IFRScommunity.com

IFRS Forums and IFRS Knowledge Base

Presentation of Financial Statements (IAS 1)

Last updated: 14 November 2023

IAS 1 serves as the main standard that outlines the general requirements for presenting financial statements. It is applicable to ‘general purpose financial statements’, which are designed to meet the informational needs of users who cannot demand customised reports from an entity. Documents like management commentary or sustainability reports, which are often included in annual reports, fall outside the scope of IFRS, as indicated in IAS 1.13-14. Similarly, financial statements submitted to a court registry are not considered general purpose financial statements (see IAS 1.BC11-13).

The standard primarily focuses on annual financial statements, but its guidelines in IAS 1.15-35 also extend to interim financial reports (IAS 1.4). These guidelines address key elements such as fair presentation, compliance with IFRS, the going concern principle, the accrual basis of accounting, offsetting, materiality, and aggregation. For comprehensive guidance on interim reporting, please refer to IAS 34 .

Note that IAS 1 will be superseded by the upcoming IFRS 18 Presentation and Disclosure in Financial Statements .

Now, let’s explore the general requirements for presenting financial statements in greater detail.

Financial statements

Components of a complete set of financial statements.

Paragraph IAS 1.10 outlines the elements that make up a complete set of financial statements. Companies have the flexibility to use different titles for these documents, but each statement must be presented with equal prominence (IAS 1.11). The terminology used in IAS 1 is tailored for profit-oriented entities. However, not-for-profit organisations or entities without equity (as defined in IAS 32), may use alternative terminology for specific items in their financial statements (IAS 1.5-6).

Are you tired of the constant stream of IFRS updates? I know it's tough! That's why I created Reporting Period – a once-a-month summary for professional accountants. It consolidates all essential IFRS developments and Big 4 insights into one readable email. I personally curate every issue to ensure it's packed with the most relevant information, delivered straight to your inbox. It's free, with no spam, and you can unsubscribe with just one click. Ready to give it a try?

Compliance with IFRS

Financial statements must include an explicit and unreserved statement of compliance with IFRS in the accompanying notes. This statement is only valid if the entity adheres to all the requirements of every IFRS standard (IAS 1.16). In many jurisdictions, such as the European Union, laws mandate compliance with a locally adopted version of IFRS.

IAS 1 does consider extremely rare situations where an entity might diverge from a specific IFRS requirement. Such a departure is permissible only if it prevents the presentation of misleading information that would conflict with the objectives of general-purpose financial reporting (IAS 1.20-22). Alternatively, entities can disclose the impact of such a departure in the notes, explaining how the statements would appear if the exception were made (IAS 1.23).

Identification of financial statements

The guidelines for identifying financial statements outlined in IAS 1.49-53 are straightforward and rarely cause issues in practice.

Going concern

The ‘going concern’ principle is a cornerstone of IFRS and other major GAAP. It assumes that an entity will continue to operate for the foreseeable future (at least 12 months). IAS 1 mandates management to assess whether the entity is a ‘going concern’. Should there be any material uncertainties regarding the entity’s future, these must be disclosed (IAS 1.25-26). IFRSs do not provide specific accounting principles for entities that are not going concerns, other than requiring disclosure of the accounting policies used. One of the possible approaches is to measure all assets and liabilities using their liquidation value.

See also this educational material at IFRS.org.

Materiality and aggregation

IAS 1.29-31 emphasise the importance of materiality in preparing user-friendly financial statements. While IFRS mandates numerous disclosures, entities should only include information that is material. This concept should be at the forefront when preparing financial statements, as reminders about materiality are seldom provided in other IFRS standards or publications.

Generally, entities should not offset assets against liabilities or income against expenses unless a specific IFRS standard allows or requires it. IAS 1.32-35 offer guidance on what can and cannot be offset. Offsetting of financial instruments is discussed further in IAS 32 .

Frequency of reporting

Entities are required to present a complete set of financial statements at least annually (IAS 1.36). However, some Public Interest Entities (PIEs) may be obliged to release financial statements more frequently, depending on local regulations. However, these are typically interim financial statements compiled under IAS 34 .

