- Find a Lawyer

- Ask a Lawyer

- Research the Law

- Law Schools

- Laws & Regs

- Newsletters

- Justia Connect

- Pro Membership

- Basic Membership

- Justia Lawyer Directory

- Platinum Placements

- Gold Placements

- Justia Elevate

- Justia Amplify

- PPC Management

- Google Business Profile

- Social Media

- Justia Onward Blog

- How to Draft an Effective Business Plan Considering the Legal Implications

The road to the creation of a new business is a long one that is often filled with unexpected challenges and accomplishments. While the unpredictable nature of starting a business can be appealing to some, for many there is value in developing a plan to help guide new owners through the first months and years of operation. For this reason, one of the most important steps that entrepreneurs can take when starting out is to carefully and thoughtfully develop a comprehensive business plan.

What Is a Business Plan?

A business plan is both a map and a marketing tool for your business. A business plan helps you carefully set forth the purpose, goals, and priorities of your new business, along with guideposts to help ensure that you stay on the right path. For instance, a business plan may require you to consider what the primary purpose of your business is, or the good or service you intend to provide, who your potential customers are, and how you intend to reach them in an effective and efficient manner. A business plan also allows you to make an honest evaluation of the current status of your business and what you will need to do to get to where you would like to be. This includes taking the time to compile your business balance sheet, analyze existing income and expenses, and determine anticipated financial needs.

Creating a detailed business plan can help business owners acquire outside funding .

In addition, a business plan serves as a marketing tool for new business owners who are attempting to gain financial backing, operational support, or mentoring for their new business. The financial aspects of a business plan lets potential funders or lenders analyze your current income streams and the likelihood of repayment, while the detailed explanation of your business objectives and operational plans helps to convince interested parties that you have taken the time to carefully plan your business endeavors and are invested in the success of your company.

How to Write a Business Plan

There is no one specific way to write a business plan. However, there are key components that most business plans should include, and these are good starting points when working on your own plan. It may also be worth reaching out to an experienced corporate attorney to help you review and revise your business plan before presenting it to others in the business community.

Business plans typically start with a summary of the business and its objectives, and then they describe the operations of the business, the good or service it will be providing, and potential income streams in more detail. Business plans should also include a detailed description of the proposed management structure of the business, including officers or directors and possibly the envisioned composition of the board. Additionally, business plans typically include extensive financial documentation, such as balance sheets, income projections or growth model projections, any pending loan applications, tax returns of the entity, and copies of any relevant legal agreements. If the business has already been in operation for some time, the business plan may also include financial records for the months of operation.

- Summarize the business and its objectives

- Outline how the business is organized and managed

- Describe what the business sells

- Identify potential income streams

- Include financial information, such as balance sheets and projections

Using Your Business Plan

Once you have completed a business plan that you are happy with, you will find that you will often continue to refer to your plan even months or years after it was initially completed. In the initial stages, you can use your business plan to attract investors, partners, board members, or other advisors who are interested in the model you have proposed and would like to contribute to its success. As your business develops, you can continue to refer to the plan to guide you in business decisions, as well as to track timelines or certain goals that you hoped to meet. Even after your business is well-developed, returning to your business plan can help guide your yearly planning for your company, allowing you to modify your goals as they are achieved.

Last reviewed October 2024

Small Business Legal Center Contents

- Small Business Legal Center

- Starting a Business & Choosing a Legal Ownership Structure

- Hiring and Managing Employees & Relevant Legal Considerations

- Financing a Business & Relevant Legal Considerations

- Tax Law Compliance for Business Owners

- Contract Law & Business Transactions

- Business Law Compliance

- Business Assets and Equipment — Legal & Practical Considerations

- Collections and Credit Laws for Businesses

- E-Commerce Laws in Business Operations

- Emergency Planning for Businesses — Legal & Practical Considerations

- Selling or Closing a Business & Potential Legal Issues

- Growing Your Small Business — Legal & Financial Concerns

- Business Disputes & Related Lawsuits

- Social Media Influencer Marketing & Related Legal Issues

- Making a Business Contract

- Commercial Real Estate & the Law

- Small Business Law FAQs

- Find a Business Law Lawyer

Related Areas

- Employment Law Center

- Intellectual Property Law Center

- Banking and Finance Law Center

- Tax Law Center

- Immigration Law Center

- Insurance Law Center

- Workers’ Compensation Law Center

- Bankruptcy Law Center

- Administrative Law Center

- Agricultural Law Center

- Cannabis Law Center

- Related Areas

- Bankruptcy Lawyers

- Business Lawyers

- Criminal Lawyers

- Employment Lawyers

- Estate Planning Lawyers

- Family Lawyers

- Personal Injury Lawyers

- Estate Planning

- Personal Injury

- Business Formation

- Business Operations

- Intellectual Property

- International Trade

- Real Estate

- Financial Aid

- Course Outlines

- Law Journals

- US Constitution

- Regulations

- Supreme Court

- Circuit Courts

- District Courts

- Dockets & Filings

- State Constitutions

- State Codes

- State Case Law

- Legal Blogs

- Business Forms

- Product Recalls

- Justia Connect Membership

- Justia Premium Placements

- Justia Elevate (SEO, Websites)

- Justia Amplify (PPC, GBP)

- Testimonials

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

16 Important Legal Requirements for Starting a Small Business

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Starting a new business is a challenging pursuit. Part of what makes it so complicated is all the legal implications that come with starting a business. As a business owner, you want to make sure you have covered all your legal bases to avoid any fines, lawsuits, or—worst case—even jail time.

Fortunately, there are plenty of legal resources available to small businesses both online and through hired legal counsel. Use this list as a jumping off point, covering the legal requirements for starting a small business. Checking these off your to-do list will help you ensure that you don't run afoul of any laws. The sooner you take care of these things, the sooner you can focus on what you do best—selling your product or service.

16 legal requirements for starting a small business

1. designate the proper business entity..

First things first. Choose the proper business entity or structure for your startup. This is crucial because it affects your personal liability, what you pay in taxes, and your fundraising ability. Possible structures include sole proprietorship, general and limited partnership, C-corporation, S-corporation, and limited liability company. Once you decide which structure is best for your company, you need to officially designate it through your secretary of state.

Most small businesses start out as sole proprietorships or partnerships because these require minimal paperwork and set up time. However, these types of businesses also don't offer sufficient liability protection for business owners. A corporation or LLC is generally a better choice as your business grows, particularly if you're planning to secure a business loan or raise venture capital.

» MORE: LLC vs. corporation

2. Check which licenses, permits, and registrations your business needs.

Depending on your type of business and where it’s located, you might need specific business licenses and permits from your country, state, county, or city. Licenses, permits, and registrations come in many variations. Examples include local business licenses, building permits, health safety-related permits, permits for home-based businesses, fire permits, industry-related permits (like running a legal practice, hospitality, construction, or manufacturing business), liquor licenses, and more.

