Forex Brokerage Business Plan [Sample Template]

By: Author Tony Martins Ajaero

Home » Business Plans » Financial Services

Are you about starting a Forex brokerage firm? If YES, here’s a complete sample Forex brokerage business plan template & feasibility report you can use for FREE to raise money .

If you are interested in Forex (foreign exchange), one of the viable and profitable businesses that you can start along that line is a fore brokerage company. Forex brokerage firm just like any other brokerage firm is an intermediary between retail Forex traders (those who trade on foreign exchange market and the Forex market.

Forex brokerage companies provide the platform for retail Forex traders to trade Forex on the internet. The fact that you will be competing with people from all over the globe is enough reason for you to be creative with your Forex brokerage firm.

In order to attract Forex traders you should ensure that your Forex trading platform is user friendly and the payment portal is secured. It is also very important that you make the withdrawal process seamless for your clients (retail Forex traders).

A Sample Forex Brokerage Firm Business Plan Template

1. industry overview.

The financial services industry is indeed a broad industry and one of the active line of businesses in the industry that any entrepreneur who have solid understanding on how foreign exchange works is to either start a Forex brokerage firm or to launch an online Forex trading business.

A non-bank foreign exchange company also known as foreign exchange broker or simply Forex broker is a company that offers currency exchange and international payments to private individuals and companies. The term is typically used for currency exchange companies that offer physical delivery rather than speculative trading. i.e., there is a physical delivery of currency to a bank account.

As a Forex brokerage company, your responsibility is to provide Forex trading platform for retail Forex traders. So what you need to do is to hire experts to help you develop a user friendly Forex trading platform. Your trading platform must be secured and easy to navigate.

It is also important to make use of secured payment portal and also Forex traders should be able to withdraw their earnings without stress.

The truth is that the numbers of people that register and trade on your Forex trading platform is what will determine the money you will make. In order to attract people to your trading platform, you should develop Forex trading demo; a learning tool for Forex trading.

The Forex Brokerage Services industry is indeed in a mature stage of its growth. The industry is characterized by growth in line with the overall outlook of the economy, consolidation from the largest players in the industry and wholehearted market acceptance of industry products (currencies from different nations) and services.

The Forex Brokerage services line of business will continue to be in high demand by business establishment in the united states, most especially as the number of businesses and international trade increases. Manufacturing industries and other corporate organizations are also expected to continue to source for Forex especially when they are involved in intentional trade or have international business partners.

The Forex Brokerage Services industry is indeed a large industry and pretty much active in countries such as United States of America, United Kingdom, France, Italy, Nigeria, South Africa Japan, China, Germany, and Canada et al.

Over and above, starting a Forex brokerage firm requires professionalism and good grasp of our foreign exchange works on a global platform.

Besides, you would need to get the required certifications and license and also meet the standard capitalization for such business before you can be allowed to start a Forex brokerage firm in the United States; the industry is heavily regulated to guide against fraud and criminality.

2. Executive Summary

Freeman Jones Forex Brokerage Firm, LLC is a registered and licensed Forex brokerage company that will be located in the heart of Las Vegas – Nevada. The company will be involved in dealing in currencies from leading countries of the world whose currencies are traded in the United States of America.

Aside from the fact that we will serve as a bureau de change for business and individuals who want to buy or sell foreign currencies, we will also engage in Forex trading on the internet. We are aware that to run an all – round and standard Forex brokerage firm can be demanding which is why we are well trained, certified and equipped to perform excellently well.

Freeman Jones Forex Brokerage Firm, LLC is a client – focused and result driven Forex brokerage firm that will buy and sale Forex from leading nations, trade Forex online for clients and also provide broad- based Forex services at an affordable fee that won’t in any way put a hole in the pocket of our clients.

We will offer a standard and professional Forex services to all to our individual clients, and corporate clients. We will ensure that we work hard to meet and surpass our clients’ expectations whenever they patronize our services.

At Freeman Jones Forex Brokerage Firm, LLC, our client’s best interest would always come first, and everything we do is guided by our values and professional ethics. We will ensure that we hire professionals who are well experienced in the Forex bureau firms industry with strong bias in online Forex trading.

Freeman Jones Forex Brokerage Firm, LLC will at all times demonstrate her commitment to sustainability, both individually and as a firm, by actively participating in our communities and integrating sustainable business practices wherever possible.

We will ensure that we hold ourselves accountable to the highest standards by meeting our client’s needs precisely and completely. We will cultivate a working environment that provides a human, sustainable approach to earning a living, and living in our world, for our partners, employees and for our clients.

Our plan is to position the business to become the leading brand in the Forex brokerage services line of business in the whole of Nevada, and also to be amongst the top 20 Forex brokerage firms in the United States of America within the first 10 years of fully launching the business.

This might look too tall a dream but we are optimistic that this will surely be realized because we have done our research and feasibility studies and we are enthusiastic and confident that Las Vegas is the right place to launch our Forex brokerage cum Forex trading company before sourcing for clients from other cities in The United States of America.

Freeman Jones Forex Brokerage Firm, LLC is founded by, Mr. Freeman Jones and his family. Freeman Jones is Forex trader per excellence with adequate results to show for it.

He has well over 15 years of experience working at various capacity within the financial consulting industry with strong bias for Forex in the United States of America. Mr. Freeman Jones graduated from both University of California – Berkley with a Degree in Accounting, and University of Harvard (MSc. Finance) and he is a chartered account.

3. Our Products and Services

Freeman Jones Forex Brokerage Firm, LLC is going to offer varieties of services within the scope of the Forex brokerage services industry in the United States of America and of course on the global stage. Our intention of starting our Forex brokerage firm in Las Vegas – Nevada is to leverage on the opportunities available in the city.

We are well prepared to make profits from the industry and we will do all that is permitted by the law in the United States to achieve our business goals, aim and ambition. Our business offering are listed below;

- Trade Forex on behalf of our clients ( both corporate clients and individual clients )

- Buy and sell Forex from leading countries of the world

- Provide other related Forex and financial consulting and advisory services

4. Our Mission and Vision Statement

- Our vision is to build a Forex brokerage services brand that will become the number one choice for individuals, smaller businesses and corporate clients in the whole of Las Vegas – Nevada. Our vision reflects our values: integrity, security, service, excellence and teamwork.

- Our mission is to provide professional, reliable and trusted Forex trading and Forex brokerage services that assist start – ups, corporate organization, manufacturing companies and non-profit organizations in sorting out their foreign exchange and financial related concerns.

- We will position the business to become the leading brand in the bookkeeping and payroll services line of business in the whole of Nevada, and also to be amongst the top 20 bookkeeping and payroll services firms in the United States of America within the first 10 years of operations.

Our Business Structure

Freeman Jones Forex Brokerage Firm, LLC, is a Forex brokerage cum Forex trading firm that intend starting small in Las Vegas – Nevada, but hope to grow big in order to compete favorably with leading Forex brokerage cum Forex trading firms in the industry both in the United States and on a global stage.

We are aware of the importance of building a solid business structure that can support the picture of the kind of world class business we want to own. This is why we are committed to only hire the best hands within our area of operations.

Ordinarily we would have settled for two or three staff members and settle for just online Forex trading services, but as part of our plan to build a standard Forex brokerage services firm in Las Vegas – Nevada that will also be involved in buying and selling of Forex, hence we have perfected plans to get it right from the beginning.

The picture of the kind of Forex brokerage services business we intend building and the business goals we want to achieve is what informed the amount we are ready to pay for the best hands available in and around Las Vegas – Nevada as long as they are willing and ready to work with us to achieve our business goals and objectives.

At Freeman Jones Forex Brokerage Firm, LLC, we will ensure that we hire people that are qualified, hardworking, and creative, result driven, customer centric and are ready to work to help us build a prosperous business that will benefit all the stake holders (the owners, workforce, and customers).