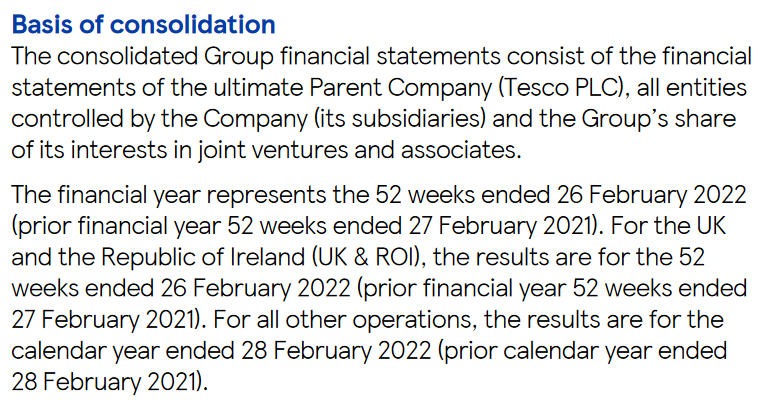

IAS 1 also allows for a 52-week reporting period instead of a calendar year (IAS 1.37). This excerpt from Tesco’s annual report serves to demonstrate this point, showing that the group uses 52-week periods for their financial year, even when some subsidiaries operate on a calendar-year basis:

If an entity changes its reporting period, it must clearly disclose this modification and provide the rationale for the change (IAS 1.36). It is advisable to include an explanatory note with comparative data that aligns with the new reporting period for clarity.

Comparative information

As a general guideline, entities should present comparative data for the prior period alongside all amounts reported for the current period, even when specific guidelines in a given IFRS do not require it. However, there’s no obligation to include narrative or descriptive information about the preceding period if it isn’t pertinent for understanding the current period (IAS 1.38).

If an entity opts to provide comparative data for more than the immediately preceding period, this additional information can be included in selected primary financial statements only. However, these additional comparative periods should also be detailed in the relevant accompanying notes (IAS 1.38C-38D).

IAS 1.40A-46 outlines how to present the statement of financial position when there are changes in accounting policies, retrospective restatements, or reclassifications. This entails producing a ‘third balance sheet’ at the start of the preceding period (which may differ from the earliest comparative period, if more than one is presented). Key points to note are:

- The third balance sheet is required only if there’s a material impact on the opening balance of the preceding period (IAS 1.40A(b)).

- If a third balance sheet is included, there’s no requirement to add a corresponding third column in the notes, although this could be useful where numbers have been altered by the change (IAS 1.40C).

- Interim financial statements do not require a third balance sheet (IAS 1.BC33).

IAS 8 also requires comprehensive disclosures concerning changes in accounting policies and corrections of errors .

Statement of financial position

IAS 1.54 enumerates the line items that must, at a minimum, appear in the statement of financial position. Entities should note that separate lines are not required for immaterial items (IAS 1.31). Additional line items can be added for entity-specific or industry-specific matters. IAS 1 permits the inclusion of subtotals, provided the criteria set out in IAS 1.55A are met.

Additional disclosure requirements are set out in IAS 1.77-80A. Of particular interest are the requirements pertaining to equity (IAS 1.79), which begin with the number of shares and extend to include details such as ‘rights, preferences, and restrictions relating to share capital, including restrictions on the distribution of dividends and the repayment of capital.’ While these kinds of limitations are common across various legal jurisdictions (for example, not all retained earnings can be distributed as dividends), many companies neglect to disclose such limitations in their financial statements.

For guidance on classifying assets and liabilities as either current or non-current, please refer to the separate page dedicated to this topic.

Statement of profit or loss and other comprehensive income

IAS 1 provides two methods for presenting profit or loss (P/L) and other comprehensive income (OCI). Entities can either combine both P/L and OCI into a single statement or present them in separate statements (IAS 1.81A-B). Additionally, the P/L and total comprehensive income for a given period should be allocated between the owners of the parent company and non-controlling interests (IAS 1.81B).

Minimum contents in P/L and OCI

IAS 1.82-82A specifies the minimum items that must appear in the P/L and OCI statements. These items are required only if they materially impact the financial statements (IAS 1.31).

Entities are permitted to add subtotals to the P/L statement if they meet the criteria specified in IAS 1.85A. Operating income is often the most commonly used subtotal in P/L. This practice may be attributed to the 1997 version of IAS 1, which mandated the inclusion of this subtotal—although this is no longer the case. IAS 1.BC56 clarifies that an operating profit subtotal should not exclude items commonly considered operational, such as inventory write-downs, restructuring costs, or depreciation/amortisation expenses.

