Happy Hour: Operationalizing your next product launch

The pricing strategy guide: Choosing pricing strategies that grow (not sink) your business

Choosing the pricing strategy for your business requires research, calculation, and a good amount of thought. Simply guessing may put you out of business. Here's what you need to know.

Definition of pricing

What are pricing strategies.

- Importance of pricing strategy

Top 7 pricing strategies

- 3 real-world examples

- How to create your strategy

- Determine value metric

- Customer profiles & segments

- User research & experiments

- Bonus: 10 data-driven tips

- Industry differences

- Final takeaway

Pricing strategies FAQs

Join our newsletter for the latest in SaaS

By subscribing you agree to receive the Paddle newsletter. Unsubscribe at any time.

Too many businesses set their pricing without putting much thought into it. This is a mistake causing them to leave money on the table from the beginning. The good news is that taking the time to get your product pricing right can act as a powerful growth lever. If you optimize your pricing strategy so that more people are paying a higher amount, you'll end up with significantly more revenue than a business who treats pricing more passively. This sounds obvious, but it's rare for businesses to put much effort into finding the best pricing strategy.

This guide will cover everything you need to know about setting a pricing strategy that works for your business.

Check out this introduction video made by the Paddle Studios team.

Price Intelligently is Paddle’s dedicated team of pricing and packaging experts for SaaS and subscription companies. We combine unrivaled expertise and first-party data to solve your unique pricing challenges, break the mold, and catapult your growth. Learn more

Pricing is defined as the amount of money that you charge for your products, but understanding it requires much more than that simple definition. Baked into your pricing are indicators to your potential customers about how much you value your brand, product, and customers. It's one of the first things that can push a customer towards, or away from, buying your product. As such, it should be calculated with certainty.

Pricing strategies refer to the processes and methodologies businesses use to set prices for their products and services. If pricing is how much you charge for your products, then product pricing strategy is how you determine what that amount should be. There are different pricing strategies to choose from but some of the more common ones include:

- Value-based pricing

- Competitive pricing

- Price skimming

- Cost-plus pricing

- Penetration pricing

- Economy pricing

- Dynamic pricing

Pricing is an underutilized growth lever

Many companies focus on acquisition to grow their business, but studies have shown that small variations in pricing can raise or lower revenue by 20-50%. Despite that, even among Fortune 500 companies, fewer than 5% have functions dedicated to setting the best price possible. There's a missed opportunity in the business world to see immediate growth for relatively little effort.

Navigating PLG billing and pricing? Read our latest guide on product-led SaaS

Because most businesses spend less than 10 hours per year thinking about pricing, there's a lot of untapped growth potential in optimizing what you charge. In fact, choosing the best pricing method is a more powerful growth lever than customer acquisition. In some cases, it can be up to 7.5 times more powerful than acquisition.

The importance of nailing your pricing strategy

Having an effective pricing strategy helps solidify your position by building trust with your customers, as well as meeting your business goals. Let's compare and contrast the messaging that a strong pricing strategy sends in relation to a weaker one.

A winning pricing strategy:

- Portrays value

The word cheap has two meanings. It can mean a lower price, but it can also mean poorly made. There's a reason people associate cheaply priced products with cheaply made ones. Built into the higher price of a product is the assumption that it's of higher value.

- Convinces customers to buy

A high price may convey value, but if that price is more than a potential customer is willing to pay, it won't matter. A low price will seem cheap and get your product passed over. The ideal price is one that convinces people to purchase your offering over the similar products that your competitors have to offer.

- Gives your customers confidence in your product

If higher-priced products portray value and exclusivity, then the opposite follows as well. Prices that are too low will make it seem as though your product isn't well made.

A weak pricing strategy:

- Doesn't accurately portray the value of your product

If you believe you have a winning product, and you should if you are selling it, then you need to convince customers of that. Setting prices too low sends the opposite message.

- Makes customers feel uncertain about buying

Just as the right price is one that customers will pull the trigger on quickly, a price that's too high or too low will cause hesitation.

- Targets the wrong customers

Some customers prefer value, and some prefer luxury. You have to price your product to match the type of customer it is targeted towards.

Let's now take a closer look at the seven most common pricing strategies that were outlined above with more from Paddle Studios .

Click on any of the links below for a more in-depth guide to that particular pricing strategy.

1. Value-based pricing

With value-based pricing, you set your prices according to what consumers think your product is worth. We're big fans of this pricing strategy for SaaS businesses.

2. Competitive pricing

When you use a competitive pricing strategy, you're setting your prices based on what the competition is charging. This can be a good strategy in the right circumstances, such as a business just starting out , but it doesn't leave a lot of room for growth.

3. Price skimming

If you set your prices as high as the market will possibly tolerate and then lower them over time, you'll be using the price skimming strategy. The goal is to skim the top off the market and the lower prices to reach everyone else. With the right product it can work, but you should be very cautious using it.

4. Cost-plus pricing

This is one of the simplest pricing strategies. You just take the product production cost and add a certain percentage to it. While simple, it is less than ideal for anything but physical products.

5. Penetration pricing

In highly competitive markets, it can be hard for new companies to get a foothold. One way some companies attempt to push new products is by offering prices that are much lower than the competition. This is penetration pricing. While it may get you customers and decent sales volume, you'll need a lot of them and you'll need them to be very loyal to stick around when the price increases in the future.

6. Economy pricing

This strategy is popular in the commodity goods sector. The goal is to price a product cheaper than the competition and make the money back with increased volume. While it's a good method to get people to buy your generic soda, it's not a great fit for SaaS and subscription businesses.

7. Dynamic pricing

In some industries, you can get away with constantly changing your prices to match the current demand for the item. This doesn't work well for subscription and SaaS business, because customers expect consistent monthly or yearly expenses.

Three real-world pricing strategy examples

Real-world pricing strategy examples are the best way for a business to better understand the above-listed pricing strategies. Evaluating other businesses' approaches can be a good starting point but keep in mind that the right pricing strategy is based on math, market research, and consumer insights. For now, let’s look at the pricing strategy examples of some of the biggest brands of today:

1. Streaming services

Have you noticed that you pay roughly the same amount for Netflix, Amazon Prime Video, Disney+, Hulu, and other streaming services? That's because these companies have adopted competitive pricing , or at least a form of it, called market-based pricing .

2. Salesforce

When Salesforce first came out, they were the only CRM in the cloud. (It wasn't even called 'the cloud' back then!) Armed with ground-breaking deployment and a target customer of a large enterprise, Salesforce could charge what they wanted. Later, after they'd grown, they were able to lower prices so small businesses could sign up. This is a classic example of price skimming .

3. Dollar Shave Club

At one time, you couldn't turn on your TV without an ad for Dollar Shave Club telling you how much cheaper they were than razors at the store. Although an aggressive marketing strategy and advertising like that is unusual for the pricing model, they were nevertheless employing economy pricing. It worked out well for them. They were acquired by Unilever in 2016 for a reported $1 billion.

How to create a winning pricing strategy

In the beginning, the actual number you're charging isn't that important.

There are some exceptions, but for the most part, you should first be figuring out the range you're in: a $10 product, $100 product, $1k product, etc. Don't waste time debating $500 vs. $505, because this doesn't matter as much until you have a stronger foundation beneath you.

Instead, understanding the following is much more important:

- Finding your value metric

- Setting your ideal customer profiles and segments

- Completing user research + experimentation

This video from Paddle Studios goes deep on mastering a winning pricing strategy.

Step 1: Determine your value metric

A “ value metric ” is essentially what you charge for. For example: per seat, per 1,000 visits, per CPA, per GB used, per transaction, etc.

If you get everything else wrong in pricing, but you get your value metric right, you'll do ok . It's that important. Partly because it bakes lower churn and higher expansion revenue into your monetization.

A pricing strategy based on a value metric (vs. a tiered monthly fee) is important because it allows you to make sure you're not charging a large customer the same as you'd charge a small customer.

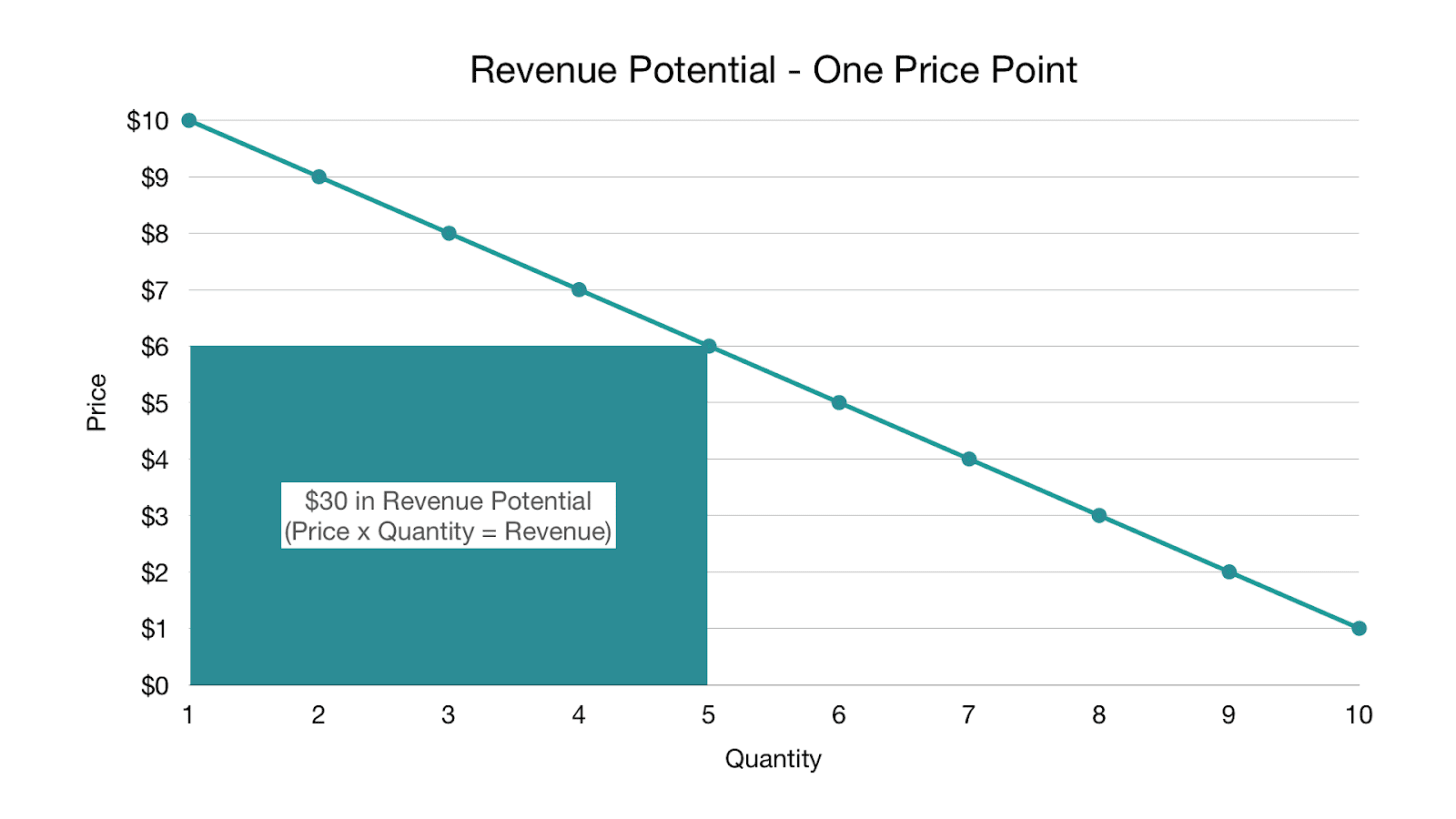

If you remember your high school or college economics class, the professor put a point on a demand curve for the perfect price and said “the revenue a firm gets is the area under that point.” The problem here is: what about all that other area under the curve? You’re missing out on that revenue by charging a flat monthly fee.