The possibilities are many, so make sure to do thorough research—perhaps with the help of your counsel—on what you need to be compliant with the law in your area. Your city or county's business licensing agency is also a good place to start.

3. Make sure you are paying proper business taxes.

Every business owner is legally required to pay taxes. This includes income tax, self-employment taxes, and for some businesses, sales tax. It's wise to hire an accountant or tax advisor to make sure you are compliant with all tax laws. Accounting software for startups can also help you figure when to file taxes and what forms you need to fill out.

Most small business owners can't wait until March or April to pay taxes. The IRS has a pay-as-you-go tax schedule for businesses, requiring business owners to pay estimated taxes on a quarterly basis. Make sure you check the IRS requirements for your business type to avoid any fines and back taxes.

4. Do proper bookkeeping.

In most places, you are obligated by law to record all business transactions according to a specific accounting method. See what’s required of you for your industry and location in terms of record-keeping obligations, and set up a proper filing and bookkeeping system for all documents and transactions. This will greatly help you down the line in doing taxes or if you ever run into other legal troubles.

5. Get a founders agreement in writing.

If your business operates with multiple business owners, it’s important to make sure that each person knows and understands their rights and responsibilities in relation to the business. How this comes about depends on your business structure. If you form a corporation, you need a proper shareholder agreement and articles of incorporation. If you form an LLC, you will need articles of organization and an LLC operating agreement. You also need designated legal counsel to make sure the agreements and articles are sound.

6. Set a vesting schedule for all founders and early employees.

This is a practical measure many startups often overlook when they’re just starting out and excited about getting off the ground. But this will protect your business down the line and ensure a certain level of commitment each founder or early employee brings to the table.

Creating a vesting schedule upon incorporation states that stock ownership will vest over time, preventing investors from selling all their stock whenever they please. Note that most investors require this measure before they'll make any initial investments.

7. Get your employer identification number (EIN).

In order to open a corporate bank account and to properly file your business tax returns, many businesses need an employer identification number (EIN). You can easily request one for free from the IRS over the phone or by using an online application on the IRS website. Only sole proprietorships and single-member LLCs with no employees are exempt from this requirement.

You need the social security number of the person completing the form for the company (usually the president or CEO). Include information on your business entity and date of incorporation. Make sure to keep a signed copy of this application in your files.

8. Protect your intellectual property (IP).

Intellectual property is the bread and butter of many businesses. IP includes patents, copyrights, trademarks, and trade secrets as well. Be sure to file any patents as soon as possible—a process that can take more than five years. Protecting your intellectual property will be attractive to investors—but it will also help you sleep easier at night. Having exclusive rights to reproduce and display your work will make your life much, much easier down the line and ensure that no one tries to rip any IP rugs out from under you.

IP can be vastly complicated from a legal standpoint, so it might be wise to consult an experienced IP attorney who can help you through the process and provide you the greatest protection.

9. Classify your workers properly.

Many startups often misclassify their early employees. It’s important to know what kind of worker you’re hiring—essentially, the difference between an independent contractor vs. employee. This is important for tax reasons for both you and the employee and will help clarify what is and isn’t expected from you and the employee. If you misclassify an employee as an independent contractor, you could be on the hook for costly penalties and back wages.

10. Purchase workers' compensation insurance.

In all states but Texas, most businesses with employees are legally required to purchase workers' compensation insurance . Coverage should begin from the very first day your employee starts working. This insurance covers medical and legal costs associated with work-related employee injuries and illnesses. State laws about workers' compensation vary, so make sure you check your state's rules.

11. Make sure you’re in compliance with securities laws.

Founders and investors of LLCs, C-corporations, and partnerships are subject to federal and state securities laws. These laws were made to require companies to provide reliable and accurate information about their businesses to enable a fair market. They also protect from insider trading and trading fraud.

Failure to comply with these laws can result in the startup having to repurchase all of its shares at the issuance price, even if the company has lost all of its money.

12. Follow email regulations.

Email marketing is a huge part of many businesses. When you send emails to your customers or when you are targeting potential customers via email campaigns, you need to find out what the applicable email regulations are. Note that each country has its own set of rules.

Aspects covered by these rules generally include opt-in versus opt-out, B2B or B2C emails, unsubscribe rules, and minimum information to be included in your emails.

13. Make sure your investors are accredited.

The current definition of an accredited investor under the Securities and Exchange Commission rules includes eight categories of investors, but the most general investor accreditation means that the person:

Has at least $1 million in the bank

Has at least $200,000 in annual income

Understands and is willing to take the investment risk

The SEC has guidelines for what constitutes “reasonable efforts” on these accounts. It’s possible to raise funds outside the narrow limitation of accredited investors, but it will open up a Pandora’s box in terms of securities and compliance enforcement. So, if you want to be the most legally sound you can possibly be, go through accredited investors.

14. Establish a privacy policy.

A privacy policy is a legal statement that specifies what a business does with the personal data collected from users or customers, along with how the data is processed and why. Violation of privacy laws can lead to criminal liability—depending on your state, this can mean hefty fines—so it’s important that startups have proper privacy policies in place and carefully adhere to them. The Small Business Administration has a great guide for establishing an appropriate privacy policy for your business.

15. Create a company handbook.

Once you have all the legal headaches sorted out and sounded, make sure everyone in the company is aware and understands your company’s legal liabilities just as well as you do—as a business owner, you could be liable for anything your employees do while representing your organization.

Company or employee handbooks are a great way to instill the values and legal boundaries of your company. It can also help to establish what is and isn’t appropriate behavior internally and externally. Have your legal counsel look this over well or even help you write it, and then get the company together to go over the material.

16. Hire competent legal counsel.

In case this hasn’t been clear throughout, work with lawyers on these complicated legal issues from the start. Startups are often so concerned about expenses that they overlook the importance of sound legal advice that could save them thousands, if not millions, down the line. You really can’t put a price on having the right attorneys on your side.

Ideally, you’ll hire an experienced business attorney on employment law, contract law, securities law, and intellectual property law. You could hire a “general counsel” on your staff at some point, but it’s common for the work to be spread out between different firms and attorneys. The cost is worth avoiding any legal trouble.

The bottom line

Starting a business is hard—don’t let anyone tell you otherwise. But if you are meticulous about getting your startup legal checklist in order, you’ll save yourself from some serious headaches down the line. Some of these items are things you can take care of yourself. But for more complicated tasks, or if you run into questions, it's important to hire a competent attorney to help you.

This article originally appeared on JustBusiness, a subsidiary of NerdWallet.

On a similar note...

New elevated offer

American Express® Business Gold Card

Rates and Fees

on American Express' website

Our Recommendations

- Best Small Business Loans for 2024

- Businessloans.com Review

- Biz2Credit Review

- SBG Funding Review

- Rapid Finance Review

- 26 Great Business Ideas for Entrepreneurs

- Startup Costs: How Much Cash Will You Need?