Profit or loss (P/L)

All items of income and expense must be recognised in P/L (or OCI). This means that no income or expenses should be recognised directly in the statement of changes in equity, unless another IFRS specifically mandates it (IAS 1.88). Direct recognition in equity may also result from intra-group transactions . IAS 1.97-98 require separate disclosure of material items of income and expense, either directly in the income statement or in the notes.

Expenses in P/L can be presented in one of two ways (IAS 1.99-105):

- By their nature (e.g., depreciation, employee benefits); or

- By their function within the entity (e.g., cost of sales, distribution costs, administrative expenses).

When opting for the latter, entities must provide additional details on the nature of the expenses in the accompanying notes (IAS 1.104).

Other comprehensive income (OCI)

OCI encompasses income and expenses that other IFRS specifically exclude from P/L. There is no conceptual basis for deciding which items should appear in OCI rather than in P/L. Most companies present P/L and OCI as separate statements, partly because OCI is generally overlooked by investors and those outside of accounting and financial reporting circles. The concern is that combining the two could reduce net profit to merely a subtotal within total comprehensive income.

All elements that constitute OCI are specifically outlined in IAS 1.7, as part of its definitions.

Reclassification adjustments

A reclassification adjustment refers to the amount reclassified to P/L in the current period that was recognised in OCI in the current or previous periods (IAS 1.7). All items in OCI must be grouped into one of two categories: those that will or will not be subsequently reclassified to P/L (IAS 1.82A). Reclassification adjustments must be disclosed either within the OCI statement or in the accompanying notes (IAS 1.92-96).

To illustrate, foreign exchange differences arising on translation of foreign operations and gains or losses from certain cash flow hedges are examples of items that will be reclassified to P/L. In contrast, remeasurement gains and losses on defined benefit employee plans or revaluation gains on properties will not be reclassified to P/L.

The practice of transferring items from OCI to P/L, commonly known as ‘recycling’, lacks a concrete conceptual basis and the criteria for allowing such transfers in IFRS are often considered arbitrary.

Tax effects

OCI items can be presented either net of tax effects or before tax, with the overall tax impact disclosed separately. In either case, entities must specify the tax amount related to each item in OCI, including any reclassification adjustments (IAS 1.90-91). Interestingly, there is no such requirement to disclose tax effects for individual items in the income statement.

Statement of changes in equity

IAS 1.106 outlines the minimum line items that must be included in the statement of changes in equity. Subsequent paragraphs specify the disclosure requirements, which can be addressed either within the statement itself or in the accompanying notes. It’s crucial to note that changes in equity during a reporting period can arise either from income and expense items or from transactions involving owners acting in their capacity as owners (IAS 1.109). This means that entities cannot adjust equity directly based on changes in assets or liabilities unless these adjustments result from transactions with owners, such as capital contributions or dividend payments, or are otherwise mandated by other IFRSs.

Statement of cash flows

The statement of cash flows is governed by IAS 7 .

- Explanatory notes

Structure of explanatory notes

The structure for explanatory notes is detailed in IAS 1.112-116. In practice, there are several commonly adopted approaches to organising these notes:

Approach #1:

- Primary financial statements (P/L, OCI, etc.)

- Statement of compliance and basis of preparation

- Accounting policies

Approach #1 is logically coherent, as understanding accounting policies is crucial before delving into the financial data. However, in reality, few people read the accounting policies in their entirety. Consequently, users often have to navigate past several pages of accounting policies to reach the explanatory notes.

Approach #2:

- Primary financial statements (P/L, OCI, etc)

In Approach #2, accounting policies are treated as an appendix and positioned at the end of the financial statements. The advantage here is that all numerical data is clustered together, uninterrupted by extensive descriptions of accounting policies.

Approach #3:

- Explanatory notes integrated with relevant accounting policies

Approach #3 pairs accounting policies directly with the associated explanatory notes. For example, accounting policies relating to inventory would appear alongside the explanatory note that breaks down inventory components.

Management of capital

IAS 1.134-136 outline the disclosures related to capital management. These provisions apply to all entities, whether or not they are subject to external capital requirements. An important note here is that entities are not obligated to disclose specific values or ratios concerning capital objectives or requirements.

IAS 1.137 mandates disclosure of dividends proposed or declared before the financial statements were authorised for issue but not recognised as a distribution to owners during the period. Furthermore, entities are required to disclose the amount of any cumulative preference dividends not recognised.

Disclosure of accounting policies

IAS 1 specifies the requirements for disclosing accounting policy information which are discussed here .

Disclosing judgements and sources of estimation uncertainty

IAS 1 mandates disclosing judgements and sources of estimation uncertainty .

