- Free Photos

- Free Guides

- New Arrivals

- Free Stock Photos

- Pick A Photo

- Photo Collections

- 28 Free Captions

- Monthly Captions

- Monthly Reels Ideas

- Content Ideas

- Pick A Template

- Pinterest Pins

- Free Content Planner

- Browse All Plans

- PLR / Resell

- Profit Growth

- Leads Growth

- Social Media Growth

- Plan & Systems

- Banding & Design

- Profit Boost Bundles (VIP)

- New Tutorials

- Instagram Tutorials

- Pinterest Tutorials

- Email Tutorials

- Money Making Tutorials

- Branding Tutorials

- Enroll in Accelerator

- All Courses

- Become a Member

- Plans & Pricing

get 500+ free images, templates & marketing strategies! You're one click away, Don't Miss It.

Included Free:

550+ templates, photos, & strategies, get new free downloads monthly, unlimited downloads, special offers & trends newsletter, save and sort your favorites, access 500+ free templates, photos, & strategies with a free account, free user creation for popup.

- Enter Email

- Create Password

- Are you human?

By creating an account, I agree to Ivory Mix's Website terms, Privacy Policy and Licensing Terms

Already have an account? Log in

How to make a 12 month plan — Goals, Vision, and Content

Back to Blog

This post may contain affiliate links. Please read the disclaimer

Ready to kiss this year goodbye and look ahead to the new year!? The #1 enemy of not accomplishing goals is a broken focus, so to get back on track for your new year, we need to reclaim our focus and make a plan!

> Download my free Annual Planner and Yearly Journal (50 page pdf)

Why create a plan?

- Knowing you have a pathway to follow feels good

- Planning inspires action

- Setting goals makes you feel accomplished

In this post, we’re going to talk about setting goals with ease and taking inspired action for the year ahead. To do this, I recommend retreating to a quiet place and giving yourself time to really ask the big questions and ponder your big goals.

Set aside an afternoon, a day, or even a couple of days if you can!

This is your business, and it deserves attentive and focused planning to grow and evolve.

I’m going to let you in on a little biz secret — the most effective way to plan is to focus on ONE thing at a time.

Don’t dive in and scatter lists all over the table or open up a million google docs at once. When you have too many things on your plate, your focus becomes blurred. Instead, take your time and work through this process slowly.

I love this acronym…

FOCUS: Following One Course Until Success.

This acronym demonstrates how important it is to take action and follow through on each part of your business plan. The more action you take, the more progress you’ll make, and the more satisfaction you’ll feel!

The exercises I’m leading you through in this post are NOT about doing everything perfectly! We cannot let perfect action become the enemy of good action.

If the past few years have taught us anything, it’s that perfect plans aren’t always the best.

Step One – Pick Your Theme for the Year (Word/Idea for the year)

Choose a theme that will help inspire action all year long. To narrow one down, think about how you want to feel throughout the year. For example, this year my theme will be “inspired action.”

Step Two – Brainstorm How to Get There

Begin a list of ways that you can embody your chosen theme in the new year. How can you bring that theme into your life?

Use this list to invigorate yourself when you get off track.

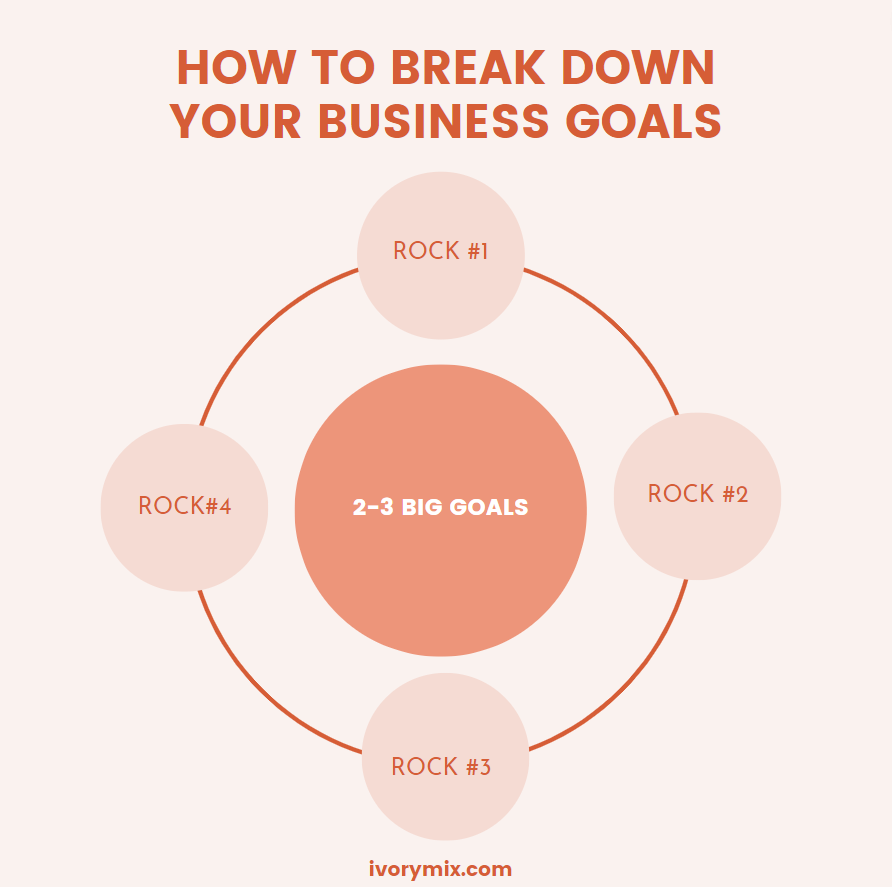

Step Three – Set 2 to 3 BIG Goals

Now it’s time to get more specific.

If you were to accomplish something distinct in the coming year, what would make you the most excited? The proudest? What 2-3 big things will make this upcoming year feel like a success if you get close or achieve them?

Maybe it’s scaling your revenue with existing products, or creating clear boundaries in your business? Whatever the case, set goals that are a little uncomfortable but not TOO uncomfortable. The best goals are hard to reach, but not impossible.

What 2-3 goals come to mind?

Step Four – Create a “Would Be Nice” List

Brainstorm outcomes that could be easily achieved by working on them for a few days or by occasionally working them into your schedule. These would-be-nice outcomes don’t need to be major goals , but they do need to help support how you want to feel throughout the year.

An example? Maybe you want to feel more refreshed and at peace in the new year, so you choose to spend more time in nature and hike at least once a month.

Brain dump a list of “would-be-nices” like this example that will help you feel better. Go for it and list as many things as you can!

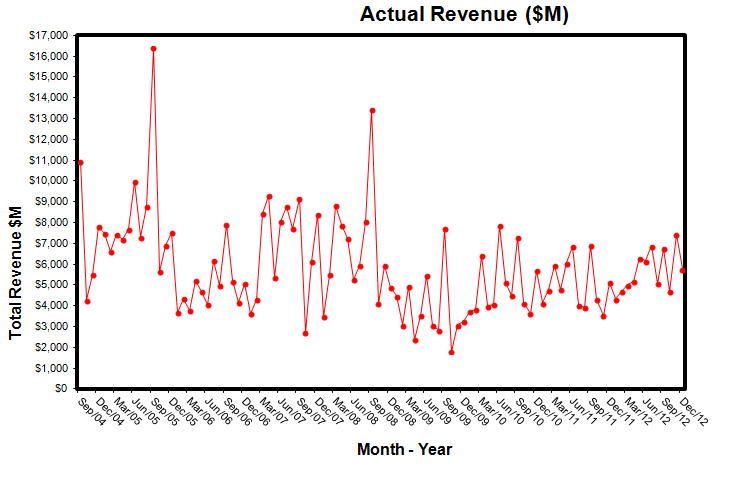

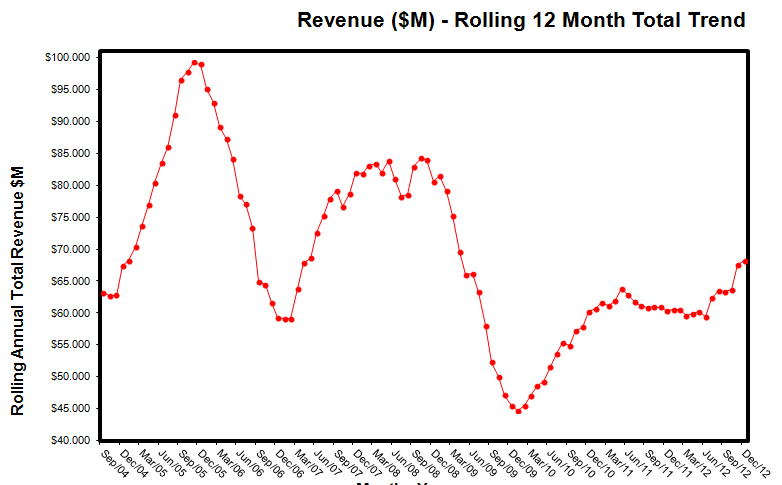

Step Five – Gather Data from the previous year

Now that you’ve set your theme, big goals, and would-be-nice ideas, it’s time to dig into the numbers to see where you have room for improvement. Open up those past year metrics and take a look! They are the key to making a plan and achieving your goals.

A quick note: Some people tend to start with the numbers and work backward. My advice is to not do that. Instead, begin with how you want to feel in the next year, like we have in the steps above, and set those intentions before you ever look at the data.

As business owners, we can easily get wrapped up in the numbers. But to be fulfilled in our lives, we need to start making decisions based on our desires.

So what do you really want from the new year?