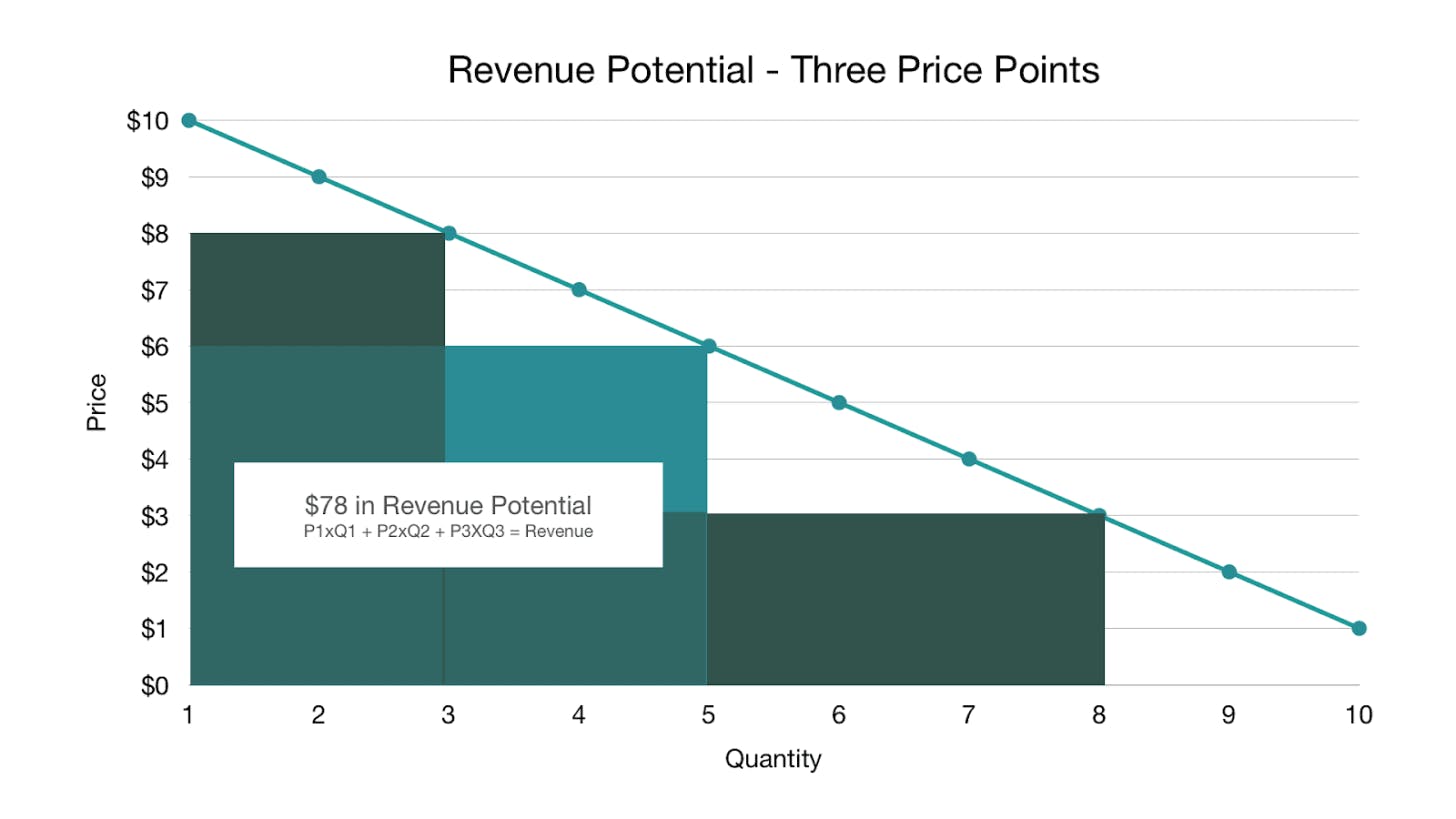

“Good, better, best” pricing strategy is a bit more advantageous, because you end up with three points on our trusty demand curve, and thus more revenue potential. You see this problem among many eCommerce businesses and retailers whose products are constrained by being physical goods—the car with the basic package vs. the car with the stereo and sunroof vs. the car with everything. In software, it’s thankfully dying out, but you’ll still see it with mass-market products: Netflix, Adobe Creative Cloud, etc.

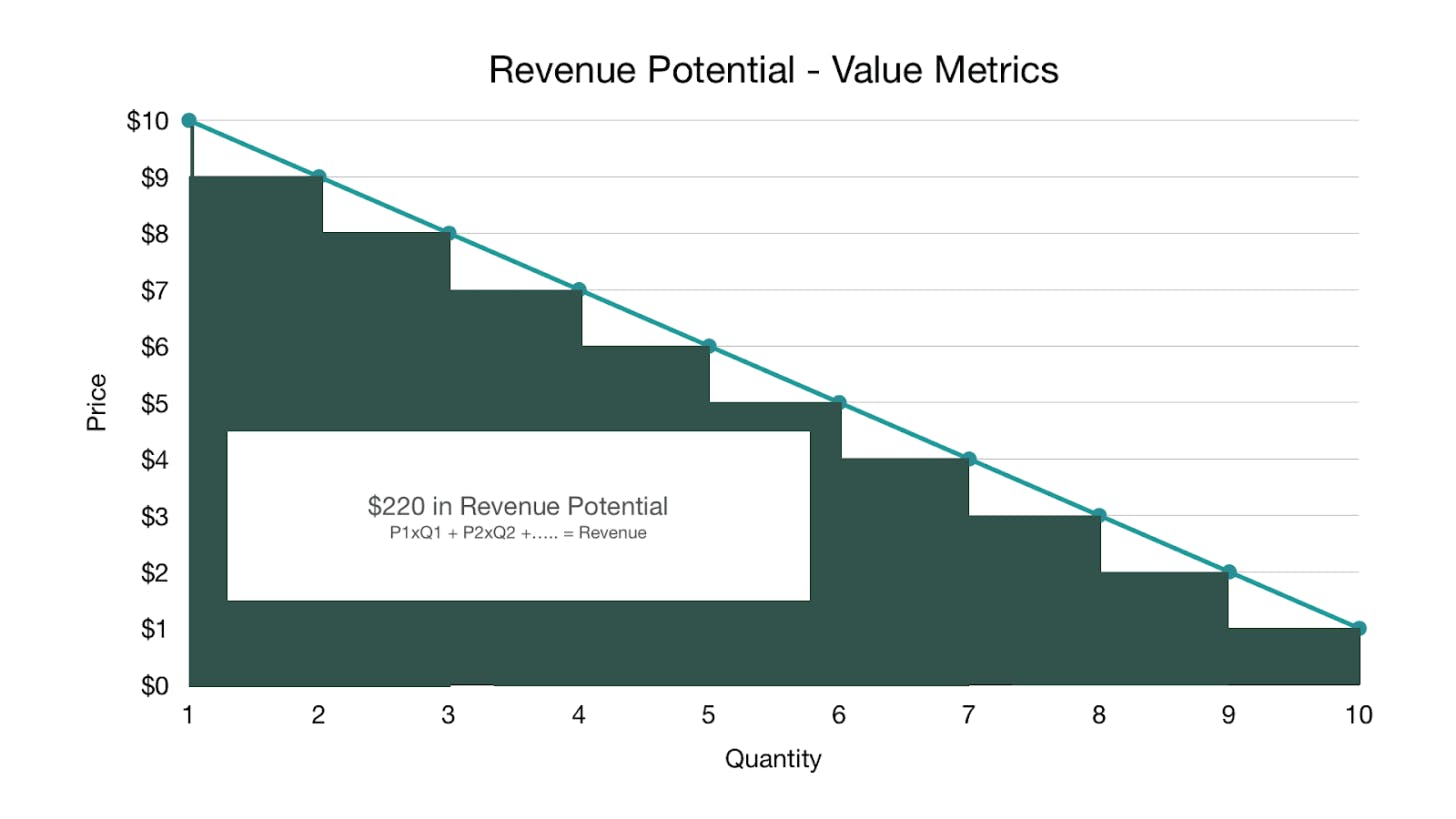

A value metric, however, allows you to have essentially infinite price points—maximizing your revenue potential. In practice, you’ll never show infinite price points on your pricing page , sales deck, or mobile conversion page, but you may have a new customer come in at a certain level and then grow.

Value metrics also bake growth directly into how you charge because as usage or the amount of value received goes up (and those are not the same thing), the customer pays more. If they end up using or consuming less, they pay less (and thus avoid churning). This is why companies using value metrics are typically growing at double the rate with half the churn and 2x the expansion revenue when compared to companies that charge a flat fee or where the only difference between their pricing tiers are features.

To determine your value metric, think about the ideal essence of value for your product—what value are you directly providing your customer?

In B2B, it's likely going to be money saved, revenue gained, time saved, etc. In DTC , it may be the joy you bring them, fitness achieved, increased efficiency, etc. Obviously, we can't measure all of these, but if you can, and your customer trusts your measurement (meaning you say you saved them $100 and they agree you saved them $100), that’s your value metric.

