Home » Healthcare

A Sample Non Medical Home Care Business Plan Template

With more senior citizens preferring to age at home for as long as they can, there is a massive demand for non-medical home care providers in the United States. According to reports, non-medical home care has become one of the fastest-growing businesses – but it is not to be confused with medical home care.

Medical home care providers tend to offer licensed nursing and rehab services that are prescribed by a physician with stipulated guidelines. Non-medical home care services serve as personal assistants and their services include meal preparation, daily errands, personal care assistance, assistance with daily living activities like bathing/showering, housekeeping, and transportation needs.

Also note that these business offerings go beyond just senior citizens, as they work with those with disabilities or even those recovering from an injury.

Steps on How to Write a Non-Medical Home Care Business Plan

1. executive summary.

King’s Care is a certified non-medical home care service provider that will be based in San Diego, California. We will also cover other cities like Coronado, National City, Chula Vista, Lemon Grove, Bonita, La Mesa, Imperial Beach, La Presa, Spring Valley, El Cajon, Rancho San Diego, Santee, Bostonian, and Lakeside.

Company Profile

A. our products and services.

Our plan at King’s Care is to provide non-medical care services to elderly people who would prefer to age at home, yet require some assistance with certain daily or weekly activities. We offer services like:

- Warm Companionship

- Meal Preparation

- Incidental Transportation

- Light Housekeeping

- Errands & Shopping

- Medication Reminders

- Laundry & Linen Washing

- Recreational Activities

- Personal Hygiene & Dressing Assistance

- Senior Information Resource

- Alzheimer’s/Dementia care

- Respite Care

b. Nature of the Business

At King’s Care, we will make available caregivers and workers who specialize in non-medical home care. We aim to offer excellent and affordable home health care and community-based social services to individuals and families of Southeastern Kansas.

c. The Industry

Since our agency specializes in non-medical home care and community-based social services, we are primarily in the home care industry.

d. Mission Statement

At King’s Care, our mission is to establish a first-class nonmedical home care service that will adequately cater to both highly and lowly placed clients as long as they can afford our services.

e. Vision Statement

At King’s Care, our primary aim is to become the number one choice when it comes to nonmedical home care service delivery in the whole of California and also to be amongst the top five non-medical home care service providers in the United States of America within the next 15 years.

f. Tagline or Slogan

King’s Care LLC – Exactly Where and How You Want It

g. Legal Structure of the Business (LLC, C Corp, S Corp, LLP)

King’s Care will be registered as a limited liability company in the State of California, because of the limited liability protection and pass-through taxation it offers.

h. Organizational Structure

We intend to employ an Administrative Director, three employees, and then work with a contracted agency to provide Caregivers, Physical Therapists, Occupational Therapists, and Speech Therapists. Aside from roles to be filled by Premium Control LLC, a well known human resource firm in San Diego, we intend to employ the following at King’s Care;

- Administrative Director

- Sales and Marketing Executive

- Accounting Officer

i. Ownership / Shareholder Structure and Board Members (If Any)

King’s Care being a limited liability company will solely be owned and managed by Sandra Jackson, a retired social worker with over 30 years of experience in the caregiving industry.

SWOT Analysis

A. strength.

- Comprehensive Non-Medical Home Care and Personal Care Services

- Experienced, Well-Trained Staff

- Long Operational Hours.

b. Weakness

- Little or No Brand Identity and Image

- Low Staffing Numbers

- Not Enough Marketing Budget.

c. Opportunities

- Fast-Growing Market

- Aging Population

- Affordability and Comfort

- Protractible Business Model

i. How Big is the Industry?

According to a recently published report, the market size of the Home Care Providers industry in the US grew faster than the economy overall. When measured by revenue, the Home Care Providers industry generated about $109.6bn in 2023 and is ranked the 8 th Healthcare and Social Assistance industry by market size and the 111 th largest in the US.

ii. Is the Industry Growing or Declining?

Note that the market size of the Home Care Providers industry in the US has increased by 3.3% per year on average between 2016 and 2022 and is expected to keep growing at 0.1% in 2023.

iii. What are the Future Trends in the Industry

Even with rising staffing challenges, the care industry is still growing encouragingly. However, numerous emerging trends will define that ascent in the year ahead. These trends include;

- New labor battles are expected to emerge.

- Care management will become an utmost priority

- More franchise opportunities

- Growing demand for companionship services

iv. Are There Existing Niches in the Industry?

Yes. The niches include;

- Nursing Aide

- Skilled Nursing

- Social Work

- Personal Injury Case Management

- Physical, Occupational, and Speech Therapy

- Personal Assistance Services

- Home Medication Management

v. Can You Sell a Franchise of your Business in the Future?

Yes, the in-home care industry has grown massively in recent years, and franchises have taken a massive place in that market. However, according to industry reports, the top franchises in this sector are all relatively new businesses, mainly in response to increasing customer demand, and long-term social changes that entail that this sector is set for more growth.

Owing to these facts and market demand, we at King’s Care also intend to sell a franchise of our business in the future, more preferably after our first 10 years in business.

- Local Competition

- Recruiting, Hiring, And Retaining Quality

- Business Cash Flow and Funding

- Regulatory Changes.

i. Who are the Major Competitors?

- Nurse Next Door.

- Seniors Helping Seniors.

- Home Instead.

- Home Care Assistance.

- Visiting Angels.

- Comfort Keepers.

- Senior Helpers.

ii. Is There a Franchise for Non-Medical Home Care Business?

- Amada Senior Care: $101,900 to $163,100

- Assisting Hands Home Care: $82,050 to $152,000

- Home Care Assistance: $77,775 to $245,250

- ComForCare Home Care: $81,300 to $185,300

- FirstLight HomeCare: $99,681 to $152,926

- Home Instead Senior Care: $125,000 to $135,000

- Right at Home: $79,250 to $137,900

- Acti-Kare: $30,000 to $55,000

- Homewatch CareGivers: $50,000 to $350,000.

- Senior Helpers: $113,300 to $152,300

- BrightStar Care: $105,735 to $170,457

- Griswold Home Care: $108,181 to $181,431

- Qualicare Family Homecare: $84,550 to $194,550

- Interim HealthCare: less than $200,000

- Nurse Next Door: $120,000 to $200,000

- Synergy HomeCare: $39,130 – $160,057

- Visiting Angels: $77,985 to $102,285

iii. Are There Policies, Regulations, or Zoning Laws Affecting Non-Medical Home Care Businesses?

Yes, state and county laws can thwart certain services from being provided by increasing the requirements and certification levels. Therefore, it is very necessary to contact your state’s department of health services to understand the rules and regulations governing your business model.

