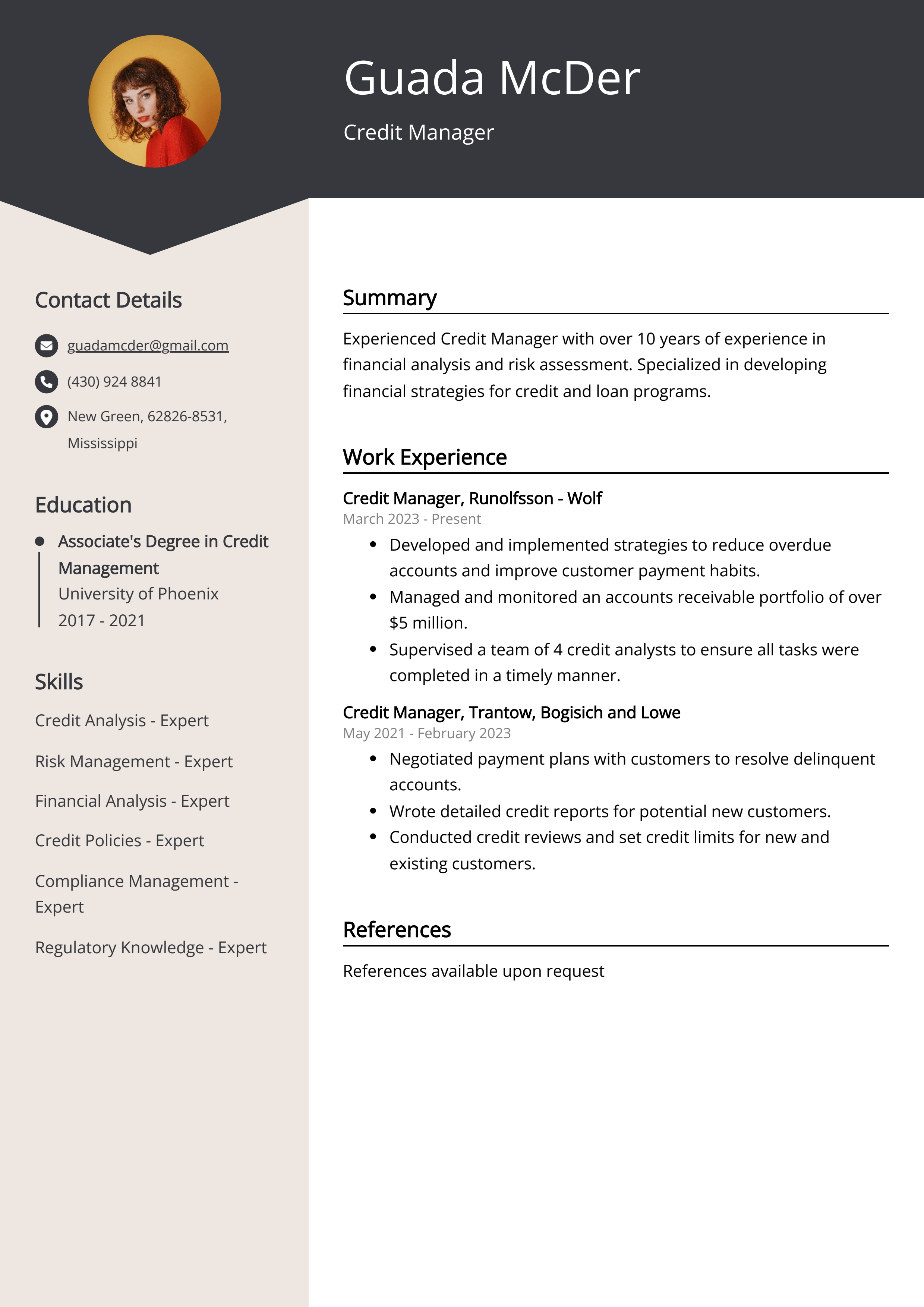

Download in google doc, word or pdf for free. designed to pass resume screening software in 2022., credit manager resume sample.

Being a Credit Manager, you deal with the capricious side of finance - risks and returns. You're tasked with setting credit policies and procedures, making tough calls on applications, and nurturing your team's development. Lately, the role has been morphing, with companies increasingly demanding more strategic insights from their Credit Managers. Having a good handle on big data and analytics, and demonstrating this in your resume is key. When crafting your resume, remember the recruiters are not only looking for your technical competence but also leadership skills and strategic ability. For a Credit Manager role, it's all about the evidence. You have to persuade a potential employer that you're not only familiar with financial analysis and risk assessment but have implemented them effectively in previous roles. Also, industry trends suggest that a Credit Manager with a strong ability to collaborate with sales, customer service, and other departments is highly desirable. So, don't simply focus on the financial side in your resume, demonstrate how you've worked cross-departmentally to enhance overall company performance too.