As a matter of fact, profit-sharing arrangement will be made available to all our senior management staff and it will be based on their performance for a period of five years or more as agreed by the board of trustees of the company. In view of the above, we have decided to hire qualified and competent hands to occupy the following positions;

- Chief Executive Officer

- Forex Traders / Consultants

Admin and HR Manager

Marketing and Sales Executive

- Customer Care Executive / Front Desk Officer

5. Job Roles and Responsibilities

Chief Executive Office:

- Increases management’s effectiveness by recruiting, selecting, orienting, training, coaching, counseling, and disciplining managers; communicating values, strategies, and objectives; assigning accountabilities; planning, monitoring, and appraising job results; developing incentives; developing a climate for offering information and opinions; providing educational opportunities.

- Creates, communicates, and implements the organization’s vision, mission, and overall direction – i.e. leading the development and implementation of the overall organization’s strategy.

- Responsible for fixing prices and signing business deals

- Responsible for providing direction for the business

- Responsible for signing checks and documents on behalf of the company

- Evaluates the success of the organization

Forex Traders / Forex Consultants

- Responsible for trading Forex for the organization and for our clients under the firm’s platform

- Handle business activities such as buying and selling Forex from leading countries of the world in a highly professional manner

- Responsible for ensuring that all Forex transactions whether it is cash transaction or online credit transaction are recorded in the correct daybook, supplier’s ledger, customer ledger, and general ledger

- Provides other related Forex and financial consulting and advisory services

- Responsible for overseeing the smooth running of HR and administrative tasks for the organization

- Designs job descriptions with KPI to drive performance management for clients

- Regularly hold meetings with key stakeholders to review the effectiveness of HR Policies, Procedures and Processes

- Maintains office supplies by checking stocks; placing and expediting orders; evaluating new products.

- Ensures operation of equipment by completing preventive maintenance requirements; calling for repairs.

- Defines job positions for recruitment and managing interviewing process

- Carries out staff induction for new team members

- Responsible for training, evaluation and assessment of employees

- Responsible for arranging travel, meetings and appointments

- Updates job knowledge by participating in educational opportunities; reading professional publications; maintaining personal networks; participating in professional organizations.

- Oversee the smooth running of the daily office activities.

- Identifies, prioritizes, and reaches out to new partners, and business opportunities et al

- Identifies development opportunities; follows up on development leads and contacts; participates in the structuring and financing of projects; assures the completion of relevant projects.

- Writes winning proposal documents, negotiate fees and rates in line with company policy

- Responsible for handling business research, marker surveys and feasibility studies for clients

- Responsible for supervising implementation, advocate for the customer’s needs, and communicate with clients

- Develops, executes and evaluates new plans for expanding increase sales

- Documents all customer contact and information

- Represents the company in strategic meetings

- Helps increase sales and growth for the company

- Responsible for preparing financial reports, budgets, and financial statements for the organization

- creates reports from the information concerning the financial transactions recorded by the bookkeeper

- Prepares the income statement and balance sheet using the trial balance and ledgers prepared by the bookkeeper.

- Provides managements with financial analyses, development budgets, and accounting reports; analyzes financial feasibility for the most complex proposed projects; conducts market research to forecast trends and business conditions.

- Responsible for financial forecasting and risks analysis.

- Performs cash management, general ledger accounting, and financial reporting for one or more properties.

- Responsible for developing and managing financial systems and policies

- Responsible for administering payrolls

- Ensures compliance with taxation legislation

- Handles all financial transactions for the company

- Serves as internal auditor for the company

Client Service Executive / Front Desk Officer

- Welcomes guests and clients by greeting them in person or on the telephone; answering or directing inquiries.

- Ensures that all contacts with clients (e-mail, walk-In center, SMS or phone) provides the client with a personalized customer service experience of the highest level

- Through interaction with clients on the phone, uses every opportunity to build client’s interest in the company’s products and services

- Manages administrative duties assigned by the manager in an effective and timely manner

- Consistently stays abreast of any new information on the company’s products, promotional campaigns etc. to ensure accurate and helpful information is supplied to clients

- Receives parcels / documents for the company

- Distribute mails in the organization

- Handles any other duties as assigned my the line manager

6. SWOT Analysis

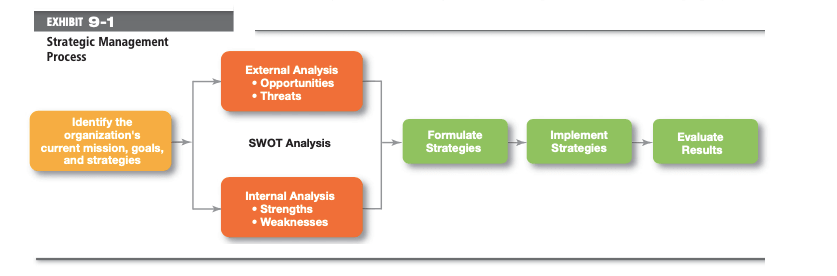

Freeman Jones Forex Brokerage Firm, LLC engaged the services of a core professional in the area of business consulting and structuring to assist our organization in building a well – structured Forex brokerage cum Forex trading firm that can favorably compete in the highly competitive Forex market in the United States and the world at large.

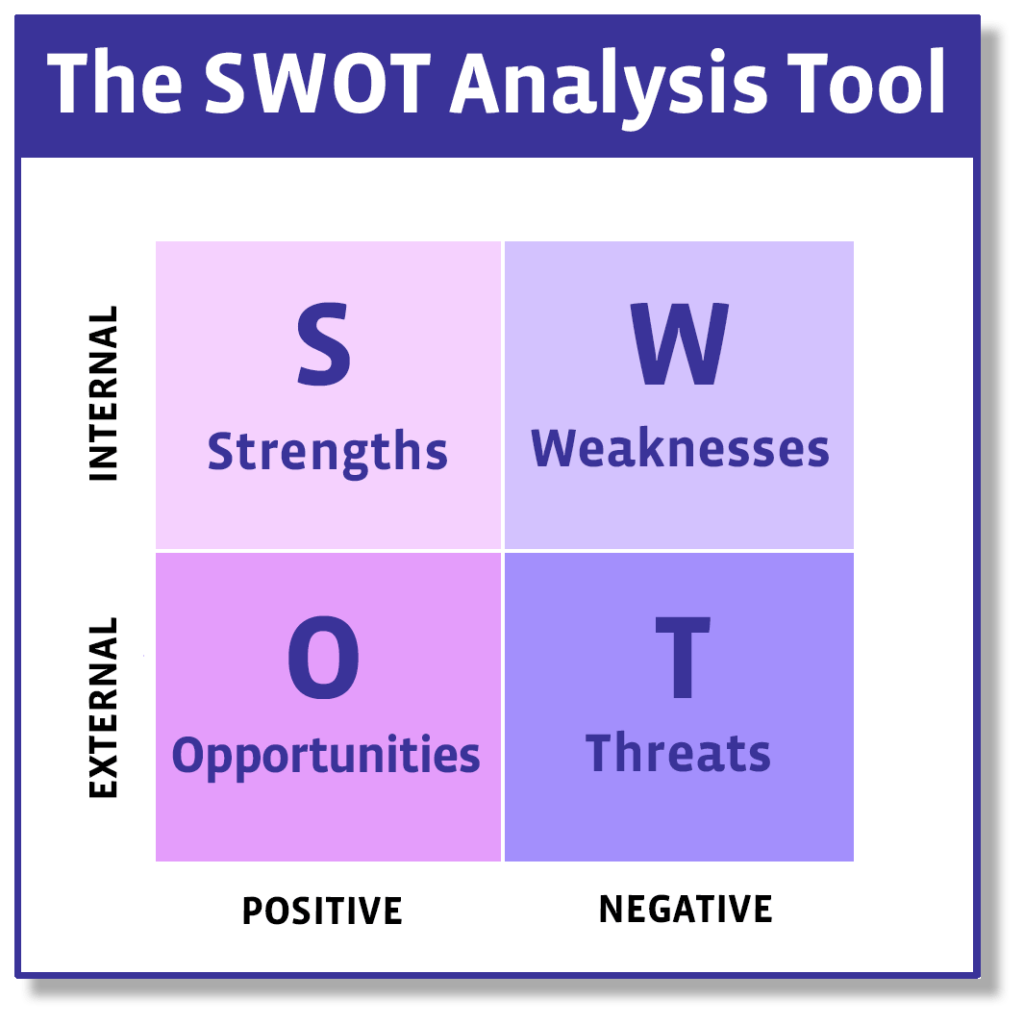

Part of what the team of business consultant did was to work with the management of our organization in conducting a SWOT analysis for Freeman Jones Forex Brokerage Firm, LLC. Here is a summary from the result of the SWOT analysis that was conducted on behalf of Freeman Jones Forex Brokerage Firm, LLC;

Our core strength lies in the power of our team; our workforce. We have a team that can go all the way to give our clients value for their money; a team that are trained and equipped to pay attention to details and to deliver excellent returns whenever our clients engage our services to trade Forex for them. We are well positioned and we know we will attract loads of clients from the first day we open our doors for business.