Once you’ve decided what you want, the data will show you how to make informed decisions to get there.

Data to gather may include:

- Website analytics

- Subscriber info

- Profit and Loss sheets

- Notes and Journals

Think about how much you made in the past year, how many email subscribers you added to your list, how many visits there were to your sales pages, etc. Look at where your website traffic comes from and what blog posts performed the best. Really dig in and study the metrics.

In addition, look at what you’re spending on your team, your projects, and the tools you’re paying for to see if they are accomplishing what you intended them to.

What has created success? Let this data inform your next steps.

Step Six – Ask deeper questions about your Top 4 Priorities as a Business Owner

When you peel away the outer layers, most business owners really have the same set of priorities no matter their niche. These 4 priorities need to be considered when you’re setting your goals for the coming year:

- What will increase sales?

- What will increase my social proof?

- What will improve my profitability/operations?

- What do you need to do to master your craft?

Make sure you’re revisiting these questions often to determine if your plans will help you achieve one of these four goals.

Step 7 – Set Your Specific Quarterly Goals

To help you achieve your 2-3 BIG goals, it’s time to dive into the nitty-gritty.

I like to place one “ROCK” goal on my planner per quarter. This goal is “set like a rock” and requires long-term planning, focus, and strategy. Sure, some ROCK goals may take longer than a quarter, and that’s okay, but break them down as much as you can to fit them into a smaller, more defined time frame.

If you find you have too many goals on the calendar, be willing to cut the fat and move them to the “would be nice” list.

Then ask yourself: What should I DO, what should I DELEGATE, and what can I DELETE?

Use this method to pair down your plans into steps that you and/or your team can accomplish day in and day out.

Step 8 – Specify the details

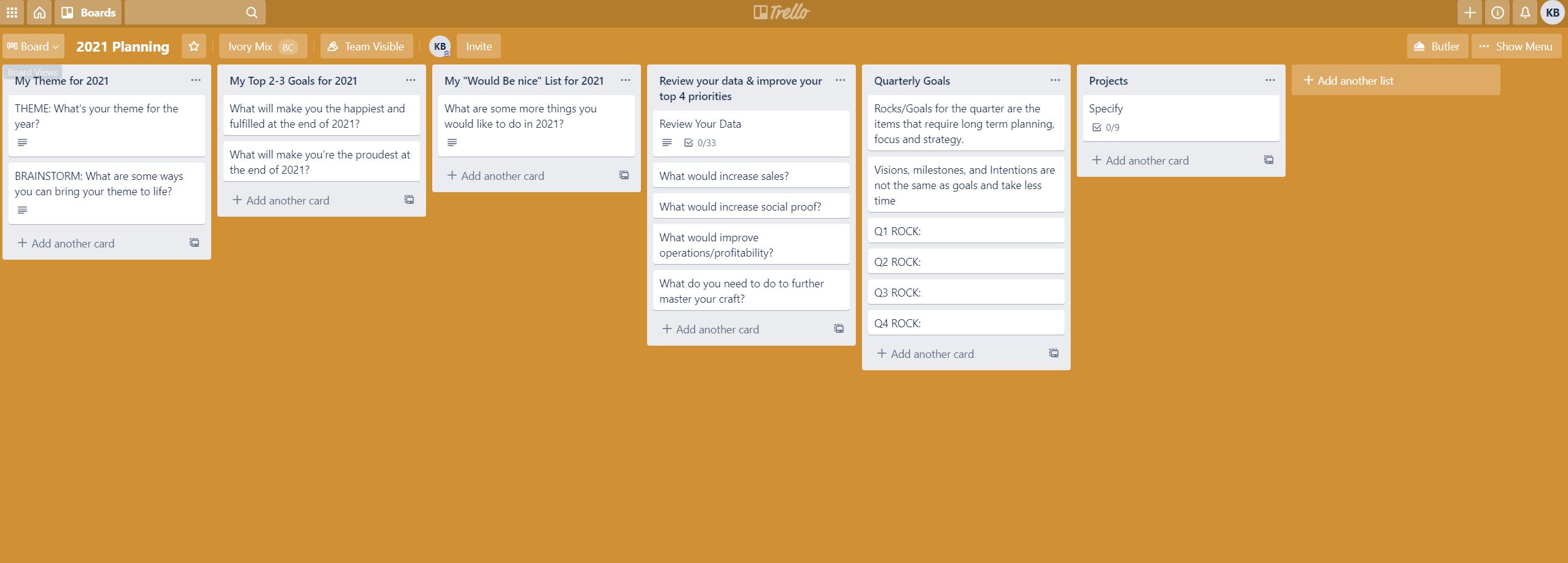

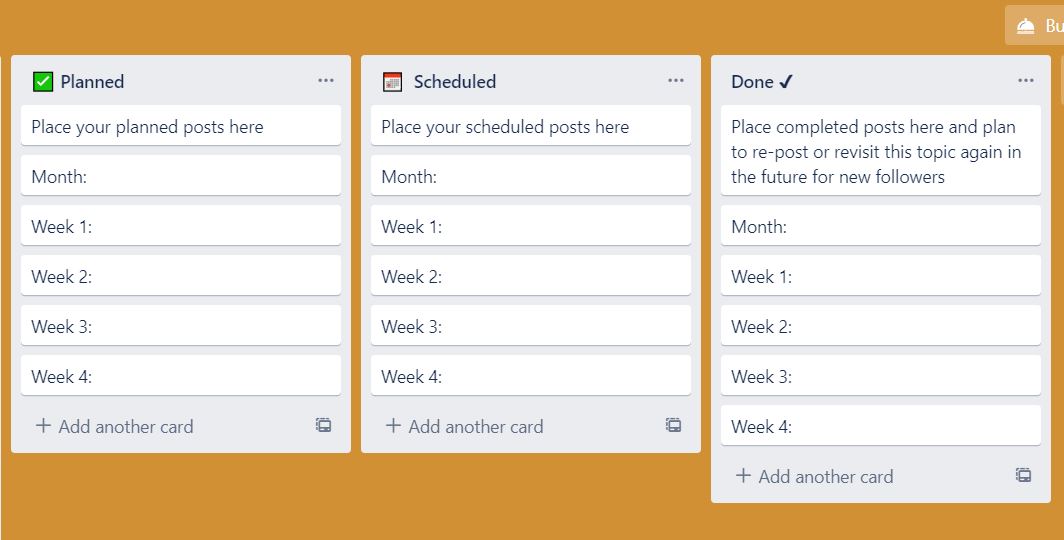

Once you have your ROCK goals set, you need to spend time outlining the specifics and how you make these goals happen. Using Trello, Asana, or Click Up, create and schedule tasks that can be checked off when complete.

You can organize your goals and plans on a Trello board like this example here:

Step 9 – Gather Content Ideas

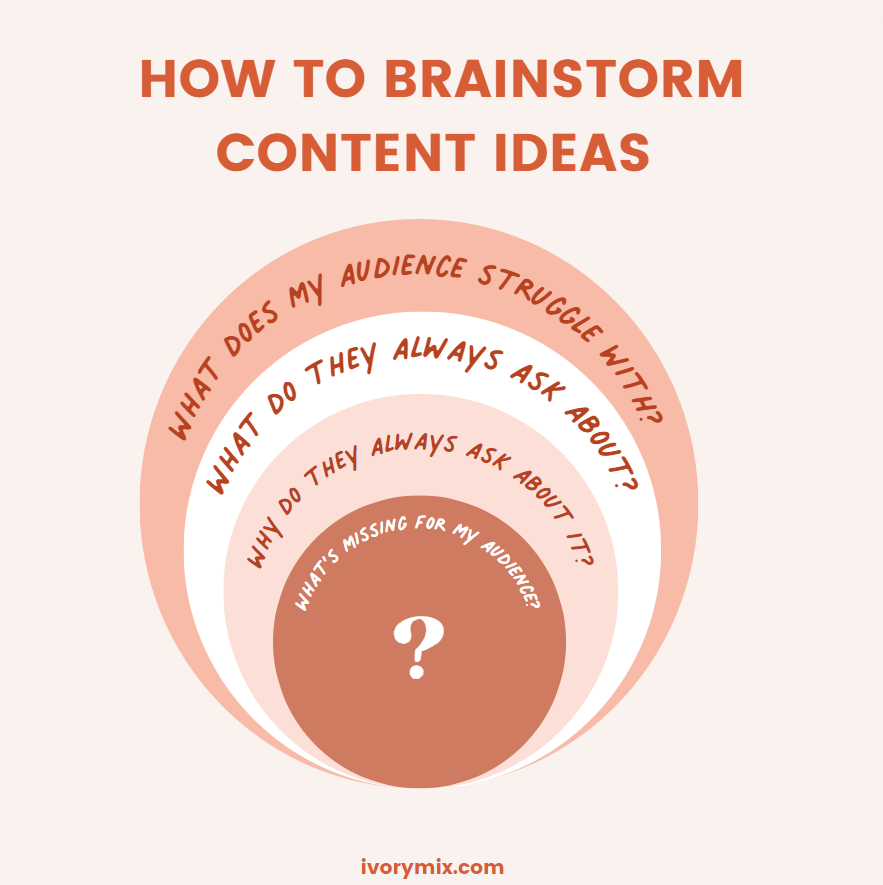

Creating supporting content is a step we can’t leave out of your new year planning! After all, your content is the key to supporting your goals. Start by brainstorming content ideas that will help you move toward success.

To get started, ask yourself :

- What does my audience struggle with?

- What do they always ask about?

- Why do they always ask about it?

- What’s missing for my audience?