We're just getting the template ready for you, just a second left.

Recruiter Insight: Why this resume works in 2022

Tips to help you write your credit manager resume in 2024, highlight your accomplishments in risk assessment.

You should always provide concrete examples of how you've successfully managed risk in previous roles. Use numbers and percentages to provide context and demonstrate the impact of your actions.

Demonstrate your Collaborative Skills

Credit management is not done in isolation. Highlight instances where you've successfully worked with other departments like sales or customer service to optimize credit processes, resolve issues and enhance customer relationships.

The role of a credit manager is to coordinate the process of granting credit. They are responsible for overseeing the entire credit department. Hence, you should highlight your leadership skills in your resume. Credit managers determine credit score benchmarks, analyze customers’ trustworthiness, and approve or deny loan requests.

Indicate your familiarity with accounting software.

Credit managers must analyze financial statements and conduct data analytics to determine the reliability of potential lenders. Therefore, it is almost imperative to have computer literacy and familiarity with accounting software. To reflect this in your resume, you can mention some of the tools you use in your research process.

Use strong action verbs to indicate reliability.

Credit managers have a higher-level responsibility than credit analysts. They manage the entire operations in the credit department, so they have a significant influence on the organization’s finances. That’s why your potential employer is looking for someone to hold accountable and who makes decisions for the team and drives success for the company. If you want to demonstrate this, use the right words. Action verbs are descriptive words that can help you look more proactive. Instead of using vague expressions, go with something like “established,” “analyzed,” or “forecasted.”