As a new Forex brokerage cum Forex trading firm in Las Vegas – Nevada, it might take some time for our organization to break into the market and gain acceptance especially from corporate clients in the already saturated Forex brokerage services industry; that is perhaps our major weakness.

So also, we may not have the required cash to leverage on the opportunities of buying huge Forex as permitted by the law of the United States when such opportunity present itself to us. So also, we may not have enough budget to give our business the kind of publicity we would have loved to.

- Opportunities:

The opportunities in the Forex brokerage services industry is massive considering the number of individuals especially students, players in the manufacturing sector, importers and exporters, start – ups and of course corporate organizations who can’t afford to do without the services of Forex brokerage cum Forex trading companies.

As a standard and well – positioned Forex brokerage cum Forex trading firm, we are well – equipped and ready to take advantage of any opportunity that comes our way.

Some of the threats that we are likely going to face as a Forex brokerage cum Forex trading firm operating in the United States are unfavorable government policies , the arrival of a competitor within our location of operations and global economic downturn which usually affects purchasing / spending power. There is hardly anything we can do as regards these threats other than to be optimistic that things will continue to work for our good.

7. MARKET ANALYSIS

- Market Trends

The Forex brokerage cum Forex trading services industry is indeed a very large industry and of course it is one industry that works for businesses across different industries. If you are conversant with the trend in the Forex brokerage cum Forex trading industry, you will agree that loads of businesses but in the United States and in other part of the world are becoming active in international trades hence the increase demand for Forex.

The truth is that, a company in the manufacturing sector that depend on raw materials from the international market, or a company actively involved in importing and exporting and of course international tourist and international students et al cannot effectively operate their business or fit into a new country without having the currency of the host nation.

Another notable trend in the Forex brokerage services industry is that in the last five years, the industry has performed impressively as a large reduction in unemployment boosted the revenue generated in the industry.

So also, the Forex brokerage services cum Forex trading industry has benefited from the advancement of online Forex trading software and platforms, with new cloud-based offerings providing a new revenue stream for operators, and attracting new customers. Going forward, increasing product penetration and of course an expanding customer base is expected to drive growth in the industry.

8. Our Target Market

The demographic and psychographics composition of those who need the services of Forex brokerage cum Forex trading firms cuts across individuals, small businesses and large corporations.

Freeman Jones Forex Brokerage Firm, LLC will initially serve small to medium sized business, from new ventures to well established businesses and individual clients, but that does not in any way stop us from growing to be able to compete with the leading Forex brokerage service firms in the United States.

As a standard and licensed Forex brokerage cum Forex trading service firm, Freeman Jones Forex Brokerage Firm, LLC offers a wide range of Forex related services hence we are well trained and equipped to services a wide range of clientele base.

Our target market cuts across businesses of different sizes and industries. We are coming into the industry with a business concept that will enable us work with individuals, small businesses and bigger corporations in and around Las Vegas – Nevada and other cities in the United States of America. Below is a list of the businesses and organizations that we have specifically design our products and services for;

- Manufacturing Companies

- Blue Chips Companies

- Corporate Organizations

- International businessmen and businesswomen

- International Students

- Importers and exporters

- International Tourists and visitors

- Individuals

- Entrepreneurs and Start – Ups

Our Competitive Advantage

The level of competitions in the Forex brokerage services industry does not in any way depend on the location of the business since most people on that trade Forex can operate from any part of the world and still effectively compete in the Forex trading platforms.

We are quite aware that to be highly competitive in the Forex brokerage services industry means that we should be able to make available Forex from leading countries of the world and also to produce results and give good returns on investments when our clients, both individual clients and corporate clients give us Forex to trade on their behalf.

Freeman Jones Forex Brokerage Firm, LLC might be a new entrant into the Forex brokerage services industry in the United States of America, but the management staffs and owners of the business are considered gurus. They are people who are core professionals and licensed and highly qualified Forex traders in the United States. These are part of what will count as a competitive advantage for us.

Lastly, our employees will be well taken care of, and their welfare package will be among the best within our category (start – ups Forex brokerage cum Forex trading firms) in the industry meaning that they will be more than willing to build the business with us and help deliver our set goals and achieve all our aims and objectives.

9. SALES AND MARKETING STRATEGY

- Sources of Income

Freeman Jones Forex Brokerage Firm, LLC is established with the aim of maximizing profits in the Forex brokerage services industry and we are going to go all the way to ensure that we do all it takes to attract both corporate and individual clients on a regular basis.

Freeman Jones Forex Brokerage Firm, LLC will generate income by offering the following Forex trading cum Forex brokerage services for individuals, manufacturing companies, NGOs and for corporate organizations;

- Trade Forex on behalf of our clients (both corporate clients and individual clients)

10. Sales Forecast

We are well positioned to take on the available market in Las Vegas – Nevada and on our online platforms and we are quite optimistic that we will meet our set target of generating enough income / profits from the first six month of operations and grow the business and our clientele base beyond Las Vegas to other cities in Nevada and other states in the U.S.

We have been able to critically examine the Forex brokerage cum Forex trading market and we have analyzed our chances in the industry and we have been able to come up with the following sales forecast. The sales projection is based on information gathered on the field and some assumptions that are peculiar to startups in Las Vegas – Nevada.

Below is the sales projection for Freeman Jones Forex Brokerage Firm, LLC, it is based on the location of our business and the wide range of financial consulting services that we will be offering;

- First Year-: $250,000

- Second Year-: $550,000

- Third Year-: $950,000

N.B: This projection is done based on what is obtainable in the industry and with the assumption that there won’t be any major economic meltdown and natural disasters within the period stated above. There won’t be any major competitor offering same additional services as we do within same location. Please note that the above projection might be lower and at the same time it might be higher.

- Marketing Strategy and Sales Strategy

We are mindful of the fact that there is stiffer competition amongst Forex brokerage firms cum Forex trading firms in the United States of America; hence we have been able to hire some of the best business developer to handle our sales and marketing.

Our sales and marketing team will be recruited base on their vast experience in the industry and they will be trained on a regular basis so as to be well equipped to meet their targets and the overall goal of the organization.

We will also ensure that our excellent service deliveries speaks for us in the market place; we want to build a standard bookkeeping and payroll service business that will leverage on word of mouth advertisement from satisfied clients (both individuals and corporate organizations).

Our goal is to grow our Forex brokerage services firm to become one of the top 20 Forex brokerage firms in the United States of America which is why we have mapped out strategy that will help us take advantage of the available market and grow to become a major force to reckon with not only in the Las Vegas but also in other cities in the United States of America.

Freeman Jones Forex Brokerage Firm, LLC is set to make use of the following marketing and sales strategies to attract clients;

- Introduce our business by sending introductory letters alongside our brochure to corporate organizations, schools with international students, players in the manufacturing sector, importers and exporters, international tourists and other key stake holders in Las Vegas and other cities in Nevada.

