Start my free trial

Please fill out the form below and an AlphaSense team member will be in touch within 20 minutes to help set up your trial.

Equity Research Reports: A Complete Guide

Equity research reports are documents prepared by equity research analysts that provide insights on whether investors should buy, hold, or sell shares of a public company. For anyone looking to stay up-to-date on market and industry trends, equity research is a crucial and differentiated asset.

In this guide, you will learn about the type of information contained in equity research, the value it offers to corporate professionals, and how the most advanced teams are already leveraging the expertise of Wall Street’s top analysts to inform critical business decisions.

Introduction

Equity research, which forms a multi-billion dollar industry for investment banks, is produced by thousands of analysts worldwide to provide the market with valuable information on companies, industries, and market trends. Today, over 90% of equity research is consumed by fund managers, who have the Wall Street relationships to acquire it and the analyst resources to mine it for insights. For corporate strategy professionals who lack this access, however, equity research has historically been challenging to obtain and navigate.

To help corporations circumvent these challenges, AlphaSense has introduced Wall Street Insights, the first and only equity research collection purpose-built for the corporate user. Through the AlphaSense platform, any business making strategic plans or product decisions, conducting competitive analysis, evaluating M&A, or engaging in investor relations can now tap into the deep industry expertise of Wall Street’s top analysts.

What is Equity Research?

Equity research is developed by sell-side firms to help investors and hedge fund managers discover market opportunities and make informed investment decisions. Increasingly, this expert analysis has also been identified by forward-looking corporations as a highly valuable tool to inform strategic decision-making.

There are thousands of sell-side firms that employ expert analysts around the globe to write equity research for the market. The majority of firms producing equity research are hyper-focused and only have one or two analysts developing reports on a specific industry. However, larger firms, such as Morgan Stanley and Bank of America, collectively employ thousands of analysts to write reports on thousands of public companies–covering everything from TMT giants to niche products.

Equity research analysts are deep subject matter experts who are often former executives, industry veterans, or academics. These analysts conduct in-depth research and publish reports on corporations, industries, and macro trends, offering an expert lens into a subject.

Historically, over 90% of equity research was consumed by buy-side fund managers, who had the Wall Street relationships to acquire it and the analyst resources to mine it for insights. For buy-side professionals, equity research is a critical tool to inform sound investment decisions backed by expert insights.

Today, equity research is increasingly relied upon by corporate teams as a high-value source of information. These teams leverage equity research to make strategic business plans, conduct competitive analysis, evaluate mergers and acquisitions, and make product and marketing decisions. For corporations, the value of equity research lies in the detailed coverage of their company, their competitors, and how they are performing related to the marketplace they are within.

What is an Equity Research Report?

An equity research report is a document prepared by an equity research analyst that often provides insight on whether investors should buy, hold, or sell shares of a public company. In an equity research report, an analyst lays out their recommendation, target price, investment thesis, valuation, and risks.

There are multiple forms of equity research, including (but not limited to):

An update report that highlights the latest news, company announcements, earnings reports, Buy Sell Hold ratings, M&A activity, anything that impacts the value of the company.

A comprehensive company report that is compiled when an analyst or firm initiates their coverage of a stock. Initiation reports cover all of the divisions and products of a company in-depth to provide a baseline of what the company is and how it is performing. Initiation reports can be tens to hundreds of pages long, depending on the complexity of a company.

General industry updates that cover a group of similar companies within a sector. Industry-specific reports typically dive into additional factors such as loan growth, interest rates, interest income, net income, and regulatory capital.

A report compiled by research firms either daily or weekly. These reports can often be a great place to get more in-depth insight on commodities and also get market opinions from commodity analysts or traders who write the reports.

A quick 1-2 page report that comments on a news release from a company or other quick information

What is Included in a Typical Equity Research Report?

Research reports don’t need to follow a specific formula. Analysts at different investment banks have some latitude in determining the look and feel of their reports. But more often than not, research reports follow a certain protocol of what investors expect them to look like.

A typical equity research report includes in-depth industry research, management analysis, financial histories, trends, forecasting, valuations, and recommendations for investors. Sometimes called broker research reports or investment research reports, equity research reports are designed to provide a comprehensive snapshot that investors or corporate leaders can leverage to make informed decisions.

Here’s a quick overview of what a standard equity research report covers:

This section covers events, such as quarterly results, guidance, and general company updates.

Upgrades/Downgrades are positive or negative changes in an analyst’s outlook of a particular stock valuation. These updates are usually triggered by qualitative and quantitative analysis that contributes to an increase or decrease in the financial valuation of that security.

Estimates are detailed projections of what a company will earn over the next several years. Valuations of those earnings estimates form price targets. The price target is based on assumptions about the asset’s future supply & demand and fundamentals.