Other disclosures

Additional miscellaneous disclosure requirements are detailed in paragraphs IAS 1.138.

IFRS 18 Presentation and Disclosure in Financial Statements

The upcoming IFRS 18 Presentation and Disclosure in Financial Statements , which will supersede IAS 1, aims to enhance the comparability and transparency of financial reporting, focusing on the statement of profit or loss. Key changes include:

- The introduction of two new subtotals in the P/L statement: ‘operating profit’ and ‘profit before financing and income taxes’.

- A requirement for the reconciliation of management-defined performance measures (also known as ‘non-GAAP’ measures) with those specified by IFRS.

- Refined guidelines for the aggregation and disaggregation of information within the primary financial statements.

- Limited changes to the statement of cash flows, establishing operating profit as a starting point for the indirect method and eliminating options for the classification of interest and dividend cash flows.

Learn more in this BDO’s publication .

The release of IFRS 18 is expected in Q2 2024. This new IFRS will be effective from 1 January 2027 with early application permitted.

© 2018-2024 Marek Muc

The information provided on this website is for general information and educational purposes only and should not be used as a substitute for professional advice. Use at your own risk. Excerpts from IFRS Standards come from the Official Journal of the European Union (© European Union, https://eur-lex.europa.eu). You can access full versions of IFRS Standards at shop.ifrs.org. IFRScommunity.com is an independent website and it is not affiliated with, endorsed by, or in any other way associated with the IFRS Foundation. For official information concerning IFRS Standards, visit IFRS.org.

Questions or comments? Join our Forums

The IFRS Foundation is a not-for-profit, public interest organisation established to develop high-quality, understandable, enforceable and globally accepted accounting and sustainability disclosure standards.

Our Standards are developed by our two standard-setting boards, the International Accounting Standards Board (IASB) and International Sustainability Standards Board (ISSB).

About the IFRS Foundation

Ifrs foundation governance, stay updated.

IFRS Accounting Standards are developed by the International Accounting Standards Board (IASB). The IASB is an independent standard-setting body within the IFRS Foundation.

IFRS Accounting Standards are, in effect, a global accounting language—companies in more than 140 jurisdictions are required to use them when reporting on their financial health. The IASB is supported by technical staff and a range of advisory bodies.

IFRS Accounting

Standards and frameworks, using the standards, project work, products and services.

IFRS Sustainability Disclosure Standards are developed by the International Sustainability Standards Board (ISSB). The ISSB is an independent standard-setting body within the IFRS Foundation.

IFRS Sustainability Standards are developed to enhance investor-company dialogue so that investors receive decision-useful, globally comparable sustainability-related disclosures that meet their information needs. The ISSB is supported by technical staff and a range of advisory bodies.

IFRS Sustainability

Education, membership and licensing.

IAS 1 Presentation of Financial Statements

You need to Sign in to use this feature

IAS 1 sets out overall requirements for the presentation of financial statements, guidelines for their structure and minimum requirements for their content. It requires an entity to present a complete set of financial statements at least annually, with comparative amounts for the preceding year (including comparative amounts in the notes). A complete set of financial statements comprises:

- a statement of financial position as at the end of the period;

- a statement of profit and loss and other comprehensive income for the period. Other comprehensive income is those items of income and expense that are not recognised in profit or loss in accordance with IFRS Standards. IAS 1 allows an entity to present a single combined statement of profit and loss and other comprehensive income or two separate statements;

- a statement of changes in equity for the period;

- a statement of cash flows for the period;

- notes, comprising a summary of significant accounting policies and other explanatory information; and

- a statement of financial position as at the beginning of the preceding comparative period when an entity applies an accounting policy retrospectively or makes a retrospective restatement of items in its financial statements, or when it reclassifies items in its financial statements.

An entity whose financial statements comply with IFRS Standards must make an explicit and unreserved statement of such compliance in the notes. An entity must not describe financial statements as complying with IFRS Standards unless they comply with all the requirements of the Standards. The application of IFRS Standards, with additional disclosure when necessary, is presumed to result in financial statements that achieve a fair presentation. IAS 1 also deals with going concern issues, offsetting and changes in presentation or classification.

Standard history

In April 2001 the International Accounting Standards Board (IASB) adopted IAS 1 Presentation of Financial Statements , which had originally been issued by the International Accounting Standards Committee in September 1997. IAS 1 Presentation of Financial Statements replaced IAS 1 Disclosure of Accounting Policies (issued in 1975), IAS 5 Information to be Disclosed in Financial Statements (originally approved in 1977) and IAS 13 Presentation of Current Assets and Current Liabilities (approved in 1979).