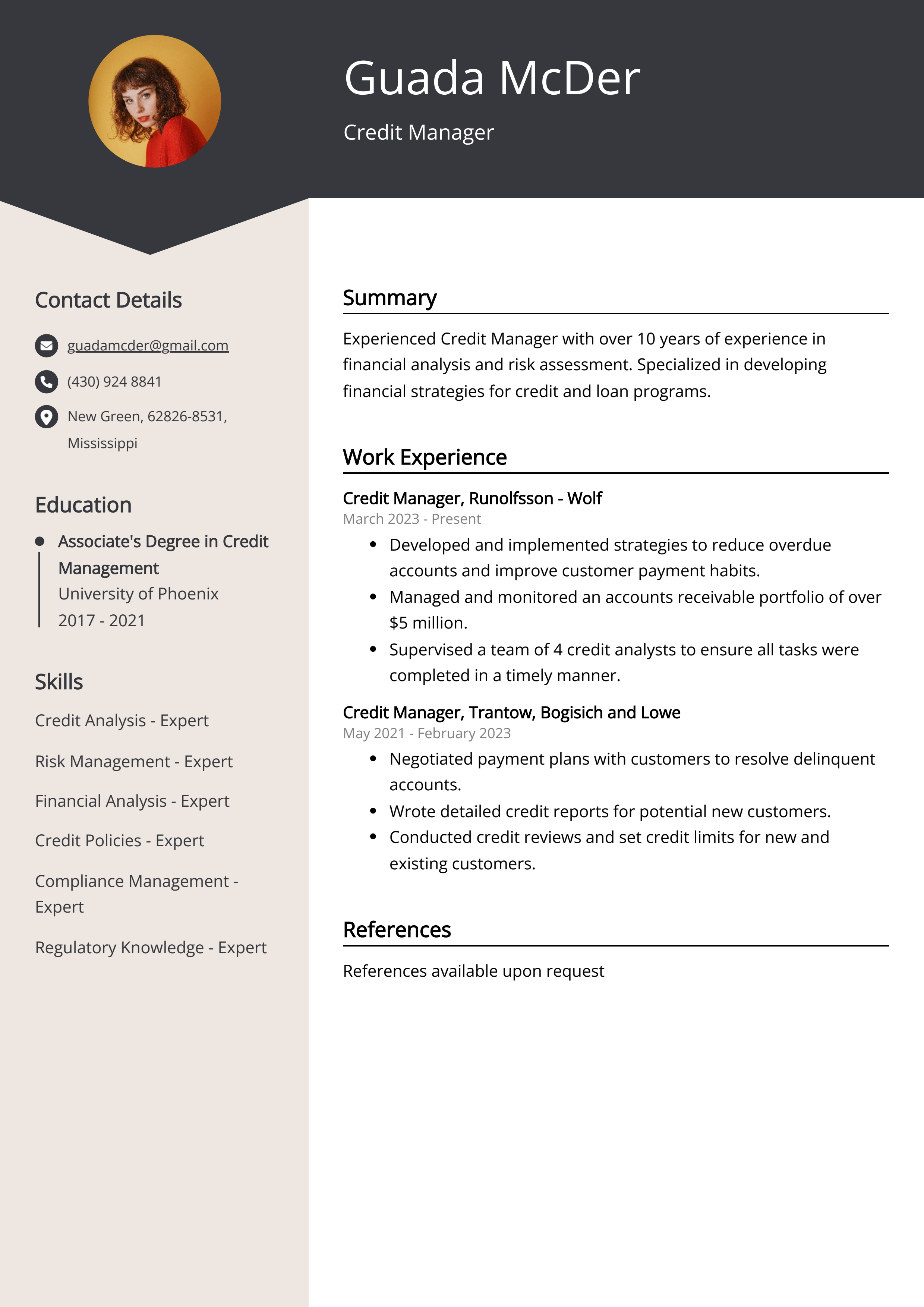

Senior Credit Manager Resume Sample

We spoke to hiring managers who recruit Credit Managers at companies like Wells Fargo, American Express, and Bank of America. They shared with us the most important things they look for in resumes of top candidates. Here are some of their best tips for your Credit Manager resume:

Show your ability to assess credit risk

Hiring managers want to see that you can accurately assess credit risk. Provide specific examples like:

- Analyzed financial statements and credit reports to determine creditworthiness of 50+ new clients per month

- Developed risk assessment model that reduced default rates by 20%

- Identified early warning signs and implemented risk mitigation strategies for high-risk accounts, saving the company $500K in potential losses

Highlight your experience managing credit portfolios

Employers look for Credit Managers who have successfully managed credit portfolios. Weak resumes say:

- Managed credit portfolio for company

- Responsible for extending credit to customers

Instead, quantify your accomplishments:

- Managed $50M credit portfolio across 500+ accounts

- Grew portfolio by 25% while maintaining credit quality and reducing delinquency rates by 15%

- Implemented new credit policies that increased approval rates by 10% without additional risk

Demonstrate your negotiation and problem-solving skills

Credit Managers often have to negotiate with clients and solve complex problems. Show examples of how you've done this, such as:

- Negotiated payment plans with delinquent accounts, recovering 80% of outstanding balances

- Worked with sales team to structure deals that met client needs while mitigating credit risk

- Investigated and resolved billing disputes, resulting in 95% customer satisfaction ratings

Include your experience with credit systems and software

Familiarity with credit systems and software is important. Rather than just listing the software, describe how you've used it:

Used Oracle Credit Management to automate credit application process, reducing approval times by 50% while ensuring compliance with credit policies

Implemented SAP Credit Management module, integrating it with existing ERP system and training team of 10 on its use

Showcase your industry knowledge and certifications

Demonstrating your knowledge of credit industry standards and regulations helps you stand out. You can mention:

- Certified Credit Executive (CCE) certification from the National Association of Credit Management

- Experience ensuring compliance with FCRA, ECOA, and UDAAP regulations

- Knowledge of GAAP and IFRS accounting standards

Also, if you have experience in specific industries like healthcare, construction, or manufacturing, be sure to highlight that expertise.

Emphasize your leadership and team management skills

Many Credit Manager roles involve leading and managing teams. Provide examples of your leadership abilities:

- Led team of 5 credit analysts, improving productivity by 30% through coaching and process improvements

- Collaborated with cross-functional teams in sales, finance, and operations to develop and implement new credit strategies

- Mentored and trained junior credit staff, resulting in 2 promotions to Senior Credit Analyst positions

By highlighting these skills, you show that you can not only manage credit effectively but also lead and develop a high-performing team.

Writing Your Credit Manager Resume: Section By Section

summary.

A resume summary is an optional section that appears at the top of your resume, just below your contact information. It's a brief overview of your professional experience, skills, and achievements that highlights your qualifications for the job you're applying for. While a summary is not required, it can be a valuable addition to your resume if you have extensive experience in your field or are making a career change.

In contrast, an objective statement focuses on your career goals rather than your qualifications. Objective statements are generally not recommended as they don't provide value to the employer. Instead, use the summary to showcase how you can contribute to the company's success.

When writing a summary for a Credit Manager position, focus on your relevant experience, key skills, and notable achievements in the field of credit management. Tailor your summary to the specific requirements of the job posting to demonstrate your fit for the role.

To learn how to write an effective resume summary for your Credit Manager resume, or figure out if you need one, please read Credit Manager Resume Summary Examples , or Credit Manager Resume Objective Examples .