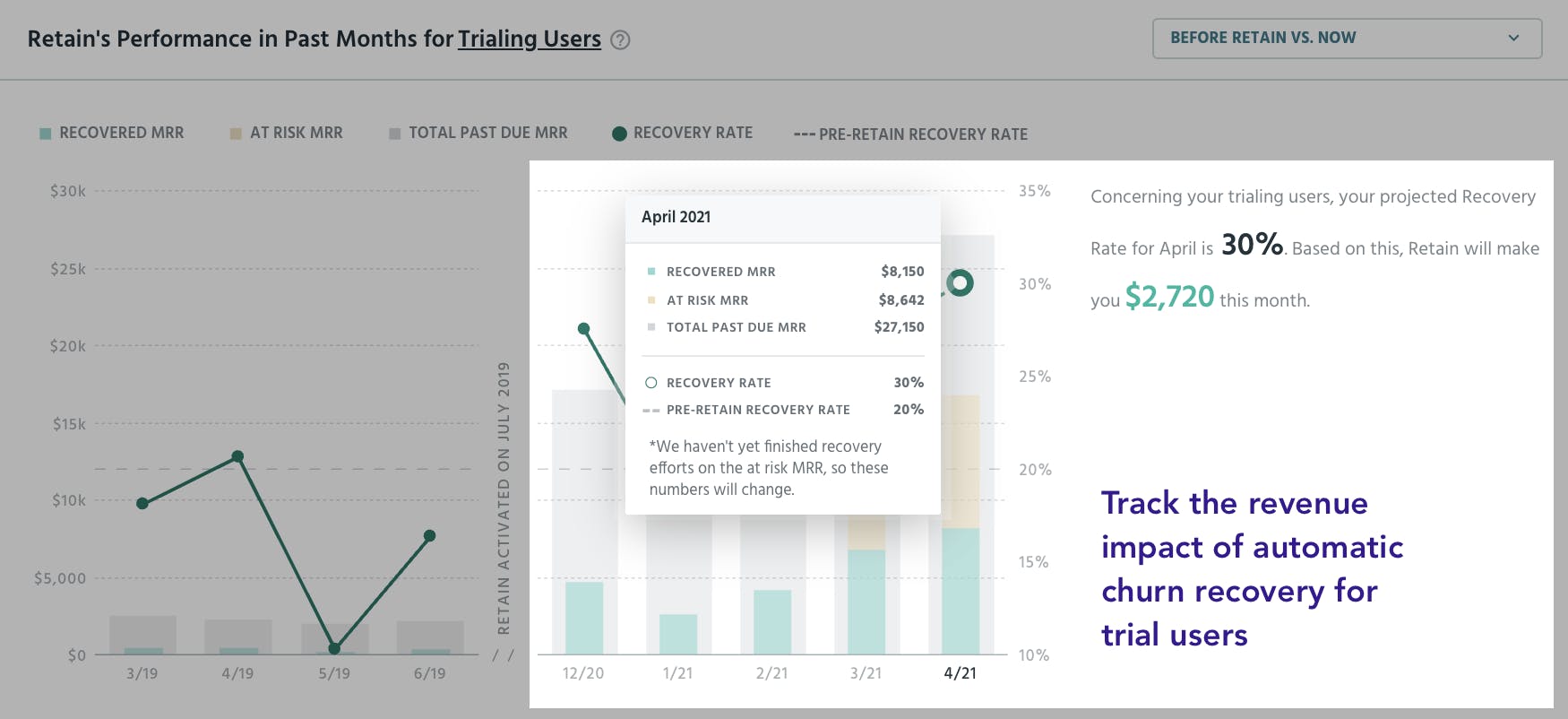

As an example, the perfect value metric for Paddle Retain (our churn recovery product) is how much churn we recover for you. We can measure this, and our customers agree to the measurement, so we can charge on that axis. Other pure value metric products include MainStreet , which handles government paperwork to automatically get you back tax credits—you pay a percentage of the money saved.

Most of you won't have a pure value metric, so the next step is to find a proxy for that metric. Take for example HubSpot ’s marketing product. Their pure value metric is the amount of revenue their tool drives for your business. This is hard to measure and hard for the customer to agree to in terms of what percentage of credit HubSpot deserves for revenue from a blog post. Proxies for HubSpot are things like the number of contacts, number of visits, number of users, etc.

To find the right proxy metric, you want to come up with 5-10 proxies and then talk to your customers and prospects. You’ll typically find 1-2 of these pricing metrics will be most preferred amongst your target customers. You then want to make sure those 1-2 also make sense from a growth perspective. Your larger customers should be using/getting more of the metric, whereas your smaller customers should be using/getting less of the metric. You also want to make sure the metric encourages retention.

When we look at HubSpot, if they were to primarily price on “number of seats”, folks could share a login and HubSpot wouldn’t make much more money on large customers vs. small. Ironically they wouldn’t get as many people invested in HubSpot, because there’d be friction to adding additional seats. Instead, if they give unlimited seats and price based on “number of contacts” there’s minimal friction to getting as many people into HubSpot as possible to do activities (e.g., blog posts, email campaigns , landing pages, etc.) that then produce contacts.

The result: HubSpot’s marketing product’s value metric is “contacts”, which ensures growth is baked directly into how they make money. The usage drives the metric, which therein drives revenue. Most importantly customers small, medium, and large are all paying at the point they see the value and then can grow.

Some other examples:

- Wistia charges by the number of videos or channels you use/have

- Zapier invented the concept of zap (connection of software) and charge based on time to connect

- Theater in Barcelona charged based on the number of laughs

- Husqvarna charges based on time for lawn care products vs. making you buy them

- Rolls Royce charges per mile for airplane engines. They own the engines on the plane you own and do all the maintenance. Cool model.

- Fresh Patch charges based on the amount of grass you want per month for your dog—yes they deliver grass to you monthly

As a side note, you should stop pricing based on seats for products where each seat doesn’t provide a unique experience. For instance, imagine you're an AE using a CRM. If you log into the account of the AE sitting next to you, you can’t really do your work because you are only seeing their leads and accounts. Conversely, if you were a marketing exec and were to log in to another marketing manager’s account in HubSpot, you could do all the work you need to. Thus, for the latter, seats are not the right value metric.

Per-seat pricing is a relic of the perpetual license era when we couldn’t measure usage or value enough within our products. We’re beyond that point, so use the above as a good litmus test.

Step 2: Determine your customer profiles and segments

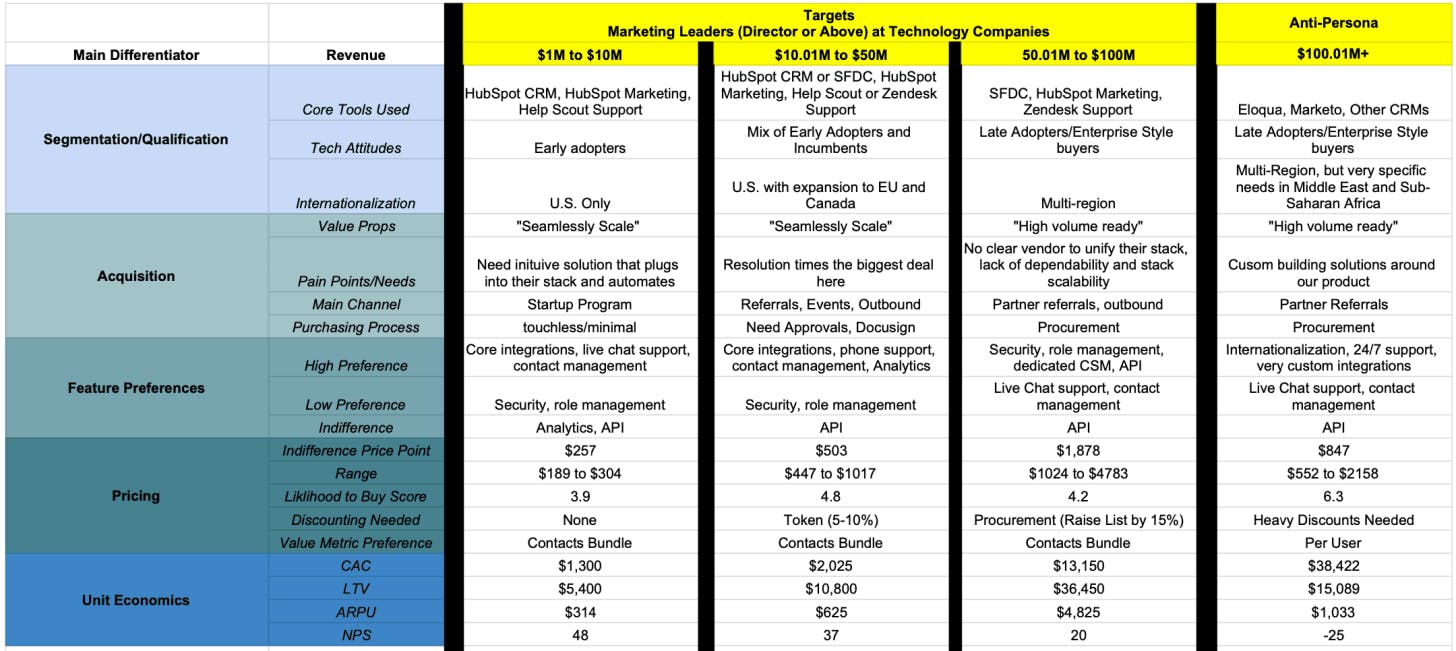

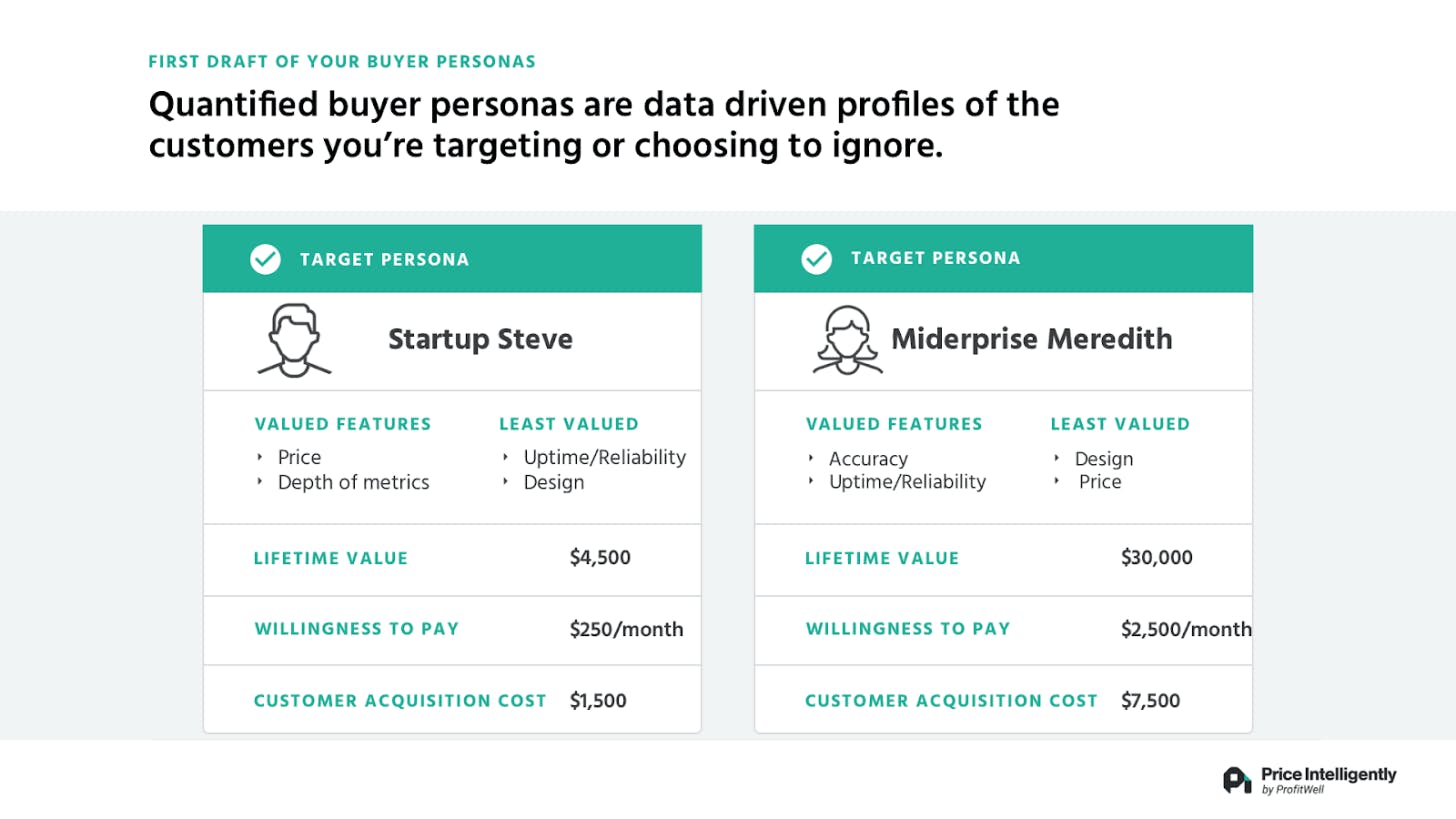

The second key component of your pricing strategy is determining your target segment and ideal customer profile. We've all heard about personas, and you may be rolling your eyes at the concept, but most personas are useless because they aren’t quantitative enough. When used properly, quantified personas and segments are beautiful tools. The information needs to go beyond just cute names like “Startup Steve" with a cute avatar, and cute meetings where people tell you they’re targeting "developers."