You can organize your content ideas on a Trello board like this one.

Come up with themes for your audience to meet these needs and address these specific pain points. If possible, try creating quarterly content themes, then break those up into monthly themes.

Your content themes should easily relate back to your offerings, so the sales conversations can continue, and you can easily turn your audience into paying customers. If they don’t, ask why, and revisit your goals to fix that.

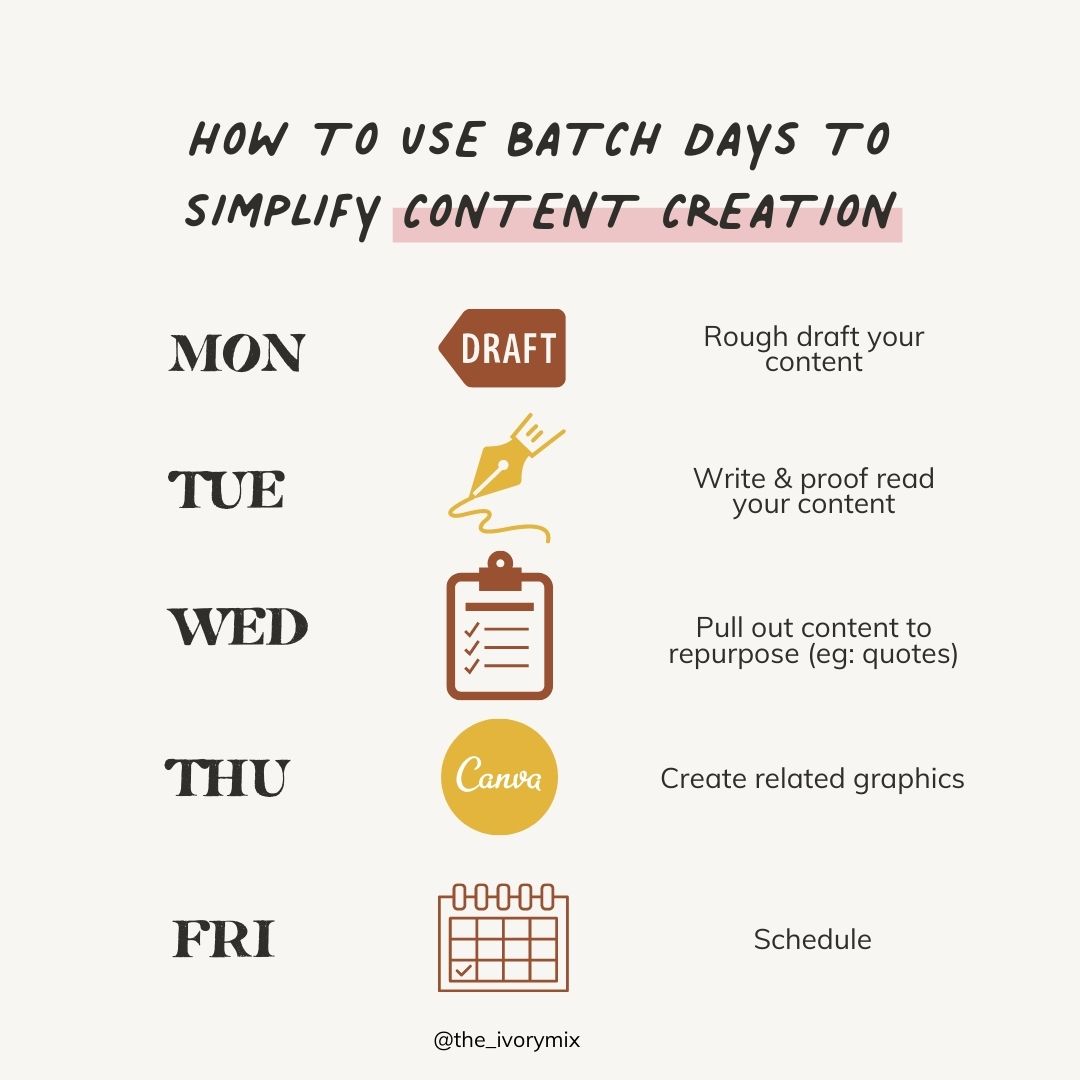

Step 10- Create Batch Days on Your Calendar

Batch days are ways of organizing your time by doing similar tasks on similar days. For instance, when it comes to content creation, batching may look like this:

- Monday — Draft Day. Create your outline and bullet points for blog posts, lead magnets, webinars, and Facebook Lives.

- Tuesday — Writing Day. Fill in your outlines and do the bulk of the writing for your blog, emails, webinar content, etc.

- Wednesday — Repurpose Day. Pull points from blog posts and create social content.

- Thursday — Graphics Day. Create graphics to pair with your content.

- Friday — Admin Day. Finalize, proofread, and schedule.

Step 11 – Reward Yourself!

Last but not least, be sure to set up rewards along the way to boost your mood and celebrate your wins all year long — after all, you’ve planned like a boss and deserve it!

Ready to get started on your planning session

I’ve created a Trello Board that summarizes all the steps we’ve walked through in this post. This board will help you align your goals with your actions.

Let’s do the work and implement these action steps to achieve your BIG dreams.

FREE PLANNER DOWNLOAD

Want a full training and trello board too.

> Check out my full 90 minute workshop training complete with trello board access

What Next? Learn More from these other articles:

- How to turn a blog into a business with digital products and online courses

- 6 Profitable online income streams that make me $30k/month

- 6 steps to more clients

- 16 questions to help you find more clarity

Thank you, Kayla. As usual you bring such obvious clarity to things I always struggle with. I’m still blogging after a few years where I’ve gained little traction and this year I really hope to FOCUS and be consistent. Your tools always help me get organized, it’s just me that falls off the schedule. Jessica, http://www.digitalplanningmom.com

Leave a Comment Cancel Reply

You must be logged in to post a comment.

You may also like reading:

How to Develop a Slow Content Creation Strategy for a Soft Business

15 Unbeatable Ways to Come Up with Endless Content Ideas

#1 Way to Stay Motivated with Content for Your Digital Product Business

7 Ways To Blend Your Multiple Passions into Your Business and Content (Guide For the Multi-Passionate Entrepreneur)

Hey there content creator!

I'm Kayla Butler

I'm the founder and CEO of Ivory Mix

More About Me →

Blog Categories

- Canva Tutorial

- Content Calendar Ideas

- Create a Stunning Brand

- Grow with Email Marketing

- Grow with Instagram

- Grow with Pinterest

- Grow with Video Content

- Grow Your Traffic

- Improve Your Focus and Mindset

- Make More Money

- Membership Updates

- Random Anecdotes

- Visionary Women Like You

- Collections

- Content Plans

- Profit Plans

- Plans & Systems

- Branding & Designs

- Enroll in The Accelerator

- Enroll in all Courses

- Course Directory

- Branding and Marketing

- Business and Life Planning

- wjr business beat

- Management and Operations

- social media

- Technology and Web

- Inspiration for Entrepreneurs

- Launch Your Business

- Manage Your Business

- Plan Your Business

- Plan Your Life

- Start a Business

Ready to Launch a Business? Here’s Your 12-Month Plan to Making it a Success

Is this the year you make your entrepreneurial dreams come true? Congratulations! But… you’ll need a plan. Consider this your month-by-month guide to ensuring that the business you launch thrives.

StartupNation exclusive discounts and savings on Dell products and accessories: Learn more here

Month 1: dream big (and write it down).

I know you’re excited to get going, but first you really need to articulate what you want your business to look like. You probably know in general what the product you want to sell is or what the service you wish to deliver is, but dive deeper and consider:

- Who your clients are

- Who your competitors are

- How you will market your business

- How you will price your products or services

- How much money you need (approximately; we’ll go deeper next month)

- What you want your business to look like one, five and 10 years from now

Don’t be shy about dreaming big! But realize that in order to accompany those dreams, you’ll need an action plan .

Month 2: Get your finances in order

This month, dedicate energy to your finances. Make a detailed budget that includes operating expenses, inventory, payroll (if you’re planning on hiring in the future ), marketing and emergencies.

Consider where the money to start will come from. Do you have a nest egg you can tap, or would you need to take out a loan or perhaps seek a form of alternative funding ?

Open a business checking account this month. It’s best to keep your personal and business finances separate, and when it comes time to file your business taxes, you’ll thank me.

Month 3: Get your website and social media up and running

Now it’s time to lay the groundwork for a website and marketing. Hire a web designer to create a stunning professional site, or if you have a little design and technical expertise, try a website builder like Wix .

Also, create social media profiles on the channels you think are best to connect with your audience (this goes back to Month 1 when you identified your target audience and what platforms they use). Less is more here: rather than setting up profiles on every site available, focus on just one or two to start so you know you’ll have time to manage them.

Month 4: Situate your space

Now’s the time to start looking for the ideal property that fits your needs and budget, whether that be a retail space, office, coworking space, etc. And i f you’ll be working out of your home, designate a space for your home office that will minimize distractions and help you be productive. It might also allow for a deduction come tax time .

You’ll need to buy supplies and equipment this month, as well. Consider opening tradelines (or credit with vendors) so you can get supplies when you need them and pay later, usually 30 days after receiving an invoice. Look for vendors who report to business credit bureaus so you can build your business credit.

Related: 5 Founders Share the One Piece of Advice They Wish They Knew Before Launching a Business

Month 5: get your permits and licenses.

Chances are, you’re going to need at least one business license before you can start operating. Depending on the type of business you’re running, you may need several months to get these approved, so start getting them in line before you launch your business.

Even if you work out of your home, you will need a sales tax certificate or some type of permit(s) specific to your business. Check with your city, county and state government to find out what you need.