- Advertise our business in relevant financial and business related magazines, newspapers, TV stations, and radio station.

- List our business on yellow pages ads (local directories)

- Attend relevant international and local Forex, finance and business expos, seminars, and business fairs et al

- Create different packages for different category of clients (start – ups and established corporate organizations) in order to work with their budgets and still deliver profits to them they hire our services to trade Forex on their behalf

- Leverage on the internet to promote our business

- Engage direct marketing approach

- Encourage word of mouth marketing from loyal and satisfied clients

11. Publicity and Advertising Strategy

We have been able to work with our brand and publicity consultants to help us map out publicity and advertising strategies that will help us walk our way into the heart of our target market. We are set to take the financial consulting services industry by storm which is why we have made provisions for effective publicity and advertisement of our Forex brokerage cum Forex trading firm.

Below are the platforms we intend to leverage on to promote and advertise Freeman Jones Forex Brokerage Firm, LLC;

- Place adverts on both print (community based newspapers and magazines) and electronic media platforms; we will also advertise our Forex brokerage company on financial magazines and other relevant financial programs on radio and TV

- Sponsor relevant community based events / programs

- We will leverage various online platforms to promote the business. It makes it easier for people to enter our website (Forex trading platform) with just a click of the mouse. We will take advantage of the internet and social media platforms such as; Instagram, Facebook , twitter, YouTube, Google + et al to promote our brand

- Install our Bill Boards on strategic locations all around Las Vegas – Nevada.

- Engage in road show from time to time all around Las Vegas – Nevada to promote our brand

- Distribute our fliers and handbills in target areas all around Las Vegas – Nevada

- Ensure that all our workers wear our branded shirts and all our vehicles are well branded with our company’s logo et al.

12. Our Pricing Strategy

It is a fact that Forex trading both online and offline is driven by the demand of a certain currency which is why the prices cannot be fixed; prices for Forex fluctuates on a regular basis.

At Freeman Jones Forex Brokerage Firm, LLC we will keep the prices of our services below the average market rate for all of our customers by keeping our overhead low and by collecting payment in advance from corporate organizations who would hire our services. In addition, we will also offer special discounted rates to all our customers at regular intervals.

- Payment Options

At Freeman Jones Forex Brokerage Firm, LLC our payment policy will be all inclusive because we are quite aware that different people prefer different payment options as it suits them. Here are the payment options that we will make available to our clients;

- Payment by via bank transfer

- Payment via online bank transfer

- Payment via check

- Payment via bank draft

- Payment with cash

In view of the above, we have chosen banking platforms that will help us achieve our plans with little or no itches.

13. Startup Expenditure (Budget)

Starting a Forex brokerage cum Forex trading firm can be cost effective; this is so because on the average, you are not expected to acquire expensive machines and equipment.

Aside from the working capital or capitalization as is required by the regulating body, basically what you should be concerned about is the amount needed to secure a standard office facility in a good and busy business district, the amount needed to furniture and equip the office, the amount to purchase the required software applications, the amount needed to pay bills, promote the business and obtain the appropriate business license and certifications.

This is the financial projection and costing for starting Freeman Jones Forex Brokerage Firm, LLC;

- The Total Fee for incorporating the Business in the United States of America – $750.

- The budget for basic insurance policy covers, permits and business license – $2,500

- The Amount needed to acquire a suitable Office facility in a business district 6 months (Re – Construction of the facility inclusive) – $40,000.

- The amount required for capitalization (working capital) – $50,000

- The Cost for equipping the office (computers, software applications, printers, fax machines, furniture, telephones, filing cabins, safety gadgets and electronics et al) – $5,000

- The cost for purchase of the required software applications (CRM software, Accounting and Bookkeeping software and Payroll software et al) – $10,500

- The Cost of Launching your official Website – $600

- Budget for paying at least three employees for 3 months plus utility bills – $10,000

- Additional Expenditure (Business cards, Signage, Adverts and Promotions et al) – $2,500

- Miscellaneous: $1,000

Going by the report from the market research and feasibility studies conducted, we will need over one hundred and fifty thousand (200,000) U.S. dollars to successfully set – up a medium scale but standard Forex brokerage cum Forex trading services firm in the United States of America.

It is important to state that the testing and evaluating expenses would be high because of the large amount needed as working capital.

Generating Funding / Startup Capital for Freeman Jones Forex Brokerage Firm, LLC

Freeman Jones Forex Brokerage Firm, LLC is a business that will be owned and managed by Freeman Jones and his immediate family members. They are the sole financial of the firm, but may likely welcome partners later which is why they decided to restrict the sourcing of the start – up capital for the business to just three major sources.

These are the areas we intend generating our start – up capital;

- Generate part of the start – up capital from personal savings

- Source for soft loans from family members and friends

- Apply for loan from my Bank

N.B: We have been able to generate about $50,000 (Personal savings $40,000 and soft loan from family members $10,000) and we are at the final stages of obtaining a loan facility of $150,000 from our bank. All the papers and document has been duly signed and submitted, the loan has been approved and any moment from now our account will be credited.

14. Sustainability and Expansion Strategy

The future of a business lies in the numbers of loyal customers that they have the capacity and competence of the employees, their investment strategy and the business structure. If all of these factors are missing from a business (company), then it won’t be too long before the business close shop.

One of our major goals of starting Freeman Jones Forex Brokerage Firm, LLC is to build a business that will survive off its own cash flow without the need for injecting finance from external sources once the business is officially running.

We know that one of the ways of gaining approval and winning customers over is to offer our Forex brokerage cum Forex trading services a little bit cheaper than what is obtainable in the market and we are well prepared to survive on lower profit margin for a while.

Freeman Jones Forex Brokerage Firm, LLC will make sure that the right foundation, structures and processes are put in place to ensure that our staff welfare are well taken of. Our company’s corporate culture is designed to drive our business to greater heights and training and re – training of our workforce is at the top burner of our business strategy.

As a matter of fact, profit-sharing arrangement will be made available to all our management staff and it will be based on their performance for a period of three years or more as determined by the board of the organization. We know that if that is put in place, we will be able to successfully hire and retain the best hands we can get in the industry; they will be more committed to help us build the business of our dreams.

Check List / Milestone

- Business Name Availability Check : Completed

- Business Incorporation: Completed

- Opening of Corporate Bank Accounts various banks in the United States: Completed

- Opening Online Payment Platforms: Completed

- Application and Obtaining Tax Payer’s ID: In Progress

- Application for business license and permit: Completed

- Purchase of All form of Insurance for the Business: Completed

- Conducting Feasibility Studies: Completed

- Generating part of the start – up capital from the founder: Completed

- Applications for Loan from our Bankers: In Progress

- Writing of Business Plan: Completed

- Drafting of Employee’s Handbook: Completed

- Drafting of Contract Documents: In Progress

- Design of The Company’s Logo: Completed

- Graphic Designs and Printing of Packaging Marketing / Promotional Materials: Completed

- Recruitment of employees: In Progress

- Purchase of the Needed software applications, furniture, office equipment, electronic appliances and facility facelift: In Progress

- Creating Official Website for the Company: In Progress

- Creating Awareness for the business (Business PR): In Progress

- Health and Safety and Fire Safety Arrangement: In Progress

- Establishing business relationship with vendors and key players in the industry: In Progress

Related Posts:

- Insurance Agency Business Plan [Sample Template]

- Crowdfunding Platform Business Plan [Sample Template]

- Judgement Recovery Business Plan [Sample Template]

- Financial Coaching Business Plan [Sample Template]

- Investment Advisory Business Plan [Sample Template]

Create a Winning Forex Trading Business Plan: Key Components and Strategies for Success

Table of Contents

Introduction

A trading business plan is an essential component of successful Forex trading. It serves as a roadmap, guiding traders in making informed decisions, managing risks, and achieving consistent profitability. In this article, we will explore the key components of a Forex trading business plan, offering insights on setting trading goals, developing a strategy, risk management, broker selection, and more. By incorporating these elements into your trading business plan, you will be better prepared to navigate the dynamic world of Forex trading.