To get quantified personas, you need to pull out a spreadsheet. Here’s a template you can use.

1. Columns: Customer profiles you're targeting

These can take many forms, but the ultimate goal is to be as specific as possible so that you not only know who you’re targeting but how to monetize and retain them. Pragmatically, you typically separate these customer profiles based on size or role (or both). For example, a marketing automation product may target the following profiles:

- Marketing leaders (Director and higher) at companies $1M to $10M

- Marketing leaders (Director and higher) at companies $10.01M to $50M

- Marketing leaders (Director and higher) at companies $50.01M to $100M

The point is you can’t be everything to all people and you need to understand who you’re targeting in order to make better decisions.

2. Rows: Characteristics of each profile to help you differentiate between them

- Most valued features

- Least valued features

- Willingness to pay

- Lifetime value (LTV)

- Customer acquisition costs (CAC)

- ... and any other metric or category you think could be useful

If you're just starting out or you don't have some of this data, it’s fine. Still fill it out though with your hypotheses. You know something about your customers.

Next, you then need to validate (or invalidate) the most pressing hypothesis in that spreadsheet based on the decisions you’re going to make. If you're going to validate a new feature for a particular segment, then that's where you should start. Price point the biggest question? Start by researching the price point with each of these roles/segments.

If you don't know who your key roles/segments are, there's no way in hell you’ll set up an efficient growth flywheel, let alone an optimized pricing strategy. Personas act as a constitution within your business to centralize your focus and arguments about direction.

If you don't do segment and persona analysis, you better be able to raise a ton of money. I guarantee you there's some persona or segment on some vision document or in that euphoric part of your entrepreneurial brain that is completely wrong for your business. I see it all the time. Even I—someone who thinks about segments and customer research all the time—fall prey to being an absolute idiot with who we should target.

When we built ProfitWell Metrics (our free subscription metrics tool) I thought we were geniuses who were going to be billionaires. Turns out analytics products are terrible. Willingness to pay for them is terrible; retention for them is terrible; NPS is terrible. Everything is just terrible, mainly because customers don't appreciate graphs or at least aren't willing to pay much for them. When we did our research this became obvious and put us 18 months ahead of our competitors, pushing us to change up the positioning of the product to freemium, which has fueled our business ever since (oh and our NPS is 70, because we massively over-deliver a free product better than the paid competition).

Never underestimate the power of focusing on the customer through research. You should never, ever just do what they ask, but you need to be an anthropologist who knows them better than anyone else.

Step 3: User research + experimentation

Beyond your value metric and core segments, the monetization game becomes extremely tactical and research-based. Figuring out your price point involves researching those segments and then making decisions in the field. Same with discounting, add-on, and packaging strategies. The point: monetization is never finished because it’s the very essence of translating your value into an optimal framework for your target customer segments.

Practically this is why you should be experimenting with your monetization every quarter. Experimentation can get tricky and have a few quirks, but you’ll find it’s similar to most growth frameworks out there (which are all versions of the scientific method).

Here’s a good prioritization list of what business owners should attack in optimizing their monetization strategy once they have the core segments and value metric figured out:

Priority 1: Foundational [see above]

- Core customer segments

- Value metrics

Priority 2: Core

- Order of magnitude price point (are you a $10 product vs. a $500 product)

- Positioning and value props

Priority 3: Optimizations

- Add-on strategy

- Specific price point (are you a $10 product vs. a $11 product)

- Price localization/internationalization

- Discounting strategy

- Contract Term optimization

Priority 4: Growth accelerators

- Market expansion (going up or down market)

- Vertical expansion

- Multi-Product

Your true order of operations with monetization will vary, but for the most part, all companies should work through the foundational and core sections before moving to the optimizations and growth accelerators. If you’re larger or there’s a fire, you may start with an optimization. In fact, this is sometimes a good idea. Something more scoped like “price localization” can help get momentum, be a forcing function to clean up tech and experimentation stacks, and mitigate political conversations. Remember, monetization is something that’s important, uncomfortable, and something you likely don’t know much about, so progress is better than nothing. Start small. You can (and should) always do more.

Bonus: 10 rapid-fire pricing strategy tips rooted in data⚡

In case you're still hungry for more tips on nailing your pricing strategy and achieving maximum profitability, look no further. We've got you covered:

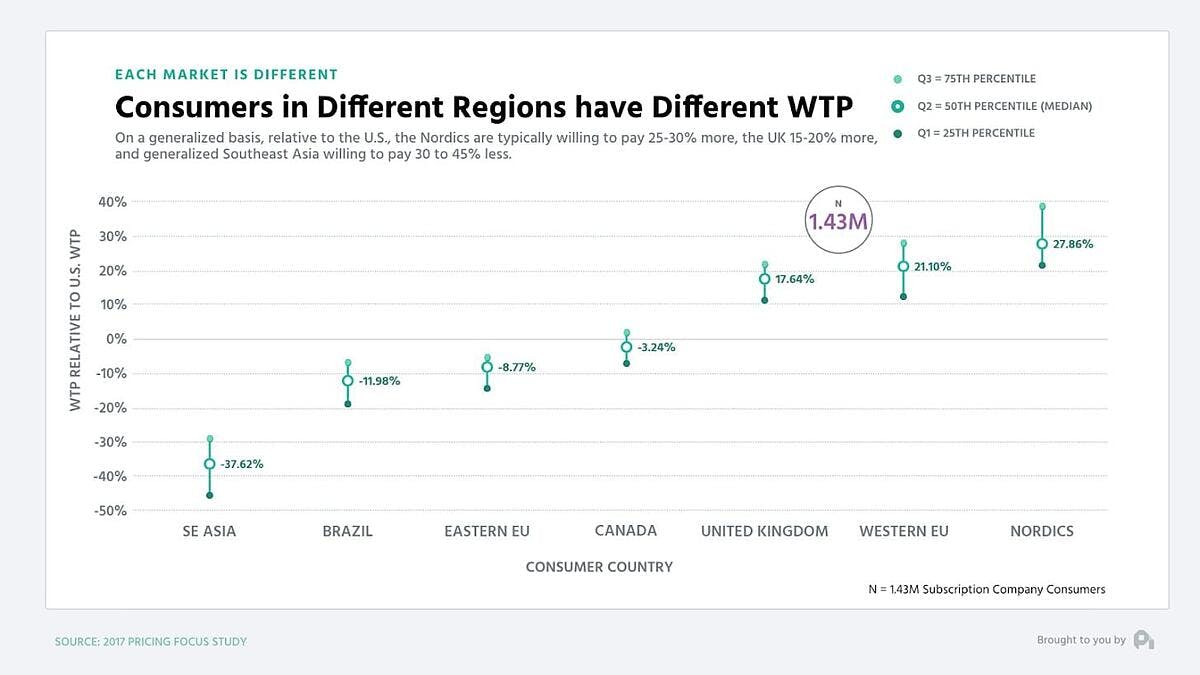

1. You should localize your pricing to the currency and willingness to pay of the prospect's region

- Revenue per customer is 30% higher when you just use the proper currency symbol

- Having different price points in different regions increases revenue per customer further, and is justified based on different consumer demands in different regions

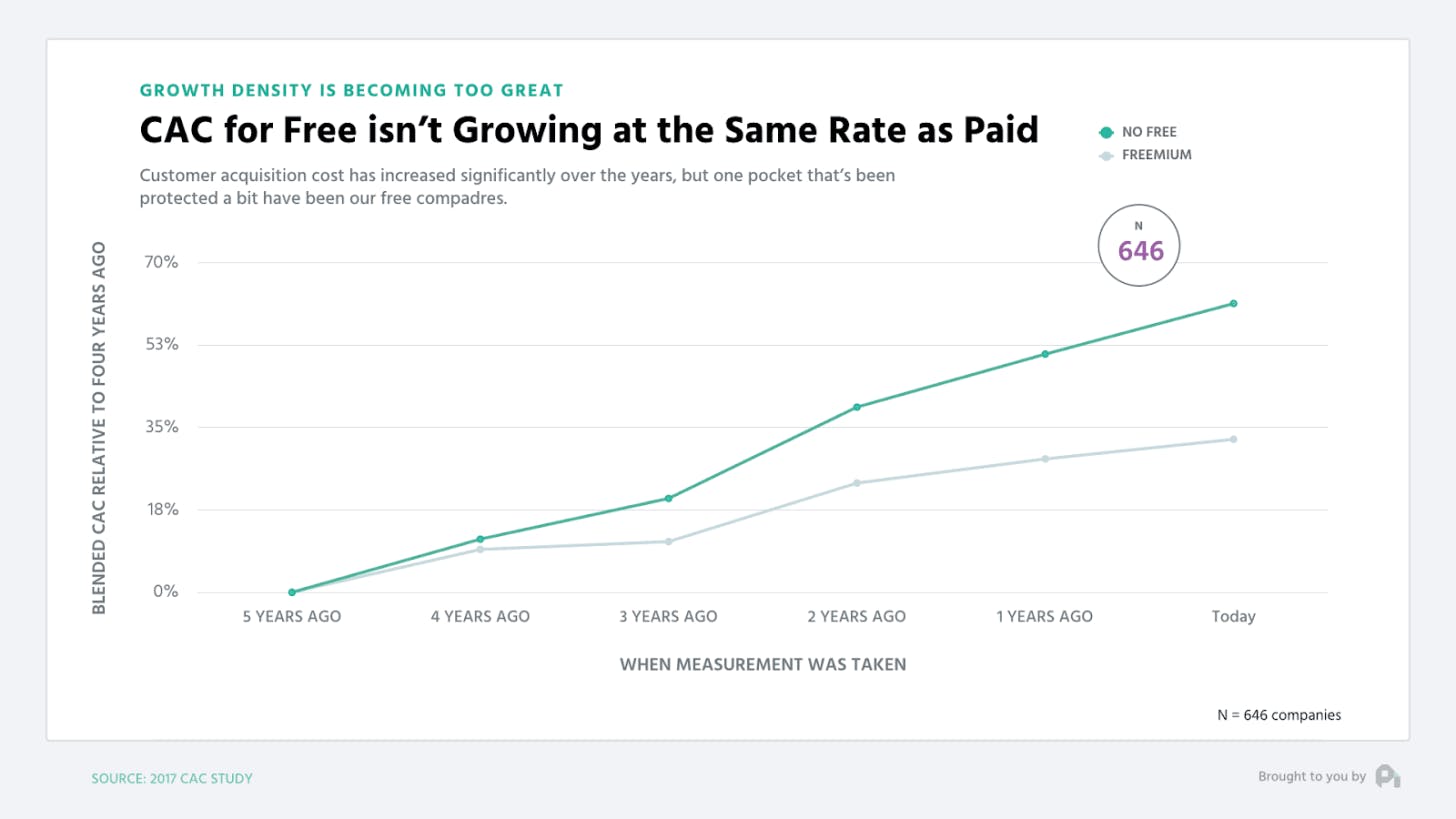

2. Freemium is an acquisition model, not a part of pricing

- Think of freemium as a premium ebook driving leads, not another pricing tier

- Don't do freemium until you truly understand how to convert leads to customers, because you’ll end up increasing noise or false positives when you’re trying to figure out your segment beachheads. The best folks who deploy free typically don’t implement freemium until two to three years into their business. The exceptions to this notion are if you have a very specific need or network effect (eg., marketplaces, social networks, etc.) or if you have a top 50 growth person on your team.