You will also be expected to put together business policies and procedures that will serve as a driver’s manual for your business. A good non medical home care Policies and Procedures handbook will include:

- Company mission and values statements

- Client admission process

- Scheduling guidelines and rules

- Time-sheet and employee expense reimbursement procedures and policies

- Hiring practices

- Training and Orientation

- Client Rights and responsibilities

Marketing Plan

A. who is your target audience.

i. Age range

Our services at King’s Care will be for adults 65 years and above.

ii. Level of Educational

According to reports, the educational level of the older population has been increasing over the years. Between 1970 and 2020, the percentage of older persons who had completed high school rose from 28% to 89%. At least one-third (33%) in 2020 had a bachelor’s degree or higher. The Education level of older adults can also vary exponentially by race and ethnic origin.

iii. Income Level

Note that the median income of older persons in the United States was $27,398 in 2020. Men enjoyed a higher Median income overall: $36,921 compared to $21,815 for women.

iv. Ethnicity

- African American (not Hispanic): 12%

- Asian American (not Hispanic): 13%

- Native Hawaiian and Other Pacific Islander (not Hispanic): 10%

- American Indian and Alaska Native (not Hispanic): 12%

- Hispanic: 8%

- Persons identifying as two or more groups: 6%

v. Language

There is no restriction when it comes to the language spoken by the people we are looking to render our non medical home care services to.

vi. Geographical Location

- California (5.8 million)

- Florida (4.5 million)

- Texas (3.7 million)

- New York (3.3 million)

- Pennsylvania (2.4 million)

- Ohio (2 million)

- Illinois (2 million)

- Michigan (1.8 million)

- North Carolina (1.8 million)

vii. Lifestyle

According to industry reports, over half (61%) of persons age 65 and older lived with their spouse (including partner) in 2020. Approximately 18 million or 73% of older men, and 15 million or 50% of older women, lived with their spouse.

About 27% (14.7 million) of all older adults living in the community in 2020 lived alone (5 million men, 9.7 million women). Note that they represented 20% of older men and 33% of older women. The proportion living alone increases with advanced age for both men and women. Among women age 75 and older, for example, 42% lived alone.

b. Advertising and Promotion Strategies

- Press Releases

- Social Media Marketing

- E-mail Marketing

- E-mail Program

i. Traditional Marketing Strategies

- Develop a list of local health care facilities, senior organizations, and social centers to cold call to gain client referrals.

- Develop informational (postcard) brochures and flyers and distribute via a targeted direct mail campaign.

- Share press releases highlighting news about our agency to print news outlets in our target area.

- Distribute business cards in high-profile gatherings and share them indiscriminately to spread word of mouth regarding our services.

- Participate in health care industry trade shows and events hosted by senior organizations and other relevant industry events, workshops, and seminars to generate buzz about our agency.

- Join local and regional organizations like Health Care and Insurance organizations.

ii. Digital Marketing Strategies

- List our agency on industry lead sites

- Optimize our Google My Business profile

- Develop an organic SEO strategy

- Launch a Google Ads campaign

- Collect reviews on key third-party websites

- Use our blog to educate and attract website visitors.

- Retarget warm website traffic

iii. Social Media Marketing Plan

- Use images and video to build your brand on social media

- Amplify content with Facebook ads

- Encourage our clients and staff to share their experiences and opinions of our company.

- Tell real-life success stories because this is what prospects want to hear about.

c. Pricing Strategy

Nonmedical home care is a human-centered service, and no discussion on billing rates and pricing strategy is complete without acknowledging the human side to it. Howbeit, we will work towards ensuring that all our services are offered at highly competitive prices compared to what is obtainable in the United States of America.

Sales and Distribution Plan

A. sales channels.

At King’s Care, sales to us simply entail top-notch patient service and absolute satisfaction from referring physicians and health care facilities.

b. Inventory Strategy

After extensive research and deliberations, we intend to leverage AxisCare to efficiently manage our business dealings and inventory. This software is a web-based home care scheduling and management platform designed for personal care home care agencies.

It also offers user-friendly scheduling, a GPS Mobile App, automatic invoicing, medication reminders, custom forms and reports, payroll and billing integrations, EVV capabilities, visit insights, and so much more. It also features a marketing and CRM platform that will let us track revenue by referral source, analyze advertising methods, and track connections and relationships.

c. Payment Options for Customers

At King’s Care, we will make available the following payment options to clients.

- Payment via bank transfer

- Payment with cash

- Payment via online bank transfer

- Payment via check

- Payment via mobile money transfer

- Payment via bank draft

d. Return Policy, Incentives, and Guarantees

At King’s Care we do not offer any form of return policy; but being a well-established business, we will ensure that our employees and caregivers are well-trained, properly instructed, and duly monitored. We will also carry extensive insurance to ensure our agency can recover from mistakes or claims and can continue to provide valuable service to our clients.

e. Customer Support Strategy

To set King’s Care apart from other non medical home care businesses in California, we will also strive to establish our reliability. We understand that being flexible enough to adjust to a client’s change in schedule will go a long way in cementing trust. For example, accompanying a client to an unscheduled medical appointment if a health-related issue arises will make life easier for family and friends.

Operational Plan

At King’s Care, one of our major objectives is to employ well-trained, caring, and qualified individuals who are responsive to the needs of our patients. In addition, every member of our staff member will definitely meet the State of California educational and training requirements for the services they provide.

a. What Happens During a Typical Day at a Non-Medical Home Care Business?

For caregivers and personal aides, much of their time is spent with clients. A single visit might warrant preparing meals, basic cleaning, running errands, taking the client to appointments, and social engagements. In some cases, it might also involve basic hygiene and/or other simple non medical services. For owners, their responsibilities more or less transition to more administrative tasks. Owners will have to invest time in finding and managing assistants and aides, and less time working directly with clients.

b. Production Process (If Any)

There are no production processes at King’s Care!

c. Service Procedure (If Any)

All our service offerings and procedures at King’s Care will be to assist every client with improving their quality of life, encouraging independence, and allowing them to be comfortable with excellent care in their own homes by providing first-class, professional care with respect, dignity, compassion, high ethical standards, and honor.

d. The Supply Chain

Owing to our extensive feasibility research, we acknowledge there is a significant need for quality non-medical home care within this region (San Diego, California) and we believe that by employing competent staff, we can grow King’s Care to become the non medical care/social service agency of choice in Southern California within our first 3 years in business.

e. Sources of Income

At King’s Care, we intend to generate income by servicing the following clients.

- Private Patients

- HHC – Medicare Patients

- HHC – Medicaid and Private Insurance Patients

- PICM Patients

Financial Plan

A. amount needed to start your non-medical home care business.

We understand that starting a Non medical home health agency is quite inexpensive, compared to other businesses. However, being a business with exciting goals and objectives, we will need around $72,000 to start and run King’s Court for the first year.

b. What are the Cost Involved?

- Attorney Fees – Setting Up a Limited Liability Company: $1,200

- State of California Home Health Agency License: $110

- Medisoft Billing Program plus Support: $4 760

- Professional Liability Insurance: $2 800

- Workman’s Comp Insurance Deposit: $410

- Premises and Content Insurance Deposit: $210

- Contract Retainer with PT/OT/ST: $504

- Deposit plus First: $400

- Phone Set-Up (Excluding Phones): $250

- Utility Deposit: $150

- Post Office Box: $26

- 2 Computers (Fully Loaded): $3 000

- 4-in-1 Printer/Fax/Copier/Scanner: $750

- QuickBooks Pro: $150

- Phones: $290

- Stationary: $200

- Business Cards: $150

- Brochures: $150

- Other Misc. Office Supplies: $450

c. Do You Need to Build a Facility?

No, King’s Care will be started and managed out of a lavish facility at the hub of San Diego, California.

d. What are the Ongoing Expenses for Running a Non-Medical Home Care Business?