Setting Clear Trading Goals

The first step in creating a trading business plan is to establish clear trading goals. These goals should be tailored to your individual financial situation, risk tolerance, and personal preferences. Consider the following when setting your trading goals:

- Short-term, medium-term, and long-term goals : Your goals should cover various timeframes, ranging from daily or weekly targets to longer-term objectives, such as annual returns or overall account growth.

- Profit targets and performance metrics : Establish specific profit targets and performance metrics to measure your progress, such as return on investment (ROI), win rate, or risk-adjusted return.

- Aligning goals with your risk tolerance and personal financial situation : Ensure that your trading goals align with your risk tolerance and financial situation. For example, if you cannot afford significant losses, it is essential to set conservative profit targets and maintain strict risk management protocols.

Developing a Trading Strategy

A solid trading strategy is the foundation of your trading business plan. Here are some key considerations when developing your strategy:

- Fundamental analysis and technical analysis : Fundamental analysis involves analyzing macro-economic and geopolitical factors that affect currency prices, while technical analysis involves using charts and technical indicators to identify trading opportunities. Determine which type of analysis aligns with your trading style and use it as the basis for your strategy.

- Identifying your trading style : There are three primary trading styles: day trading, swing trading, and position trading. Choose the one that best aligns with your personality, time constraints, and financial goals.

- Selecting the best trading strategies and techniques for your style : Each trading style requires different strategies and techniques. For example, day traders may use scalping strategies, while position traders may employ trend following strategies. Research and experiment with different strategies to find the ones that work best for your trading style.

- Adapting your strategy to various market conditions : The Forex market is dynamic and constantly evolving, so it’s essential to adapt your strategy to changing market conditions. Learn to identify different market phases, such as trending or ranging, and adjust your strategy accordingly.

Risk Management

Risk management is a critical component of a trading business plan. Without proper risk management, traders can quickly incur significant losses. Consider the following when managing risk:

- Position sizing and leverage : Determine the appropriate position size and leverage for each trade based on your risk tolerance and account size.

- Stop loss and take profit orders : Always use stop loss and take profit orders to limit your losses and lock in profits.

- Risk-reward ratio : Maintain a favorable risk-reward ratio by ensuring that your potential profit is always greater than your potential loss.

- Managing emotions and maintaining discipline : Trading can be emotionally challenging, so it’s essential to maintain discipline and manage emotions such as fear and greed. Stick to your trading plan, and avoid overtrading or deviating from your strategy.

Choosing the Right Broker

Selecting the right broker is crucial to the success of your trading business plan. Consider the following when choosing a broker:

- Evaluating broker reputation, regulation, and financial security : Choose a broker with a good reputation, strong regulation, and financial security.

- Analyzing trading platforms and tools : Ensure that the broker offers a trading platform and tools that align with your trading strategy.

- Comparing fees, spreads, and commissions : Compare the fees, spreads, and commissions of different brokers to ensure that you are getting the best value for your money.

Creating a Trading Routine

Creating a trading routine is essential for consistent success in Forex trading. Consider the following when creating a trading routine:

- Establishing a daily schedule for market analysis, trade execution, and monitoring : Set aside specific times each day for market analysis, trade execution, and monitoring.

- Maintaining a trading journal : Keep a trading journal to track your progress and identify areas for improvement.

- Regularly reviewing and updating your trading plan : Periodically review and update your trading plan to ensure that it continues to align with your goals and strategies.

Education and Skill Development

Continuous education and skill development are critical to the success of your trading business plan. Consider the following when seeking education and skill development:

- Continual learning through books, courses, webinars, and other resources : Stay up-to-date on Forex trading trends and best practices by engaging in continuous learning through various resources.

- Networking with other traders and participating in trading communities : Join Forex trading communities and engage with other traders to gain insights and feedback.

- Utilizing demo accounts to practice and refine your strategy : Practice and refine your strategy using demo accounts before committing real money to trades.

Performance Evaluation and Plan Adjustments

Periodic performance evaluation and plan adjustments are necessary for continuous improvement in Forex trading. Consider the following when evaluating your performance and making plan adjustments:

- Periodic performance analysis and goal assessment : Regularly analyze your performance and compare it to your trading goals and metrics.

- Identifying areas for improvement and implementing changes : Use performance analysis to identify areas for improvement and implement changes to your trading strategy and plan.

By incorporating these elements into your trading business plan, you can create a comprehensive and effective roadmap for successful Forex trading.

Creating a trading business plan is essential for successful Forex trading . By setting clear trading goals, developing a solid trading strategy, managing risk, choosing the right broker, creating a trading routine, seeking education and skill development, and regularly evaluating performance and making adjustments, traders can navigate the dynamic world of Forex trading with confidence and consistency. Remember, a trading business plan is not a one-time task, but rather an ongoing process of learning, adapting, and refining your approach to achieve your trading goals.

- Forex Trading Education

- Trading Plan Articles

Forex Trading Business Plan and Risk Analysis

One of the best things you can do as a forex trader to assure your long term survival in the business is develop a sound and objective forex trading business plan and the discipline to stick to it.

Going through this important process will help you overcome the emotional responses to trading that have been the downfall of so many novice traders.

Once you have developed a good trading plan that you think you can trade in a disciplined way, another good idea is to put all of your trading-related plans and ideas together into an overall trading business plan.

Benefits of a Forex Trading Business Plan

Even if you have been trading for a while, but have not yet written down a forex trading business plan, you can still derive considerable benefits from doing so even now.

Producing a business plan will help you review and solidify your personal trading business activities and goals.

Another major advantage of having a business plan is that if your trading business plan still looks good after its initial testing and trading period, you might even be able to use it to find new investors to put money into your trading business.

Having more funds to trade with can help you access better trading spreads, information, customer service and ultimately, better and more profitable trading opportunities.

Components of a forex Trading Business Plan

Your forex trading business plan does not need to be complex. At a minimum, it should contain your forex trading plan, how you intend to manage any money invested, and a risk assessment of your engagement in the business.

Additional components of a trading business plan might include:

(1) What the competition is doing.

(2) Necessary start up and running costs of your trading business.

(3) The equipment necessary for your business to start operating.

(4) How you plan on running your trading activities in detail.

(5) How invested money will be held and managed within your trading business.

(6) What you plan on achieving with your trading business in terms of profits and meeting other goals.

(7) An overall risk/reward analysis showing that your trading business makes sense.

Most of the above forex trading business plan items are relatively self-explanatory; however the risk/reward analysis mentioned in item #(7) will be covered in greater detail in the following section.

Assessing the Risks of Your Trading Business

If you honestly believe that your trading business is worth pursuing, then it really cannot hurt to take a closer look at it from a risk/reward perspective. You can do this by assessing as objectively as possible what risks the business might face and what rewards you can reasonably expect to gain from pursuing it.

Furthermore, since some risks might occur with a greater probability than others, they can be weighted in a risk analysis according to their probability of happening. You can then multiply that weight by the potential size of risk involved to get a probability weighted risk exposure.

To get the overall risk/reward profile of your business, you would then sum up all of the risks and compare them to the rewards to see if your business makes sense.

Not only is such a business risk/reward analysis well worth doing, but it makes up an important part of your trading business plan that would ideally be created before you even make your first trade.

Many potential investors will want to see this risk/reward analysis information to help them assess whether your trading business stands a good chance of success for the risk you will be taking.

We also recommend you to read about the basic forex trading plan and why you should have it.

Risk Statement: Trading Foreign Exchange on margin carries a high level of risk and may not be suitable for all investors. The possibility exists that you could lose more than your initial deposit. The high degree of leverage can work against you as well as for you.

Privacy Overview

Trading Business Plan Template

Written by Dave Lavinsky

Trading Business Plan

Over the past 20+ years, we have helped over 500 entrepreneurs and business owners create business plans to start and grow their trading companies.