- How to Get a Bank Loan for Your Small Business

- Articles of Incorporation: What New Business Owners Should Know

How to Choose the Best Legal Structure for Your Business

Small business resources.

- Business Ideas

- Business Plans

- Startup Basics

- Startup Funding

- Franchising

- Success Stories

- Entrepreneurs

- The Best Credit Card Processors of 2024

- Clover Credit Card Processing Review

- Merchant One Review

- Stax Review

- How to Conduct a Market Analysis for Your Business

- Local Marketing Strategies for Success

- Tips for Hiring a Marketing Company

- Benefits of CRM Systems

- 10 Employee Recruitment Strategies for Success

- Sales & Marketing

- Social Media

- Best Business Phone Systems of 2024

- The Best PEOs of 2024

- RingCentral Review

- Nextiva Review

- Ooma Review

- Guide to Developing a Training Program for New Employees

- How Does 401(k) Matching Work for Employers?

- Why You Need to Create a Fantastic Workplace Culture

- 16 Cool Job Perks That Keep Employees Happy

- 7 Project Management Styles

- Women in Business

- Personal Growth

- Best Accounting Software and Invoice Generators of 2024

- Best Payroll Services for 2024

- Best POS Systems for 2024

- Best CRM Software of 2024

- Best Call Centers and Answering Services for Busineses for 2024

- Salesforce vs. HubSpot: Which CRM Is Right for Your Business?

- Rippling vs Gusto: An In-Depth Comparison

- RingCentral vs. Ooma Comparison

- Choosing a Business Phone System: A Buyer’s Guide

- Equipment Leasing: A Guide for Business Owners

- HR Solutions

- Financial Solutions

- Marketing Solutions

- Security Solutions

- Retail Solutions

- SMB Solutions

Business News Daily provides resources, advice and product reviews to drive business growth. Our mission is to equip business owners with the knowledge and confidence to make informed decisions. As part of that, we recommend products and services for their success.

We collaborate with business-to-business vendors, connecting them with potential buyers. In some cases, we earn commissions when sales are made through our referrals. These financial relationships support our content but do not dictate our recommendations. Our editorial team independently evaluates products based on thousands of hours of research. We are committed to providing trustworthy advice for businesses. Learn more about our full process and see who our partners are here .

Choosing the right legal structure is a necessary part of running a business. Whether you're just starting out or your business is growing, it's crucial to understand the options.

Table of Contents

Your business’s legal structure has many ramifications. It can determine how much liability your company faces during lawsuits. It can put up a barrier between your personal and business taxes – or ensure this barrier doesn’t exist. It can also determine how often your board of directors must file paperwork – or if you even need a board. [Related article: What to Do if Your Business Gets Sued ]

We’ll explore business legal structures and how to choose the right structure for your organization.

What is a business legal structure?

A business legal structure, also known as a business entity, is a government classification that regulates certain aspects of your business. On a federal level, your business legal structure determines your tax burden. On a state level, it can have liability ramifications.

Why is a business legal structure important?

Choosing the right business structure from the start is among the most crucial decisions you can make. Here are some factors to consider:

- Taxes: Sole proprietors, partnership owners and S corporation owners categorize their business income as personal income. C corporation income is business income separate from an owner’s personal income. Given the different tax rates for business and personal incomes, your structure choice can significantly impact your tax burden.

- Liability: Limited liability company (LLC) structures can protect your personal assets in the event of a lawsuit. That said, the federal government does not recognize LLC structures; they exist only on a state level. C corporations are a federal business structure that includes the liability protection of LLCs.

- Paperwork: Each business legal structure has unique tax forms. Additionally, if you structure your company as a corporation, you’ll need to submit articles of incorporation and regularly file certain government reports. If you start a business partnership and do business under a fictitious name, you’ll need to file special paperwork for that as well.

- Hierarchy: Corporations must have a board of directors. In certain states, this board must meet a certain number of times per year. Corporate hierarchies also prevent business closure if an owner transfers shares or exits the company, or when a founder dies . Other structures lack this closure protection.

- Registration: A business legal structure is also a prerequisite for registering your business in your state. You can’t apply for an employer identification number (EIN) or all your necessary licenses and permits without a business structure.

- Fundraising: Your structure can also block you from raising funds in certain ways. For example, sole proprietorships generally can’t offer stocks. That right is primarily reserved for corporations.

- Potential consequences for choosing the wrong structure: Your initial choice of business structure is crucial, although you can change your business structure in the future. However, changing your business structure can be a disorganized, confusing process that can lead to tax consequences and the unintended dissolution of your business.

Types of business structures

The most common business entity types are sole proprietorships, partnerships, limited liability companies, corporations and cooperatives. Here’s more about each type of legal structure.

Sole proprietorship

A sole proprietorship is the simplest business entity. When you set up a sole proprietorship , one person is responsible for all a company’s profits and debts.

“If you want to be your own boss and run a business from home without a physical storefront, a sole proprietorship allows you to be in complete control,” said Deborah Sweeney, vice president and general manager of business acquisitions at Deluxe Corp. “This entity does not offer the separation or protection of personal and professional assets, which could prove to become an issue later on as your business grows and more aspects hold you liable.”

Proprietorship costs vary by market. Generally, early expenses will include state and federal fees, taxes, business equipment leases , office space, banking fees, and any professional services your business contracts. Some examples of these businesses are freelance writers, tutors, bookkeepers , cleaning service providers and babysitters.

A sole proprietorship business structure has several advantages.

- Easy setup: A sole proprietorship is the simplest legal structure to set up. If you – and only you – own your business, this might be the best structure. There is very little paperwork since you have no partners or executive boards.

- Low cost: Costs vary by state, but generally, license fees and business taxes are the only fees associated with a proprietorship.

- Tax deduction: Since you and your business are a single entity, you may be eligible for specific business sole proprietor tax deductions , such as a health insurance deduction.

- Easy exit: Forming a proprietorship is easy, and so is ending one. As a single owner, you can dissolve your business at any time with no formal paperwork required. For example, if you start a daycare center and wish to fold the business, refrain from operating the day care and advertising your services.

The sole proprietorship is also one of the most common small business legal structures. Many famous companies started as sole proprietorships and eventually grew into multimillion-dollar businesses. These are a few examples:

- Marriott Hotels

Partnership

A partnership is owned by two or more individuals. There are two types: a general partnership, where all is shared equally, and a limited partnership, where only one partner has control of operations and the other person (or persons) contributes to and receives part of the profits. Partnerships can operate as sole proprietorships, where there’s no separation between the partners and the business, or limited liability partnerships (LLPs), depending on the entity’s funding and liability structure.