- Payroll and Payroll Taxes

- Depreciation

- Heat and Lights

- Water and Garbage

- Internet Access

- Professional Liability Insurance

- Workman’s Comp Insurance

- Premises and Content Insurance

- Advertising and Marketing

- Meals and Entertainment

- Professional Development

- Office Equipment and Supplies

e. What is the Average Salary of your Staff? (First Year)

- Administrative Director (Owner) – $0

- Administrative Assistant: $39 404

- Skilled Nurse: $41 389

- Nurse Aide: $30 915

- Social Worker: $21 214

f. How Do You Get Funding to Start a Non-Medical Home Care Business

King’s Care will be solely financed by Sandra Jackson herself and she will control the direction of the business to ensure that it is expanding at the forecasted rate. In terms of our business start-up, no equity funding or outside loans will be required.

Financial Projection

A. how much should you charge for your service.

Note that a good number of our services are covered under Medicaid, Medicare, and other private insurance providers, and the rates are set by them.

b. Sales Forecast?

- First Year: $350,000 (From Self – Pay Clients): $180,000 (From Medicaid Covers)

- Second Year: $670,000 (From Self – Pay Clients): $400,000 (From Medicaid Covers)

- Third Year: $910,000 (From Self – Pay Clients): $1,200,000 (From Medicaid Cover)

c. Estimated Profit You Will Make a Year?

- First Fiscal Year (FY1): $110,000 (30% of revenue generated)

- Second Fiscal Year (FY2): $400,000 (35% of revenue generated)

- Third Fiscal Year (FY3): $670,000 (45% of revenue generated)

d. Profit Margin of a Non-Medical Home Care Business Product/Service

According to experts, the average profit margin for Non medical home care services is about 30 and 40%, depending on certain factors such as services provided, pricing strategy, number of clients and workers, and also business expenses.

Growth Plan

At King’s Care, we intend to start selling franchises by our 10 th year in business. Just like we noted above, the in-home care industry has grown massively in recent years, and franchises have become a massive part of the industry. Owing to fact that the top franchises in this sector are all relatively new businesses, we also intend to sell a franchise of our business in the future.

We intend to expand to the following locations mentioned below;

- California (5.8 million seniors)

- Florida (4.5 million seniors)

- Texas (3.7 million seniors)

- New York (3.3 million seniors)

- Pennsylvania (2.4 million seniors)

- Ohio (2 million seniors)

- Illinois (2 million seniors)

- Michigan (1.8 million seniors)

- North Carolina (1.8 million seniors)

10. Exit Plan

King’s Care is an agency that will invest so much in its employees and we believe that management buyout is our only exit plan option. Some industry experts also believe that an employee-owned model is a perfect business opportunity to keep home care companies open.

More on Healthcare

Non Medical Home Care Business Plan Template

Written by Dave Lavinsky

Non Medical Home Care Business Plan

You’ve come to the right place to create your Non Medical Home Care business plan.

We have helped over 1,000 entrepreneurs and business owners create business plans and many have used them to start or grow their Non Medical Home Care businesses.

Below is a template to help you create each section of your Non Medical Home Care business plan.

Executive Summary

Business overview.

Caring Companions Home Care is a startup non medical home care company located in Missoula, Missouri. The company is founded by Jim and Janice Lockwood, former managers for a home care business for over twenty years. Their experience in all facets of the business, including operations and administrative management, led to repeated stellar reviews of the business by the residents of Missoula who hired them to manage the care for their loved ones.

Jim and Janice Lockwood formed a team to produce an online system that assists the in-home caregivers with up-to-the-minute information on the status of the home client, medication needs, recent events/experiences, medical changes and other pertinent information. This allows each caregiver to enter the home of their client fully prepared with the latest information on the needs of their client. Caregivers provide general non medical assistance and care for the elderly or infirm in their own homes, offering a stable, reassuring continuance of familiar surroundings while able to remain in their own homes.

Product Offering

The following are the services that Caring Companions Home Care will provide:

- Personal care

- Companionship

- Meal planning and preparation

- Medication reminders

- Light housekeeping

- Transportation and Errands

- 24/7 assistance

Customer Focus

Caring Companions Home Care will focus on family caregivers of seniors and on seniors. They will focus on individuals with chronic illnesses. They will also focus on post-surgical or post-hospitalization individuals. They will focus on individuals with disabilities. They will focus on medical doctor organizations and community associations who work with elderly and disabled individuals.

Management Team

Caring Companions Home Care will be owned and operated by Jim and Janice Lockwood. They have recruited two former assistants to join them in starting their new company, Shawn Trentham and Cassidy Lovell, who will now take on the roles of assistant managers in the startup company, each managing specific areas according to their abilities and skills.

Caring Companions Home Care is the realization of a dream for Jim and Janice Lockwood. While working at their former place of employment, they saw all that could be accomplished and improved by processing many operations digitally, scheduling efficiently, and coordinating with home care companions via a client/caregiver digital platform. With these improvements now on the way, they’ve set out to improve all systems and processes to give their customers the best possible care in their own homes.

Shawn Trentham is a former caregiver with seven years of experience. His strength and mobility create a significant plus when working with clients who are larger and require movement from a wheelchair, for instance, to a sofa, or other movement requirements of a similar nature. Shawn’s new role will be that of the Training Manager for all new employees, as well as the first point of contact for employees who are already trained.

Cassidy Lovell, also a former caregiver with six years of experience, will take on the role of Scheduling Manager. She will oversee and direct all schedules for the team of caregivers at Caring Companions Home Care and will dedicate her efforts to assist customers efficiently, with compassion, in every contact.

Success Factors

Caring Companions Home Care will be able to achieve success by offering the following competitive advantages:

- Friendly, knowledgeable, and highly-qualified team at Caring Companions Home Care

- Comprehensive menu of services, customized to need, provided for each client

- Complete digital platform system of up-to-the-minute caregiver and client notes

- Caring Companions Home Care offers the best pricing in town. Their pricing structure is the most cost effective compared to the competition.

Financial Highlights

Caring Companions Home Care is seeking $200,000 in debt financing to launch its Caring Companions Home Care. The funding will be dedicated toward securing the office space and purchasing office equipment and supplies. Funding will also be dedicated toward three months of overhead costs to include payroll of the staff, rent, and marketing costs for the marketing costs. The breakout of the funding is below:

- Office space build-out: $20,000

- Office equipment, supplies, and materials: $10,000

- Three months of overhead expenses (payroll, rent, utilities): $150,000

- Marketing costs: $10,000

- Working capital: $10,000

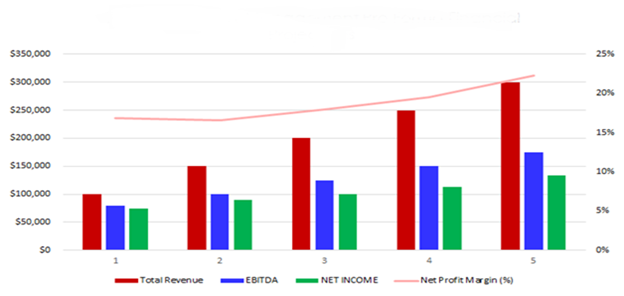

The following graph outlines the financial projections for Caring Companions Home Care.

Company Overview

Who is caring companions home care.