Management Overview and Commentary helps potential investors understand the quality and makeup of a company’s management team. This section can also include a history of leadership within the company and their record with capital allocation, ESG, compensation, incentives, stock ownership. Plus, an overview of the company’s board of directors.

This section covers competitors, industry trends, and a company’s standing among its sector. Industry research includes everything from politics to economics, social trends, technological innovation, and more.

Historical Financial Results typically cover the history of a company’s stock, plus expectations based on the current market and events surrounding it. To determine if a company is at or above market expectations, Analysts must deeply understand the history of a specific industry and find patterns or trends to support their recommendations.

Based on the market analysis, historical financial results, etc., an analyst will run equity valuation models. In some cases, analysts will run more than one valuation model to determine the worth of company stock or asset.

Absolute valuation models : calculates a company’s or asset’s inherent value.

Relative equity valuation models : calculates a company’s or asset’s value relative to another company or asset. Relative valuations base their numbers on price/sales, price/earnings, price/cash flow.

An equity research analyst’s recommendation to buy, hold, or sell. The analyst also will have a target price that tells investors where they expect the stock to be in a year’s time.

Related Reading: Best Stock and Investment Research Tools (Buyer’s Guide)

What Does an Equity Research Analyst Do?

Equity research analysts exist on both the buy-side and the sell-side of the financial services market. Although these roles differ, both buy-side and sell-side analysts produce reports, projections, and recommendations for specific companies and stocks.

An equity research analyst specializes in a group of companies in a particular industry or country to develop high-level expertise and produce accurate projects and recommendations. Since ER analysts generally focus on a small set of stocks (5-20), they become specialists in those specific companies and industries that they evaluate or follow. These analysts monitor market data and news reports and speak to contacts within the companies/industries they study to update their research daily.

Analysts need to comprehend everything about their ‘coverage’ to give investment endorsements. Equity research analysts must be conversant with the business regulations and regime policies within the country to decide how it will affect the market environment and business in general. The more you understand the industries in detail, the easier it will be for you to decipher market dynamics.

One prevalent aspect of an equity research analyst’s job is building and maintaining valuable relationships with corporate leaders, clients, and peers. Equity research is largely about an analyst’s ability to service clients and provide insightful ideas that positively influence their investing strategy.

EQUITY RESEARCH ANALYSTS:

- Analyze stocks to help portfolio managers make better-informed investment decisions.

- Analyze a stock against market activity to predict a stock’s outlook.

- Develop investment models and provide trading strategies.

- Provide expertise on markets and industries based on their competitive analysis, business analysis, and market research.

- Use data to model and measure the financial risk associated with particular investment decisions.

- Understand the details of various markets to compare a company’s and sector’s stock

Buy-Side vs. Sell-Side Analysts

Although the roles of buy-side and sell-side analysts do overlap in some respects, the purpose of their research differs.

Related Reading: Sell-Side vs Buy-Side Research: Comparison Guide

How Can Corporate Teams Access Equity Research?

If you were to Google “equity research reports,” you would not get access to equity research, earnings call transcripts or trade journals. You would, however, discover an unmanageable amount of noise to sift through.

Accessing equity research reports is highly dependent on relationships and entitlements, particularly for corporate teams. Unlike financial firms and investor relations teams, who can access equity research by procuring the right entitlements, corporate teams have a much harder time finding and purchasing high-quality equity research.

If you were to search online for equity research, for example, you would be presented with sub-par options such as:

Some websites allow you to search for research reports on companies or by firms. Some of the reports are free, but you must pay for most of them. Prices range from just $15 to thousands of dollars.

If you want just the bottom-line recommendations from analysts, many sites summarize the data. Nearly all the websites that provide stock quotes also compile analyst recommendations, however, you will only get the big picture and not any of the detailed analysis.

Some independent research providers sell their reports directly to investors. These reports typically include an overview of what a stock’s price could be, plus an analysis of the company’s earnings. These reports often cost less than $100 but can be more.

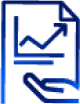

The majority of equity research is completely unsearchable, which is why AlphaSense’s Wall Street Insights is changing the game for corporations globally. Now, with WSI, corporations can leverage this high-quality research to augment their understanding of specific companies and industries; plus, AlphaSense’s corporate clients can now conduct more meaningful analysis and make more data-driven decisions.

Real-Time Research : Real-Time research is available to eligible users (based on an entitlement) immediately upon publication by the broker. Financial Services users with entitlements are the primary consumers of real-time research, while some Corporate professionals are also eligible. Payment for real-time research is made directly from clients to brokers through trading commissions or hard dollar agreements.

Aftermarket Research : Aftermarket research is a collection of many of the same documents as the real-time collection, but it is available after a zero to fifteen-day delay. Investment bankers, consultants, and corporate users are the primary consumers of Aftermarket research.

What is Wall Street Insights (WSI)?