1. Highlight your credit management expertise

When crafting your summary, emphasize your expertise in credit management. Consider the following examples:

- Experienced professional with a diverse background in finance, sales, and customer service.

- Detail-oriented individual with strong analytical skills and a passion for problem-solving.

While these examples showcase valuable skills, they don't specifically target the Credit Manager role. Instead, focus on your directly relevant experience and skills:

- Credit Management professional with 8+ years of experience in risk assessment, credit analysis, and portfolio management.

- Skilled in developing and implementing credit policies, managing accounts receivable, and negotiating payment terms to minimize financial risk and improve cash flow.

By highlighting your specific credit management expertise, you demonstrate your qualifications and value to potential employers.

2. Showcase your achievements with metrics

To make your summary more impactful, include quantifiable achievements that demonstrate your success in credit management. Compare the following examples:

Experienced Credit Manager with a track record of successfully managing credit risk and improving collections.

Credit Manager with 5+ years of experience, reducing DSO by 20% and increasing collections efficiency by 15% through the implementation of streamlined processes and advanced analytics.

The second example is more effective because it uses specific metrics to illustrate the impact of the candidate's work. When showcasing your achievements, use numbers, percentages, and dollar amounts to quantify your results and provide context for your accomplishments.

Experience

Your work experience section is the heart of your resume as a credit manager. It's where you highlight your professional achievements and show hiring managers how you've excelled in your previous roles. To make this section truly stand out, focus on showcasing your impact and value through specific examples and metrics.

In this guide, we'll walk you through the key steps to crafting a compelling work experience section that will catch the eye of hiring managers and demonstrate your expertise in credit management.

1. Highlight relevant credit management accomplishments

When describing your work experience, don't just list your day-to-day responsibilities. Instead, focus on your most impressive accomplishments that are relevant to credit management. Consider achievements like:

- Implemented a new credit risk assessment model that reduced bad debt by 20%

- Negotiated payment plans with delinquent accounts, recovering $500K in outstanding receivables

- Streamlined credit application process, shortening approval times by 30%

Quantify your accomplishments with metrics whenever possible. This helps hiring managers understand the tangible impact you made in your previous roles.

2. Use strong credit management action verbs

When writing your work experience bullet points, use strong action verbs that are relevant to credit management. Weak, generic verbs can make your experience sound bland and uninspiring. Compare the following:

- Responsible for analyzing credit reports and financial statements

- Worked on collecting past-due accounts

Now see how much stronger these bullet points sound with credit-specific action verbs:

- Analyzed credit reports and financial statements to assess creditworthiness of new applicants

- Spearheaded collection efforts on past-due accounts, resulting in a 95% recovery rate

Other great action verbs for credit managers include: forecasted, audited, investigated, reconciled, resolved, and more.

3. Showcase your career growth and promotions

Hiring managers love to see candidates who have progressively advanced in their careers. If you've been promoted or taken on increasing responsibilities in your previous credit management roles, make sure to highlight this in your work experience section.

Credit Analyst, XYZ Corporation, 2018-2021 Senior Credit Analyst, XYZ Corporation, 2021-Present - Promoted to Senior Credit Analyst due to strong performance and leadership skills - Mentored and trained a team of 5 junior credit analysts - Developed and implemented a new credit scoring system that increased approval rates by 15% while maintaining low default rates

By showcasing your career progression, you demonstrate your ability to thrive and grow within an organization - a key quality hiring managers look for.

4. Highlight key credit management tools and technologies

Credit managers today rely on a variety of software tools and technologies to do their jobs effectively. Showcasing your proficiency with these tools in your work experience section can give you a competitive edge. Some examples:

- Utilized SAP Credit Management module to automate credit limit monitoring and risk assessments

- Leveraged SQL to extract and analyze large datasets from credit databases

- Proficient in Experian's PowerCurve decisioning software for credit application processing

By highlighting your technical skills, you show hiring managers that you're well-equipped to handle the demands of a modern credit management role.

Education

As a credit manager, your education sets the foundation for your career. It's important to highlight your relevant education and certifications in your resume. In this section, we'll guide you on how to effectively showcase your education to catch the attention of hiring managers.

1. List your highest degree first

Start with your most recent and highest degree earned. This is typically a bachelor's degree in finance, accounting, or a related field. If you have a master's degree or higher, list that first.

Here's an example:

Master of Business Administration (MBA) University of California, Los Angeles (UCLA) Graduated: May 2019

If your degree is not directly related to credit management, you can still list it. However, consider adding relevant coursework or projects to tie it back to the job.