Caring Companions Home Care is a newly established, full-service non medical home care company in Missoula, Missouri. Caring Companions Home Care will be the most reliable, cost-effective, and efficient choice for those who need care in Missoula and the surrounding communities. Caring Companions Home Care will provide a comprehensive menu of personal and domestic services for any chronically ill, senior, or disabled individual to utilize. Their full-service approach includes a comprehensive array of services and assistance choices.

Caring Companions Home Care will be able to offer the very best home care assistance available. The team of professionals are highly qualified and experienced in all aspects of care and assistance and will be fully trained by Caring Companions Home Care before responding to client calls for care. Caring Companions Home Care removes all headaches and issues of the disabled, elderly and chronically ill individuals of Missoula, and it ensures all issues are taken care of expeditiously, while delivering the best customer service.

Caring Companions Home Care History

Since incorporation, Caring Companions Home Care has achieved the following milestones:

- Registered Caring Companions Home Care, LLC to transact business in the state of Missouri.

- Has a contract in place at one of the area buildings for a 10,000 square foot office and staff conference room.

- Reached out to numerous former clients and contacts to include Caring Companions Home Care when they need assistance.

- Began recruiting a staff of ten and office personnel to work at Caring Companions Home Care.

Caring Companions Home Care Services

The following will be the services Caring Companions Home Care will provide:

- Transportation and errands

Industry Analysis

The non medical home care industry is expected to grow over the next five years to over $10 billion. The growth will be driven by the increase in age of the general population, as more seniors live longer, independent lives. The growth will also be driven by the ability of younger generations to cover the cost of personal care for parents and family members. The growth will be driven by an increased number of caregivers who are trained in the non medical caregiver industry. The growth will be driven by individuals who are amenable to working all hours of the day or night. Costs will likely be reduced as digital platforms will assist caregivers in providing communication online rather than in-person visits.

Customer Analysis

Demographic profile of target market.

Caring Companions Home Care will target family caregivers of seniors and seniors. They will target individuals with chronic illnesses. They will also target post-surgical or post-hospitalization individuals. They will target individuals with disabilities. They will target medical doctor organizations and community associations who work with elderly and disabled individuals.

Customer Segmentation

Caring Companions Home Care will primarily target the following customer profiles:

- Elderly and infirm individuals who need care assistance

- Individuals with disabilities who need care assistance

- Post-surgical or post-hospitalization individuals who need care assistance

- Medical groups and community associations who work with elderly and disabled

Competitive Analysis

Direct and indirect competitors.

Caring Companions Home Care will face competition from other companies with similar business profiles. A description of each competitor company is below.

Mountain View Respite Care

Mountain View Respite Care is an indirect competitor in that the care offered is for caregivers who need rest from their typical duties. Caregivers can rest for up to two weeks, bringing heir loved ones with them for care at the same time. This allows family members an optimal situation and a rest from assisting seniors who are seriously ill or have dementia and other cognitive disabilities. By providing for both the clients with assistance needs and the caregiver who visits for a rest, Mountain View Respite Care becomes the perfect solution for both parties.

Roger Stone formed Mountain View Respite Care as a result of watching the care given to both his parents during their years of declining health. He noted that the caregivers worked 24/7, often with shift changes in the middle of the night, and were in need of help themselves to continue their duties. When he noted the family members needed help as much as those they cared for, he pursued the idea and launched the Mountain View Respite Care center in 2017. The needs of caregivers are now met, as well as the elderly and disabled or ill clients who visit the center with them.

Harmony Home Care Solutions

Harmony Home Care Solutions is a direct competitor located in the northeast suburban area of MIssoula, Missouri. It is owned and operated by Henry Dowling, who owns two additional locations in other regions of Missouri. Harmony Home Care Solutions provides care attendants who help with personal grooming, bathing, and toileting. They also provide transportation and run errands for clients. The assistants often take care of housekeeping, as well.

The caregiver shifts for Harmony Home Care Solutions are up to 6 hours each; in any 24-hour period of time 4 care attendants are provided. This allows the company to avoid paying full-time wages for any employee, listing each as part-time and not eligible for health care services. The company has fifteen part-time caregivers and three in-office administrative clerks. The outreach and target audience for the company is to seniors who need to augment Medicare benefits with non medical home care. Harmony Home Care Solutions provides those weekly hours and coordinates with Medicare services to effect a full week of care, while providing limited service during those hours.

Serenity Support Services

Serenity Support Services provides hospice care to patients who are typically within the final six to eight months of their lives. The company is owned by Greta Simmons, a former caregiver who chose hospice services because she believes the clients need the most concentrated, mindful care during those last months of life. Serenity Support Services is a direct competitor; however, the service is limited compared to the wide array of services offered by Caring Companions Home Care. The care attendants for Serenity Support Services provide medications, which entails regulating the professional certifications for aides in order to do so, and they assist with bathing and other personal care issues. They run errands and provide transportation to medical appointments, often helping them communicate with doctors or other care providers. The hospice staff is focused on end-of-life care, which is typically pain relief. Therefore, care attendants must be carefully vetted to avoid any abuse of medication usage by staff members.

Competitive Advantage

Caring Companions Home Care will be able to offer the following advantages over their competition:

Marketing Plan

Brand & value proposition.

Caring Companions Home Care will offer the unique value proposition to its clientele:

- Highly-qualified team of skilled employees who are able to provide a comprehensive array of personalized services, crafted to meet the individual needs of each client.

- Unique digital platform offering up-to-the-minute client information for caregivers.

- 24-hour care with detailed attention provided for medication reminders and assistance.

- Unbeatable pricing to its clients; they will offer the lowest pricing in town.

Promotions Strategy

The promotions strategy for Caring Companions Home Care is as follows:

Word of Mouth/Referrals

Caring Companions Home Care has built up an extensive list of contacts over the years by providing exceptional service and expertise to the clients of their other locations and because they’ve offered stellar care as managers of a home care company themselves. Most clients have already indicated they will follow Jim and Janice to their new company and will also help spread the word of Caring Companions Home Care.

Professional Associations and Networking

Jim and Janice Lockwood will network extensively within the community groups, hospital associations and senior/elderly groups that can direct clients to their care group. They will become actively engaged in assist others within these groups, with the hoped for result of growing their own business.

Website/SEO Marketing

Caring Companions Home Care will fully utilize their website. The website will be well organized, informative, and list all the services that Caring Companions Home Care is able to provide. The website will also list their contact information and schedules for care attendants and clients. The interactive platform allows caregivers to instantly detail information for the other caregivers on their team, offering outstanding results for the clients of the company. The website presence will use enhanced SEO marketing tactics so that anytime someone types in the Google or Bing search engine “non medical home care company” or “home caregivers near me”, Caring Companions Home Care will be listed at the top of the search results.

The pricing of Caring Companions Home Care will be moderate and on par with competitors so customers feel they receive excellent value when purchasing their services.

Operations Plan

The following will be the operations plan for Caring Companions Home Care. Operation Functions:

- Jim and Janice Lockwood will be the co-owners of the company. They will jointly oversee all staff and manage client relations. Jim and Janice have spent the past year recruiting the following staff:

- Shawn Trentham is a former caregiver who will be the Training Manager for all new personnel. His ability to demonstrate best practices while maintaining professionality will be a winning combination of skills to demonstrate to new employees.