Wall Street Insights® is the first and only equity research collection purpose-built for the corporate market, providing corporations unprecedented access to a deep pool of equity research reports from thousands of expert analysts.

Through partnerships with Morgan Stanley, Bank of America, Barclays, Bernstein, Bernstein Autonomous, Cowen, Deutsche Bank, Evercore ISI, HSBC, and others, corporate professionals can now access the world’s most revered equity research, indexed and searchable in the AlphaSense platform.

From macro market trends and industry analyses to company deep-dives, the Wall Street Insights® content collection provides corporate professionals with a 360-degree view of every market. With the valuable expertise of thousands of analysts on your side, corporate teams can quickly compare insights, validate internal assumptions, and generate new ideas to guide critical business decisions and strategies.

In terms of search and accessibility, Wall Street Insights® is the first of its kind. Not only does AlphaSense offer hard-to-find equity research reports, but we also provide a robust and seamless search experience.

What Equity Research Do You Get Access to with AlphaSense?

On the AlphaSense platform, users can access several critical types of equity research reports, including:

- Upgrades/downgrades: published when a stock analyst changes their opinion of a stock, and subsequently, their investment recommendation

- Estimate / price target revisions: published when an analyst revises their previous price target (their prediction of the future price of a security)

- Initiation reports: published when a broker first begins covering a company

- Credit research

- All other company reports

- Industry reports – Analyze a set of companies within the same industry

- Fixed income reports – Demonstrate maturity distribution of portfolios

- Economic/macro reports – Shares analysts’ views on growth expectations, inflation, stock market volatility, and global market trade

- Commodities reports – Provide analysis of commodities within a particular industry, published weekly or monthly

Related Reading: 7 Things You Miss By Only Using Bloomberg for Investment Research

Using these reports, companies can perform the following key strategic tasks:

- Create investment ideas

- Monitor peers in real-time (and discover what equity research is being produced about them)

- Model and evaluate companies (for M&A or general benchmarking)

- Dive deep into customers, partners, and prospects

- Get up-to-speed quickly on specific industry trends

- Prepare for earnings season

Unlock More Value From Equity Research With Artificial Intelligence and Automation

When you rely on an equity research platform that utilizes the power of AI search technology, you can be more confident in your research, knowing you are no longer at the mercy of human error. AlphaSense also allows you to automate certain research processes that previously would have required hours of manual work, streamlining your entire process so you can take action and make mission-critical decisions faster than ever.

Here’s how our semantic search and smart automations can transform your workflow:

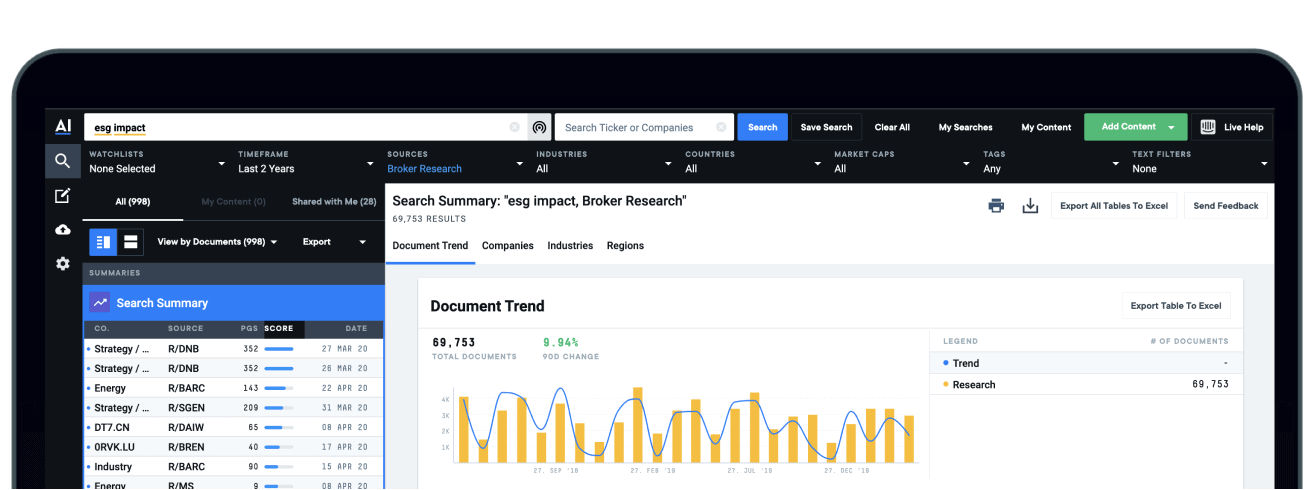

Smart Search

Smart Search technology doesn’t just recognize the keywords included in your query—it understands the intent behind your search, delivering content sources with the highest relevance and value to your search. It allows you to find all relevant data points with a single search, saving countless hours and increasing precision in your research.