2. Include relevant certifications

In addition to your degree, include any relevant certifications you have earned. These demonstrate your expertise and commitment to the field. Some common certifications for credit managers include:

- Certified Credit Executive (CCE)

- Certified Credit and Risk Analyst (CCRA)

- Certified Credit Professional (CCP)

List the certification name, issuing organization, and date earned. For example:

Certified Credit Executive (CCE) National Association of Credit Management Earned: November 2020

3. Keep it concise for senior roles

If you're a senior credit manager with extensive work experience, your education section should be brief. Employers will be more interested in your professional accomplishments and skills.

Here's an example of what not to do:

Bachelor of Science in Accounting University of Texas at Austin Graduated: May 1995 Relevant Coursework: Financial Accounting, Managerial Accounting, Auditing, Tax Accounting

Instead, keep it short and sweet:

B.S. in Accounting, University of Texas at Austin

Skills

The skills section is a crucial component of your credit manager resume. It's where you showcase your expertise and qualifications to potential employers. In this section, you'll want to highlight the specific skills that are most relevant to the credit manager role, and that will help you stand out from other candidates.

When crafting your skills section, keep in mind that hiring managers and applicant tracking systems (ATS) will be looking for specific keywords and phrases that match the job description. By including these key skills, you'll increase your chances of getting noticed and moving on to the next stage of the hiring process.

1. Highlight credit analysis and risk management expertise

As a credit manager, your primary responsibility is to assess the creditworthiness of potential customers and manage the risk associated with extending credit. Therefore, it's essential to showcase your skills in credit analysis and risk management.

Some key skills to include in this area might be:

- Credit analysis

- Risk assessment

- Financial statement analysis

- Credit policy development

- Portfolio management

Credit Analysis : Financial statement analysis, Risk assessment, Credit policy development, Portfolio management

2. Showcase proficiency in relevant software and tools

Credit managers rely on a variety of software and tools to perform their job duties effectively. Including your proficiency in these tools can help you stand out from other candidates and demonstrate your ability to hit the ground running in a new role.

Some common software and tools used by credit managers include:

- CRM software (e.g. Salesforce, HubSpot)

- Accounting software (e.g. QuickBooks, NetSuite)

- Credit analysis software (e.g. Moody's Analytics, S&P Capital IQ)

- Microsoft Office Suite (Excel, Word, PowerPoint)

Software Skills : Salesforce (Advanced), QuickBooks (Intermediate), Moody's Analytics (Advanced), Microsoft Excel (Expert)

3. Include relevant financial and accounting skills

While credit management is a specialized field, it still requires a strong foundation in financial and accounting principles. Including these skills on your resume can demonstrate your ability to understand and analyze financial statements, which is crucial for making informed credit decisions.

Some important financial and accounting skills for credit managers include:

- GAAP accounting principles

- Budgeting and forecasting

- Cost accounting

- Accounts receivable management

Accounting Skills : Financial statement analysis, GAAP accounting, Budgeting and forecasting, Accounts receivable management

4. Tailor your skills to the job description

When applying for a credit manager position, it's important to tailor your skills section to the specific requirements and preferences outlined in the job description. Many companies use applicant tracking systems (ATS) to screen resumes for relevant keywords, so including these terms can help your resume make it past the initial screening process.

For example, if a job description emphasizes experience with a specific CRM software or credit analysis tool, be sure to include that skill on your resume. Similarly, if the job requires experience with a particular industry or type of credit (e.g. commercial lending, consumer credit), highlight any relevant experience you have in that area.

Skills : Credit analysis, Risk management, Financial statement analysis, Microsoft Excel, Communication, Teamwork

While this skills section includes some relevant terms, it also includes generic soft skills like "Communication" and "Teamwork" that don't specifically relate to the credit manager role. Instead, focus on highlighting the technical skills and expertise that are most important for the job:

Skills : Credit analysis, Risk assessment, Financial statement analysis, Moody's Analytics (Advanced), Salesforce (Intermediate), GAAP accounting principles

Skills For Credit Manager Resumes

Here are examples of popular skills from Credit Manager job descriptions that you can include on your resume.

- Commercial Lending

- Underwriting

- Risk Management

- Credit Risk

- Portfolio Management

- Cash Flow Analysis

- Financial Modeling

- Financial Risk

Skills Word Cloud For Credit Manager Resumes

This word cloud highlights the important keywords that appear on Credit Manager job descriptions and resumes. The bigger the word, the more frequently it appears on job postings, and the more likely you should include it in your resume.

How to use these skills?

Similar resume templates, credit analyst.

Underwriter

- Bookkeeper Resume Guide

- Risk Management Resume Guide

- Loan Processor Resume Guide

- Equity Research Resume Guide

- Financial Analyst Resume Guide

Resume Guide: Detailed Insights From Recruiters

- Credit Analyst Resume Guide & Examples for 2022

Improve your Credit Manager resume, instantly.