“This entity is ideal for anyone who wants to go into business with a family member, friend or business partner – like running a restaurant or agency together,” Sweeney said. “A partnership allows the partners to share profits and losses and make decisions together within the business structure. Remember that you will be held liable for the decisions made as well as those actions made by your business partner.”

General partnership costs vary, but this structure is more expensive than a sole proprietorship because an attorney should review your partnership agreement. The attorney’s experience and location can affect the cost.

A business partnership agreement must be a win-win for both sides to succeed. Google is an excellent example of this. In 1995, co-founders Larry Page and Sergey Brin created a small search engine and turned it into the leading global search engine. The co-founders met at Stanford University while pursuing their doctorates and later left to develop a beta version of their search engine. Soon after, they raised $1 million in funding from investors, and Google began receiving thousands of visitors a day. Having a combined ownership of 11.4% of Google provides them with a total net worth of nearly $226.4 billion.

Business partnerships have many advantages.

- Easy formation: As with a sole proprietorship, there is little paperwork to file for a business partnership. If your state requires you to operate under a fictitious name ( “doing business as,” or DBA ), you’ll need to file a Certificate of Conducting Business as Partners and draft an Articles of Partnership agreement, both of which have additional fees. You’ll usually need a business license as well.

- Growth potential: You’re more likely to obtain a business loan with more than one owner. Bankers can consider two credit histories rather than one, which can be helpful if you have a less-than-stellar credit score.

- Special taxation: General partnerships must file federal tax Form 1065 and state returns, but they do not usually pay income tax. Both partners report their shared income or loss on their individual income tax returns. For example, if you opened a bakery with a friend and structured the business as a general partnership, you and your friend are co-owners. Each owner brings a certain level of experience and working capital to the business, affecting each partner’s business share and contribution. If you brought the most seed capital for the business, you and your partner may agree that you’ll retain a higher share percentage, making you the majority owner.

Partnerships are one of the most common business structures. These are some examples of successful partnerships:

- Warner Bros.

- Hewlett-Packard

- Ben & Jerry’s

Limited liability company

A limited liability company (LLC) is a hybrid structure that allows owners, partners or shareholders to limit their personal liabilities while enjoying a partnership’s tax and flexibility benefits. Under an LLC, members are shielded from personal liability for the business’s debts if it can’t be proven that they acted in a negligent or wrongful manner that results in injury to another in carrying out the activities of the business.

“Limited liability companies were created to provide business owners with the liability protection that corporations enjoy while allowing earnings and losses to pass through to the owners as income on their personal tax returns,” said Brian Cairns, CEO of ProStrategix Consulting. “LLCs can have one or more members, and profits and losses do not have to be divided equally among members.”

The cost of forming an LLC comprises the state filing fee and can vary depending on your state. For example, if you file an LLC in New York, you must pay a $200 filing fee, a $9 biennial fee, and file a biennial statement with the New York Department of State .

Although small businesses can be LLCs, some large businesses choose this legal structure. The structure is typical among accounting, tax, and law firms, but other types of companies also file as LLCs. One example of an LLC is Anheuser-Busch, one of the leaders in the U.S. beer industry. Headquartered in St. Louis, Anheuser-Busch is a wholly owned subsidiary of Anheuser-Busch InBev, a multinational brewing company based in Leuven, Belgium.

Here some other well-known examples of LLCs:

- Hertz Rent-a-Car

Corporation

The law regards a corporation as separate from its owners, with legal rights independent of its owners. It can sue, be sued, own and sell property, and sell the rights of ownership in the form of stocks. Corporation filing fees vary by state and fee category.

There are several types of corporations, including C corporations , S corporations, B corporations, closed corporations, and nonprofit corporations.

- C corporations: C corporations, owned by shareholders, are taxed as separate entities. JPMorgan Chase & Co. is a multinational investment bank and financial services holding company listed as a C corporation. Since C corporations allow an unlimited number of investors, many larger companies – including Apple, Bank of America and Amazon – file for this tax status.

- S corporations: S corporations were designed for small businesses. They avoid double taxation, much like partnerships and LLCs. Owners also have limited liability protection. Widgets Inc. is an example of an S corporation that operates very simply: Employee salaries are subject to FICA tax (as are all employee salaries), while the distribution of additional profits from the S corporation does not incur further FICA tax liability. [Learn more about FICA taxes for small businesses .]

- B corporations: B corporations, otherwise known as benefit corporations, are for-profit entities committed to corporate social responsibility and structured to positively impact society. For example, skincare and cosmetics company The Body Shop has proven its long-term commitment to supporting environmental and social movements, resulting in an awarded B corporation status. The Body Shop uses its presence to advocate for permanent change on issues like human trafficking, domestic violence, climate change, deforestation and animal testing in the cosmetic industry.

- Closed corporations: Closed corporations, typically run by a few shareholders, are not publicly traded and benefit from limited liability protection. Closed corporations, sometimes referred to as privately held companies, have more flexibility than publicly traded companies. For example, Hobby Lobby is a closed corporation – a privately held, family-owned business. Stocks associated with Hobby Lobby are not publicly traded; instead, the stocks have been allocated to family members.

- Open corporations: Open corporations are available for trade on a public market. Many well-known companies, including Microsoft and Ford Motor Co., are open corporations. Each corporation has taken ownership of the company and allows anyone to invest.

- Nonprofit corporations: Nonprofit corporations exist to help others in some way and are rewarded by tax exemption. Some examples of nonprofits are the Salvation Army, American Heart Association and American Red Cross. These organizations all focus on something other than turning a profit.

Corporations enjoy several advantages.

- Limited liability: Stockholders are not personally liable for claims against your corporation; they are liable only for their personal investments.

- Continuity: Corporations are not affected by death or the transferring of shares by their owners. Your business continues to operate indefinitely, which investors, creditors and consumers prefer.

- Capital: It’s much easier to raise large amounts of capital from multiple investors when your business is incorporated.

This structure is ideal for businesses that are further along in their growth, rather than a startup based in a living room. For example, if you’ve started a shoe company and have already named your business, appointed directors and raised capital through shareholders, the next step is to become incorporated. You’re essentially conducting business at a riskier, yet more lucrative, rate. Additionally, your business could file as an S corporation for the tax benefits. Once your business grows to a certain level, it’s likely in your best interest to incorporate it.

These are some popular examples of corporations:

- General Motors

- Exxon Mobil Corp.

- Domino’s Pizza

- JPMorgan Chase

Learn more about how to become a corporation .

Cooperative

A cooperative (co-op) is owned by the same people it serves. Its offerings benefit the company’s members, also called user-owners, who vote on the organization’s mission and direction and share profits.

Cooperatives offer a couple main advantages.

- Increased funding: Cooperatives may be eligible for federal grants to help them get started.

- Discounts and better service: Cooperatives can leverage their business size, thus obtaining discounts on products and services for their members.