Additionally, broker research is often inconsistently tagged because different firms may use different classification taxonomies, or include their own terms to define industries and trends. In addition to recognizing relevant language patterns, Smart Search assigns correct tagging to reports from thousands of analysts and research firms, regardless of which analyst published the report.

Smart Synonyms™ , our proprietary element of Smart Search, weeds out the sources that may include similar keywords but are not topically significant to your research, meaning you’ll never have to cut through excess noise to find the insights you need.

Relevance Rankings

AlphaSense automatically ranks results by their relevance to your research using a number of algorithmic factors, including search term proximity, Smart Synonyms™ , and document decay. You can be confident that the content sources at the top of your search results page are the ones most aligned with your current research needs.

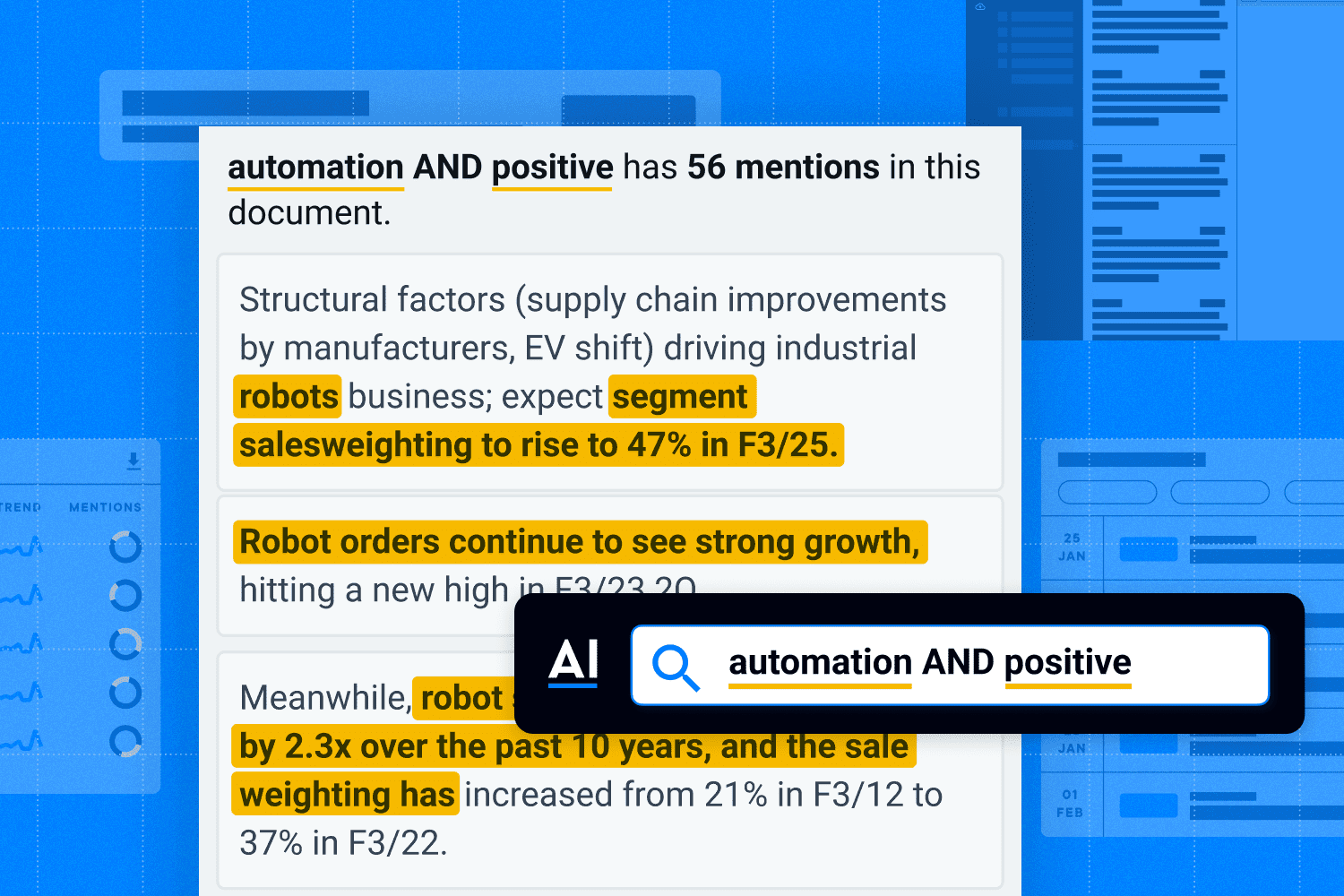

Real-Time Monitoring

Without a centralized search system, analysts are left to perform multiple manual searches and parse through Google Alerts for the ones with real relevance. On the AlphaSense platform, real-time alerts are customizable and can be set up for a particular company, industry, keyword, or topic (or a set/list of any of the above).