- Cassidy Lovell, also a former caregiver with six years of experience, will take on the role of Scheduling Manager. She will oversee and determine all schedules for the team of caregivers. She will also direct her efforts to assist customers efficiently, with compassion, with every contact.

Milestones:

Caring Companions Home Care will have the following milestones completed in the next six months.

- 5/1/202X – Finalize contract to lease office space

- 5/15/202X – Finalize personnel and staff employment contracts

- 6/1/202X – Finalize client contracts for Caring Companions Home Care

- 6/15/202X – Begin networking at association events

- 6/22/202X – Begin moving into Caring Companions Home Care office

- 7/1/202X – Caring Companions Home Care opens its office for business

Financial Plan

Key revenue & costs.

The revenue drivers for Caring Companions Home Care are the fees they will charge to the customers for their extensive list of services provided in non medical home care.

The cost drivers will be the overhead costs required in order to staff Caring Companions Home Care. The expenses will be the payroll cost, rent, utilities, office supplies, and marketing materials.

Funding Requirements and Use of Funds

Caring Companions Home Care is seeking $200,000 in debt financing to launch its non medical home care company. The funding will be dedicated toward securing the office space and purchasing office equipment and supplies. Funding will also be dedicated toward three months of overhead costs to include payroll of the staff, rent, and marketing costs, along with association memberships. The breakout of the funding is below:

Key Assumptions

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and in order to pay off the startup business loan.

- Number of Home Care Clients Per Month: 125

- Average Revenue per Month: $250,000

- Office Lease per Year: $100,000

Financial Projections

Income statement, balance sheet, cash flow statement, non medical home care business plan faqs, what is a non medical home care business plan.

A non medical home care business plan is a plan to start and/or grow your non medical home care business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your Non Medical Home Care business plan using our Non Medical Home Care Business Plan Template here .

What are the Main Types of Non Medical Home Care Businesses?

There are a number of different kinds of non medical home care businesses , some examples include: Personal Care, Homemaking, and Companionship.

How Do You Get Funding for Your Non Medical Home Care Business Plan?

Non Medical Home Care businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

What are the Steps To Start a Non Medical Home Care Business?

Starting a non medical home care business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop A Non Medical Home Care Business Plan - The first step in starting a business is to create a detailed non medical home care business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your non medical home care business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your non medical home care business is in compliance with local laws.

3. Register Your Non Medical Home Care Business - Once you have chosen a legal structure, the next step is to register your non medical home care business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your non medical home care business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Non Medical Home Care Equipment & Supplies - In order to start your non medical home care business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your non medical home care business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful non medical home care business:

- How to Start a Non Medical Home Care Business

Non-Medical Home Care Business Plan [Sample Template]

By: Author Tony Martins Ajaero

Home » Business ideas » Healthcare and Medical » Home Healthcare for Seniors

Are you about starting a non-medical home care business ? If YES, here is a complete sample non-medical home care business plan template & feasibility study you can use for FREE .

If you want to start a medical based business, you can choose to start a non- medical home care business. It is less technical and can provide great help to those that are in need of such services. In the united states of America, as well as other parts of the world, this business has continued to gain popularity.

A Sample Non-Medical Home Care Business Plan Template

1. industry overview.

When it comes to caring for people who can’t take care of themselves, there are several options and one of them is to take them to non-medical home care facility.

Basically, a non – medical home care facility is a private residence for the elderly, children or young people who cannot live with their families due to obvious reasons, or people with chronic disabilities who may be adults or seniors and can’t take proper care of themselves if left to live alone.

The law in the United States and in some countries states that before a non – medical home care facility can commence operations, there should be at least six residents and at least one trained caregiver there 24 hours a day and 7 days a week.

So also a standard non-medical home care facility is expected to have a house manager, night manager, weekend activity coordinator, and 2 or more caregivers depending on the size of the facility.

It is important to state that residents of non – medical home care facilities are people who don’t have need for medical care; it is basically designed for elderly people, and people with one form of disability or the other.

Non – medical home care facilities are not expected to accommodate people with medical conditions such as autism, intellectual disability, chronic or long-term mental/psychiatric disorder, or physical or even multiple disabilities et al.

As a matter of fact, some non – medical home care facilities were funded as transitional homes to prepare for independent living (in an apartment or return to family or marriage and employment), and others were viewed as permanent community homes.

Society may prevent people with significant needs from living in local communities with social acceptance key to community development.

The residents of non – medical home care facilities sometimes need continual or supported assistance in order for them to be able to complete daily basic and simple tasks such as:

Taking medication or bathing, making dinners, having conversations, making appointments, and getting to work or a day service, budget their personal allowance, select photos for their room or album, meet neighbors and “carry out civic duties,” go grocery shopping, eat in restaurants, make emergency calls or inquiries, and exercise regularly amongst other activities.

Going by the data published by the US Census Bureau, the regions that account for the largest share of establishments in the industry are the Southeast (23.9% of total establishments), Great Lakes (17.3%), West (12.9%) and Mid-Atlantic (12.7%) regions. This data basically reflects the age distribution in the United States.

So also, the data shows that employment in this industry is also concentrated in the Southeast, the Mid-Atlantic and the Great Lakes regions. The largest states in terms of employment are New York, California, Texas, Ohio and Florida.

The Home care industry of which non – medical home care is a subset of is indeed a very large industry and pretty much thriving in developed countries such as United States of America, Canada, United Kingdom, Germany, Australia and Italy et al.

Statistics has it that in the United States of America alone, there are about 386,384licensed and registered Non – Medical Home Care Facilities responsible for employing about 1,737,543employees and the industry rakes in a whopping sum of $84bn annually with an annual growth rate projected at 4.0 percent. It is important to state that there is no company with dominant market share in this industry.

Over and above, the Group Home/Non – medical home care facility line of businesses in developed countries are still enjoying good patronage particularly if they are well positioned and if they know how to reach out to their target market; the aging population and those who can’t take care of themselves.

2. Executive Summary

Noah’s Ark Non – Medical Home Care, LLC is a standard and licensed non-medical home care facility that will be located in the heart of Duluth – Minnesota in a neatly renovated and secured spacious housing facility.

Our non – medical home care facility is specifically designed and equipped with the needed accommodation facilities/gadgets to give comfort and security to all our residence irrespective of the religious affiliations, their race, and health condition.

We are set to take care of people with can’t take care of themselves be it the elderly, the young, or people with one form or disability or the other.

Noah’s Ark Non – Medical Home Care, LLC is a family owned and managed business that believes in the passionate pursuit of excellence and financial success with uncompromising services and integrity which is why we have decided to venture into the hospitality industry by establishing our own non – medical home care facility (assisted living facility business).

We are certain that our values will help us drive the business to enviable heights and also help us attract the numbers of residents that will make our facility fully occupied year in year out.

Despite the fact that we are a non – medical home care facility, we are going to be a health conscious and customer-centric with a service culture that will be deeply rooted in the fabric of our organizational structure and indeed at all levels of the organization.

With that, we know that we will be enables to consistently achieve our set business goals, increase our profitability and reinforce our positive long-term relationships with our clientele, partners (vendors), and all our employees as well.

Our accommodation facility will be decorated in an exquisite and elegant facade, so much so that it will be a conspicuous edifice in the city where it is located. Noah’s Ark Non – Medical Home Care, LLC will provide a conducive home for our residents.