Use our free resume checker to get expert feedback on your resume. You will:

• Get a resume score compared to other Credit Manager resumes in your industry.

• Fix all your resume's mistakes.

• Find the Credit Manager skills your resume is missing.

• Get rid of hidden red flags the hiring managers and resume screeners look for.

It's instant, free and trusted by 1+ million job seekers globally. Get a better resume, guaranteed .

Credit Manager Resumes

- Template #1: Credit Manager

- Template #2: Credit Manager

- Template #3: Credit Manager

- Template #4: Senior Credit Manager

- Skills for Credit Manager Resumes

- Free Credit Manager Resume Review

- Other Finance Resumes

- Credit Manager Interview Guide

- Credit Manager Sample Cover Letters

- Alternative Careers to a Credit Analyst

- All Resumes

- Resume Action Verbs

Download this PDF template.

Creating an account is free and takes five seconds. you'll get access to the pdf version of this resume template., choose an option..

- Have an account? Sign in

E-mail Please enter a valid email address This email address hasn't been signed up yet, or it has already been signed up with Facebook or Google login.

Password Show Your password needs to be between 6 and 50 characters long, and must contain at least 1 letter and 1 number. It looks like your password is incorrect.

Remember me

Forgot your password?

Sign up to get access to Resume Worded's Career Coaching platform in less than 2 minutes

Name Please enter your name correctly

E-mail Remember to use a real email address that you have access to. You will need to confirm your email address before you get access to our features, so please enter it correctly. Please enter a valid email address, or another email address to sign up. We unfortunately can't accept that email domain right now. This email address has already been taken, or you've already signed up via Google or Facebook login. We currently are experiencing a very high server load so Email signup is currently disabled for the next 24 hours. Please sign up with Google or Facebook to continue! We apologize for the inconvenience!

Password Show Your password needs to be between 6 and 50 characters long, and must contain at least 1 letter and 1 number.

Receive resume templates, real resume samples, and updates monthly via email

By continuing, you agree to our Terms and Conditions and Privacy Policy .

Lost your password? Please enter the email address you used when you signed up. We'll send you a link to create a new password.

E-mail This email address either hasn't been signed up yet, or you signed up with Facebook or Google. This email address doesn't look valid.

Back to log-in

These professional templates are optimized to beat resume screeners (i.e. the Applicant Tracking System). You can download the templates in Word, Google Docs, or PDF. For free (limited time).

access samples from top resumes, get inspired by real bullet points that helped candidates get into top companies., get a resume score., find out how effective your resume really is. you'll get access to our confidential resume review tool which will tell you how recruiters see your resume..

Writing an effective resume has never been easier .

Upgrade to resume worded pro to unlock your full resume review., get this resume template (+ 3 others), plus proven bullet points., for a small one-time fee, you'll get everything you need to write a winning resume in your industry., here's what you'll get:.

- 📄 Get the editable resume template in Google Docs + Word . Plus, you'll also get all 3 other templates .

- ✍️ Get sample bullet points that worked for others in your industry . Copy proven lines and tailor them to your resume.

- 🎯 Optimized to pass all resume screeners (i.e. ATS) . All templates have been professionally designed by recruiters and 100% readable by ATS.

Buy now. Instant delivery via email.

instant access. one-time only., what's your email address.

I had a clear uptick in responses after using your template. I got many compliments on it from senior hiring staff, and my resume scored way higher when I ran it through ATS resume scanners because it was more readable. Thank you!

Thank you for the checklist! I realized I was making so many mistakes on my resume that I've now fixed. I'm much more confident in my resume now.