Additionally, you can easily set up customizable dashboards and watchlists to monitor the industries, topics, and companies of interest to you and ensure that you receive instant notifications of any pertinent updates—without getting bogged down by alerts that are not relevant to your research.

Smart Summaries

AlphaSense’s generative AI is purpose-built for business professionals, leaning on 10+ years of AI tech development. Our proprietary genAI tool, Smart Summaries , generates insights across all four key perspectives—company documents, news, expert calls, and broker research.

Sourced from across all broker research you are entitled to, published within the past 90 days, Smart Summaries covers sections including:

- Upgrades and downgrades – Covers which brokers have upgraded/downgraded this company within the past 90 days and why

- SWOT analysis – Covers the topics/trends identified as strengths/opportunities or threats/weaknesses from across broker reports about this company

- Competitive landscape – Covers the competitive landscape for this company from across broker reports

Generative Search

Our generative AI chat experience transforms how users can extract insights from hundreds of millions of premium content sources. Our chatbot is trained to think like an analyst, so it understands the market research intent behind your natural language queries. Whenever you search for information, our genAI is available to summarize key company events, emerging topics, and industry-wide viewpoints. You can dig deeper into topics by asking follow-up questions or choosing a suggested query.

Level Up Your Equity Research Strategy With AlphaSense

AlphaSense is the leading equity research platform for modern financial and research professionals. Trusted by 88% of the S&P 100, 80% of the top asset management firms, 95% of the top consulting companies, and 20 of the largest pharmaceutical companies, AlphaSense delivers insights that drive growth to organizations and research teams across industries and around the globe.

Providing a 360-degree view of every market—from macro trends and industry analyses to company deep-dives and individual stock valuations—AlphaSense’s Wall Street Insights® is a key component of an investment research workflow that wins.

Discover the power of equity research reports with AlphaSense today.

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Newsletters

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- The Morning Brief

- Biden Economy

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds Rates

- Top Mutual Funds

- Options: Highest Open Interest

- Options: Highest Implied Volatility

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Screeners Beta

- Stock Comparison

- Advanced Chart

- Currency Converter

- Credit Cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Credit Card Offers

- Best Free Checking

- Student Loans

- Personal Loans

- Car insurance

- Mortgage Refinancing

- Mortgage Calculator

- Editor's Picks

- Investing Insights

- Trending Stocks

- Morning Brief

- Opening Bid

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

New on Yahoo

- Privacy Dashboard

Yahoo Finance

- S&P 500 5,870.62 -1.32%

- Dow 30 43,444.99 -0.70%

- Nasdaq 18,680.12 -2.24%

- Russell 2000 2,303.84 -1.42%

- Crude Oil 66.95 -2.55%

- Gold 2,567.40 -0.21%

- Silver 30.33 -0.77%

- EUR/USD 1.0543 +0.08%

- 10-Yr Bond 4.4280 +0.23%

- GBP/USD 1.2622 -0.35%

- USD/JPY 154.3090 -1.23%

- Bitcoin USD 91,323.00 +4.22%

- XRP USD 0.97 +23.88%

- FTSE 100 8,063.61 -0.09%

- Nikkei 225 38,642.91 +0.28%

Newman: Republicans will regret Elon Musk's efficiency project

The federal bureaucracy is sprawling because Congress wants it that way. Musk won't change that.

Stocks sink as post-election rally fades, Fed spurs rate-cut rethink

Nvidia to report Q3 earnings as AI fever powers Wall Street

The public (and messy) race to become Trump's Treasury secretary

Major trump media shareholder sells nearly entire stake, t-mobile hacked in massive chinese telecom breach: wsj, what is bluesky, the social platform welcoming fleeing x users, china to retaliate if trump boosts tariff: ex-pboc official, is anyone crazy enough to audit super micro computer, treasury yield surge draws buyers after 10-year tops 4.5%, russian gas exports via ukraine to europe stable despite austria cuts, forget downtown or the ’burbs. the far-flung exurbs are where people are moving, bill hwang should get 21 years for archegos crimes, us says, alaska political leaders hope to see trump undo restrictions on oil drilling, archegos' bill hwang deserves 21 years in prison, us says, netflix down for thousands of users in united states, downdetector says, what is bluesky, the fast-growing social platform welcoming fleeing x users, t-mobile hacked in massive chinese breach of telecom networks, wsj reports, are you on track to retire rich here's the nest egg you need to be considered a wealthy retiree, warren buffett told young investors to buy homes instead of stocks, calling 30-year mortgages 'a terrific deal', new welcome offer: earn a $400 statement credit and 40,000 points with southwest credit cards just in time for the holidays, 10 things the middle class won’t be able to afford in less than a decade, apple intelligence arrives next week heres how to get it, 9 ways to save money and avoid debt this black friday, stock market today: dow, s&p 500, nasdaq sink as post-election rally fades, fed prompts rate-cut rethink, nuclear seeing 'crazy amounts' of demand: oklo ceo.