- To be clear, we're not saying DON’T do freemium. we're saying it's a scalpel, not a sledgehammer that requires thought. A lot of people end up reading our articles on freemium and end up going, “Cool, let’s do freemium and we’ll be a unicorn.” I’m being pragmatic in that you need to realize freemium is fantastic, but doing freemium properly takes a lot of effort and nuance.

- Paid users who convert from free tend to have higher NPS, better retention, and much lower CAC .

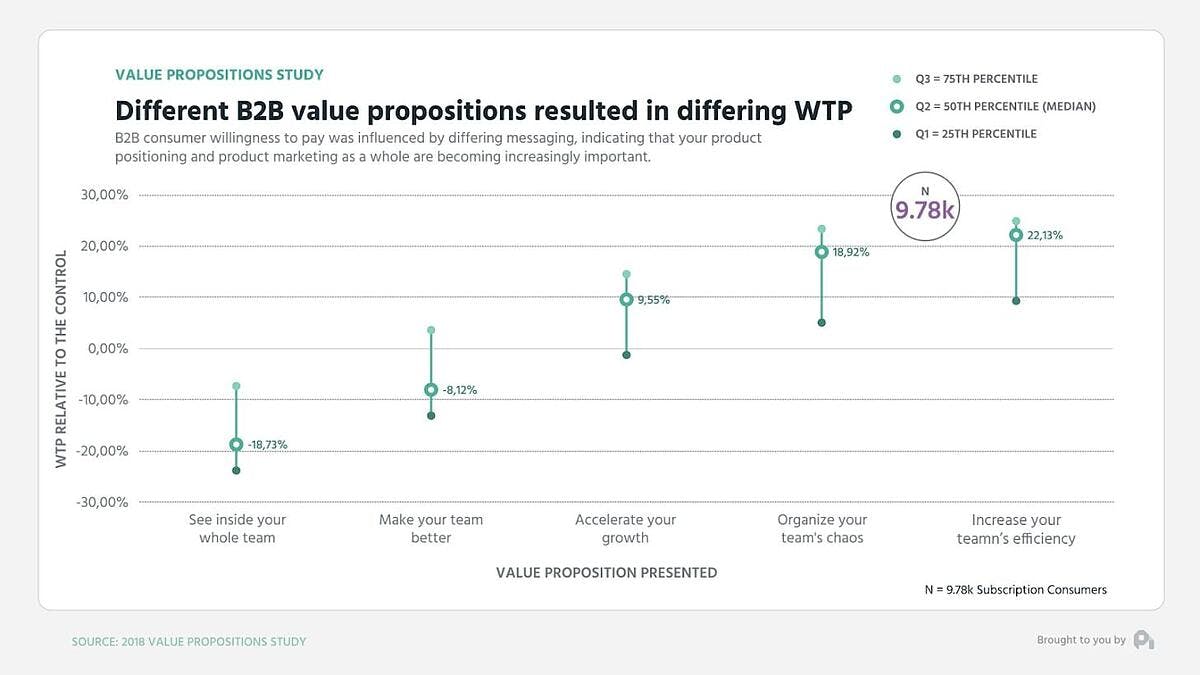

3. Value propositions matter oh so much

In B2B value propositions can swing willingness to pay ±20%, in DTC it's ±15%

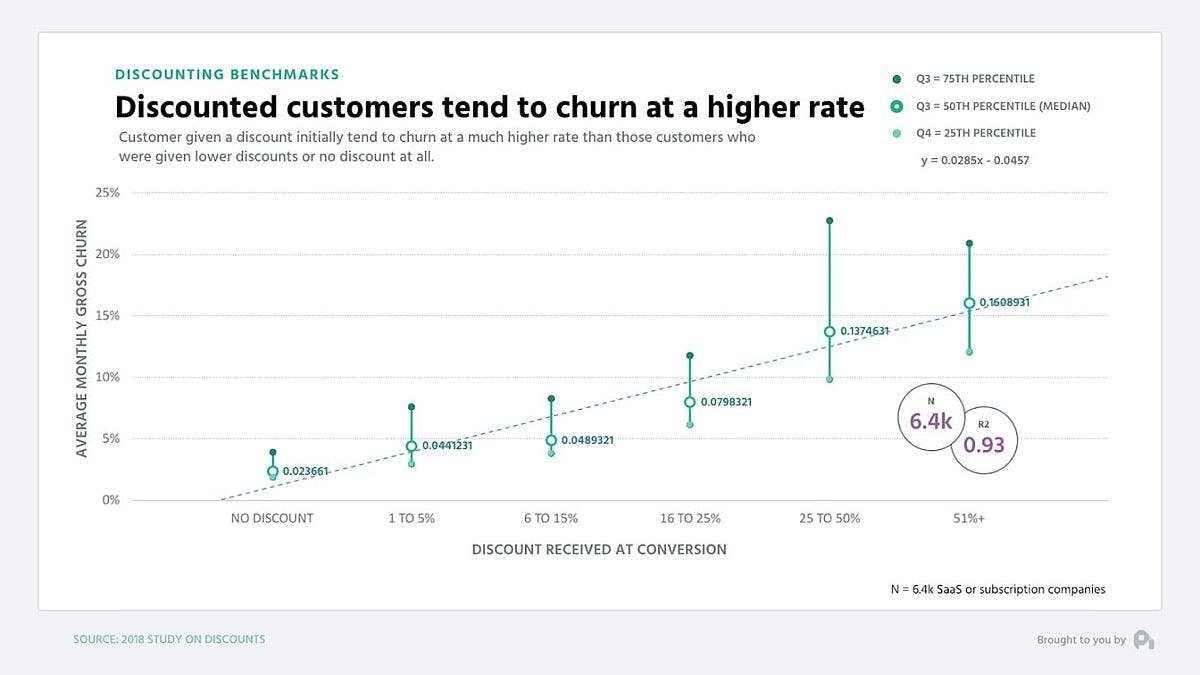

4. Don't discount over 20%

In some verticals discounting over 20% may be fine, but you're likely not in one of them (although you may think you are), but the size of the discount almost perfectly correlates with higher churn. Large discounts get people to convert, but they don't stick around.

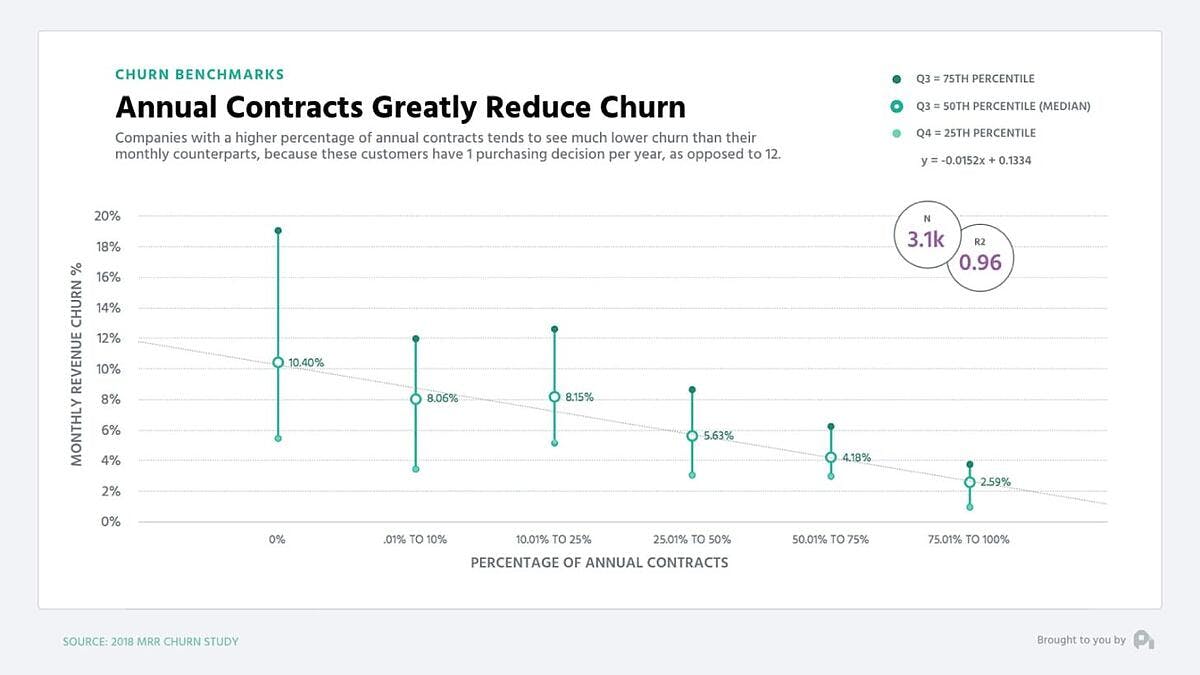

5. For upgrades to annual discounts, don't use percentages and try offers

Percentages don't work as well as whole dollar amounts for discounts (ie., "one month" will work better than "X percent off"). Annuals see much lower churn rates.

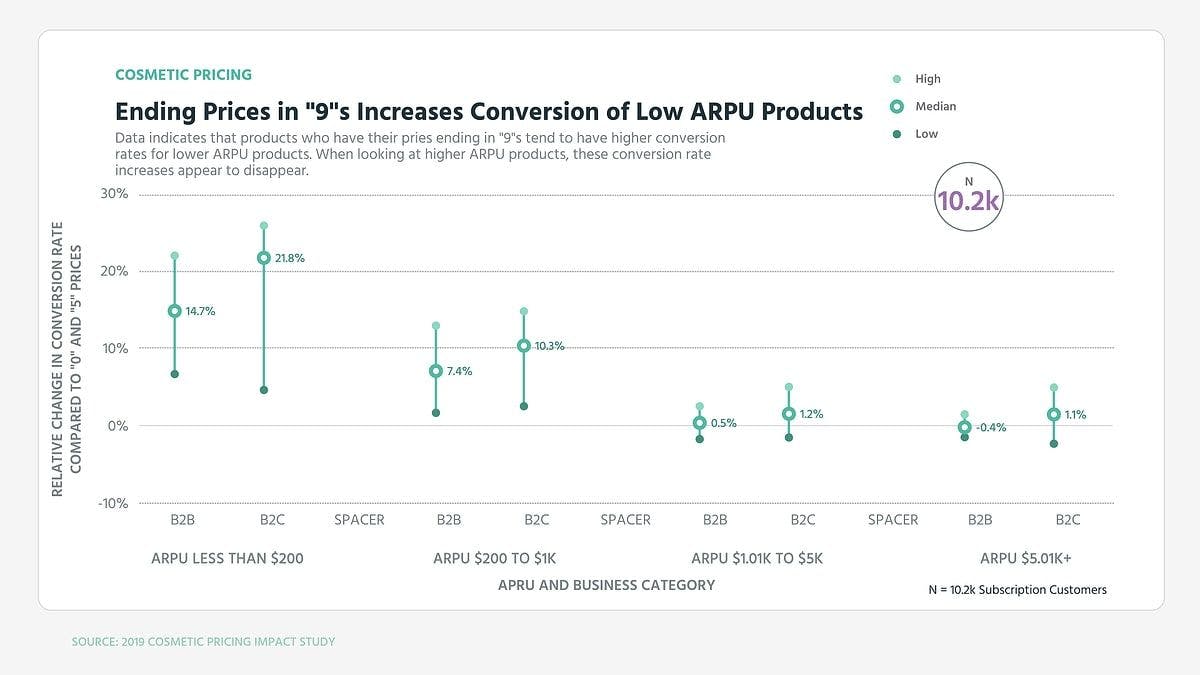

6. Should you end your price in 9s or 0s? Depends on your price point

Ending your prices in 9s evokes a discount brand, making the customer feel like they're getting something. Ending in 0 evokes luxury or premium, making them feel like they're getting a high-end product. Studies on this for technology products are inconclusive. We have seen it increase conversion in lower-cost products, but retention isn't as good with those customers.