If you’re unfamiliar with creating a trading business plan, you may think creating one will be a time-consuming and frustrating process. For most entrepreneurs it is, but for you, it won’t be since we’re here to help. We have the experience, resources, and knowledge to help you create a great plan.

In this article, you will learn some background information on why business planning is important. Then, you will learn how to write a trading business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What is a Trading Business Plan?

A business plan provides a snapshot of your trading company as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategies for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for a Trading Company

If you’re looking to start a trading company or grow your existing company, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your trading business to improve your chances of success. Your business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Trading Companies

With regards to funding, the main sources of funding for a trading company are personal savings, credit cards, bank loans, and angel investors. When it comes to bank loans, banks will want to review your plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to ensure that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Personal savings and bank loans are the most common funding paths for trading companies.

Finish Your Business Plan Today!

How to write a business plan for a trading company.

If you want to start a trading business or expand your current one, you need a business plan. The guide below details the necessary information for how to write each essential component of your trading business plan.

Executive Summary

Your executive summary provides an introduction to your trading business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your executive summary is to quickly engage the reader. Explain to them the kind of trading company you are running and the status. For example, are you a startup, do you have a trading business that you would like to grow, or are you operating a chain of trading companies?

Next, provide an overview of each of the subsequent sections of your plan.

- Give a brief overview of the trading industry.

- Discuss the type of trading business you are operating.

- Detail your direct competitors. Give an overview of your target customers.

- Provide a snapshot of your marketing strategy. Identify the key members of your team.

- Offer an overview of your financial plan.

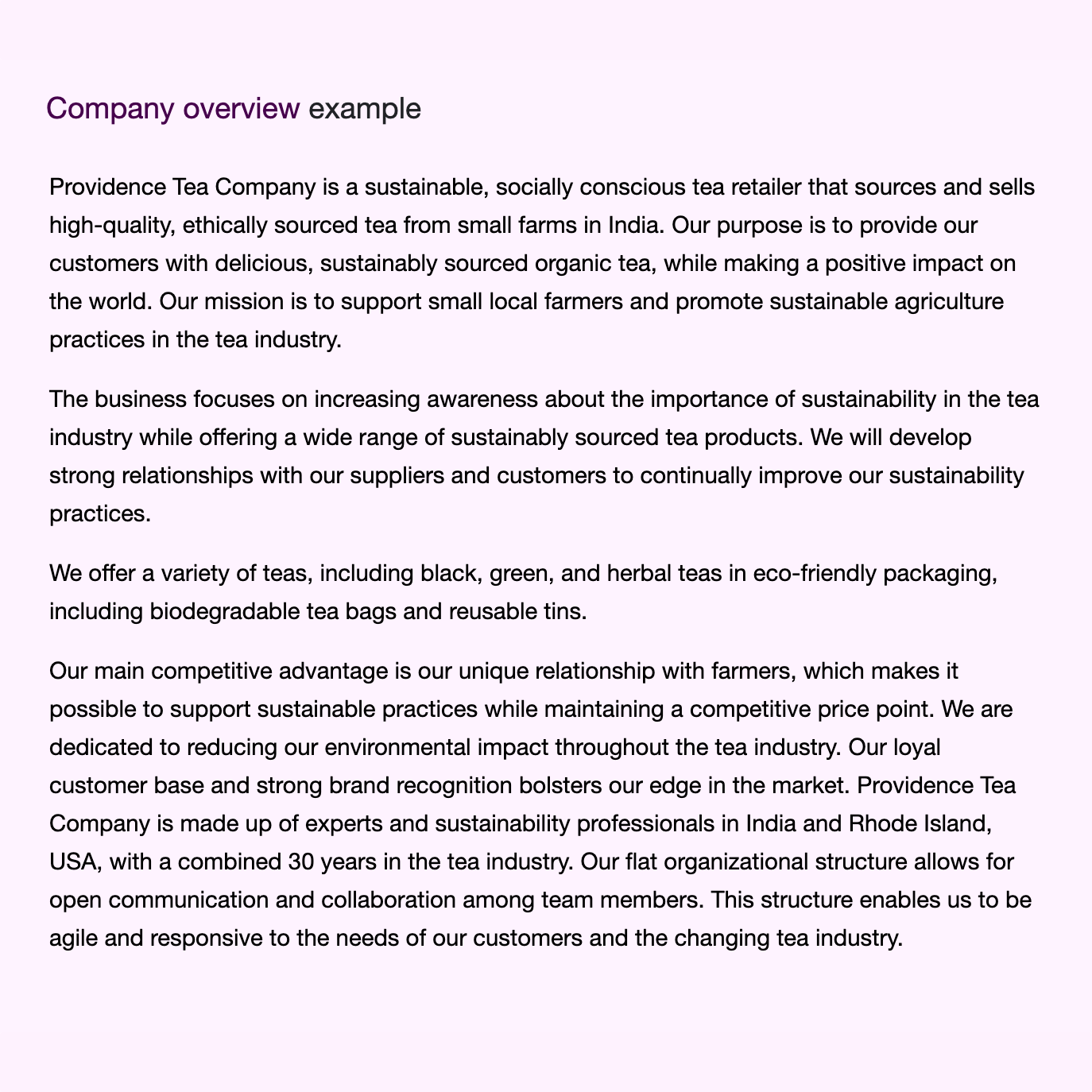

Company Overview

In your company overview, you will detail what type of trading business you are operating.

For example, you might specialize in one of the following types of trading businesses:

- Retail trading business: This type of business sells merchandise directly to consumers.

- Wholesale trading business: This type of business sells merchandise to other businesses.

- General merchandise trading business: This type of business sells a wide variety of products.

- Specialized trading business: This type of business sells one specific type of product.

In addition to explaining the type of trading business you will operate, the company overview needs to provide background on the business.

Include answers to questions such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of customers served, the number of products sold, and reaching $X amount in revenue, etc.

- Your legal business Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry or market analysis, you need to provide an overview of the trading industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the trading industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your marketing strategy, particularly if your analysis identifies market trends.

The third reason is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section:

- How big is the trading industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential target market for your trading business? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: individuals, schools, families, and corporations.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of trading business you operate. Clearly, individuals would respond to different marketing promotions than corporations, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, including a discussion of the ages, genders, locations, and income levels of the potential customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can recognize and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Trading Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other trading businesses.

Indirect competitors are other options that customers have to purchase from that aren’t directly competing with your product or service. This includes other types of retailers or wholesalers, re-sellers, and dropshippers. You need to mention such competition as well.

For each such competitor, provide an overview of their business and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as

- What types of customers do they serve?

- What type of trading business are they?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you make it easier for customers to acquire your product or service?

- Will you offer products or services that your competition doesn’t?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