Month 6: Put your marketing plan together

If you’ve done your homework and truly understand where you will best connect with your audience, this is the time to put together a detailed plan on how you will market to spread the word about your business and attract customers.

In your plan, include which marketing channels you’ll use, what your budget is for each, and whether you, an employee, or a third party (freelancer or agency) will help with the marketing tasks.

Month 7: Hire help

You’re getting closer to opening your business, and you’re going to need some help! Consider what aspects of your business you will need the most help with. Sure, you could try to do it all yourself, but you’ll end up doing a mediocre job with everything. Instead, put your attention on running your business and hire others to do the rest.

If hiring a team of full-time employees isn’t in your budget, start with part-time help and/or freelancers.

Month 8: Plan your launch

The type of business you’re opening will impact what sort of business launch you should have. If you’re opening a services business online, you can activate your website and be up and running. But if you’re opening a brick-and-mortar business, you may want to alert local media and social followers to attend your grand opening event. The bigger the splash you can make, the more aware of your new business people will be.

Plan an event with giveaways, discounts, entertainment, and food and beverage. Promote it in your local newspaper, online publications and through your social media channels.

Month 9: Launch!

All your hard work has paid off, because now you can officially open your company for business!

Don’t be disappointed if sales are slow to trickle in; this is also a period of learning, where you pay attention to what’s driving revenue and what isn’t. M ake sure to track website visits through Google Analytics so you know which marketing channels are driving visitors to your site, and any areas where you might need to reconsider strategy.

Month 10: Focus on promotions

You may see a little slowdown in traffic or sales after your initial launch, and that’s when it’s time to start thinking about promotions and sales. Discount products that are slow to move. Bundle two items together to push some of those slower-moving items. Create a loss leader to drive people to your store where, hopefully, they’ll buy more.

Sign Up: Receive the StartupNation newsletter!

Month 11: assess results.

By now, you’ve had some time to build up your web traffic and social media following. If you have a physical store, you’ve gotten some face-to-face time and have spoken to customers. You may have developed an email subscriber list as part of your marketing efforts in Month 6. Use all these points of contact to determine where you should take your marketing efforts in the future.

Are customers asking for a loyalty program? That could be a good way to drive repeat sales. Are your emails not getting opened? Look at the subject lines you’re using and test out different copy.

Month 12: Look to the future

You put a tremendous amount of energy into the launch of your business, but your work isn’t done.

Now is time to look ahead: where do you want to take your business in the following year? Five years out? How about 10? Look back at your business plan and see if you’re still aligned with the direction you were initially going in, and if not, tweak it to reflect your new direction.

- business license

Leave a Reply Cancel reply

You must be logged in to post a comment.

Related Posts

Free Digital Skills Training This Week: From Branding to Pitch Practice

3 Trends in Dining (and Takeout) that Restaurants Need to Know

Raise, Cut or Hold Interest Rates? How Federal Reserve Action Affects Your Startup.

Last Chance to Apply for Verizon Digital Ready $10K Grants

How to write a business plan in 12 steps (2024 edition)

Updated 26 June 2024 • 12 min read

This guide breaks down how to write a business plan, step-by-step, detailing what your document needs to include and what you need to think about to make your business plan as persuasive as possible.

What is a business plan?

A business plan is an essential document that can provide immense value for new and existing companies of all sizes. It is an overview that includes an outline of your business, its key objectives and plan for achieving important goals.

This information can be used to communicate strategic actions to internal teams and also attract interest from potential partners and investors . However, writing a business plan can be a lengthy and involved process. For many, using a business plan template can be a good way to get started.

For best results, you’ll need to do a lot of thinking and planning before you start writing your business plan. This way you have all the information and resources you need at your fingertips and won’t be under time pressure to come up with something at the last minute. After all, a well-thought-out business plan can help you avoid generic information and set your company up for success.

Download your free business plan template .

Why write a business plan?

Writing your business plan helps to get your strategy nailed down and onto the page. A plan that stays in your head is probably going to be full of unrealistic assumptions and biases, whereas a strategically thought-out and organised approach forces you to notice your blind spots and find a way forward.

If you’re looking for financing, a bank or investor needs to be persuaded by your business proposal and the opportunity to work with you. Therefore, a well-written business plan can help provide potential financial partners with the confidence that your business can become profitable. Your business plan gives them a comprehensive view of all aspects of your business and details your strategy for achieving your goals.

What are the main sections of a business plan?

Whatever your line of work, your business plan will generally need to provide the following:

An executive summary

A business overview

The market opportunity

Your products/services

How to write a business plan

Make sure you cover each of the following steps when preparing your document:

1. Write an executive summary

This section of your business plan should be 1–2 pages in length and enables potential financiers or partners to get an overview of what your business does and – most importantly — what the opportunity is for them. If they’re interested in the opportunity, they’ll conduct their own due diligence - and this will start with going through your business plan and financials.

It’s a good idea to write your executive summary last, when you’ve clarified your thinking around every section of the document. As an overview section, you don’t want to add any new content that isn’t in your business plan. Aim to keep this summary succinct and engaging by using simple, plain language, as this is much more persuasive than complicated or academic wording.

Use sub-headings and bullet points to help your most important information stand out, especially as busy executives may simply scan your executive summary and use this to decide whether they want to find out more.

What to include in an executive summary?

Make sure you include details on:

What your business does

What the opportunity is

What your unique selling points / differentiators are

How much funding you’re looking for

What the funding will be used for

How you'll succeed

Remember, you’re providing the big picture overview of your business - the detail is in the rest of the document and in the appendices.

2. Write your business overview

This section of your business plan needs to be more than just a list of what your business does. Its purpose is to excite those you’re hoping will work with you or help to fund your business.

Information to address includes:

What's the purpose of your business?

What problem does your business’ product or service solve?

What niche could it fill?

What’s different about your offering?

How are you better than anyone else at what you do?

Consider what your customer value proposition is by deciding what you want to achieve and what your number 1 benefit is for your customer.

3. Identify your USP

Think about what your unique selling points (USP) or differentiators are, and what proof-points you can provide to back them up.

For example, you can use terms like “market-leading” but if you don’t provide any evidence to back up your claims, your reader will take them with a big pinch of salt!

You should certainly reference any awards or endorsements that position you as the best person to provide your product or service, as well as any client testimonials. Make sure you include any education or experience that makes you an expert in your field as well.

4. Describe the market opportunity

Show you understand your industry, market and where you fit in it. While no-one can predict the future, offer up where you think the opportunity is for your business and make sales projections based on that.

For example, imagine your business is selling personalised cookies - there's little competition in your area and you see your market opportunity to create designs for all calendar and holiday events. You expect to increase sales by 30% in one year and 50% in three years, driven primarily by word-of-mouth referrals.

Make sure you also consider macro trends that may create opportunities for you, such as social, environmental, or technological changes that may affect buying behaviour.

5. Include a SWOT analysis

Whatever your business strengths or opportunities, they’ll always be known and unknown weaknesses and threats; there’s no such thing as certainty in business or in life!

However, you can demonstrate that you’ve examined your business through different lenses and have a thorough understanding of it by doing a SWOT (strengths, weaknesses, opportunities, threats) analysis.

Don’t worry about drawing attention to your business’ shortcomings - every opportunity has them and it’ll give investors and partners confidence in you that you won't bury your head in the sand. Naturally, it's important that you specify what you’re going to do to address these weaknesses and counter these threats.

Here are some areas you can think about to get started: reputation, technology, location, experience, staff, overheads, competition, suppliers and price.

6. Present a competitor analysis

Let’s face it, no matter what industry you’re in, or what you’re selling, there’s going to be other businesses offering the same thing. But instead of worrying about the competition, use this as a positive opportunity to up your game and work out the unique advantages you have that will keep you competitive.

Identify your top 3 competitors and analyse what they're doing well and where they’re coming up short. Try to be as objective as possible and identify how to differentiate yourself from them.

You should also look into who the industry leaders are and what the benchmarks are for your industry so that you can set yourself targets for continuous improvement.

7. Create a customer persona

A customer persona is a fictional person who represents your company's ideal customer. Naturally, the persona can be based on a real person - the more you get to know your ideal customer, the more targeted and successful your marketing efforts will be.

To create a customer persona, you need to conduct research into your ideal customer’s age, sex, income, employment, daily activities, interests and hobbies. If you’re feeling unsure about your customer persona, you may need to give your ideal customer further thought and download the customer persona template to get started.

8. Write your marketing strategy

When you’ve created your customer persona, you need to work out how you’re going to reach them. Do they hang out on social media apps, like Facebook, Instagram, Pinterest, Twitter or LinkedIn? Or are they more used to local, traditional marketing like free local papers or high foot traffic areas?

Once you’ve figured where your audience is likely to hang out, you can outline your strategies for promoting and advertising your products or services in the next 12 months.

Make a list of the marketing channels you’ll use to achieve your advertising strategy and be sure to include your budget. How much can you set aside for advertising? And where are you most likely to see a return on your efforts? Paid ads on Facebook? Half or full paid spreads in an industry magazine? Or even a direct mail out?

For more structured help around this, check out free course: Business 101 | Get social with your business on Facebook .

9. Design your customer retention strategy

Business success relies heavily on the relationship you’re able to build with your customers. What techniques will you use to keep them coming back? Consider the following:

What can your business do to increase the number of repeat customers?

Does your business have a referral or loyalty program?

Do you have a post-purchase follow up in place?

Will you use surveys to track customer satisfaction?

What ways can you continue delivering outstanding service?