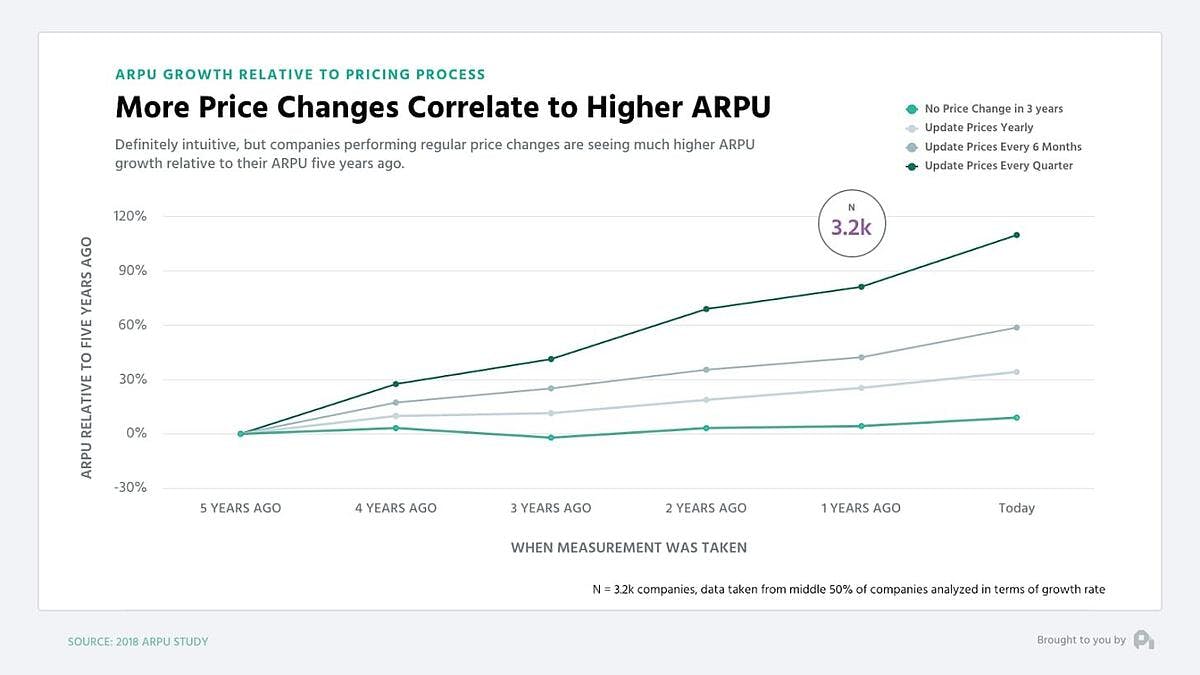

7. You should experiment with your pricing in some manner every quarter

This doesn't mean change you should the price point each quarter, but experiment with variable costs. More changes correlate with increasing revenue per customer. Like all things, focusing on something makes you improve it.

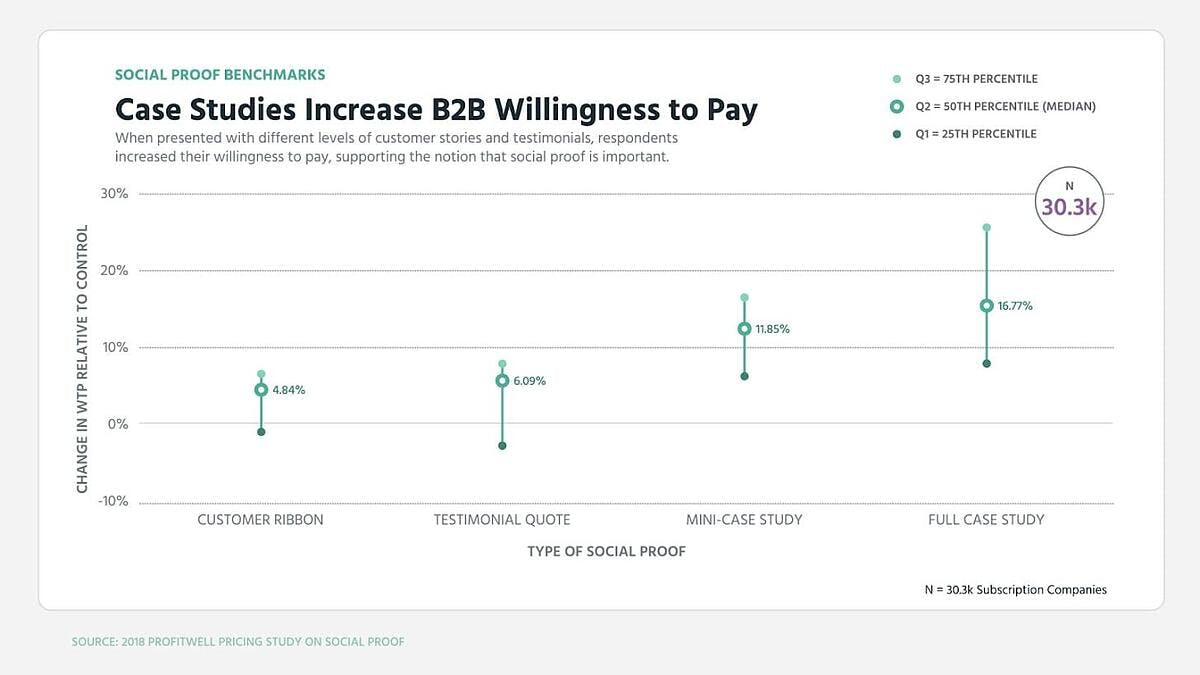

8. Case studies boost willingness to pay quite a bit

Social proof is important. Case studies that offer proof of the high quality of your products can boost willingness to pay by 10-15% in both B2B and in DTC.

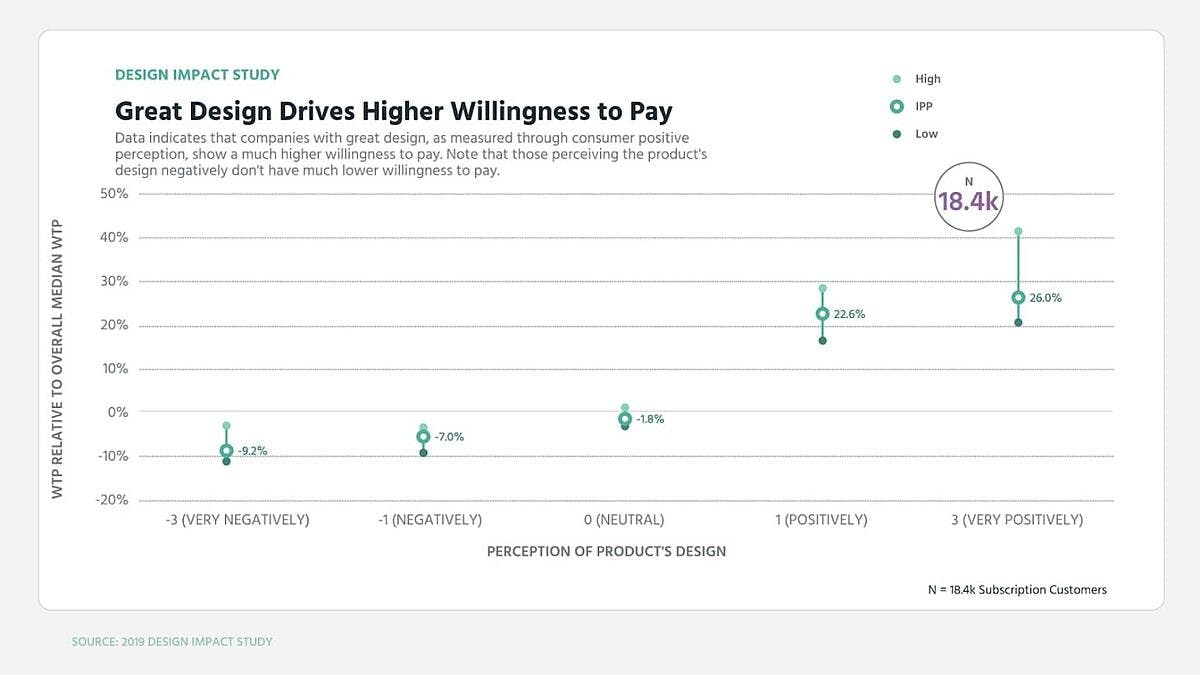

9. Design helps boost willingness to pay by 20%

This graph didn't look this way 10 years ago when design didn't do much for willingness to pay. Today, affinity for a company's design can boost willingness to pay considerably.

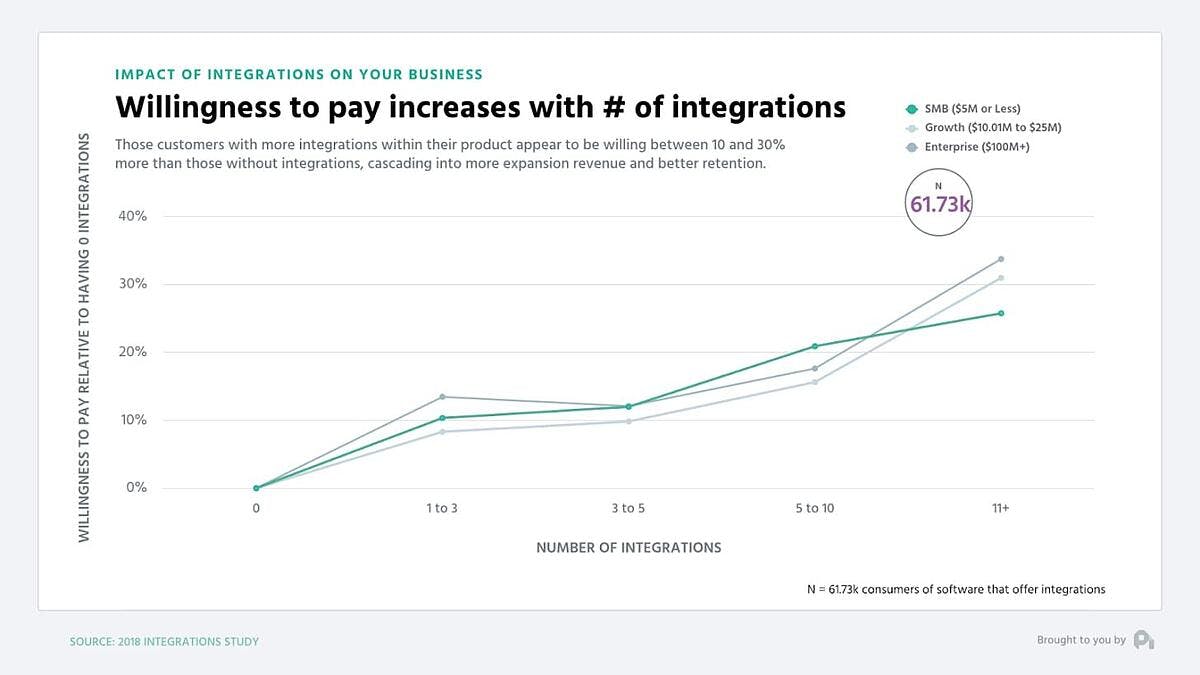

10. Integrations boost retention and willingness to pay

The more integrations a customer is using, typically the higher their willingness to pay and the better their retention. I wouldn't charge for the integrations, but I'd use this as a tool to get people hooked in and paying more or buying different add-ons.