Forming a cooperative is complex and requires you to choose a business name that indicates whether the co-op is a corporation (e.g., Inc. or Ltd.). The filing fee associated with a co-op agreement varies by state.

An example of a co-op is CHS Inc., a Fortune 100 business owned by U.S. agricultural cooperatives. As the nation’s leading agribusiness cooperative, CHS reported a net income of $547.5 million for fiscal year 2023. These are some other notable examples of co-ops:

- Land O’Lakes

- Navy Federal Credit Union

- Ace Hardware

Factors to consider before choosing a business structure

For new businesses that could fall into two or more of these categories, it’s not always easy to decide which structure to choose. Consider your startup’s financial needs, risk and ability to grow. It can be challenging to switch your legal structure after registering your business, so give it careful analysis in the early stages of forming your business.

Here are some crucial factors to consider as you choose your business’s legal structure. You should also consult a CPA for advice.

Flexibility

Where is your company headed, and which type of legal structure allows for the growth you envision? Turn to your business plan to review your goals and see which structure best aligns with those objectives. Your entity should support the possibility for growth and change, not hold it back from its potential. [Learn how to write a business plan with this template .]

When it comes to startup and operational complexity, nothing is more straightforward than a sole proprietorship. Register your name, start doing business, report the profits and pay taxes on it as personal income. However, it can be difficult to procure outside funding. Partnerships, on the other hand, require a signed agreement to define the roles and percentages of profits. Corporations and LLCs have various reporting requirements with state governments and the federal government.

A corporation carries the least amount of personal liability since the law holds that it is its own entity. This means creditors and customers can sue the corporation, but they can’t gain access to any personal assets of the officers or shareholders. An LLC offers the same protection but with the tax benefits of a sole proprietorship. Partnerships share the liability between the partners as defined by their partnership agreement.

An owner of an LLC pays taxes just as a sole proprietor does: All profit is considered personal income and taxed accordingly at the end of the year.

“As a small business owner, you want to avoid double taxation in the early stages,” said Jennifer Friedman, principal at Rivetr. “The LLC structure prevents that and makes sure you’re not taxed as a company, but as an individual.”

Individuals in a partnership also claim their share of the profits as personal income. Your accountant may suggest quarterly or biannual advance payments to minimize the effect on your return.

A corporation files its own tax returns each year, paying taxes on profits after expenses, including payroll. If you pay yourself from the corporation, you will pay personal taxes, such as those for Social Security and Medicare, on your personal return.

If you want sole or primary control of the business and its activities, a sole proprietorship or an LLC might be the best choice. You can negotiate such control in a partnership agreement as well.

A corporation is constructed to have a board of directors that makes the major decisions that guide the company. A single person can control a corporation, especially at its inception, but as it grows, so does the need to operate it as a board-directed entity. Even for a small corporation, the rules intended for larger organizations – such as keeping notes of every major decision that affects the company – still apply.

Capital investment

If you need to obtain outside funding from an investor, venture capitalist or bank, you may be better off establishing a corporation. Corporations have an easier time obtaining outside funding than sole proprietorships.

Corporations can sell shares of stock and secure additional funding for growth, while sole proprietors can obtain funds only through their personal accounts, using their personal credit or taking on partners. An LLC can face similar struggles, although, as its own entity, it’s not always necessary for the owner to use their personal credit or assets.

Licenses, permits and regulations

In addition to legally registering your business entity, you may need specific licenses and permits to operate. Depending on the type of business and its activities, it may need to be licensed at the local, state and federal levels.

“States have different requirements for different business structures,” Friedman said. “Depending on where you set up, there could be different requirements at the municipal level as well. As you choose your structure, understand the state and industry you’re in. It’s not ‘one size fits all,’ and businesses may not be aware of what’s applicable to them.”

The structures discussed here apply only to for-profit businesses. If you’ve done your research and you’re still unsure which business structure is right for you, Friedman advises speaking with a specialist in business law.

Think about your businesses needs

When it comes to choosing the right legal structure for your business, considering your business’s needs is of the utmost importance. By prioritizing your business’s unique situation, you can choose the right structure to ensure your business can grow to the heights you envision. As it does grow, you can restructure so the legal parameters match the phase your business is in.

Max Freedman and Matt D’Angelo contributed to this article. Source interviews were conducted for a previous version of this article.

- Best CRM Software for Nonprofits

Building Better Businesses

Insights on business strategy and culture, right to your inbox. Part of the business.com network.

Book a 30min Appointment or Call: 301 365 6305

Our Firm

Robert D. Roseman

Representative Matters

Testimonials

Business Acquisition

Business Consultant

Business Debt Restructure

Business Financing

Buying and Selling a Business

Contract Negotiation and Litigation

Deal Negotiation

Trademarks and Intellectual Property

Real Estate

Commercial Real Estate

Commercial Real Estate Financing

Landlord Leasing

Real Estate Acquisition and Disposition

Real Estate Brokers/Tenant Leasing

Small Business

General Counsel for Small Business

Small Business Entity Formation

Start Up Law

Non-Profit Board Representation

Top Tips for Creating a Business Plan: Legal Considerations and Best Practices

Creating a business plan requires more than just a good idea. It plays a crucial role in securing your business’s future. This article will guide you through the essential legal steps and strategic best practices to ensure your business plan is both comprehensive and legally sound. Topics include choosing your business structure, protecting intellectual property, and complying with data protection laws.

Key Takeaways

- A solid business plan is essential for guiding a new venture, attracting investors, and adapting to market changes and risks.

- Choosing the right business structure, such as a sole proprietorship, partnership, LLC, or corporation, impacts tax obligations, fundraising capabilities, and personal asset protection.

- Compliance with legal considerations, including registering your business name, protecting intellectual property, obtaining adequate insurance, and adhering to data protection laws, is crucial for business legitimacy and risk management.

Importance of a Solid Business Plan

Business pioneers recognize the importance of a solid, well-structured business plan in guiding ventures through the challenging startup world. It’s more than a mere document; it’s a strategic blueprint that articulates your vision, maps out the journey ahead, and invites others to join the quest. Establishing a solid business plan is the first step in protecting your business, as it lays the groundwork for all subsequent decisions and actions. It’s the anchor that fortifies your entrepreneurial ship against the unpredictability of the market, enabling you to navigate through opportunities and potential risks with the confidence of having a clear, strategic vision.

Think of the business plan as:

- A testament to your business’s potential

- A narrative that convinces investors and stakeholders to invest in your vision

- A mirror reflecting your business’s strengths, weaknesses, opportunities, and threats

- Crafted through meticulous industry, market, and competitive research

- A dynamic tool that evolves with your business

- Adapting to new insights and feedback from trusted professionals

- Helps in refining your strategy and identifying areas of improvement.