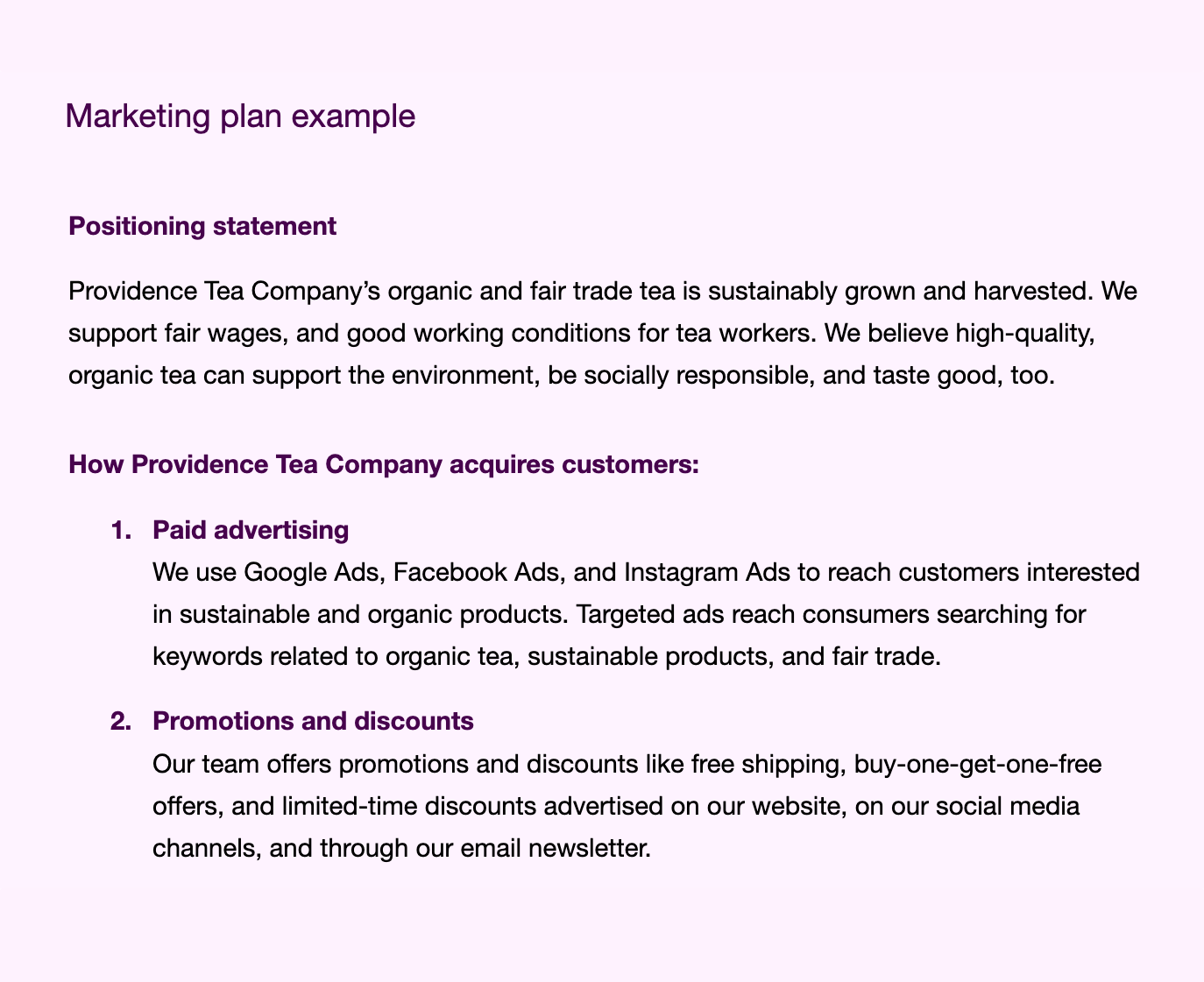

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a trading company, your marketing strategy should include the following:

Product : In the product section, you should reiterate the type of trading company that you documented in your company overview. Then, detail the specific products or services you will be offering. For example, will you sell jewelry, clothing, or household goods?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your plan, you are presenting the products and/or services you offer and their prices.

Place : Place refers to the site of your trading company. Document where your company is situated and mention how the site will impact your success. For example, is your trading business located in a busy retail district, a business district, a standalone facility, or purely online? Discuss how your site might be the ideal location for your customers.

Promotions : The final part of your trading marketing plan is where you will document how you will drive potential customers to your location(s). The following are some promotional methods you might consider:

- Advertise in local papers, radio stations and/or magazines

- Reach out to websites

- Distribute flyers

- Engage in email marketing

- Advertise on social media platforms

- Improve the SEO (search engine optimization) on your website for targeted keywords

Operations Plan

While the earlier sections of your plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your trading business, including answering calls, scheduling shipments, ordering inventory, and collecting payments, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to acquire your Xth customer, or when you hope to reach $X in revenue. It could also be when you expect to expand your trading business to a new city.

Management Team

To demonstrate your trading business’ potential to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally, you and/or your team members have direct experience in managing trading businesses. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act as mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing a trading business.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet, and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenue and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you charge per item or per pound and will you offer discounts for bulk orders? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your trading business, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a lender writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

Your cash flow statement will help determine how much money you need to start or grow your business, and ensure you never run out of money. What most entrepreneurs and traders don’t realize is that you can turn a profit but run out of money and go bankrupt.

When creating your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a trading business:

- Cost of equipment and supplies

- Payroll or salaries paid to staff

- Business insurance

- Other start-up expenses (if you’re a new business) like legal expenses, permits, computer software, and equipment

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your facility location lease or a list of your suppliers.

Writing a business plan for your trading business is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will understand the trading industry, your competition, and your customers. You will develop a marketing strategy and will understand what it takes to launch and grow a successful trading business.

Trading Business Plan Template FAQs

What is the easiest way to complete my trading business plan.

Growthink's Ultimate Business Plan Template allows you to quickly and easily write your trading business plan.

How Do You Start a Trading Business?

Starting a trading business is easy with these 14 steps:

- Choose the Name for Your Trading Business

- Create Your Trading Business Plan (use a trading business plan template or a forex trading plan template)

- Choose the Legal Structure for Your Trading Business

- Secure Startup Funding for Trading Business (If Needed)

- Secure a Location for Your Business

- Register Your Trading Business with the IRS

- Open a Business Bank Account

- Get a Business Credit Card

- Get the Required Business Licenses and Permits

- Get Business Insurance for Your Trading Business

- Buy or Lease the Right Trading Business Equipment

- Develop Your Trading Business Marketing Materials

- Purchase and Setup the Software Needed to Run Your Trading Business

- Open for Business

What is a Trading Business?

There are several types of trading businesses:

- Retail trading business- sells merchandise directly to consumers

- Wholesale trading business- sells merchandise to other businesses

- General merchandise trading business- sells a wide variety of products

- Specialized trading business- sells one specific type of product

Don’t you wish there was a faster, easier way to finish your Trading business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to see how Growthink’s business plan advisors can give you a winning business plan.

Other Helpful Business Plan Articles & Templates

How To Write a Business Plan for Forex Trading Platforms in 9 Steps: Checklist

By henry sheykin, resources on forex trading platforms.

- Financial Model

- Business Plan

- Value Proposition

- One-Page Business Plan

- SWOT Analysis

- Business Model

- Marketing Plan

- Bundle Business Plan & Fin Model

Forex trading platforms have gained immense popularity in the US, offering individuals the opportunity to trade in the global foreign exchange market. If you're considering starting your own platform, this blog post is a must-read. We'll walk you through the essential steps to write a comprehensive business plan for your Forex trading platform, ensuring your success in this ever-growing industry.

The Forex trading industry is booming, with a staggering growth rate of over 20% annually . The market is valued at trillions of dollars, making it one of the largest financial markets globally. With such promising statistics, now is the perfect time to capitalize on this thriving industry by launching your own Forex trading platform.

Before diving into the intricacies of writing a business plan, conducting thorough market research is crucial. You need to understand the current trends, customer preferences, and potential opportunities that exist in the market. By gathering valuable insights, you'll be equipped to develop a platform tailored to your target market's needs and preferences.

Identifying your target market is the next step in crafting your business plan. Determine the specific demographic or niche you want to cater to, whether it's experienced traders, beginners, or a specific geographic location. By clearly defining your target market, you can tailor your platform's features and offerings to meet their requirements and stand out from the competition.

Speaking of competition, it's essential to analyze your competitors . Identify existing Forex trading platforms in the market and assess their strengths, weaknesses, and unique selling points. This analysis will enable you to differentiate your platform, highlight your unique features, and develop effective marketing strategies.

To gain a competitive edge, it's crucial to define your unique selling points . Determine what sets your platform apart from others, whether it's advanced analytics, exceptional user experience, or access to industry experts. Clearly articulating your unique selling points in your business plan will ensure you stand out and attract traders to your platform.

Creating a successful Forex trading platform requires investment . Evaluate the costs associated with developing and launching your platform, such as technology infrastructure, software development, and marketing expenses. Determining the required investment early on will help you secure funding and ensure a smooth launch.