Pricing strategies for different industries

Pricing strategies are not one size fits all. Finding the proper pricing strategy is dependent on your industry, as well as your company's unique objectives. But to give you an idea, we've listed a couple of industries and strategies that are well suited for each other.

SaaS/Subscriptions

For SaaS and subscription-based businesses, value-based pricing is the winner hands down. As long as your customers are willing to pay, you can charge much more than your competitors. Because your price is based on how much customers will spend, it isn't artificially lowered like other methods that fail to account for that.

We also like value-based pricing for B2B companies. Value-based pricing requires you to look outward and understand your customers better. This is good for finding the optimal price, but it's also good for building optimal relationships that will also help grow your company.

No more price guessing, just pricing that works

Accurately pricing your product for maximum growth requires a lot of market research and even more expertise on how to conduct and analyze that research. Our Price Intelligently service combines our years of experience in the field with powerful machine learning tools to understand your target customer base and what makes them tick. We know the data to collect, the questions to ask, and the people to ask them of. This is important because businesses in different stages of growth need different strategies for evaluating pricing. Additionally, every business has a unique set of potential selling points and a unique target audience to pitch to.

You need someone in your corner who knows how to evaluate pricing options for your specific businesses. With our help, you can be confident that your pricing strategy and chosen price points will unlock growth levers at your company that have been sitting idle, because they'll be tailored to finding and maximizing the value propositions that are unique to your business.

Which pricing strategy is best?

This depends on your business model. For SaaS and subscription companies, as well as many others, we recommend value-based pricing.

How do you determine the selling prices of a product?

First, find a pricing strategy that fits well with your business model and product. As you've seen, pricing strategies differ, but they all give clear instructions for how to use them to set prices.

What is the simplest pricing strategy?

Since you only need to add up the cost to make your product and add a percentage to it, cost-plus pricing is the simplest form of pricing to use.

What is a pricing curve?

A pricing curve is a graph that shows you the number of people who are willing to pay a given price for a product.

What are the 4 major pricing strategies?

Value-based, competition-based , cost-plus, and dynamic pricing are all models that are used frequently, depending on the industry and business model in question.

Related reading

Take a look at all our Webinars and Events!

Elevate Pricing with Elasticity

Optimise Pricing with Sensitivity

Case study - 6 min read, how to write a pricing strategy for my business plan.

In this blog you will learn about the importance of choosing the right pricing strategy for a successful business plan.

BLOGS & ARTICLES

Get your ceo book for intelligent pricing.

- How to become a Hyperlearning organisation

- How to develop your organisational processes

- How to choose an algorithm that fits your business

Get your playbook for behavior-Based Pricing and using AI Driving Tooling

- Increase margin & revenue

- Become a Frontrunner in your market

- Be agile, use AI pricing software & learn from it to become a Hyperlearning Organisation

Why is a pricing strategy important for a business plan?

A business plan is a written document outlining a company’s core business practices – from products and services offered to marketing, financial planning and budget, but also pricing strategy. This business plan can be very lengthy, outlining every aspect of the business in detail. Or it can be very short and lean for start ups that want to be as agile as possible.

This plan can be used for external investors and relations or for internal purposes. A business plan can be useful for internal purposes because it can make sure that all the decision makers are on the same page about the most important aspects of the business.

A 1% price increase can lead to an 8% increase in profit margin.

A business plan could be very lengthy and detailed or short and lean, but in all instances, it should have a clear vision for how pricing is tackled. A pricing strategy ultimately greatly determines the profit margin of your product or service and how much revenue the company will make. Thorough research of consultancy agencies also show that pricing is very important. McKinsey even argues that a 1% prices increase can lead up to an 8% increase in profits. That is a real example of how small adjustments can have a huge impact!

It is clear that each business plan should have a section about pricing strategies. How detailed and complicated this pricing strategy should be depends for each individual business and challenges in the business environment. However, businesses should at least take some factors into account when thinking about their pricing strategy.

What factors to take into account?

The pricing strategy can best be explained in the marketing section of your business plan. In this section you should describe what price you will charge for your product or service to customers and your argumentation for why you ask this. However, businesses always balance the challenging scale of charging too much or too little. Ideally you want to find the middle, the optimal price point.

The following questions need to be answered for writing a well-structured pricing strategy in your business plan:

What is the cost of your product or service?

Most companies need to be profitable. They need to pay their expenses, their employees and return a reasonable profit. Unless you are a well-funded-winner-takes-all-growth-company such as Uber or Gorillas, you will need to earn more than you spend on your products. In order to be profitable you need to know how much your expenses are, to remain profitable overall.

How does your price compare to other alternatives in the market?

Most companies have competitors for their products or services, only few companies can act as a monopoly. Therefore, you need to know how your price compares to the other prices in the market. Are you one of the cheapest, the most expensive or somewhere in the middle?

Why is your price competitive?

When you know the prices of your competitors, you need to be able to explain why your price is better or different than that of your competitions. Do you offer more value for the same price? Do you offer less, but are you the cheapest? Or does your company offer something so unique that a premium pricing strategy sounds fair to your customer? You need to be able to stand out from the competition and price is an efficient differentiator.

What is the expected ROI (Return On Investment)?

When you set your price, you need to be able to explain how much you are expeciting to make. Will the price you offer attract enough customers to make your business operate profitable? Let’s say your expenses are 10.000 euros per month, what return will your price get you for your expected amount of sales?

Top pricing strategies for a business plan

Now you know why pricing is important for your business plan, “but what strategies are best for me?” you may ask. Well, let’s talk pricing strategies. There are plenty of pricing strategies and which ones are best for which business depends on various factors and the industry. However, here is a list of 9 pricing strategies that you can use for your business plan.

- Cost-plus pricing

- Competitive pricing

- Key-Value item pricing

- Dynamic pricing

- Premium pricing

- Hourly based pricing

- Customer-value based pricing

- Psychological pricing

- Geographical pricing

Most of the time, businesses do not use a single pricing strategy in their business but rather a combination of pricing strategies. Cost-plus pricing or competitor based pricing can be good starting points for pricing, but if you make these dynamic or take geographical regions into account, then your pricing becomes even more advanced!

Pricing strategies should not be left out of your business plan. Having a clear vision on how you are going to price your product(s) and service(s) helps you to achieve the best possible profit margins and revenue. If you are able to answer thoughtfully on the questions asked in this blog then you know that you have a rather clear vision on your pricing strategy.

If there are still some things unclear or vague, then it would be adviceable to learn more about all the possible pricing strategies . You can always look for inspiration to our business cases. Do you want to know more about pricing or about SYMSON? Do not hesitate to contact us!

Do you want a free demo to try how SYMSON can help your business with margin improvement or pricing management? Do you want to learn more? Schedule a call with a consultant and book a 20 minute brainstorm session!

HAVE A QUESTION?

Frequently asked questions, related blogs.

4 Tips for keeping your pricing manageable

How to implement a new pricing strategy in 4 steps

How To Price Your Products: 5 Most Common Strategies

Other case studies you might be interested in.

B2B Price Monitoring: How to Monitor Competitor Prices Beyond B2B Portals Logins

How LLM-Powered Tools Help You Optimise Your Business Processes

Hyperlearning

Ready to kickstart your pricing journey?

Talk to a SYMSON expert now

Empowering hyperlearning ™.

The Ultimate Guide to Pricing Strategies & Models

Discover how to properly price your products, services, or events so you can drive both revenue and profit.

FREE SALES PRICING CALCULATOR

Determine the best pricing strategy for your business with this free calculator and template.

Updated: 09/13/24

Published: 05/21/19

Pricing your products and services can be challenging, especially since over 80% of consumers say they compare prices between competitors before making a purchase decision.

Set prices too high, and you risk losing sales. Set them too low, and you lose out on revenue.

Fortunately, pricing doesn’t have to be a gamble. There are many pricing models and strategies to help you find the right prices for your audience and revenue goals.

That’s why I created this guide.

Whether you’re a business beginner or a pricing pro, the tactics and strategies in this guide will get you comfortable with pricing your products. Bookmark this guide for later and use the chapter links to jump around to sections of interest.

Table of Contents

Pricing Strategy

Pricing analysis, cost, margin, & markup in pricing, types of pricing strategies, pricing strategy examples, pricing models, how to create a pricing strategy, pricing models based on industry or business.

A pricing strategy is a model or method used to establish the best price for a product or service. It helps you choose prices to maximize profits and shareholder value while considering consumer and market demand.

If only pricing was as simple as its definition — there’s a lot that goes into the process.

Pricing strategies account for many of your business factors, including:

- Revenue goals.

- Marketing objectives.

- Target audience.

- Brand positioning.

- Product attributes.

They’re also influenced by external factors like consumer demand, competitor pricing, and overall market and economic trends.

It’s not uncommon for entrepreneurs and business owners to skim over pricing. They often look at the cost of their products (COGS) , consider their competitors’ rates, and tweak their own selling price by a few dollars. While your COGS and competitors are important, they shouldn’t be at the center of your pricing strategy.

The best pricing strategy maximizes your profit and revenue.

Before I talk about pricing strategies, let’s review an important pricing concept that will apply regardless of what strategies you use.

.png)

Free Sales Pricing Strategy Calculator

- Cost-Plus Pricing

- Skimming Strategy

- Value-Based Pricing

Download Free

All fields are required.

You're all set!

Click this link to access this resource at any time.

Price Elasticity of Demand

Price elasticity of demand is used to determine how a change in price affects consumer demand.

If consumers still purchase a product despite a price increase (such as cigarettes and fuel), that product is considered inelastic .

On the other hand, elastic products suffer from pricing fluctuations (such as cable TV and movie tickets).

Unitary elastic demand occurs when the percentage change in quantity demanded is exactly equal to the percentage change in price.

You can calculate price elasticity using the formula:

% Change in Quantity ÷ % Change in Price = Price Elasticity of Demand

The concept of price elasticity helps you understand whether your product or service is sensitive to price fluctuations. Ideally, you want your product to be inelastic — so that demand remains stable if prices do fluctuate.

Pricing analysis is a process of evaluating your current pricing strategy against market demand. Generally, pricing analysis examines price independently of cost. The goal of a pricing analysis is to identify opportunities for pricing changes and improvements.

You typically conduct a pricing analysis when considering new product ideas, developing your positioning strategy, or running marketing tests. I also think it’s wise to run a price analysis once every year or two to evaluate your pricing against competitors and consumer expectations .

Doing so preemptively avoids having to wait for poor product and sales performance . Likewise, a blunder in this regard can be calamitous and result in negative cash flow in the long term.

How to Conduct a Pricing Analysis

Conducting a pricing analysis is essential for setting competitive and profitable prices for your products or services. Here’s a step-by-step guide to help you through the process:

1. Determine the true cost of your product or service.

To calculate the true cost of a product or service that you sell, you’ll want to recognize all of your expenses, including both fixed and variable costs.