In December 2003 the IASB issued a revised IAS 1 as part of its initial agenda of technical projects. The IASB issued an amended IAS 1 in September 2007, which included an amendment to the presentation of owner changes in equity and comprehensive income and a change in terminology in the titles of financial statements. In June 2011 the IASB amended IAS 1 to improve how items of other income comprehensive income should be presented.

In December 2014 IAS 1 was amended by Disclosure Initiative (Amendments to IAS 1), which addressed concerns expressed about some of the existing presentation and disclosure requirements in IAS 1 and ensured that entities are able to use judgement when applying those requirements. In addition, the amendments clarified the requirements in paragraph 82A of IAS 1.

In October 2018 the IASB issued Definition of Material (Amendments to IAS 1 and IAS 8). This amendment clarified the definition of material and how it should be applied by (a) including in the definition guidance that until now has featured elsewhere in IFRS Standards; (b) improving the explanations accompanying the definition; and (c) ensuring that the definition of material is consistent across all IFRS Standards.

In February 2021 the IASB issued Disclosure of Accounting Policies which amended IAS 1 and IFRS Practice Statement 2 Making Materiality Judgements . The amendment amended IAS 1 to replace the requirement for entities to disclose their significant accounting policies with the requirement to disclose their material accounting policy information.

In October 2022, the IASB issued Non-current Liabilities with Covenants . The amendments improved the information an entity provides when its right to defer settlement of a liability for at least twelve months is subject to compliance with covenants. The amendments also responded to stakeholders’ concerns about the classification of such a liability as current or non-current.

Other Standards have made minor consequential amendments to IAS 1. They include Improvement to IFRSs (issued April 2009), Improvement to IFRSs (issued May 2010), IFRS 10 Consolidated Financial Statements (issued May 2011), IFRS 12 Disclosures of Interests in Other Entities (issued May 2011), IFRS 13 Fair Value Measurement (issued May 2011), IAS 19 Employee Benefits (issued June 2011), Annual Improvements to IFRSs 2009–2011 Cycle (issued May 2012), IFRS 9 Financial Instruments (Hedge Accounting and amendments to IFRS 9, IFRS 7 and IAS 39) (issued November 2013), IFRS 15 Revenue from Contracts with Customers (issued May 2014), Agriculture: Bearer Plants (Amendments to IAS 16 and IAS 41) (issued June 2014), IFRS 9 Financial Instruments (issued July 2014), IFRS 16 Leases (issued January 2016), Disclosure Initiative (Amendments to IAS 7) (issued January 2016), IFRS 17 Insurance Contracts (issued May 2017), Amendments to References to the Conceptual Framework in IFRS Standards (issued March 2018) and Amendments to IFRS 17 (issued June 2020).

Related active projects

IFRS Accounting Taxonomy Update—Primary Financial Statements

Related completed projects

Clarification of the Requirements for Comparative Information (Amendments to IAS 1)

Classification of Liabilities as Current or Non-current (Amendments to IAS 1)

Definition of Accounting Estimates (Amendments to IAS 8)

Disclosure Initiative (Amendments to IAS 1)

Disclosure Initiative (Amendments to IAS 7)

Disclosure Initiative—Accounting Policies

Disclosure Initiative—Definition of Material (Amendments to IAS 1 and IAS 8)

Disclosure Initiative—Principles of Disclosure

Disclosure Initiative—Targeted Standards-level Review of Disclosures

IFRS Accounting Taxonomy Update—Amendments to IAS 1, IAS 8 and IFRS Practice Statement 2

IFRS Accounting Taxonomy Update—Amendments to IFRS 16 and IAS 1

Joint Financial Statement Presentation (Replacement of IAS 1)

Non-current Liabilities with Covenants (Amendments to IAS 1)

Presentation of Items of Other Comprehensive Income (Amendments to IAS 1)

Presentation of Liabilities or Assets Related to Uncertain Tax Treatments (IAS 1)

Presentation of interest revenue for particular financial instruments (IFRS 9 and IAS 1)

Puttable Financial Instruments and Obligations Arising on Liquidation (Amendments to IAS 32 and IAS 1)

Revised IAS 1 Presentation of Financial Statements: Phase A

Supply Chain Financing Arrangements—Reverse Factoring

Related IFRS Standards

Related ifric interpretations.