Key Components of a Business Plan

A masterful business plan is an orchestra of key components, each playing a significant role in the symphony of your business’s story. At the forefront is the executive summary, a snapshot capturing the essence of your plan and the ambition driving your business. It’s followed by a detailed business description that outlines the mission, objectives, and the unique value your business intends to deliver to its target customer base.

Further in the plan, the market analysis explores the industry landscape, examining competitors and trends to carve out a niche for your business. The marketing plan, a crucial subset of your strategy, delineates the sales tactics you’ll employ to captivate your target market and differentiate your brand from the rest. And let’s not overlook the financial projections; these figures are not mere numbers but the fiscal heartbeat of your business, projecting its financial health for the years to come.

Choosing the Right Business Structure

Choosing the right business structure is like selecting the foundation for a building; it sets the stage for your business entity’s strength and resilience. The decision influences everything a business entity requires, from income tax obligations to your ability to raise funds and even how you register your business.

Here are some common business structures to consider for a small business owner:

- Sole proprietorship: offers simplicity and tax benefits but also places your personal assets at risk.

- Partnership: allows for shared decision-making and profits, yet requires mutual trust and understanding, as partners are jointly responsible for the business’s obligations.

- Limited liability company (LLC): provides personal liability protection and flexibility in management and taxation.

- Corporation: offers the most protection for personal assets and allows for raising capital through the sale of stock.

Consider your specific needs and consult with a legal or financial professional, including the Internal Revenue Service, to determine the best structure for your business, as well as the right business bank account to conduct business.

Venturing further, the Limited Liability Company (LLC) structure provides entrepreneurs the coveted shield of limited liability while still enjoying the benefits of pass-through taxation. Corporations, both C and S, offer robustness in terms of investment attraction and shareholder structures, with each having its nuances, such as the S corporation’s favorable tax designation but with limitations on the number and type of shareholders.

Understanding these structures is paramount, as the legal structure you choose will underpin all aspects of your business operations and growth potential.

Registering Your Business Name

Your business name is more than a label; it serves as the banner for your company’s journey. It’s the first impression, the beginning of a relationship with your customers, and as such, it demands protection and legal compliance. Registering your business name fortifies your brand identity and safeguards it from being claimed by others. The process, which involves filing for Articles of Incorporation or Articles of Organization, bestows upon your business a legal standing and a sense of permanence.

This registration transcends mere formality; it’s a declaration to the world and to the District of Columbia Department of Consumer and Regulatory Affairs that your business is legitimate, serious, and here to stay. While other businesses may come and go, your registered business name stands as a testament to your presence and your promise to the marketplace.

Protecting Intellectual Property

The lifeblood of many businesses, especially startups, is the innovation and creativity they bring to the market. Securing this intellectual property (IP) is compulsory; it’s a legal requirement to protect your business from potential threats to your success. Registering trademarks, securing patents, and ensuring non-disclosure agreements are in place are all essential steps to protect your business’s unique products, services, and identity.

Enlisting the expertise of legal counsel is advisable to navigate the complexities of the U.S. Patent and Trademark Office procedures and to ensure your IP assets are properly safeguarded. With the proper protection, your trademarks and patents become intangible fortresses, preventing unauthorized use or theft that could otherwise harm your business and revenue.

Raising Capital Legally

Securing capital is a critical and challenging part of fostering a startup. However, it’s not just about securing the funds; it’s about doing it within the full scope of the law. Legal compliance when raising capital involves an intricate understanding of federal and state securities laws and ensuring that all investor agreements are airtight and legally sound.

Failure to adhere to these laws and regulations can lead to dire consequences, including financial penalties and legal issues that could jeopardize the very foundation of your business. It’s a delicate dance, one where a misstep is not an option. Thus, it is critical for startups to seek legal counsel to ensure that every penny raised is done so legally and ethically, aligning with the overarching solid business plan.

Obtaining Adequate Insurance Coverage

Uncertainty is an inevitable part of the business journey, making sufficient insurance coverage essential, not optional. Insurance acts as a safety net, protecting your business from potential risks that could otherwise lead to financial ruin. Some types of insurance coverage that are important for businesses include:

- General liability insurance, which shields your company from legal claims

- Commercial property insurance, which covers damages to your business property

- Professional liability insurance, which protects against claims of negligence or errors in professional services

- Workers’ compensation insurance, which provides coverage for employees who are injured on the job

- Cyber liability insurance, which protects against data breaches and cyber attacks

Each business insurance type serves a protective purpose and can help safeguard your business from unexpected events.

Moreover, specialized policies such as errors and omissions insurance and workers’ compensation insurance are not just about legal compliance but about ensuring that both the business and its employees are safeguarded in the event of unforeseen circumstances. It’s about peace of mind, knowing that your business can withstand the storms that may come.

Complying with Data Protection Laws

In the current digital era, data holds immense value, and its protection is a legal mandate, not just a technicality. Complying with data protection laws such as GDPR, CCPA, and numerous others is a multifaceted challenge that businesses must rise to meet. These laws are designed to safeguard consumer information, and non-compliance can result in significant financial penalties, legal repercussions, and irreparable damage to your business’s reputation.

Startups must work hand-in-hand with cybersecurity and legal professionals to weave a tapestry of legal compliance and best practices that not only protect consumer information but also the integrity of the business. It’s a commitment to upholding the trust your customers place in your business, ensuring that their data is as secure as the products or services you offer.

Establishing Internal Processes for Disputes

Conflict is unavoidable in any business, but the way it’s handled can be transformative. Establishing internal processes for disputes is about creating a culture of open communication and systematic conflict resolution. It’s about drafting clear contracts and agreements that not only protect business interests but also provide clarity in expectations and obligations, reducing the likelihood of disputes arising in the first place.

Utilizing Dispute System Design (DSD) principles and ensuring that steps such as negotiation, mediation, and, where necessary, arbitration or litigation are in place, can save your business from the drawbacks of unresolved conflicts. An effective DSD system is not just a conflict resolution mechanism; it’s a statement of your business’s commitment to fairness and respect for all parties involved.

Incorporating Sustainable Practices

Sustainability has evolved beyond a buzzword to a business requirement, indicating a company’s commitment to environmental responsibility and legal compliance. Incorporating sustainable practices into your business plan not only demonstrates corporate responsibility but can also enhance your competitive advantage. It requires staying abreast of local jurisdictional laws and may necessitate consultation with legal advisors to navigate the complexities of environmental regulations.

This dedication to sustainability often resonates with consumers and can lead to increased loyalty and trust in your brand. It’s about aligning your business with the global shift towards a more eco-conscious marketplace and ensuring that your business practices uphold these values.

Regularly Reviewing and Updating Your Business Plan

A business plan is a dynamic document that must be continuously updated to match your business’s evolution. Regularly reviewing and updating your business plan is crucial for adapting to changes in the market, business goals, and legal requirements. It’s an ongoing process of refinement and recalibration, ensuring that your strategies remain relevant and effective in the face of new challenges and opportunities.

