Market Entry Framework: How to Apply in Case Interviews

The market entry framework is a tool to assess whether a company should enter a particular market or introduce new products in existing markets by assessing growth opportunities, capabilities, and challenges. In case interviews , these frameworks are useful templates for market entry cases.

In this article, I will explain how you can apply market entry frameworks in market entry cases using a four-step guide and case examples. Let’s get started!

Table of Contents

Market entry cases in case interview

A market entry is a type of case interview that asks candidates to evaluate and decide whether a client company should enter a particular market. The market entry case is one of the most common types of cases in consulting interviews since, in practice, consultants frequently deal with this type of cases

Among MBB (Big 3) firms , market entry cases are more common at BCG and Bain than McKinsey.

Our Case Interview End-to-End Secrets Program assembled everything you need to know about consulting case interviews and how to pass them, so that’s the best place to go if you have general questions.

Types of market entry cases

There are three commonly encountered market entry cases: New geographic market case, New product category case, and New customer segment case.

However, you also need to be aware that there are countless types of market entry cases and you can face any type of case in your case interview. Each case you receive has certain differences and comes with a different breakdown and solution.

Type 1: New geographic market case

Geographic market entry cases ask candidates to assess whether the business should expand to a new geographical market , for example, if Amazon Go should enter the UK or if Mercy Meats should enter South America.

Type 2: New product category case

On the other hand, product expansion cases ask candidates to assess whether the business should launch new business lines into their existing market , for example, if Disney should launch their own streaming service, or if Walmart should start selling meal kits from its service partners.

Type 3: New customer segment case

Lastly, targeting different customer segment cases ask candidates to assess whether the company ought to consider offering a version of an existing product to a new customer segment , for example, if KFC should serve premium fried chicken for the wealthy or if Gucci should target working class people.

Examples of market entry cases

A French soft drink company, Le Seine, is looking to diversify its holdings by investing in a new fast food chain in the US. You are hired to determine whether they should pursue this path and, if so, how they should go about execution (HBS Case Interview Guide).

The client is a grocery store chain considering whether they should enter the emerging Internet-based grocery shopping/delivery market in the Boston area. This regional chain is currently one of the leaders in northern New England's traditional grocery store market.

In their core market, two competitors have emerged in the Internet/at-home grocery shopping business and are rapidly gaining market share. Should the client enter the market?

Apple, a technology company renowned for its premium smartphones and computers, has predominantly focused on individual consumers and creative professionals. Apple is now contemplating the prospect of expanding its market by targeting the corporate sector. Should Apple venture into the corporate market? If so, how should they do it?

Case interview frameworks – Definition & characteristics

Understanding what a framework is, the characteristics of good frameworks, and how to apply them in case interviews is essential to sounding structured and methodical – two main consulting traits interviewers look for.

What is a case interview framework?

The most important thing to remember when using frameworks to solve a problem is to be FLEXIBLE. Consulting problems are complex and usually, there are no clear-cut, ready-to-use frameworks to solve them. The interviewer looks for context-relevant frameworks, not complicated but inappropriate ones.

Hence, the more you master the “building-blocks” frameworks, the better you can draw specific frameworks suitable to each context. Learn more about frameworks here .

Characteristics of a good framework

When building a framework, you should keep these three priorities in mind:

A good framework is top-down: The problem must be broken down from the generic to the specific, with each hypothesis staying on one level of the issue tree .

A good framework is MECE: MECE is extremely important in problem-solving because it ensures complete coverage of the problem while preventing effort duplications.

A good framework is geared toward isolating the root cause: To isolate the root cause, your framework must strictly follow the problem-solving methodology .

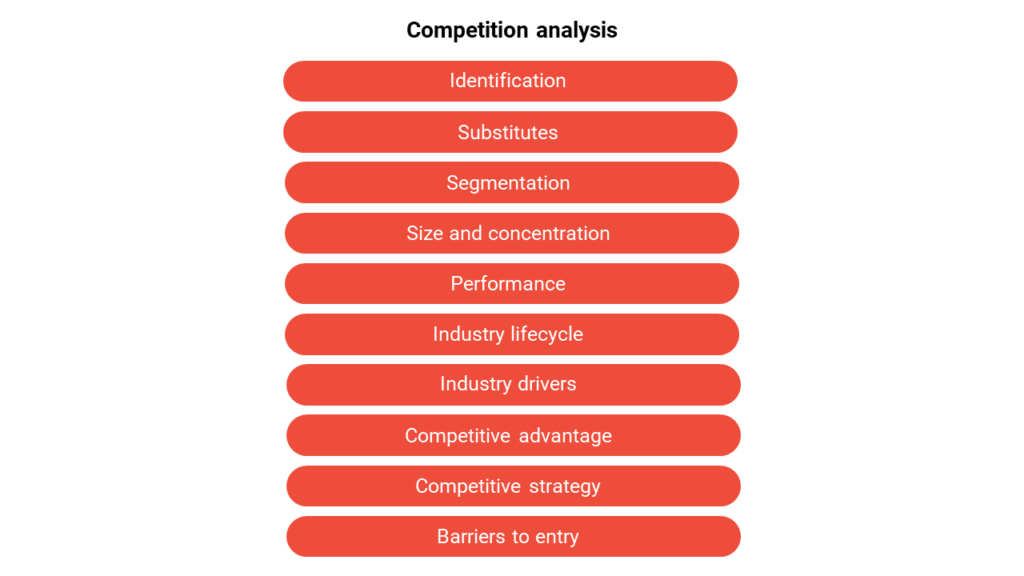

The MConsultingPrep market entry framework

In a market entry case interview , you are expected to evaluate an expansion opportunity (entry into new markets, new segments or new product lines in existing markets), decide whether the client company should pursue it , and, if yes, suggest an entry strategy . The underlying principle of the market entry framework is based on this process.

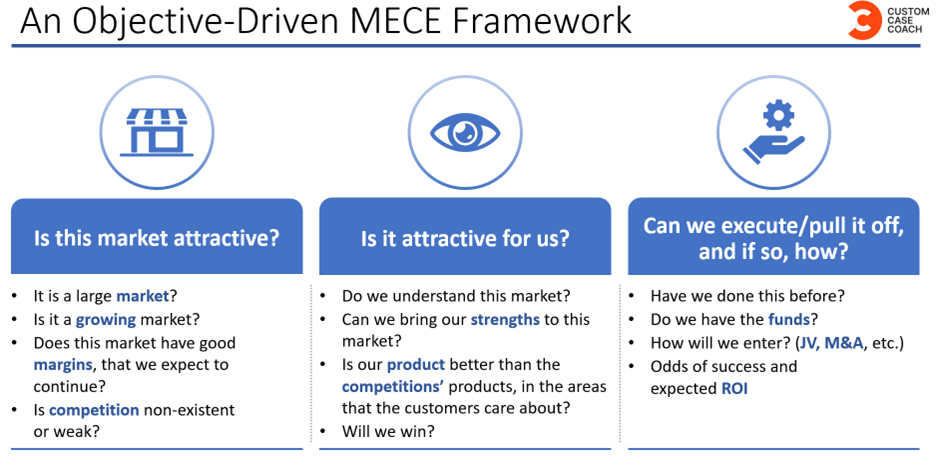

A market entry framework answers three questions, in order: “Should I enter?”, “Can I enter?”, “How to enter?” .

These ordered questions make up the three steps of a market entry framework: Assessment, Feasibility, and Implementation.

Step 1: Assessment – Should I enter?

The first step is to justify WHY the company should pursue a particular expansion opportunity. To answer “Should I enter?”, you have to make two assessments – market assessment and company assessment .

Company assessment will reveal the company’s internal motivations to expand, whereas market assessment shows the external motivations driving expansion decisions.

Company assessment

The first step after receiving a case is to ask for more information about your client company. Use that data to understand if there are internal motivations driving expansion decisions.

For example, let’s say you asked about revenue and were informed of a declining trend. You know this is a market entry case, so you might hypothesize that the client company’s revenue is declining because their product is at the mature stage of the product life cycle.

If the hypothesis is confirmed, this implies an internal motivation for the company’s expansion to other markets to capture new market shares or introduce new products to capture more revenues from their early life cycles.

Market assessment

The next step is to inquire into the market of interest to pinpoint the external motivations that can justify the need to expand. What is attractive about this market? Is it the market size, or the potential market demand?

If information about the market size is available in the case, this implies that you need to first estimate it .

Sometimes, markets are attractive because of their location advantage , which can save transport costs or enable the client company to obtain cheap inputs .

The open trade environment of a market might also help firms jump trade barriers. Finally, political stability is also attractive for minimizing risks and conducting business sustainably in the long run.

Other information to ask for:

What is the current product portfolio? What is the life cycle of each product? How closely related are the current products?

Who are the customers? How are they segmented?

What are the company’s key strengths and weaknesses?

What are the current distribution channels?

Who are the key suppliers and partners?

Regardless, the most important information to ask for are:

What geographical area will I serve, and how much demand will there be in the market?

What is the market’s growth rate? What are the current trends in the industry?

At what stage of the life cycle is it? Emerging, Mature, Declining?

Who are the existing competitors in the market?

Are there substitute products or potential entrants?

Are there any location-specific advantages that can save transport/ input costs?

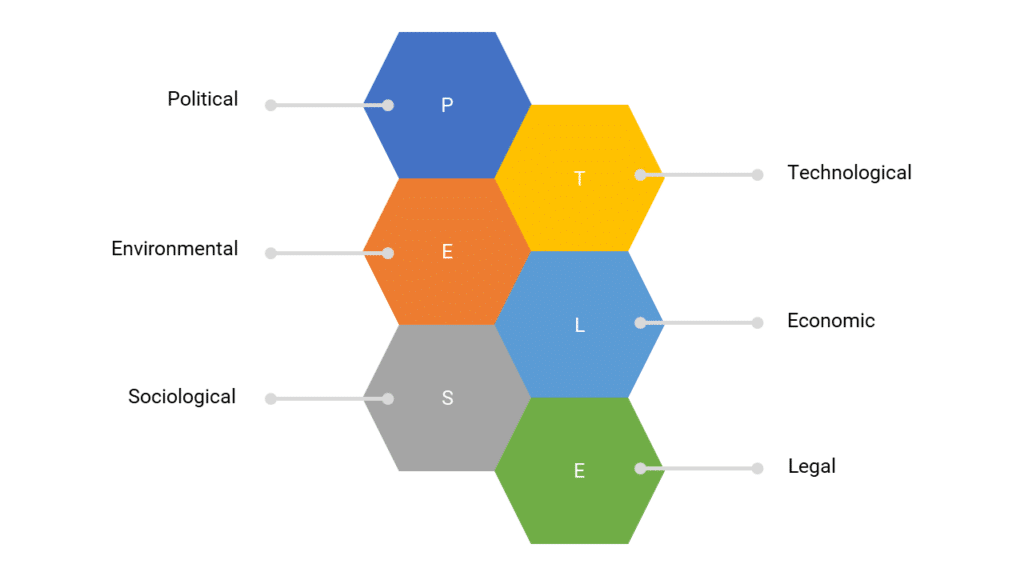

Are there any macroeconomic, social, or geopolitical factors to consider?