IFRIC 1 Changes in Existing Decommissioning, Restoration and Similar Liabilities

Unconsolidated amendments

Implementation support, your privacy.

IFRS Foundation cookies

We use cookies on ifrs.org to ensure the best user experience possible. For example, cookies allow us to manage registrations, meaning you can watch meetings and submit comment letters. Cookies that tell us how often certain content is accessed help us create better, more informative content for users.

We do not use cookies for advertising, and do not pass any individual data to third parties.

Some cookies are essential to the functioning of the site. Other cookies are optional. If you accept all cookies now you can always revisit your choice on our privacy policy page.

Cookie preferences

Essential cookies, always active.

Essential cookies are required for the website to function, and therefore cannot be switched off. They include managing registrations.

Analytics cookies

We use analytics cookies to generate aggregated information about the usage of our website. This helps guide our content strategy to provide better, more informative content for our users. It also helps us ensure that the website is functioning correctly and that it is available as widely as possible. None of this information can be tracked to individual users.

Preference cookies

Preference cookies allow us to offer additional functionality to improve the user experience on the site. Examples include choosing to stay logged in for longer than one session, or following specific content.

Share this page

- Skip to primary navigation

- Skip to main content

Free ACCA & CIMA online courses from OpenTuition

Free Notes, Lectures, Tests and Forums for ACCA and CIMA exams

20% off ACCA & CIMA Books

OpenTuition recommends the new interactive BPP books for June 2024 exams, Get your discount code >>

ACCA March 2024 Exam Results (Comments and Instant Poll) >>

Presentation of financial statements (ias 1) – acca strategic business reporting (sbr) lectures.

Reader Interactions

January 28, 2024 at 6:53 pm

Great, thank you, Sir

August 29, 2023 at 8:08 pm

best lecturer ever

October 5, 2022 at 8:58 am

hi i noticed that the notes for SBR from this chapter is a bit different, is this video still relevant for 2022 sitting?

October 30, 2021 at 12:07 pm

I have the online SBR BPP practice and revision kit for exam September 20 – June 21. I am sitting the December 21 exam. Is the above kit going to be okay to use? Providing that I look at up to date current issues question? or will I be missing other changes in other areas?Thank you :).

April 28, 2020 at 9:26 pm

November 27, 2018 at 8:19 am

When we doing the other comprehensive income part , Gain on non current assets revaluations are classified under “items that will not be reclassified to profit or loss”

But practically when the non current assets were sold, eventually the revaluation gain will be adjusted in to P&L.

So why The standard asks to classify this under “items that will not be reclassified to profit or loss” section ?

November 27, 2018 at 5:10 pm

The gain on the revaluation is not reclassified through profit or loss. On its ultimate disposal the gain is transferred to retained earnings in the SOCIE.

November 20, 2018 at 2:37 am

detailed, logical and inspiring!

Leave a Reply Cancel reply

You must be logged in to post a comment.

The IFRS Foundation is a not-for-profit, public interest organisation established to develop high-quality, understandable, enforceable and globally accepted accounting and sustainability disclosure standards.

Our Standards are developed by our two standard-setting boards, the International Accounting Standards Board (IASB) and International Sustainability Standards Board (ISSB).

About the IFRS Foundation

Ifrs foundation governance, stay updated.

IFRS Accounting Standards are developed by the International Accounting Standards Board (IASB). The IASB is an independent standard-setting body within the IFRS Foundation.

IFRS Accounting Standards are, in effect, a global accounting language—companies in more than 140 jurisdictions are required to use them when reporting on their financial health. The IASB is supported by technical staff and a range of advisory bodies.

IFRS Accounting

Standards and frameworks, using the standards, project work, products and services.

IFRS Sustainability Disclosure Standards are developed by the International Sustainability Standards Board (ISSB). The ISSB is an independent standard-setting body within the IFRS Foundation.

IFRS Sustainability Standards are developed to enhance investor-company dialogue so that investors receive decision-useful, globally comparable sustainability-related disclosures that meet their information needs. The ISSB is supported by technical staff and a range of advisory bodies.

IFRS Sustainability

Education, membership and licensing.

IFRS 18 Presentation and Disclosure in Financial Statements

You need to Sign in to use this feature

IFRS 18 Presentation and Disclosure in Financial Statements was issued by the International Accounting Standards Board (IASB) on 09 April 2024. The IASB will undertake activities to support implementation and consistent application of the Standard.

View key terms for IFRS 18 for definitions of common terminology.