Oklo is looking to meet the growing power demand for AI data centers. The Sam Altman-backed company making progress in starting to produce power. Oklo CEO Jacob DeWitte saying the company is “on a good trajectory” for its first commercial advanced fission plant. DeWitte adding that “it's a really exciting time to be in this business. Just crazy amounts of demand coming forward.” As part of that demand, Oklo (OKLO) recently announced partnerships to provide power for two major data center providers. Oklo, however, is not revealing the new customers, DeWitte explaining “they don't necessarily want to get out there and tip their hand.” In the meantime, the nuclear tech company is working to fill in the near-term power deployment opportunities.To watch more expert insights and analysis on the latest market action, check out more Market Domination Overtime here. This post was written by Ivana Freitas.

Trump 2.0, Elon Musk, and government efficiency: Capitol Gains

How Gen Z is shaping the future of personal finance

Plug Power CEO confident in new hydrogen plants despite Q3 miss

Stocks see $100B in inflows: Market Takeaways

Investment ideas, top daily gainers, top daily losers, stockstory top picks, most active stocks, undervalued growth stocks, build your wealth.

Do I have to pay taxes on a bank account bonus?

We examined a recent Reddit thread about how bonuses are taxed and provided our own expert take.

Smart Money Moves

An inside look at a powerful real estate negotiating tool

How to get a heloc in 6 simple steps, what to know before buying gold from costco, 9 important money moves to make before the end of the year, more ways to save.

How to save on trip costs during the holidays with credit cards

5 easy credit cards to get approved for, here are the best credit cards for thanksgiving groceries, when will mortgage rates go down what experts say about 2025., 7 strategies for reducing closing costs when buying a home.

Retail sales jump up in October, September revised sharply higher

October retail sales grew from the prior month, reflecting continued resilience in the American consumer.

Retail sales signal a 'solid' quarter of economic growth

October's retail sales report was closely watched by investors for signs that the US economy remains on solid footing.

Auto sales provided a key boost

US retail sales advanced in October, boosted by a jump in autos purchases, while other categories signaled some momentum.

E-commerce also stood out

One analyst says Walmart is starting to give Amazon some competition.

Retirement planning feels like solving a puzzle with half the pieces hidden. You know you're supposed to save, but how much is enough to secure a comfortable – or even wealthy – retirement? Here's what you need to know to set yourself on the right path. Don't Miss: The average American couple has saved this much money for retirement – How do you compare? Many are using this retirement income calculator to check if they’re on pace – here’s a breakdown on how on what’s behind this formula. $100K S

When Warren Buffett gives advice, people tend to listen. In 2012, he weighed in on the classic young investor's question – should I buy stocks or my first home? Speaking with CNBC's Becky Quick, Buffett stated: "Well, if I thought I was going to live – if I knew where I was going to want to live the next five or 10 years, I would – I would buy a home and I’d finance it with a 30-year mortgage and it’s a terrific deal." Don't Miss: This Jeff Bezos-backed startup will allow you to become a landlor

Southwest credit cards have new welcome offers with elevated rewards — just in time for the holidays and kickstarting your 2025 travel plans.

In a world where the financial landscape is constantly shifting, the American middle class often finds itself in a precarious position. Find Out: 4 Secrets of the Truly Wealthy, According to Dave...

Having a plan ready can help you avoid debt during Black Friday shopping — especially if you’re using a credit card.

Wall Street is absorbing a jump in retail sales and Jerome Powell's hawkish comments as Trump-fueled optimism starts to wear off.

Richmond Fed’s Barkin expects inflation will fall into next year, hints at slowing rate-cut pace

Richmond Fed president Tom Barkin said Friday that he expects inflation will continue to drop into next year and hinted at slowing down the pace of rate cuts.

Anduril CEO sees opportunity for defense tech startups under Trump

President-elect Donald Trump confronts a number of geopolitical challenges when he returns to the White House, including managing the US-China relationship, a potential escalation in the Middle East, and the ongoing Russia-Ukraine war.

Nvidia to report Q3 earnings Wednesday as AI fever continues to power Wall Street

Nvidia will report its Q3 earnings after the bell on Wednesday. Here's what is at stake.

Mortgage refinance: How to get started

A mortgage refinance involves replacing your original mortgage loan with a new one. Find out how to refinance a mortgage and whether it's a good idea for you.

Admiral Bill McRaven on hiring veterans: 'You’re always going to get hard work'

Admiral Bill McRaven, retired United States Navy four-star admiral, tells Yahoo Finance’s Warrior Money that vets have a lot to offer in the professional sphere.