Is there a key technology involved? How fast are technologies changing in the industry?

After gathering information about the company and market opportunities, do your cost-benefit analysis. By then, you can decide if the company SHOULD enter a new market or not.

If you decide that the company should not enter , you no longer need to answer the other two questions. If you decide that it should enter , move on with the next step.

Part 2: Feasibility – Can I enter?

Remember, only move on with this step if you’ve decided that the estimated benefit of this market entry outweighs the estimated cost.

At this point, you need to assess the FEASIBILITY of entering a new market – does the client company have the financial capacities and capabilities to adapt to and profit from the new market?

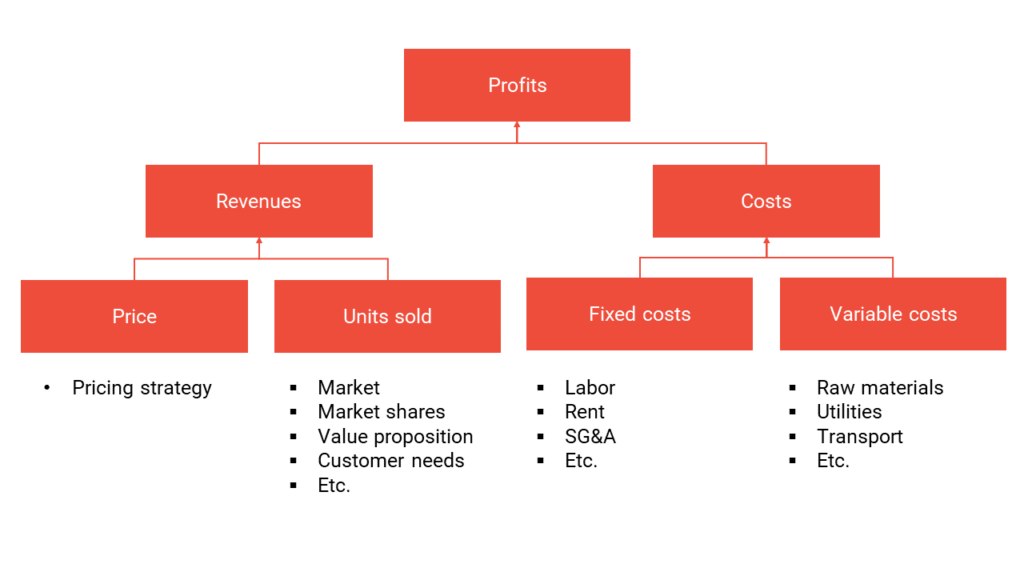

Financial feasibility

Figure out whether the client company’s financial situation can cover investment costs . To do this, you first need to estimate the amount of investment required.

You can follow these questions, in order:

What investments are required for this market entry? (R&D, warehouse rent, factory rent, marketing, distribution, etc)

What is the current financial situation of the company?

Can the company fund these investments itself or can it raise the required capital?

Capability feasibility

The company’s capabilities help it secure market share by differentiating it from other competitors in the market.

Examples of capabilities are firm-specific competitive advantages such as patented technologies, efficient logistics & production capacities, local knowledge, a low-cost structure, etc.

Important information to ask for:

Does the company have efficient distribution channels/ logistics?

Does the company have efficient production capacities?

Does the company have a patented technology/design that makes room for no substitution of its products?

Can the company obtain the capabilities it currently lacks?

Step 3: Implementation – How to enter?

This step will be applied if it’s feasible for the client to enter this new market and you must next suggest an entry strategy or an implementation plan. This plan must be specific in terms of timeline, modes of expansion, and execution details.

However, there are some market entry scenarios where the project may just require the first two components, which entails responding to the customer's inquiry regarding whether or not they should enter the market they desire.

Propose a timeframe

Propose a time frame for your expansion strategy. When is the right time for the client company to enter the market? Is there a first-mover advantage at present?

Don’t forget to refer back to the above information about the company’s situation and market opportunities to support your decision.

Propose a method of expansion

Regarding modes of expansion, there are three common strategies:

Partnership: Partnership entry modes are those wherein two (bilateral partnership) or more (network partnership) firms co-join their finance, skills, information and/or other resources to minimize risks. These are joint ventures , licensing , or joint distribution networks .

Organic: Organic entry modes involve those that increase the company’s sales using only internal resources. In other words, they are trade-based entry modes, such as exporting.

Mergers and Acquisitions (M&A): M&A generally occurs when one company directly purchases another company. Together, they form a new legal entity under one mother corporation.

Again, evaluate the information about the company and carefully compare that with the risks of each entry mode to decide on a suitable one. For example, if the client company has a patented technology, choosing a partnership entry mode runs the risk of technological theft.

You should also consider the commitment factor – how much control does the company want over the new market, and how much investment is it willing to make?

With a simple strategy like exporting, you can exit easily but have less control. Meanwhile, with a wholly-owned subsidiary, investment costs are high but you also have more control.

Finalize your execution plan

The final step is to specify your execution plan, containing the key objectives to be implemented. The plan will also need to specify what tasks to be completed, who is in charge of each task, and how they should be carried out.

The final plan will be the final deliverable to the client. The client can then choose to implement it themselves or sign another implementation contract.

The market entry framework – Sample case

Now, let’s apply the framework to a sample case so you can see the flow.

Situation:

Your client company is Mercy Meats, an international plant-based meat producer in the US. The main ingredients in their products are soy protein and heme – a genetically modified ingredient extracted from soy roots that makes their products look and taste identical to animal meat.

Mercy Meats is considering an expansion in South American countries, Brazil in particular, after major successes in the US, Hong Kong, and Canada. Our client would like your help in deciding whether or not to pursue this growth opportunity, and if so, what their entry strategy should be.

We’ll begin by assessing the company – Mercy Meats, and Brazil’s market, to make an entry decision.

Company Assessment

For company assessment, we want to find out if there are any internal motivations specific to Mercy Meats regarding this entry decision. We are told that the only motivation is to satisfy its stakeholders’ expectations, profitability-wise and mission-wise.

Profitability-wise, shareholders want to scale up production to capitalize on economies of scale, thereby maximizing profits.

Mission-wise, the CEO and investors want to reduce the environmental footprint of the factory farming industry, by competing with conventional meat producers and making more consumers cut back on animal meat consumption.

Market Assessment

For market assessment, we will look at external motivations that Mercy Meats seek to justify its entry decision – attractive characteristics of Brazil’s alternative protein market.

What is the market’s size, growth rate, trends, and industry life cycle?

First, we’ll want to know the life cycle of plant-based meat, its market size in Brazil, the market’s growth rate, and trends. The plant-based industry is in its growth stage, with an annual average compound growth rate of 8% globally and 20% in Brazil’s market.

Meanwhile, we’re told that Brazil’s plant protein market size is predicted to reach $30.2 billion by 2023. This is mainly attributable to a strong shift in attitude towards vegetarianism among young Brazilian consumers. With a strong growth rate driven by positive attitude shifts, this market is an attractive place to be.

Who are the customers? What are their needs and preferences?

We can broadly construct a portfolio of our customers: people who are health-conscious, high-income, concerned about animal welfare, would buy plant-based protein as a substitution for animal protein, and enjoy similar tastes of real meat.

The interviewer might also inform us that our customers could be swayed by lab-grown meat for its real taste and “real meat” brand, although this technology is yet to be marketable due to its high price and environmental concerns.

The competitors of Mercy Meats will consist of any businesses meeting the same customer demand mentioned above. We’re told that direct competitors in the market are local plant-based brands, however, the tough competition will be posed by conventional meat players (such as Marfrig or JBS), who are starting to develop their own plant-based products.

Here, we should talk about events that can broadly affect our entry strategy. For example, we might point out that complex bureaucracy and lack of transparency are the two biggest barriers to doing business in Brazil.

As a response, the interviewer might say that Brazilian governments are committed to reducing bureaucracy by simplifying their tax structure and investing in public services digitalization (such as digitized tax fillings). This is a positive improvement, making Brazil a more attractive place to do business. You can raise other concerning issues in a similar manner if needed.

To summarize, we have sufficient reasons to decide that Mercy Meats should enter Brazil . Brazil’s plant-based protein market is overall attractive, with a strong predicted growth rate and, as a leading soy producer, can create a cost-saving advantage for the company.

The biggest concern so far is competition from well-established meat players, and lab-grown meat competitors in the near future.

Step 2: Feasibility – Can I enter?

Now that we’ve decided that entering Brazil is beneficial for Mercy Meats, we need to see whether the client company is equipped with what’s required to do so, capability-wise and finance-wise.

First, we need to understand whether Mercy Meats has the capabilities (competitive advantages), to sustainably compete in the new market.

In the US, Canada, and Singapore, Mercy Meats have very efficient logistical channels, with low warehouse capacity, minimal shipping time, low inventory turnover rate, and a high number of orders relative to all of its major competitors. The company definitely has the required capability to replicate another efficient logistical channel in Brazil.

Can the company produce premium quality products at a lower cost than its competitors?

Mercy Meats products, Mercy Burger, Mercy Sausage, and Mercy Pork, are much more expensive compared to animal meat products in Brazil. For example, one Impossible Burger pack weighing 1.4kg is currently priced at around $30, nearly 4 times higher than the same amount of beef (around $8 per 1.4kg) in Brazil.

However, Brazil is the leading exporter of soybean in quantity due to its low price and premium quality. Hence, if the company can take advantage of the low soybean input in Brazil and can scale up its production, a more reasonable product pricing can be achieved.