IFRS Standard

Educational materials, educational webcasts and webinars.

Our webcasts provide an introduction into various aspects of IFRS 18.

Technical enquiries and implementation questions

Although the IASB does not provide a formal technical enquiry service , stakeholders may make us aware of implementation questions relating to IFRS 18.

For any other queries please contact us.

We are processing your request

Email successfully submitted

Your privacy

IFRS Foundation cookies

We use cookies on ifrs.org to ensure the best user experience possible. For example, cookies allow us to manage registrations, meaning you can watch meetings and submit comment letters. Cookies that tell us how often certain content is accessed help us create better, more informative content for users.

We do not use cookies for advertising, and do not pass any individual data to third parties.

Some cookies are essential to the functioning of the site. Other cookies are optional. If you accept all cookies now you can always revisit your choice on our privacy policy page.

Cookie preferences

Essential cookies, always active.

Essential cookies are required for the website to function, and therefore cannot be switched off. They include managing registrations.

Analytics cookies

We use analytics cookies to generate aggregated information about the usage of our website. This helps guide our content strategy to provide better, more informative content for our users. It also helps us ensure that the website is functioning correctly and that it is available as widely as possible. None of this information can be tracked to individual users.

Preference cookies

Preference cookies allow us to offer additional functionality to improve the user experience on the site. Examples include choosing to stay logged in for longer than one session, or following specific content.

Share this page

IMAGES

VIDEO

COMMENTS

Overview. IAS 1 Presentation of Financial Statements sets out the overall requirements for financial statements, including how they should be structured, the minimum requirements for their content and overriding concepts such as going concern, the accrual basis of accounting and the current/non-current distinction. The standard requires a complete set of financial statements to comprise a ...

Approval by the Board of Classification of Liabilities as Current or Non-current—Deferral of Effective Date issued in July 2020. Classification of Liabilities as Current or Non-current—Deferral of Effective Date, which amended IAS 1, was approved for issue by all 14 members of the International Accounting Standards Board. Hans Hoogervorst.

IAS 1 allows an entity to present a single combined statement of profit and loss and other comprehensive income or two separate statements; a statement of financial position as at the beginning of the preceding comparative period when an entity applies an accounting policy retrospectively or makes a retrospective restatement of items in its ...

155 IPSAS 1, "Presentation of Financial Statements" (IPSAS 1) is set out in paragraphs 1−155 and Appendices A−B. All the paragraphs have equal authority. IPSAS 1 should be read in the context of its objective, the Basis for Conclusions, and the "Preface to International Public Sector Accounting Standards.".

IFRS 18 introduces some key changes for the income statement, including: • two newly required subtotals on the face of the income statement; • income and expenses classified into three new categories, depending on a company's main business activities; and

IPSAS 1 specifies minimum line items to be presented on the face of the statement of financial position, statement of financial performance, and statement of changes in net assets/equity, and includes guidance for identifying additional line items, headings, and subtotals. Analysis of expenses in the statement of financial per ...

Presentation of Financial Statements and IAS 7 Statement of Cash Flows is identified after each relevant paragraph. Proposals that will be in the IASB exposure draft but not the FASB ... from other information in the same published document. [IAS 1.49] 13 IFRSs apply only to financial statements, and not necessarily to other information

In this Essentials, we highlight two of the principles in IAS 1: 1. Financial statements should fairly present the company's performance; and. 2. Disclosure of immaterial items can obscure material information. We explain how investors can use their knowledge of these fundamental principles of IFRS to have an efective dialogue with management ...

IAS 1 serves as the main standard that outlines the general requirements for presenting financial statements. It is applicable to 'general purpose financial statements', which are designed to meet the informational needs of users who cannot demand customised reports from an entity. Documents like management commentary or sustainability ...

IAS 1 allows an entity to present a single combined statement of profit and loss and other comprehensive income or two separate statements; a statement of financial position as at the beginning of the preceding comparative period when an entity applies an accounting policy retrospectively or makes a retrospective restatement of items in its ...

IAS 1 prescribes the components of the financial statements that together would be considered a complete set of financial statements. Under IAS 1, entities are required to make an explicit statement of compliance with International Financial Reporting Standards (IFRS) in their notes if their financial statements comply with IFRS.

Publication date: 31 Mar 2024. us Financial statement presentation guide. A PDF version of this publication is attached here: Financial statement presentation guide (PDF 13.8mb) PwC is pleased to offer our Financial statement presentation guide. This guide serves as a compendium of many of today's presentation and disclosure requirements ...