The public (and sometimes messy) race to become Trump’s Treasury secretary

The race to become Donald Trump’s Treasury Secretary is getting more harried — and public — by the day as candidates jockey for the attention of the president-elect.

Moderna, Novavax stocks slide after Trump nominates Robert F. Kennedy Jr. to be top health official

Vaccine stocks slid late Thursday as reports stated noted anti-vaccine politician Robert Kennedy Jr. will serve as the next head of the Department of Health and Human Services.

Republicans will regret Elon Musk’s efficiency project

The federal bureaucracy is sprawling because Congress wants it that way. Elon Musk won't change that.

October retail sales top estimates, September spending revised sharply higher

October's retail sales report will be closely watched by investors for signs that the US economy remains on solid footing as the Federal Reserve begins to cut interest rates.

Analysts think Wall Street's reaction to the RFK Jr. news is 'overdone.' Sort of.

President-elect Donald Trump tapped Robert F. Kennedy Jr. to lead the US Health and Human Services Department. Vaccine stocks slid on the news.

Trump, tariffs, and one unpredictable economy in 2025

Here's what one top economist thinks tariffs might mean for the 2025 economy.

How this chocolatier is navigating an unexpected spike in cocoa prices

An unexpected surge in costs meant chocolatier and Deux Cranes founder Michiko Marron-Kibbey needed to adapt in order to continue growing her business.

Wall Street ponders a potential debt reckoning from Trump spending plans: Morning Brief

The incoming Trump administration's plans, if enacted, would involve a large increase in the US government's debt. For years, this hasn't been a problem for markets. But once again, Wall Street is asking if this time will be different.

Savings interest rates today, November 15, 2024 (up to 4.75% APY return)

Savings interest rates are the highest they’ve been in over a decade. Here’s where you can find the best savings interest rates today.

CD rates today, November 15 2024 (up to 4.50% APY return)

CD rates are the highest they’ve been in over a decade. Here’s where you can find the best CD rates today.

Mortgage and refinance rates today, November 15, 2024: It could be a good time to buy

These are today's mortgage and refinance rates. Since rates shouldn't plummet anytime soon, you might find it's a good time to buy. Lock in your rate today.

Money market account rates today, November 15, 2024 (up to 5.00% APY return)

Money market account rates vary widely. So which banks are offering the best money market account rates today? Find out here.

Tesla stock falls as Trump trade fades, EV tax credits come under threat

Tesla stock was under pressure on Thursday afternoon as the broader Trump trade was fading after a furious post-election rally.

This week on Reddit: Do I have to pay taxes on a bank account bonus?

Bank account bonuses are a nice perk, but do you have to pay taxes on them? We examined a recent Reddit thread about how bonuses are taxed and provided our own expert take.

Jamie Dimon and Donald Trump make it official: They won’t be joining forces

President-elect Donald Trump and JPMorgan Chase CEO Jamie Dimon made it clear Thursday they won’t be working together when Trump moves back into the White House.

Powell 'certainly' intends to stay at Fed until chairmanship ends

Jay Powell on Thursday once again reinforced his intention to serve out his term as chair of the Federal Reserve while making it clear the central bank is not "in a hurry" to lower interest rates.

Stock market today: Dow, S&P 500, Nasdaq slide as Powell says Fed in no 'hurry' on rate cuts

Stocks moved lower after Federal Reserve Chair Jerome Powell said the central bank is in 'no hurry' on rate cuts.

Bob Iger says Disney doesn't 'need more assets right now' to thrive in 'disrupted media world'

Disney CEO Bob Iger doesn't think the company needs to engage in mergers and acquisitions to compete in streaming.

Disney stock jumps as earnings, streaming profit, and guidance top estimates

Disney reported fiscal fourth quarter earnings that beat expectations on both the top and bottom lines as its streaming business swung to a profit.

How do fixed-rate HELOCs work, and which lenders offer them?

Home equity lines of credit (HELOCs) usually charge variable rates, but you can find fixed-rate HELOCs with certain lenders. Learn how a fixed-rate HELOC works.

Jenius Bank vs. SoFi: Which online-only bank is better?

Jenius Bank and SoFi both offer high-yield savings accounts and lending products. Here’s a rundown of Jenius Bank vs. SoFi to help you choose the right bank for your needs.

How Trump’s proposed tariffs could affect the cost of jeans, appliances, and everyday items

Inflation is moderating, but economists expect that trend could reverse quickly if Donald Trump follows through with a proposal to impose 10%-20% tariffs on all imports and a 60% tariff on Chinese goods.

Stock market today: Tech lags as inflation print keeps Fed rate cut on track

The wait is on for fresh consumer inflation data as investors weigh whether a Donald Trump White House would whip up price pressures.

To get a HELOC, you must meet equity, credit score, and DTI ratio requirements and then go through the application process. Learn more about how to get a HELOC.