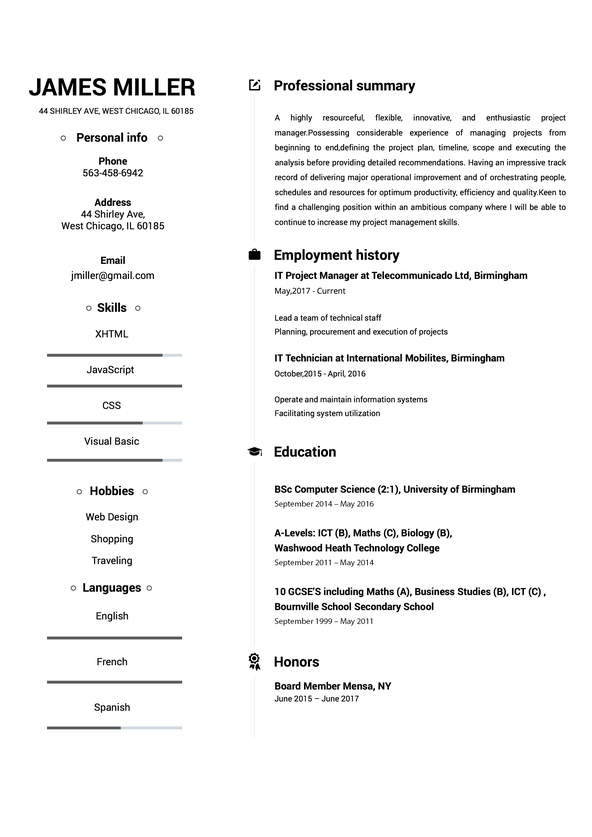

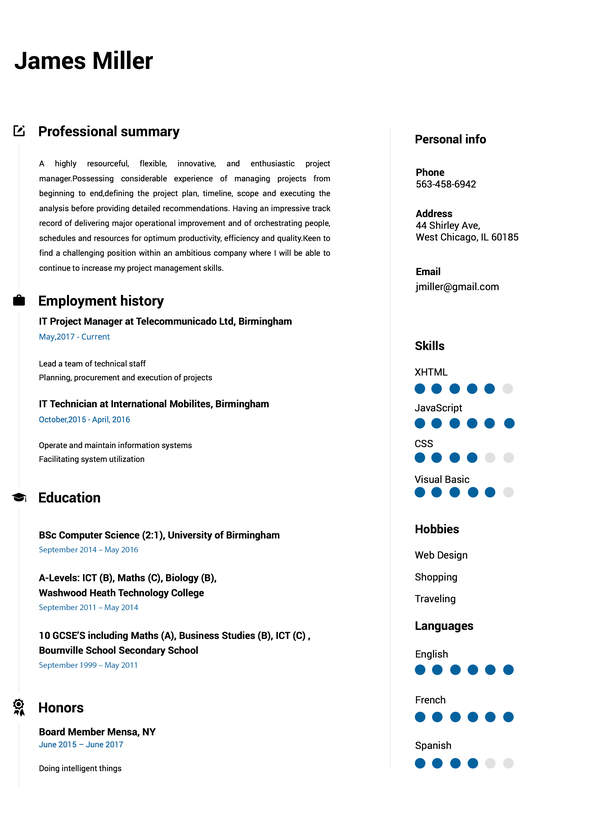

Credit Manager Resume Examples and Templates

This page provides you with Credit Manager resume samples to use to create your own resume with our easy-to-use resume builder . Below you'll find our how-to section that will guide you through each section of a Credit Manager resume.

What do Hiring Managers look for in a Credit Manager Resume

- Credit Analysis Skills : Strong credit analysis abilities to assess creditworthiness and make informed lending decisions.

- Risk Management : Proficiency in managing credit risk by setting credit limits, monitoring accounts, and implementing risk mitigation strategies.

- Financial Knowledge : A deep understanding of financial principles, accounting, and lending practices.

- Communication Skills : Effective communication, both written and verbal, to interact with clients, credit teams, and stakeholders.

- Leadership Abilities : The capability to lead and manage credit teams and set credit policies and procedures.

How to Write a Credit Manager Resume?

To write a professional Credit Manager resume, follow these steps:

- Select the right Credit Manager resume template.

- Write a professional summary at the top explaining your Credit Manager’s experience and achievements.

- Follow the STAR method while writing your Credit Manager resume’s work experience. Show what you were responsible for and what you achieved as a Credit Manager.

- List your top Credit Manager skills in a separate skills section.

How to Write Your Credit Manager Resume Header?

Write the perfect Credit Manager resume header by:

- Adding your full name at the top of the header.

- Add a photo to your resume if you are applying for jobs outside of the US. For applying to jobs within the US, avoid adding photo to your resume header.

- Add your current Credit Management to the header to show relevance.

- Add your current city, your phone number and a professional email address.

- Finally, add a link to your portfolio to the Credit Manager resume header. If there’s no portfolio link to add, consider adding a link to your LinkedIn profile instead.

- Bad Credit Manager Resume Example - Header Section

Arturo Miller 19 Adams Street Lorain, OH 44052 Marital Status: Married, email: [email protected]

- Good Credit Manager Resume Example - Header Section

Arturo Miller Miller, Lorain, OH, Phone number: +1-555-555-5555, Link: linkedin/in/johndoe

Make sure to add a professional looking email address while writing your resume header. Let’s assume your name is John Doe - here is a formula you can use to create email addresses:

- [email protected] - [email protected]

- [email protected] - [email protected]

- [email protected] - [email protected]

- [email protected] - [email protected]

- [email protected] - [email protected]

- [email protected] - [email protected]

For a Credit Manager email, we recommend you either go with a custom domain name ( [email protected] ) or select a very reputed email provider (Gmail or Outlook).