Does the company have a patented technology/design that distinguishes it from other competitors?

Mercy Meats owns a patented technology over its heme ingredient, a soy root-extracted ingredient that makes its products taste and look almost identical to animal meat. In fact, Burger Queen, a major fast food chain, chose to partner with Mercy Meats in the US because its products taste much more like real meat than that of Beyond Meat, Mercy Meats’ biggest competitor in the plant-based industry.

What is the current financial situation of the company? Can the company fund the investments itself or can it raise the required capital?

Next, we will look at how much investment is required and whether the company can financially cover it. The total investment cost is estimated at $80 million, while the expected return is over $180 million in 2 years.

Finance-wise, the company is doing really well, with average yearly revenue of $151 million. Mercy Meats also attracted many investors in the past, with $1.4 billion in total funding, of which $200 million was acquired in 2020. These figures exhibit investor confidence in the company, which implies a high chance of getting more funding in the near future.

After analyzing the facts and evidence, we can conclude that Mercy Meats clearly has the finance and capability to enter Brazil . Hence, we proceed with the decision to advise the client to say “Yes” to the entry decision.

The final step is to formulate an entry strategy, which includes deciding the implementation timeline, choosing the methods of expansion, and drafting an execution plan. We will examine each aspect, in the above order.

When is the best time to enter Brazil’s market?

The best time to enter Brazil is right now. We’ve observed that our major competitors, such as Marfrig, have started developing their own lines of plant-based meat. These competitors have better local knowledge than our client company and an already widely-recognized brand name in Brazil. Mercy Meats needs to move fast if it wants to secure a fair share of the plant-based meat market.

Which method of expansion is the most suitable?

To effectively gauge demand, Mercy Meats should consider expanding under trade-based modes, exporting in particular, and growing organically first. After that, it is recommended that Mercy Meats establish its own subsidiary, to have better control of two aspects: technology and market.

First, partnership modes are risky due to the potential of technological theft, subsidiaries or M&A modes can eliminate this risk, although they require more investment. Second, establishing a production subsidiary will enable the company to exert more control over the target market, by quickly adjusting production to customers’ needs and reducing logistic costs to be more cost-competitive .

What is the execution plan?

Finally, we need to develop an execution plan.

What: The breakdown of tasks in the overall implementation plan, for example, establishing partnerships for exporting, marketing the product, setting up the factory, etc.

Who: Who will be in charge of the aforementioned tasks? What are their deliverables?

How: What are the targets for each task, what are the expected quality standards that align with the key objectives?

Market entry case: examples & guidelines

Case 1: medicare plus.

Our client, MediCare Plus, is considering opening a new medical clinic in the affluent Riverside neighborhood of Los Angeles. Riverside is known for its high-income residents, including individuals from various socio-economic segments.

The client aims to diversify their healthcare services and tap into the lucrative Riverside market that aligns with their expertise. They seek your guidance on whether to proceed with this investment.

Should MediCare Plus open a new medical clinic in Riverside, Los Angeles?

Step 1: Assessment - Should I Enter?

Current Capability: Can MediCare Plus handle this expansion given its current resources and expertise?

Strategic Alignment: Does this expansion align with MediCare Plus' long-term goals?

Market Size: How big is the Riverside healthcare market?

Market Growth: Is the Riverside healthcare market expected to grow?

Competitors: Who are the competitors in Riverside's healthcare market?

Step 2: Feasibility - Can I Enter?

Financial Feasibility

Initial Investment: What's the cost to set up the new clinic?

Operating Costs: What are the ongoing expenses, including salaries, maintenance, and utilities?

Revenue Projection: How much revenue can we expect from different patient segments and specialties?

Capability Assessment

- Facilities: Can MediCare Plus handle clinic setup and management in Riverside?

- Financing: How can we finance this expansion?

- Doctor and Patient Attraction: Can we attract top doctors and patients to Riverside?

Step 3: Implementation - How I Enter?

Key Milestones: What are the critical milestones and deadlines for the expansion?

Responsibility: Who is responsible for each task?

Tasks: What specific activities are needed for a successful launch?

Methods: How will we execute each task effectively?

Approaches: What strategies and methods will we use for marketing, patient acquisition, and operations?

Case 2: TechGizmo Inc .

Our client, TechGizmo Inc., is a leading manufacturer of smartphones and consumer electronics. They have been experiencing steady growth, with revenues of $500 million last year and a healthy profit margin of 15%. However, they are concerned about the cyclical nature of the consumer electronics industry, which can lead to fluctuations in their business.

The CEO is considering entering the market for smart home devices. They want your opinion on whether this would be a good strategic move for TechGizmo Inc.?

Current Capability: Can TechGizmo handle this expansion with its existing resources and expertise?

Strategic Alignment: Does this expansion align with TechGizmo's long-term goals and expertise in consumer electronics?

Market Size: How big is the smart home devices market in Westwood?

Market Growth: Is the smart home devices market in Westwood expected to grow?

Competitors: Who are the competitors in Westwood's smart home devices market?

Initial Investment: What's the cost to develop and launch the new line of smart home devices?

Operating Costs: What are the ongoing expenses, including production, marketing, and distribution?

Revenue Projection: How much revenue can we expect from different customer segments and product lines?

Product Development: Can TechGizmo efficiently develop and manufacture smart home devices?

Financing: What are the financing options available for this expansion?

Customer and Retailer Attraction: Can TechGizmo attract both customers and retailers to sell their smart home devices in Westwood?

Step 3: Implementation

Key Milestones: What are the critical milestones and deadlines for launching the new line of smart home devices?

Responsibility: Who is responsible for each task, from product development to marketing?

Tasks: What specific activities are needed for a successful product launch?

Methods: How will we execute each task effectively, from marketing strategies to distribution?

Approaches: What marketing strategies and distribution methods will we use to promote and sell our smart home devices in Westwood?

What do you think about the market entry framework sample presented above? It’s super detailed, isn’t it? Even so, it’s just theory.

The only way to master the market entry framework is to practice. You need to learn and understand the fundamentals of market entry cases.

And it would be best if you had any consulting experts review your performance. Reach out to our ex-consultants , who can give you concrete feedback on your answer to a specific market entry framework case.

Meet your coach today to start sharpening your skills! They’ll help you determine your weak areas and suggest effective improvement methods.

Scoring in the McKinsey PSG/Digital Assessment

The scoring mechanism in the McKinsey Digital Assessment

Related product

/filters:quality(75)//case_thumb/1669783363736_case_interview_end_to_end_secrets_program.png)

Case Interview End-to-End Secrets Program

Elevate your case interview skills with a well-rounded preparation package

A case interview is where candidates is asked to solve a business problem. They are used by consulting firms to evaluate problem-solving skill & soft skills

Case interview frameworks are methods for addressing and solving business cases. A framework can be extensively customized or off-the-shelf for specific cases.

Market Entry Framework: How to Use It + Consulting Case Example

- Last Updated May, 2024

Rebecca Smith-Allen

Former McKinsey Engagement Manager

Company X wants to know if they can profitably introduce their widget to the Chinese market.

Company Y wants to leverage its knowledge of the North American fast-food market to introduce a new restaurant format. How should they do it and how long will it take to reach profitability?

Have you read case interview examples that sound like these?

Of course you have, because all successful businesses want to become more successful by expanding into new markets, so there are many case interview questions on this topic.

Because of this, it’s important that you have a thorough understanding of the market entry case framework.

We’ve got you covered!

In this article, we’ll:

- Discuss market entry case interview,

- Break down the framework into 4 easy steps,

- Provide an example of a market entry case,

- Provide tips on using the framework, and

- Point to additional resources to help you with the market entry framework and cases.

Let’s get started!

What is a Market Entry Case Interview?

Our Ultimate Guide to Case Interview Prep goes through everything you need to know about consulting case interviews and how to pass them, so if you have general questions, that’s the best place to turn. But if you’re ready to move on to market entry cases, read on. If you’re asked a market entry case question, there’s a lot of information you’ll need to cover. You’ll be better prepared if you practice this type of case. A market entry case starts with a company deciding to enter a new market.

- They could sell a new product into an existing market. Example: Netflix produces its own content to air over its existing streaming service.

- Or they could take an existing product to a new geography. Example: Starbucks enters the Chinese market.

Whether a company is contemplating entering a new geography or a new product-space, the decision is a big one. The CEO will face complicated questions like:

- Is the market profitable?

- Does the company have the skills needed to compete in the new market?

- Does it have the financial resources needed to successfully enter the market?

- Should the company create the capabilities to enter the new market in-house? Buy a company already competing in the market? Form a joint venture with another company?

- What regulatory hurdles might they face?

The high stakes and complexity of market entry decisions are the reason corporate executives facing these decisions often turn to consultants for help.

Nail the case & fit interview with strategies from former MBB Interviewers that have helped 89.6% of our clients pass the case interview.

Breaking Down The Market Entry Framework Into 4 Easy Steps

Step 1: assess the target market.

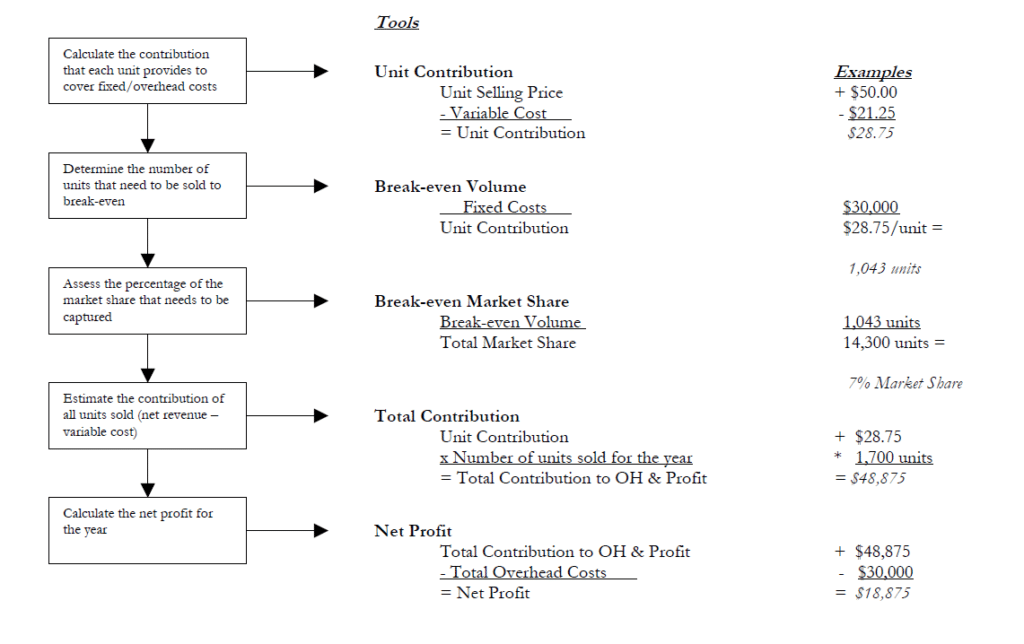

Assessing the market is step 1 because if the new market isn’t profitable (or won’t be profitable in the future), there’s no point in going further with this case.