Adhering to regulatory and legal requirements is paramount in the Forex trading industry. It's imperative to evaluate these requirements and understand the legal framework that governs Forex trading platforms in the US. This will ensure compliance and avoid any legal pitfalls that may hinder your platform's operations.

A comprehensive marketing and sales strategy is crucial to attract and retain traders to your platform. Outline your strategies for acquiring new customers, such as digital marketing campaigns, referral programs, or partnerships with industry influencers. Additionally, detail your plans for retaining customers, leveraging customer satisfaction surveys, loyalty programs, or personalized services.

No business plan is complete without a financial projection . Develop a detailed projection that outlines your revenue streams, expected costs, and profitability over the next few years. This financial roadmap will serve as a guidepost and assist you in making informed financial decisions as your platform grows.

Lastly, surrounding yourself with the right team or forming partnerships is essential. Identify individuals with expertise in Forex trading, software development, and marketing, who can contribute to the success of your platform. Collaborations with industry experts or partnering with established brokerage firms can also enhance your platform's credibility and attract more traders.

Aspiring entrepreneurs in the Forex trading industry must follow these nine essential steps when crafting a business plan for their platform. Understanding the market, identifying your target audience, and creating a unique value proposition are all crucial components to ensure your platform's success in the ever-evolving Forex trading landscape.

Conduct Market Research

Market research is a critical step in developing a business plan for forex trading platforms. By conducting thorough market research, you can gather important information about the industry, target audience, and potential competition. This knowledge will enable you to make informed decisions and create a strong foundation for your platform's success.

When conducting market research for forex trading platforms, there are several key areas to focus on:

- Industry Analysis: Gain a deep understanding of the forex trading industry, its trends, and its future growth potential. Research factors that affect the industry, such as regulations, technology advancements, and market volatility.

- Target Audience: Identify and define your target market. Consider factors like demographics, trading experience, investment goals, and potential demand for your platform's services.

- Competition Analysis: Analyze the existing forex trading platforms in the market. Identify their strengths, weaknesses, and unique selling points. Determine how you can differentiate your platform to attract users.

- Customer Needs: Understand the needs and pain points of your target audience. What are the challenges they face while trading? How can your platform address those challenges and provide value?

Tips for conducting effective market research:

- Utilize both primary and secondary research methods. Primary research involves collecting data directly from potential customers through surveys or interviews. Secondary research involves analyzing existing data from industry reports, articles, and market research studies.

- Use online platforms and forums to gather insights from active traders. Engage with the forex trading community to understand their preferences and pain points.

- Keep a close eye on industry news, regulatory changes, and technological advancements that can impact the forex trading industry.

- Consider hiring a market research firm or consulting experts in the forex trading industry to gain specialized knowledge and insights.

By thoroughly conducting market research, you can create a solid foundation for your business plan and gain a competitive edge in the forex trading platform market. The insights gained will help you make informed decisions and tailor your platform's offerings to meet the needs of your target audience.

| Forex Trading Platforms Financial Model Get Template |

Identify Target Market

The success of a Forex trading platform greatly depends on identifying and understanding its target market. By accurately defining and targeting your audience, you can effectively tailor your marketing strategies, user experience, and platform features to meet their specific needs and preferences.

When identifying your target market, consider the following:

- Demographics: Understand the characteristics of your potential users, such as age, gender, location, occupation, and income level. This information will help you craft targeted marketing messages and create a user-friendly platform.

- Experience Level: Determine whether your platform will cater to beginner traders, experienced professionals, or both. This will influence the level of educational resources and support you provide.

- Trading Style: Identify the trading styles your target market prefers, such as day trading, swing trading, or long-term investing. This will help you design features and tools that align with their trading strategies.

- Needs and Pain Points: Understand the specific challenges and goals your target market faces in the Forex trading world. This knowledge will enable you to offer solutions and services that address their pain points and add value to their trading experience.

Target Market Tips:

- Conduct Surveys and Interviews: Engage with potential users to gather insights and feedback on their trading preferences and needs.

- Research Competitors: Analyze the target markets of your competitors to identify any gaps or opportunities.

- Stay Updated: Continuously monitor industry trends and changes in the Forex market to ensure your platform remains relevant to your target market.

Analyze Competition

When starting a Forex trading platform, it is essential to conduct a thorough analysis of the competition in the market. Understanding your competitors' strengths and weaknesses can provide valuable insights on how to differentiate yourself and gain a competitive edge. Here are the key steps to analyze your competition:

- Identify your direct competitors: Research and create a list of other Forex trading platforms that offer similar services in your target market. Consider factors such as their user base, reputation, and market share.

- Evaluate their trading features: Take a closer look at the trading features and functionalities offered by your competitors. Look for any unique selling points or innovative features that set them apart from others.

- Analyze pricing and commission structures: Study the commission rates and pricing models used by your competitors. Understand how they structure their fees and whether they offer any additional premium services or packages.

- Assess their marketing strategies: Examine how your competitors market their trading platforms. Look at their advertising campaigns, social media presence, and content marketing strategies. Pay attention to any partnerships or collaborations they have formed to attract more traders.

- Consider user reviews and feedback: Read user reviews and testimonials to gather insights about your competitors' strengths and weaknesses. Learn from their customer feedback to identify areas where you can improve your own platform.

- Do not underestimate the importance of market research. Stay updated with the latest trends and innovations in the Forex trading industry.

- Identify any gaps in the market that your competitors have not addressed. This can serve as an opportunity for you to offer unique value to your target audience.

- Keep an eye on emerging competitors and new entrants into the industry. Adapt and evolve your strategies to stay ahead of the competition.

Define Unique Selling Points

When developing a business plan for a Forex trading platform, it is crucial to define your unique selling points (USPs) that set you apart from the competition. Your USPs are the factors that make your platform attractive to potential traders and give them a reason to choose your platform over others in the market.

- Platform Features: Highlight the features that make your trading platform stand out. This could include advanced charting tools, real-time market data, customizable user interfaces, or innovative order types. Clearly communicate how these features can enhance the trading experience for your users.

- Trading Education: Consider offering comprehensive educational resources to help traders improve their skills and make informed decisions. This could include tutorials, webinars, or access to educational material from experienced traders. Emphasize how your platform can empower traders to become more successful.

- Customer Support: Provide exceptional customer support to differentiate your platform. Offer multiple channels for traders to reach out for assistance, such as live chat, email, or phone support. Highlight your prompt response times and knowledgeable support team.

- Security Measures: In the Forex trading industry, security is a significant concern for traders. Assure potential users that your platform has robust security measures in place to protect their personal and financial information.

- Research your competitors to identify their strengths and weaknesses. Look for gaps in the market that you can fill with your unique offerings.

- Get feedback from potential traders to understand their needs and preferences. Use this information to refine your USPs and tailor your platform accordingly.

- Consider conducting surveys, focus groups, or beta testing to gather insights and validate your unique selling points.

Determine The Required Investment

Before launching a forex trading platform, it is essential to determine the required investment to ensure that you have enough capital to start and sustain the business. Here are some important factors to consider when determining the required investment:

- Technology Infrastructure: Developing a robust and reliable trading platform requires a significant investment in technology infrastructure, including servers, software development, and cybersecurity measures. It is crucial to allocate a budget for these technical requirements.

- Compliance and Legal Costs: Forex trading platforms are subject to various regulatory and legal requirements, such as obtaining licenses and adhering to anti-money laundering rules. It is important to consult with legal experts to understand the compliance costs involved and budget accordingly.

- Marketing and Advertising: To attract traders to your platform, you will need to invest in marketing and advertising campaigns. This may include online advertising, social media marketing, content creation, and public relations activities.

- Operational Expenses: Consider the costs of running the platform, such as office space, employee salaries, customer support, and administrative expenses. It is important to estimate these ongoing operational costs to ensure financial viability.