How to Write a Professional Credit Manager Resume Summary?

Use this template to write the best Credit Manager resume summary: Credit Manager with [number of years] experience of [top 2-3 skills]. Achieved [top achievement]. Expert at [X], [Y] and [Z].

How to Write a Credit Manager Resume Experience Section?

Here’s how you can write a job winning Credit Manager resume experience section:

- Write your Credit Manager work experience in a reverse chronological order.

- Use bullets instead of paragraphs to explain your Credit Manager work experience.

- While describing your work experience focus on highlighting what you did and the impact you made (you can use numbers to describe your success as a Credit Manager).

- Use action verbs in your bullet points.

Credit Manager Resume Example

Credit Manager

- Evaluate, recommend, and approve proposals in accordance with delegation of authority.

- Supervise the team's credit decisions.

- Foster the development and motivation of the credit team.

- Review delinquent cases and document insights and portfolio reviews for risk management.

- Propose policy or process changes based on local factors and competitor feedback.

- Establish and oversee vendors while maintaining a growth and attrition pipeline.

- Execute system integration plans.

- Assist the Risk Management Group in researching and analyzing industries, clients, and markets.

- Maintain an effective departmental structure to achieve goals and objectives.

- Motivate the credit and collections team effectively.

- Assess departmental performance using suitable metrics.

- Ensure continuous training for the credit staff.

- Evaluate high-ticket personal loan applications.

- Perform due diligence on qualitative parameters using internal policies.

- Determine appropriate credit limits and loan disbursement structures for each case.

- Manage workloads efficiently in line with industry turnaround times (TAT).

- Conduct industry analysis and strategic audits, recommending best practices for process improvement.

Financial Credit Manager & Analyst Resume Example

Financial Credit Manager & Analyst

- Analyzing client financial statements.

- Assessing potential customer creditworthiness.

- Ensuring regulatory compliance in loan procedures.

- Developing credit scoring models for risk assessment.

- Reviewing and revising the company's credit policy.

Credit Manager, Business Control Resume Example

Credit Manager, Business Control

- Leading the debt collection team across three regions.

- Streamlining the support tool and making changes to align with business needs.

- Supervising the credit control framework, encompassing risk profiles, treatment, and escalation processes.

- Collaborating closely with sales and sales support teams to ensure efficient funds collection.

Credit Manager-Mortgage Resume Example

Credit Manage-Mortgage

- Authorizing and underwriting loans, including dealing with CPAs and vendors.

- Scrutinizing and authenticating loan applications and accompanying documentation.

- Assessing loan risk and requesting additional information when required.

- Compiling reports on assessment outcomes.

- Making eligibility determinations for loans, either approving or rejecting applications.

- Reviewing and stipulating loan conditions as needed.

- Ensuring adherence to regulatory standards and company policies.

- Documenting and clearly communicating the reasons for loan approval or rejection.

- Initiating legal or other recovery actions against delinquent customers.

Top Credit Manager Resume Skills for 2023

- Credit Management

- Credit Analysis

- Credit Risk Assessment

- Credit Policies and Procedures

- Credit Scoring Models

- Financial Analysis

- Risk Mitigation

- Credit Decision Making

- Debt Collection

- Credit Underwriting

- Credit Reports and Scores

- Loan Portfolio Management

- Credit Limit Determination

- Credit Monitoring

- Compliance with Credit Regulations

- Credit Reporting Agencies

- Customer Credit Evaluations

- Creditworthiness Assessment

- Credit Documentation

- Credit Policies Review

- Credit Risk Identification

- Credit Risk Reporting

- Credit Monitoring Systems

- Debt Recovery Strategies

- Credit Risk Models

- Risk Reporting

- Credit Risk Metrics Tracking

- Vendor Credit Evaluation

- Legal Knowledge (pertaining to credit)

- Communication Skills

- Leadership Skills

- Problem Solving

- Time Management

- Attention to Detail

- Team Collaboration

- Negotiation Skills

- Credit Risk Management Tools

- Credit Risk Governance

- Customer Relationship Management

- Credit Risk Documentation

- Credit Risk Training

- Credit Risk Policy Development

- Credit Risk Policy Enforcement

- Debt Restructuring

- Credit Score Improvement Strategies

- Credit Dispute Resolution

- Credit Risk Audit

- Credit Portfolio Analysis

- Credit Loss Forecasting

- Credit Risk Strategy Development

How Long Should my Credit Manager Resume be?