This practice of revisitation and revision is the hallmark of a dynamic business that is responsive to the shifting economic landscape and proactive in its pursuit of success. It’s about continuously seeking improvement and ensuring that your business remains on the cutting edge of its industry.

Utilizing Local Business Development Centers and Incubators

The journey towards growth and success is better navigated with assistance. Local business development centers and incubators are treasure troves of resources, offering:

- Networking opportunities

- Connecting entrepreneurs with investors

- Providing financial assistance

- Offering valuable mentorship from experienced business professionals

These centers can be pivotal in helping small business startups flourish.

Moreover, incubators often provide startups with the following benefits:

- Physical space and facilities necessary to operate without the burden of high overhead costs

- Opportunity to focus on growing their business

- Synergy created within supportive environments that can catalyze innovation

- Foster collaborations

- Contribute to the local and broader economy.

Embarking on the entrepreneurial journey is a bold endeavor, one that requires careful planning, steadfast resolve, and meticulous attention to legal detail. From the fundamental step of crafting a solid business plan to the complexities of complying with data protection laws and establishing internal processes, each aspect of your business’s foundation must be built with precision and care. Remember, a business is more than its products or services; it’s a legal entity that must navigate the intricate web of regulations and responsibilities that come with its operation.

Let this guide be your roadmap, illuminating the path to a business built on legal fortitude and strategic acumen. Embrace the wisdom within these pages, and let it inspire you to forge a business that is not only successful but also responsible, sustainable, and primed for long-term prosperity.

Frequently Asked Questions

What are the key components of a business plan.

The key components of a business plan are the executive summary, business description, market analysis, organization and management, sales strategies, funding requirements, and financial projections. These sections are crucial for presenting a comprehensive overview of your business and its potential for success.

Why is choosing the right business structure important?

Choosing the right business structure is important because it affects tax liability, paperwork requirements, fundraising capabilities, and legal protection of personal assets. These factors have a significant impact on the success and sustainability of a business.

How often should I review and update my business plan?

It is essential to review and update your business plan regularly to adapt to changing market conditions, business goals, and legal requirements. This will help ensure your business stays competitive and aligned with its objectives.

What is the role of business development centers and incubators?

Business development centers and incubators play a crucial role in supporting startups by providing resources, mentorship, access to investors, and affordable working spaces for growth. This directly contributes to the success and sustainability of new businesses.

Why is protecting intellectual property vital for my business?

Protecting intellectual property is vital for your business as it safeguards your ideas, branding, and products from unauthorized use or theft, helping to maintain your competitive edge and revenue.

Call Now:

301 365 6305

327 King Farm Blvd, Ste. 105 Rockville, MD 20850

© 2024 Robert D. Roseman, PC. All Rights Reserved.

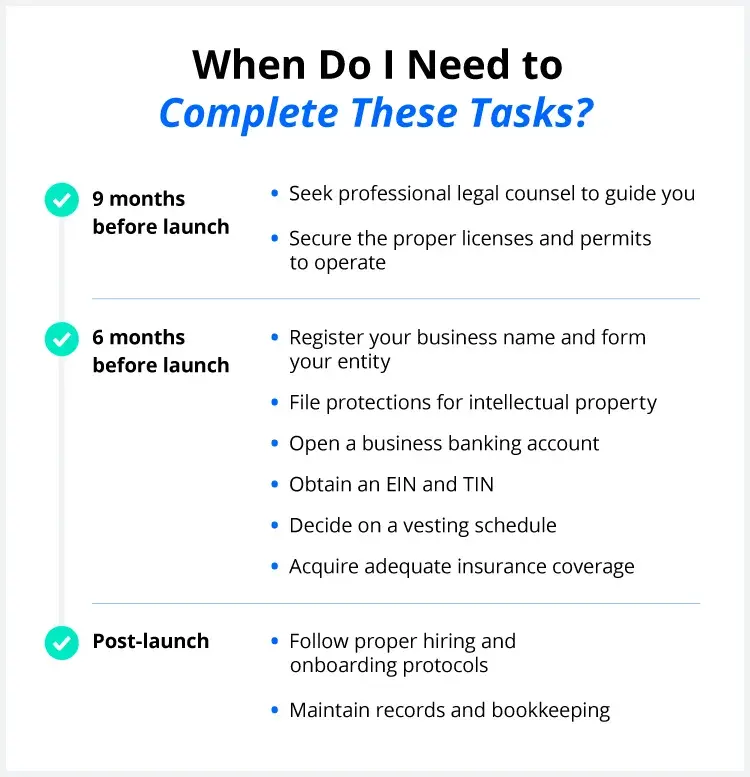

13 small business legal requirements and tips for launch

There are many small business legal requirements to keep track of when you start a business. Save yourself the extra stress and use this checklist to monitor your progress.

Ready to start your business? Plans start at $0 + filing fees.

by LegalZoom staff

Read more...

Updated on: May 7, 2024 · 7 min read

Establish and define your business

Get your financial and tax-related legal requirements in order, protect your business.

Legal requirements and best practices for starting a small business center around licensing and registration, tax liability, human resources (HR), and insurance coverage. By checking off the 13 steps in the following list, your business could have better legal protection and a stronger edge against potential competition.

You'll also want to get the scoop on common small business legal mistakes, which you can view in our infographic below:

Licensing requirements or mandated registrations are meant to help your business flourish wherever it operates. Each state governs small business formation differently, and requirements can change if you plan to do business across state lines.

Legally forming your business , coming to an agreement with your business partners, securing licenses to operate, and protecting your name, slogan, and other assets are all requirements for launching a successful company. Read on to explore each of these steps in detail.

1. Sign a founders' agreement

Properly documenting the rights and responsibilities of each owner is crucial if your small business is the result of an agreement with another party. A founders' agreement makes clear the breakdown of duties and liabilities between business partners. This is one of many important legal documents for startups that could protect you and your share of company profits in the event of a dispute.

2. Form your business entity

You may operate one of four types of businesses when you officially form your entity: a sole proprietorship, partnership, S corporation, or limited liability company (LLC). Each offers a different structure and unique protections to you as the business owner.

- Sole proprietorship: A structure for solo entrepreneurs that carries no filing requirements to form in most states and has increased liability exposure.

- Partnership: Either a limited, limited liability, or general partnership with basic filing requirements and possible liability exposure.

- S Corporation: A corporation that shields owners from liability and has a beneficial tax structure.

- LLC: A company that can be owned by unlimited individuals or entities, boasting greater liability protection.

LLCs and S corporations offer greater personal liability protection, which can save you time and money as the owner. Meanwhile, starting a partnership if you have multiple owners can be simpler than forming another entity, depending on the arrangement.