Questions to ask during the assessment of the target market include:

- What is the size of the market in terms of revenue?

- What is the market’s growth rate?

- What is the profit margin on sales in the market?

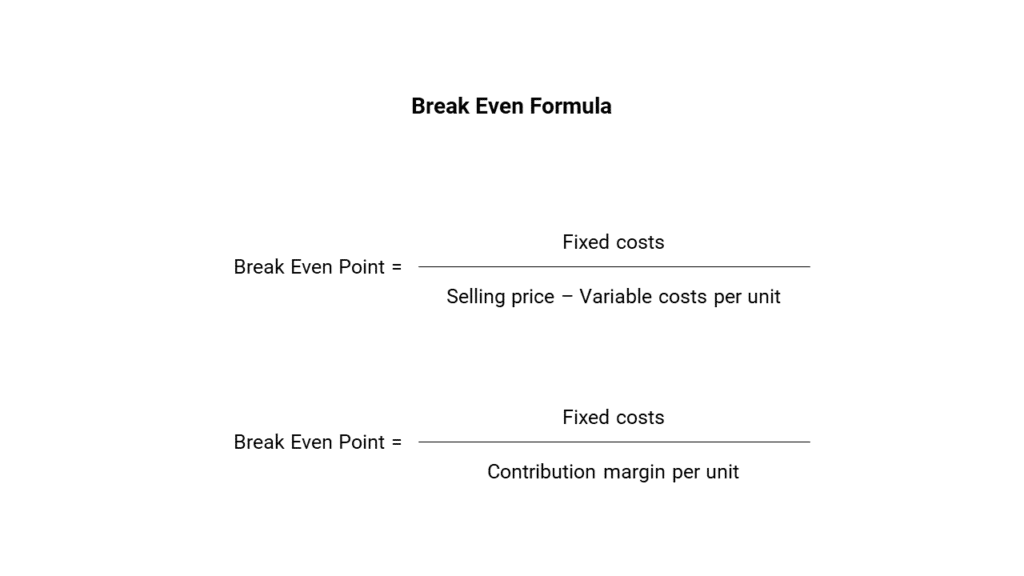

- What share of the market would the client need to break even? Become profitable?

Step 2: Assess the Client’s Capabilities

Questions to ask during the assessment of the client’s capabilities include:

- Do they have the technical skills?

- Is their cost structure competitive?

- Do they have the necessary sales or distribution channels?

- Can they get whatever capabilities they currently lack?

- Are there barriers to entering the market?

- Do they understand the customer segments in the new market?

- Can they tailor the product or service to the requirements in the new market so they can compete effectively?

- What government regulations will be encountered?

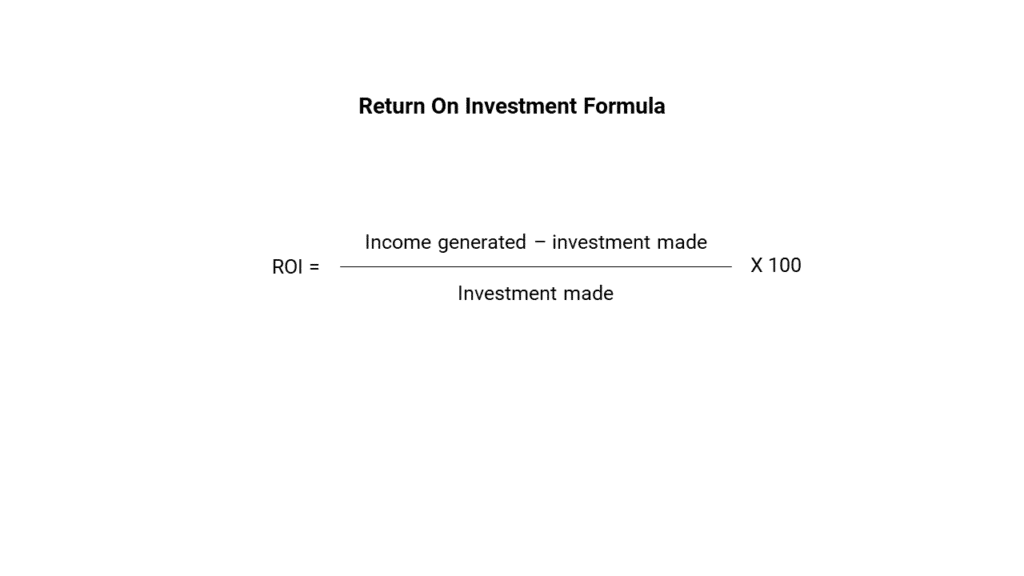

Step 3: Analyze Client Resources Relative to the Investment Needs & Expected ROI

Questions to ask while analyzing the client’s resources relative to the cost of market entry and expected ROI:

- Research & development

- Manufacturing & warehouse capacity

- Marketing launch & sales/distribution

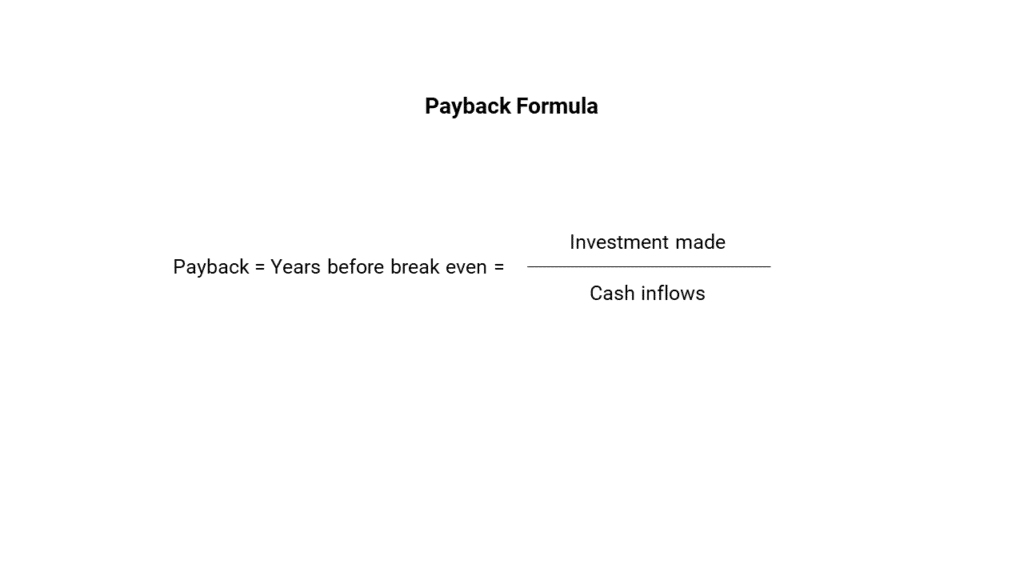

- How long will it take to pay back the company’s initial investment?

- Does the company have or can it raise the required capital?

Step 4: IF Conditions for Market Entry Are Good, Then Determine the Best Strategy to Use

You’ve decided the client in your case should enter the market.

Again, the decision of whether to enter the new market is only part of the answer. The company must decide how to enter it.

For a new product or service, they should ask whether they should:

- Create the capability to build the new product or provide the new service in-house?

- Partner with someone already in the market?

- Buy or license intellectual property?

For geographic expansions they need to ask whether they should:

- Export to the new market from their home country?

- Build a greenfield presence in the new country?

- Partner with a company that already has a presence in the target market?

- License their brand to franchisees?

Questions to ask when determining the best entry strategy:

- Are there barriers to entry in the market? Intellectual property? Regulatory approval?

- Can the company overcome these barriers on their own or will they need to partner to do so?

- How important is timing? Is there an advantage to early market entrants? How fast do they need to have a product in the market to win?

- Will partnering allow the company to enter significantly faster than building capacity in-house?

Example of The Market Entry Framework: KFC Enters China

Today, KFC has over 5,000 fast-food restaurants in China . It’s the most popular fast-food chain in the country.

How did the company enter the market to achieve this success?

When KFC first entered the China market, the success of southern-style American fried chicken in the China market was no guarantee.

The restaurant needed to transfer its successful North-American business model to the new market.

But it also needed to take into account different consumer tastes, find promotional advertising that would appeal to the Chinese consumer, deal with regulations that required that Western companies to partner with Chinese-owned companies in order to enter the market, and more.

Let’s look through the KFC China example using the market entry framework.

Yum! Brands first entered the China market in 1987. At that time, the China market was growing quickly. The country’s middle class was expanding and was receptive to western brands. The Chinese restaurant market was dominated by a large number of street vendors and small, family-owned, single-location restaurants. In comparison, growth in the North American market was slowing and there was a high level of competition from McDonald’s, Burger King, Wendy’s, Domino’s Pizza, and other restaurants. The Chinese market provided an opportunity to enter a market without well-entrenched national chains of fast-food restaurants and capitalize on the market’s growth.

KFC was positioned as the second-largest fast-food chain in the U.S. by number of stores . It had a winning formula of providing high-quality food at a competitive price and marketing it well. But KFC knew nothing about the China market. The company had to answer important questions like:

- How to tailor their menu to Chinese tastes?

- What segment of the market to target?

- Where to locate their restaurants?

- How to develop a supply chain in the country?

The challenge facing KFC can be seen by the fact that when they first entered the market, their popular slogan “finger lickin’ good” was mistranslated as “eat your fingers off.” Gaining insight into the Chinese consumer was a critical hurdle to success in this market. At that time, western companies had little experience with dealing in the Chinese communist government. But because the government required western companies to enter the market through joint ventures with Chinese-owned companies, KFC knew they would find help with these decisions by finding the right partner.