Is there a way to continue educating and adding value to your customers?

10. Present your financials

Most people who are looking at investing their time and/or money in your business will want to see your financial statements - your performance to date and your projections over the short and medium term. They'll also want to know how much you’ve received in funding to date and what these other sources of funding are - including your own investment.

Current finances

You need to show how your business has performed financially over the last year, highlighting metrics such as positive cashflow , net profit and assets.

Financial forecasts

You should also provide a balance forecast projecting total assets, total liabilities and net assets over 1, 2 and 3 years, and a profit and loss forecast for the same periods detailing gross profit /net sales, total expenses and net profit/loss. Finally, you should also provide a cash flow forecast month by month over the next year.

It’s also a good idea to speak to an expert like an accountant or bookkeeper about your finances and get advice on how best to present them in this all-important section of your business plan.

11. Detail how much funding is needed

Naturally, you also need to be very clear about how much money you’re looking for and what you plan to do with it. If you’re looking for a loan , you need to detail what it’s for, over what period it’ll be repaid, and what collateral you have to secure it.

12. Propose an exit strategy

Any financial stakeholder in your business will want a return on investment. If you’re pursuing this type of funding, you should include some detail on your proposed exit strategy . For example, do you want to sell the company at some point or go public?

Similarly, you should outline your succession plan so the business can continue to operate if you decide to step away from it. Likewise, you need a plan for what happens if the business loses money and can’t sustain itself. Documenting this means that everyone is on the same page and potential investors have this information upfront.

Frequently asked questions about writing a business plan:

When to write a business plan.

Typically, entrepreneurs write their business plans within the first year of operations. A business plan is a tool that helps business owners refine their strategy, attract partners and financiers, and grow their business.

If a business plan is written too soon, it may lack the substance that comes with time in the market. However, it’s important to note that a business plan isn't a static document - it can and should change as the business evolves.

How long should your business plan be?

There are no hard and fast rules around how long your business plan should be - it just needs to include all the relevant information. Aim for clear, concise sections and build a business plan that is as easy to read and navigate as possible.

Using a business plan template can help you make sure you have everything covered off, while also having a document that looks as professional as possible. Make sure you run a spelling and grammar check too - any sloppy errors can undermine your credibility.

What’s a business plan on a page?

It’s important to write your business plan as it helps to embed your strategy - as well as communicate what you’re about to potential partners or investors. When you have a comprehensive business plan you can easily adapt it to suit different audiences. For example, a full business plan is essential for raising capital but a business plan on a page may be enough for potential partners or employees.

What do venture capitalists look for in a business plan?

Venture capitalists invest money into businesses with the goal of achieving a return on their investment within the short to medium term. As a result, they’re looking for an attractive market opportunity, a clear point of differentiation, a strong management team, a proven track record, solid financials and, importantly, an exit opportunity.

Where to go for help or more information?

There are many great resources out there to help you fine-tune your business strategy and write your business plan. The Australian Government has a comprehensive website dedicated to supporting businesses at all stages of their journey.

You can also get help from Business Enterprise Centres , business advisors, accountants and fellow business owners. MYOB also has a list of business advisors who can give you feedback on your business plan, so your venture has the very best chance of success.

Related Guides

How to get a business loan arrow right, how to find investors: a guide for startups arrow right, business models: definitions, types and key components arrow right.

- Starting a Business

- Growing a Business

- Small Business Guide

- Business News

- Science & Technology

- Money & Finance

- For Subscribers

- Write for Entrepreneur

- Tips White Papers

- Entrepreneur Store

- United States

- Asia Pacific

- Middle East

- South Africa

Copyright © 2024 Entrepreneur Media, LLC All rights reserved. Entrepreneur® and its related marks are registered trademarks of Entrepreneur Media LLC

The Essential Guide to Writing a Business Plan Here's the no-nonsense guide on how to write a business plan that will help you map success for your startup.

By Carolyn Sun

Opinions expressed by Entrepreneur contributors are their own.

President Dwight D. Eisenhower once said, "In preparing for battle I have always found that plans are useless, but planning is indispensable." If you're starting a business, you should have a business plan regardless of whether you're bootstrapping it or looking for outside funding.

The best sorts of business plans tell a clear story of what the company plans to do and how it will do it. Given the high failure rate of startups in their first year, a business plan is also an ideal opportunity to safely test out the feasibility of a business and spot flaws, set aside unrealistic projections and identify and analyze the competition.

A business plan doesn't need to be complicated, but for it to serve its purpose and set you up for success, it must be clear to whomever is reading your plan that you have a realistic handle on the why and how your business will be a success.

To get you moving in the right direction, here's a guide on how to write a business plan.

Overall tips

There's a lot of advice in the infosphere about how to write a business plan, but there's no single correct way. Your approach depends on your industry, who is reading your plan and what the plan is intended for. Are you trying to get funding? Sara Sutton Fell, founder of FlexJobs , a job site for flexible telecommuting jobs, says her business plan was an initiator for more in-depth conversation with potential investors. "A plan does help to see if investors and entrepreneurs are on the same page with general expectations for the business," she says.

A business plan serves many purposes, but there is universal consensus on the following when it comes to your business plan:

Have several versions tailored for specific audiences: "One of the mistakes that inexperienced business owners make is not understanding who they're writing the plan for," says David Ciccarelli, a small business owner who got consultation from his local Small Business Association (SBA) when he was starting his company Voices.com , which connects employers with voiceover talent.

Your plan is a living document: Tim Berry, the founder of a business planning software company Palo Alto Software , took his company from zero to $5 million in sales in its first three years. To do so requires frequent review and close tracking, says Berry, who met with his management team every month to review the plan versus what actually happened -- and then to revise. "There is no virtue to sticking to a plan if it's not useful and responsive to what actually happens," he cautions.

Be realistic about financial estimates and projections: "When you present a plan to bankers and financiers, or even to your employees, people will get way more excited about what's real rather than some huge thing that's never going to happen," says Ciccarelli. So present an achievable sales forecasts based on bottom-upwards information (i.e. how many units per month get sold in how many stores) and stop over projecting profits.

Writing your business plan is about the process and having a blueprint: Your business plan "reflects your ideas, intuitions, instincts and insights about your business and its future," according to Write Your Business Plan (Entrepreneur, 2015). The plan serves as a safe way to test these out before you commit to a course of action. And once you get your business going, the plan also serves as a reference point. "I still print the document," says Ciccarelli. "You're capturing it in time. If you're changing it all the time, you kind of don't remember where you were last year."

Back up any claims: Follow up your projections and assertions with statistics, facts or quotes from a knowledgeable source to lend your plan credibility.

Presentation counts: Reading any long, text-heavy document is hard on the eyes, so format with this in mind. Consider formatting your text pages into two-columns and break up long passages with charts or graphs. Arial, Verdana or Times New Roman are standard industry fonts.

Writing your business plan isn't busy work or a luxury; it's a vital part of the process of starting a business and arms you with information you need to know. So, let's get into what information goes into your business plan.

Related: Bu siness Plans: A Step-by-Step Guide

What goes into a business plan?

A typical business plan is 15 to 25 pages. Its length depends on a variety of factors, such as whether your business is introducing a new product or belongs to a new industry (which requires explanation to the reader), or if you're pitching to bankers, who generally expect to see a traditional written business plan and financials.

"Most equity investors prefer either an executive summary or pitch deck for first contact, but will often request a more detailed plan later in the due diligence process. Potential customers don't need all the details of your internal operation. Your management team needs access to everything," says Akira Hirai, managing director of business plan consulting service Cayenne Consulting .

Most business plans include these seven sections:

1. Executive summary : The executive summary follows the title page and explains the fundamentals of your business. It should provide a short and clear synopsis of your business plan that describes your business concept, financial features and requirements (i.e. cash flow and sales projections plus capital needed), your company's current business position (i.e. its legal form of operation, when the company was formed, principals and key personnel) and any major achievements in the company that are relevant to its success, including patents, prototypes or results from test marketing.

2. Business description : This section typically begins with a brief description of your industry and its outlook. Get into the various markets within the industry, including any new products that will benefit or hurt your business. For those seeking funding, reinforce your data with reliable sources and footnote when possible. Also provide a description of your business operation's structure (i.e. wholesale, retail or service-oriented), who you will sell to, how you will distribute your products/services, the products/services itself (what gives you the competitive edge), your business's legal structure, your principals and what they bring to the organization.

Here are some worksheets from Write Your Business Plan that will help determine your unique selling proposition and analyze your industry.

Click to Enlarge+

3. Market strategies: Here is where you define your target market and how you plan to reach them. Market analysis requires research and familiarity with the market so that the target market can be defined and the company can be positioned (i.e. are you a premium product or a price-competitive product?) in order to garner its market share. Analyze your market in terms of size, structure, growth prospects, trends and sales/growth potential. This section also talks about distribution plans and promotion strategy and tactics that will allow you to fulfill your plans.