3. Register your business name

Excluding sole proprietorships that allow you to operate under your legal name, each business entity requires its own unique name that you file with the state. Once you determine that your business name is available, register and make it official:

- A trademark solidifies your business name and prevents other businesses from using it in every state.

- A Doing Business As (DBA) registration clarifies that the business name is fictitious and separate from your name or the official business name.

These two terms go hand-in-hand when announcing your business name to the world, but they don't carry equal protections. In fact, a DBA doesn't carry protections at all—it's just a name.

4. File protections for slogans and logos

In addition to protecting your business name, trademarks can protect intellectual property that brands your business. You can trademark slogans, catchphrases, logos, and any other names associated with your business.

The U.S. Patent and Trademark Office (USPTO) handles trademark applications at the federal level. The cost to trademark your business name averages $300 and changes depending on your state.

5. Secure the proper licenses and permits

After obtaining your DBA and registering your business, you'll need to secure operating permits and licenses. These vary widely depending on which state is home to your business, whether you do business in multiple states, whether you do business with a federal agency, or whether your business is in an industry with heavy federal oversight.

The Small Business Administration details industry-specific contact information for federal business permits as well as a database for state permit questions. If you have questions about the laws in your state, a professional can help you sort out your business queries .

Determine a vesting schedule if you plan to issue stock, and comply with tax laws by claiming the proper employer status. Tackle these steps to ensure you're on top of your finances and prepared for your taxes.

6. Open a business banking account

Record your business finances separately from your own. This not only ensures that you properly keep your records but also decreases your personal liability in the event of an audit. To open a business bank account, you'll need an EIN and founding documents that prove your ownership.

7. Get an Employer Identification Number

While it's possible that you will operate your business without hiring any employees, if and when you do hire anyone, you'll need to pay them. To pay your employees, you'll need to obtain an Employer Identification Number (EIN) that associates your business as an entity the Internal Revenue Service (IRS) recognizes. Keep in mind that you might also need a state tax identification number (TIN) depending on your state.

Even if you don't have employees, you still might want to obtain an EIN. EINs act like Social Security numbers for your business so you can avoid submitting yours on official documents. This small step can protect your business against identity theft and shield your information from view.

8. Decide on a vesting schedule

If your small business is classified as a corporation and issues stock, you can protect its value with a vesting schedule for early investors. A vesting schedule determines:

- When your investors can begin selling their shares

- What percentage of their stock investors can sell

This process protects the interests of your investors by ensuring that control and ownership remain only with people actively involved in ongoing business. Many investors demand a vesting schedule before making a commitment, so be sure not to overlook this preventative step.

Without proper protection, your newly formed small business is vulnerable to legal challenges and intellectual property theft. Business insurance and proper oversight in the hiring process both protect from liability, albeit in different ways.

Follow these preventative steps to up the legal defenses of your business.

9. Acquire adequate insurance coverage

Businesses protect their owners' personal liability but are vulnerable themselves to legal challenges. Protect your business with adequate insurance coverage to reduce business liability on several fronts. Some types of insurance are mandatory, while others are optional in some states. Here are common types of business insurance:

- General liability insurance: Guards your business and assets from several damage claims

- Commercial property insurance: Protects physical property (buildings, tools, and equipment) in the event of theft or, in some cases, damage

- Workers' compensation insurance: Covers your employees if they become sick or hurt as a result of their job; mandatory (except in Texas)

There are many other types of business insurance that can protect your investments against specific threats, like earthquakes, floods, and even data breaches. Consider all the potential risks you're facing before writing off a particular type of insurance.

10. Hire the right people

Hiring your first employees is an exciting step that signals growth. It's also a step that demands a high degree of attention to detail. By performing background checks and verifying employment eligibility, you'll assure regulators that your hiring is legal.

Many states have laws about at-will employment that govern employee terminations. In certain states, it's much more difficult to release an unfit employee, so do your homework before hiring someone you're unsure is a good fit for the job.

11. Follow proper onboarding protocols

As an employer, you must register with the U.S. Department of Labor. Complying with labor laws is important to protect your liability and ensure the safety of your employees. Requirements include:

- Displaying the correct labor posters

- Establishing an employee handbook

- Creating a labor compliance checklist

Labor law posters and employee handbooks are transparent measures that empower your employees to know their rights. In the same way, a labor compliance checklist empowers you to get ahead of potential issues that could lead to labor disputes or strikes.

12. Keep good records

As you begin to conduct business, government agencies will require records detailing your operations and profits. The law demands that you keep accurate accounting records specific to your industry, so if you have questions about proper business reporting , consult with a professional who can guide you with relevant advice.

13. Seek professional consultation to answer questions

You don't have to make any moves you're unsure about. Legal counsel and professional advice can help guide you through the business formation process so that all your individual needs and legal requirements are met.

To prepare yourself for launch and to ensure seamless operations, you can download the interactive checklist below to identify any legal requirements you might've missed. Use each step to think about your industry, location, employees, and anything else that might determine regulations that affect your business.

Once you meet the legal requirements to form a business, you're ready to launch. Running your business smoothly isn't a solitary job, even if you're forming a sole proprietorship or a single-member LLC. Remember that preparation is your biggest asset—the more prepared you are for launch, the more likely your small business will succeed.

You may also like

How to Start an LLC in 7 Easy Steps (2024 Guide)

2024 is one of the best years ever to start an LLC, and you can create yours in only a few steps.

July 29, 2024 · 22min read

How to Write a Will: A Comprehensive Guide to Will Writing

Writing a will is one of the most important things you can do for yourself and for your loved ones, and it can be done in just minutes. Are you ready to get started?

July 21, 2024 · 11min read

What Is a Power of Attorney (POA)? A Comprehensive Guide

A power of attorney can give trusted individuals the power to make decisions on your behalf—but only in certain situations.

August 29, 2024 · 20min read

IMAGES

VIDEO

COMMENTS

A business plan helps you carefully set forth the purpose, goals, and priorities of your new business, along with guideposts to help ensure that you stay on the right path. For instance, a business plan may require you to consider what the primary purpose of your business is, or the good or service you intend to provide, who your potential ...

Here, 10 members of Young Entrepreneur Council outline some of the most important legal considerations to make when starting a business and why handling these tasks should be at the top of...

Use this list of legal requirements for starting a small business—and resolve any lingering issues before you get in too deep with your business.

Turn to your business plan to review your goals and see which structure best aligns with those objectives. Your entity should support the possibility for growth and change, not hold it back...

This article will guide you through the essential legal steps and strategic best practices to ensure your business plan is both comprehensive and legally sound. Topics include choosing your business structure, protecting intellectual property, and complying with data protection laws.

Legally forming your business, coming to an agreement with your business partners, securing licenses to operate, and protecting your name, slogan, and other assets are all requirements for launching a successful company. Read on to explore each of these steps in detail. 1. Sign a founders' agreement.