We will engage in services that will help residents in our facility complete daily basic and simple tasks, such as taking medication or bathing, making dinners, having conversations, making appointments, and getting to work or a day service, budget their personal allowance, select photos for their room or album, meet neighbors and “carry out civic duties,” go grocery shopping, eat in restaurants, make emergency calls or inquiries, and exercise regularly amongst other activities.

Noah’s Ark Non – Medical Home Care, LLC will be equipped with everything that will make life comfortable for the disabled and elderly.

We will as build a fitness room and library et al. We will also install a free Wi-Fi that will enable our residents and guests surf the internet with their laptop in the room free of charge, and there will be wireless access in all the public area within the lodging facility.

Noah’s Ark Non – Medical Home Care, LLC is a family business that is owned and managed by Mrs. Abigail Washington and her family.

Mrs. Abigail Washington is a licensed non – medical home care administrator and social health worker with well over 15 years of experience working for leading brand in the industry. She has a Master’s Degree in Public Health and she is truly passionate when it comes to taking care of the aging population and people with disabilities.

3. Our Products and Services

Noah’s Ark Non – Medical Home Care, LLC is set to operate a standard non – medical home care facility in Duluth – Minnesota. The fact that we want to become a force to reckon with in the Home Care Facility industry means that we will provide our resident a conducive and highly secured accommodation.

In all that we do, we will ensure that our residents are satisfied and are willing to recommend our facility to their family members and friends. We are in the non – medical home care business to deliver excellent services and to make profits and we are willing to go the extra mile within the law of the United States to achieve our business goals, aims and objectives.

Noah’s Ark Non – Medical Home Care, LLC will provide a conducive home for our residents; we will engage in services that will help our residents complete daily basic and simple tasks such as:

4. Our Mission and Vision Statement

- Our vision is to become the number one choice when it comes to non – medical home care facility in the whole of Minnesota and also to be amongst the top 20 non – medical home care facilities in the United States of America within the next 10 years.

- Our mission is to build a non – medical home care facility that will meet and surpass the needs of all the residents of our facility; we want a profitable and successful business.

Our Business Structure

Noah’s Ark Non – Medical Home Care, LLC is a business that will be built on a solid foundation. From the outset, we have decided to recruit only qualified professionals (non – medical home care administrator, nurse’s aides, medication management counselors, county aging worker, rehabilitation counselors, and home caregivers) to man various job positions in our organization.

We are quite aware of the rules and regulations governing the home care facility industry which is why we decided to recruit only well experienced and qualified employees as foundational staff of the organization. We hope to leverage on their expertise to build our business brand to be well accepted in Minnesota and the whole of the United States.

When hiring, we will look out for applicants that are not just qualified and experienced, but homely, honest, customer centric and are ready to work to help us build a prosperous business that will benefit all the stake holders (the owners, workforce, and customers).

As a matter of fact, profit-sharing arrangement will be made available to all our management staff and it will be based on their performance for a period of five years or more. These are the positions that will be available at Noah’s Ark Non – Medical Home Care, LLC;

- Chief Executive Officer

- Non – Medical Facility Administrator (Human Resources and Admin Manager)

Nurse’s Aides

- Home Caregivers/County Aging Workers

- Sales and Marketing Executive

- Accounting Officer

- Security Officer

5. Job Roles and Responsibilities

Chief Executive Officer:

- Increases management’s effectiveness by recruiting, selecting, orienting, training, coaching, counseling, and disciplining managers; communicating values, strategies, and objectives; assigning accountabilities; planning, monitoring, and appraising job results; developing incentives; developing a climate for offering information and opinions; providing educational opportunities.

- Creates, communicates, and implements the organization’s vision, mission, and overall direction – i.e. leading the development and implementation of the overall organization’s strategy.

- Responsible for fixing prices and signing business deals

- Responsible for providing direction for the business

- Responsible for signing checks and documents on behalf of the company

- Evaluates the success of the organization

- Reports to the board.

Non – Medical Home Care Administrator (Admin and HR Manager)

- Responsible for overseeing the smooth running of HR and administrative tasks for the organization

- Designs job descriptions with KPI to drive performance management for clients

- Regularly hold meetings with key stakeholders to review the effectiveness of HR Policies, Procedures and Processes

- Maintains office supplies by checking stocks; placing and expediting orders; evaluating new products.

- Ensures operation of equipment by completing preventive maintenance requirements; calling for repairs.

- Defines job positions for recruitment and managing interviewing process

- Carries out staff induction for new team members

- Responsible for training, evaluation and assessment of employees

- Responsible for arranging travel, meetings and appointments

- Updates job knowledge by participating in educational opportunities; reading professional publications; maintaining personal networks; participating in professional organizations.

- Oversees the smooth running of the daily home activities.

- Responsible for managing our residents in their various houses

- Handles personal injury case management

- Responsible for offering home medication management services

Marketing and Sales Executive

- Identifies, prioritizes, and reaches out to new clients, and business opportunities et al

- Identifies development opportunities; follows up on development leads and contacts; participates in the structuring and financing of projects; assures the completion of projects.

- Writes winning proposal documents, negotiate fees and rates in line with organizations’ policy

- Responsible for handling business research, market surveys and feasibility studies for clients

- Responsible for supervising implementation, advocate for the customer’s needs, and communicate with clients

- Develops, executes and evaluates new plans for expanding increase sales

- Documents all customer contact and information

- Represent Noah’s Ark Non – Medical Home Care, LLC in strategic meetings

- Helps to increase sales and growth for Noah’s Ark Non – Medical Home Care, LLC.

Accountant/Cashier

- Responsible for preparing financial reports, budgets, and financial statements for the organization

- Provides managements with financial analyses, development budgets, and accounting reports; analyzes financial feasibility for the most complex proposed projects; conducts market research to forecast trends and business conditions.

- Responsible for financial forecasting and risks analysis.

- Performs cash management, general ledger accounting, and financial reporting for the organization

- Responsible for developing and managing financial systems and policies

- Responsible for administering payrolls

- Ensuring compliance with taxation legislation

- Handles all financial transactions for Noah’s Ark Non – Medical Home Care, LLC

- Serves as internal auditor for Noah’s Ark Non – Medical Home Care, LLC.

Security Officers

- Ensure that the facility is secured at all time

- Control traffic and organize parking

- Give security tips to staff members from time to time

- Patrols around the building on a 24 hours basis

- Submit security reports weekly

- Any other duty as assigned by the facility administrator

- Responsible for cleaning the facility at all times

- Ensure that toiletries and supplies don’t run out of stock

- Assist our residents when they need to take their bath and carry out other household tasks

- Cleans both the interior and exterior of the facility

- Handle any other duty as assigned by the facility manager

6. SWOT Analysis

Noah’s Ark Non – Medical Home Care, LLC is set to become one of the leading non – medical home care facility in Minnesota which is why we are willing to take our time to cross every ‘Ts’ and dot every ‘Is’ as it relates to our business.

We want our non – medical home care facility to be the number one choice of all residents of Duluth and other cities in Minnesota. We know that if we are going to achieve the goals that we have set for our business, then we must ensure that we build our business on a solid foundation. We must ensure that we follow due process in setting up the business.