KFC considered entering the China market to be an important strategic investment to maintain its revenue and store growth despite high levels of competition in the North American market. Their success in North American meant they could allocate substantial funds to the market entry in China despite the fact that it would take years for their investment to pay off.

As mentioned above, KFC was required to partner with a Chinese-owned company. They found a partner that had strong connections with the Communist government to ensure that they would be able to overcome regulatory problems. Their partner also helped KFC to identify its target market as the middle-class consumer who was interested in western culture. Their sit-down restaurants had a reputation for cleanliness which helped to set KFC apart. In the early days, KFC restaurants also leveraged the fact that they were a unique and exciting experience, a view into American culture. KFC China’s menu includes many items an American customer would not be familiar with, such as lotus roots, congee, and soy sauce wings. The restaurant had a 40-page menu because of the Chinese consumer’s preference for variety. Their promotion was tailored to focus on elements that the local culture valued, such as respect, love, and support for the elderly. The chain’s success in China depends not only on the taste of its food and its advertising, but also on the speed and convenience of its service. These attributes were as important to winning in the China market as tasty chicken. Yum China has been so successful that it has been spun off from YUM! Brands as separately listed stock on the New York Stock Exchange.

Tips On Using The Market Entry Case Framework

1. look for market entry cases buried inside other types of case study interviews..

If a company is looking for growth, market entry is one way they might achieve it, so your revenue growth case could turn into a new product or new geographic market case.

2. Ask your interviewer questions and take good notes on their answers.

Market entry cases require a lot of data–market growth, cost of entry, client capabilities. You’re likely to miss important information if you try to solve the case just through brainstorming and your own knowledge of the industry. Don’t be afraid to ask questions.

3. Don’t only consider whether the target market is attractive .

Look at all 4 elements of the market entry framework. Entering an attractive market without the right capabilities will lead to substantial losses and a CEO being fired.

4. Identify alternative market entry strategies and evaluate one relative to another .

For example, compare the advantages of a greenfield operation (full control over the business model and quality) versus partnering with a company with a presence in the local market (knowledge of the local consumer, speed). The comparison of one entry strategy to another can make the best choice clear quickly.

Additional Resources to Help You With the Market Entry Framework and Cases

This McKinsey article: Beating the Odds in Market Entry is a great resource for those who want to dig deeper on this subject.

In this article, we’ve covered:

- What market entry case interview looks like,

- Breaking down the framework into 4 easy steps,

- A market entry case example,

- Tips on using the framework, and

- Additional resources to help you with the market entry framework and cases.

Still have questions?

If you have more questions about market entry, leave them in the comments below. One of My Consulting Offer’s case coaches will answer them.

Other people prepping for consulting case interviews found the following pages helpful:

- Common Types of Case Interviews

- The Profitability Framework

- Case Interview Frameworks

- Business Situation Framework

- Market Sizing Cases

- M&A Case Study

- Revenue Growth Case Interview

- Cost Reduction Case Interview

- Pricing Case Interview

Help with Case Study Interview Prep

T hanks for turning to My Consulting Offer for advice on the market entry framework. My Consulting Offer has helped almost 89.6% of the people we’ve worked with get a job in management consulting. We want you to be successful in your consulting interviews too. For example, here is how Emma was able to get her offer from Bain.

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

© My CONSULTING Offer

3 Top Strategies to Master the Case Interview in Under a Week

We are sharing our powerful strategies to pass the case interview even if you have no business background, zero casing experience, or only have a week to prepare.

No thanks, I don't want free strategies to get into consulting.

We are excited to invite you to the online event., where should we send you the calendar invite and login information.

Mastering the Market Entry Framework for Case Interviews

Table of contents.

Consulting firms use a special type of interview, called a case interview , to test whether candidates have the skills to understand and solve real business problems.

One common example of a case interview question is a market entry question. And this covers both launching new products and entering new geographies, so it’s considered one of the most challenging types of case interview questions.

In this article, we will teach you how to recognize and ace market entry case interview questions. And you can also check out our guide to profitability case interview questions too.

Overview of the market entry framework

What is a case interview framework.

A framework is a template that can be applied to break down and solve case study questions. It aids candidates by giving them a clear approach to resolving the case question they are given.

However, frameworks are just a starting point. They should be customized according to your own thinking and understanding of the case question.

What is the market entry framework?

Market entry framework is a tool to assess and evaluate the viability of entering a new market for a company, this could be the development of a new product or entry into a new geography.

There are 2 main types of market entry cases:

- Geographic Entry : These types of cases ask the candidate to evaluate whether a company should venture into a new geography. For example, standard expansion, joint ventures, mergers, and acquisitions. For example, Lyft might want to venture into Europe or Amazon might want to expand its business into Asia by purchasing a local distributor.

- Product Entry: These types of cases ask the candidate to evaluate whether a company should diversify its product range or launch a new product line. For example, Pepsi Co might be looking to expand into the alcoholic beverages market or Tesla might be looking to expand into the airline industry.

How to apply the market entry framework

There are four steps to apply to the market entry framework in a case interview, including:

- Desirability: Do we want to enter the market?

- Feasibility : Do we have the right people, processes, and technology to enter the market?

- Viability : Can we make the market entry business case work?

- Execution plan : How do we enter the market?

Step 1. Assess the target market (desirability)

The first step is to assess if you should be entering the new market. You should ask questions like:

- How big is the revenue opportunity?

- Is the target market growing and how quickly?

- Are there desirable customer demographics in the target market?

- What is the competitive landscape in the target market?

- What stage of the industry lifecycle is the market in?

- What share of the market can we reasonably expect to capture?

Step 2. Evaluate internal capabilities (feasibility)

The second step is understanding whether our company has the internal capabilities to enter the market successfully. You should ask questions like:

- Are our current product offerings / new product offerings suitable for the target market?

- Do we have an appropriate organizational structure and operating model for the target market?

- Do we have sufficiently robust processes to scale up successfully?

Step 3. Analyze investment case (viability)

The third step is determining whether it makes economic sense to enter the new market. You should ask questions like:

- What are the estimated costs and revenue of entering the new market?

- What is the forecast payback period for any investment?

- What is the expected ROI of entering the new market?

- What are the main risks? (e.g. technological, legal, etc)

Step 4. Build an execution plan

Once you have identified and shared key considerations for market entry to your interviewer, they will often ask you how the company should enter the market.

To answer this accurately, you need to build an execution plan.

The execution plan requires you to synthesize all the information you have gathered so far and make recommendations as to how the company should enter the market.

The key questions you should answer in your execution plan include:

- How should you expand into the new market? In the case of a product expansion question, this is build vs partner vs license. And in the case of a geographic expansion question, this is expand organically (greenfield) vs enter a joint venture vs partner vs acquire a competitor.

- What is the timeline? Propose a timeline for entering the market based on the market and competitive dynamics.

Download 183 practice case interviews and over 851 pages of interview guides

The ultimate case study preparation package. Download practice cases from McKinsey, BCG, Bain, Harvard, Kellogg, Columbia, INSEAD, Cornell, and more!

Example market entry case interview questions

Example 1: grocery chain.

A grocery chain in New England is considering offering an Internet delivery service (i.e., groceries can be ordered via the Internet and delivered directly to your home). Including the client, there are three main grocery chains in the area. One of them has already entered the Internet market. The only other grocery store currently offering Internet delivery service in the U.S. is a Midwest store.

Should the client enter this market? If so, what issues would they face? If not, how should they protect their market share?

Example 2: Corn feed company

A corn feed company has eight manufacturing plants located in the Midwest. These plants service the entire United States. Their plant in Ohio is in need of refurbishing. The company has four possible options:

- Refurbish the existing plant

- Build a larger plant at the current location

- Build a similar size plant at a new location

- Build a larger plant at a new location

Which is the best option for this plant?

Example 3: Gas manufacturer

Your client is a gas manufacturer. Currently, the client owns and operates its gas plants nationwide. They have hired you to investigate whether they should enter into the business of running 3rd party gas plants. How will you structure the analysis of this case? Should the client enter or not enter into this business?

Example 4: Construction firm

An overseas construction firm wants to expand by establishing a presence in a growing U.S. regional market. What factors should it consider? How should it go about doing this? What factors are critical for its success?

Example 5: Chicken vitamin manufacturer

Your client is a chicken vitamin manufacturer. The vitamin helps increase the size of chicken breasts and reduce fat content. Should they enter China?

Example 6: Travel agent

An Israeli travel agent has been extremely successful. His primary source of revenue is customers who fly to and from the U.S. He manages to fill up over two planeloads on a daily basis. Given his success, he is considering buying an aircraft and flying the U.S.- Tel Aviv route himself. What advice would you give him?

Example 7: Food processing company

You have been hired by a food processing company that recently introduced a new hot dog to the market. Sales in the first two weeks have far exceeded the marketing department’s projections. Your client thinks he may need to add more capacity. What advice would you give him?

Example 9: Airline

A major American airline is considering establishing new routes from Tokyo to several sites in the United States. Would you recommend this action to your client?

Market Entry Case Studies - A Comprehensive Overview

Market entry cases are a recurring theme in the management consulting interview process.

This is because consultants will frequently deal with market entry when working on real projects – which in turn means they are likely to base interview case studies on recent market entry work.

Releasing new products and entering new markets is fundamental to growing any business over time. Thus, CEOs across all sectors will be consistently confronted with market-entry issues - many of which then prove complex enough to mean bringing in the consultants!

Whilst this article will aim to give you a clear overview of market-entry theory and methods , a fully exhaustive treatment is impossible here. For a comprehensive view of market-entry and related issues, your first stop should always be our MCC Academy course .

Market entry: definition

So, what exactly is market entry?

In very simple terms, it’s exactly what you would expect: the process by which a company enters a new market.

In practice, things are a bit more complicated. However, the fundamental principle that the company is getting itself into a novel situation remains. Market entry scenarios (and implicitly market entry cases) can be divided into the following broad categories:

Geographical scenarios: when a company is trying to introduce a product in a new geographical region. An example of this would be Red Bull moving into the US market.

Product diversification scenarios: when a company is introducing a new product to an existing market. The attempts by Xerox to sell computers to their customers is one such instance.