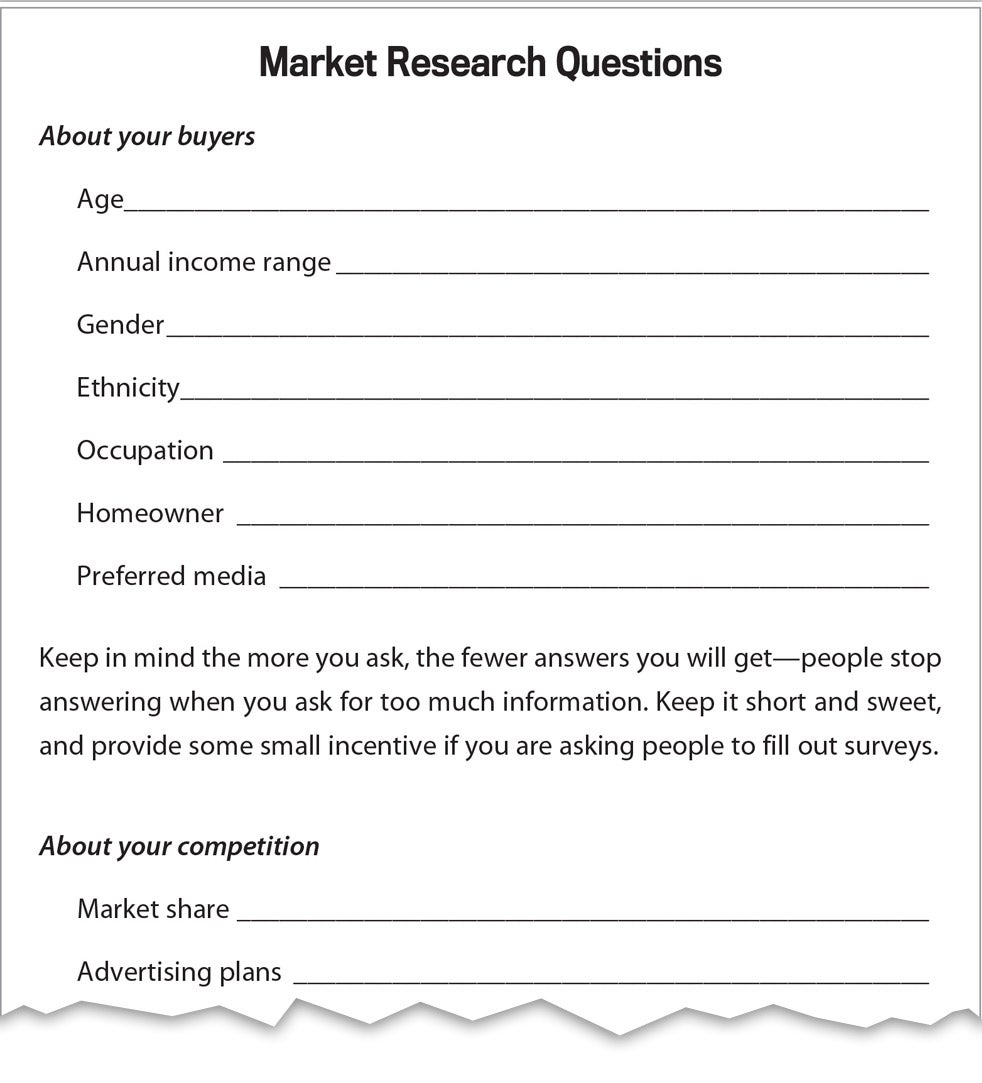

Here is a worksheet from Write Your Business Plan that will guide you toward identifying your target market.

4. Competitive analysis: The purpose of the competitive analysis is to determine the strengths and weaknesses of the competitors within your market, strategies that will provide you with a distinct advantage, the barriers that can be developed in order to prevent competition from entering your market, and any weaknesses that can be exploited within the product development cycle. Show why your business will be a success over others.

5. Design and development plan: You will only need this section if you have a product in development, such as an app. The purpose of this section is to provide investors with a description of the product's design, chart its development within the context of production and marketing and show a development budget that will enable the company to reach its goals.

6. Operations and management plan: This section describes how the business functions on a daily basis, its location, equipment, people, processes and surrounding environment. If you have a product that needs to be manufactured, explain the how and where; also, describe your work facility, the personnel, the legal environment (such as licensing, permits, special regulations, etc.), key suppliers and inventory. This section will also highlight the logistics of the organization such as the various responsibilities of the management team and the tasks assigned to each division within the company.

7. Financial factors: Financial data is always at the back of a business plan -- yet it's extremely important. The financial data can include your personal financial statement, startup expenses and capital, your projected cash flow statement and 12-month profit-and-loss statement. PaloAlto's Berry stresses that if you're going after investors, you'll need to show a cash flow statement and a break-even analysis -- or the breakdown to see where your business breaks even.

The best way to prepare for running a business is to have all the components of the plan ready. So if you are are showing a prospective lender your business plan on 10 PowerPoint slides and get asked about something that isn't in the presentation, you can speak knowledgeably and follow up with a more fleshed out plan -- and quickly.

Some business owners hire business plan writing services. Cayenne Consulting's Hirai says that his clients generally fall into one of two categories: those intimidated by the process and those who could write the plan themselves but would prefer to spend their time on other priorities.

If you find yourself intimidated or stuck, you can always write the parts of plan yourself that you understand and hire a consultant or researcher to help with parts that you find confusing.

Or if you're a startup watching every dollar, then tap the free services of the federal Small Business Association (SBA). Every state has a district office . Through the SBA, you can get business plan assistance through its various resource partners, which includes Women's Business Centers , Small Business Development Centers and Service Corps of Retired Executives .

Allow this business plan template for Business Plan for a Startup Business to guide you:

Different types of business plans

Generally, business plans can be divided into four categories :

Working plan: This plan is what you will use to operate your business and is not meant to be admired. This version of your plan is an internal document and will be long on detail, short on presentation. Here, you can omit descriptions that you need not explain to yourself or your team.

Mini plan: The reader may request a mini plan, or a condensed version of your business plan (1-10 pages), which includes most of the same components as in a longer traditional plan -- minus the details and explanation. This includes the business concept, financing needs, marketing plan, financial statements (especially cash flow), income project and balance sheet. This shorter plan is not meant to be a substitute for a full-length plan, but serves as an option to present to potential partners or investors.

Presentation plan: Whether you're using a pitch deck or a written business plan, the information in your presentation plan will be, more or less, the same as in your working plan but worded differently and styled for the eyes of an outsider. The reader of your presentation plan will be someone who is unfamiliar with your business, such as investor or venture capitalist, so lose any jargon or shorthand from your working plan, which only makes sense to you. Also, keep in mind that investors will want to see due diligence on your competition threats and risks as well as financial projections. In addition, looks count, so use the color printer, a nice cover and bindings and the fancy paper stock. Or else, if you're presenting your business plan as a PowerPoint presentation, you can use this business plan presentation template .

What-if plan: This is a contingency plan -- in case your worst case scenario happens, such as market share loss, heavy price competition or defection of a key member of your team. You want to think about what to do in the face of an of these, and if you're trying to get outside funds, having a contingency plan shows that you've considered what to do if things don't go according to plan. You don't necessarily need this, but if you are getting outside funding, then it can strengthen your credibility showing that you have thought about these what-if possibilities. Even if you're not going to get outside funding, shouldn't you be thinking of the what ifs?

If four plans seem like a mountain of work, don't panic. Select two to start off -- a working plan and a mini plan, which will be an abbreviated version of your working plan.

Take several months to write your business plan. Consider it a journey, not a sprint.

Related: The Ultimate Guide to Writing a Business Plan

Carolyn Sun is a freelance writer for Entrepreneur.com. Find out more on Twitter and Facebook .

Want to be an Entrepreneur Leadership Network contributor? Apply now to join.

Editor's Pick Red Arrow

- Lock The Average American Can't Afford a House in 99% of the U.S. — Here's a State-By-State Breakdown of the Mortgage Rates That Tip the Scale

- Richard Branson Shares His Extremely Active Morning Routine : 'I've Got to Look After Myself'

- Lock This Flexible, AI-Powered Side Hustle Lets a Dad of Four Make $32 an Hour , Plus Tips: 'You Can Make a Substantial Amount of Money'

- Tennis Champion Coco Gauff Reveals the Daily Habits That Help Her Win On and Off the Court — Plus a 'No Brainer' Business Move

- Lock 3 Essential Skills I Learned By Growing My Business From the Ground Up

- 50 Cent Once Sued Taco Bell for $4 Million. Here's How the Fast-Food Giant Got on the Rapper's Bad Side .

Most Popular Red Arrow

How keeping things simple helps your company innovate and grow.

This article explores why simplicity is challenging yet essential, highlighting examples from successful companies like Ikea and Nike, and offers practical advice on how simplifying processes, communications and product development can lead to better outcomes and substantial business success.

Four Tried-and-True Ways to Better Market Your Business

With all the technology we have today, there are quite a few marketing channels business owners can leverage — but let's take a closer look at a few that work best.

I Started Over 300 Companies. Here Are 4 Things I Learned About Scaling a Business.

It takes a delicate balance of skill, hard work and instinct to grow a successful business. This serial entrepreneur loves the unique challenge; here are the key lessons she's learned along the way.

She Grew Her Side Hustle Sales From $0 to Over $6 Million in Just 6 Months — and an 'Old-School' Mindset Helped Her Do It

Cynthia Sakai, designer and founder of the luxury personal care company evolvetogether, felt compelled to help people during the pandemic.

'Why Shouldn't They Participate?': AT&T CEO Calls on Big Tech to Help Subsidize Internet Access

AT&T's CEO called out the seven biggest tech companies in the world.

5 SEO Techniques to Help Your SaaS Business Rank in 2024

Discover five game-changing SEO techniques that can help you rely less on paid ads and cut down your customer acquisition costs.

Successfully copied link

Related Topics

- Food and Beverage

- Vitamins and Supplements

- Personal Care

- Press Releases

Recent in Natural Product Trends

- Market Data and Analysis

- Investments

- Industry News

Recent in Industry Insights

- Investors and Service Providers

Recent in Business Management

- Natural Products Expo

- Newtopia Now

- NEXTY Awards

- Toolkits and Downloads

- Business Management

12-month business planning in 5 steps

Planning ahead for 12 months from now can be a difficult task to start in the COVID-19 environment. Follow this five-step methodology to get ahead of business planning and feel more in control, despite the current uncertainty.