Even though our Chief Executive Officer (owner) has a robust experience in social work and taking care of people with disability and the aging population, we still went ahead to hire the services of business consultants that are specialized in setting up new businesses to help our organization conduct detailed SWOT analysis and to also provide professional support in helping us structure our business to indeed become a leader in the home care facility industry.

This is the summary of the SWOT analysis that was conducted for Noah’s Ark Non – Medical Home Care, LLC;

Our strength lies in the fact that we have a team of well qualified professionals manning various job positions in our organization.

As a matter of fact, they are some of the best hands in the whole of Duluth – Minnesota. Our location, the Business model we will be operating on, well equipped facility and our excellent customer service culture will definitely count as a strong strength for us.

Noah’s Ark Non – Medical Home Care, LLC is a new business which is owned by an individual (family), and we may not have the financial muscle to sustain the kind of publicity we want to give our business and also to attract some of the highly experienced hands in the home care facility industry.

- Opportunities:

The opportunities that are available to non – medical home care facilities are unlimited considering the fact that we have growing aging population and people with one form of disability or the other in the United States and we are going to position our business to make the best out of the opportunities that will be available to us in Duluth – Minnesota.

Just like any other business, one of the major threats that we are likely going to face is economic downturn and unfavorable government policies.

It is a fact that economic downturn affects purchasing / spending power. Another threat that may likely confront us is the arrival of a new and bigger / well established non – medical home care facility or group home facility brand in same location where ours is located.

7. MARKET ANALYSIS

- Market Trends

Because of the essential nature of services provided by non – medical home care facilities / group homes, the industry was able to grow even in the face of economic stagnation. In addition, the continued growth of the aging population and people with one form of disability or the other has stimulated demand for industry services.

Since the aging population are more prone to injury and illness, and therefore require more assistance with daily activities, the larger share of senior adults has propelled demand for non – medical home care facilities and of course nursing care facilities.

Despite favorable demographic trends, unsatisfactory government funding has hindered industry growth. The trend in the industry is that, players in the industry are now flexible enough to adjust their services and facilities to attract more knowledgeable and educated residents by incorporating more technology and adapting to new markets

Another trend in the industry is that, in other to make non – medical home care facilities and group home facilities more affordable for low income individuals, many states in the United States of America are enacting changes to the portion of Medicaid which can be applied to Group Home Facilities.

Before now, only individuals living in nursing homes were typically provided Medicaid assistance, but in recent time, there are now a growing number of states that have recognized the importance of offering Medicaid dollars to senior citizens living in Group Home Facilities.

No doubt the Home Care Facility industry will continue to grow and become more profitable because the aging baby-boomer generation in United States is expected to drive increasing demand for this specialized services and care.

8. Our Target Market

Noah’s Ark Non – Medical Home Care, LLC is in business to service the aging population and people with disabilities in Duluth – Minnesota and other cities in Minnesota. We will ensure that we target both self – paying customers (who do not have Medicaid cover), and those who have Medicaid cover.

Generally, those who need the services of non-medical home care facilities are the aging population, people with one form of disabilities or the other and perhaps those who need daily help.

The fact that we are going to open our doors to a wide range of customers does not in any way stop us from abiding by the rules and regulations governing the home care facility industry in the United States. Our staff is well – trained to effectively service our customers and give them value for their monies. Our customers can be categorized into the following;

- The aging population

- People with one form of disability or the other (Both young and the elderly)

- The aged who might suffer from severe joint pains and every other age categories that fall under the conditions listed by the physician as people who do not necessarily need the services health workers to survive or carry out their daily task.

Our Competitive Advantage

Aside from the competitions that exist amongst players in the non – medical home care line of business, they also compete against other home healthcare services providers such as assisted living facilities and nursing homes et al.

To be highly competitive in the home care facility industry means that you should be able to secure a conducive and secured facility, deliver consistent quality service and should be able to meet the expectations of the children / family members paying for their loved elderly parents and people with disabilities in your facility.

Noah’s Ark Non – Medical Home Care, LLC is coming into the market well prepared to favorably compete in the industry. Our facility is well positioned (centrally positioned) and visible, we have good security and the right ambience for elderly people and disabled people.

Our staff is well groomed in all aspect of non – medical home care facility services and all our employees are trained to provide customized customer service to all our residents. Our services will be carried out by highly trained professional nurse’s aides, county aging workers and home caregivers who know what it takes to give our highly esteemed residents value for their money.

Lastly, all our employees will be well taken care of, and their welfare package will be among the best within our category (startups non – medical home care facility business and other related businesses in the United States) in the industry.

It will enable them to be more than willing to build the business with us and help deliver our set goals and achieve all our business aims and objectives.

9. SALES AND MARKETING STRATEGY

- Sources of Income

Noah’s Ark Non – Medical Home Care, LLC will ensure that we do all we can to maximize the business by generating income from every legal means within the scope of our industry.

We will generate income by providing a conducive home for our residents; we will engage in services that will help our residents complete daily basic and simple tasks such as:

10. Sales Forecast

One thing is certain; there would always be elderly people and people with disabilities who would need the services of non – medical home care facility.

We are well positioned to take on the available market in Duluth – Minnesota and we are quite optimistic that we will meet our set target of generating enough income / profits from the first six month of operations and grow our non – medical home care facility business and our residents’ base.

We have been able to critically examine the non – medical home care facility services market and we have analyzed our chances in the industry and we have been able to come up with the following sales forecast. The sales projection is based on information gathered on the field and some assumptions that are peculiar to similar startups in Duluth – Minnesota.

Below is the sales projection for Noah’s Ark Non – Medical Home Care, LLC, it is based on the location of our business and of course the wide range of related services that we will be offering;

- First Year-: $100,000 ( From Self – Pay Clients ): $250,000 ( From Medicaid Covers )

- Second Year-: $250,000 (From Self – Pay Clients): $500,000 ( From Medicaid Covers )

- Third Year-: $500,000 ( From Self – Pay Clients ): $1,500,000 ( From Medicaid Cover )

N.B: This projection is done based on what is obtainable in the industry and with the assumption that there won’t be any major economic meltdown and natural disasters within the period stated above. Please note that the above projection might be lower and at the same time it might be higher.

- Marketing Strategy and Sales Strategy

The marketing and sales strategy of Noah’s Ark Non – Medical Home Care, LLC will be based on generating long-term personalized relationships with our residents. In order to achieve that, we will ensure that we offer top notch all – round non – medical home care facility services at affordable prices compare to what is obtainable in Minnesota and other state in the US.

All our employees will be well trained and equipped to provide excellent and knowledgeable services as it relates to our business.

We know that if we are consistent with offering high quality service delivery and excellent customer service, we will increase the number of our residents by more than 25 percent for the first year and then more than 40 percent subsequently.

Before choosing a location for Noah’s Ark Non – Medical Home Care, LLC, we conducted a thorough market survey and feasibility studies in order for us to be able to be able to penetrate the available market and become the preferred choice for residents of Duluth and other cities in Minnesota.

We have detailed information and data that we were able to utilize to structure our business to attract the numbers of customers we want to attract per time.

We hired experts who have good understanding of the home care facility industry to help us develop marketing strategies that will help us achieve our business goal of winning a larger percentage of the available market in Minnesota.