Building an emergency fund: Financial coach offers 3 tips to get started

An emergency can easily derail a person’s financial situation. On a recent episode of the Money Glow Up podcast, financial coach Tanya Taylor offered some tips for building an emergency savings fund to be financially prepared for unexpected life events.

Mortgage rates stay flat as Trump’s second term comes into focus

Mortgage rates stayed flat from last week at 6.78% as financial markets reacted to President Trump's re-election.

12 questions to ask when buying a house

Learn the 12 questions to ask when buying a house, from choosing a Realtor to home shopping to closing. Go through the checklist and find your dream home.

Compare today's 30-year mortgage rates

Current 30-year mortgage rates have held steady since last week, and they might stay high for a while. Lock in your 30-year fixed rate today.

Apple MacBook Pro 2024: The powerhouse laptop is as impressive as ever, but for pros only.

Apple's latest MacBook Pro is a powerhouse of a laptop for professionals and prosumers. But if you're just looking for something to browse the web and stream Netflix, stick with the MacBook Air.

Seller concessions: An inside look at a powerful real estate negotiating tool

Seller concessions are incentives sellers give home buyers, such as money toward closing costs or repairs. Learn how concessions can benefit both parties.

Fixed annuities vs. CDs: Which is better for your retirement savings?

For those approaching retirement, "safe" investments like CDs or annuities can be appealing, but there are key differences you should know.

Disney CFO: We are sticking with the TV business

Disney CFO Hugh Johnston on why the business of TV still makes sense.

2 firm inflation prints just made the Fed's 2025 rate cut path a lot 'murkier'

Strong inflation readings in October have economists arguing that the Federal Reserve will likely cut interest rates by less than initially thought in 2025.

Biden hits new milestone before leaving office: 20 million small business applications

The running tally of new small business applications filed since President Joe Biden took office, already at a record, has now passed the 20 million mark.

Cava stock on a tear as fast-casual players continue to outperform the industry

Shares of Cava and Sweetgreen are up triple digits year to date.

The 'DOGE' jokes are easy, but Musk's new side hustle is Tesla's biggest advantage yet: Morning Brief

Taking Musk's government efficiency department as a joke underestimates what he might do with this newfound power.

The House now belongs to the GOP. Here's what party leaders say they'll do first.

The House of Representatives is likely to again be under GOP rule next year, cementing a unified control of power across Washington in 2025.

The IPO window could reopen after 2 brutal years amid Trump trade 'exuberance'

Experts believe that if the Trump trade continues to drive the stock market rally higher, a flood of IPOs will soon follow suit.

Get 14 Days Free

Morningstar Equity Research - published in last 90 days

- All Sectors

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- All Star Ratings

- Company Website

- Our Signature Methodologies

Connect With Us

- Global Contacts

- Advertising Opportunities

Terms of Use Privacy Policy Modern Slavery Statement Cookie Settings Disclosures

The Morningstar Star Rating for Stocks is assigned based on an analyst's estimate of a stocks fair value. It is projection/opinion and not a statement of fact. Morningstar assigns star ratings based on an analyst’s estimate of a stock's fair value. Four components drive the Star Rating: (1) our assessment of the firm’s economic moat, (2) our estimate of the stock’s fair value, (3) our uncertainty around that fair value estimate and (4) the current market price. This process culminates in a single-point star rating that is updated daily. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn't. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Investments in securities are subject to market and other risks. Past performance of a security may or may not be sustained in future and is no indication of future performance. For detail information about the Morningstar Star Rating for Stocks, please visit here

The Morningstar Medalist Rating is the summary expression of Morningstar’s forward-looking analysis of investment strategies as offered via specific vehicles using a rating scale of Gold, Silver, Bronze, Neutral, and Negative. The Medalist Ratings indicate which investments Morningstar believes are likely to outperform a relevant index or peer group average on a risk-adjusted basis over time. Investment products are evaluated on three key pillars (People, Parent, and Process) which, when coupled with a fee assessment, forms the basis for Morningstar’s conviction in those products’ investment merits and determines the Medalist Rating they’re assigned. Pillar ratings take the form of Low, Below Average, Average, Above Average, and High. Pillars may be evaluated via an analyst’s qualitative assessment (either directly to a vehicle the analyst covers or indirectly when the pillar ratings of a covered vehicle are mapped to a related uncovered vehicle) or using algorithmic techniques. Vehicles are sorted by their expected performance into rating groups defined by their Morningstar Category and their active or passive status. When analysts directly cover a vehicle, they assign the three pillar ratings based on their qualitative assessment, subject to the oversight of the Analyst Rating Committee, and monitor and reevaluate them at least every 14 months. When the vehicles are covered either indirectly by analysts or by algorithm, the ratings are assigned monthly. For more detailed information about these ratings, including their methodology, please go to here

IMAGES

VIDEO