New customer segment scenarios: when a company targets a new segment of an existing market with its products. For example, if Old Spice made a fragrance for women.

Covert Market Entry Cases

As mentioned, because market entry cases are interconnected with growth, you might come across an ‘incognito’ market entry case, where a consideration of market entry is necessitated to solve the initial problem.

This means you might come across a question - such as “How can Heineken increase its revenues?” - which is not explicitly about market entry, but for which any one of the market entry scenarios could be applied.

Old fashioned market entry frameworks can be hard to adapt to these trickier “hybrid” cases.

This general problem where idealised frameworks encounter complex cases is why we at MCC always teach you how to structure your answers for yourself - so that you can logically break down the questions you are given and deal with any market entry aspects in a flexible manner to fit the particular scenario.

What to consider when thinking about market-entry?

A typical market entry case might sound like this:

Ecobank is a South African bank looking to expand by moving into the Congo? Should they do this?

So, how should we tackle it?

As always, the most important thing to remember is that each unique case requires its own unique approach, tailored specifically for the situation at hand .

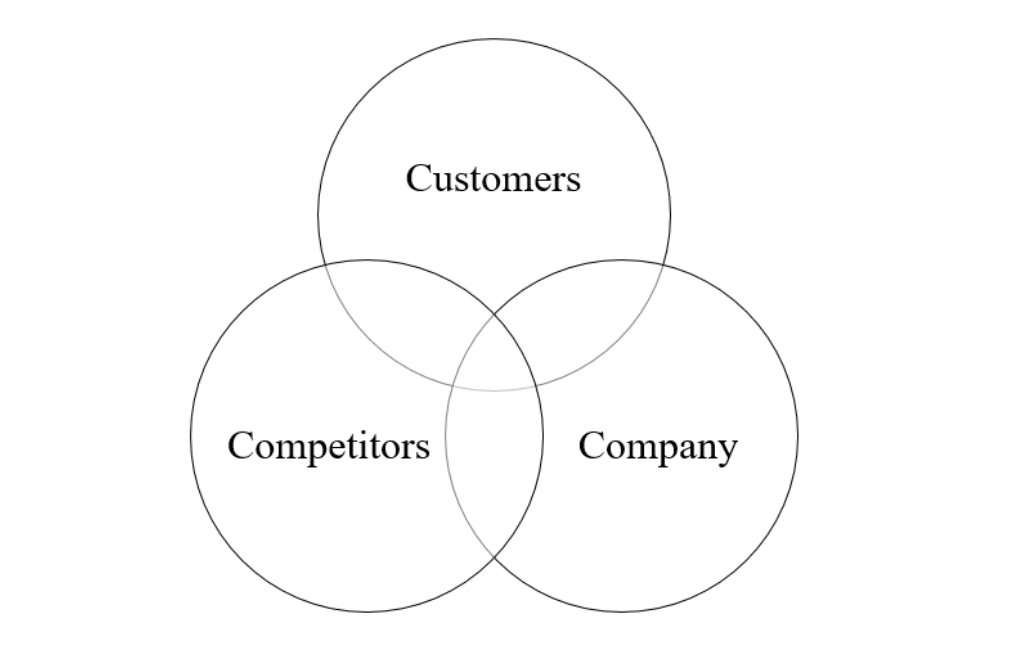

However, there are a few elements that recur in most market-entry cases and that are helpful when tailoring our analysis. Thus, we need to consider:

- The Company

- Strategies to enter the market

We’ll give a brief primer on each of these three elements over the rest of the article.

1.The Market

The first step for a company in any market entry scenario is to understand the market it’s engaging with.

In the real world, businesses continuously engage in market research, using different techniques in order to appreciate their market context.

For an example of how this then applies in a market entry context, McKinsey recommends having a reference class of previous entrants to similar (and sometimes different) markets. By doing so, companies can analyze the results of this class of previous entrants and draw better conclusions regarding the potential outcome of their endeavor.

McKinsey give the Segway as a case of failed market entry that could have been prevented. The company failed to anticipate that Segways would be confined to running on pavements rather than roads. Ultimately, they sold only 6000 units in its first 21 months as opposed to the 10,000 per week they had predicted.

If the sellers had evaluated a reference class including not only vehicles such as automobiles, fuel cell cars, hydrogen cars, but also technologies that were dependent on infrastructure like high-definition television and telephones, then Segway’s market entry might have been more successful.

However, these studies take time and money, so companies have to consider carefully what areas to inquire into.

In the same way you, in your case interview, need to think through what questions you want to ask about the market.

An unstructured, “laundry list” approach, where you just ask whichever questions come to mind will most likely irritate the interviewer. In the real world you need to be efficient when gathering expensive-to-acquire data, so asking efficient questions in the interview will be strong evidence that you can do so when it matters as well.

1.1. Market size

The first thing to determine is the size of the market being targeted. In some interviews this might be given to you as an existing figure. However, you will often have to estimate market size (read in our article on estimation ).

For example, imagine a company producing confectionery wants to expand its ice-cream business into the city of Milan. Before it does so, it needs to evaluate the potential client base.

You might start by guessing the population of Milan and then dividing it into people who are lactose intolerant (and therefore cannot eat ice-cream) or people who do not like ice-cream and people who are not lactose intolerant and do like ice-cream. You can make the assumption that each category is about 50% of the total population (remember to sense-check later). One segmentation might look like this:

Of course, there will be more than one way to segment and you will have to determine which one is most appropriate for your case. In the example above, for instance, you could have opted for a segmentation based on the age of population. As discussed in our full-length article on segmentation , make sure always to use a MECE segmentation scheme.

1.1.1. The Market Cycle and Growth

Market size is seldom static. Once you have determined (or have been given) the market size, you will have to understand how it will change over time – that is, you need to determine the market growth rate .

For example, a tech company seeking to launch a new smartphone can calculate current global demand for handsets, but will also need to factor in likely future demand as consumers in developing economies become wealthy enough to afford to buy.

Typically, the interviewer will be able to provide you with information on market growth on request.

A market goes through several phases and usually, the further along in its life cycle it is, the less likely it will be for the company entering it to make profits.

Therefore, a market early in its life cycle presents more opportunities for entrants . For example, Apple registered huge revenues with its pioneering entry into the smartphone market.

Normally, a company should avoid entering a declining phase, as this means that consumer demand for a certain service or product is dwindling or new alternatives have rendered it obsolete.

However, fast-growing markets also experience severe shakeouts – which means that, after a period of massive expansion, one of consolidation generally follows. At this stage, bigger, stronger companies use their resources to acquire or get rid of weaker ones.

Additionally, the first mover’s advantage – that is entering a certain market before the competition does – will not always translate to higher profits .

Rather, there is a high chance that companies entering later will learn from the mistakes of the first movers. Later entrants will then leverage that negative experience into improving their product, which will likely lead to higher profits.

While Google’s position as the search engine might seem perennial, in fact it climbed to the top by learning the does and don’ts from pioneers like Altavista and Ask Jeeves.

1.2 Market dynamics

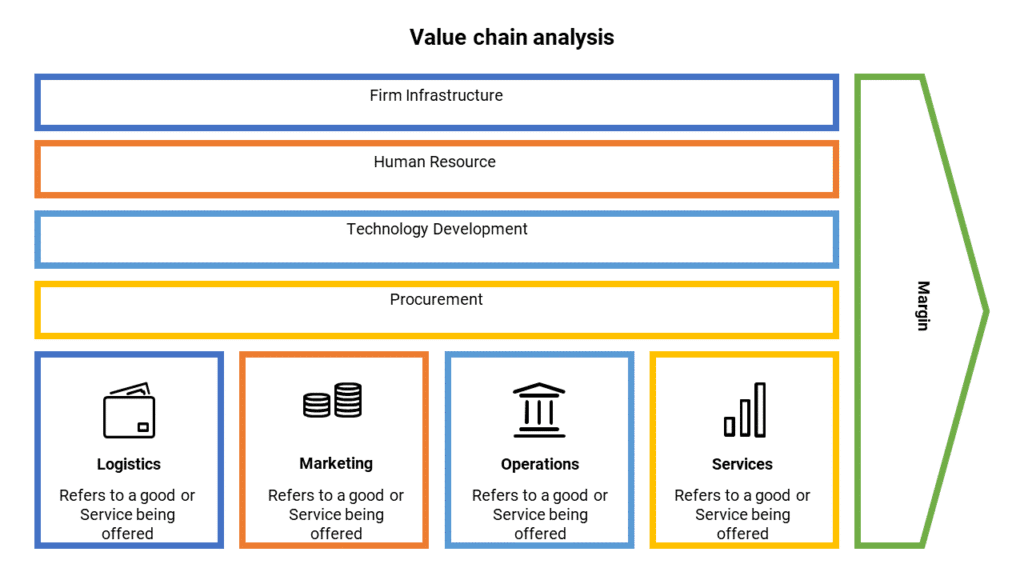

Economist Michael Porter argued that, to understand a market, you need to understand the various forces that can put pressure upon it and how they function. He divided these up into five forces:

- Buyers’ power

- Suppliers’ power

- Threat from substitutes

- Threat from new entrants

- Industry rivalry

Porter’s idea can be captured visually as follows:

Let’s look at what each of them means and how they interact with one another and the market as a whole.

1.2.1 Buyers’ power

The main things you need understand about buyers when entering a new market are:

How many there are

Whether the products they are purchasing are generally available (commodities) or unique

These factors are significant in establishing the influence that buyers can have on the market. As Porter explains, there are a few scenarios in which buyers’ power is high. These include:

When buyers purchase in bulk, their purchase power is concentrated . For example, large soft drinks manufacturers purchasing aluminum cans have the upper hand because they buy in bulk and can dictate the price.

When the products they purchase are not differentiated and therefore can be sourced from multiple suppliers. For example, in the steel industry, the product is virtually identical and can be bought from many manufacturers.

When the products purchased make up a high fraction of the cost of the buyers’ own product . Naturally, in this scenario, the buyer will be very conscious about the price, as it will impact their own pricing as well. For a car manufacturer, the more expensive the steel the car is made of, the more expensive the car. This will mean suppliers will have to keep prices low to attract any purchases in the first place.