Once you’ve determined these costs, subtract them from the price you’ve already set or plan to set for your product or service.

Cost = Sales – (fixed + variable costs)

2. Understand how your target market and customer base respond to the pricing structure.

In my experience, surveys, focus groups, or questionnaires can be helpful in determining how the market responds to your pricing model. You’ll get a glimpse into what your target customers value and how much they’re willing to pay for the value your product or service provides.

3. Analyze the prices set by your competitors.

There are two types of competitors to consider when conducting a pricing analysis: direct and indirect.

Direct competitors are those who sell the exact same product that you sell. These types of competitors are likely to compete on price, so they should be a priority to review in your pricing analysis.

Indirect competitors are those who sell alternative products that are comparable to what you sell. If a customer is looking for your product, but it’s out of stock or it’s out of their price range, they may go to an indirect competitor to get a similar product.

I suggest creating a competitive analysis chart to visualize how your pricing compares to competitors and identify any gaps or opportunities.

4. Review any legal or ethical constraints to cost and price.

There’s a fine line between competing on price and falling into legal and ethical trouble. You’ll want to have a firm understanding of price-fixing and predatory pricing while doing your pricing analysis in order to steer clear of these practices.

Analyzing your current pricing model is necessary to determine a new (and better!) pricing strategy. This applies whether you're developing a new product, upgrading your current one, or simply repositioning your marketing strategy.

Understanding the role of cost, margin, and markup is also essential when choosing a pricing strategy, especially if you want your pricing to be cost-based .

Cost refers to the fees you incur from manufacturing, sourcing, or creating the product you sell. That includes the materials themselves, the cost of labor, the fees paid to suppliers, and even the losses. Cost doesn’t include overhead and operational expenses such as marketing, advertising, maintenance, or bills.

Margin, often referred to as profit margin , is the difference between the selling price of a product and its cost, expressed as a percentage of the selling price. It shows you the profitability of your product.

There are two types of margins:

- Gross margin. This is calculated as (Sales Revenue – Cost of Goods Sold) / Sales Revenue. It reflects the profitability before accounting for operating expenses.

- Net margin. This is calculated as (Net Profit / Sales Revenue). It includes all expenses, providing a more comprehensive view of profitability.

For example, if a product is sold for $100 and the cost to produce it is $60:

Gross Margin = (100 − 60/100) × 100 = 40%

Markup refers to the additional amount you charge for your product over the production and manufacturing fees. It allows you to set prices that align with market expectations and your business goals.

For example, if a product costs $70 to produce and you sell it for $100, the markup is $30, or approximately 42.9% of the cost price.

Now, I’ll walk you through some common pricing strategies. As we do so, it’s important to note that these aren’t necessarily standalone strategies — many can be combined when setting prices for your products and services.

- Competition-Based Pricing

- Dynamic Pricing

- High-Low Pricing

- Penetration Pricing

- Skimming Pricing

- Psychological Pricing

- Geographic Pricing

Here are some of the popular pricing strategies available — many are included in our free pricing template below.

I’ll explain what makes each one unique.

1. Competition-Based Pricing Strategy

Competition-based pricing is also known as competitive pricing or competitor-based pricing. This pricing strategy focuses on the existing market rate ( or going rate ) for a company’s product or service; it doesn’t take into account the cost of its product or consumer demand.

Instead, a competition-based pricing strategy uses the competitors’ prices as a benchmark. Businesses that compete in a highly saturated space may choose this strategy since a slight price difference may be the deciding factor for customers.

2. Cost-Plus Pricing Strategy

How to Calculate Your Product's Actual (and Average) Selling Price

Want to Build A Subscription Business? Ask Yourself These 3 Questions

Competition-Based Pricing: The Ultimate Guide

How To Price A SaaS Product

Penetration Pricing: Meaning, Goals, Top Tips, & Examples

![price business plan meaning Price Skimming: All You Need To Know [+ Pricing Calculator]](https://53.fs1.hubspotusercontent-na1.net/hubfs/53/price-skimming-strategy.jpg)

Price Skimming: All You Need To Know [+ Pricing Calculator]

Psychological Pricing and the Big-Time Boost It Offers Businesses

How to Price a Product That Your Sales Team Can Sell

![price business plan meaning B2B Pricing Models & Strategies [+ Pros and Cons of Each]](https://www.hubspot.com/hubfs/b2b-pricing-models-and-strategies.jpg)

B2B Pricing Models & Strategies [+ Pros and Cons of Each]

What Is Captive Product Pricing?

Determine the best pricing strategy for your business with this free calculator.

Powerful and easy-to-use sales software that drives productivity, enables customer connection, and supports growing sales orgs

Pricing Strategy in a Business Plan: Deep Dive

- September 4, 2024

In this blog post, we’re diving into how to choose and explain your pricing strategy in your business plan. We’ll cover different pricing models like penetration, premium, and value-based. We’ll also dive into how to present your pricing strategy in your business plan.

Whether you’re starting a new business or preparing a business plan for an existing company, getting your pricing right is key to attracting customers and making a profit. Let’s break down how to make your pricing strategy clear and effective. Let’s dive in!

What are the different pricing strategies?

Different pricing strategies can significantly influence demand, profitability, and market positioning for businesses. Here’s an overview of some common pricing strategies:

- Cost-Plus Pricing: Adds a markup percentage to the cost of producing a product or delivering a service. It’s simple to calculate and ensures a profit margin.

- Value-Based Pricing: Sets prices based on the perceived value to the customer rather than the cost of production. This strategy focuses on the benefits and value the product or service brings to the customer.

- Competitive Pricing: Prices are set based on competitors’ pricing structures. Businesses might price their products slightly lower than competitors to gain market share or at a similar level to match the market rate.

- Penetration Pricing: Involves setting lower prices to enter a competitive market and attract customers quickly. The goal is to gain market share and then gradually increase prices.

- Premium Pricing: Setting the price of a product or service higher than the competitors. This strategy is used to signal superior quality or exclusivity to justify the higher cost.

- Dynamic Pricing: Adjusting prices in real-time based on market demand, competition, and other factors. Common in industries like hospitality and airlines.

- Freemium Pricing: Offering a basic product or service for free while charging for premium features. This strategy is often used by software and service companies to attract users.

- Bundle Pricing: Combining several products or services and selling them at a single price, often lower than the total cost of buying each item separately. This can increase the perceived value and encourage sales.

How to choose a pricing strategy

Here’s how to come up with an efficient pricing strategy:

Align Pricing with Market Strategy

Begin by articulating how your pricing strategy complements your overall market strategy. If you’re aiming for market penetration, explain how your pricing is designed to attract a large volume of customers by being more affordable than competitors.

For a premium pricing strategy, discuss the exceptional quality, exclusivity, or unique value your offerings bring, justifying higher price points.

If you’re adopting a value-based pricing model instead, illustrate how your pricing directly correlates with the perceived value to the customer, possibly through superior benefits or cost savings they provide.

Relate Pricing to the Target Market

Your pricing strategy should be closely tied to your understanding of your target market .

For instance, if your target market highly values sustainability and is willing to pay more for eco-friendly products, your pricing should reflect this. Similarly, if you’re targeting a price-sensitive segment, explain how your pricing strategy enables you to offer competitive value while maintaining profitability.

Consider the Competitive Landscape

A comprehensive pricing strategy also considers the competitive landscape . Analyze your competitors’ pricing and how your strategy positions you within this context.

Are you offering a more affordable alternative to premium products, or are you introducing a higher-quality option in a market segment dominated by low-cost competitors?

Discuss how your pricing strategy gives you a competitive edge, whether it’s by filling a gap in the market, offering better value, or challenging the status quo with innovative pricing models.

Where to include your prices in your business plan?

In your business plan, prices should be detailed under “Products or Services” within the Business Overview section of your business.

This part of the plan not only describes what you are offering but also provides an ideal opportunity to outline your pricing strategy and the specific prices or price ranges of your products or services.

Here, you can explain how your pricing fits into the market and aligns with your overall business strategy, giving potential investors or lenders a clear understanding of your approach to generating revenue.

Remember your pricing strategy should align with your financial projections (projected income statement, cash flow statement, and balance sheet). Indeed, you will need to give some high-level explanation of how you came up with these financial projections, based on your pricing strategy too.

Related Posts

RaceTrac Franchise Profits, Costs & Fees (2024)

- October 15, 2024

Shipley Do-Nuts Franchise FDD, Profits, Costs & Fees (2024)

Kolache Factory Franchise FDD, Profits, Costs & Fees (2024)

Privacy overview.

| Cookie | Duration | Description |

|---|---|---|

| BIGipServerwww_ou_edu_cms_servers | session | This cookie is associated with a computer network load balancer by the website host to ensure requests are routed to the correct endpoint and required sessions are managed. |

| cookielawinfo-checkbox-advertisement | 1 year | Set by the GDPR Cookie Consent plugin, this cookie is used to record the user consent for the cookies in the "Advertisement" category . |

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| CookieLawInfoConsent | 1 year | Records the default button state of the corresponding category & the status of CCPA. It works only in coordination with the primary cookie. |

| elementor | never | This cookie is used by the website's WordPress theme. It allows the website owner to implement or change the website's content in real-time. |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| __cf_bm | 30 minutes | This cookie, set by Cloudflare, is used to support Cloudflare Bot Management. |

| language | session | This cookie is used to store the language preference of the user. |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | The _ga cookie, installed by Google Analytics, calculates visitor, session and campaign data and also keeps track of site usage for the site's analytics report. The cookie stores information anonymously and assigns a randomly generated number to recognize unique visitors. |

| _ga_QP2X5FY328 | 2 years | This cookie is installed by Google Analytics. |

| _gat_UA-189374473-1 | 1 minute | A variation of the _gat cookie set by Google Analytics and Google Tag Manager to allow website owners to track visitor behaviour and measure site performance. The pattern element in the name contains the unique identity number of the account or website it relates to. |

| _gid | 1 day | Installed by Google Analytics, _gid cookie stores information on how visitors use a website, while also creating an analytics report of the website's performance. Some of the data that are collected include the number of visitors, their source, and the pages they visit anonymously. |

| browser_id | 5 years | This cookie is used for identifying the visitor browser on re-visit to the website. |

| WMF-Last-Access | 1 month 18 hours 11 minutes | This cookie is used to calculate unique devices accessing the website. |

IMAGES

VIDEO

COMMENTS

A pricing strategy is the process and methodology used to determine prices for products and services. As we’ll explore in this article, different pricing strategies work for different products and business models. A good pricing strategy can enable several things for a business: Convey value to customers.

What are pricing strategies? Pricing strategies refer to the processes and methodologies businesses use to set prices for their products and services. If pricing is how much you charge for your products, then product pricing strategy is how you determine what that amount should be.

A business plan could be very lengthy and detailed or short and lean, but in all instances, it should have a clear vision for how pricing is tackled. A pricing strategy ultimately greatly determines the profit margin of your product or service and how much revenue the company will make.

A pricing strategy is a model or method used to establish the best price for a product or service. It helps you choose prices to maximize profits and shareholder value while considering consumer and market demand. If only pricing was as simple as its definition — there’s a lot that goes into the process.

The pricing process is the series of steps a business takes to figure out how much to charge for its products and/or services. The process is both an art and a science.

Whether you’re starting a new business or preparing a business plan for an existing company, getting your pricing right is key to attracting customers and making a profit. Let’s break down how to make your pricing strategy clear and effective.