May 12, 2020

Companies that succeed best in the long term take a step back and plan. But in this unprecedented time, how do brands move from reactionary to proactive? A recent Naturally Network webinar explores the five steps to planning the next 12 months of a company’s growth.

Leading the panel, Maura Mitchell, managing partner of Brandology—a firm specializing in powerful and profitable growth plans—walked through her five steps to success, joined by entrepreneurs all facing unique challenges within the framework. The founders were Sadie Scheffer, founder of Bread SRSLY, Pete Brennan, co-founder of Soñar Foods, and Danielle Vincent, founder of Outlaw Soaps.

Here are the steps that companyies should use to start thinking about growing, scaling and thriving in the next year, and how to pivot within the steps based on unique business challenges.

1. Create two to three imaginary future scenarios.

This exercise will help brands prepare for how their category will look in 12 months. Work on creating a best, worst and somewhere-in-the-middle circumstance for how the company may face and overcome challenges. Mitchell expressed caution around mixing scenarios—each should have a clear differentiation and action plan.

Use each scenario to plan for systems that are out of the company’s control. Currently, companies may be facing a scenario where e-commerce is dominant and brick-and-mortar retail is less powerful for their category. Within this scenario, assume that the company’s product or category is not being fulfilled quickly or prioritized on Amazon. How could the strategy pivot based on this assumption?

Planning should always be in a relatively small trusted group. Make these scenario-planning decisions with key leadership and valued mentors. Be careful not to have anyone in the room who would require a lack of honesty and openness about the state of the company.

2. Find common ground and define what "winning" means.

Determine how your brand will win in each area of business, then identify the commonalities. Across channel, products, sales, marketing, operations, finance and human resources, how can the company win? What is needed to pivot within unknown and unforeseen circumstances? Use this planning to balance long-term views with short-term survival. Figure out how to time the tactics so that you can work toward getting ready for the long term, while staying afloat (and cash flow even) for now. Recognize that "getting things done" may look different now than when they are tenable and have an impact.

What does it mean to ‘"win"? This is a crucial step to define in the process.

3. Assess: Stop, start, continue.

Determine what the company needs to start, stop and continue doing to get from the circumstances of today to the next 12 months. To carry a company from now to a more scalable future, founders and teams have to really look at not only what they would like to start (which proves to be a bit easier), but what they have been doing that is no longer serving the team or working. Be careful not to take more on without letting go of other priorities as a group.

4. Identify pivotal external events and develop a ready-for-action plan around them.

Identify "forks in the road" and "signposts" that will guide decision-making. Mitchell defines forks in the road as external events that a company should be ready to respond to in real time. Use these to determine how and when to act. If food service is an important channel for your business, develop a timeline and workplan around how the company would like to be ready when the channel reopens. If Fulfill by Amazon is strategic, how will the company pivot when the channel starts accepting new SKUs?

Mitchell also expressed the value of keeping signposts in view, which she defines as external metrics that a team should monitor to help them understand the future, to increase the level of comfort with all scenarios as plans progress.

5. Reflect often. Review progress and dashboards weekly. Fine-tune but don’t overhaul.

As with all changes that companies face, there are always wildcards that may influence and interrupt planning. Mitchell stressed the importance of sticking to a plan and not letting too many outside factors radically overwhelm the plan in place. Review the 12-month progress as a team and check in on the rapid changes that are happening. Think about fine-tuning actions but try not to make big changes that can lead to overwhelm.

Watch the full webinar.

About the Author(s)

Denver Lewis

Community and Conference Content Manager, New Hope Network

As Community and Conference Content Manager, Denver is passionate about educating and supporting the growth of early stage natural products brands, strengthening understanding of the investment landscape and providing a platform for storytelling, with a focus on mission-driven business.

You May Also Like

Ayurveda in America: Q&A with Dr. Kulreet Chaudhary

The Natural List–Investing in CPG: A capital-efficient, good-growth era

Newtopia Now: A retailer's guide to education and networking sessions

Monitor: As ’shrooms boom, science starts to catch up

How to Create a 12-Month Profit Plan for Your Business

If you’re trying to create a profitable company that people love, we recommend creating a 12-month business plan around this concept every year . This isn’t just your typical business plan that you use to secure loans.

Instead, you’ll create this 12-month plan to realign your values and mission.

A major part of making your business a success is remembering the value and mission that you set when opening your company. Unfortunately, it’s easy to get distracted by shiny objections or new offerings, and these values and missions can slowly fade away.

When you know how to set up business plan yearly goals that align with creating a business people love, it will help you:

- Attract new customers

- Retain customers

- Continue to grow

12-Month Business Plan to Realign Your Values and Mission

Review your company’s values and mission.

A unified vision for your business is necessary to meet your company’s value and mission statement. This is a time to sit down and reflect on your value and mission to:

- Reinforce your business’ vision to your employees

- Review communications to make sure they align with your values and mission

Often, different employees will have different ideas of your values and mission. So, sit down with important stakeholders to ensure that all parties have a clear vision of your company’s goals.

Customer and Employee Feedback

If you want to keep your customers happy, you must listen to their feedback. A good starting point for your plan is to review all of your customer feedback and implement changes based on the bad feedback.

Perhaps shipping is too slow, or items are breaking in transit.

Take steps to improve on these key areas where customers are having issues. Inversely, also look at what customers love about your business and continue doing the same . You can learn a lot from feedback that you can then use in your planning for fulfillment, distribution, marketing, and more.

Next, be sure to consider all of your employee feedback, too. You can send out employee surveys that ask:

- What went well for the employee in the last year

- What improvements/changes the employee would like to see made

You can also gain a lot of insight into what steps your business needs to take in the coming twelve months through year-end planning for your business .

Analyze and Forecast Sales

Company mission and vision are critical, but you can only meet this vision by analyzing and forecasting sales. This is the time when you want to look through your books to determine where sales are coming in and being lost.

Have you lost certain customer segments? If so, can you pinpoint why?

Look for underserved areas or what’s lacking in segments where sales are being lost. Customer feedback can help here, too. When you consider the input, you may find answers to why sales are being lost and how to forecast future sales.

If your internal sales forecasts are low, try and determine why.

Perhaps sales are lost in a dying market segment, but if you’re losing sales in a thriving market, you need to consider your company’s vision.

That being said, we have a whole guide to growing your business. If you’re looking to do that, check out grow.cobbcpa.com to grab your free guide!

Marketing Channels and Approach

Marketing channels and the way that you reach customers may change. Think back to the time of newspaper ads, where many businesses were built. Now, marketing channels and approaches have evolved both online and offline.

In 2020, 66% of marketing executives expected to focus more on customers as individuals than a single target market.

Multichannel approaches need to be taken in today’s marketing. It’s essential to look over your marketing channels and strategy to:

- Remove marketing channels that aren’t producing results

- Consider increasing budgets for high-performing marketing channels

- Create cohesion across marketing channels

You’ll want to examine your marketing efforts to ensure that your marketing is honest, reaches the right customers, and sends the right message. If you run a more significant business with its own internal marketing team, be sure that you sit down with them at this time to discuss your goals and vision.

Finances and Profitability

When your vision is being met and properly executed on, it should lead to steady financials and profitability. You’ll want to review your books to understand where money is coming in and where expenditures occur. This is important to keep your business running smoothly.

Lean business practices should be a part of every business.

What are Lean practices?

These practices help you optimize your business by:

- Eliminating waste, which improves profitability

- Optimizing business operations

- Delivering products quickly and efficiently

- Building a quality business

The entire idea of a Lean business is to understand customer value and to continue improving key processes.

You can use this time to realign finances to training or product improvement and lower funding in areas that aren’t helping your business reach its goals. Profitability will follow as long as you maintain adequate profit margins.

Operations and Management

Your business’s operations and management need to know and enforce your company’s vision at all times. Managers should be in charge of making sure that all employees:

- Understand the company’s mission and vision

- Follow internal protocols and procedures

- Train to create an internal standard of quality

Training may be an essential part of your operations and management. As employees enter and leave your workforce, each new employee needs to be trained properly. You want to make sure that training is still taking place, is updated, and enforced. You’re also want to provide ongoing training and development to help ensure people are feeling fulfilled in their roles.

Fulfillment and Distribution

Finally, when you’re at the end of your plan, you’ll want to look at your fulfillment and distribution. You’ll want to consider:

- Markets that aren’t served or underserved

- Analyze whether these markets are a market opportunity

- Consider fulfillment channels, speed, efficiency, and accuracy

If customers complain of slow shipping speed, issues with broken products, or services not being delivered as described, you’ll want to dig into your current fulfillment and see where changes can be made. You may be able to make internal changes, add new fulfillment partners or put protocols in place to correct these issues.

Final Thoughts

A 12-month business plan can help you realign your business to make sure that you’re meeting the demands of consumers while staying true to your business’s mission and values. You can refer to this plan throughout the year as a blueprint of what you can be doing to continue growing your business into a success.

Over time, you’ll continue to grow your client or customer base while creating a profitable company that people love!

Click here to schedule a 21 minute call to discuss business planning .