1.2.2 Suppliers’ power

The same three factors are equally important when considering suppliers:

Their number

How big they are

Whether they are dealing in unique products or commodities

These also determine buyers’ power in the market. According to Porter, buyer’s power is high when:

There are only a few suppliers and they are concentrated . Again, the soft drinks market is a perfect example of how a few major players can dictate prices. Companies that bottle soft drinks have very little choice when determining their suppliers and must accept the price they dictate.

Suppliers offer a differentiated product and/or the switching costs to a different product are high . Where a school’s entire teaching infrastructure is built around Google Classroom, associated costs will make them reluctant to switch to a different product.

Suppliers are not forced to compete with other products. For instance, furniture manufacturers can choose whether to make tables out of steel or aluminum, which keeps in check the prices of companies producing each metal.

For a detailed analysis of the power of buyers and suppliers, check out the Marketing 101 and Strategy 101 sections of the MCC Academy .

1.2.3 Threat from substitutes

The existence of substitutes or alternatives to products will also determine the profitability of a market. The existence of one or more substitutes can cause the industry to plateau and eventually decline.

For example, cash is a potential substitute for credit cards but presents a low threat to the credit card industry since it is to be expected that technological advances will eventually render it obsolete.

However, mobile pay platforms such as PayPal and TransferWise might eventually cause credit card usage to decline and with it the industry.

1.2.4 Threat from new entrants

The potential entry of new players in the market can also lead to its destabilization.

For example, with the arrival of the iPhone, the mobile phone market had to re-prioritize to face the new threat. Nokia , an industry giant, then holding 51% of the market, failed to do so, nearly went bankrupt and was eventually acquired by Microsoft.

However, market destabilization is highly dependent on the type of industry and the barriers that are set in place for those wishing to enter . The size of these barriers determines whether new players will have a hard or an easy time on the market.

For example, the pharmaceutical industry is very profitable, but has a high barrier for entry in the form of regulatory practices. New medicines need to be tested thoroughly, in turn leading to long delays and high manufacturing costs.

Alternatively, the food market has relatively low barriers to enter, hence the constant emergence of new food trucks and delis.

Let's have a closer look at some of the main barriers to entry in a market, as identified by Porter:

1. Costs

Entry to certain markets is impeded by high initial costs , which may be difficult or impossible to recover. These take the form of capital expenditure for new facilities, R&D and advertising, but also come from coming up against economies of scale .

In other words, incumbent companies might have concentrated so many resources (in production, research, marketing etc.) that they will be able to produce at minimal cost.

Additionally, companies new to a market may incur other costs related to a steep learning curve, which incumbents will not.

An example of a market with high-cost entry barriers is the computer manufacturing industry, where the costs or research and development are very high.

2. Branding

In certain industries, market entry will be made difficult by brand loyalty , where new companies will have to incur significant costs to overcome the inertia of customer loyalty.

In the soft drinks world, players like Pepsi and Coca-Cola dominate the market and have well established brands. Market entrants will need to differentiate their product in some way – such as Dr Pepper’s emphasis on its unique flavor.

3. Access to distribution channels

New companies will need access to means of distribution, which can prove difficult if competitors monopolize them.

The only way out in some situations would be for the new entrant to create its own distribution network , which may prove very costly and negate potential profits.

Timex is an example of a company which met with such high distribution costs that it had to develop its own network.

4. Government regulations

Governments may restrict access in the case of certain markets by requiring licensing (such as in the alcohol industry) or limiting access to raw materials.

Legislation can also indirectly deter market entrants through environmental legislation or safety regulations, as we saw above for the pharmaceutical industry.

1.2.5 Industry rivalry

One of the most important things to understand when considering market-entry is potential competition and degree of market fragmentation.

There two paradigm kinds of market are:

Fragmented markets

Concentrated markets

Fragmented market

In a fragmented market, there are many players and each controls a small portion of the market . Typically, barriers for entry are low and the market is very competitive if players don’t differentiate between their products.

The retail clothing market is a good example of a fragmented market. There are many brands, with none really having monopoly of the market and offering similar types of apparel, which sparks competition. Raw materials are also easy to source and available from many sellers.

Below is a pie-chart showing a hypothetical fragmented market:

Concentrated market

In a concentrated market, there are few players controlling most of the market , usually with high barriers for entry . Players might engage in price wars or, alternatively, try to control a specific segment of the market. The soft drink market is a good example here again.

Here’s what concentrated markets typically look like:

It is important to understand what competitors do well and what they specialize in, since you will have to analyze them in comparison to your client’s company.

A good idea is also to look at what share of the market your competitors control, so that you have a realistic idea of what market share your company can hope to gain.

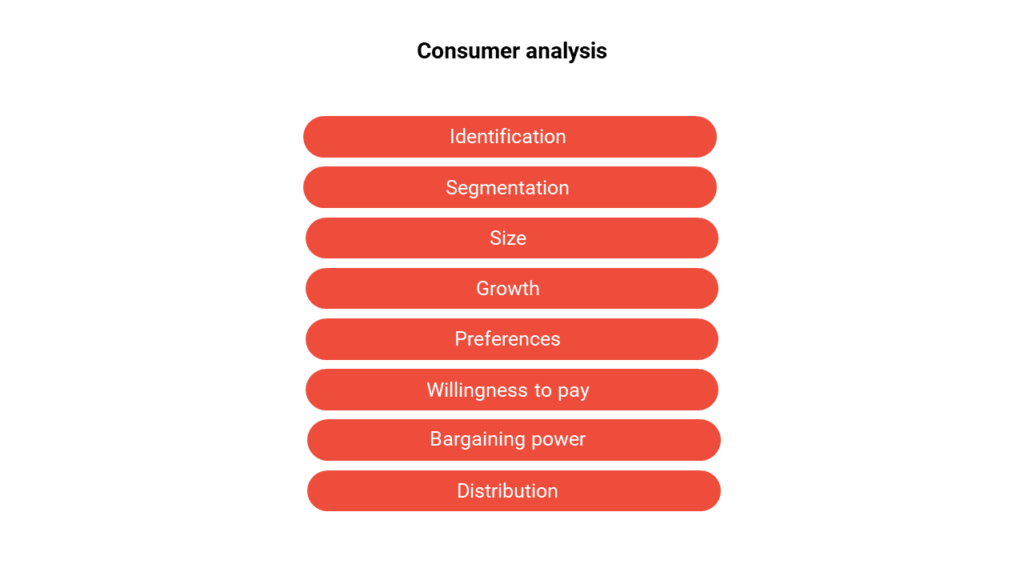

1.3 Customers

Customers are possibly the most important factor when considering market-entry, since they are at the center of most of company strategies.

You should get a good grasp of who the customers are in the proposed market, how they behave and what they look for.

This crucial information will then be used in conjunction with information you have about the company to determine whether the market is a good fit (see below).

You will likely also need to segment the market appropriately to determine where the company should operate, given its strengths and weaknesses.

For example, if your client is a domestic European airline known for low prices seeking to expand operations to service North American routes, you will most likely target customers looking to travel on a budget.

2. The Company

As a consultant, after you've understood what kind of market you’re dealing with, you must turn your attention to the client. There are three aspects you should consider:

Company profile

Essentially you want to understand the company’s brand , what it’s good at and how it’s perceived by customers.

For example, Coca-Cola is a top player in the soft drinks industry, with extensive experience producing and selling soft drinks. Its very strong brand image means customers generally consider it to be number one fizzy drink.

The value proposition

Here, you will want to determine what value the company needs to bring in order to enter its proposed market, as well as what skills are necessary to enter it and whether the company possess them.

Then you will want to determine whether the company’s brand and values are in line with those of its targeted consumers .

For example, a new energy drink company might struggle in targeting the Californian market, where a large fraction of consumers are very health conscious.

Similarly, Starbucks failed to penetrate the Australian market because, for Australians, Starbucks' offerings were simply too expensive. Furthermore, customers had a strong preference for smaller, local alternatives.

Capabilities and targets

Crucial here is what the company’s objective is and whether it would be able to compete in the proposed market. Would the costs of entering the market still allow for profitability?

Say a new soft drinks company wants to enter the global market and sets a market penetration target of 20% in the first year. However, the top two companies in the industry each hold close to that percentage of the market. This clearly wouldn’t be a realistic objective.

Here, information about previous attempts to enter the market from companies with similar profiles would be useful for comparison. Again, the interviewer can provide this information.

3.Strategies to enter

If, after evaluating these two main criteria, you decide that market entry is the right thing to do, you then need to consider your entry options.

There are three main possibilities:

Enter the market organically

Merge with, acquire or conduct a joint venture with another company already in the market

Enter through a distributor

Let’s have a look at the pros and cons of each of these systematically – just like consultant!

Organic entry

Pros : Although this means that you will enter the market without any prior contact with it, you will be in complete control over the strategy you formulate and how the company operates.

Cons : Organic entry will require significant capital expenditure – you need to make sure that your company has the capabilities (financial and otherwise) necessary for this effort. It will also be much slower than the other two options.

Uber launching on the Chinese market is an example of such organic entry.

Pros : The advantages of acquiring an existing player in the market would be that the company still retains control and it is a fast way of penetrating the market. The situation would be similar in the case of a merger, although control would be more equivocal. A joint venture would also be a quick route to entry, entailing even lower costs.

Cons : The disadvantage of a merger or acquisition would be the potentially high costs of the process, as well as the ability to fully integrate the two companies and take advantage of any synergies between them. In the case of a joint venture, the main disadvantage would be the possibility that the two companies will not see eye to eye on strategy and operations and therefore will not work well together.

Many law firms choose the M&A route to gain quick access to markets by partnering with local firms.

Selling through a distributor

Pros : If you decide to sell through a distributor you will reduce costs whilst accessing the distributor’s existing network and connections.

Cons : You will have very little direct control over strategy and operations and there will be less opportunity for you to prioritize your product if the distributor is acting on behalf of more than one company.

For example, Apple chose to use IStyle as a distributor to enter the Romanian market rather than build its own distribution chain from scratch.

Formulating a strategy

Once you’ve decided that your company needs to go through with market-entry and have decided which option to go with, you will need to determine your actual strategy.

Bear in mind that, depending on which of the three options you choose, there will be more or less scope to implement this strategy. For now, let’s assume that you’ve decided to enter the market organically.

Three key things you’ll have to consider when devising an actual marketing strategy are:

Segmentation

Positioning.