In summary, Noah’s Ark Non – Medical Home Care, LLC will adopt the following sales and marketing approach to win customers over;

- Introduce our business by sending introductory letters to residents, clubs for elderly and people with disability and other stake holders in Minnesota

- Advertise our business in community based newspapers, local TV and local radio stations

- List our business on yellow pages ads (local directories)

- Leverage on the internet to promote our business

- Engage in direct marketing

- Leverage on word of mouth marketing (referrals)

- Enter into business partnership with hospitals, government agencies and health insurance companies.

- Attend healthcare related exhibitions/expos.

11. Publicity and Advertising Strategy

We are in the non – medical home care facility business to become one of the market leaders and also to maximize profits hence we are going to explore all available conventional and non – conventional means to promote Noah’s Ark Non – Medical Home Care, LLC.

Noah’s Ark Non – Medical Home Care, LLC has a long term plan of building non-medical home care facilities in key cities in the United States of America which is why we will deliberately build our brand to be well accepted in Duluth – Minnesota before venturing out.

As a matter of fact, our publicity and advertising strategy is not solely for winning residents (customers) over but to effectively communicate our brand to the general public. Here are the platforms we intend leveraging on to promote and advertise Noah’s Ark Non – Medical Home Care, LLC;

- Place adverts on both print (community based newspapers and magazines) and electronic media platforms

- Sponsor relevant community programs that appeals to the aging population and people with disability

- Leverage on the internet and social media platforms like; Instagram, Facebook , twitter, YouTube, Google + et al to promote our brand

- Install our Billboards on strategic locations all around Duluth – Minnesota

- Engage in road show from time to time in location with growing aging population and people with disability

- Distribute our fliers and handbills in target areas with high concentration of aging population and people with disabilities

- Ensure that all our workers wear our branded shirts and all our vehicles are well branded with our company’s logo et al.

12. Our Pricing Strategy

Noah’s Ark Non – Medical Home Care, LLC will work towards ensuring that all our services are offered at highly competitive prices compare to what is obtainable in The United States of America.

On the average, non – medical home care facilities and group home facility service providers usually leverage on the fact that a good number of their clients do not pay the service charge from their pockets; private insurance companies, Medicare and Medicaid are responsible for the payment.

In view of that, it is easier for non – medical home care service providers to bill their clients based in their discretions. Be that as it may, we have put plans in place to offer discount services once in a while and also to reward our loyal residents especially when they refer clients to us.

- Payment Options

At Noah’s Ark Non – Medical Home Care, LLC, our payment policy is all inclusive because we are quite aware that different people prefer different payment options as it suits them. Here are the payment options that will be available in every of our outlets;

- Payment by cash

- Payment via Point of Sale (POS) Machine

- Payment via online bank transfer (online payment portal)

- Payment via Mobile money

In view of the above, we have chosen banking platforms that will help us achieve our payment plans without any itches.

13. Startup Expenditure (Budget)

If you are looking towards starting a non-medical care facility business , then you should be ready to go all out to ensure that you raise enough capital to cover some of the basic expenditure that you are going to incur. The truth is that starting this type of business does not come cheap.

You would need money to secure a standard residential facility big enough to accommodate the number of people you plan accommodating per time, you could need money to acquire supplies and you would need money to pay your workforce and pay bills for a while until the revenue you generate from the business becomes enough to pay them.

The items listed below are the basics that we would need when starting our non – medical home care facility business in the United States;

- The Total Fee for Registering the Business in the United States – $750.

- Legal expenses for obtaining licenses and permits – $1,500.

- Marketing promotion expenses for the grand opening of Noah’s Ark Non – Medical Home Care, LLC in the amount of $3,500 and as well as flyer printing (2,000 flyers at $0.04 per copy) for the total amount of – $3,580.

- Cost for hiring Consultant – $2,500.

- Cost for the purchase of insurance (general liability, workers’ compensation and property casualty) coverage at a total premium – $3,400.

- Cost for leasing a standard and secured facility in Duluth – Minnesota for 2 years – $250,000

- Cost for facility remodeling – $50,000.

- Other start-up expenses including stationery ($500) and phone and utility deposits ($2,500).

- Operational cost for the first 3 months (salaries of employees, payments of bills et al) – $100,000

- The cost for Start-up inventory (stocking with a wide range of products such as toiletries, food stuffs and drugs et al) – $50,000

- Storage hardware (bins, rack, shelves,) – $3,720

- The cost for the purchase of furniture and gadgets (Beds, Computers, Printers, Telephone, TVs, tables and chairs et al): $4,000.

- The cost of Launching a Website: $700

- Miscellaneous: $10,000

We would need an estimate of $750,000 to successfully set up our non – medical home care facility in Duluth – Minnesota. Please note that this amount includes the salaries of all the staff for the first month of operation.

Generating Funding/Startup Capital for Noah’s Ark Non – Medical Home Care, LLC

Noah’s Ark Non – Medical Home Care, LLC is a family business that is solely owned and financed by Mrs. Abigail Washington and her family. We do not intend to welcome any external business partner, which is why he has decided to restrict the sourcing of the start – up capital to 3 major sources.

These are the areas Noah’s Ark Non – Medical Home Care, LLC intends to generate our start – up capital;

- Generate part of the start – up capital from personal savings

- Source for soft loans from family members and friends

- Apply for loan from my Bank

N.B: We have been able to generate about $200,000 (Personal savings $150,000 and soft loan from family members $50,000) and we are at the final stages of obtaining a loan facility of $550,000 from our bank. All the papers and document have been signed and submitted, the loan has been approved and any moment from now our account will be credited with the amount.

14. Sustainability and Expansion Strategy

The future of a business lies in the numbers of loyal customers that they have the capacity and competence of the employees, their investment strategy and the business structure. If all of these factors are missing from a business (company), then it won’t be too long before the business close shop.

One of our major goals of starting Noah’s Ark Non – Medical Home Care, LLC is to build a business that will survive off its own cash flow without the need for injecting finance from external sources once the business is officially running.

We know that one of the ways of gaining approval and winning customers over is to offer our non – medical home care services a little bit cheaper than what is obtainable in the market and we are well prepared to survive on lower profit margin for a while.

Noah’s Ark Non – Medical Home Care, LLC will make sure that the right foundation, structures and processes are put in place to ensure that our staff welfare are well taken of. Our company’s corporate culture is designed to drive our business to greater heights and training and retraining of our workforce is at the top burner.

As a matter of fact, profit-sharing arrangement will be made available to all our management staff and it will be based on their performance for a period of three years or more. We know that if that is put in place, we will be able to successfully hire and retain the best hands we can get in the industry; they will be more committed to help us build the business of our dreams.

Check List/Milestone

- Business Name Availability Check: Completed

- Business Registration: Completed

- Opening of Corporate Bank Accounts: Completed

- Securing Point of Sales (POS) Machines: Completed

- Opening Mobile Money Accounts: Completed

- Opening Online Payment Platforms: Completed

- Application and Obtaining Tax Payer’s ID: In Progress

- Application for business license and permit: Completed

- Purchase of Insurance for the Business: Completed

- Leasing of facility and remodeling the facility: In Progress

- Conducting Feasibility Studies: Completed

- Generating capital from family members: Completed

- Applications for Loan from the bank: In Progress

- Writing of Business Plan: Completed

- Drafting of Employee’s Handbook: Completed

- Drafting of Contract Documents and other relevant Legal Documents: In Progress

- Design of The Company’s Logo: Completed