Recent Posts

- How an Accounting Pro Can Help You Create and Stick to a Budget

- The Impact of Branding on Product Profitability

- Pricing Strategies to Boost Your Product’s Profit Margin

- Let’s Get Started Early! Tax Planning Season 2024

- Understanding Pricing Trends: Navigating the Disconnect Between Inflation Rates and Business Costs

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- January 2021

- December 2020

- November 2020

- October 2020

- February 2020

- January 2020

- December 2019

- October 2019

- September 2019

- August 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- February 2018

- January 2018

- December 2017

- September 2017

- August 2017

- December 2016

- November 2016

- Education Planning

- For Business

- Friendly Reminders

- Retirement Planning

- Tax Central

- Tax Organizers

- Tax Problems

- Thriving Thursday

- Uncategorized

- Entries feed

- Comments feed

- WordPress.org

| You might be using an unsupported or outdated browser. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. |

How To Write A Business Plan (2024 Guide)

Updated: Apr 17, 2024, 11:59am

Table of Contents

Brainstorm an executive summary, create a company description, brainstorm your business goals, describe your services or products, conduct market research, create financial plans, bottom line, frequently asked questions.

Every business starts with a vision, which is distilled and communicated through a business plan. In addition to your high-level hopes and dreams, a strong business plan outlines short-term and long-term goals, budget and whatever else you might need to get started. In this guide, we’ll walk you through how to write a business plan that you can stick to and help guide your operations as you get started.

Featured Partners

ZenBusiness

$0 + State Fees

Varies By State & Package

On ZenBusiness' Website

On LegalZoom's Website

Northwest Registered Agent

$39 + State Fees

On Northwest Registered Agent's Website

$0 + State Fee

On Formations' Website

Drafting the Summary

An executive summary is an extremely important first step in your business. You have to be able to put the basic facts of your business in an elevator pitch-style sentence to grab investors’ attention and keep their interest. This should communicate your business’s name, what the products or services you’re selling are and what marketplace you’re entering.

Ask for Help

When drafting the executive summary, you should have a few different options. Enlist a few thought partners to review your executive summary possibilities to determine which one is best.

After you have the executive summary in place, you can work on the company description, which contains more specific information. In the description, you’ll need to include your business’s registered name , your business address and any key employees involved in the business.

The business description should also include the structure of your business, such as sole proprietorship , limited liability company (LLC) , partnership or corporation. This is the time to specify how much of an ownership stake everyone has in the company. Finally, include a section that outlines the history of the company and how it has evolved over time.

Wherever you are on the business journey, you return to your goals and assess where you are in meeting your in-progress targets and setting new goals to work toward.

Numbers-based Goals

Goals can cover a variety of sections of your business. Financial and profit goals are a given for when you’re establishing your business, but there are other goals to take into account as well with regard to brand awareness and growth. For example, you might want to hit a certain number of followers across social channels or raise your engagement rates.

Another goal could be to attract new investors or find grants if you’re a nonprofit business. If you’re looking to grow, you’ll want to set revenue targets to make that happen as well.

Intangible Goals

Goals unrelated to traceable numbers are important as well. These can include seeing your business’s advertisement reach the general public or receiving a terrific client review. These goals are important for the direction you take your business and the direction you want it to go in the future.

The business plan should have a section that explains the services or products that you’re offering. This is the part where you can also describe how they fit in the current market or are providing something necessary or entirely new. If you have any patents or trademarks, this is where you can include those too.

If you have any visual aids, they should be included here as well. This would also be a good place to include pricing strategy and explain your materials.

This is the part of the business plan where you can explain your expertise and different approach in greater depth. Show how what you’re offering is vital to the market and fills an important gap.

You can also situate your business in your industry and compare it to other ones and how you have a competitive advantage in the marketplace.

Other than financial goals, you want to have a budget and set your planned weekly, monthly and annual spending. There are several different costs to consider, such as operational costs.

Business Operations Costs

Rent for your business is the first big cost to factor into your budget. If your business is remote, the cost that replaces rent will be the software that maintains your virtual operations.

Marketing and sales costs should be next on your list. Devoting money to making sure people know about your business is as important as making sure it functions.

Other Costs

Although you can’t anticipate disasters, there are likely to be unanticipated costs that come up at some point in your business’s existence. It’s important to factor these possible costs into your financial plans so you’re not caught totally unaware.

Business plans are important for businesses of all sizes so that you can define where your business is and where you want it to go. Growing your business requires a vision, and giving yourself a roadmap in the form of a business plan will set you up for success.

How do I write a simple business plan?

When you’re working on a business plan, make sure you have as much information as possible so that you can simplify it to the most relevant information. A simple business plan still needs all of the parts included in this article, but you can be very clear and direct.

What are some common mistakes in a business plan?

The most common mistakes in a business plan are common writing issues like grammar errors or misspellings. It’s important to be clear in your sentence structure and proofread your business plan before sending it to any investors or partners.

What basic items should be included in a business plan?

When writing out a business plan, you want to make sure that you cover everything related to your concept for the business, an analysis of the industry―including potential customers and an overview of the market for your goods or services―how you plan to execute your vision for the business, how you plan to grow the business if it becomes successful and all financial data around the business, including current cash on hand, potential investors and budget plans for the next few years.

- Best VPN Services

- Best Project Management Software

- Best Web Hosting Services

- Best Antivirus Software

- Best LLC Services

- Best POS Systems

- Best Business VOIP Services

- Best Credit Card Processing Companies

- Best CRM Software for Small Business

- Best Fleet Management Software

- Best Business Credit Cards

- Best Business Loans

- Best Business Software

- Best Business Apps

- Best Free Software For Business

- How to Start a Business

- How To Make A Small Business Website

- How To Trademark A Name

- What Is An LLC?

- How To Set Up An LLC In 7 Steps

- What is Project Management?

Best West Virginia Registered Agent Services Of 2024

Best Vermont Registered Agent Services Of 2024

Best Rhode Island Registered Agent Services Of 2024

Best Wisconsin Registered Agent Services Of 2024

Best South Dakota Registered Agent Services Of 2024

B2B Marketing In 2024: The Ultimate Guide

Julia is a writer in New York and started covering tech and business during the pandemic. She also covers books and the publishing industry.

How to Create a Powerful 12 Month Vision for Your Business in 15 Minutes

Her Business

You get to create your life and business. It is within your power to be intentional about your business success by being deliberate and detailed about your vision.

You want to be able to relish your vision, sit in it, soak it in. Why? Because everything you do daily in your business, including the things that bore, overwhelm or irritate you, are in service of your vision. A strong, compelling, inspirational vision will pull you forwards.

Envisioning a new future may require a mind shift, to begin with. Your vision is more than a to-do list, more even than setting goals. It is about creating a big dream that pulls you forward.

Don’t worry if you don’t know how to get there. Thinking about getting there and how far we are from our goals is a great way to feel stuck or move backwards. So often get bogged down with the day-to-day and think like we’re not making meaningful progress. Instead, let’s focus on the word “vision” and precisely this idea of envisioning a new future. This idea of picturing what you want mentally is important because the vision starts much earlier than the practical strategies, plans, and actions.

Can you confidently and succinctly describe your 12-month vision?

When we asked women inside the HerBusiness community about their business visions, more than half had created a vision in the past but acknowledged it needed to be updated. Some women had a vision but hadn’t documented it. Some people, a tiny percentage, had a clear vision. Many had no clear vision.

We’re bombarded by this idea that we should have a really big vision, especially when we see people like Richard Branson and Oprah Winfrey changing the world. So we start to believe our vision needs to be that ambitious. But here’s the thing: if your vision is to help 100 people with Type 2 diabetes feel better about their health. Or, to help a thousand women to create a wardrobe full of clothes that they love, or to help 20 corporations overhaul their corporate identity, all of these are profound, beautiful visions. Even a vision of working less and spending more time on your hobby is a valid vision.

Creating a vision is about what’s right for you and what captures your heart’s desire.

Why do we create a 12-month vision, not a 5-year or lifetime vision for our business?

Whether you’re trying out a new business model, or you’re looking for more ideal clients, or you’re figuring out your marketing, you want a focused vision for your business. You may be tempted to go really, really big, but here’s what I know. I couldn’t see more than 12 months ahead in some years running my business. Some of us can’t even see a few weeks ahead.

Envisioning years and years ahead can be challenging because the world changes all the time. A few years ago, the phrase “Watching TikTok videos will entertain us during the COVID pandemic” would have meant nothing to us. What commonly understood terms will we be using in another two years that we have no idea about today?

In my first few years of business, the vision I had is markedly different from my vision today. This is why I recommend focusing on the next 12 months.

Let’s envision what your business looks like one year from now.

Why is YOU the most essential Growth Zone in your business?

When women join the HerBusiness network, they experience a 12-month cycle of working on different parts of their business, from being savvier in their marketing, finding the right technology to manage their processes, understanding how to build a team, and so on. We call each of these areas Growth Zones.

One Growth Zone is called the You Growth Zone. You are the most essential part of your business. Your mindset, vision, and confidence are integral to having a successful business. I tell you this because vision is part of the You Growth Zone and is core to taking care of you. It helps you design a business you love.

What do you want? What is ideal for you? And what is your 12-month vision?

Where do you want your business to be in 12-months’ time – even if you don’t yet know how you’re going to get there? If nothing that’s happened up until now mattered to the future of your business, how would your business look 12 months from now?

In 2019, I envisioned spending 10 weeks in New York City with my partner, PJ. I’d had this dream for many, many years, and I decided 2019 would be the year we were going to make it happen. Although, I admit I was scared to create this vision because I knew it would take a hell of a lot of work to get there.

I knew there’d be planning. We’d have to upgrade our technology. We’d have to manage the logistics far away and in different time zones. And what about the team? What promotions could we reasonably execute? It turned out to be one of the most rewarding, exciting experiences of my life. And it started as a vision.