This means you’ll start off by breaking up the population of a target market into consumer groups. This can be done in several ways, such as:

Demographics

For example, Starbucks, trying to enter the Italian market, might divide the population as follows:

In this case, we have opted for a need-based segmentation that will allow you to take the next step, which is target your customer group.

There are several elements to consider here:

Size – is the segment we want to target big enough and will it generate the revenue that the company is looking for?

Profitability – how profitable is the targeted segment?

Growth – is the segment of the market chosen growing or shrinking?

Fit – does the segment fit with what the company offers and its strengths?

A company could, of course, choose to cater to the entire market but this would be difficult and generally undesirable . Think of Nokia again, who couldn’t figure out what its customer base was after the emergence of smartphones and got ‘stuck in the middle’, trying to do everything and eventually losing its position.

Let’s say Starbucks has decided to target the segment of regular drinkers since, it’s both the most profitable (pretty much everyone in Italy frequently drinks coffee) and fastest growing.

Taking all these factors into consideration and learning from its mistakes in Australia, Starbucks has decided it can’t compete with local coffee shops in price and wants to instead position itself as a premium coffee seller. As such, it will further target the high-revenue consumers (who make over 35k a year) who drink coffee regularly – primarily time poor business people who will benefit most from Starbucks' fast, quality service.

This article is a great primer, and gives you a solid introduction into to the key ideas around market entry theory. As such, it should be immediately useful when practicing market-entry case studies.

However, if you want to perform in top level interviews, you are going to need more detailed knowledge and to learn how to apply it. In particular, you will have to deal with more complex cases, where market entry overlaps with other concerns.

This is where generic frameworks fail most notably. They might (perhaps) cover simple, idealized cases, but real-life scenarios are never so clear cut – and navigating this complexity is how consultants earn their fees! So, in order to cope with tough questions in interviews for top firms, you need to be able to cope with realistically complex, unique cases.

Learning How

The MCC Academy is your ideal tool here! It is a structured course that will provide you with all the detailed knowledge you need in order to solve these more demanding cases, including business fundamentals in its Case Interview Foundation and Building Blocks sections.

You will also need to practice seriously to form the mental muscle memory necessary to quickly structure and solve cases. Our extensive case library and meeting board give you the opportunity to practice both individually and with other applicants.

Work with the Pros

However, while practicing with peers is useful, there’s only so far you can get when neither of you has any real consulting experience.

The best way to practice is with a real consultant, and our coaching program provides you with a way to do just that! It is designed to give the best possible interview preparation and feedback by MBB consultants with at least two years of experience in the field.

All of this prep that’s required might seem like a lot to take in – especially if you are working or studying at the same time. Fear not, though! Our comprehensive mentoring program will streamline everything for you!

It is the full package, making most efficient use of your time by having an MBB consultant plan and oversee your entire prep–from planning your CV and cover letter to learning business fundamentals, through to final case practice.

Candidates who sign up to our free services are 3 times more likely to land a job in one of their target firms . How?

- We teach how to solve cases like consultants , not through frameworks

- Our Meeting Board lets you practice with peers on 100+ realistic, interactive cases.

- Our AI mentor creates a personalised study roadmap to give you direction.

- All the advice you need on resume, cover letter and networking.

We believe in fostering talent, that’s why all of the above is free .

Account not confirmed

Hacking the Case Interview

Case interview frameworks or consulting frameworks are arguably the most critical component of a case interview. Outstanding case frameworks set you up for success for the case while poor frameworks make the case difficult to solve.

Struggling on how to use frameworks in your case interviews? Unsure of which frameworks to use?

Don't worry because we have you covered! We'll teach you step-by-step, how to craft tailored and unique frameworks for any case interview situation.

By the end of this article, you will learn four different strategies on how to create unique and tailored frameworks for any case interview.

Strategy #1: Creating Frameworks from Scratch

- Strategy #2: Memorizing 8 – 10 Broad Business Areas

- Strategy #3: Breaking Down Stakeholders

- Strategy #4: Breaking Down Processes

- Strategy #5: Two-Part MECE Frameworks

You will apply these strategies to learn how to create case frameworks for the six most common types of case interviews.

Profitability Framework

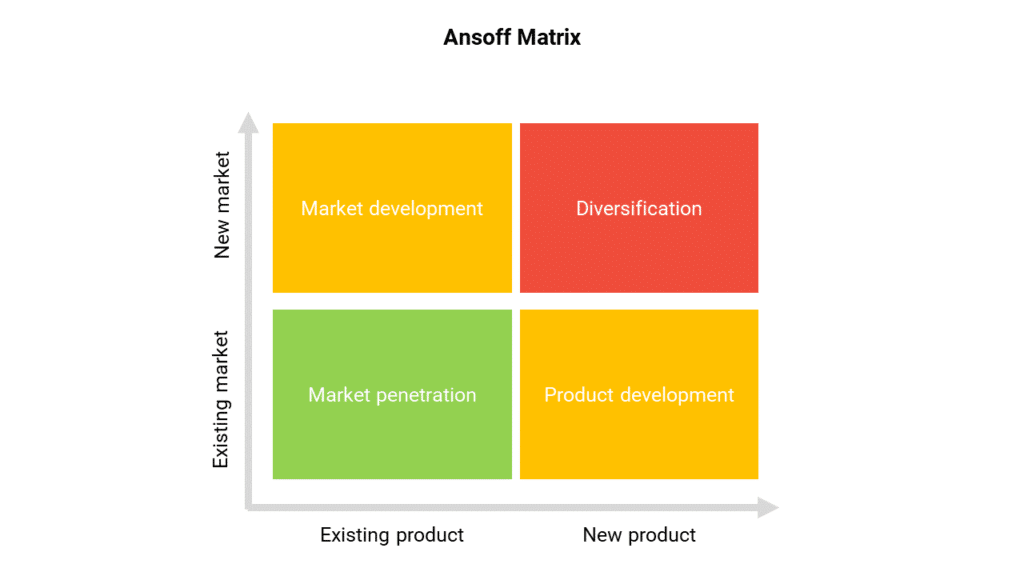

Market entry framework, merger and acquisition framework, pricing framework, new product framework, market sizing framework.

You will also learn six consulting frameworks that nearly every consultant knows.

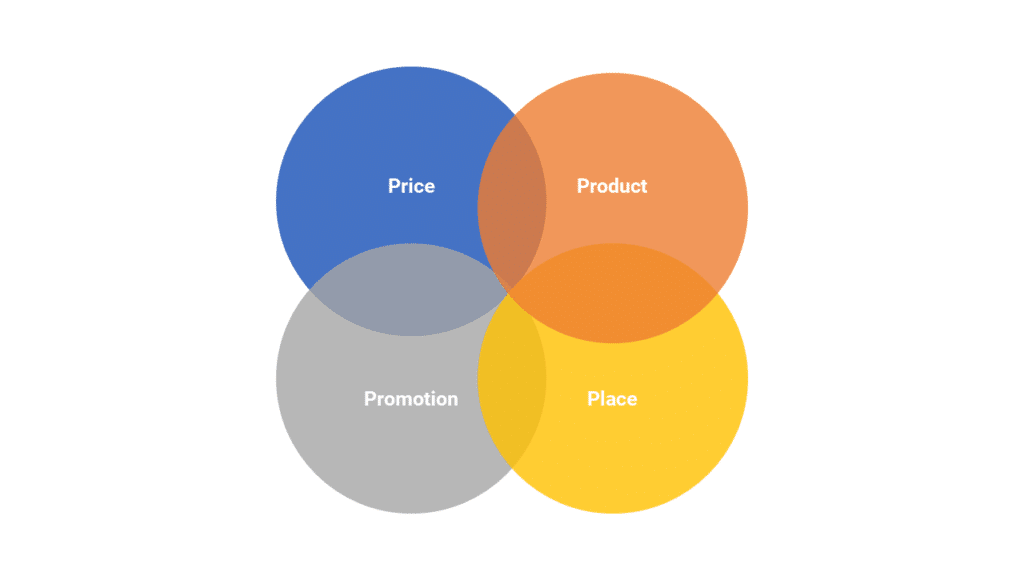

Porter’s Five Forces Framework

Swot framework, 4 p’s framework, 3 c’s / business situation framework, bcg 2x2 matrix framework, mckinsey 7s framework.

If you’re looking for a step-by-step shortcut to learn case interviews quickly, enroll in our case interview course . These insider strategies from a former Bain interviewer helped 30,000+ land consulting offers while saving hundreds of hours of prep time.

What is a Case Interview Framework?

A case interview framework is simply a tool that helps you structure and break down complex problems into simpler, smaller components. Think of a framework as brainstorming different ideas and organizing them into different categories.

Let’s look at an example: Coca-Cola is a large manufacturer and retailer of non-alcoholic beverages, such as sodas, juices, sports drinks, and teas. They are looking to grow and are considering entering the beer market in the United States. Should they enter?

In order for you to decide whether Coca-Cola should enter the beer market, you likely have many different questions you’d like to ask:

- Does Coca-Cola know how to produce beer?

- Would people buy beer made by Coca-Cola?

- Where would Coca-Cola sell its beer?

- How much would it cost to enter the beer market?

- Will Coca-Cola be profitable from selling beer?

- How would Coca-Cola outcompete competitors?

- What is the size of the beer market in the United States?

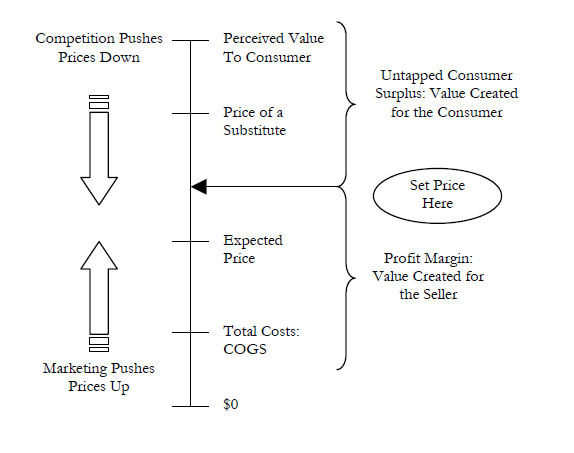

This is not a very structured way of thinking through the case. The questions are listed in no particular order. Additionally, many of the questions are similar to one another and could be grouped together.