The following disclosures are required by IFRS 18 if not disclosed elsewhere in information published with the financial statements: [IFRS 18.116] domicile and legal form of the entity, country of incorporation, address of registered office or principal place of business; description of the entity's operations and principal activities;

Specific guidance on materiality and its application to the financial statements is included in paragraphs 29-31 of IAS 1 Presentation of Financial Statements. Preparers may also consider Practice Statement 2 Making Materiality Judgements, which provides guidance and examples on applying materiality in the preparation of financial statements.

It discusses the structure and content of financial statements, focusing on compliance with IFRS, accounting policies, and fairness exception under IAS 1. An entity might refer to IFRS in describing the basis on which its financial statements are prepared without making this explicit and unreserved statement of compliance with IFRS.

IFRS 18 will enable companies to tell their story better through their financial statements. Investors will benefit from greater consistency of presentation in the income and cash flow statements, and more disaggregated information. Making certain 'non- GAAP' measures part of the audited financial statements will bring more credibility to ...

Financial Statements, published by the International Accounting Standards Board (IASB). Extracts from IAS 1 are reproduced in this publication of the International ... IPSAS 1, Presentation of Financial Statements was issued in May 2000. In December 2006 the IPSASB issued a revised IPSAS 1. Since then, IPSAS 1 has been amended by the following ...

This video explains how to prepare the published financial statements in accordance with IAS 1 (Presentation of financial statements).It cover the element of...

Financial Statements 2021' ('Example Financial Statements'). These Example Financial Statements are based on the activities and results of Illustrative Corporation and its subsidiaries ('the Group') - a fictional consulting, service and retail entity that has been preparing IFRS consolidated financial statements for several years.

Presentation of financial statements - introduction - ACCA Financial Reporting (FR)Free lectures for the ACCA Financial Reporting (FR) Exam To benefit from t...

ACCA March 2024 Exam Results (Comments and Instant Poll) >>. Presentation of Financial Statements (IAS 1) - ACCA Strategic Business Reporting (SBR) lectures. [email protected]. January 28, 2024 at 6:53 pm. Presentation of Financial Statements (IAS 1) - ACCA Strategic Business Reporting (SBR) lectures.

On April 9, 2024, the International Accounting Standards Board (IASB) published its new standard, IFRS 18 'Presentation and Disclosures in Financial Statements,' that will replace IAS 1 'Presentation of Financial Statements'. The new standard is the result of the primary financial statements project, which aims at improving how entities communicate in their financial statements.

The IASB published the accounting standard IFRS 18 Presentation and Disclosure in Financial Statements on 9 April 2024. ... IFRS 18 will replace the current IAS 1 Presentation of Financial Statements and will amend IAS 7 Statement of Cash Flows. The press release is available for download on the IASB website.

This news release should be read in conjunction with the attached unaudited financial information. Cautionary Statements and Risk Factors That May Affect Future Results This news release contains "forward-looking statements" within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995.

The following slide deck was published by MidWestOne Financial Group, Inc. ... Earnings Call Presentation. Apr. 26, 2024 4:55 PM ET MidWestOne Financial Group, Inc. (MOFG) Stock. SA Transcripts.

Close. IFRS 18 Presentation and Disclosure in Financial Statements was issued by the International Accounting Standards Board (IASB) on 09 April 2024. The IASB will undertake activities to support implementation and consistent application of the Standard. View key terms for IFRS 18 for definitions of common terminology.

The following slide deck was published by Bread Financial Holdings, Inc. ... Earnings Call Presentation. Apr. 26, 2024 2:27 AM ET Bread Financial Holdings, Inc. (BFH) Stock. SA Transcripts.

IFAC's Financial Statements are prepared in accordance with International Public Sector Accounting Standards (IPSAS) and include an independent auditor's report.

Financial Statements, published by the International Accounting Standards Board (IASB). Extracts from IAS 1 are reproduced in this publication of the International ... IPSAS 1, Presentation of Financial Statements was issued in May 2000. In December 2006 the IPSASB issued a revised IPSAS 1. Since then, IPSAS 1 has been amended by the following ...

The International Accounting Standards Board (IASB) has published its new standard IFRS 18 'Presentation and Disclosures in Financial Statements' that will replace IAS 1 'Presentation of Financial Statements'. The new standard is the result of the so-called primary financial statements project, aims at improving how entities communicate in their financial statements and will be effective for ...